How Veridion Saves $2 Million Monthly by Going Bare Metal

The most dangerous decision a deep tech founder can make is choosing comfort today over power tomorrow. We’re often told there are two paths for a startup: the path of short-term velocity and the path of long-term, compounding power. Conventional wisdom, backed by a deluge of cloud credits and slick marketing, tells you to always choose the first. Spin up the cluster, deploy the code, and worry about the bill later.

However, for a deep tech company, one whose very essence is intertwined with massive data processing, complex AI models, and relentless R&D, this conventional wisdom is dangerously flawed. Your cloud bill isn’t just an expense; it’s a leading indicator of your startup’s future potential. And right now, it’s probably telling you that you’re buying the wrong thing.

This article was partly inspired by Digital Society’s write-up on their move to Hetzner Cloud. Reading their breakdown made us realize we should share our own story too; what we did, why we did it, and what we learned along the way.

For a deep tech startup, there is one resource you can never have too much of: compute. Compute is the lifeblood of innovation. It’s the engine that runs your machine learning pipelines, the power that ingests petabytes of data, and the force that uncovers the answers to incredibly difficult questions. Your goal as a founder or CTO should not be to simply manage your infrastructure budget, but to get the absolute maximum compute power from every single dollar.

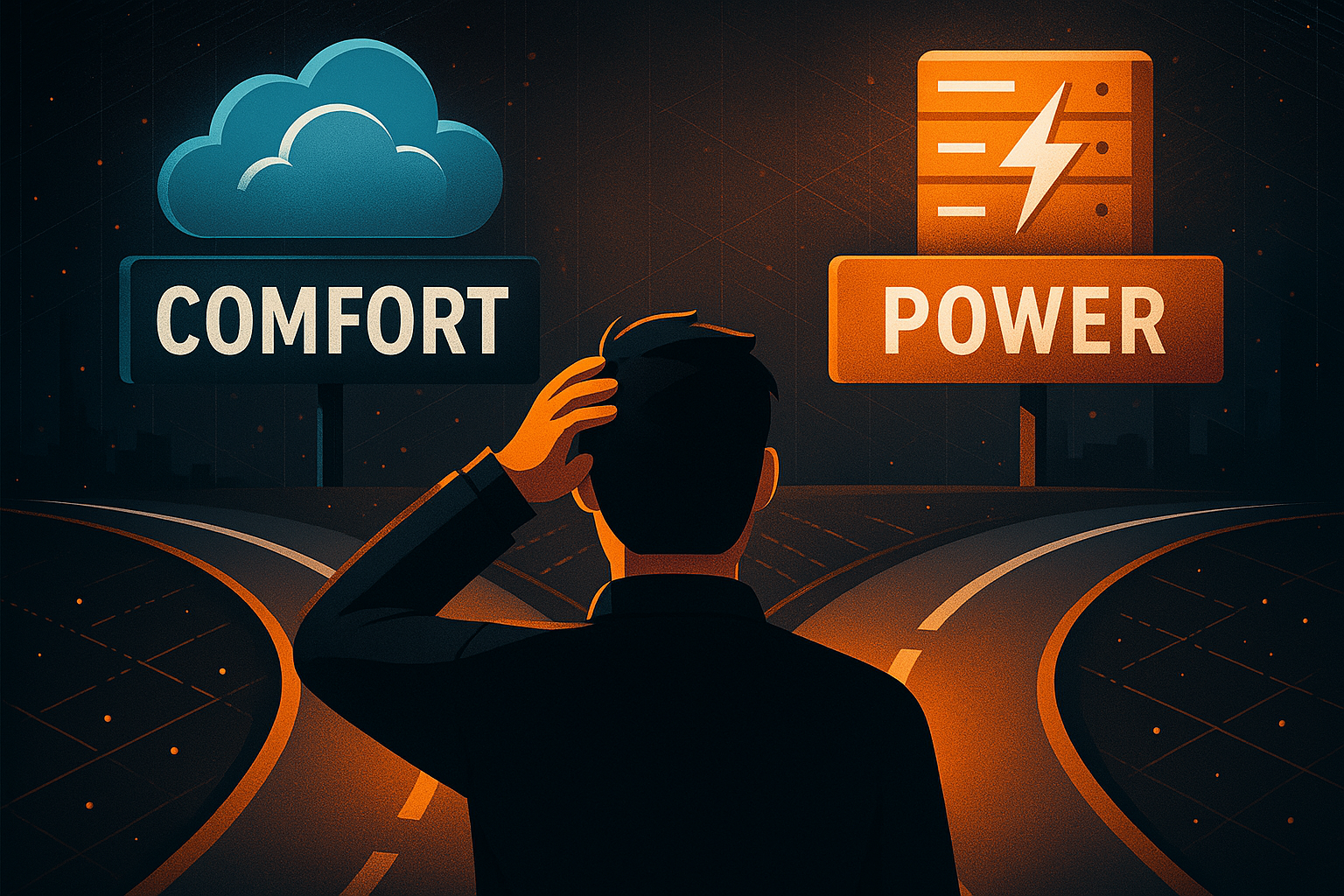

