Top 5 Challenges of Indirect Spend Management

Indirect spend, that area of company spending that keeps your business running behind the scenes without directly contributing to your final product, often doesn’t get the attention it deserves.

And it’s no surprise.

Managing indirect spend can be cumbersome, time-consuming, and labor-intensive, no doubt about it.

But what makes managing indirect spend so tricky?

More importantly, how are these challenges impacting your bottom line, and why should you take action?

In this article, we’ll answer those very questions.

But we’re not just going to talk about how hard indirect spend management is.

We will give you practical, actionable tips to help you get a handle on your indirect spend, minimize risks, and ultimately save money.

Ready to step up your financial game?

Let’s get started.

Unlike direct spend, which typically receives more attention, indirect spend is often poorly tracked, resulting in limited visibility.

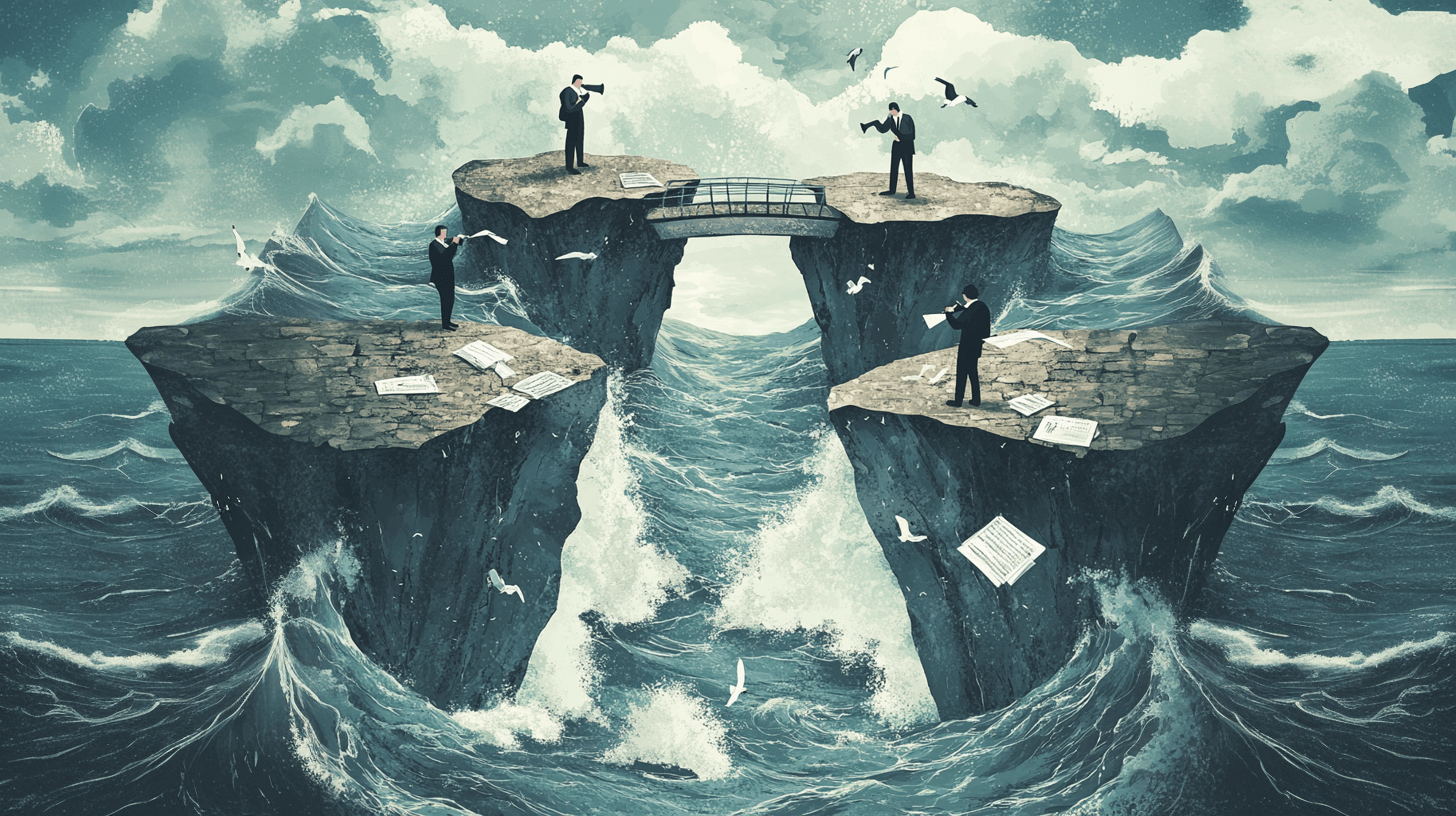

In fact, according to a 2023 Globaility survey, 82% of procurement leaders acknowledge that their companies aren’t managing spend efficiently.

