What Is Vendor Risk Management?

Key Takeaways:

Every vendor partnership introduces opportunities mixed with risks.

Whether it’s compliance gaps, financial instability, or cybersecurity vulnerabilities, companies need to stay two steps ahead.

And that’s exactly what vendor risk management helps you achieve, even in an unpredictable business environment.

This guide outlines key reasons for adopting this approach, as well as specific practices to help you safeguard your organization’s profitability and reputation.

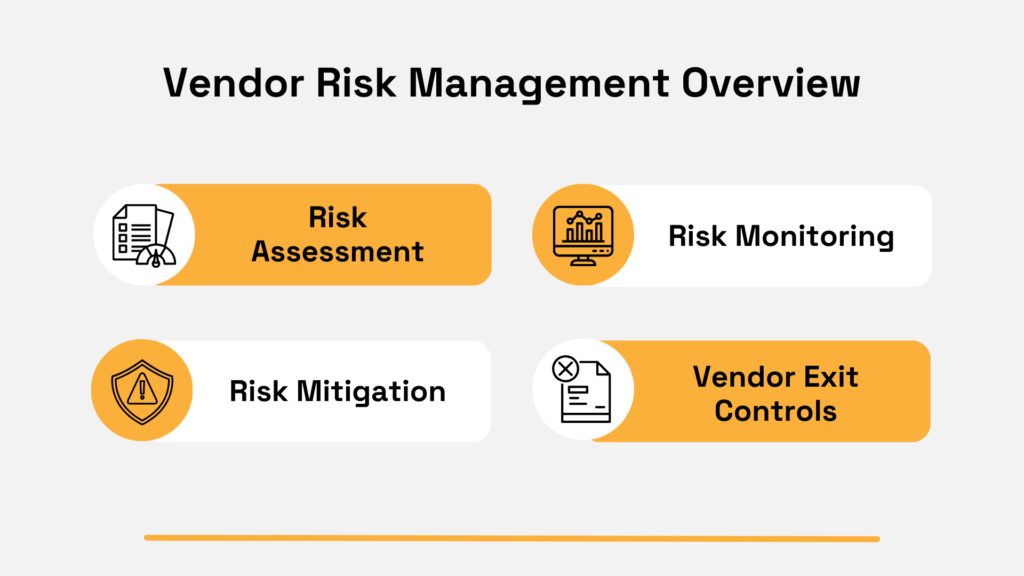

Vendor risk management focuses on identifying, assessing, and mitigating risks that vendors may introduce to your organization, from compliance issues to broader financial instability.

Having a comprehensive vendor risk program in place enables you to spot potential threats originating from your vendors, including:

With robust frameworks and tools to assess the likelihood and impact of these risks, even the biggest organizations can stay on top of evolving vendor and TPRM risks in general.

Source: Veridion

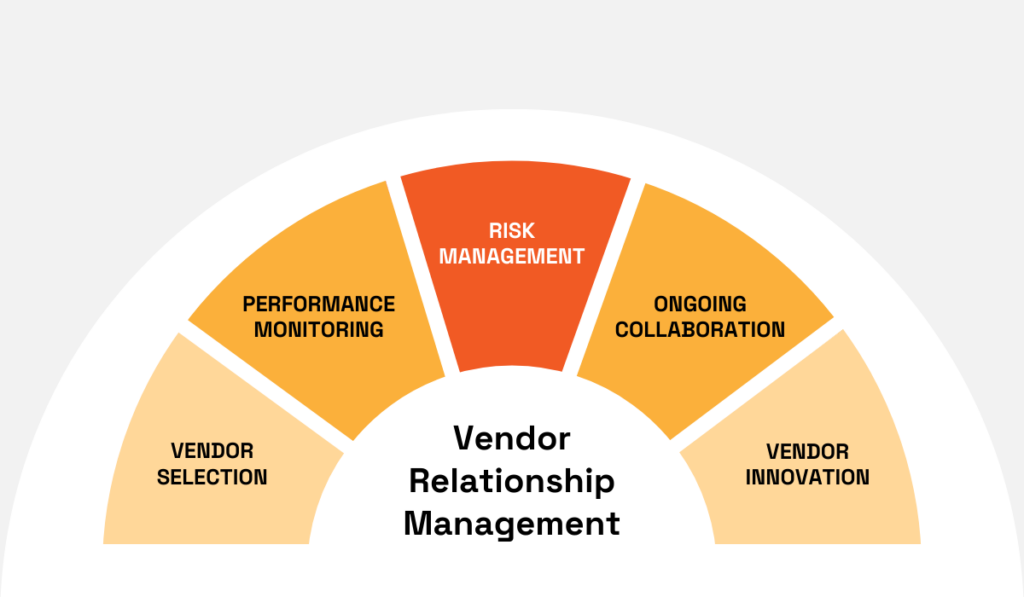

Vendor risk management guarantees that you can proceed safely with a specific vendor relationship, making it a pillar of many vendor relationship management programs.

