Supplier ESG Assessment: A Quick Guide

Key Takeaways:

Do you know whether your suppliers’ operations are environmentally friendly, socially responsible, ethical, and sustainable?

Being able to answer this question is more critical than ever as customers, investors, and regulatory bodies increasingly demand transparency and accountability in supply chains.

That’s where supplier ESG assessments come in and that’s why we prepared this guide for you.

We’ll first explore why you should be doing these assessments.

Then we’ll help you conduct ESG supplier assessments effectively with practical tips and tools recommendations.

Let’s dive in.

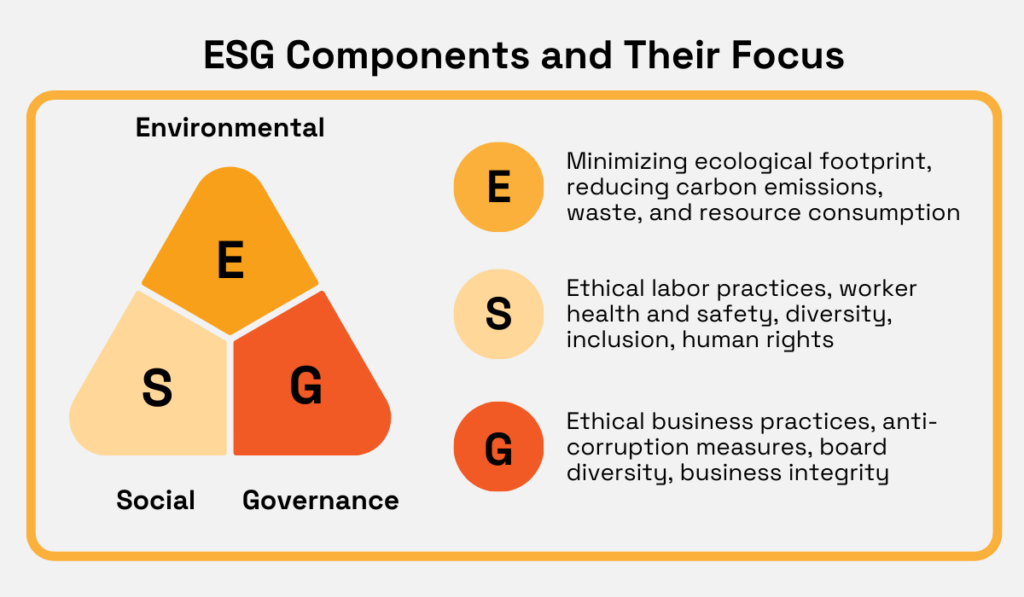

A supplier ESG assessment is a structured process aimed at ensuring your existing and potential suppliers meet environmental, social, and governance (ESG) standards.

These standards, often called sustainability requirements, encompass a wide range of practices.

Despite some misconceptions, ESG assessments go beyond environmental concerns to evaluate other operational aspects as well.

As such, these assessments involve analyzing, evaluating, quantifying, and tracking specific requirements across three critical aspects of supplier operations.

You can see these three ESG components and their focus areas summarized below.

Source: Veridion

In simple terms, assessing suppliers against criteria stemming from these components allows you to be as certain as possible that they are NOT:

Of course, verifying these aspects is additional to traditional supplier selection criteria, such as cost, quality, and delivery reliability.

Now that we now know what supplier ESG assessments are, let’s examine when they should be conducted.

For starters, ESG enters the stage when your team is establishing supplier selection criteria.

This involves defining specific sustainability criteria that align with your company’s corporate values and industry standards.

Here are some typical criteria for supplier evaluation across ESG components.

| Environmental | Social | Governance |

|---|---|---|

| Carbon emissions | Labor practices and fair wages | Ethical business conduct |

| Energy efficiency | Workplace health & safety measures | Anti-corruption and anti-bribery measures |

| Waste management policies | Diversity, equity, and inclusion (DEI) initiatives | Transparency in reporting |

| Use of sustainable materials | Impact on local communities | Board diversity and accountability |

| Possession of environmental certifications | Compliance with human rights standards | Data privacy and security policies |

| Sustainable use of resources |

With a set of ESG criteria in hand, suppliers are initially assessed during the discovery and screening stage.

This preliminary screening is typically based on data collected from desktop research and third-party sources, without direct contact with suppliers.

The purpose of this step is to filter out suppliers who do not meet the minimum ESG standards.

Shortlisted suppliers are then asked to provide detailed information about their ESG practices, usually through self-assessment questionnaires and supporting documentation.

