Supplier Relationship vs Performance Management: Key Differences

Key Takeaways:

Many procurement professionals struggle to differentiate between Supplier Relationship Management (SRM) and Supplier Performance Management (SPM), often using the terms interchangeably.

While they often overlap in practice, SRM and SPM serve distinct purposes.

In this article, we’ll break down both processes to give you a clear picture of when and how each is used.

When procurement professionals are asked about the difference between SRM and SPM, many find it difficult to distinguish between the two.

That’s not surprising since both SRM and SPM share common goals such as ensuring supplier reliability, mitigating risks, and driving value for the organization.

However, they serve distinct roles in achieving these objectives.

SRM focuses on building strong, long-term relationships with suppliers to drive collaboration, innovation, and mutual growth.

In contrast, SPM is centered on ensuring suppliers meet the performance standards and expectations set in contracts.

Alan Day, Managing Director of State of Flux, explains it very clearly:

Illustration: Veridion / Quote: State of Flux

To illustrate the difference, consider these examples:

In an SRM scenario, a tech company partners with a trusted supplier to develop a cutting-edge product.

Both sides engage in regular meetings, share insights on product development, and collaborate to address market demands, fostering innovation and mutual growth.

By contrast, SPM is exemplified when the same company works with a supplier to deliver standard components for production.

The focus is on ensuring delivery schedules, quality standards, and contractual compliance.

Supplier performance is tracked through KPIs, with issues resolved through corrective action plans or penalties.

A real-world example of SPM in action is Levi Strauss & Co.’s response to poor working conditions at a supplier’s factory in Turkey.

Source: Sourcing Journal

After Levi investigated the union-busting allegations, the company and the supplier agreed on a corrective action plan to improve workplace compliance.

Under this plan, the supplier was required to:

By addressing underperformance through SPM, Levi’s mitigated risks tied to non-compliance and operational inefficiencies.

While both SRM and SPM contribute to supplier risk management, their approaches differ:

This distinction in how SRM and SPM mitigate risks sets the stage for a closer look at their scope and focus areas.

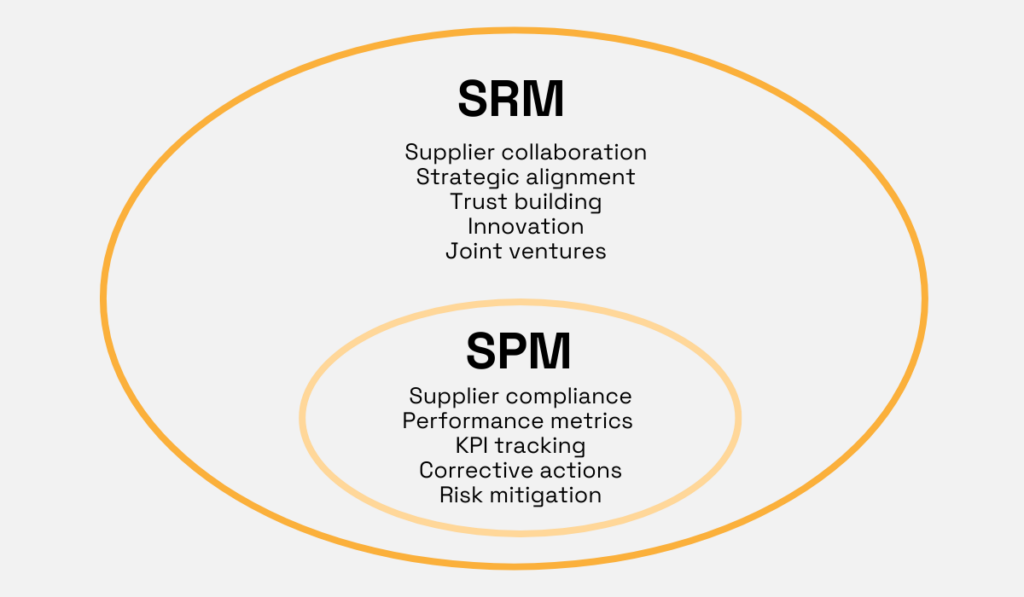

SRM is a broad, strategic approach that encompasses a wide range of activities aimed at fostering strong, long-term relationships with suppliers.

