5 Challenges Hindering Strategic Spend Management

Strategic spend management is essential for companies aiming to reduce costs and improve procurement efficiency.

However, many organizations face significant challenges that can undermine these efforts.

These obstacles prevent them from effectively managing spend, optimizing procurement processes, and improving their bottom line.

In this article, we’ll explore these challenges and show you how to overcome them.

Let’s dive in.

Siloed spend data is a major challenge to strategic spend management.

Simply put, when key decision-makers don’t have a complete view of a company’s total spending, this leads to fragmented and incomplete insights.

These gaps in information prevent us from making informed decisions, launching effective cost-saving initiatives, and fully leveraging the company’s purchasing power.

But how does siloed spend data even happen?

Typically, it’s the result of company departments or units using different and disconnected systems for expense tracking and management.

This means data is stored in disparate locations and varying formats, making it difficult to consolidate and analyze it holistically.

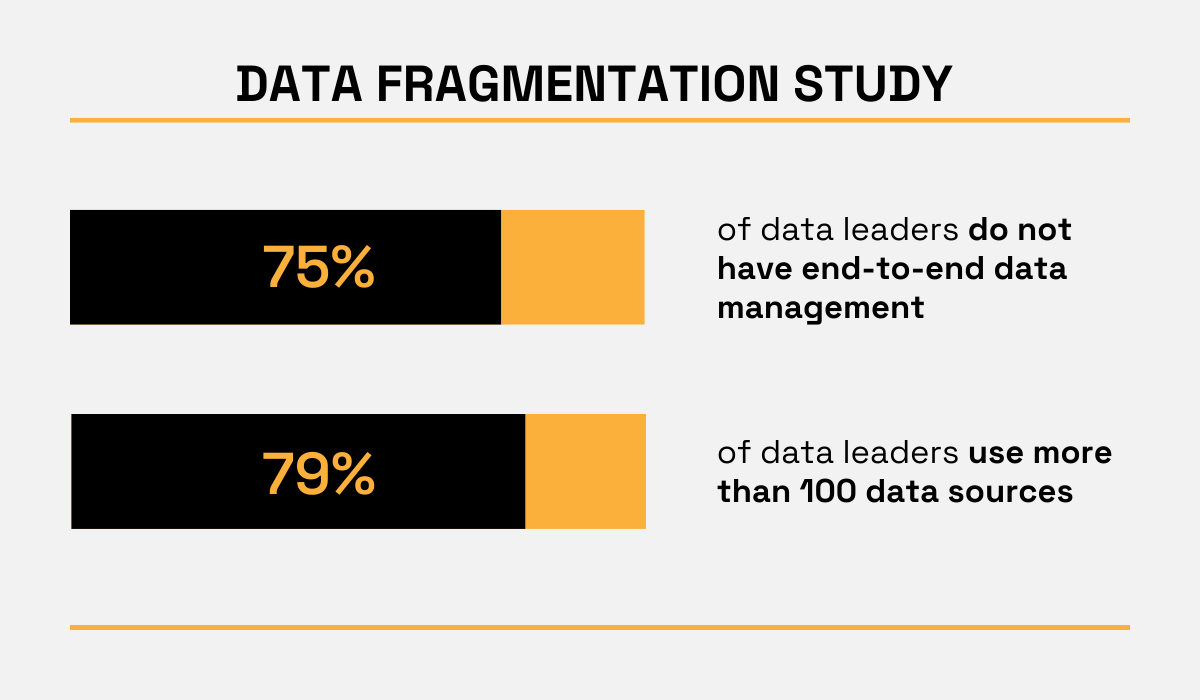

This lack of data integration is more prevalent than one might think, as evidenced in a 2022 data fragmentation study by Informatica.

Illustration: Veridion / Data: Informatica

As shown, 3 out of 4 data leaders don’t have a full view of all their company data, which includes their organization’s total expenditures.

Another relevant point is the number of data sources used, where 4 out of 5 data leaders say they use more than 100 sources in their business.

