6 Types of Tools to Use for Vendor Risk Assessment

Key Takeaways:

Procurement teams face mounting pressure to spot vendor risks before they impact contracts, compliance, or reputation.

This article breaks down six practical types of tools that help organizations gain actionable, verifiable insights into even the most complex vendor ecosystems.

Ready to move beyond static checklists and guesswork? Then let’s jump right in.

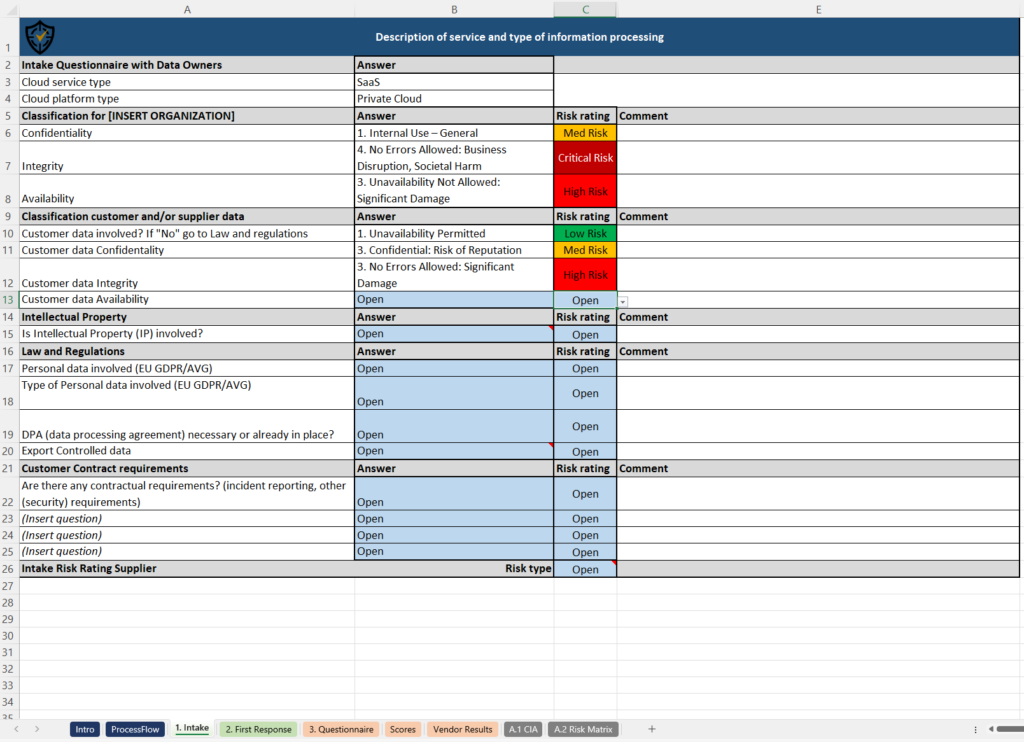

Vendor questionnaires are among the most common tools for collecting risk-related information directly from the source.

They help you probe several critical areas, including:

While Prevalent’s 2024 survey found that 75% of organizations use continuous monitoring feeds compared to 61% who use questionnaires, it’s important to note that these tools aren’t mutually exclusive.

Monitoring feeds capture external risk signals, while questionnaires provide deeper insights into internal controls and practices that the former simply can’t uncover.

For instance, here’s what a cybersecurity risk questionnaire template might look like:

Source: CyberZoni

The lack of insights collected through questionnaires like these would directly impact your organization’s ability to inspect and influence your vendors’ internal controls and practices, or take remedial action.

That’s why a well-designed cybersecurity questionnaire should aim to:

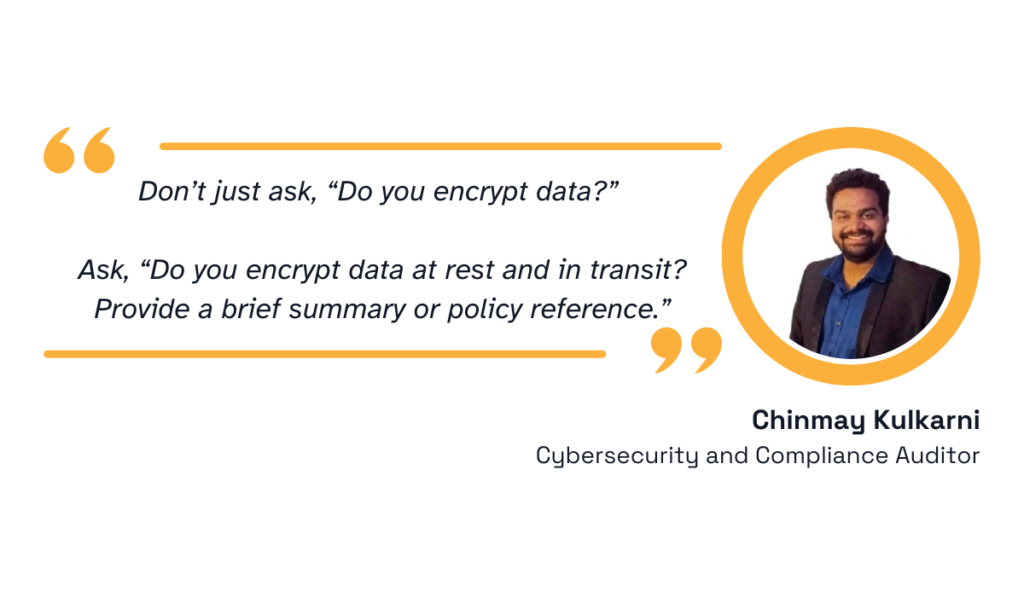

Chinmay Kulkarni, freelance cybersecurity and compliance auditor, notes that framing questions around specific practices helps make questionnaires more relevant and strategic.

Illustration: Veridion / Quote: LinkedIn

This principle applies beyond cybersecurity.

Compliance questionnaires assess a vendor’s adherence to regulations, financial questionnaires explore stability, and operational resilience questionnaires test business continuity.

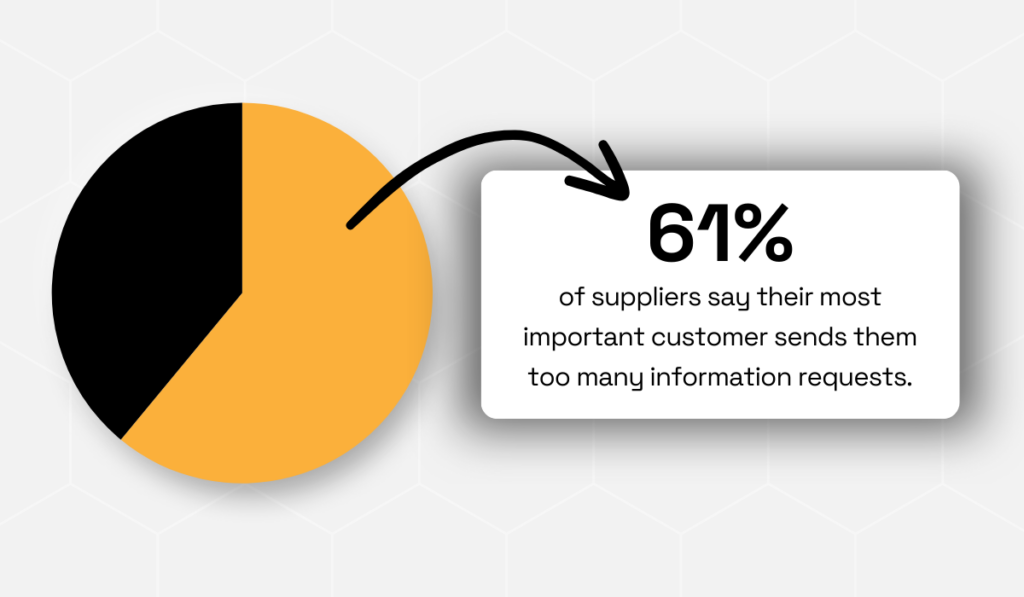

Each provides actionable insights, but only if you don’t overwhelm suppliers.

According to HICX, 61% of suppliers say their most important customer sends too many information requests.

Illustration: Veridion / Data: HICX

Repeated requests can quickly cause frustration, leading to incomplete responses and seriously eroded vendor relationships.

To avoid this, many procurement teams maintain a curated bank of preset questions that they can adapt to changing conditions.

This keeps questionnaires comprehensive yet focused, delivering useful insights without overloading suppliers.

The takeaway?

Use questionnaires as a targeted lens into your vendors’ practices, strengthening risk evaluation and decision-making while preserving key relationships.

On-site audits serve to directly evaluate vendor processes, controls, and security practices by visiting their facilities.

Unlike questionnaires, they provide a firsthand account of how a potential or current vendor actually operates, helping you expose gaps that may otherwise remain hidden.

Prompted by travel restrictions, many organizations have leaned toward remote or virtual audits in recent years.

Although more cost-effective and practical for preliminary checks or low-risk vendors, on-site audits remain irreplaceable, especially for critical or high-risk vendors.

The Economist research sponsored by GEP found that supply chain disruptions incur substantial financial costs, eating up 6–10% of annual revenues on average.

Illustration: Veridion / Data: The Economist Intelligence Unit

And that’s without taking into account indirect reputational costs.

Some organizations rely heavily on certifications such as ISO 27001, SOC 2, HIPAA, or PCI-DSS, but they can’t replace on-site audits either.

