How to Build a Strong Market Intelligence Strategy

Key Takeaways:

Today, most businesses have access to vast amounts of market intelligence (MI) data.

Unfortunately, few know what to do with it.

Without a clear strategy, market signals get lost in the noise, and opportunities slip by unnoticed.

To help you avoid this issue, we’ll show you how to build a solid MI strategy in this article.

By following the steps below, you’ll create a framework that keeps your focus on what matters, aligns teams around shared insights, and turns data into meaningful, coordinated action.

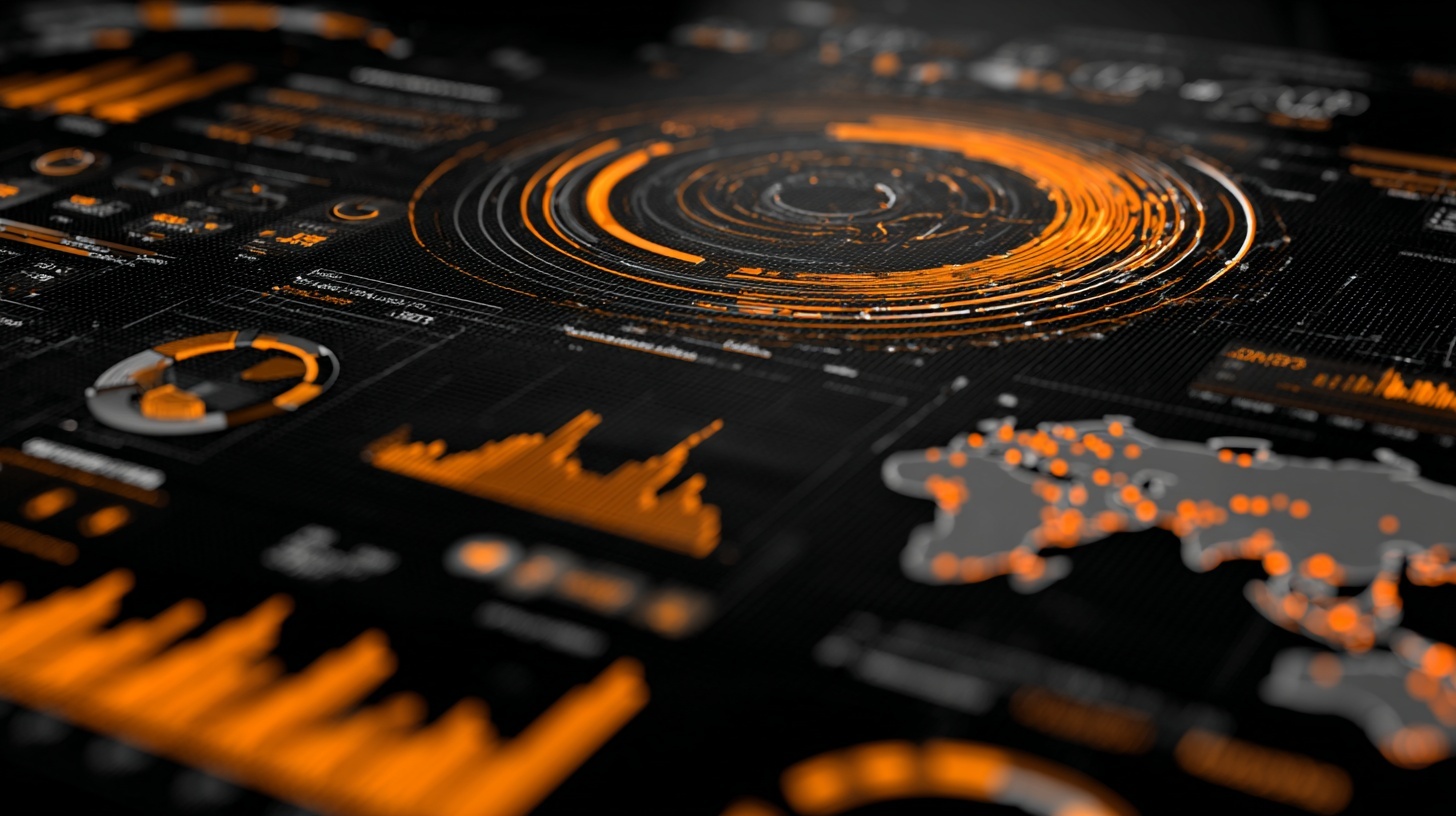

The first step in building a strong market intelligence strategy is defining which objectives you’re looking to achieve.

