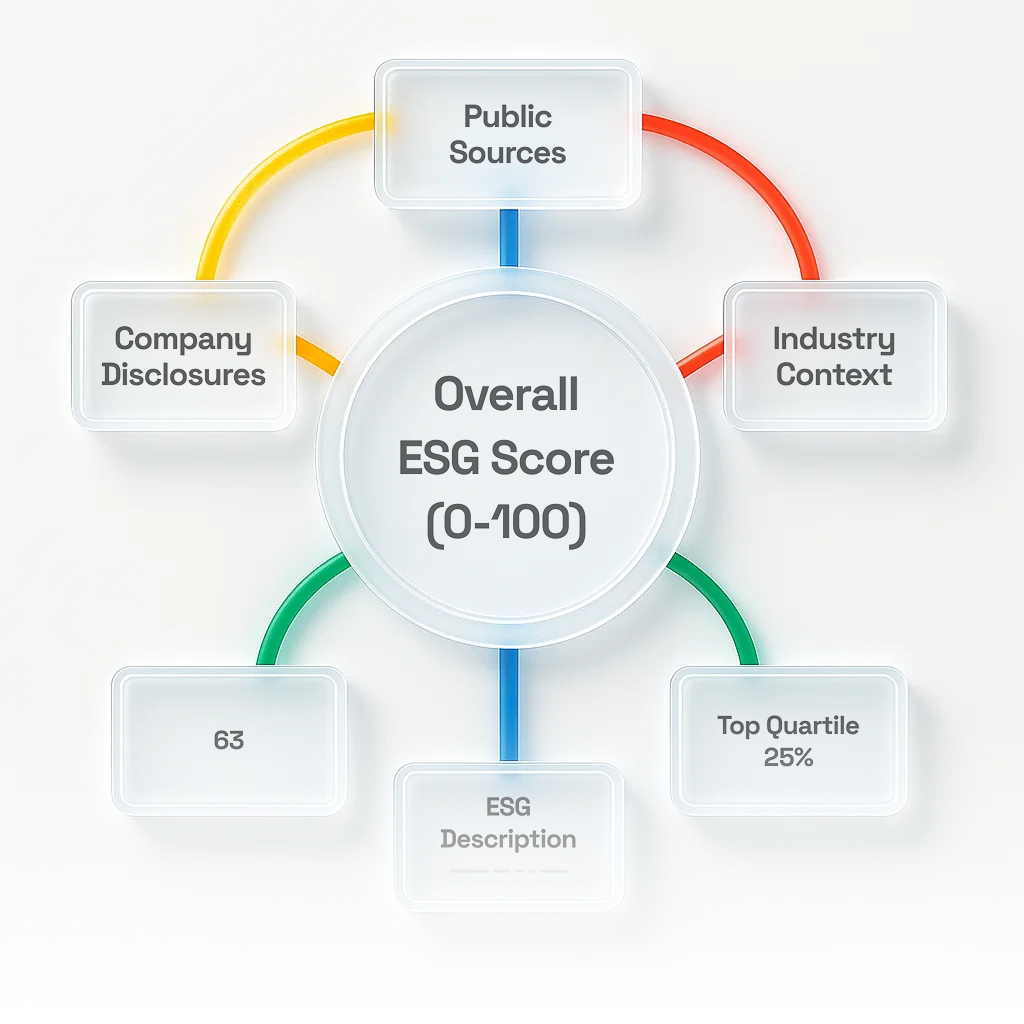

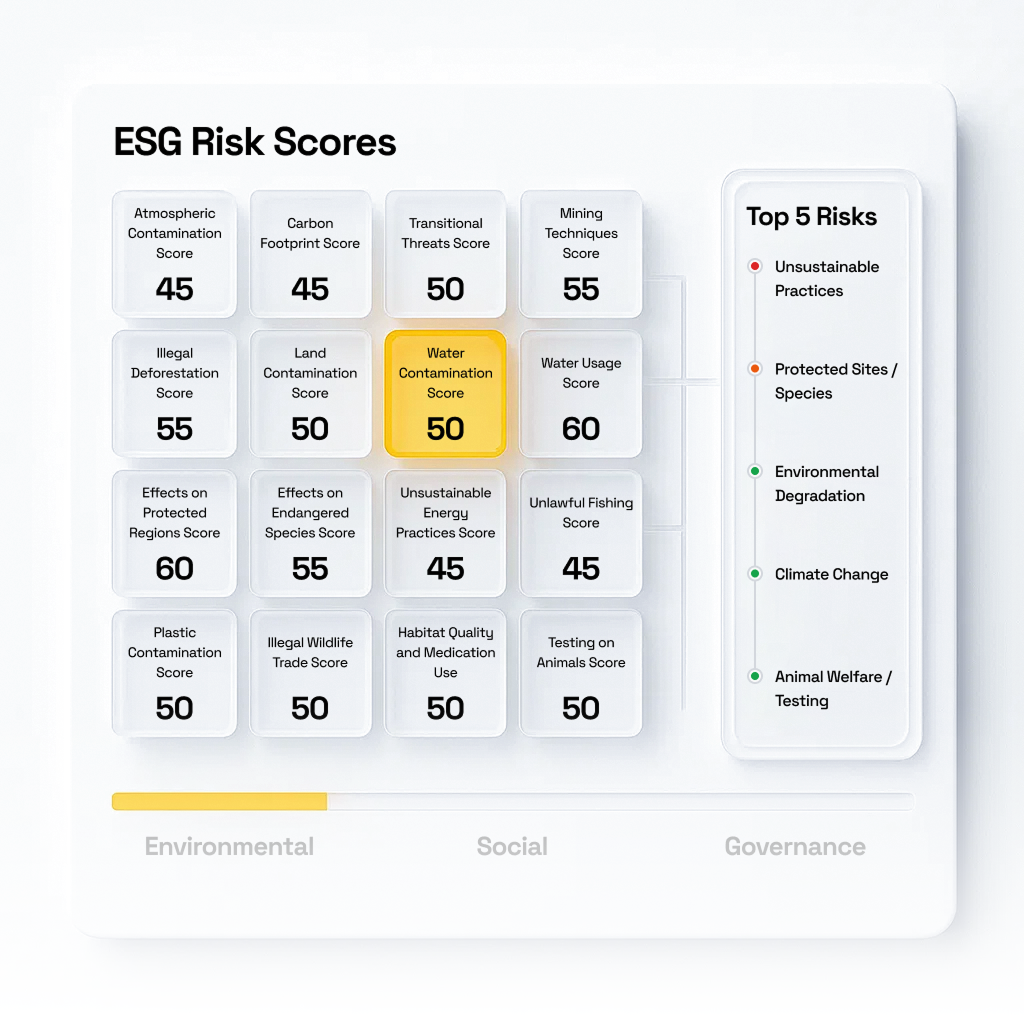

Evaluate ESG Risk in Hours — Not Months.

Veridion gives procurement, risk, and ESG teams the power to instantly assess real ESG exposure across over 100M global companies — with weekly updates, audit-ready scores, and no need for company disclosures.

Trusted by global procurement, risk, and sustainability teams