Yes, third-party certifications demonstrate adherence to recognized frameworks, but they don’t necessarily reflect how a vendor meets your specific operational needs.

Here’s a quick comparison between on-site audits and third-party certifications:

| Aspect | On-Site Audits | Third-Party Certifications |

|---|---|---|

| Conducted by | Your internal audit/risk/compliance team | Auditors from independent certifying bodies |

| Initiated by | Buyer – tailored to specific requirements | Vendor – to meet regulatory/market expectations |

| Purpose | Evaluate processes against the buyer’s risk profile | Demonstrate adherence to recognized external standards |

| Outcome | Direct assurance, often tied to contract terms | Formal certification that enhances vendor credibility |

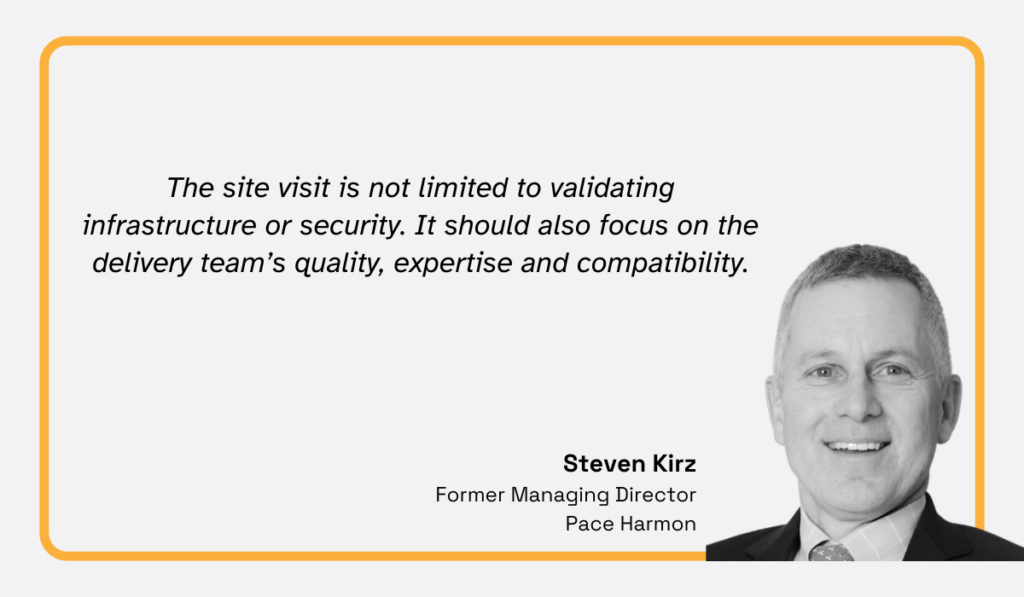

The bottom line is that seeing things with your own eyes is non-negotiable, and not just because of infrastructural conditions.

The opportunity to meet the people behind the processes is just as important.

Steven Kirz, Former Managing Director at Pace Harmon, argues that site visits enable you to assess the quality, expertise, and compatibility of the delivery team.

Illustration: Veridion / Quote: ISM

Remote calls can’t fully capture the expertise and the overall work culture of the team you’ll be working with.

Ultimately, site visits are essential because they enable you to evaluate both the systems and the people, giving you a holistic view of the partnership’s potential right off the bat.

Vendor data verification platforms provide accurate, up-to-date information about a vendor’s background, ownership, and market presence.

They reduce reliance on self-reported or outdated details, which can quietly undermine the accuracy of risk assessments.

And research shows that the scale of data accuracy issues is more concerning than you might think.