More so, it defines objectives in a way that clarifies the deeper business value of your future strategy to both yourself and other stakeholders.

Common examples of such MI objectives include:

Note, however, that these objectives must align with your broader business needs.

In other words, they should help achieve bigger goals set by your organization, such as expanding to new markets.

If they don’t, chances are your MI strategy won’t be particularly helpful nor likely to draw backing from relevant stakeholders.

To illustrate our point, here is how the above objectives relate to broader business goals:

Source: Veridion

To ensure your objectives always serve a broader business goal, set them by asking questions such as:

Thinking through your objectives this way ensures they are both relevant and concrete.

This is important because they’ll guide all subsequent phases of your strategy and play a key role in securing buy-in.

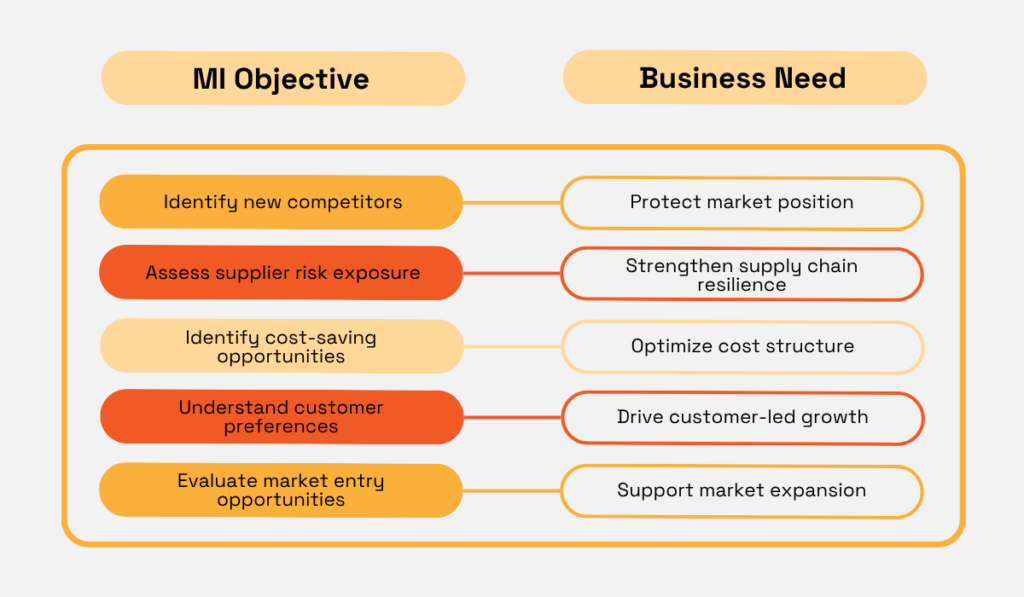

And, according to leaders like Dr. John Kotter, gaining buy-in is critical to the success of any organizational initiative, including a market intelligence strategy.

Illustration: Veridion / Quote: HR Bartender

As Kotter points out, a lack of buy-in is one of the main reasons why around 70% of organizational efforts fail.

Avoid the same fate with your MI strategy by ensuring it delivers clear business value.

If needed, consult relevant stakeholders before making any final decisions.

According to Valona, most intelligence teams get 80% of their actionable insights from just 20% of their data sources.

Illustration: Veridion / Data: Valona

That’s one reason why creating a sourcing plan is so important.