These issues illustrate why many companies struggle to identify spending patterns, fail to recognize redundant or unnecessary expenditures and miss out on cost-saving opportunities.

Consequently, this prevents them from effectively enforcing compliance with company-wide purchasing policies or leveraging data to negotiate better supplier contracts.

Furthermore, the inability to see the bigger picture can lead to budget overruns and poor financial forecasting.

So, how can this challenge be addressed?

The best way is to implement a centralized spend management system that integrates data from all departments and business units.

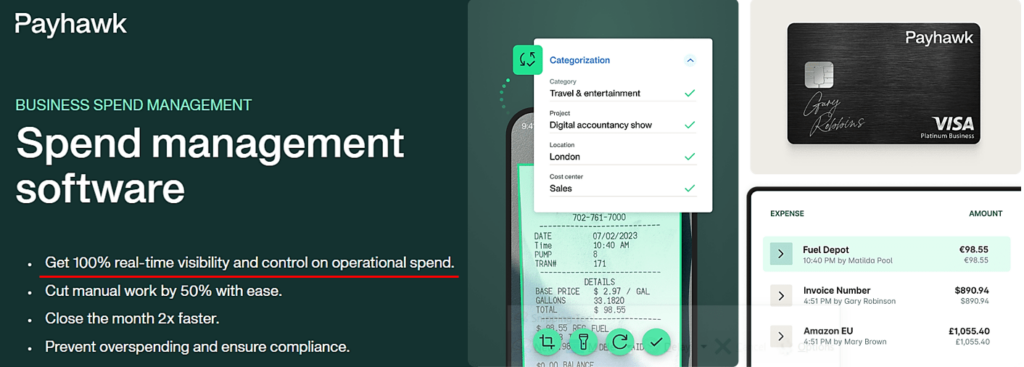

Here’s an example of one such solution.

Source: Payhawk

Payhawk collects all your spend data in one place, provides real-time insights into your organization’s spending patterns, and detects anomalies in spending.

It can also be easily integrated with your other digital tools like accounting software and enterprise resource management (ERP) systems to give you a single source of truth and 100% spend visibility.

This example shows how a centralized spend management system can effectively break down data silos by ensuring employees have access to all spend data in one place.

Concurrently, such a system allows you to conduct more accurate spend analysis, enhance cross-departmental collaboration, and foster a more strategic approach to spend management.

Another major obstacle to effective strategic spend management is inaccurately recorded spend data.

This issue is not surprising, given that incorrect data can compromise the reliability of your subsequent spend analysis.

Error-ridden spend data can enter your system in several ways, such as:

All this means that anyone conducting spend analysis has a significant amount of work to do to ensure data accuracy and avoid skewed results.

This challenge is not unique to procurement either.