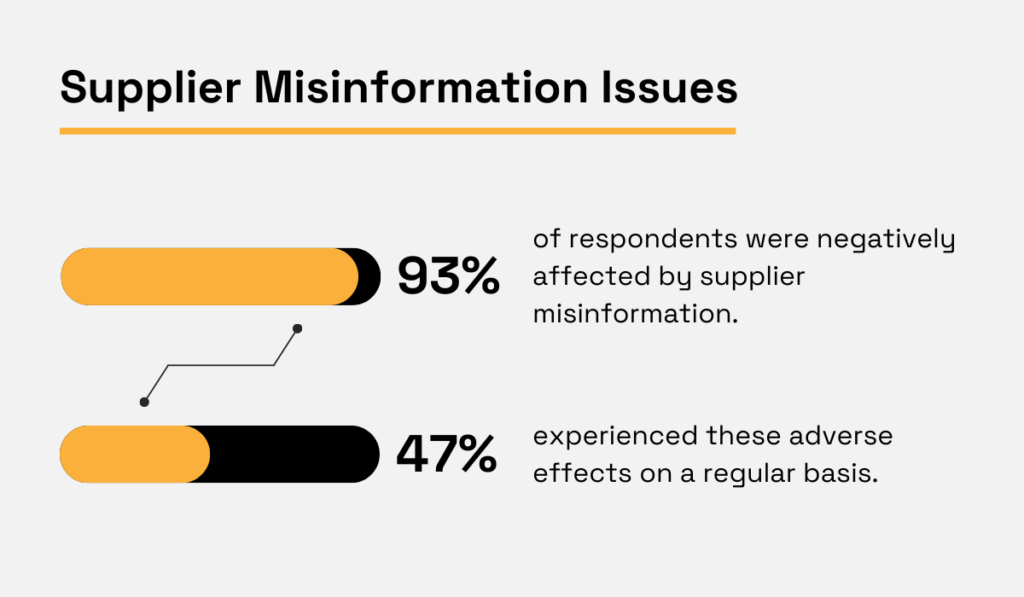

TealBook’s 2020 report showed that 93% of procurement and supply chain leaders had experienced adverse effects from supplier misinformation, while nearly half (47%) face such negative effects regularly.

Illustration: Veridion / Data: TealBook

The consequences of inaccurate data are far-reaching, leading to missed red flags about ownership ties and overlooked hints of compliance issues or bankruptcy.

Imagine onboarding a logistics provider only to discover months later, after delays and service breakdowns, that you based your decision on outdated figures.

In reality, the company had been quietly struggling, thereby inviting a greater threat of disruptions, reputational damage, and costly re-sourcing under pressure.

But that’s where vendor data verification platforms come in.

These tools continuously validate and refresh supplier information, creating a reliable foundation for vendor risk assessment.

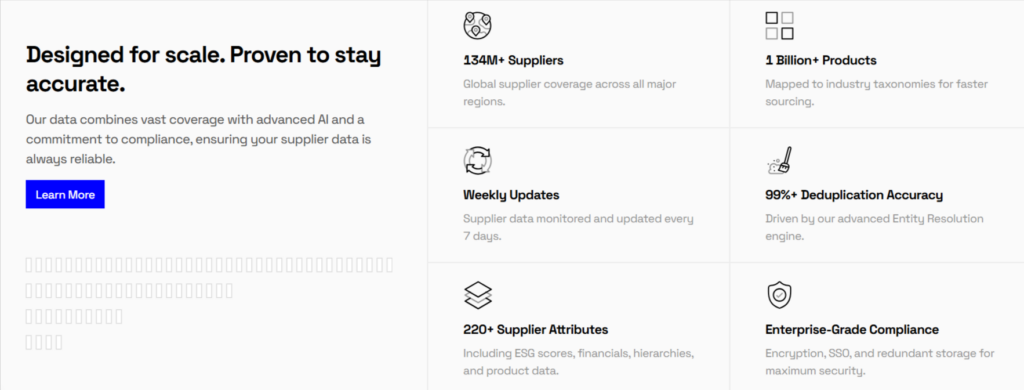

Veridion, for example, offers AI-powered insights across a global dataset of over 134 million companies, supplying you with verified, weekly-updated data for vendor management and risk evaluations.

Source: Veridion

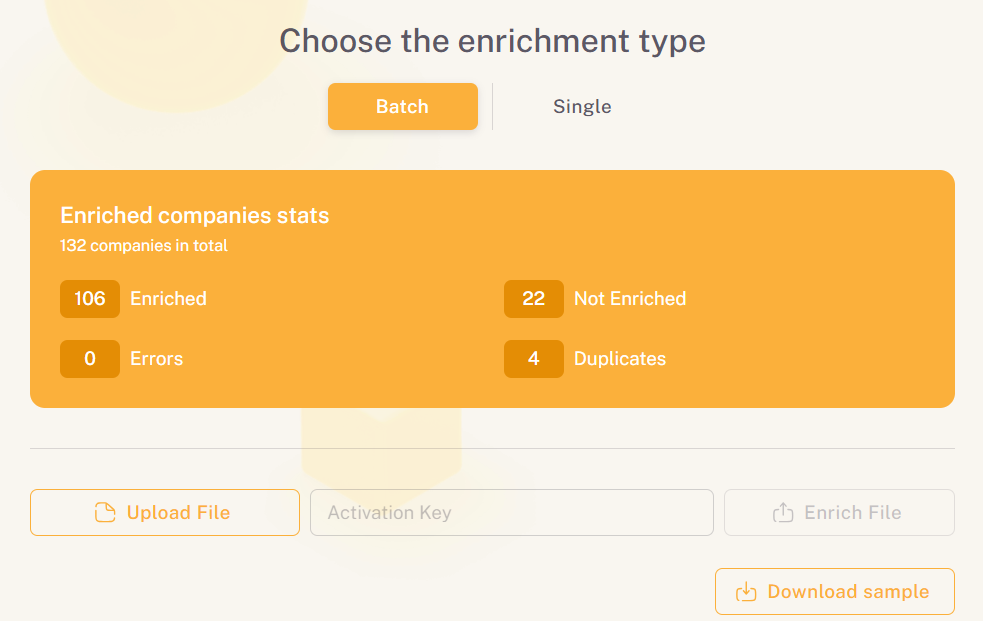

Its Match & Enrich capability automatically aligns your vendor records with verified company data, enriching them with over 220 critical attributes like ownership, subsidiaries, and operational footprint.

