Spend Statistics: Global IT Spending State and Trends

If you’re a procurement professional looking for a clear and concise overview of the latest global IT spend statistics, you’ve come to the right place.

This article provides valuable insights into current IT spending patterns, including global forecasts, regional breakdowns, and key trends like cloud computing and SaaS adoption.

Whether you’re negotiating IT contracts, managing software licenses, or simply trying to understand the big picture of IT spend, this article will equip you with some key insights for decision-making.

First off, let’s see the projections for global IT spending.

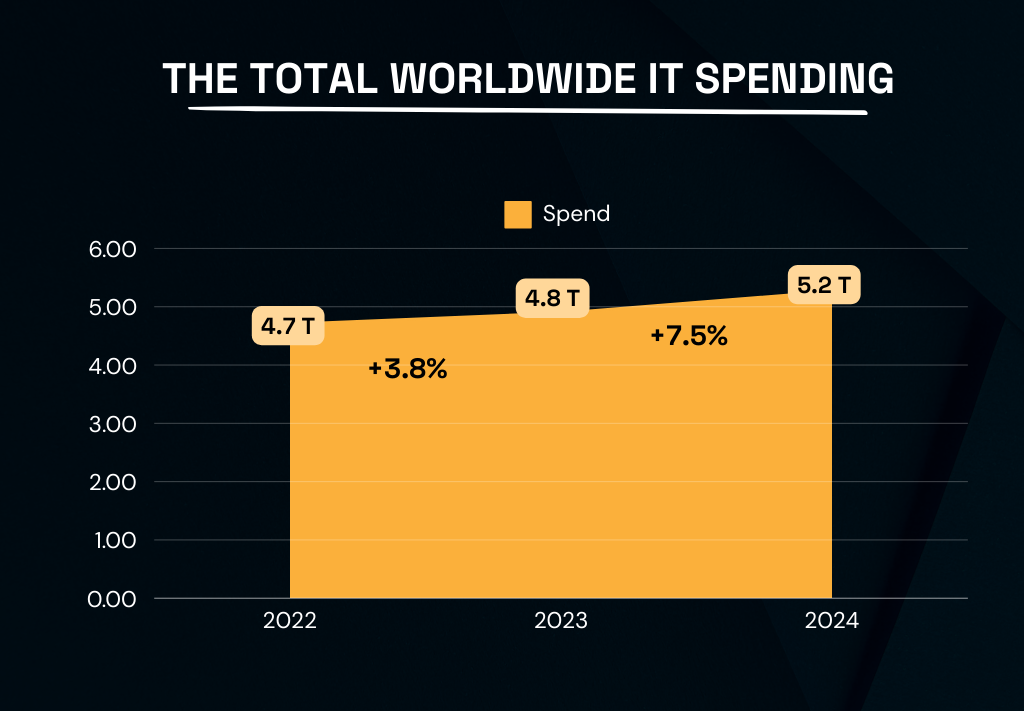

We’re looking at data from Gartner’s IT Spending Forecast for 2024 which analyzed sales by over a thousand vendors across the entire range of IT products and services.

They estimated that IT spend would total $5.26 trillion by the end of 2024.

Illustration: Veridion / Data: Gartner

Compared to 2023, this is an increase of 7.5%.

According to their chief forecaster, John Lovelock, much of this growth is attributable to the rise of Generative AI.

Illustration: Veridion / Data: Gartner

This AI technology can create original content, such as text, images, and code, opening up a world of possibilities for new IT products.

While he points out that software companies now have to account for spending revenue on AI model providers for AI features, these features are still a big boost to the overall health of the IT industry.

To break up the IT spending data, let’s look at regional spend.