This is where the great cloud illusion lies. A recent spend analysis of company cloud bills reveals a shocking truth: less than 25% of the money is spent on compute. The other 75%? It’s going to marked-up storage, networking, and managed services, the equivalent of paying $1,000 for water and snacks from a penthouse minibar. You’re spending the majority of your innovation budget on 50-year-old technology like SSDs and networking cables, not on the high-performance CPUs and GPUs that actually move your business forward.

This problem starts innocently. You’re an entrepreneur moving fast. You spin up an ElasticSearch cluster to store a few hundred gigabytes of data. It works flawlessly. You just saved yourself a week of a DevOps engineer’s time. It feels like a victory.

But this is the first payment on a loan with crushing interest: the compounding debt of convenience.

Fast forward three years. Your “simple” cluster now holds hundreds of terabytes. Your data problems have become exponentially more complex. And you make a horrifying discovery: the “easy” managed service you chose no longer works out of the box. You need deep, specialized expertise to tune, optimize, and prevent it from burning all your cash. The idea that these tools “just work” with default settings at scale is laughable.

You haven’t escaped the need for expertise; you’ve merely postponed acquiring it. Now, you’re trapped. You are locked into an expensive platform, and the cost of migrating is astronomical. You’ve traded a small amount of early effort for a massive, permanent handicap on your ability to innovate.

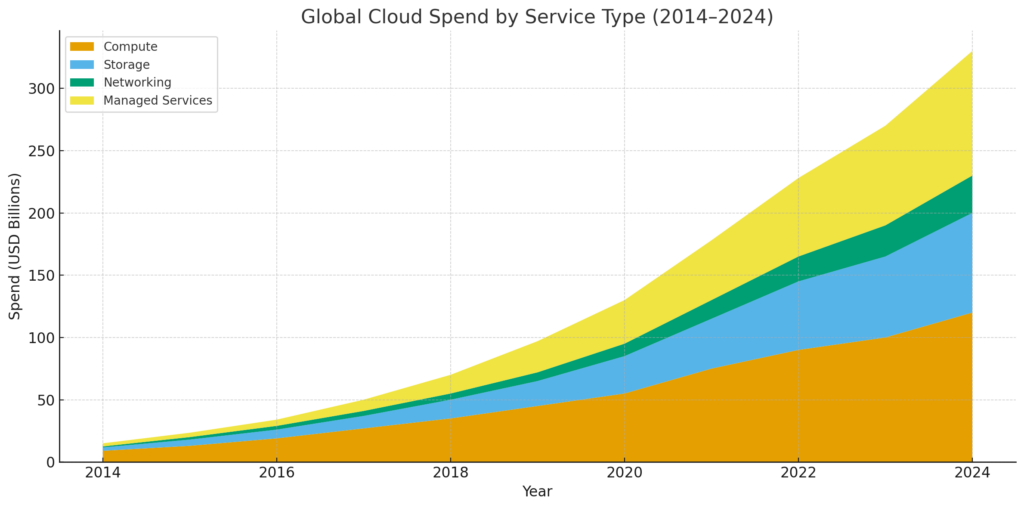

This isn’t a theoretical exercise. At Veridion, we distill the entire public internet into a comprehensive knowledge graph of the world’s companies. To do this, we operate at a scale that pushes the boundaries of conventional infrastructure. Our core data processing stack alone is a beast.