Illustration: Veridion / Data: Globality

It’s not hard to see why.

Indirect spend usually involves numerous buyers spread across multiple departments, a wide range of suppliers, and many low-volume transactions.

At first glance, tracking all of this data may seem like more effort than it’s worth.

As a result, no one makes it a priority, and companies end up with little to no visibility into their indirect spend.

However, just because you don’t see it doesn’t mean it can’t hurt you.

Without indirect spend transparency, businesses can miss lots of savings opportunities.

Sure, these purchases may seem small on their own, but they do add up over time.

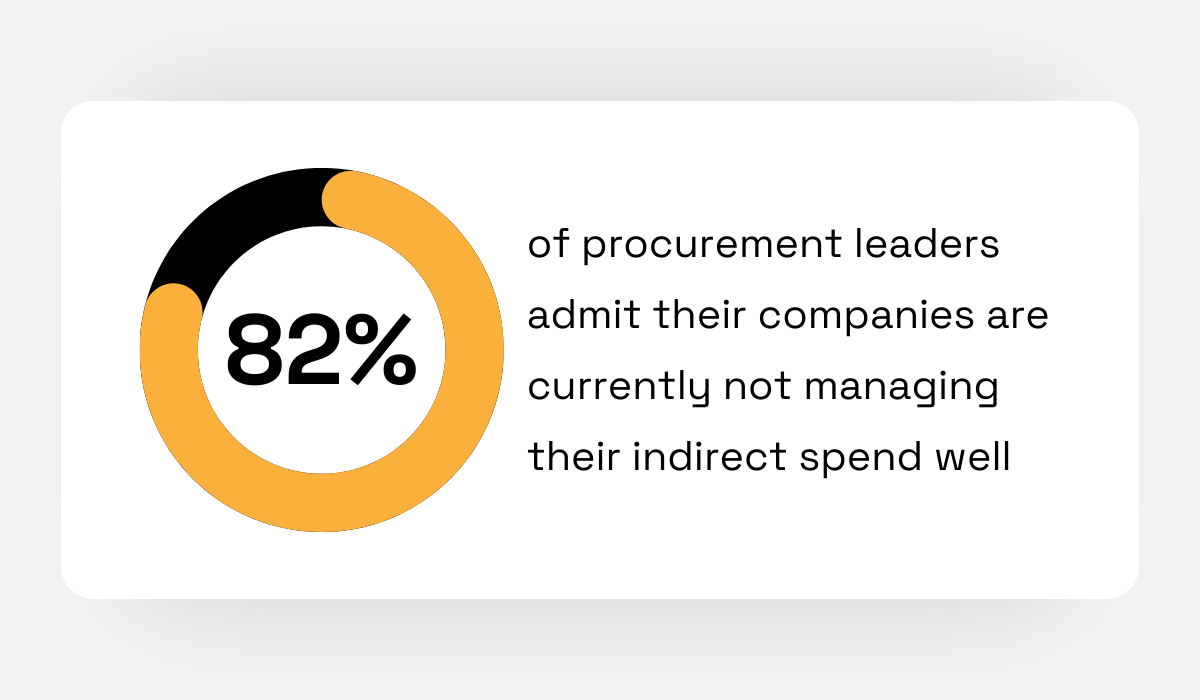

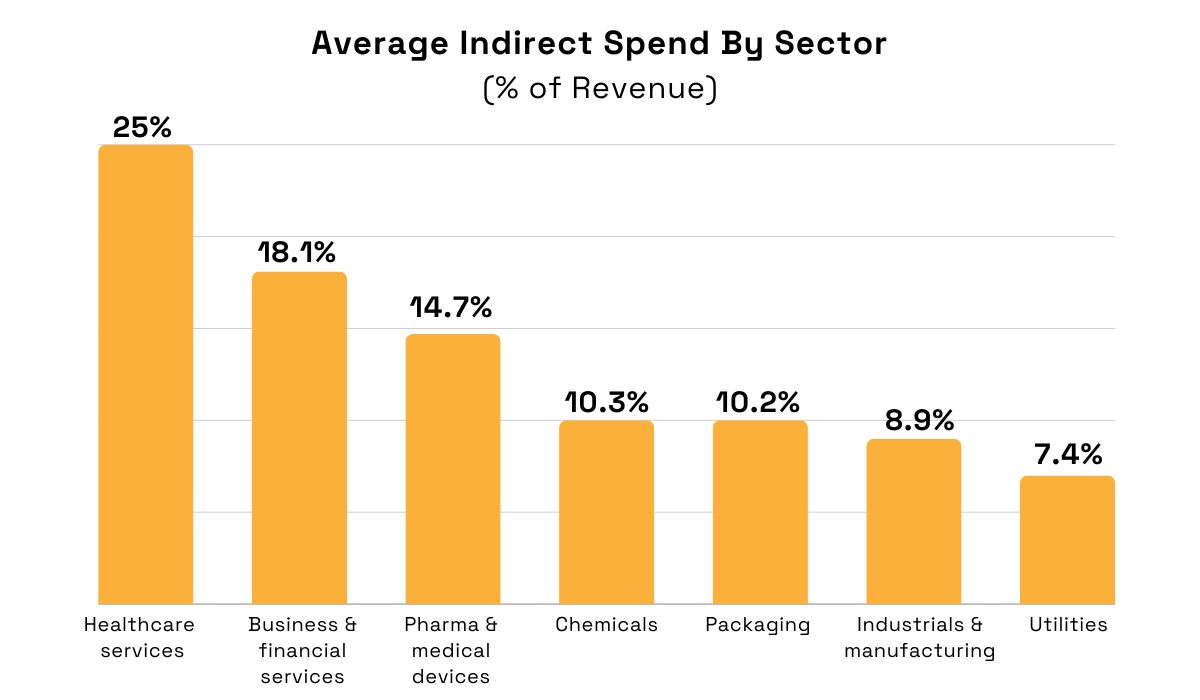