It includes supplier engagement, strategic initiatives, joint ventures, and innovation opportunities, all designed to align supplier capabilities with organizational goals.

SPM, on the other hand, is a tactical framework focused on measuring supplier performance through various key metrics.

The two approaches complement each other.

SPM ensures suppliers meet defined performance standards, while SRM provides the foundation for deeper collaboration, innovation, and mutual growth.

The following illustration highlights their scope and focus areas:

Source: Veridion

As shown, SRM’s scope is expansive, encompassing all activities under the SPM framework and extending far beyond it.

A notable example of supplier relationship management is the joint venture between car manufacturer Chery and its supplier, Forvia.

Source: All About Industries

In this partnership, Chery and Forvia have joined forces to develop and manufacture systems and modules for the entire vehicle interior.

The joint venture focuses on seats, cockpit electronics, and interior fittings, with a sales target of one billion euros by 2029.

This collaboration underscores the strategic nature of SRM, where suppliers and companies align to achieve shared goals, such as innovation and market expansion.

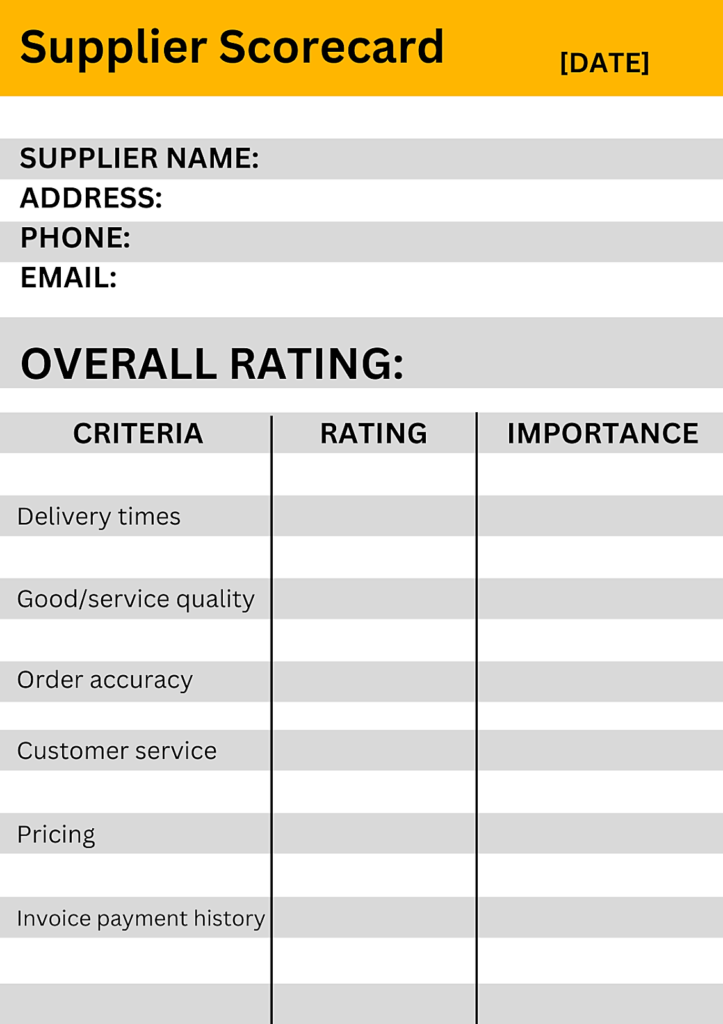

Meanwhile, SPM relies on tools like supplier scorecards to track KPIs such as on-time delivery and compliance.

Source: Tipalti

These scorecards enable procurement teams to evaluate a supplier’s contract performance, pinpoint areas for improvement, and communicate expectations effectively.

If a supplier’s performance declines, corrective actions can be taken promptly to prevent disruptions.

By focusing on these measurable outcomes, SPM ensures that suppliers consistently meet the performance levels required to support broader organizational goals.

When combined with SRM’s strategic emphasis, SPM’s tactical focus strengthens the overall supplier relationship, creating a balanced and effective approach to supplier management.

Supplier engagement in SRM goes beyond the basics of performance tracking.

It emphasizes collaboration and long-term strategic alignment, requiring frequent communication, joint planning, and shared goals.

SRM teams work with suppliers to create sustainable value that extends beyond immediate needs.