And that’s exactly where the difference between the two lies.

Vendor relationship management is a broader concept that includes selection, onboarding, performance oversight, governance, incentives, collaboration, innovation, and exit strategies.

As a whole, it enables you to build and maintain strong, win-win relations with your vendors, maximizing value in terms of better quality products, cost cuts, joint innovation, and more.

In other words, risk management is just one segment within the vendor relationship umbrella, as shown below.

Source: Veridion

Another key point to note here is the difference in mindset that guides the two.

Vendor risk management is oriented toward protection and resilience, while relationship management is more opportunity and growth-oriented.

While it’s true that the former enables the latter, it’s essential to clarify the nature of risk management.

This is how Tony Martin-Vegue, a technology risk consultant previously affiliated with the likes of Netflix, puts it:

Illustration: Veridion / Quote: LinkedIn

No vendor is without risk, and your business success will always depend on a broad network of vendor partnerships.

As such, the focus can’t be on eliminating risk, but ensuring you’re in a position to make the best vendor decisions possible.

Managing vendor risks helps your organization mitigate or even avoid incidents altogether.

Simply put, it creates a shield to keep you away from regulatory fines, data breaches, and or ripple effects of vendor scandals.

Let’s explore how in more detail.

At its most fundamental level, managing vendor risks helps you protect yourself against regulatory penalties.

Let’s take ESG as an example.

There are plenty of reasons to focus on environmental, social, and governance, from making the most of innovative supplier technologies to countering hidden supply chain risks.

However, BARC’s research shows that the number of companies citing compliance as the main reason behind their ESG reporting efforts jumped from 38% to 59% in just one year.

The reason? Avoiding regulatory penalties.

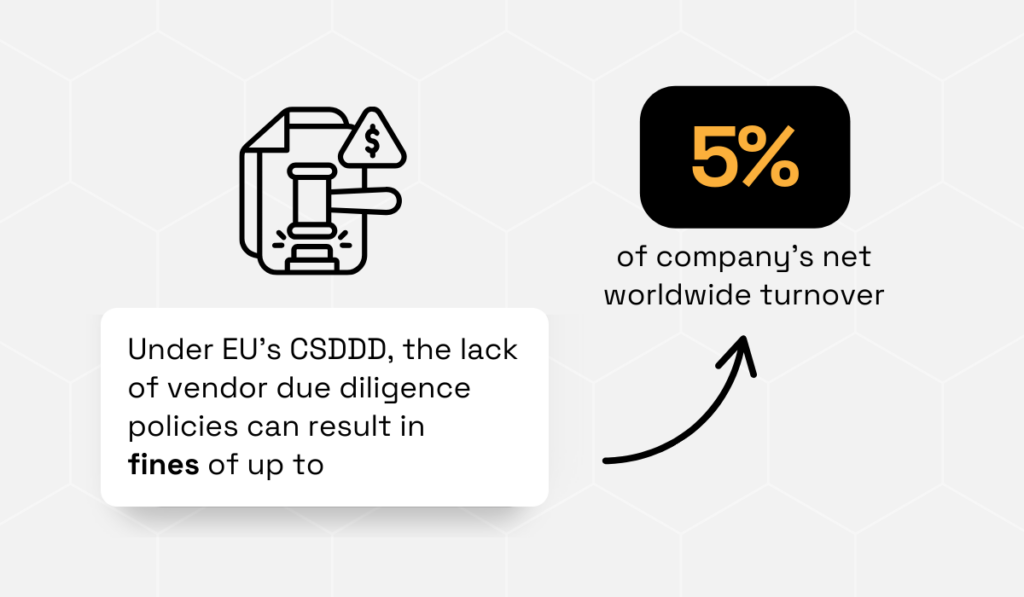

The risks increase given the evolving legal frameworks, such as the EU’s Corporate Sustainability Due Diligence Directive (CSDDD).