Without it, you could easily overlook sources that could provide the most critical of insights, or simply focus too much energy on the less relevant ones.

That’s why mapping your key data sources is the second step on our list.

First, it’s important to understand that extracting trustworthy market insights requires combining multiple market intelligence sources.

It’s also not just about the number of sources, but their type, too.

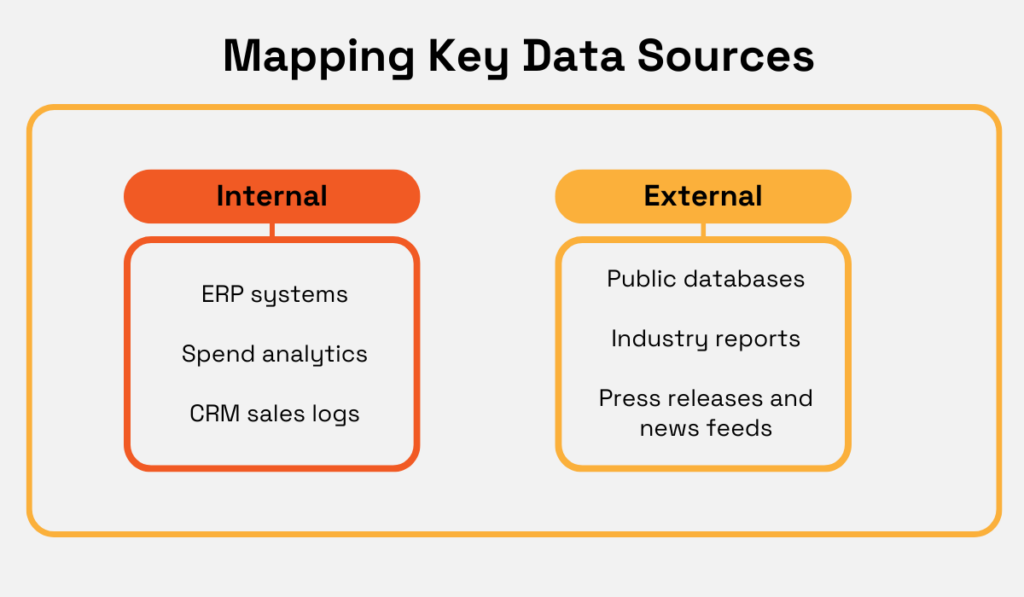

For best results, you should combine internal and external ones.

This approach provides a complete view of your market: internal sources reveal signals observed first-hand, while external sources give you a broader context.

Individually, each perspective is incomplete, but together they deliver a comprehensive market view.

Here are just some examples of sources in both categories:

Source: Veridion

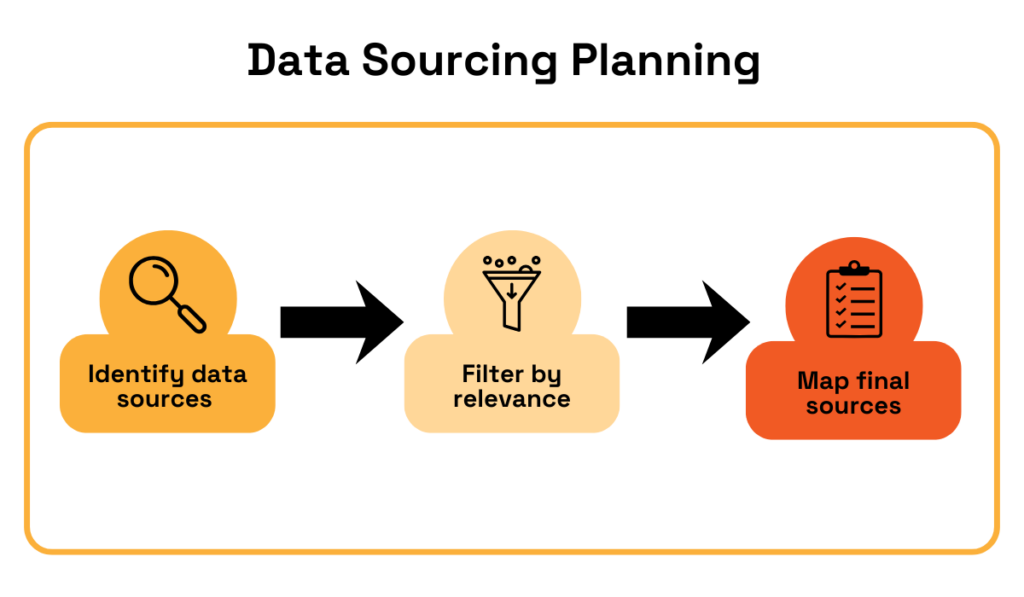

To make the most of this vast range of sources, you’ll first need to map them out.

Start by listing everything you have available.

For example, if you’ve previously conducted a customer survey or other internal research, be sure to include those in your strategy.

If needed, consult colleagues about available data sources.

The key is not to rely on templated checklists but to take stock of what you need and have.

Once your initial list is ready, filter potential sources by relevance.

Focus on the ones that truly matter.

These are the sources that can help you achieve objectives defined in the previous step; everything else is just noise.

Source: Veridion

For example, if one of your objectives is assessing current supplier risk exposure, supplier financial filings from previous fiscal years may or may not be relevant.

Perhaps you’re not interested in historical financial performance, but rather the current state and emerging issues.

In that case, it would only be worth looking at the most recent reports.

Again, the key is to carefully consider your objectives and tailor your sourcing strategy accordingly.

When you make the final adjustments, you’re ready to move on to the next step.

With your data landscape blueprint in place, the next step is to collect the data, make it actionable, and keep it up to date.

This requires effort because of common data-related challenges you’re likely to encounter.

These are the three most frequent ones:

Now, if you tried to mitigate these issues manually, you’d probably need a horde of people employed solely for data-related tasks.

Even then, you’d get less-than-perfect results due to the fast-changing nature of data.

A better way to tackle this is to use tools that automate the gathering, filtering, and processing of MI data.

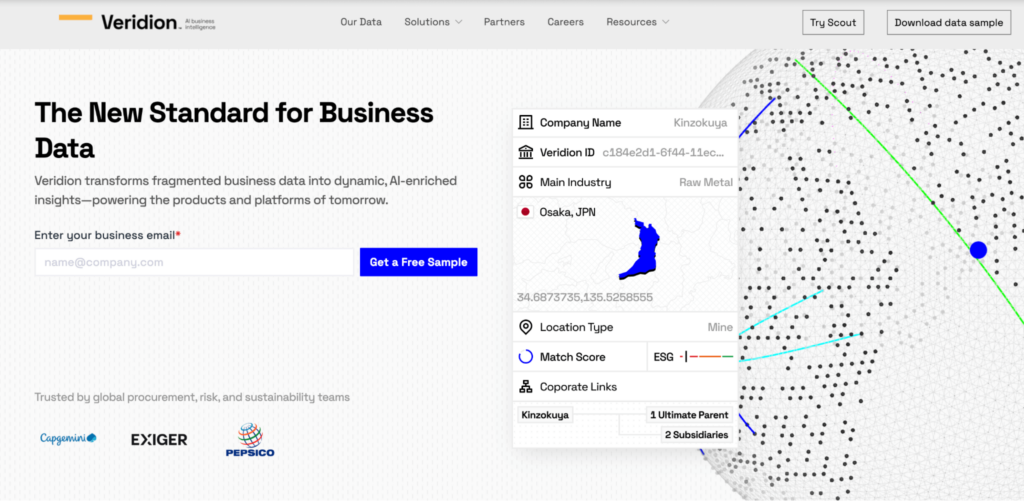

Take Veridion as an example.

This tool collects market intelligence on 134M+ companies globally.

It automatically gathers vast amounts of relevant data, including more complex information like ESG policies and operational footprint, and updates it on a weekly basis.