Most importantly, these detailed insights are easy to access and act on thanks to an intuitive interface that gives you all the essential stats at a glance.

Source: Veridion

The platform also integrates seamlessly with your existing systems via APIs, so your assessments rest on a constantly refreshed stream of reliable data.

That way, risk evaluations are both comprehensive and trustworthy, not static or outdated.

Relying on vendor data verification platforms ensures your risk assessments are based on the latest data, safeguarding you against unpleasant surprises down the line.

Risk scoring models assign numerical or categorical values to different risk categories.

This would include, for example, financial stability, compliance posture, or cybersecurity readiness.

By turning risk into measurable outputs, they provide a standardized way to compare vendors at a glance and prioritize those that require closer scrutiny.

Supplier scorecards are one of the most common applications of risk scoring, used for vendor selection, performance monitoring, and ongoing risk management.

Source: Veridion

But they’re only one form.

Broader scoring systems can be built into procurement workflows, due diligence processes, or enterprise-wide risk management platforms.

The real value lies in the way scoring supports prioritization.

After all, organizations with hundreds or thousands of suppliers can’t audit everyone equally.

Quantitative scoring ensures resources are allocated to high-risk vendors, replacing subjective judgments with measurable insights.

Compared to qualitative reviews, which vary by evaluator and department, this kind of risk scoring introduces consistency, comparability, and the ability to track trends over time.

Laura Greenwood, Third Party Assurance Managing Consultant at Crossword Cybersecurity Plc, points out that assessment tools like scorecards create an environment where supplier risks can be recorded, visualized, and understood in their entirety.

Illustration: Veridion / Quote: CPO Strategy

This visibility is why scorecards remain a reliable and adaptable source of information.

They can be updated as conditions change and shared across teams to align understanding.

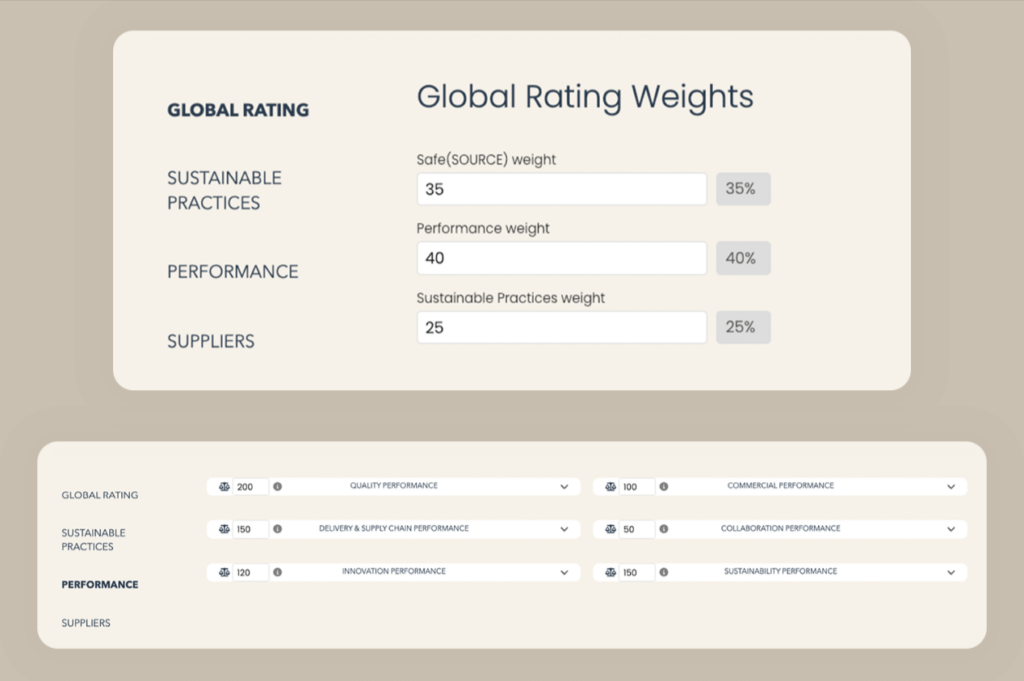

Here’s what that looks like in practice.