According to the World Economic Forum, simply failing to outline vendor due diligence policies can easily lead to investigations and fines of up to 5% of a company’s net worldwide turnover.

Illustration: Veridion / Data: World Economic Forum

And it’s hardly only European regulators who are taking ESG policies seriously.

In 2022, the U.S. investment bank and financial giant Goldman Sachs was fined $4 million for its ESG compliance violations.

Source: Financial Times

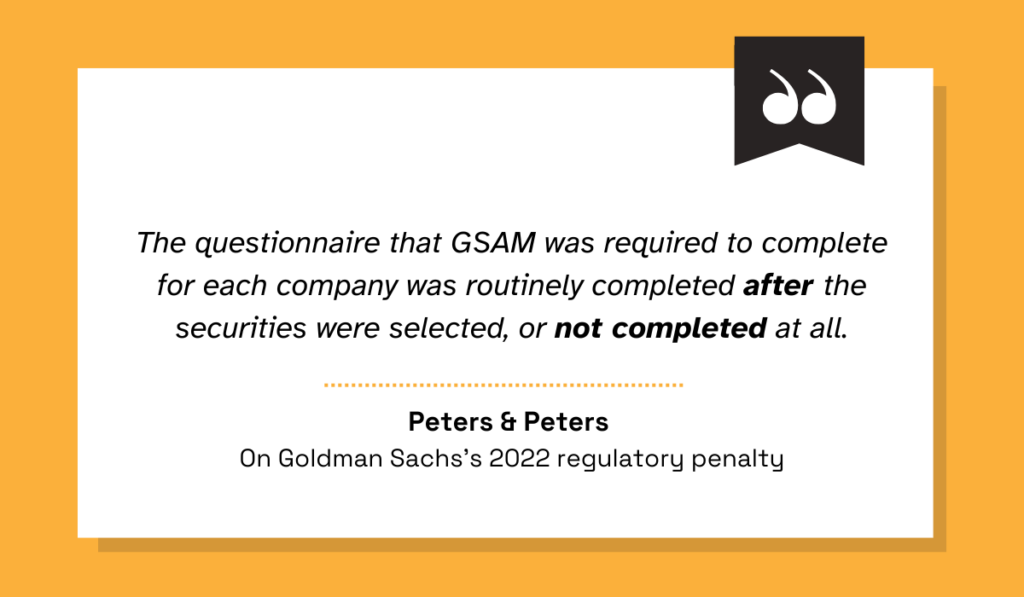

UK-based solicitors, Peters & Peters, took a closer look at the 2022 case, highlighting the regulator’s findings that GSAM operated without the necessary written policies and procedures.

What’s worse, even after the required policies were put in place, there was simply no follow-through when it came to obligatory screening of companies.

As records show, ESG evaluation was conducted after the company’s inclusion in product investment portfolios, and sometimes not even then.

Illustration: Veridion / Quote: Peters & Peters

Now imagine this scenario with vendor questionnaires and your partners’ supply chain.

If vendors fail to meet compliance obligations, your company is the first in line to be exposed to fines, audits, and reputational damage.

Managing vendor risks ensures you only work with partners who meet the right standards, safeguarding both your finances and brand credibility.

Another compelling reason to invest in vendor risk management is to safeguard sensitive data.

Vendors often have access to critical customer or business data, or simply provide products and services that are ideal entry points for cyberattacks.

Most recently, a cyberattack targeting a third-party technology vendor affected airports in four countries, disrupting passenger flights across Europe.

Source: Cybersecurity Dive

As was later confirmed by Collins Aerospace’s parent company, RTX Corp., widespread delays and cancellations were a result of a ransomware attack targeting check-in and boarding systems.

While RTX stated that they didn’t expect the attack to have a material impact on operations or its financial condition, financial and reputational repercussions are rarely avoidable.

Software supply chain attacks, in which vendor software is unknowingly compromised, exposing your sensitive data and entire system to hackers, are gaining more attention.

IBM’s 2023 report shows that this type of attack accounted for 12% of recorded data breaches, costing companies $4.63 million on average.

Illustration: Veridion / Data: IBM

While it can be difficult to guard against compromised vendor software, lax vetting procedures, and weak oversight of suppliers significantly raise the risk of cyberattacks.

In addition to high recovery costs and potential regulatory scrutiny, affected organizations are looking at lasting reputational harm.

This is why comprehensive risk management is so important.

Dedicated vendor risk management programs help ensure that only those vendors with strong security practices will be handling sensitive information.