Source: Veridion

This ensures teams are working with the freshest, most accurate, and most comprehensive vendor data possible.

To clean it, Veridion further employs AI-powered processing methods.

For instance, this ensures the data is free of any duplication errors, like the ones that might occur with brand aliases, subsidiaries, and similar naming inconsistencies.

By automating these important processes, Veridion can save teams days of work while delivering real-time, structured, and relevant intelligence.

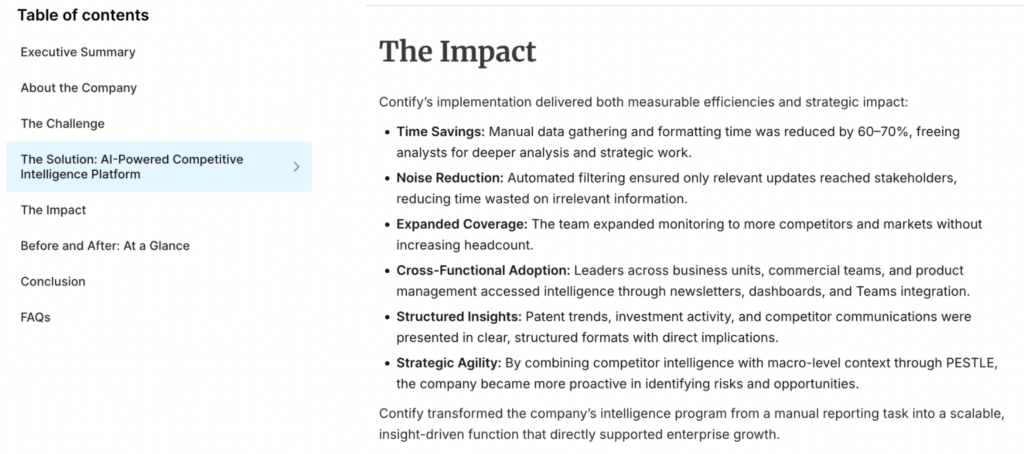

In fact, some case studies show that MI tools save teams up to 70% of their time.

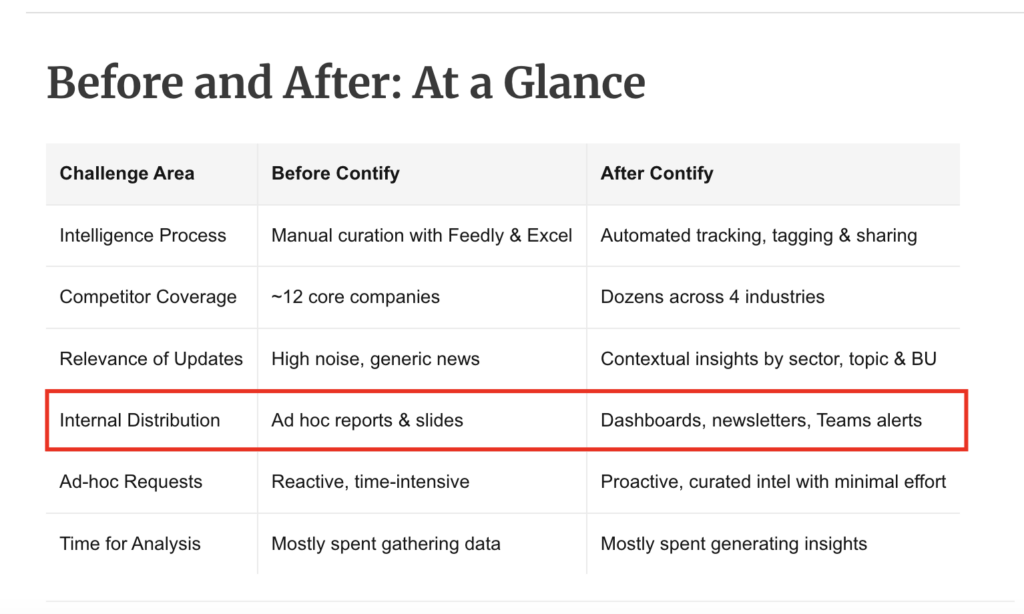

Source: Contify

But, as seen above, time savings aren’t the only benefit of automating important data processes.