To illustrate, here are two example self-assessment questions for each ESG component, courtesy of Case Paper:

| Does your company have environmental targets and objectives to continually improve your environmental performance? |

| Is your company aware of and does it fully comply with all applicable laws and regulations of the countries you operate in? |

| Does your company have Anti-corruption and Anti-bribery training and policies in place? |

| Does the facility have a recycling program to reduce or eliminate pollution and waste in its operations? |

| How does your company assure the fair treatment of your employees irrespective of ethnic origin, nationality, religion, political views, gender, sexual orientation or age? |

| Has your company been involved in any legal case regarding corruption, bribery and/or anti-trust during the last five years? |

Next, for those suppliers that passed through this filter to the next round, conducting audits and site visits becomes crucial to verify their ESG claims.

Similarly, once suppliers are onboarded, implementing a system for ongoing performance measurement against ESG criteria ensures continuous alignment with your sustainability goals.

Finally, during the contract execution stage, specific ESG requirements should be incorporated into supplier agreements to formalize expectations and accountability.

Overall, ESG assessments not only ensure supplier compliance but also—as discussed next—unlock significant benefits for your organization.

Supplier ESG assessments offer significant advantages that go beyond meeting sustainability goals.

By leveraging these assessments, companies can proactively mitigate risks, ensure supplier compliance, protect their reputation, and uncover long-term cost-saving opportunities.

Let’s delve into these four key benefits to illustrate how ESG assessments contribute to a more resilient and sustainable supply chain.

One overarching benefit of supplier ESG assessments is the ability to identify and avoid or mitigate potential risks in your supply chain.

When assessing the ESG practices of potential suppliers, the focus is on preventing risks before they enter your supply chain.

This involves screening for red flags such as inadequate waste management, unethical labor practices, untransparent ownership, etc.

By excluding high-risk suppliers at the selection stage, you can avoid disruptions, regulatory penalties, or reputational damage down the line.

However, as many news stories illustrate, this is easier said than done.

For instance, one fast fashion brand faced significant financial and reputational damage when allegations of modern-day slavery surfaced against one of its UK-based suppliers.

Source: The Guardian

This example highlights the complexity of assessing supplier ESG practices and the critical need for continuous monitoring once suppliers are contracted.

For instance, a supplier that initially met minimum wage standards might later fall out of compliance due to reasons like competitive pressures or profit chasing.

That’s why regular assessments, audits, and performance reviews are essential to ensure ongoing alignment with your ESG criteria.

By maintaining this vigilance, you can timely address emerging risks, ultimately safeguarding your supply chain’s resilience and integrity.

Another key benefit of supplier ESG assessments is that they enable your company to stay aligned with evolving regulatory requirements and industry standards.

Simply put, having ESG-compliant suppliers helps avoid fines, penalties, or delivery disruptions imposed by various regulatory bodies.

Examples of the consequences of ESG non-compliance are easy to find.

For instance, a small electronic component in Volkswagen cars—allegedly sourced from a sub-supplier using forced labor—resulted in vehicles being detained by US customs.

Source: VOA News

To resolve the issue, Volkswagen had to replace the part before delivering vehicles from ports to dealers, incurring significant costs and delays.

This example underscores the critical need for continuous monitoring of:

As global and local regulations—led by EU sustainability directives—increasingly regulate ESG practices, proactive assessments ensure your suppliers stay compliant with these evolving standards.

Beyond mitigating risks and ensuring regulatory compliance, supplier ESG assessments enable your organization to build a positive brand reputation.

In other words, adopting strong ESG practices and ensuring your suppliers do the same can:

As ESG issues increasingly influence consumer and investor decisions, many companies are leveraging their sustainability initiatives to reap the rewards.