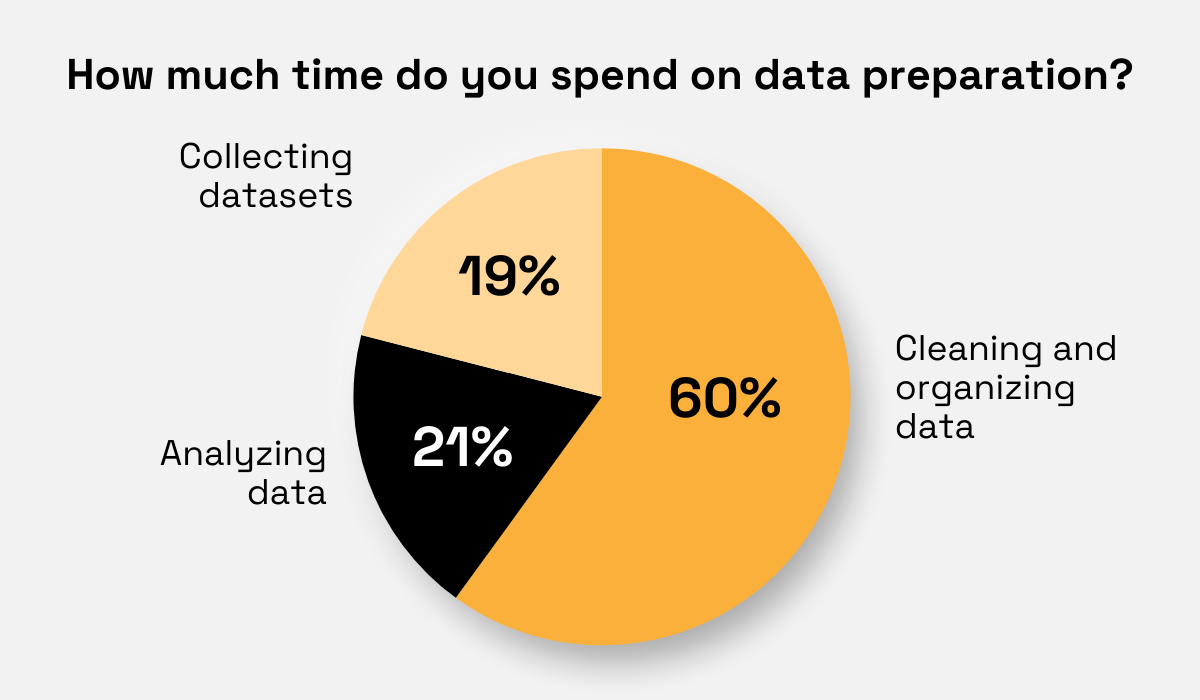

For example, a survey by Dataversity revealed that data scientists spend around 80% of their working hours on data preparation rather than analysis.

Here’s a more detailed breakdown of this survey’s findings.

Illustration: Veridion / Data: Dataversity

It’s reasonable to assume that finance and procurement teams conducting spend analyses face similar challenges.

Even if your spend data isn’t siloed and is readily accessible, this would still imply that around 60% of their time will be spent on cleansing and organizing data.

On the other hand, working with unrefined data and not preparing it for analysis can lead to poor decision-making based on flawed analysis results.

So, what can you do to minimize inaccuracies in your expense records and free up your team’s time for analyzing data and extracting actionable insights?

The first step is to standardize data formats and taxonomies across various data sources, so employees know exactly what data to enter and how.

Additionally, it’s recommended to use automated data validation, where AI-driven algorithms are the ones that ensure that data is correct.

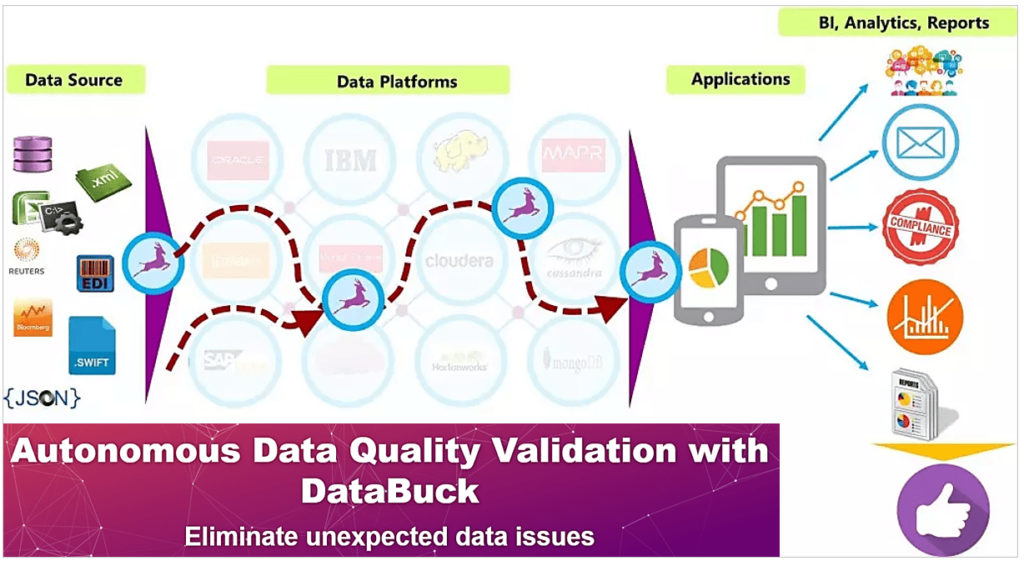

One such tool is DataBuck.