Just look at an overview of average indirect spend by sector from 2021.

Illustration: Veridion / Data: Alvarez & Marsal

Looking at those numbers, you can’t help but wonder how much lower these figures could be with strategies like bulk purchasing, contract renegotiation, or supplier consolidation.

The problem is that you can’t unlock any of these if you don’t know what your indirect spend looks like.

Those opportunities will keep slipping through the cracks if your contracts and agreements are scattered across different employees’ inboxes and desks.

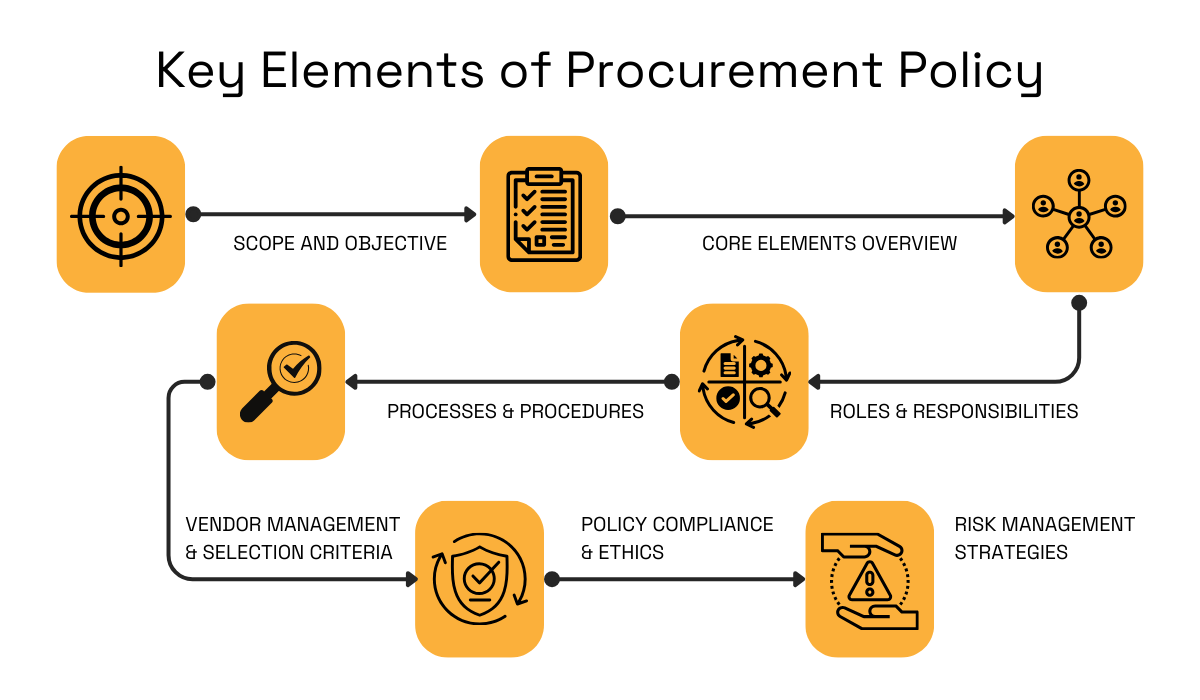

So, to begin improving indirect spend visibility, first, establish standardized procurement and spending policies.