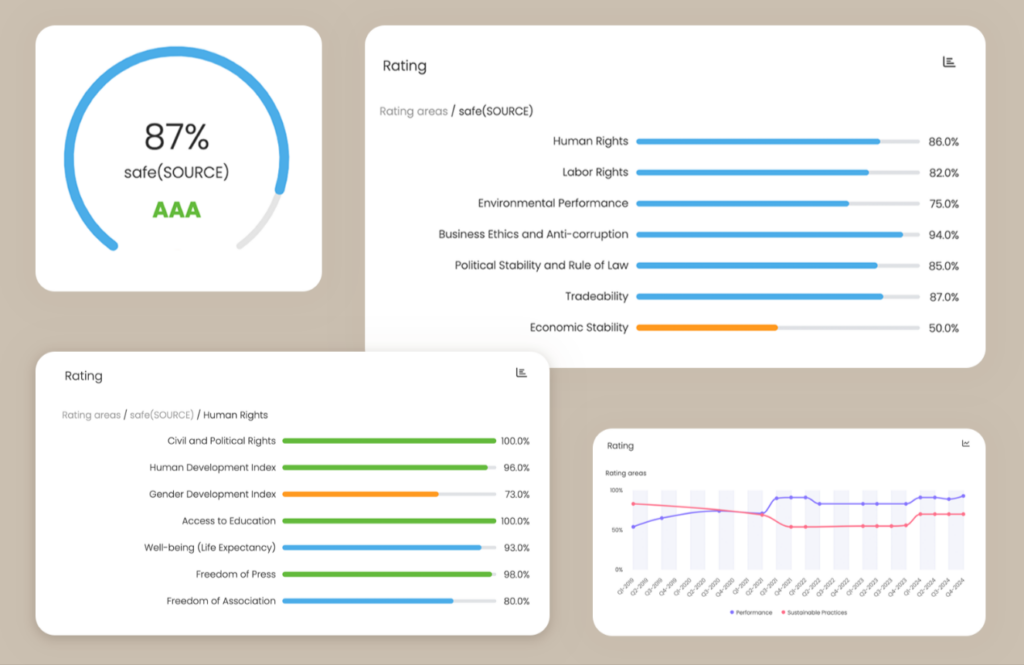

Kodiak Hub’s dashboard, for instance, clearly visualizes risk scoring areas such as human rights, environmental performance, business ethics and anti-corruption, and economic stability.

Source: Kodiak Hub

Beyond visualization, customization is crucial.

Kodiak Hub also allows global teams to apply weighting, i.e., deciding how much importance to assign to each category.

For example, one business unit may weigh sustainability higher, while another emphasizes financial resilience.

Source: Kodiak Hub

Businesses that use risk scoring tools also benefit from automated notifications.

If a supplier falls below these predefined thresholds, you’ll immediately receive an alert, thus enhancing both efficiency and resilience.

To sum up, ongoing risk scoring ensures risk management is proactive, consistent, and tailored to what matters to your organization.

Compliance management systems (CMS) are the backbone of vendor risk oversight.

At its core, this structured set of tools and controls automates compliance, helping organizations verify whether vendors meet relevant laws, standards, and industry regulations.

Recent data underscores why these systems matter.

According to one study, 60% of organizations now prioritize redundancy and resilience over speed and efficiency in their supply chains.

Illustration: Veridion / Data: The Economist Intelligence Unit

That shift signals a new reality:

One where continuity and reliability are part of compliance expectations, and not just operational preferences.

In heavily regulated sectors like finance, healthcare, and critical infrastructure, proving that suppliers can withstand disruption has become as important as demonstrating cost-effectiveness.

Yet readiness is uneven.

