2025 Best Practices for Procurement

By: Cristina Iani27 February 2024

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

including digital disruption that demands rapid adaptation to new technologies, and an increase in catastrophic claims due to more frequent natural disasters and climate change.

These external pressures require a strategic shift in technology, talent management, and customer expectations. Insurers are therefore focusing on driving efficiency improvements and adapting their business models, products, and corporate culture to remain profitable and competitive.

data collection and management, elevating customer experience, and digitalizing underwriting and pricing processes.

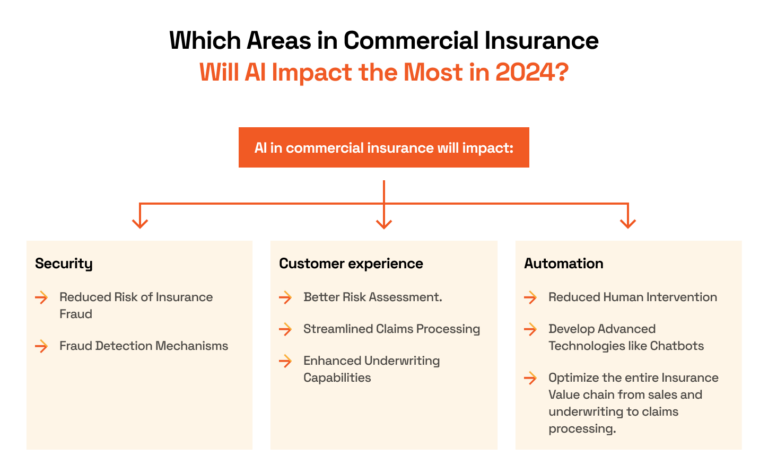

Artificial Intelligence (AI) emerges as the cornerstone of this transformative journey, with 52% of insurance CEOs planning to significantly increase their AI investments in 2024.

Our report unveils 7 groundbreaking AI use cases in commercial insurance, showcasing not just incremental advancements but also substantial strides in strategic capabilities and competitive edge.

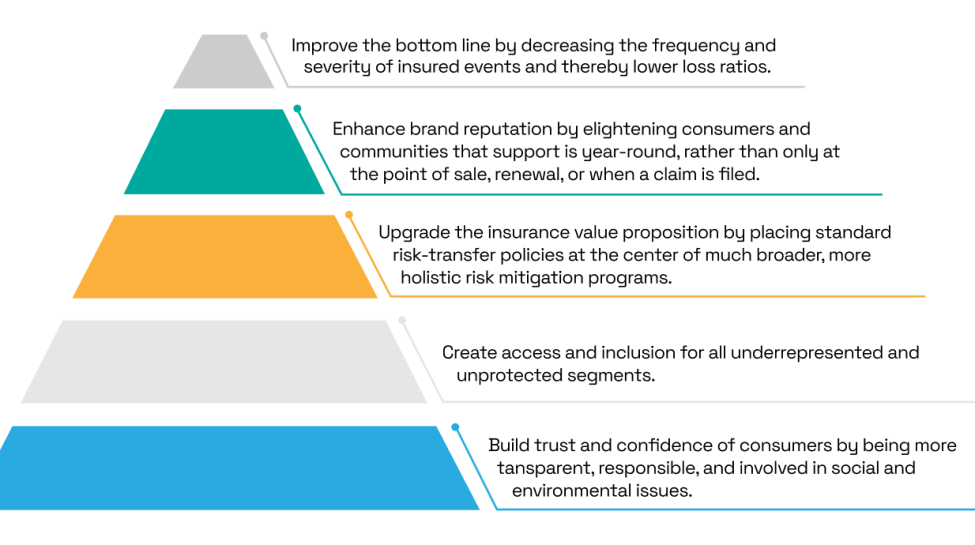

Our report deep dives into how insurers are shifting paradigms by prioritizing proactive prevention, risk assessment, and educational initiatives to exceed customer expectations.