Put clear rules in place for everything—from approval workflows and purchase orders to vendor selection and expense reports.

Here’s a simple outline of what a well-structured policy should entail.

Source: Veridion

But don’t get caught up in creating rules for absolutely every possible situation.

That way, you’ll only end up with pages upon pages of hard-to-understand documents nobody will adhere to.

Instead, it’s much more important to communicate the goals and intent of the policy to other stakeholders.

This will ensure each stakeholder understands what’s expected of them in various scenarios.

Overall, when you standardize the process, you’ll consistently capture all spending, making it easier to track and manage over time.

After all, where there’s standardization, there’s efficiency, transparency, and better control.

Having indirect spend scattered across numerous suppliers makes building any kind of relationship with them challenging.

These purchases tend to be infrequent, small-scale, and driven by immediate, short-term procurement savings—hardly a recipe for long-lasting, productive supplier-buyer partnerships.

Plus, with so many vendors, monitoring and controlling a sea of contracts, connections, and performance metrics becomes a major burden for your team.

Did you know that, according to an RS Components survey, UK companies work with an average of 156 indirect suppliers?

Illustration: Veridion / Data: RS Components

Imagine tracking efficiency and maintaining relationships with all of them. It’s a significant time drain.

However, neglecting supplier performance management can be even more damaging.

By overlooking this important task, you miss out on savings opportunities that naturally come from strong partnerships—better product quality, competitive pricing, and resilience in the face of supply chain disruptions.

Marc Hutchinson, a board member at the Chartered Institute of Procurement & Supply, points out that suppliers are always ready to lend a helping hand to their partners.

Illustration: Veridion / Quote: RS Components

But you need to take that first step.

One effective approach is supplier rationalization, also known as supply base reduction (SBR).

This process involves reducing the number of vendors to focus your spend on fewer, more strategic partners.

By doing so, you can streamline purchasing and unlock the potential for deeper, more productive relationships with those who truly deliver.

Michael Dolan, Project Manager at Smarter Grid Solutions, an enterprise energy software company, agrees.

Illustration: Veridion / Quote: LinkedIn

The goal here is to zero in on the best suppliers who provide the right balance of price, quality, and delivery performance and phase out the rest.

Here are some factors that will help you decide who makes the cut:

| Cost efficiency | Are they helping you save in the long term? |

| High performance | Do they consistently deliver quality products on time? |

| Product range | Do they offer multiple product categories you need, making consolidation easier? |

| Flexibility | Are they agile enough to handle changes in demand? |

Once you’ve identified your top suppliers, you’ll have your preferred supplier list (PSL).

PSLs are common where there are many vendors to choose from, making them ideal for managing indirect spend.

They ensure you’re only working with thoroughly evaluated and approved suppliers, guaranteeing consistent quality without the headache of frequent vetting.