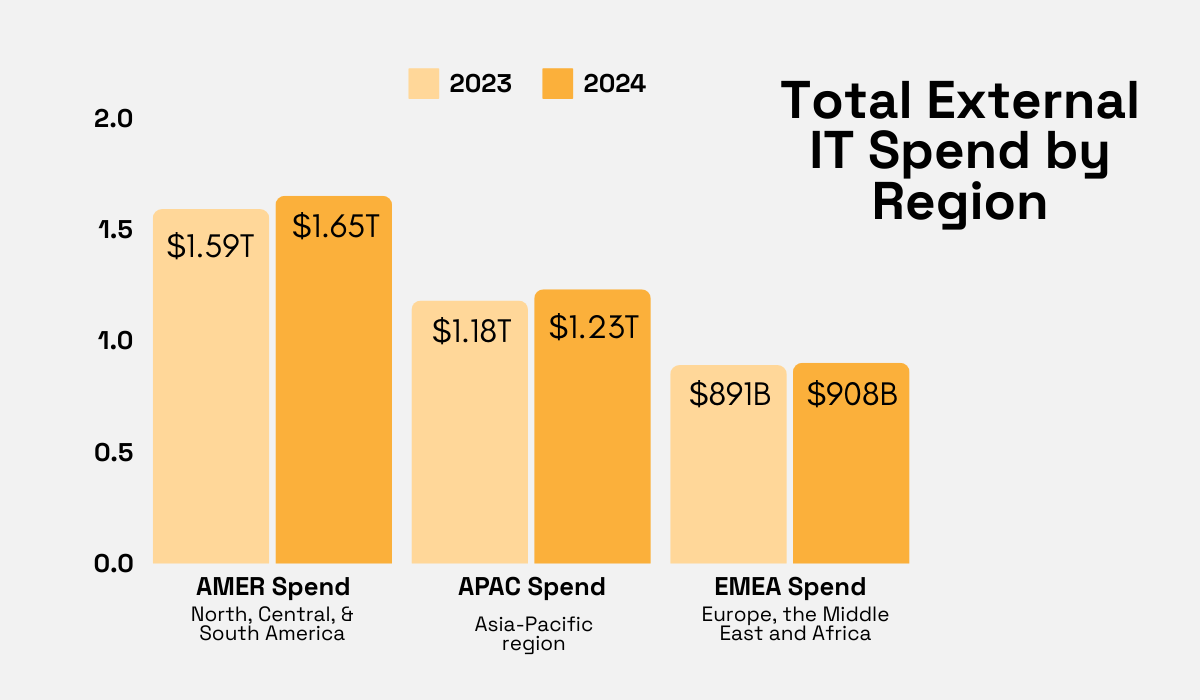

HGInsights identified 4.2 million businesses worldwide that are buying IT products and services. Unlike Gartner, which examined enterprise and consumer spending, HGInsights analyzed only enterprise spending.

They estimated the total value of enterprise IT spend to be $3.8 trillion in 2024—a 3.8% year-over-year (YoY) increase.

And as you can see below, the AMER region has the highest spending, with $1.65 trillion in 2024, a growth of 3.9% from last year.

Illustration: Veridion / Data: HGInsights

However, it’s also worth tracking the Asia-Pacific (APAC) region.

While they have much lower spend than AMER, with $1.23 trillion in 2024, their growth is higher with a 4.2% YoY increase.

So, it’s paying attention to these markets, especially as the economies of countries like India and China continue to grow.

When looking at spend data within organizations, the trends are positive.

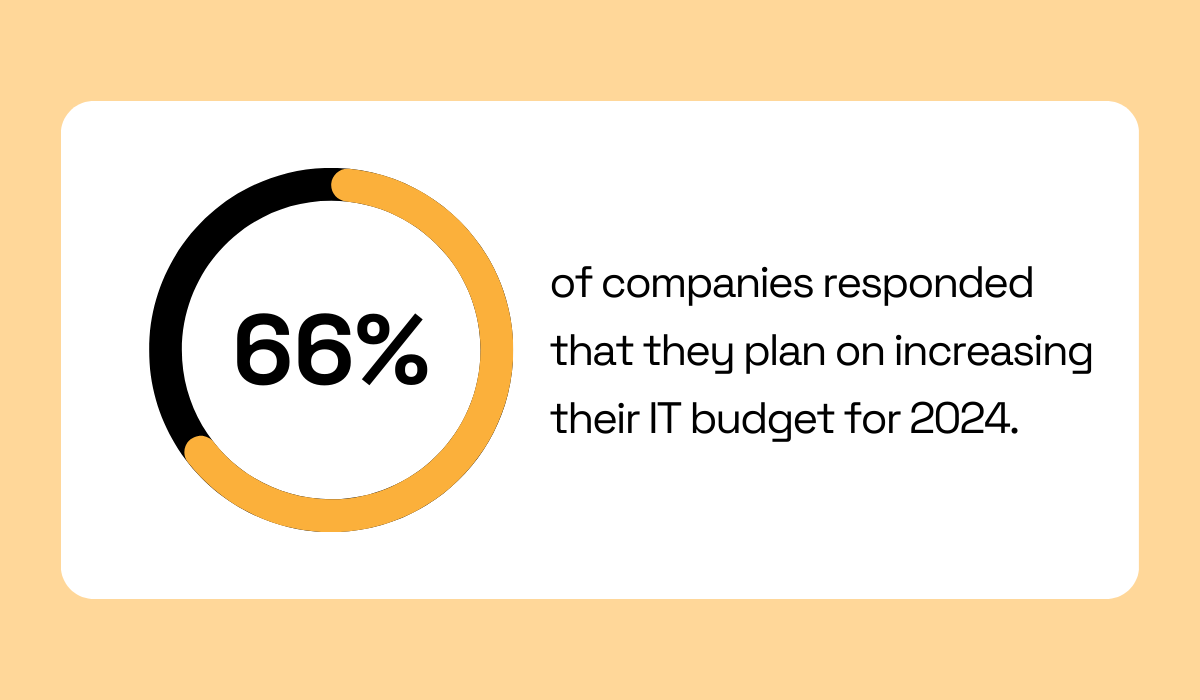

The State of IT, an annual study from Spiceworks and Aberdeen Strategy & Research, provides insights into IT budgets and adoption plans.