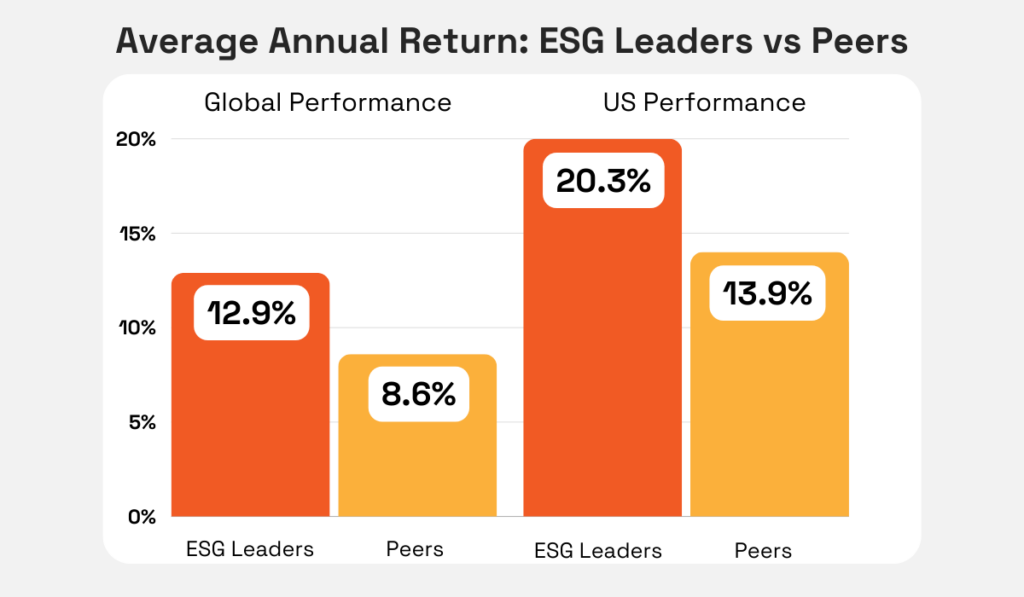

A 2023 study underscores this trend, revealing that ESG leaders consistently outperform their peers in financial returns—both globally and in the US.

Illustration: Veridion / Data: Sustainable Brands

A positive brand image cultivated by ESG leaders undoubtedly contributes to their financial success.

However, their performance also echoes the fact that everybody, from consumers to employees and investors, wants to see ESG practices actualized.

For instance, one PwC study found that 76% of consumers would stop purchasing from companies that mistreat workers, communities, or the environment.

Supplier ESG assessments are essential for addressing these concerns and ensuring your company meets consumer expectations.

As part of a wider risk management process, they enhance supply chain visibility and foster closer supplier relations.

Along with other corporate ESG efforts, this empowers your company to publicly share its commitment to responsible practices—strengthening its reputation in the process.

The ultimate benefit of supplier ESG assessments is the potential for significant cost savings, of course.

By ensuring compliance, companies can save money in various ways.

| Avoiding Fines and Penalties | By ensuring that your suppliers meet the necessary ESG standards, you reduce the likelihood of incurring fines or regulatory penalties for non-compliance. |

| Improved Purchasing Power | A supplier base that aligns with ESG criteria is more likely to be reliable and transparent, resulting in better purchasing terms. This can lead to cost savings through negotiated discounts or more favorable contract terms. |

| Operational Efficiency and Risk Mitigation | By selecting suppliers that align with ESG values, procurement teams reduce the likelihood of disruptions caused by poor practices. Fewer delays and compliance issues translate into cost savings over time. |

By focusing on working with ESG-compliant suppliers, procurement teams not only minimize risks but also optimize their purchasing strategies and safeguard against potential costs, which leads to overall financial savings for the company.

At the core of these assessments is the need to clearly define your company’s ESG goals and expectations, using them as the foundation for evaluating supplier practices.

To guide this process, standardized frameworks and metrics provide invaluable benchmarks for assessing supplier ESG performance.

Given the complexity of ESG considerations, numerous international and national standards can help structure these efforts.

Here’s an overview of some widely recognized frameworks and their focus areas:

| Framework | Focus Area |

|---|---|

| ISO 14001(Environmental management) | Focuses on effective environmental management systems to reduce waste and improve resource efficiency |

| SA8000(Social accountability) | Addresses labor standards, worker safety, and fair treatment across the supply chain |

| UN Global Compact | Encourages businesses to align strategies with principles on human rights, labor, environment, and anti-corruption |

| GRI standards(Global Reporting Initiative) | Offers guidelines for reporting on environmental, social, and governance impacts |

| SASB standards(Sustainability Accounting Standards Board) | Provides industry-specific metrics for disclosing material ESG factors |

| CDP standards(Carbon Disclosure Project) | Focuses on transparency in climate impact, water use, and deforestation efforts |

| ESRS(European Sustainability Reporting Standards) | Regulates corporate sustainability disclosures, including climate-related reporting, social, and governance data |

It’s worth noting that these frameworks are still predominantly voluntary, with countries around the world introducing their own regional or national mandatory ESG regulations.

Examples of this are the EU’s Corporate Sustainability Reporting Directive (CSRD) and the German Supply Chain Due Diligence Act.

This means your organization may need to integrate regulatory requirements alongside voluntary ESG frameworks, depending on its geographic scope and the location of its suppliers.