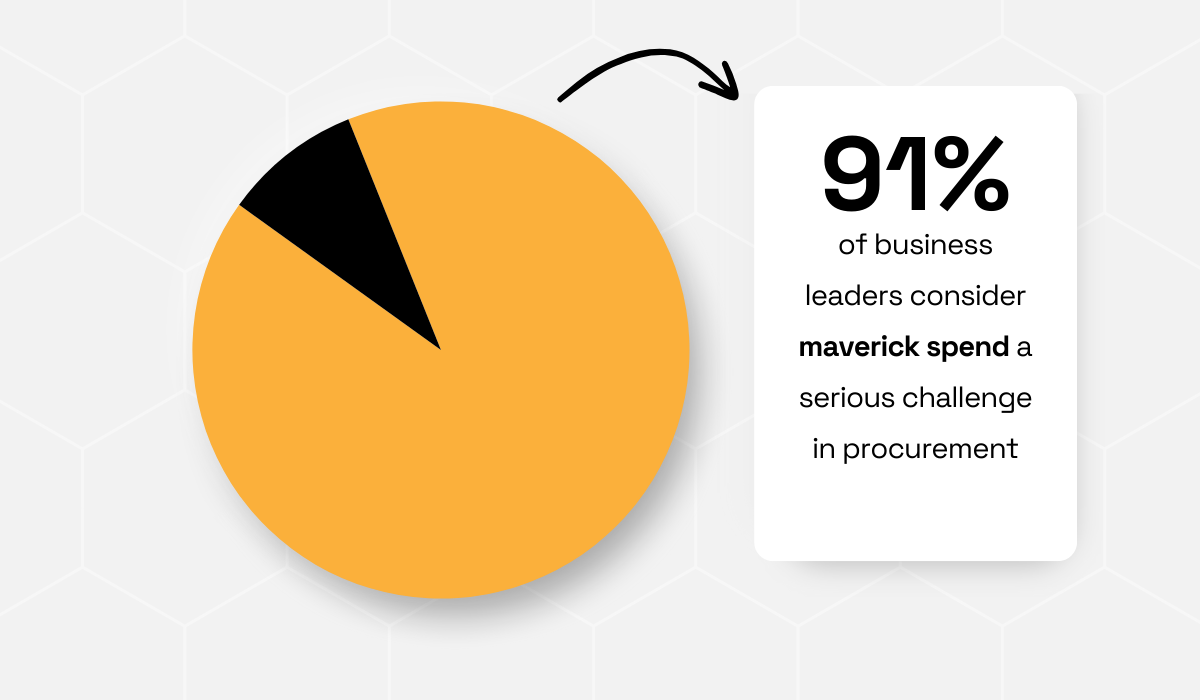

Indirect spend is sort of like the “wild west” of procurement—rarely tracked or managed properly.

This, in turn, frequently leads to purchases made outside of agreed contracts and procurement procedures, an issue known as maverick spend.

And according to the SDI Inc. survey, 91% of business leaders agree: maverick spend is a serious challenge for them.

Illustration: Veridion / Data: SDI Inc.

But why is it such a problem?

Put simply, this kind of unauthorized spending directly translates to missed cost-saving opportunities and strained relationships with your suppliers.

Say you’ve negotiated a discount with a hotel chain, but someone on your team bypasses that deal and books accommodation through their favorite booking platform.

Not only do you miss out on the discount, essentially losing money, but the hotel also loses out on the bookings they were promised.

Another area where maverick spend is becoming increasingly common is in IT, where employees purchase and use software without IT department approval, costing companies a lot of money.

Sarah Monette, Head of Marketing at a spend optimization platform, Vertice, sheds light on why this happens.

Illustration: Veridion / Quote: CFO Dive

Interestingly, her explanation also points to the solution.

Namely, maverick spend often occurs because it’s seen as the easier option.

So, the key to solving this issue is to make purchasing that adheres to company policies the easier, more attractive choice.

If your procurement process is cumbersome and time-consuming, that just won’t cut it.

Workers need a system that guides them through purchasing, allowing them to request, buy, and pay for goods and services with ease, from anywhere.

Flint Group, a large supplier of inks and printing products, discovered such a solution through a procure-to-pay platform.

With over 130 centers across six continents, their indirect spend was out of control, resulting in a lack of visibility and maverick spend.

However, as Arno de Groot, their VP of Procurement and Regulatory, notes, introducing this new system changed everything.

Illustration: Veridion / Quote: SAP

Just like he says, it’s all about improving the purchasing experience and making the right choice the easy choice.

P2P platforms succeed in that because they centralize all approved suppliers, making it easy for everyone to choose from vetted vendors with pre-negotiated rates.

Plus, they feature pre-configured approval workflows and guided buying that direct employees to approved catalogs.

The entire process becomes so intuitive and controlled that purchasing outside of contracts just doesn’t seem like a more convenient option anymore.

Indirect spend is subject to legal regulations, industry standards, and internal policies.

However, making sure your purchases actually adhere to them can be challenging, especially in decentralized environments, which is often the case with indirect spend.

And if your purchasing isn’t compliant, you’re opening the door to all kinds of risks, ranging from legal ramifications and penalties to increased costs.

Remember the example of unsanctioned IT procurement from earlier?

Aside from out-of-control spending, these purchases could fail to meet certain cybersecurity standards.

For instance, they may not align with your organization’s encryption requirements, leaving sensitive data unprotected and vulnerable to theft or hacking.

But it can get even worse.

What if that new SaaS product doesn’t comply with data privacy laws like GDPR?

As you can see below, the fines, particularly for serious violations of these rules, can be substantial.

Illustration: Veridion / Quote: Intersoft Consulting

Even in less severe cases, non-compliant IT purchases can still harm your efficiency.

For example, if someone buys unapproved software that doesn’t integrate with your existing tech stack, you’re left with a tool that can’t communicate with the rest of your system.