Source: DataBuck

As illustrated, DataBuck acts as a data accuracy checker standing between your data sources and your analytics and reporting tools.

According to their website, this tool can:

Of course, regular data quality audits are another important element in ensuring spend data is up-to-date, accurate, and conforms to your company’s data management standards.

Overall, to avoid the negative consequences of inaccurately recorded spend data, you should standardize data entry rules across your organization while also leveraging appropriate data cleansing and validation tools.

We have already seen how some challenges can be mitigated with the use of various tools that automate inefficient manual processes.

However, resistance to these tools and automation, whether on the management or employee level, can hinder the adoption of more efficient procurement processes.

This resistance, i.e., insisting on sticking to manual methods, often stems from a fear of change, concerns about job security, or a lack of understanding of the benefits that process automation can bring.

On the management side, resistance often revolves around budget constraints or uncertainty about the return on investment (ROI) in new technology.

However, many surveys and case studies have shown that procurement automation can bring significant savings compared to the costs usually associated with manual processes.

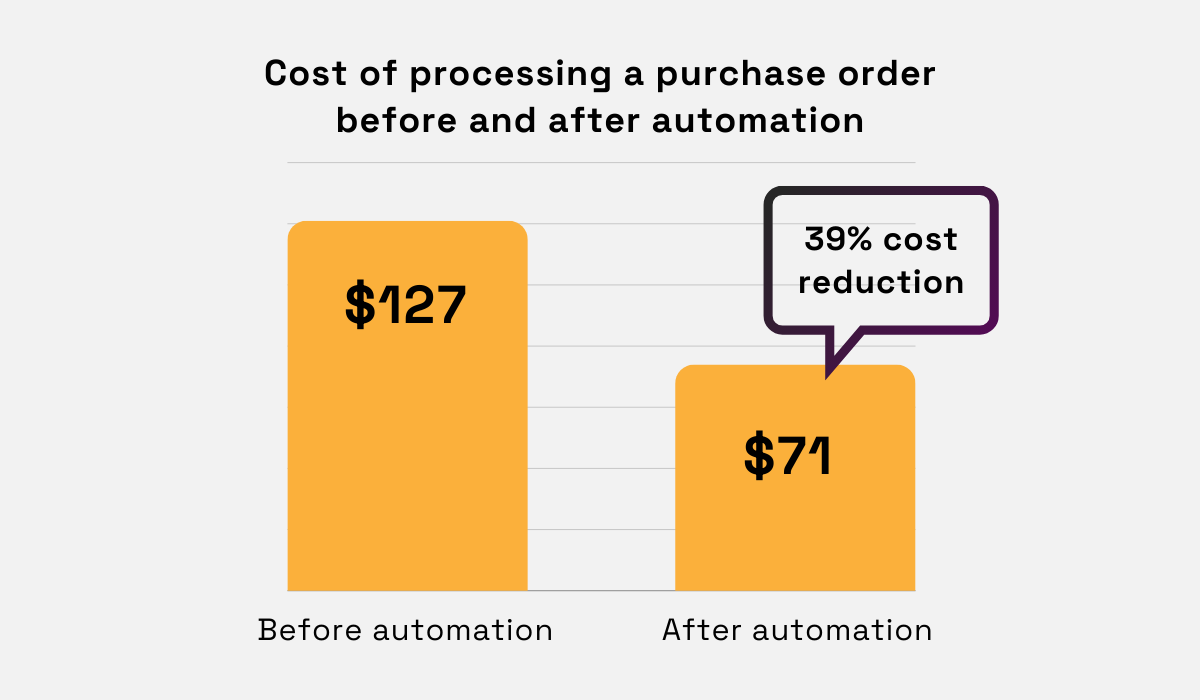

For example, a client of PairSoft, an automated procurement software provider, reduced their costs for processing a purchase order (PO) by 39% or, more precisely, from $121 to $74.