In any case, these various frameworks, standards, regulations, and protocols can help you set clear ESG criteria for your suppliers.

The next step involves preliminary research and screening, where you gather essential information on suppliers, such as their location, industry, and past ESG performance.

At this stage, you can leverage various tools to streamline the ESG assessment process.

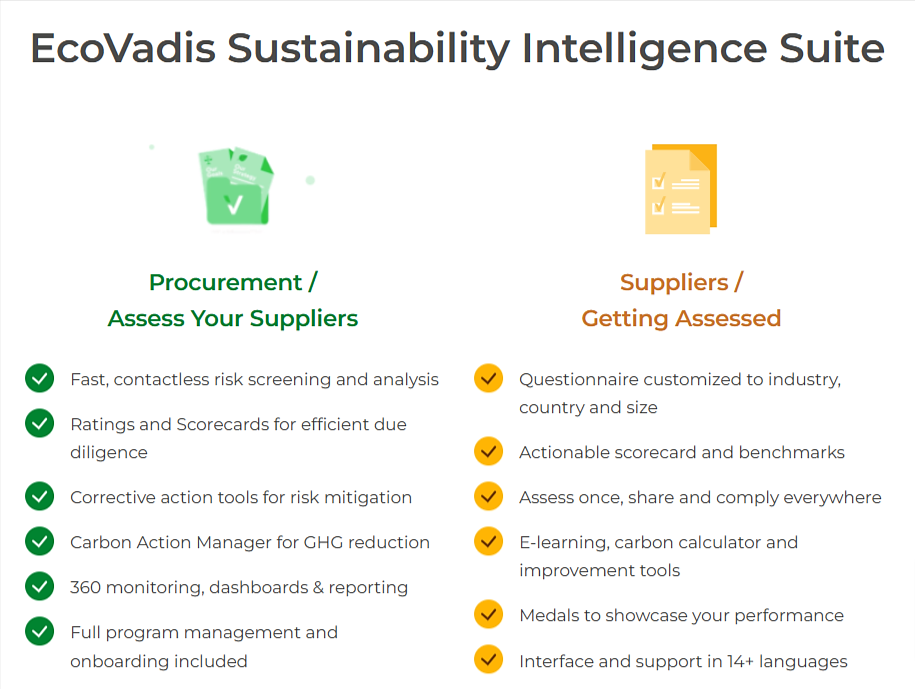

For example, EcoVadis is an online platform that offers sustainability ratings, benchmarking tools, and educational resources to help assess supplier performance.

Source: EcoVadis

With over 2 million companies screened and more than 150,000 rated, EcoVadis helps organizations conduct initial, contactless ESG screening of suppliers.

It also facilitates the creation of customized questionnaires for suppliers that move to the next evaluation round.

For both new and existing suppliers, it’s equally important to implement a continuous ESG performance monitoring system, which includes regular audits and, when necessary, site visits.

This approach is crucial for ensuring ongoing supplier compliance with the ESG requirements specified in their contracts.

Overall, while ESG assessments are complex, there is a range of frameworks, standards, and tools available to streamline the process.

Together, they enable your procurement team to effectively evaluate, monitor, and improve supplier ESG performance over time.

Access to accurate and up-to-date supplier data is essential.

Without it, this process would be overly time-consuming and labor-intensive, leading to inefficiencies and potential inaccuracies.

This is where artificial intelligence (AI) and its subset, machine learning (ML), come into play.

These technologies have revolutionized supplier ESG assessments by automating data collection, analyzing large datasets, and quickly identifying trends and risks.