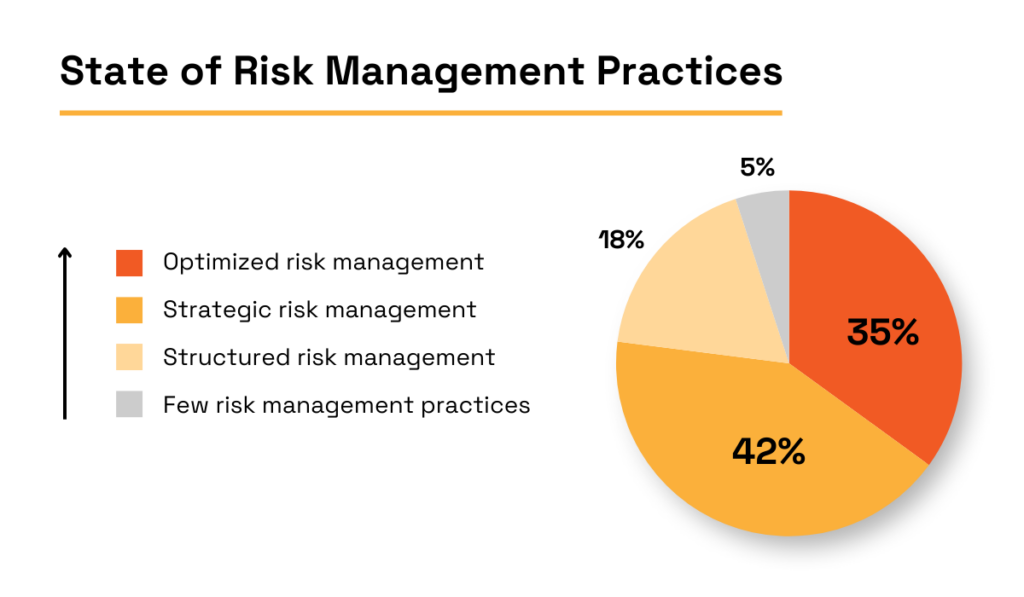

And, Auditboard’s research shows that 77% of surveyed organizations are either moving towards or already practicing cohesive risk management.

Illustration: Veridion / Data: Auditboard

In practice, this means that teams, processes, data, and technology are fully integrated, giving you a 360-degree view of all risks, including those inherent to vendor relationships.

Ultimately, staying operational and safeguarding sensitive data gives you a major incentive to practice cohesive and thorough vendor risk management.

Investing in vendor risk management is one of the most effective ways to keep your brand reputation intact.

Reputation is fragile.

One vendor’s unethical behavior, poor quality standards, or public scandal can erode trust in your company simply by association.

And while reputations may take decades to build, once customer and stakeholder confidence is lost, recovery is painfully slow.

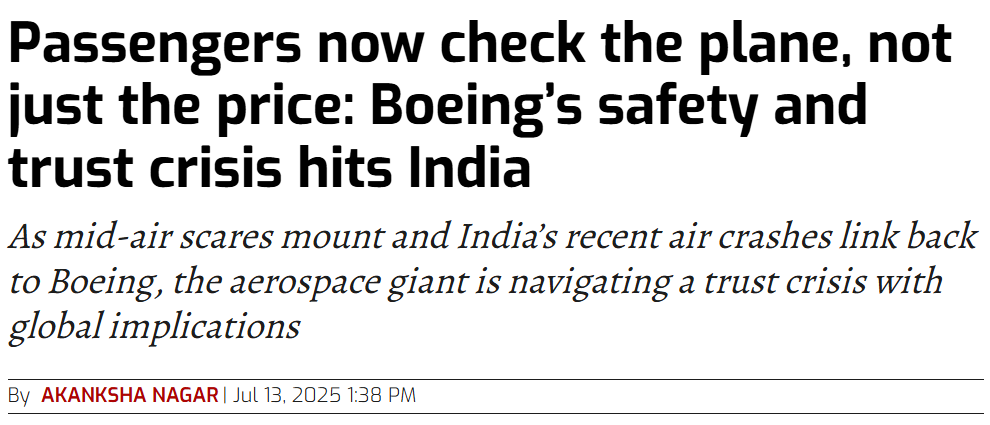

The 2018 and 2019 crashes of the 737 MAX triggered Boeing’s ongoing credibility crisis.

Not five years later, the company faced additional scrutiny.

Following the 2024 Alaska Airlines door-plug incident, the FAA audit uncovered serious quality-control lapses at both Boeing and its key supplier, Spirit AeroSystems.