As a result, your team is forced to constantly manually transcribe details across systems, which can lead to data entry errors and incomplete data.

See how a single non-compliant purchase can cause so many issues?

Now, ensuring compliance in indirect spend is no easy feat, but following the tips from previous sections can set you on the right track.

To recap, try to:

Granted, these steps alone might not solve all your problems.

However, there are plenty of different tools out there designed to make indirect spend management easier and more compliant.

Let’s explore some of them.

When you lack the right tools for managing indirect spend, the process becomes slow, error-prone, and lacks the transparency necessary for effective spend analysis and control.

This leads to many, if not all, of the problems we previously discussed.

Gates Little, President at The Southern Bank Company, a Community Bank based in Gadsden, Alabama, agrees that relying on manual methods simply doesn’t cut it anymore.

Illustration: Veridion / Quote: Fyle

Although he talks explicitly about expense management, which includes employee-initiated costs like travel, the same can be applied to overall indirect spend control.

So, let’s get into some tools that can help you tackle these inefficiencies and take your indirect spend management to the next level.

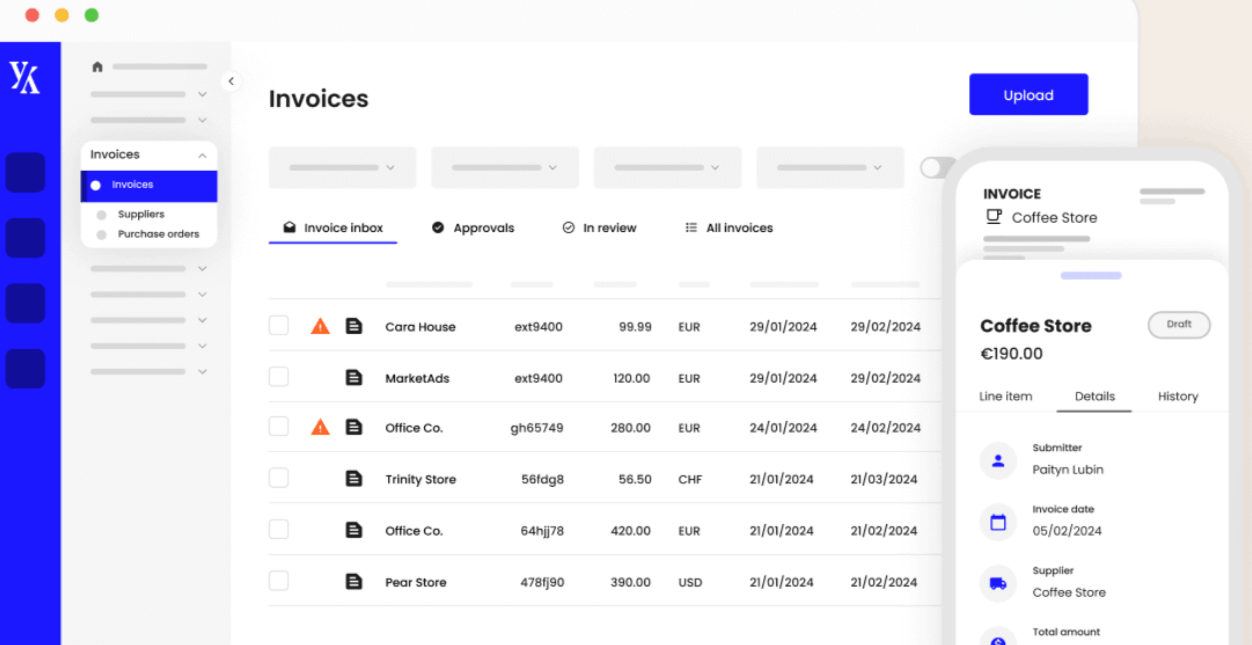

First up, spend management systems are a must-have in this context.

These software solutions centralize all your expenses, invoices, and corporate card payments into a single, integrated platform, eliminating visibility issues once and for all.

Source: Yokoy

Thanks to their AI capabilities, they can also extract, classify, and analyze data from various sources to provide you with real-time, data-driven insights that empower you to make smarter decisions.

Even better, they allow you to set up approval workflows and spend controls, reducing instances of unauthorized spending and noncompliant expense reporting.