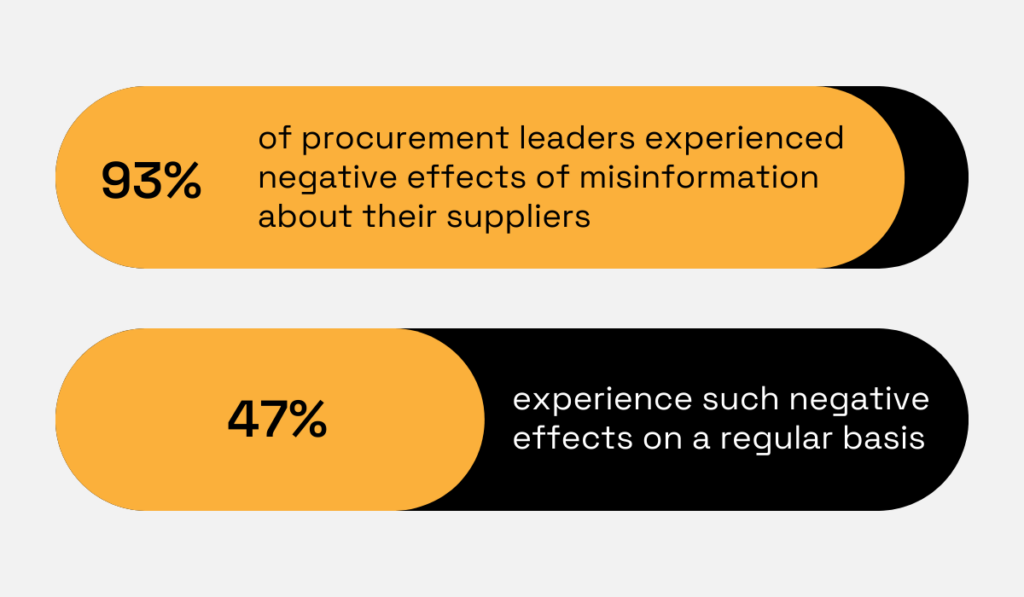

All of the above is critical, as research shows that most procurement professionals face negative consequences due to missing or inaccurate supplier information.

Illustration: Veridion / Data: TealBook

By leveraging AI in supplier ESG assessments, organizations can significantly reduce these adverse effects, enhancing both accuracy and efficiency.

For instance, our AI-powered data platform, Veridion, collects and regularly updates info on all companies with an active online presence (+123 million in 250 countries).

With access to Veridion’s global company database, your procurement team can input specific criteria, including critical ESG factors, and receive a tailored list of suitable suppliers in seconds.

Here’s what Veridion’s ESG data offers:

| esg_content_pillar | esg_content_theme | esg_content_risk_criteria |

|---|---|---|

| Environmental | Climate change | Atmospheric Contamination |

| Environmental | Climate change | Carbon Footprint |

| Environmental | Climate change | Transitional Threats |

| Environmental | Environmental degradation | Mining Techniques |

| Environmental | Environmental degradation | Illegal Deforestation |

| Environmental | Environmental degradation | Land Contamination |

| Environmental | Environmental degradation | Water Contamination |

| Environmental | Environmental degradation | Water Usage |

| Environmental | Protected sites/species | Effects on Protected Regions |

| Environmental | Protected sites/species | Effects on Endangered Species |

| Environmental | Unsustainable practices | Unsustainable Energy Practices |

| Environmental | Unsustainable practices | Unlawful Fishing |

| Environmental | Unsustainable practices | Plastic Contamination |

| Environmental | Animal welfare/testing | Illegal Wildlife Trade |

| Environmental | Animal welfare/testing | Habitat Quality and Medication Use |

| Environmental | Animal welfare/testing | Testing on Animals |

| Social | Human rights | Child Exploitation and Human Trafficking |

| Social | Human rights | Involuntary Displacement |

| Social | Human rights | Worker Rights |

| Social | Human rights | Misbehavior by Security Staff |

| Social | Controversial weapons | Sensitive Weapons Involvement |

| Governance | Bribery & corruption | Corrupt and Unethical Transactions |

| Governance | Corporate governance | Monopoly Practices |

| Governance | Product safety & quality | Immoral Behaviour or Adverse Health Influence on Consumers |

| Governance | Diversity & pay | Inclusivity |

| Governance | Diversity & pay | Wage Disparity |

Source: Veridion

You can also leverage Veridion to set custom ESG risk factors and receive real-time alerts if there are indications that any of those risks could arise.

This capability ensures your procurement team can address ESG non-compliance issues promptly, preventing them from escalating into significant disruptions.

Additionally, Veridion’s data integrates seamlessly with other tools, such as predictive analytics platforms via API.

These tools analyze data from internal and external sources, enabling organizations to anticipate ESG risks by identifying patterns and trends in supplier performance.

By combining AI-powered data insights with predictive analytics, your team can anticipate and prepare for future ESG challenges, enabling proactive risk management.

Overall, the significance of AI and ML in supplier ESG assessments will only continue to grow, revolutionizing how businesses ensure sustainability and resilience across their supply chains.

Assessing the ESG practices of your potential and existing suppliers is undoubtedly complex.

However, incorporating supplier ESG assessments into your procurement strategy is no longer optional—it’s a critical step toward ensuring sustainable and responsible operations.

This process can be streamlined by leveraging the right frameworks, methodologies, and tools, enabling efficient evaluation and monitoring of supplier compliance.

As ESG expectations grow, adopting these practices positions your company for long-term success in an increasingly sustainability-focused business environment.