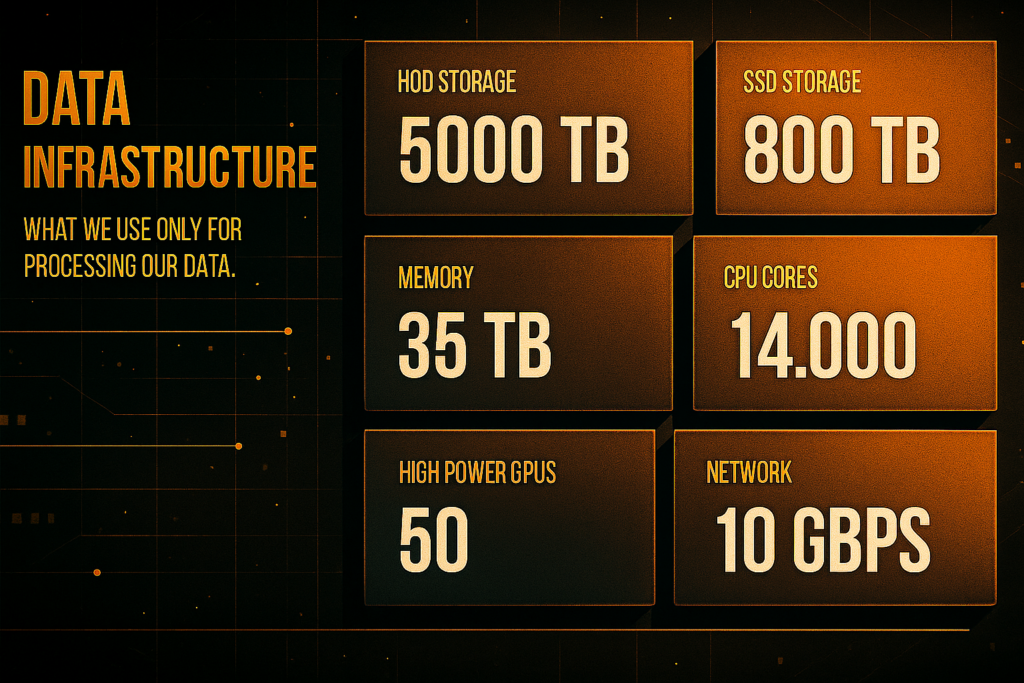

To give you a sense of the scale, we require over 4 petabytes (4,096 TB) of HDD storage and 800 TB of high-speed SSD storage. The brains of the operation consist of 14,000 CPU cores, 35 TB of RAM, and a cluster of 50 high-power GPUs to handle our machine learning pipelines. This is the raw power needed to make sense of the internet’s chaos.

Naturally, we asked ourselves: what would it cost to simply rent this power from a major cloud provider? Using conservative, publicly listed prices, we calculated the hypothetical bill.