Fast-forward a few months, and the company was dealt another reputational blow after a fatal 787 Dreamliner crash in India amplified questions about Boeing’s safety culture.

Source: Storyboard 18

As headlines confirm, the reputational fallout has been global, affecting Boeing’s customer confidence, regulatory standing, and market position.

But surely not all of that is a result of poor vendor management?

While it’s true that multiple factors contributed to Boeing’s fall from grace, here’s one interesting point that traces back to vendor risks.

In his analysis, Army Colonel and Leadership Coach Damon Wells highlights Boeing’s overall shift in the company’s mindset.

Illustration: Veridion / Quote: Medium

The increased focus on the bottom line also meant diminished oversight of suppliers, which is a dangerous blind spot for any company that prides itself on its engineering excellence.

And this is where vendor risk management becomes critical.

While poor vendor oversight creates reputational vulnerabilities, strong risk management helps preserve trust through systematic monitoring and clear procedures and requirements.

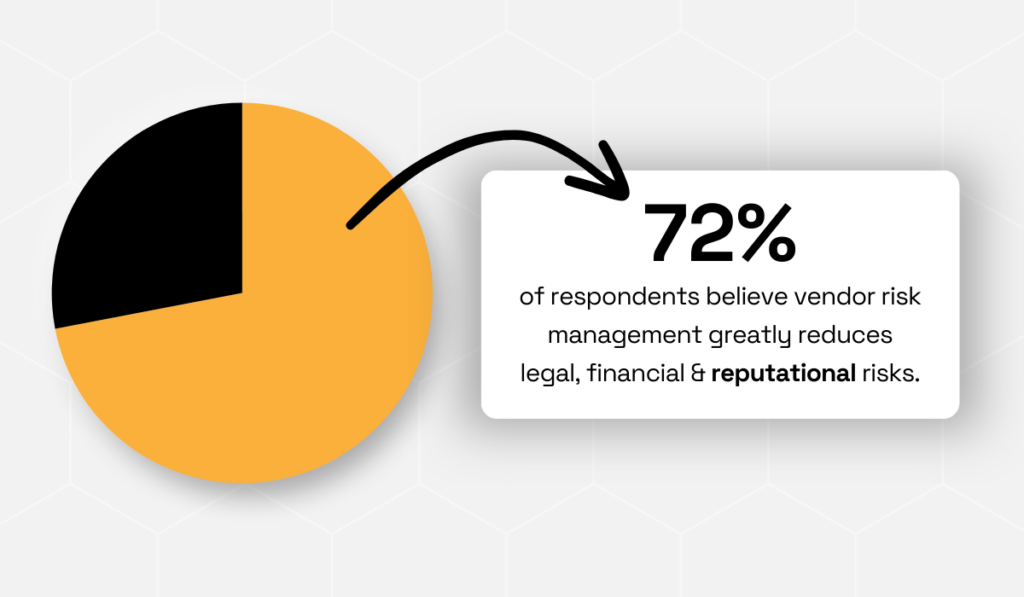

According to Navex, 72% of organizations identify vendor risk management as one of the most effective strategies for reducing legal, financial, and reputational risk.

Illustration: Veridion / Data: Navex

Ultimately, organizations need to put more concentrated effort into proactively managing vendor risks.

No system can eliminate issues, but ongoing risk management creates a reputational buffer while giving you the means to sharpen your competitive edge.

We’ve established some of the key reasons for you to develop and implement vendor risk management practices.

Now, it’s time to take a closer look at how to do that.

Organizations should never treat vendor onboarding as a mere formality.

A structured due diligence process lays the groundwork for identifying risks before contracts are signed.

This baseline of assessing a vendor’s financial health, compliance history, data security, and operational reliability is especially important given today’s complex, multi-tiered supply chains.

As BCI’s Knowledge Strategist Rachael Elliott notes, organizations are beginning to dig deeper, extending due diligence well beyond their immediate suppliers.

Illustration: Veridion / Quote: BCI

But scaling such efforts requires both standardization and prioritization.

Vendor questionnaires, verification platforms, and background checks provide consistency, while risk-tiering ensures your resources are directed where they matter most.

Keep in mind, though, that even the foundations require periodic reviews.

Early assessments need to remain valid in the face of a shifting risk environment, a point reinforced by Richard Reichman, partner at BCL Solicitors.