In late June and July 2023, they surveyed 883 IT professionals representing companies in North America and Europe and discovered that 66% of these companies planned to increase their IT budgets in 2024.

Illustration: Veridion / Data: Spiceworks

Out of the surveyed, only 4% intended to decrease their budgets, indicating that the vast majority (96%) have either increased or maintained their IT budgets this year.

In fact, despite widespread concerns about a recession expressed by many respondents, the value of IT services and products is considered crucial for business success.

Larger organizations with over 1,000 employees demonstrated the most significant investment in IT, with 75% planning to increase their tech budgets to support their operations.

Overall, IT spending is unquestionably on the rise.

Despite the rise in IT budgets, companies are not blindly spending on technology.

In fact, the same Spiceworks study revealed that a significant majority (75%) of organizations have adjusted their purchasing behaviors to reduce costs.

To understand this apparent contradiction, see specific strategies they’ve implemented, illustrated in the image below.

Illustration: Veridion / Data: Spiceworks

As evident, there’s a growing emphasis on optimizing IT spend management.

Delaying purchases, conducting more thorough evaluations of vendors and contracts, cleaning up unused systems, and consolidating tech to streamline operations are all in practice.

Furthermore, companies are increasingly exploring open-source or cost-effective IT solutions to reduce upfront costs and gain greater flexibility.

These strategic changes are beneficial as they help companies maximize the value of their IT investments and use their increased budgets more effectively.

In other words, IT spending is up, and organizations aim to manage their resources optimally.

When it comes to where organizations are allocating their IT budgets, the answer is clear: software.

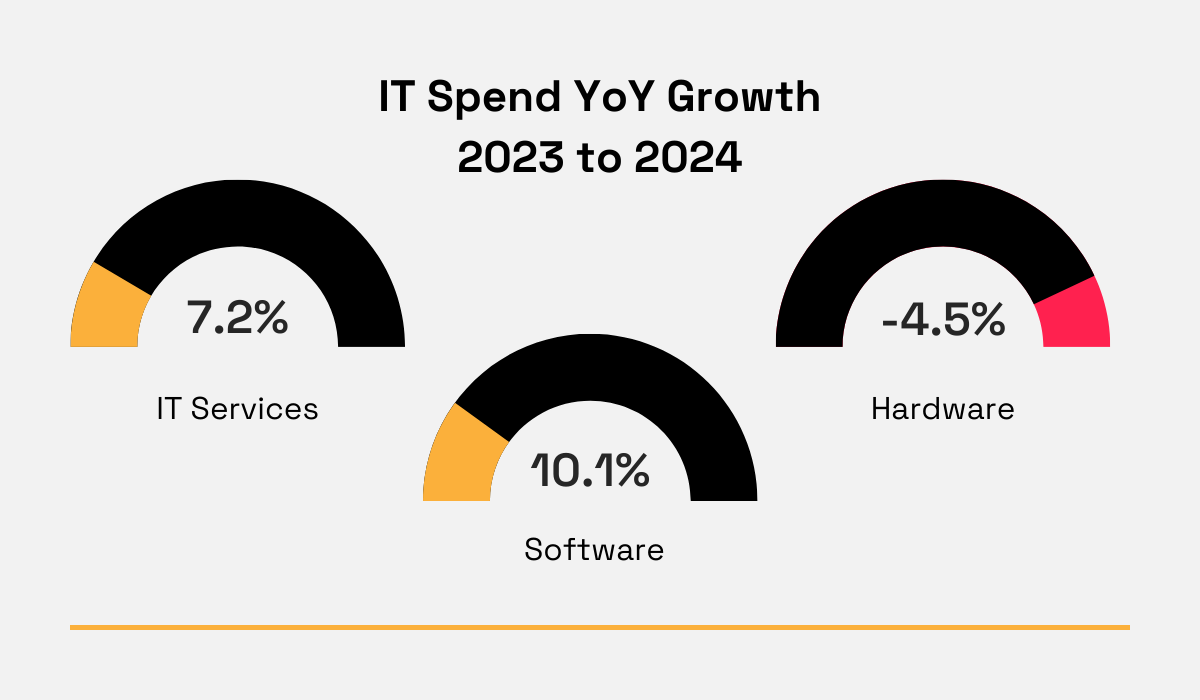

HGInsight’s IT Spending Report reveals that the software category has experienced the most significant year-over-year growth at 10.1%.

Illustration: Veridion / Data: HG Insights

In comparison, IT services have shown a more modest growth of 7.2%, while spending on hardware is actually declining.

This trend is hardly surprising, given the rise of software as a service (SaaS) products.

With SaaS, organizations can access and deploy software solutions over the internet, eliminating the need for extensive on-premises hardware and infrastructure.