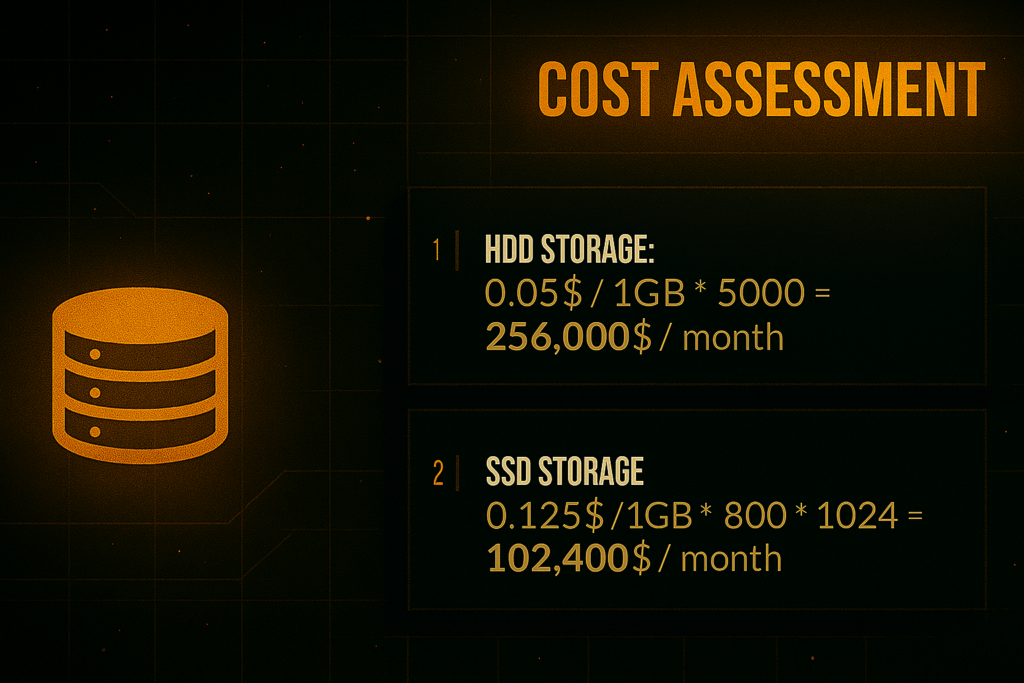

First, the storage. Keeping our data on cloud servers would cost over $256,000 per month for HDDs and another $102,000 per month for SSDs. That’s more than $358,000 every month, just for storage.

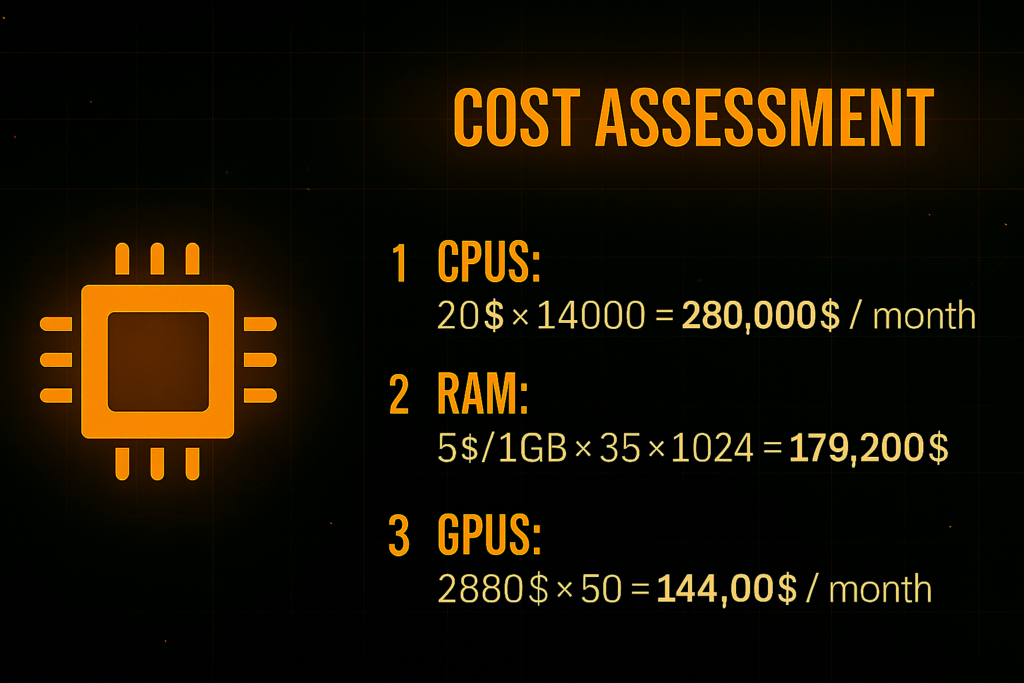

Next, we calculated the cost of the engine itself—the compute. The bill for CPUs, RAM, and GPUs totaled an additional $603,000 per month. This is the price tag for the raw intelligence of our system.