On the other hand, SPM is more transactional.

It’s focused on periodic supplier evaluations and addressing immediate performance issues.

So, this distinction in engagement styles reflects a deeper change in supplier relationships, moving from short-term performance management to long-term value creation.

Costas Xyloyiannis, CEO of HICX, points out that many leaders still operate with a transactional mindset.

However, supplier collaboration is crucial in today’s landscape, as he emphasizes:

Illustration: Veridion / Quote: Global Trade Magazine

So, how can SRM teams improve collaboration and maintain regular engagement?

Clear and transparent communication is key.

Additionally, SRM teams can organize structured interactions like quarterly business reviews (QBRs), joint planning sessions, and collaborative innovation workshops.

These frequent touchpoints ensure both parties stay aligned on long-term goals and can adapt to shifts in the market or business environment.

However, poorly executed interactions can significantly undermine their effectiveness.

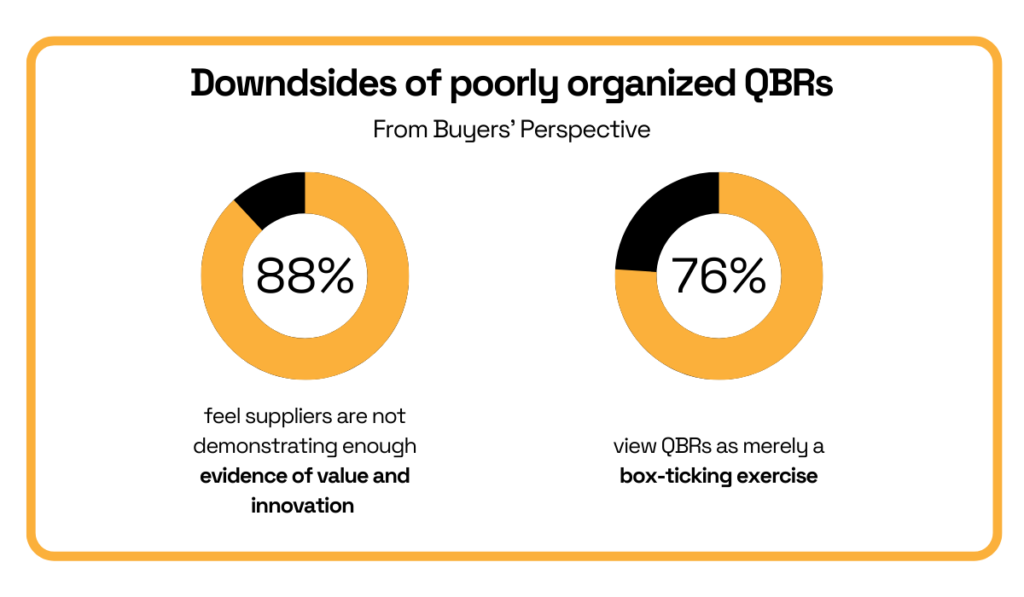

Take QBRs as an example.

These reviews should be a key opportunity for suppliers to showcase their value, innovation, and long-term strategic alignment with your company.

Yet, as revealed by a Clientshare survey, a large percentage of buyer organizations find that QBRs often fall short of expectations.

Illustration: Veridion / Data: Facilities Management Journal

The survey results highlight a clear gap between what suppliers present during QBRs and what buyers expect from them.

This underscores the importance for SRM teams to:

These engagements are focused on building sustainable value over time, which further underscores SRM’s long-term approach compared to SPM.

As mentioned earlier, SPM tends to focus on short-to-medium-term goals, primarily aimed at achieving immediate or periodic performance improvements.

Therefore, SPM engagements involve performance tracking, regular evaluations, quality audits, and recertifications.

Now, let’s explore how SRM and SPM measure their success.