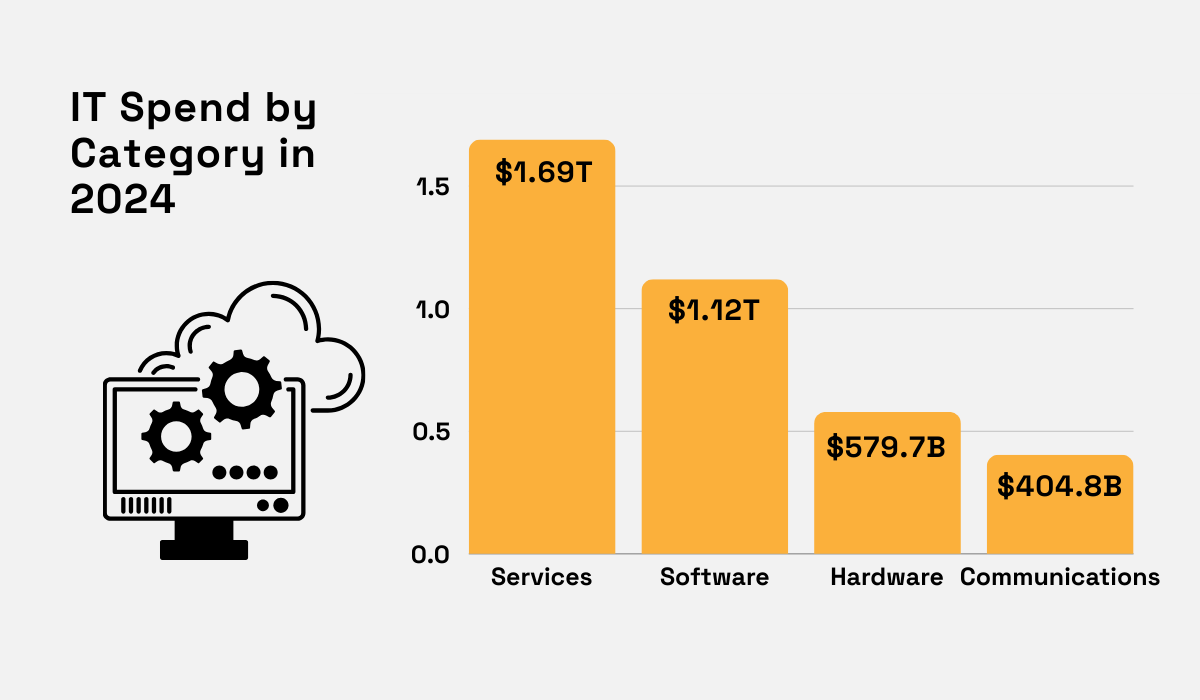

Considering these growth statistics, it’s crucial to examine the overall spending distribution across IT categories.

Illustration: Veridion / Data: HG Insights

While IT services remain the highest category in terms of spend in 2024, we may gradually shift towards SaaS solutions.

This trend is important for you to understand because it highlights the growing dominance of software and cloud-based solutions in the IT landscape.

By staying informed about these shifts, you can make strategic decisions about your own IT investments and ensure your organization remains competitive.

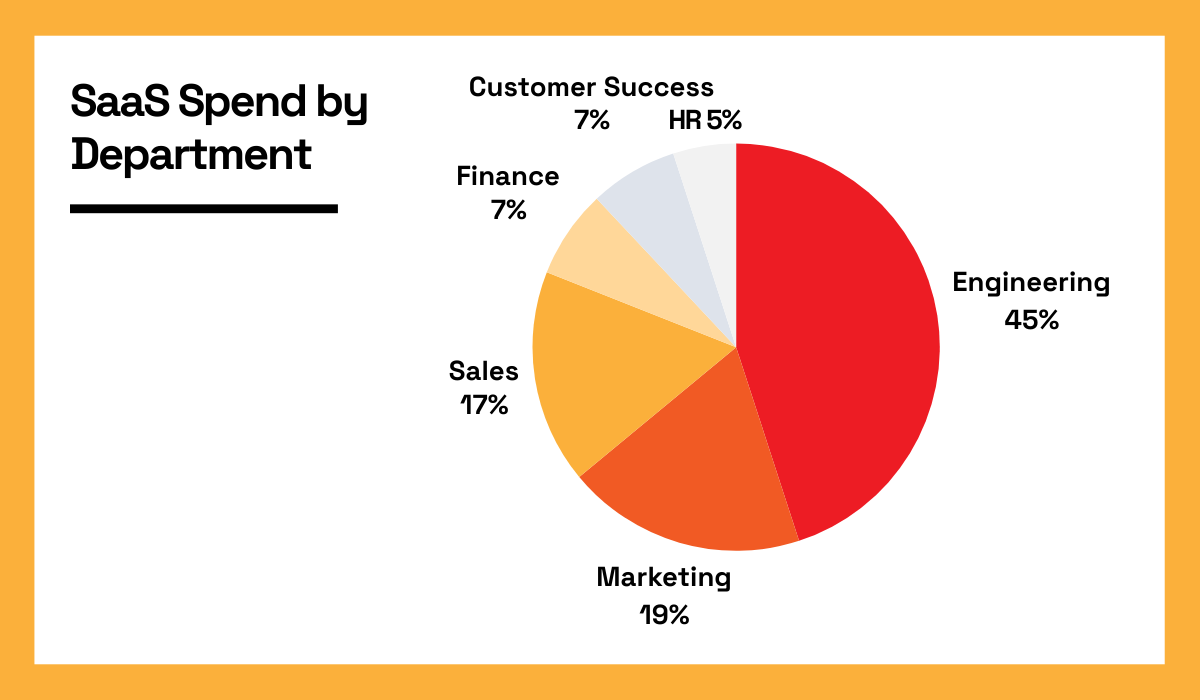

Drilling down further into SaaS spend, data reveals that engineering departments account for the largest share of SaaS spending across all departments.