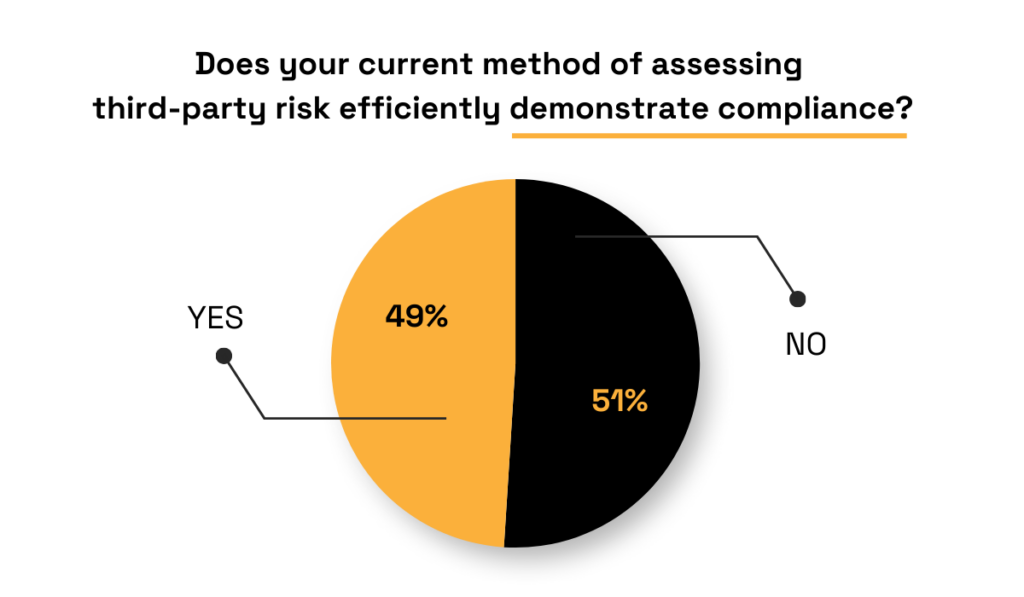

Prevalent’s survey found that slightly more than half of organizations lack sufficient automation or reporting to demonstrate compliance, thus impeding third-party risk assessments.

Illustration: Veridion / Data: Prevalent

This gap creates a double risk: falling short of regulator requirements while also failing to anticipate vendor breakdowns impacting supply chains.

A CMS provides a framework that can close it, reducing compliance blind spots, strengthening supplier relationships, and mitigating cascading risks in the process.

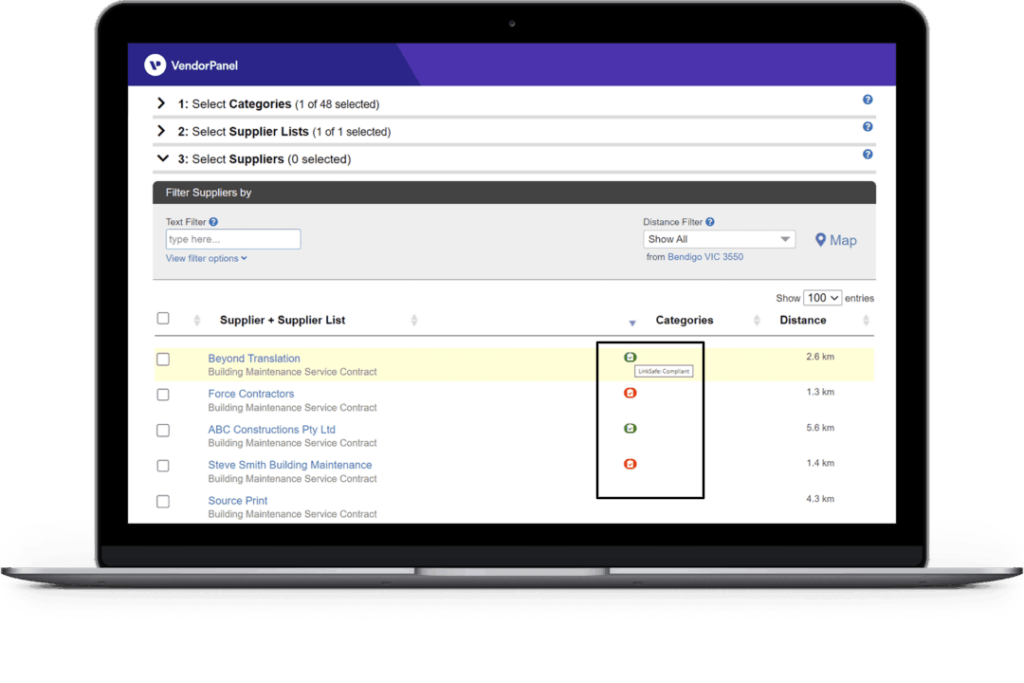

Compliance management systems typically cover vendor onboarding, qualification, ongoing monitoring, and performance evaluation.

By embedding vendor risk assessments into compliance workflows, companies can transform abstract concepts like “resilience” into measurable, auditable criteria.

In practice, this means that certification tracking, audit results, and regulatory obligations are centralized, informing you that a vendor has completed required checks before any interaction is made.

Source: Vendor Panel

With automation and visibility, compliance checks become standardized, documentation is centralized, and due diligence is easier to demonstrate.

To put it differently, you’re satisfying regulator demands while also reassuring internal teams and stakeholders that obligations have been systematically addressed.

In an environment where regulators and customers alike demand assurance, CMS turns compliance from a box-ticking exercise into a symbol of operational resilience.