Others, like gaining trusted insights and moving to proactive decision-making, are just as impactful.

One benefit that’s often overlooked is the ability to share relevant insights across teams more easily.

Let’s take a closer look at why that’s so crucial and how automated tools can help in this area, too.

Sharing insights across teams allows all functions to work in unison.

You can, for instance, share insights with marketing, sales, and product development teams for a unified strategy.

But there’s no reason to stop there.

Almost everyone in your organization can benefit from market intelligence insights, including stakeholders in finance, R&D, supply chain, and executive teams.

Source: Veridion

But how do you ensure that insights are always distributed in a timely manner and reach all relevant teams?

Well, the Contify case study we mentioned earlier can offer some ideas.

It specifically mentions distributing insights through newsletters, dashboards, and email alerts.

Additionally, it explains how insights can be integrated directly into workflows.

It demonstrates this capability through an integration of an MI platform with Microsoft Teams, which users already rely on for communication and daily work.

The integration allows the platform to deliver alerts and notifications directly within Teams, making them easily accessible and difficult to overlook.

Source: Contify

The bottom line is, the more you can automate the distribution, the better.

This ensures that insights are shared automatically, with minimal manual effort and reduced risk of error.

However, it’s still a good idea to occasionally exchange and discuss insights live.

To do so, you can combine automated distribution with live interaction, like regular team briefings, workshops, or brainstorming calls.

With this in mind, here is an overview of the key distribution methods you can use:

Source: Veridion

Which methods you’ll choose is less important than ensuring insights are delivered on time and provided to all relevant stakeholders.

Remember: market intelligence can only create value when it’s accessible to decision-makers.

It needs to reach the right people in order to be interpreted, discussed, and acted upon.

With this in mind, let’s discuss perhaps the most important step of any MI strategy: using insights to drive action.

Market intelligence is only useful if it influences actions.

The insights you collect should inform real decisions, like choosing the right supplier, adjusting contract terms, or reallocating spend based on market trends.

Here are just a few examples of insights translated into practice:

However, to be able to achieve similar outcomes, you need a strategic approach to uncovering and leveraging actionable insights.

This starts by analyzing the collected MI.

You should regularly set time aside to review MI reports and consult subject-matter experts if necessary.

The second prerequisite is embedding MI into your workflows and long-term strategy.

It’s not enough to occasionally extract and leverage MI insights, but rather to make this an integral part of your processes.

For instance, Dr. Christoph Flöthmann, CPO and Co-Founder at akirolabs, says that MI needs to be deeply integrated into procurement workflows.

Illustration: Veridion / Quote: akirolabs

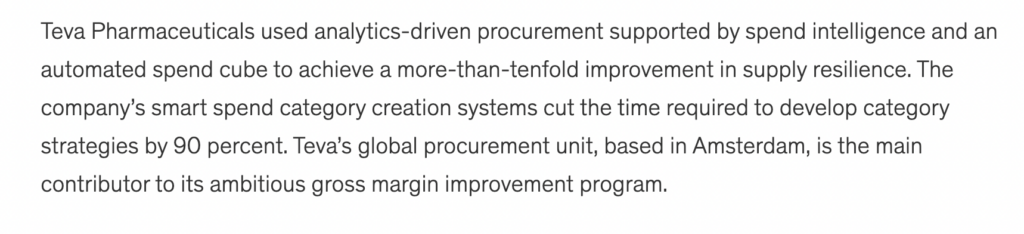

When applied correctly, data-backed actions can lead to significant organizational benefits.

For instance, McKinsey mentions how a pharmaceutical company, Teva Pharmaceuticals, strengthened its supply resilience more than tenfold by using spend intelligence and an automated spend cube.

Source: McKinsey

However, to achieve such outstanding results, companies must make MI an operational habit.