Illustration: Veridion / Data: PairSoft

Of course, when management is considering process automation, this should be preceded by a detailed cost-benefit analysis.

Such analysis should compare the expenses associated with manual procurement processes to the potential savings from automation.

If automating all procurement processes at once seems too daunting, management can also consider implementing a pilot program for a specific process, see the results, and then move on to other processes.

As for employee resistance, overcoming it requires a strategic approach.

For starters, it’s essential to address any concerns employees might have about their future roles following the introduction of process automation.

Next, the benefits of automation, such as improved data accuracy, faster processing times, and better data visibility, should be clearly communicated.

Additionally, showing how automation can free up employee time for more enjoyable and higher-value activities can help further alleviate their concerns.

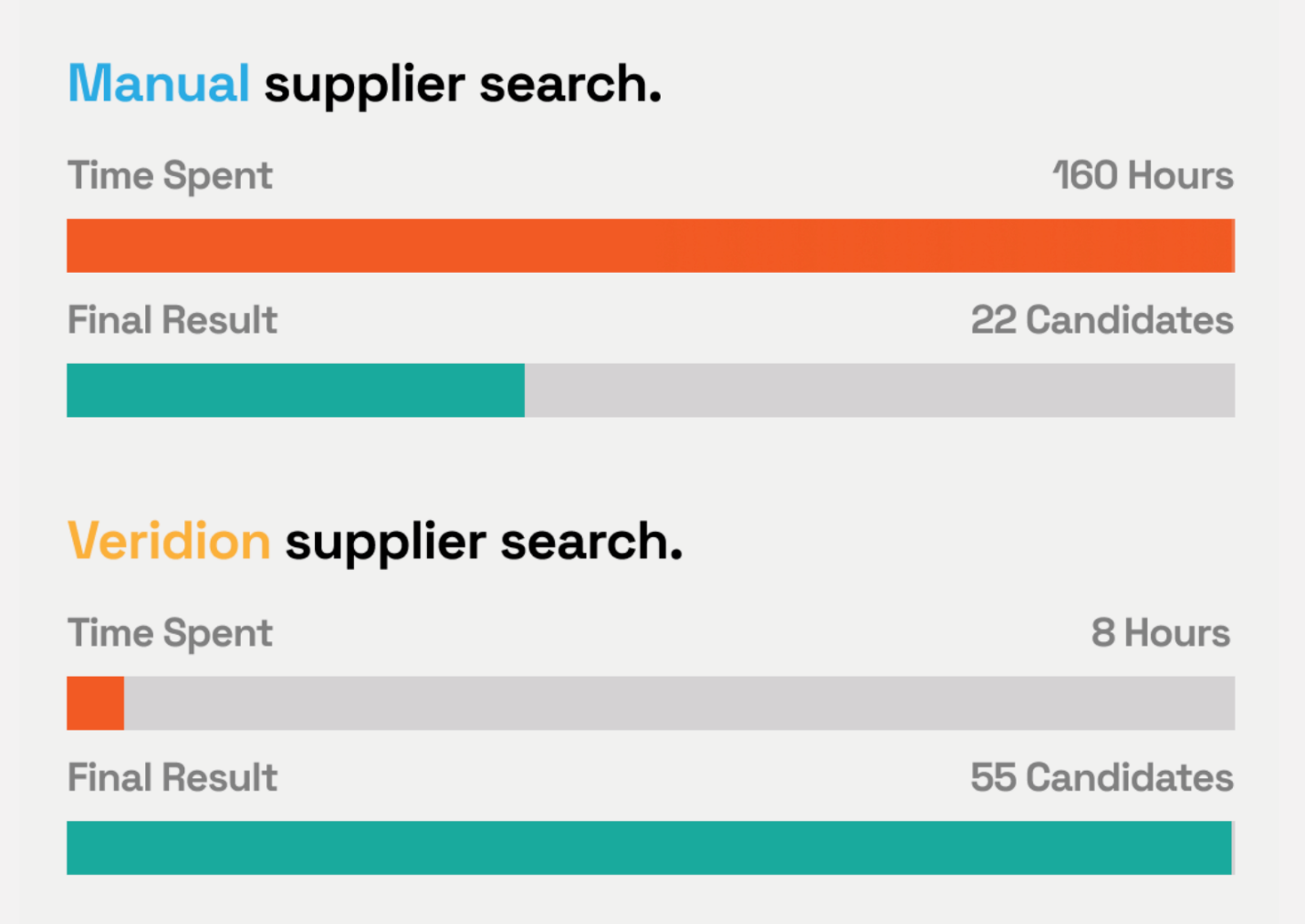