This insight comes from CloudEagle’s 2024 SaaS Spend Trends and Insights report, a half-yearly analysis based on $400 million worth of transactions processed through their platform.

The breakdown of IT spending by department is illustrated below.

Illustration: Veridion / Data: CloudEagle

The data shows that Engineering spends the most, followed by Marketing and Sales.

A key factor contributing to this trend is the substantial investment organizations make in cloud services.

This includes not only major cloud providers like AWS, Microsoft Azure, and Google Cloud Platform, but also a variety of other SaaS cloud-native applications.

These systems have become indispensable for development teams, providing essential capabilities for efficient data management and enhanced security.

It’s no surprise, then, that we’re seeing this trend emerge.

After all, engineers are at the forefront of innovation, and they look for SaaS tools and technologies that enable them to build and deploy cutting-edge solutions.

With such a significant emphasis on SaaS adoption, it’s not surprising that some spending inefficiencies arise.

CloudEagle’s data highlights the sheer volume of applications used by different departments. Marketing leads the pack with an average of 76 apps used, followed by Engineering with 56 and Sales with 42.

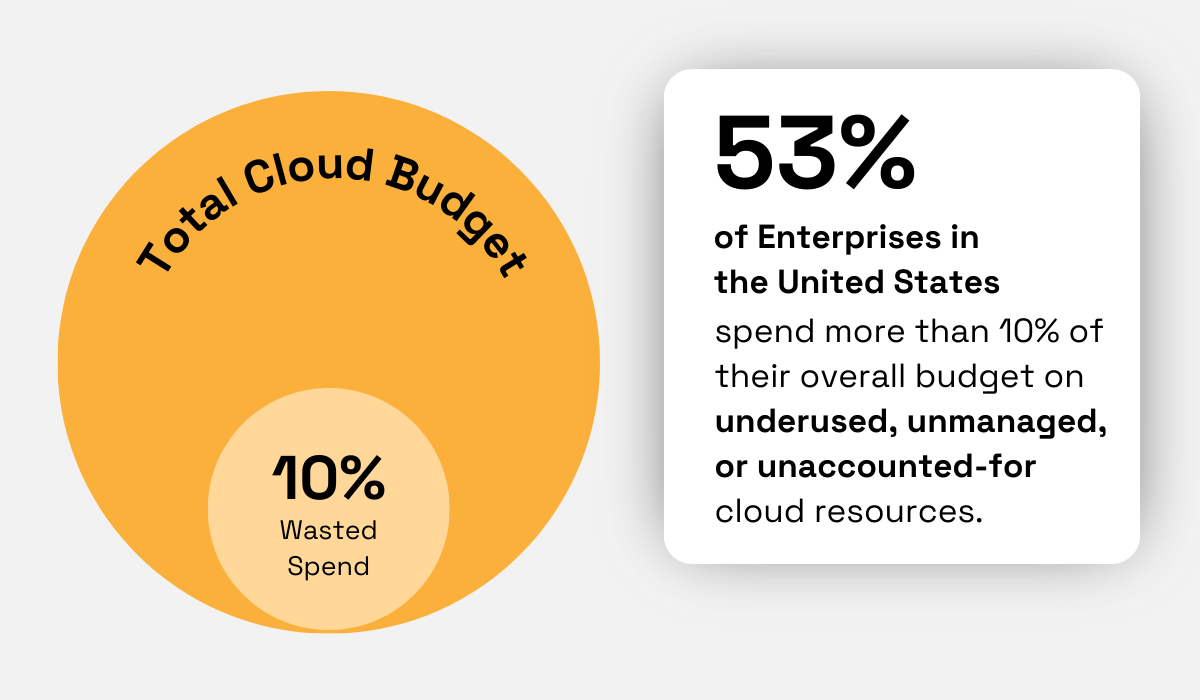

This insight connects to a critical finding from the 2023 Snapshot Survey on Cloud and SaaS Spend Optimization & Automation, conducted by YouGov research.

This survey examined how enterprises manage their IT budgets and revealed a sizable percentage of wasted resources.

Illustration: Veridion / Data: Oomnitza

The survey shows that over half of all U.S. enterprises waste 10% or more of their IT budgets on underutilized cloud resources.

These findings are based on responses from 213 senior IT decision-makers in enterprises with 1,000 to over 10,000 employees across various industries in the United States.

This represents a substantial amount of wasted spending, especially considering the scale of these organizations and their budgets.