Illustration: Veridion / Quote: Raconteur

In short, thorough and recurring due diligence forms the backbone of effective vendor risk management.

Engaging in continuous risk monitoring isn’t optional.

Since vendor risks are never static, you need to look at financial stability, compliance status, and cybersecurity resilience throughout the vendor relationship.

Yet most organizations still fall short.

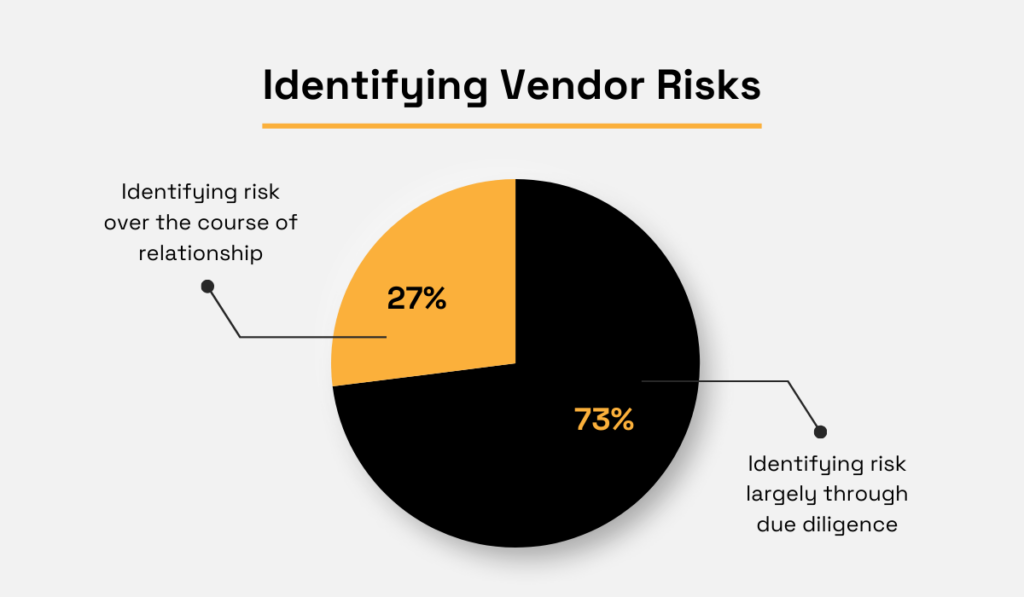

Gartner’s 2019 TPRM model found that legal and compliance leaders devote only 27% of their ongoing efforts to identifying vendor risks.

Illustration: Veridion / Data: Gartner

Such a limited focus means that problems are often detected only after damage occurs.

And modern risks make such reactive approaches even more obsolete and unsustainable.

As risk management specialist Björn Hartong points out, climate change, cybersecurity vulnerabilities, and geopolitical instability are three of the most pressing and constantly evolving risk exposures.

Illustration: Veridion / Quote: BCI

Of course, all mitigation efforts rest on sufficient foresight.

For geopolitical risk, in particular, tools like supply chain mapping and supplier location intelligence can help your organization understand where risks originate and prepare the most relevant contingency strategies.

It boils down to this: Continuous monitoring equips companies with the agility needed to respond before crises escalate.

Technology has become indispensable to modern vendor risk management.

Platforms and enrichment tools streamline repetitive tasks such as monitoring, reporting, and recordkeeping.

Automation, on the other hand, ensures assessments remain current without overburdening compliance teams.

It’s not surprising, then, that EY research has found that two-thirds of organizations are either already using automation in risk management or actively exploring its potential.

Illustration: Veridion / Data: EY

Automation supports a range of use cases, from generating comprehensive risk scores and monitoring for regulatory changes to updating compliance certifications in real time.

By reducing manual effort, these tools free up teams to focus on higher-value activities like strategy and relationship management.

This is also where enriched vendor intelligence makes a difference.