For instance, one of the key tasks in strategic spend management is identifying reliable suppliers who offer competitive prices.

When done manually—through internet searches and spreadsheets—this process is often one of the most daunting and time-consuming tasks for procurement teams.

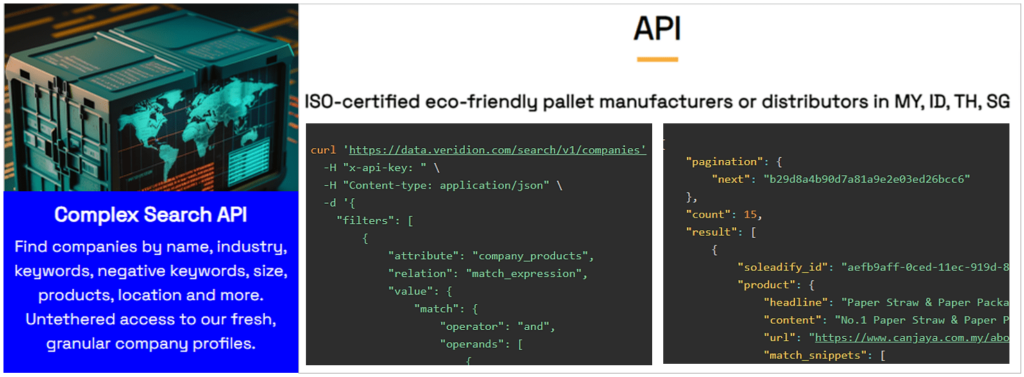

However, by using big data platforms like our Veridion, your team can significantly accelerate this process while increasing the number of identified suitable candidates.

Here’s a comparison.

Source: Veridion

As shown, a manual supplier search that required 160 hours of work to come up with 22 candidates can be reduced to 8 hours needed to discover 55 candidates.

This is achieved by giving your team access to a global, weekly updated, database of suppliers along with an advanced search API.

Employees can enter their search parameters in a natural language, and Veridion’s AI-driven algorithms will perform the initial search in a few seconds.

Source: Veridion

Showing your employees how this supplier search automation makes them more productive while still needing their expertise can help quelch their initial resistance.