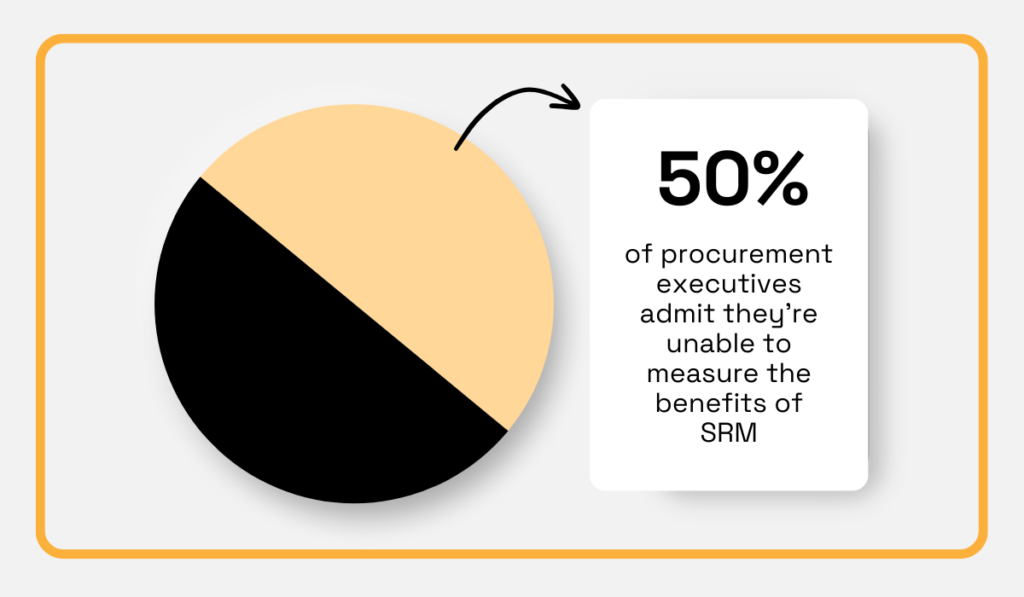

SRM success is harder to measure than SPM because it relies on subjective factors like relationship strength, supplier satisfaction, and long-term value creation.

While procurement executives often believe strong supplier relationships drive value, many struggle to quantify the benefits.

A State of Flux survey of over 200 procurement leaders found that half admitted difficulty in measuring SRM’s impact.

Illustration: Veridion / Data: State of Flux

Unlike SPM, which has clear performance metrics, SRM lacks universal measurement tools.

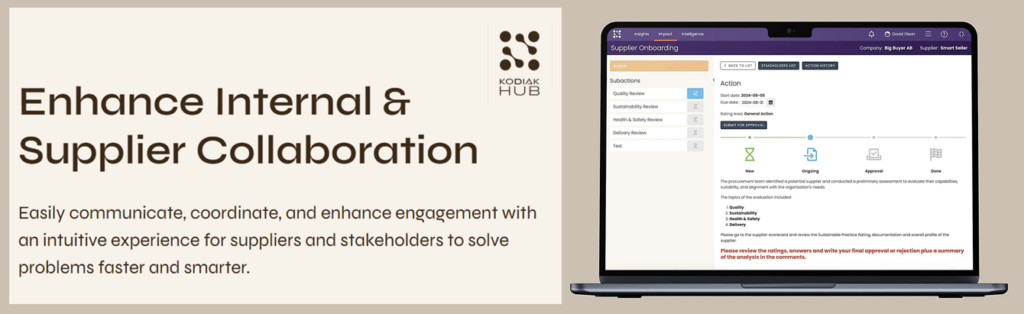

Instead, companies define their own indicators and use tools that foster collaboration, such as Slack, Microsoft Teams, or dedicated SRM software like SAP Ariba, Coupa, and Kodiak Hub.

These platforms facilitate communication, track performance, and support joint planning, helping procurement teams manage supplier relationships more effectively.

Source: Kodiak Hub

While these can help quantify some aspects of SRM success, its overall impact remains somewhat elusive.

For instance, a company might measure SRM success by the number of joint innovation projects completed with a supplier.

Although this is a clear indicator of a thriving, collaborative partnership, it overlooks other benefits of strong supplier relationships.

For example, how many times has a supplier reacted promptly to changes or disruptions because of loyalty spurred on by SRM activities?

Such nuances underscore the importance of concrete, operational metrics—this is where SPM takes center stage.