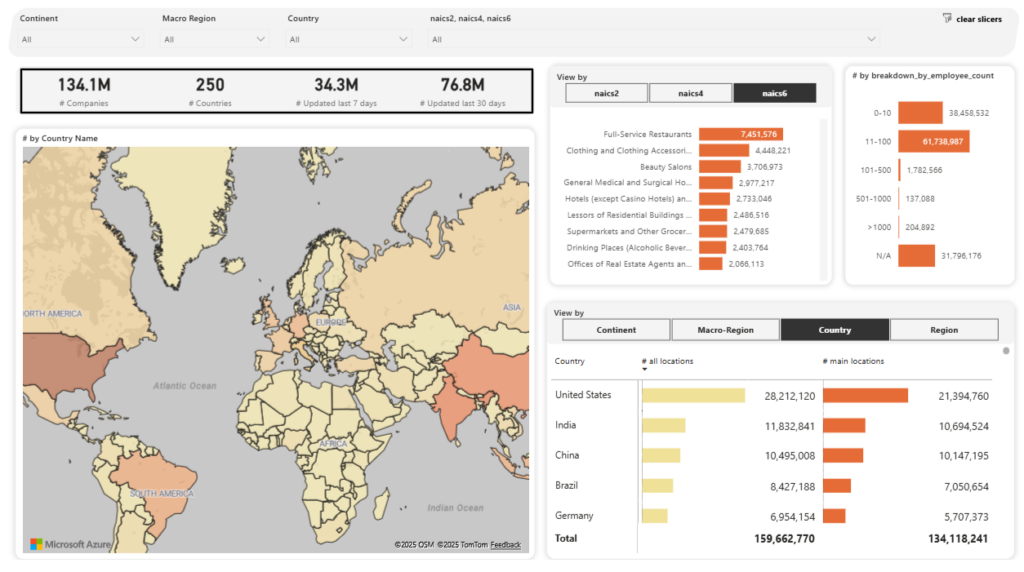

For example, Veridion’s AI-powered platform provides global coverage of over 134 million company profiles across 250 countries, with 220+ enriched attributes.

Not only is all the data at your fingertips, but it stays fresh thanks to weekly updates.

Source: Veridion

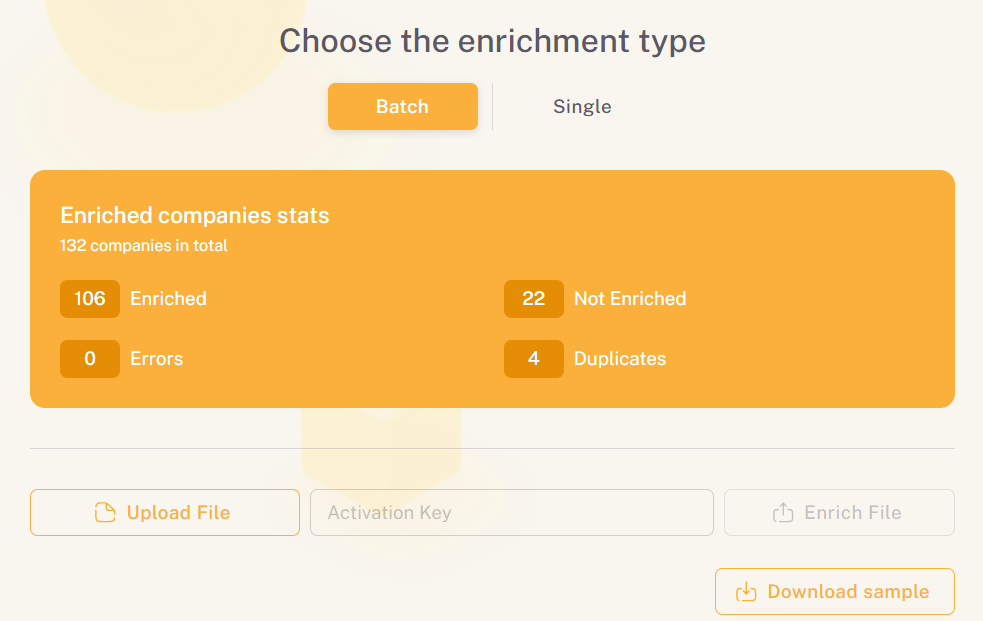

Veridion’s enrichment dashboard simplifies vendor management, as it allows users to refresh vendor profiles with natural language queries, keeping critical data both accurate and accessible.

Source: Veridion

By pairing automation with enriched data, organizations gain sharper visibility into their supply base and the agility to respond to emerging risks.

Given all the benefits, the only conclusion is that technology has become the foundation for scalable, effective vendor risk management.

Identifying risks will mean little unless you have clear, actionable steps to address them.

This includes well-defined mitigation strategies, clearly assigned responsibilities, and dedicated tools for tracking the resolution of each logged incident.