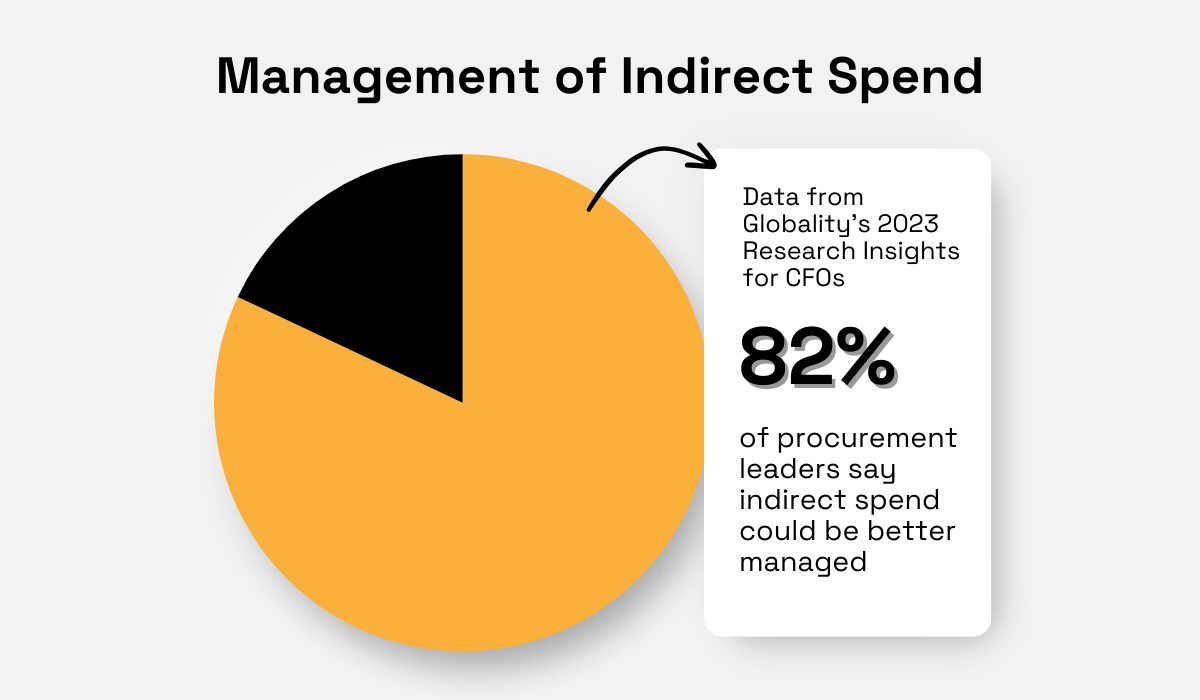

Another challenge is the lack of control over tail spend, which can also lead to inefficiencies and missed savings opportunities.

Tail spend refers to infrequent, low-value purchases of items not directly related to final products or services that the company sells to its customers.

As such, it is a subset of a company’s indirect spend that is often not controlled by the procurement department.

In fact, according to Globality’s 2023 Research Insights for CFOs, over 80% of procurement leaders say these indirect expenditures could be better managed.

Illustration: Veridion / Data: Globality

Despite this high percentage, some major indirect spend categories, such as IT services, marketing, or travel, are often at least influenced by procurement and overseen by other company functions.

Conversely, tail spend involves purchases outside established procurement channels.

That’s why tail spend is often synonymous with maverick or rogue spend, i.e. off-contract, unauthorized purchases.

Of course, such purchases reduce the overall spend visibility, making it harder to identify spending patterns and recognize savings opportunities.

Moreover, this can prevent your organization from recognizing when similar items are purchased from different suppliers, which could otherwise open room for supplier consolidation or volume discounts.

So, how can your company gain more control over tail spending?

Similar to breaking spend data silos, the best way is to implement spend management software that provides visibility into all transactions regardless of size.

Here’s an example from Ramp software.

Source: Ramp

This platform offers easy-to-use corporate debit and credit cards that can be issued to employees with predefined spending limits, thus ensuring compliance with company policies.

Likewise, employees can take pictures of receipts, which the software will process automatically, reducing manual data entry errors and ensuring all purchases are recorded in the system in real time.

Other tail spend control measures include standardizing procurement processes even for small purchases and consolidating suppliers where possible.

Strategic spend management largely depends on how accurately and efficiently your organization tracks its cash flow.

When cash flow is poorly tracked, it becomes difficult to ensure that funds are available when needed, leading to challenges in managing procurement budgets.

The consequences of inefficient cash flow tracking can be severe.

They range from worst-case scenarios like bankruptcy and insolvency to missed payment deadlines, financial reporting compliance issues, and a damaged reputation.