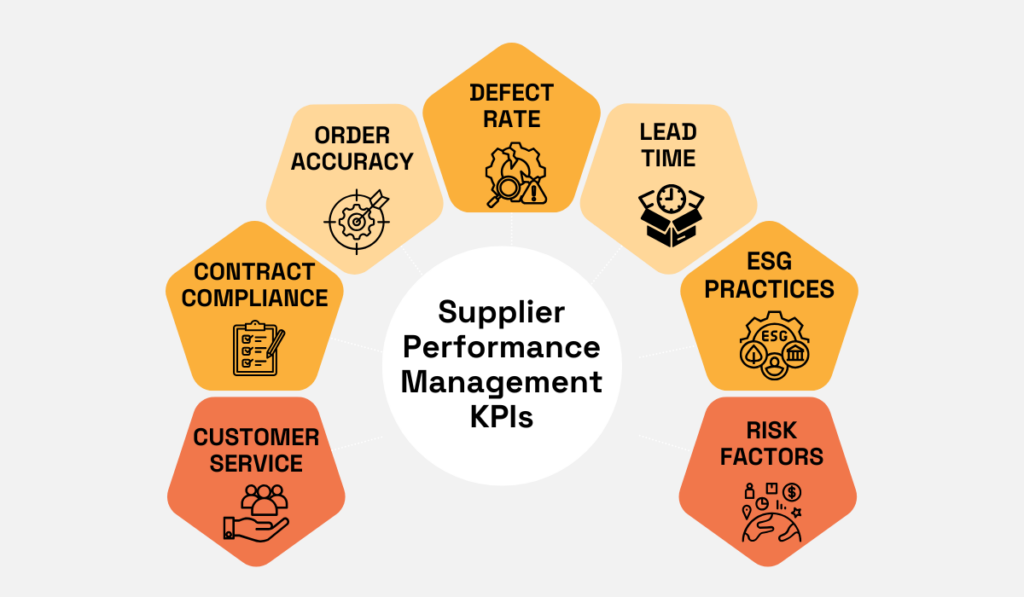

As we’ve already explained, SPM uses KPIs to track immediate supplier performance and reliability.

These KPIs give procurement teams a structured framework to evaluate supplier effectiveness across key areas, as shown below.

Source: Veridion

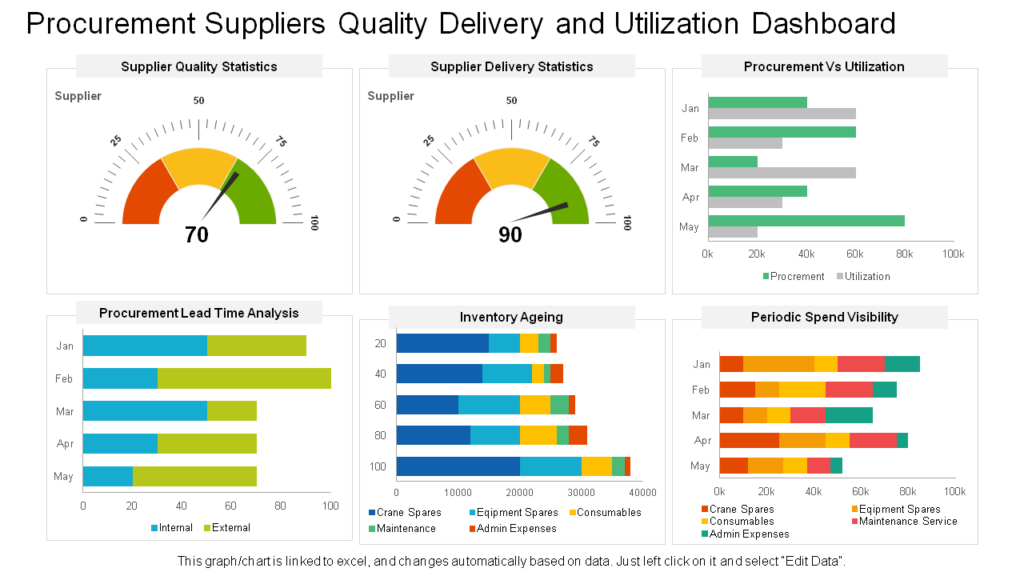

To effectively measure these KPIs, procurement teams rely on a mix of methods and software tools tailored to different aspects of supplier performance.

Typically, data on supplier performance, such as order accuracy, lead times, and defect rates, is collected in your company’s procurement platform or supply chain management system.

These tools feature dashboards that centralize and visualize performance metrics, making it easier for procurement teams to track and compare suppliers over time.