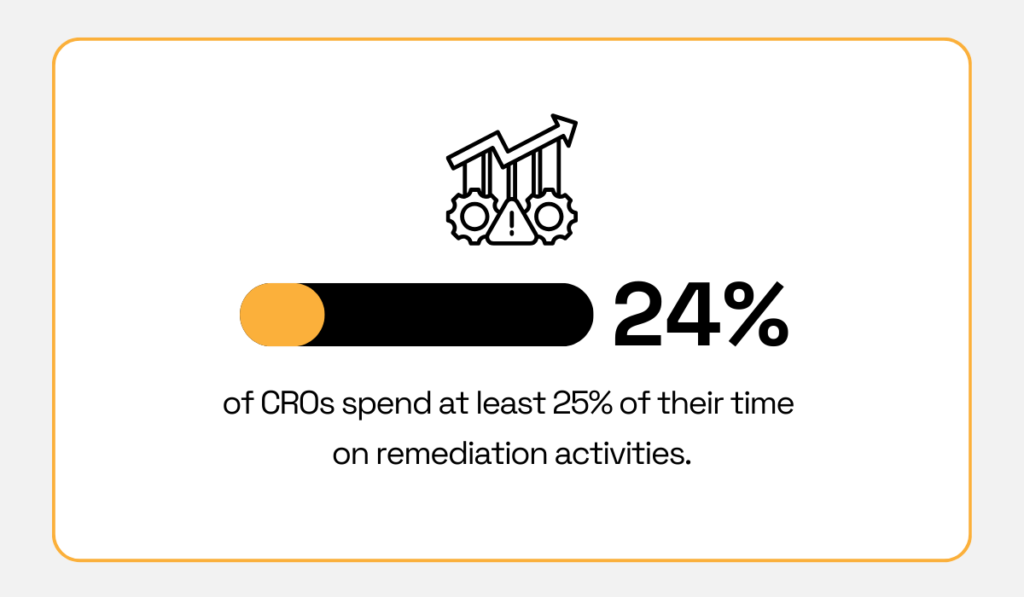

Consider this statistic.

The aforementioned EY research shows that, while Chief Risk Officers devote most of their time to traditional risk management, only 24% of them focus equally on remediation activities.

Illustration: Veridion / Data: EY

Keep in mind, though, that these numbers don’t automatically reflect the lack of attention for these processes.

If you have strong detection frameworks and effective risk prevention in place, you’ll simply spend less time on remediation.

Alternatively, it can reflect the presence of robust mitigation plans and software solutions.

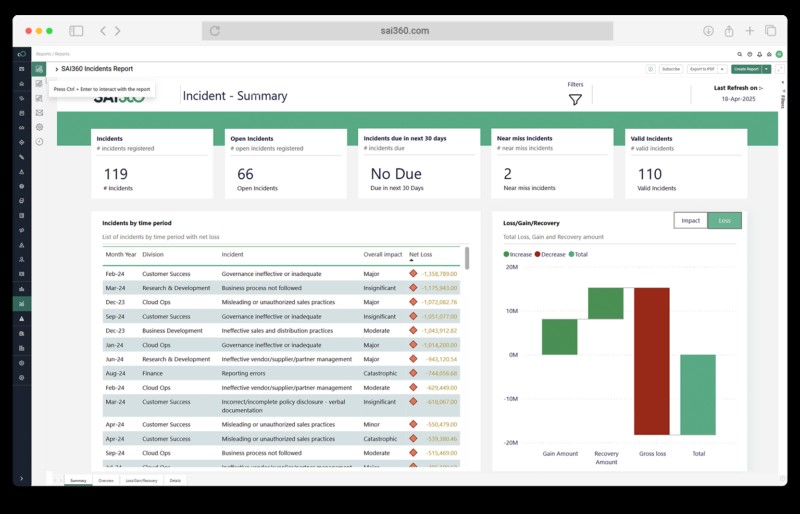

Dedicated TPRM tools can streamline incident management, offering modules to automate intake, investigation, and response workflows.

Source: SAI360

These tools enable faster, more consistent responses, ensuring teams can extract deeper insights into root causes and impacts.

Ultimately, clear risk mitigation plans turn vendor risk management from a reactive process into a proactive shield, safeguarding both operations and reputation.

Vendor risk management and relationship management may serve different purposes, but they converge on a single truth: partnerships only thrive when they are both productive and safe.

Organizations that embed risk awareness into vendor relationship-building gain the foresight to prevent compliance violations, data breaches, and costly disruptions.

Now is the time to reassess your strategies and strengthen oversight with targeted tools and processes.

Done well, this approach will help you avoid pitfalls and unlock lasting value.