This data underscores the critical importance of diligently tracking and managing cloud resources within organizations.

Without proper oversight, companies risk overspending on unnecessary services or failing to optimize existing resources.

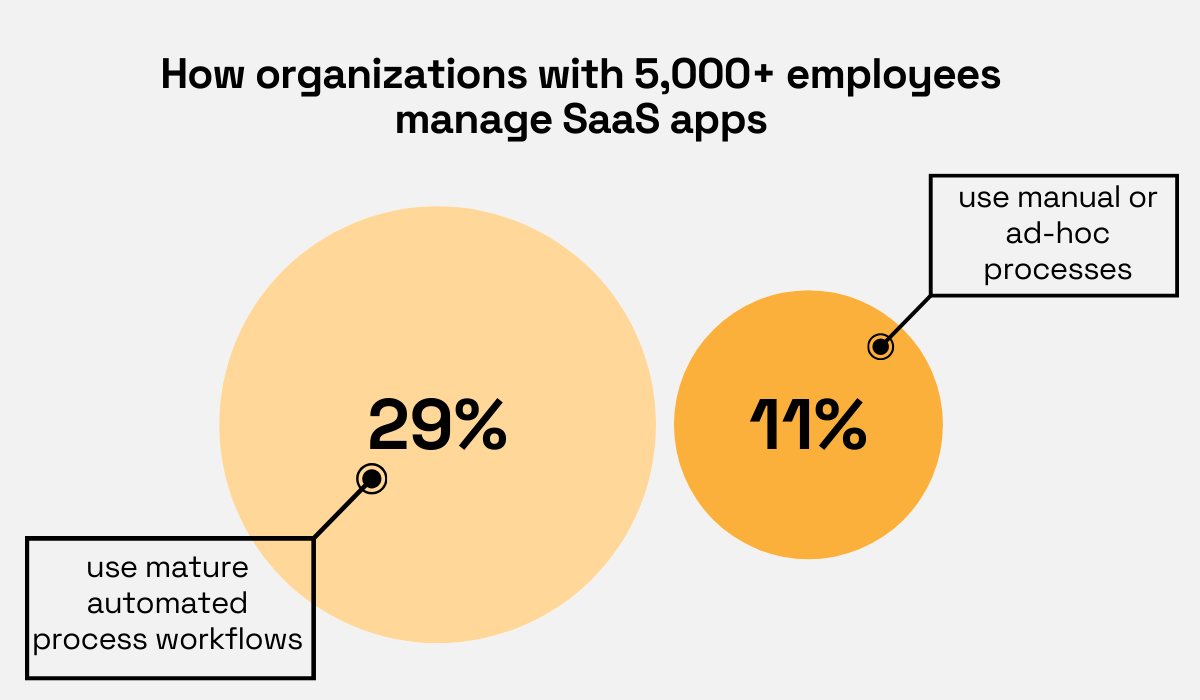

The source of IT budget waste becomes clearer when we examine how organizations manage their SaaS and cloud infrastructure.

The same YouGov research revealed that 11% of U.S. organizations still rely on manual processes for managing these critical resources.

Illustration: Veridion / Data: Oomnitza

This means that tasks like procuring new software, tracking usage, managing licenses, and optimizing cloud spending are handled manually, often through spreadsheets and time-consuming processes.

Furthermore, the study found that only 29% of organizations have achieved mature automated processes for SaaS and cloud management.

This means that most companies are still implementing or refining their automation workflows.

Given the prevalence of wasted IT spend and other inefficiencies, there’s a clear need for organizations to prioritize the automation of SaaS and cloud management.

This can involve implementing dedicated SaaS management platforms, utilizing cloud-based tools for procurement automation and scaling, and establishing clear workflows for software approval.

All in all, companies shouldn’t shy away from more automated approaches, as the benefits are well worth it.