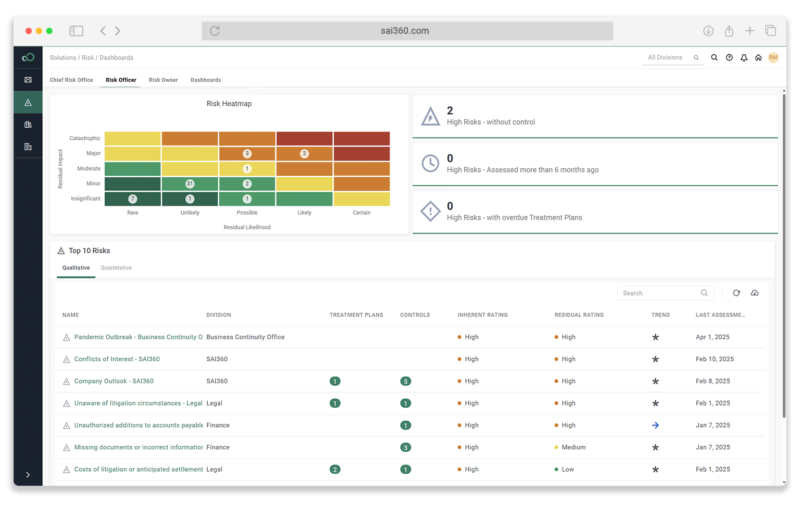

Third-party risk management (TPRM) platforms are designed to cover the entire vendor lifecycle, from onboarding and due diligence to ongoing monitoring and offboarding.

For organizations managing large or complex vendor ecosystems, these platforms centralize risk data, automate workflows, and provide dashboards that consolidate visibility across suppliers.

Now, why would you need TPRM platforms on top of the other systems we mentioned?

For one, the vendor risk landscape is continuously evolving, as explained by Daniel Hartnett, Third-Party Risk Director at LSEG.

Illustration: Veridion / Quote: Financier Worldwide

This fact alone makes automation indispensable.

TPRM platforms allow companies to define risk factors such as supplier financial instability or regulatory lapses and receive real-time alerts when these occur.

As shown below, risks can be viewed at a glance, often in the form of tables and heat maps that combine top risk categories, assessment dates, and active alerts.

Source: SAI 360

This structured view transforms what could otherwise be fragmented signals into actionable intelligence.

Still, coverage across all stages of the third-party risk lifecycle remains uneven.

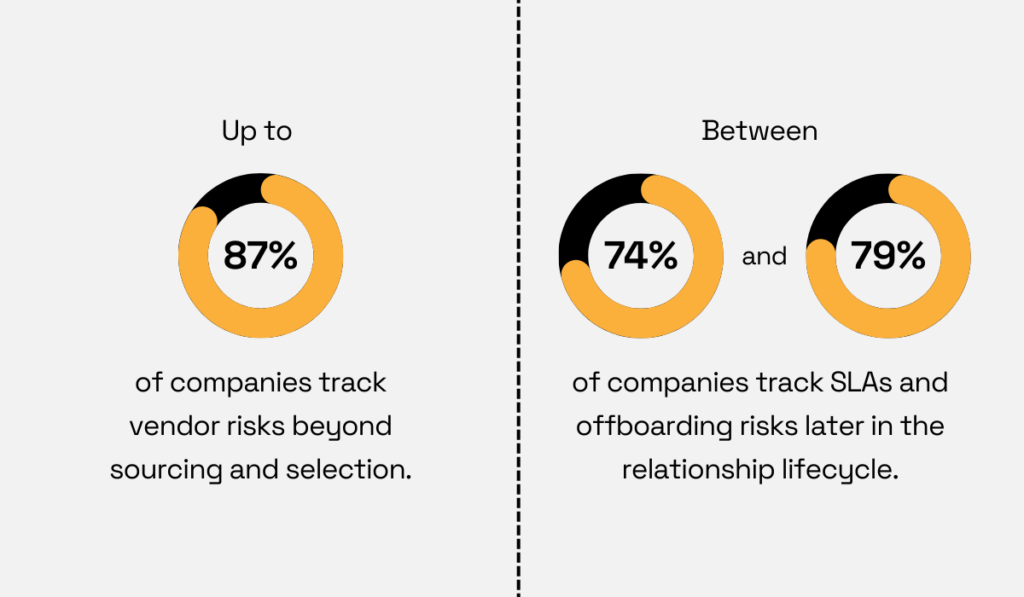

According to Prevalent, while 85–87% of organizations practice ongoing monitoring after onboarding, only 74–79% track service-level agreements (SLAs) and offboarding risks.

Illustration: Veridion / Data: Prevalent

This gap is significant because risks don’t end when a contract does.

Termination carries its own set of challenges related to:

Perhaps most critically, failure to revoke a vendor’s access to networks, systems, or facilities creates lingering vulnerabilities that can lead to data breaches.

By embedding offboarding controls alongside onboarding, monitoring, and performance evaluation, TPRM platforms ensure that no stage is left unmanaged.

The value of third-party risk management platforms lies in creating a consistent, auditable record of vendor relationships that’s updated in real time.

Vendor risk management requires you to embed resilience into every stage of the supplier lifecycle.

From risk scoring to compliance systems and full-scale TPRM platforms, the types of tools we covered in this guide exist to reduce blind spots and strengthen oversight.

The next step is to assess whether your current practices and technology can keep up with evolving risks.

Remember: investing in the right systems today means fewer disruptions, stronger compliance, and more strategic value tomorrow.