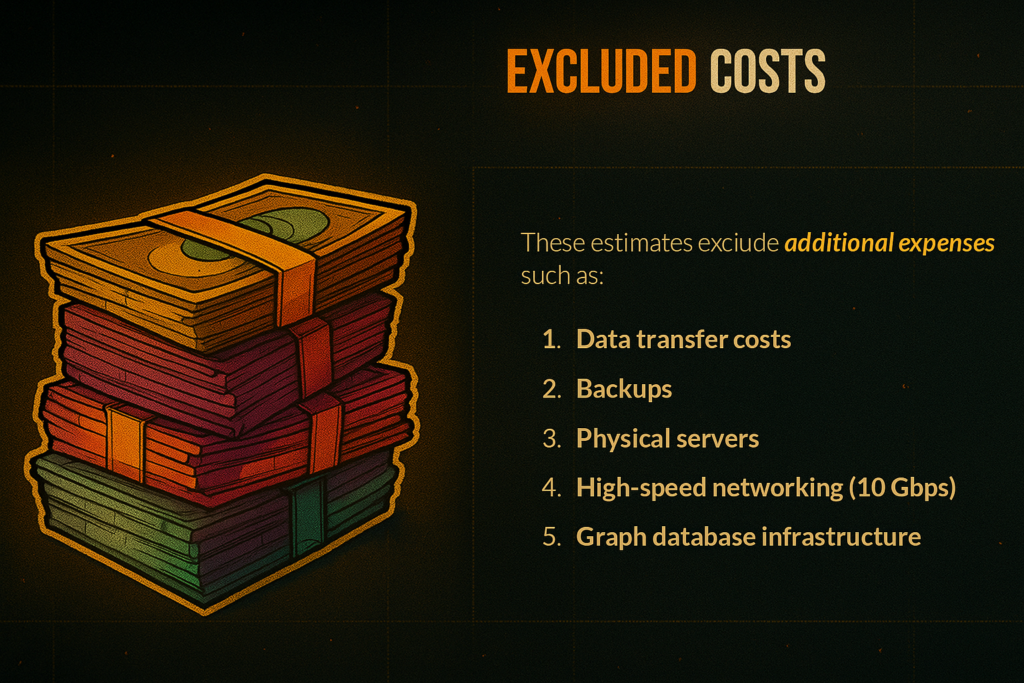

And here’s the critical part: this massive figure is an understatement. It excludes a long list of essential, high-margin services that cloud providers charge for, such as data transfer costs (the notorious egress fees), backups, high-speed networking, and the underlying costs of managed graph database software. The real bill would be significantly higher.

When we tallied just the raw resource costs, the total came to an astonishing $2,000,000 per month.

Our total monthly cost for our entire infrastructure, which includes our crawling fleet, big data cluster, GPU cluster, and delivery systems, is $60,000.

This isn’t a cost saving; it’s a strategic realignment of capital. We unlocked a 30x Innovation Multiplier. For the same price that a cloud-native competitor would pay for their base infrastructure, we could build fourteen such systems. Imagine what your R&D team could achieve with fourteen times the resources. That is the power of owning your foundation.

So, how did we do it?

Our approach is built on a simple principle: own the core, rent the periphery. We rely on bare metal servers for the vast majority of our operations. By leveraging cost-efficient providers, we gain direct access to hardware without the massive overhead and margins typically associated with cloud services. This gives us optimal compute pricing and maximum performance.

