2025 Best Practices for Procurement

By: Cristina Iani27 June 2024

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

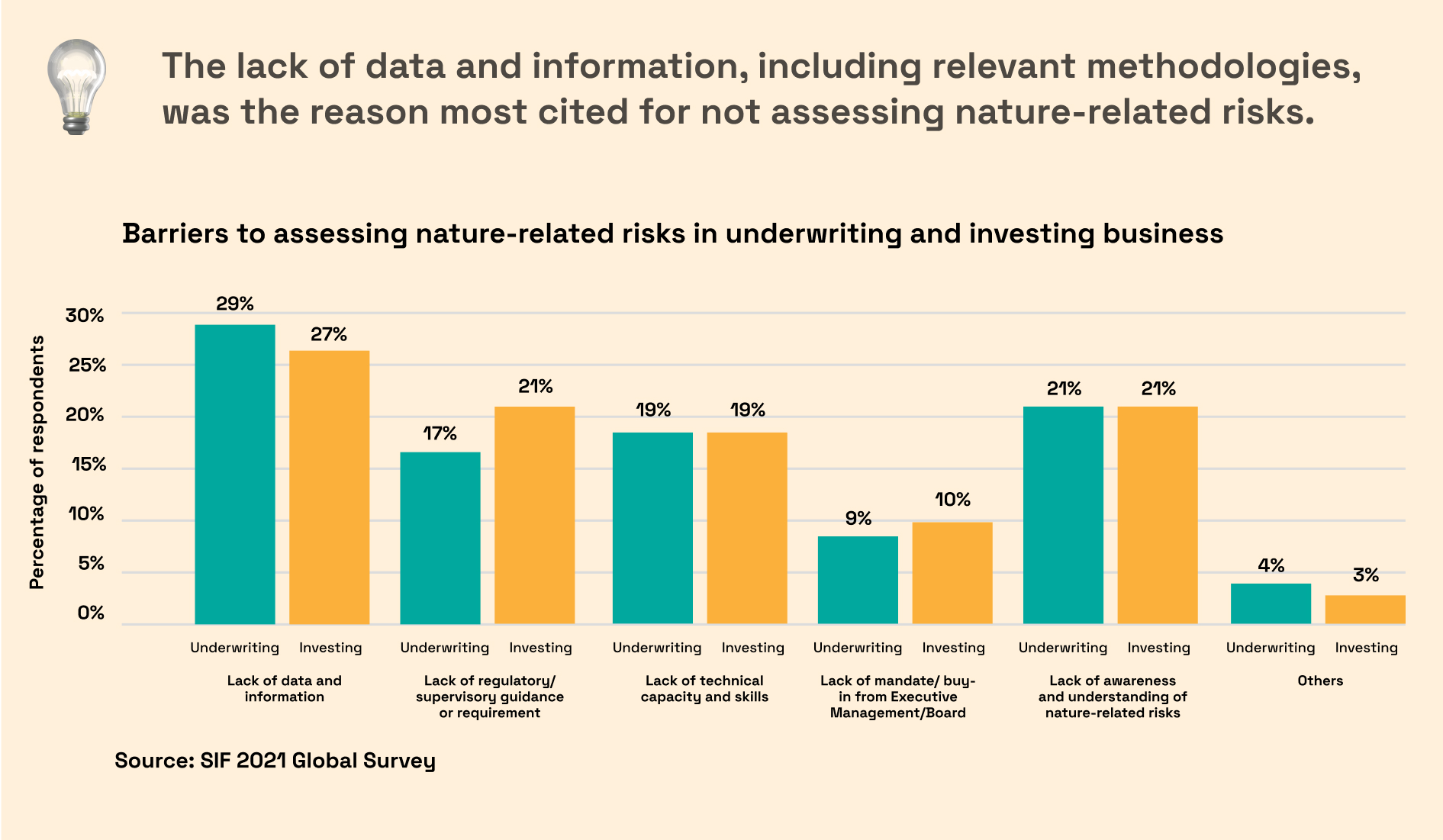

Explore examples of ESG risks and current regulations, and examine their potential impact on commercial insurance underwriting.

We will look into Howden and Fidelis 2022 study that correlates higher ESG ratings with better underwriting outcomes.