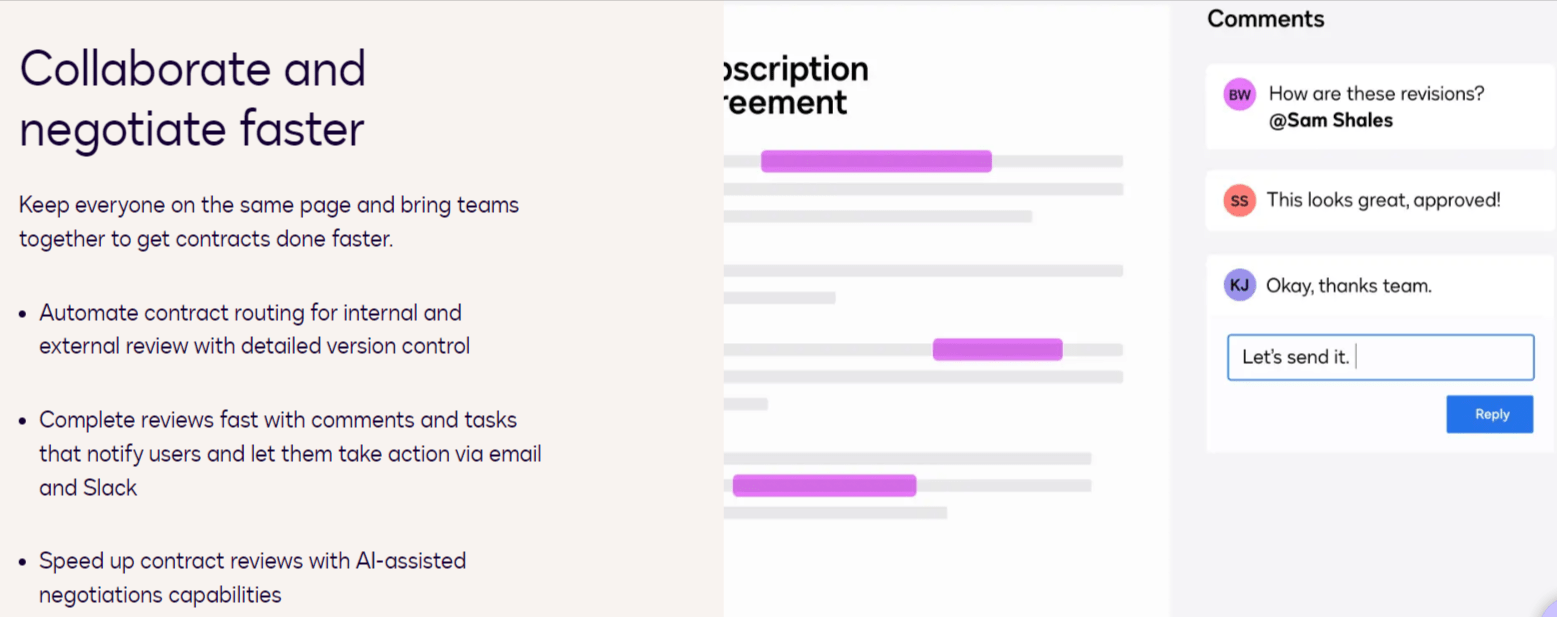

Contract lifecycle management software is worth mentioning here, too.

It simplifies and expedites contract creation by providing intuitive templates, auto-populating features, and allowing legal teams to define a library of pre-approved clauses.

The software also enables both internal and external stakeholders to collaborate, review, and comment on these contracts together, making negotiation more streamlined than ever.

Source: Docusign

Overall, with centralized contract management and detailed version control these tools offer, you can manage obligations and renewals with ease, ensuring compliance while minimizing time spent on these cumbersome processes.