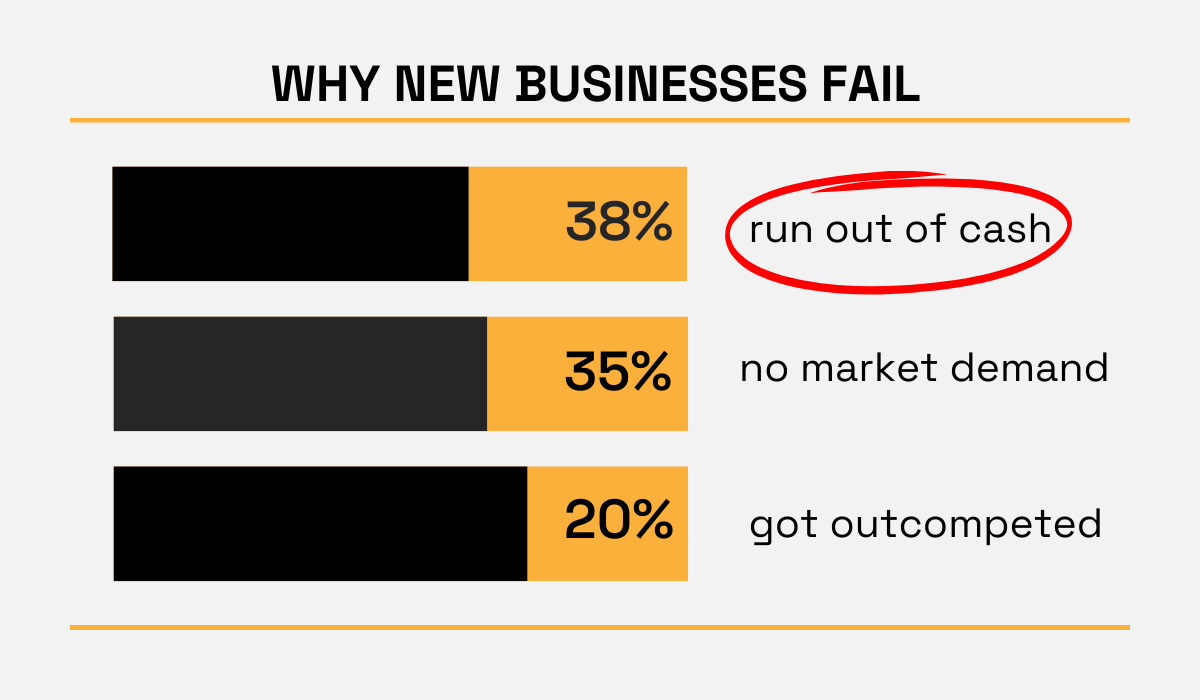

To underscore the importance of efficient cash flow monitoring, consider the top three reasons why new businesses fail, according to CBInsights’ analysis of 101 failed startups:

Illustration: Veridion / Data: CBInsights

These numbers demonstrate that, while market demand and competition are critical factors, running out of cash remains a leading cause of business failure.

Therefore, diligent cash flow management is essential.

Moreover, efficient cash flow tracking enables you to optimize your company’s spending by analyzing and balancing future income and expenses.

By leveraging cash flow forecasts, you can prevent potential cash shortages and make informed decisions about your company’s total spend, including procurement budgets.

So, how can you ensure that your cash flow data is always accurate and up-to-date?

Recognizing that manual cash flow tracking can be time-consuming and error-prone, companies should implement robust cash flow management tools and processes.

For instance, Agicap is an all-in-one cash management tool that provides real-time cash tracking, liquidity planning, cash collection, and supplier invoice management.

Take a look at their short and informative video.

Source: Agicap on YouTube

By connecting with your bank accounts and existing financial software, Agicap centralizes all your cash flow data.

It automatically retrieves transactions and account balances, enabling users to view the continuously updated cash flow situation in a single software interface.

It also provides cash flow forecasting features, thus enabling companies to anticipate future cash needs and adjust their spending accordingly.

Coupled with clear and standardized cash flow management processes, such tools allow you to streamline cash flow tracking on a company level and gain real-time insights.

Ultimately, this enables you to make data-driven decisions that support strategic spend management, including ensuring funds for critical procurement activities.

We’ll close by highlighting that strategic spend management is essential for maintaining your company’s financial health and maximizing value in procurement.

To effectively address the challenges we outlined, from siloed or inaccurate spend data to inefficient cash flow tracking, the first step is recognizing and understanding them.

From there, you can implement practical solutions—like centralized data systems, automation tools, and robust cash flow management—to help your organization overcome these obstacles.

The end result?

Optimized spending, reduced costs, and a competitive edge.