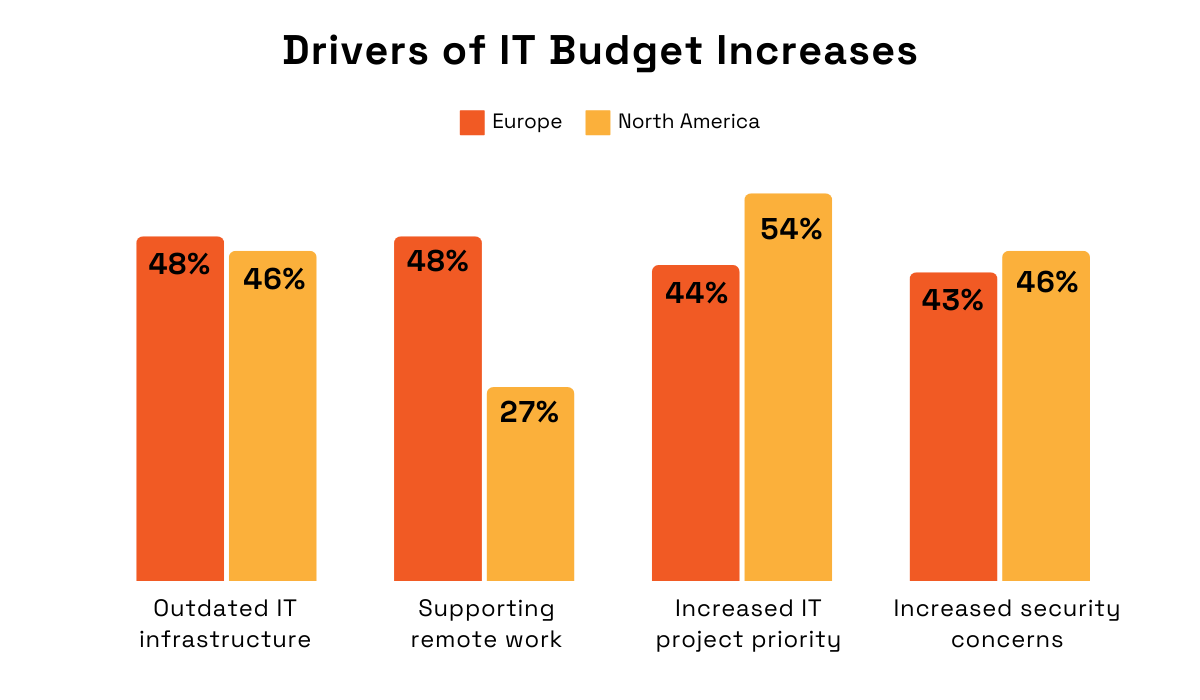

Next, we’ll go into the Spiceworks Ziff Davis annual State of IT study, which aims to provide insights into tech adoption trends.

Their 2022 report compared data from Europe and North America, featuring responses from thousands of IT decision-makers based in both regions.

Here’s what experts from these regions cited as the main drivers of IT budget increases.

Illustration: Veridion / Data: SWZD

In Europe, the primary driver was outdated IT infrastructure.

This means that over the past two years, European organizations have invested in IT modernization and improvement.

This might have included:

Comparably, North American organizations were more driven by increased IT project priorities, suggesting a greater focus on new initiatives and strategic investments.

This implies a more proactive approach to IT spending, aligning technology with evolving business needs and opportunities.

Overall, while European and North American organizations prioritized different aspects, both regions are heavily invested in increasing IT spending.

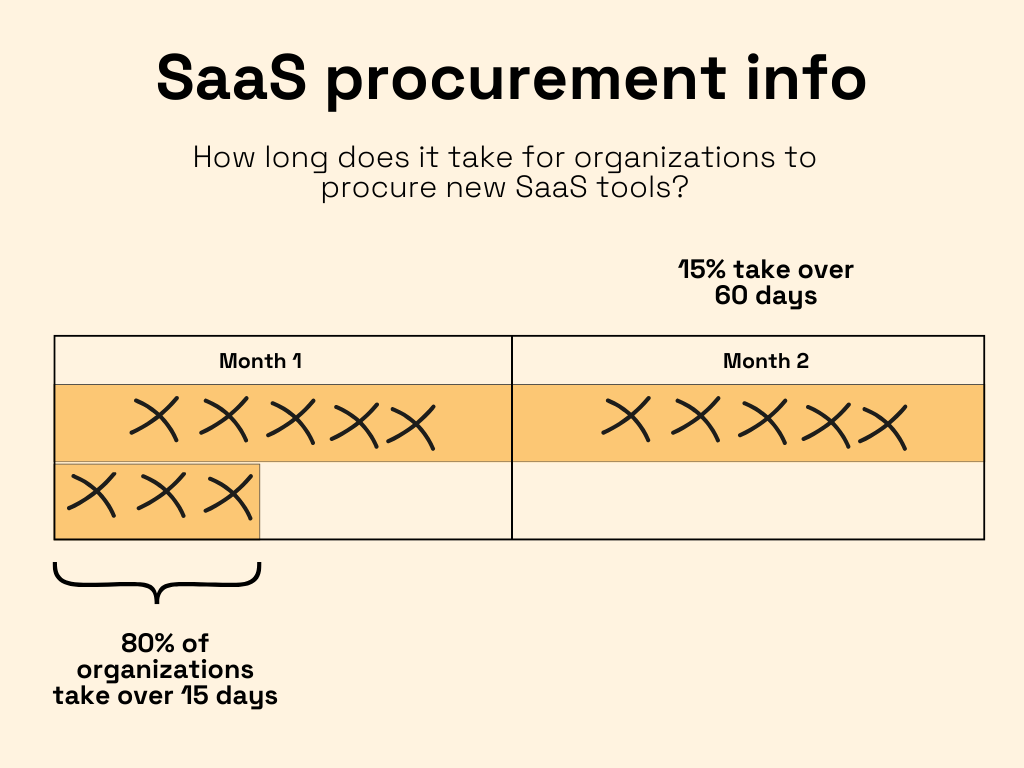

A significant challenge we’re seeing emerge is the lengthy time it takes to acquire SaaS tools.