Source: SlideTeam

However, collecting supplier data from external sources is equally important for successful SPM—and SRM.

With accurate, real-time external supplier data, procurement teams can monitor factors like supplier risk exposure, financial stability, and sustainability practices.

This is where supplier data platforms like our Veridion provide valuable insights.

Source: Veridion

Veridion’s AI-driven bots constantly collect information from web sources, providing procurement teams with real-time insights into suppliers’ operations, risks, and changes in their activities.

In addition to internal and external data collection, SPM also relies on methods such as supplier questionnaires, performance reviews, and audits for a more complete picture of supplier performance.

Given the distinctions between SRM and SPM covered so far, it’s no surprise that these two areas also differ in the level of supplier and stakeholder involvement.

In SRM, suppliers are treated as strategic partners, leading to high involvement from both sides.

From the buying company’s perspective, this approach typically requires senior executives or strategic procurement teams to manage the relationship closely.

In contrast, SPM involves more moderate supplier engagement, with a primary focus on assessing performance.

Here, operational procurement teams or supply chain managers typically handle the process.

Due to this difference in involvement, companies often find it easier to implement SPM than SRM.

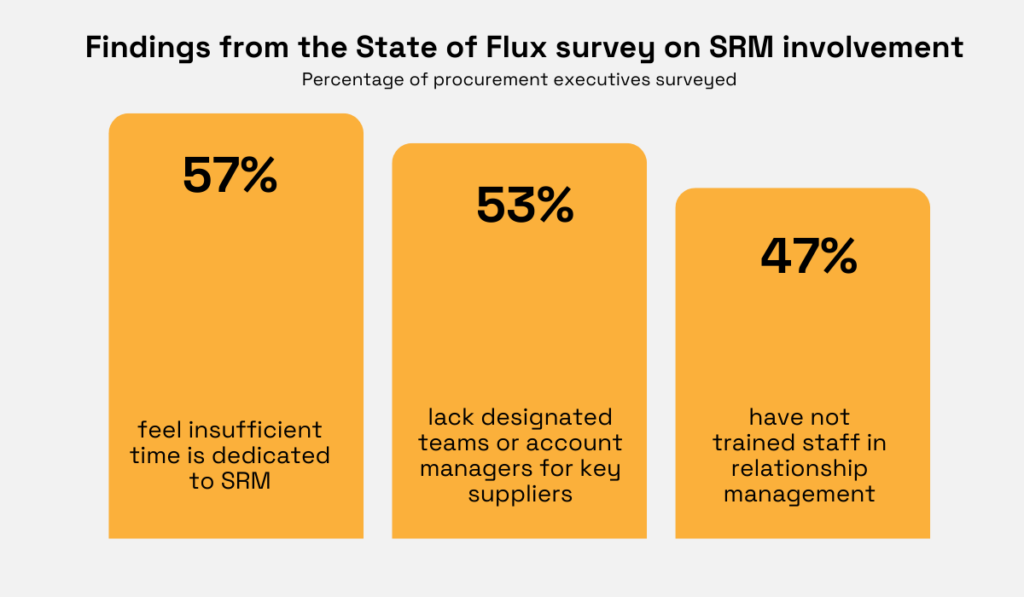

These challenges in managing deeper supplier relationships are reflected in findings from a survey we previously mentioned.

Illustration: Veridion / Data: State of Flux

These findings highlight the challenges organizations face in dedicating adequate resources to SRM.

SRM’s strategic approach requires senior leadership and well-structured teams to manage long-term relationships effectively.

In contrast, SPM’s more structured, performance-focused approach is easier to manage and scale, which is likely why it’s more widely implemented.

However, SPM can sometimes come across as formal and transactional, lacking deeper supplier engagement.

That’s why integrating a more human, relationship-driven approach into SPM can be a great starting point for broader SRM efforts.

Ultimately, by fostering mutually beneficial relationships through high-involvement SRM, you can create greater long-term value for your business.

Despite all the distinctions outlined in this article, it’s clear that SRM and SPM have complementary roles in supplier management.

While SRM fosters long-term partnerships for innovation and growth, SPM ensures measurable performance standards are met.

By understanding and leveraging these differences, your organization can build stronger supplier relationships and optimize performance.