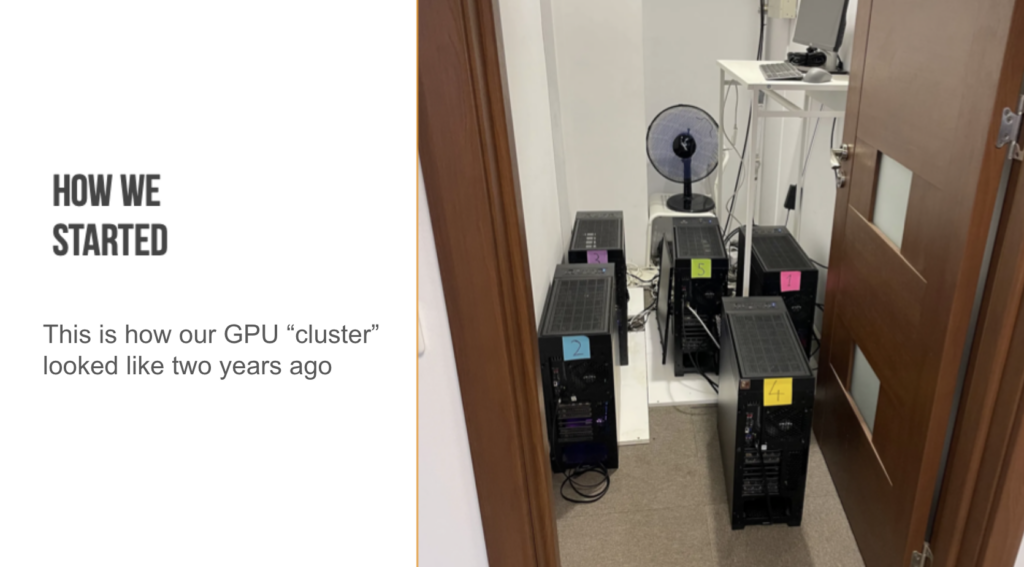

When it came to our most specialized need—GPUs—we took it a step further. Faced with scarcity and exorbitant rental costs, we chose to build our own in-house GPU infrastructure. We sourced the components and assembled the rigs ourselves. It wasn’t easy; we battled faulty CPUs and unexpected software errors. However, this difficult choice provided us with a critical capability at a fraction of the cost.

Shifting your mindset from “renting convenience” to “building power” doesn’t mean you need to build a data center in your garage, complete with a fan in the back. It means making strategic, deliberate choices about your architecture.

Focus on the Core and Maximize Compute Per Dollar. Our mantra is “Build, Don’t Buy,” but this isn’t about everything. It’s about owning the core systems that give you a competitive advantage. For every dollar you spend, the primary question must be: “How much compute am I getting?” This creates a positive feedback loop: increased efficiency leads to greater computing power, which in turn drives more innovation.

Embrace an Asymmetrical Strategy. The choice isn’t “100% cloud vs. 100% bare metal.” It’s about using the right tool for the right job. For any workload that doesn’t require instant, customer-facing scalability, bare metal is a phenomenal option that offers unbeatable performance per dollar. Use the cloud for what it’s good at, handling unpredictable, spiky workloads, while running your massive, predictable processing jobs on a foundation you control.

Invest in Expertise as a Durable Advantage. Owning your stack forces you to build deep, institutional knowledge. When Apache Cassandra 5 was released in beta with a vector database component crucial to our roadmap, we didn’t have to wait for a cloud provider to support it. We took a gamble, installed it on one of our own clusters, and integrated a game-changing feature into our product months or even years before a cloud-dependent competitor could have. That is a durable, long-term competitive advantage.

Make the Hard Choice Now, Before It’s Made for You

Every founder starts their journey with big dreams. But years down the line, many find themselves trapped in the penthouse conundrum: their business is successful, but they’re completely dependent on an ecosystem that forces them to pay $1,000 for a bottle of water because they believe they can’t afford the time to leave the room and buy it for $2.

The infrastructure decisions you make in your first year, when it feels like they matter the least, will have the biggest impact on your ability to innovate in year five. Don’t trade long-term power for short-term comfort. Scrutinize your bills, question the defaults, and start building a foundation that not only enables your business today but also empowers it to dominate tomorrow.

This article is based on a keynote by Mihai Vinaga, CTO of Veridion, delivered at the How to Web Conference. In his talk, Mihai shared how Veridion rebuilt its infrastructure for long-term power and efficiency, revealing the strategy that helped the company unlock massive innovation potential while saving millions in cloud costs. Watch the full keynote to see how deep tech companies can turn infrastructure decisions into a lasting competitive advantage.