Let’s look at a 2024 survey by Spendflo, conducted in the spring of 2024, where they distributed questionnaires about SaaS usage, procurement, management, and artificial intelligence.

The survey received 130 responses from across the United States, Europe, and India, with most respondents in the B2B SaaS industry.

According to the results, 80% of organizations report that procuring new SaaS tools took over two weeks.

Illustration: Veridion / Data: Spendflo

When looking at the cause of this figure, 61% of respondents identified complex and unclear pricing, while 34% acknowledged their lack of expertise.

A particularly surprising finding is that 15% of respondents said it takes over 60 days to renew tools they are already using and have contracts with.

This suggests that not only the initial onboarding process but that these challenges create delays in regular SaaS renewals.

To address these challenges, organizations should focus on streamlining their SaaS procurement processes, gaining a better understanding of pricing models, and developing the necessary expertise to negotiate effectively.

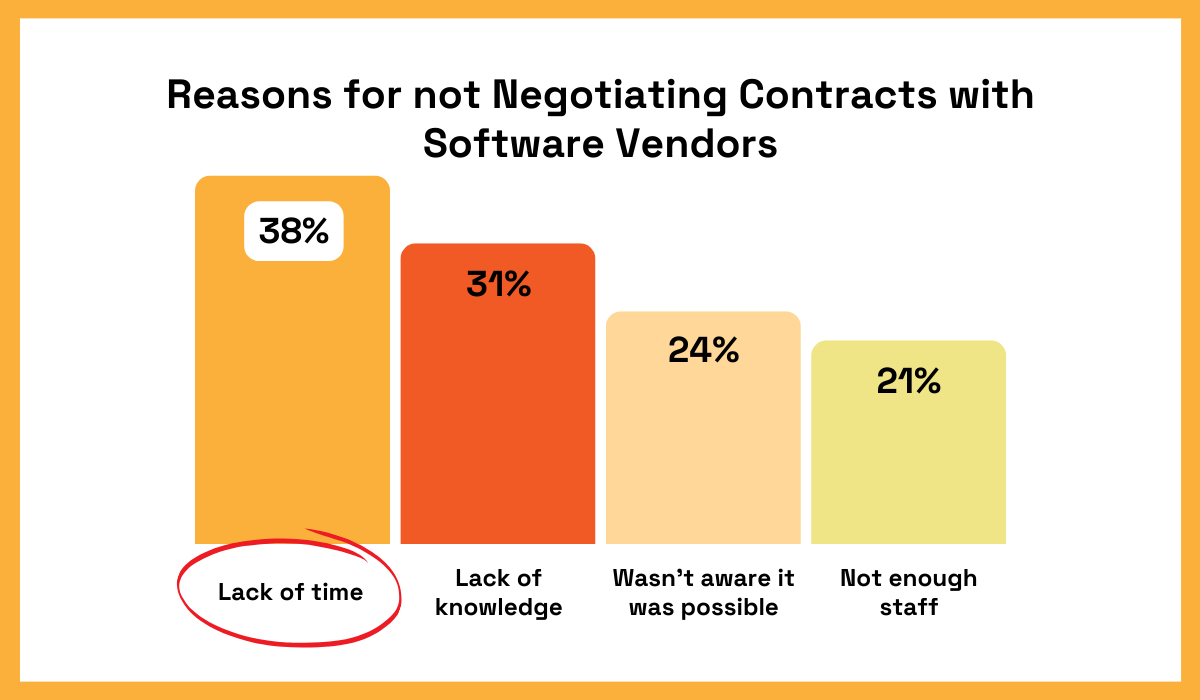

Finally, let’s see how a significant portion of organizations may be missing out on potential cost savings.

According to the 2023 SaaS Procurement Industry Report by Appinio and Sastrify, 14% of companies failed to negotiate contracts when purchasing new software and licenses.

The survey focused on senior managers, heads of departments, VPs, and C-levels working in companies with over 150 employees across the DACH, Benelux, UK, France, Spain, and Nordic regions.

While the majority (86%) of respondents did negotiate and manage their SaaS contracts, a smaller but significant portion did not.

When asked about the reasons for not negotiating, respondents cited the following.

Illustration: Veridion / Data: Sastrify

The primary reasons for not negotiating contracts were lack of time, followed by lack of knowledge and unawareness that negotiation was even possible.

This data points to the necessity for organizations to invest more resources, or even dedicated employees for managing SaaS contracts. In fact, according to the same report:

The overall SaaS negotiation and management process demands at least 8 to 40 hours per week, often making it a full-time job for one person.

So, while lack of time and resources is a valid excuse, organizations should start prioritizing contract negotiation as a strategic tool to optimize IT spending.

That wraps up our overview of the latest IT spend statistics.

We’ve examined a wide range of data and hopefully provided you with valuable insights into the current state of IT spend and the key factors influencing its future.

By understanding the trends and challenges discussed, you can better navigate the complexities in this spend category.

So, keep these insights in mind as you make strategic decisions about procurement in the IT sector.

With the right knowledge, you can effectively manage IT spending and contribute to your organization’s overall success.