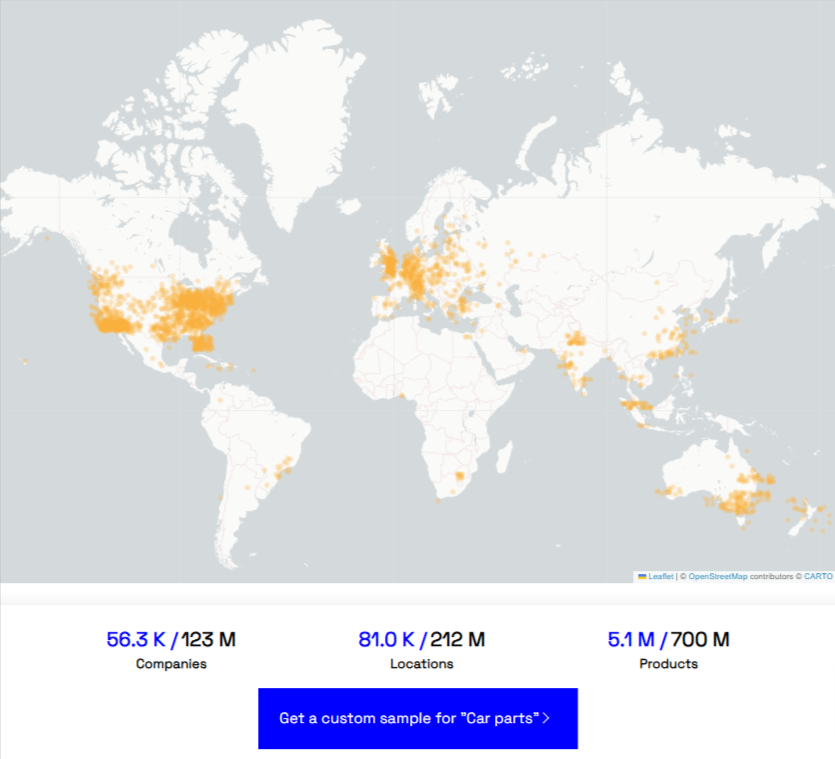

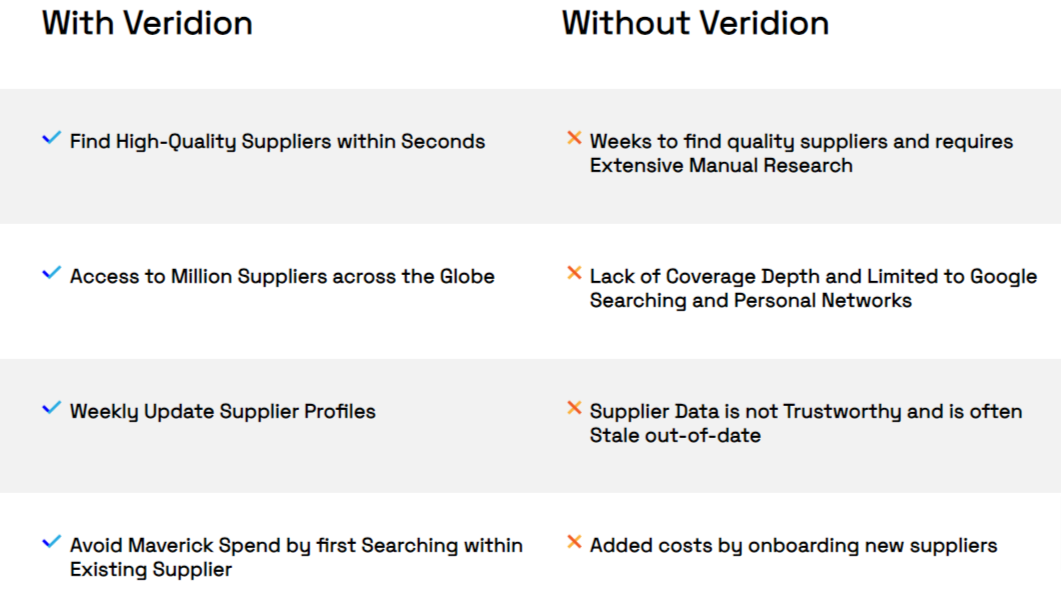

Lastly, supplier discovery tools are another must in any spend management toolkit.

Take our Veridion, for example.

Through Veridion’s Search Service, you can access a continuously updated, vetted database of millions of manufacturers, service providers, products, and more.

For example, let’s see what kind of results we get if we search for “car parts” suppliers.

Source: Veridion

Manual sourcing just fades in comparison, right?

This capability allows you to speed up your sourcing process, compare different vendors, and build reliable preferred supplier lists.

And as for your existing suppliers, you can use Veridion’s Data Enrichment Service to clean up, update, and consolidate your Supplier Master Records.

Simply enter a company name and address, and Veridion will fill in the gaps, helping you identify the best-performing partners.

Without an effective sourcing tool, you’re limited to Google searches and personal networks, which don’t give you the data coverage or depth you need.

Source: Veridion

Plus, they’re just so time-consuming.

But with Veridion, you get all the vendor data you can imagine, from ESG criteria to product specifications, even for areas that aren’t covered that well by other data providers, such as Asia or the Middle East—all within moments.

Overall, direct spend will always take priority over indirect spend in most companies, that’s for sure.

It’s easier to manage and has a more immediate impact on production.

However, never forget that indirect spend also significantly affects your bottom line and operational efficiency.

If you invest some time, money, and effort into the right technology and processes now, you can address much of the complexity that comes with managing this area of spending.

The benefits are well worth it.

By being smart and never underestimating indirect spend, you can reduce risk, lower overspending, and improve compliance for more efficient, cost-effective purchasing across the board.