Insights should be reviewed and applied continuously, rather than left in static reports.

This is why the final step on our list is ensuring ongoing, real-time market monitoring.

As mentioned, continuous, real-time scanning is essential for keeping your MI actionable and accurate.

Both parts of the equation are important: the market should not only be monitored on an ongoing basis, but also in real-time to catch changes as they happen.

Achieving this manually, however, is close to impossible.

What you should consider instead is once again turning to automated solutions.

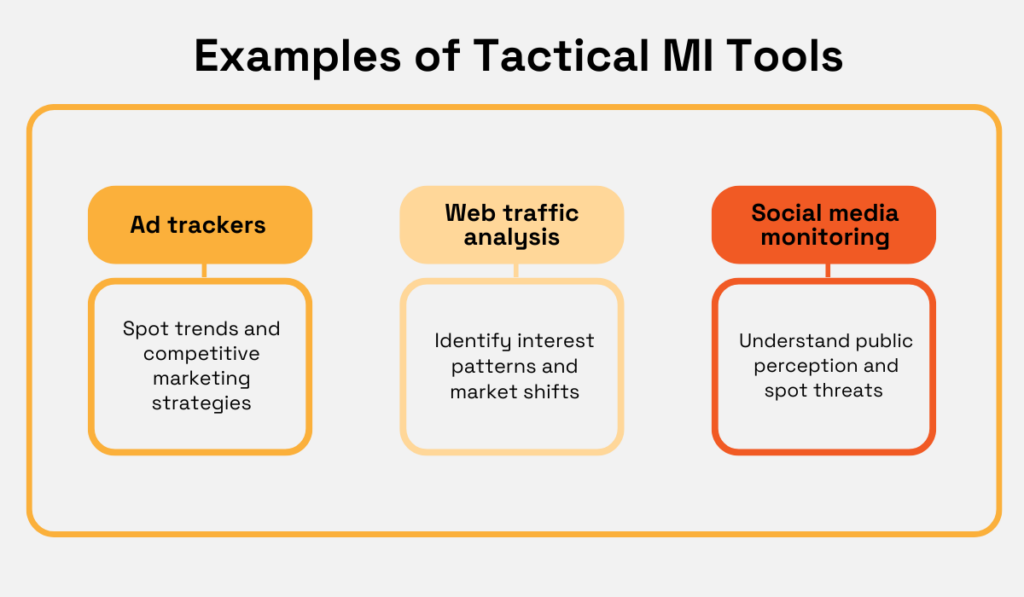

You can, for instance, combine tactical tools for capturing day-to-day signals, like ad trackers, website traffic analysis, and social media monitoring, with more strategic MI platforms.

Illustration: Veridion / Data: Stravito

Tactical MI tools can provide real-time, granular insights into daily market activity, while specialized platforms offer a broader, strategic view to inform long-term decisions.

Strategic platforms also offer another crucial benefit: consolidating data into a centralized dashboard.

The purpose of a centralized dashboard is to integrate diverse data sources into one display.

Illustration: Veridion / Quote: Industry Intelligence

By combining these two types of tools, you’ll create a robust system for strategic market monitoring.

To determine which tools you’ll need, consider what you’re looking to get out of them.

For instance, is it important that your system alerts you of relevant changes?

Which external signals are you looking to track?

Price shifts, supply chain volatility, regulatory changes, or something else?

Your answers should influence the choice of your go-to tools.

When they do, you’re bound to make better investments and ensure long-term success.

Most businesses today have unprecedented amounts of market intelligence data.

That means purely having it won’t give you a competitive edge. Knowing what to do with it will.

That’s exactly what an MI strategy enables.

By defining your goals and outlining the steps to achieve them, you learn how to leverage your data to achieve meaningful outcomes.

The payoff is simple but powerful: faster decisions, sharper foresight, and stronger results.

So don’t wait for perfect information.

Build your MI strategy, stay curious, and use intelligence to guide every key decision.