5 ESG Benchmarking Challenges to Overcome

Key Takeaways:

Trying to compare your company’s performance on sustainability metrics against others often feels confusing and frustrating.

Especially so if we consider the many ESG benchmarking challenges present in this process.

If you’re struggling to find the right data, make sense of different regulations, or just figure out where to start, this guide is for you.

We will walk you through the five biggest challenges in ESG benchmarking and provide clear, actionable solutions to help you measure what truly matters for your business.

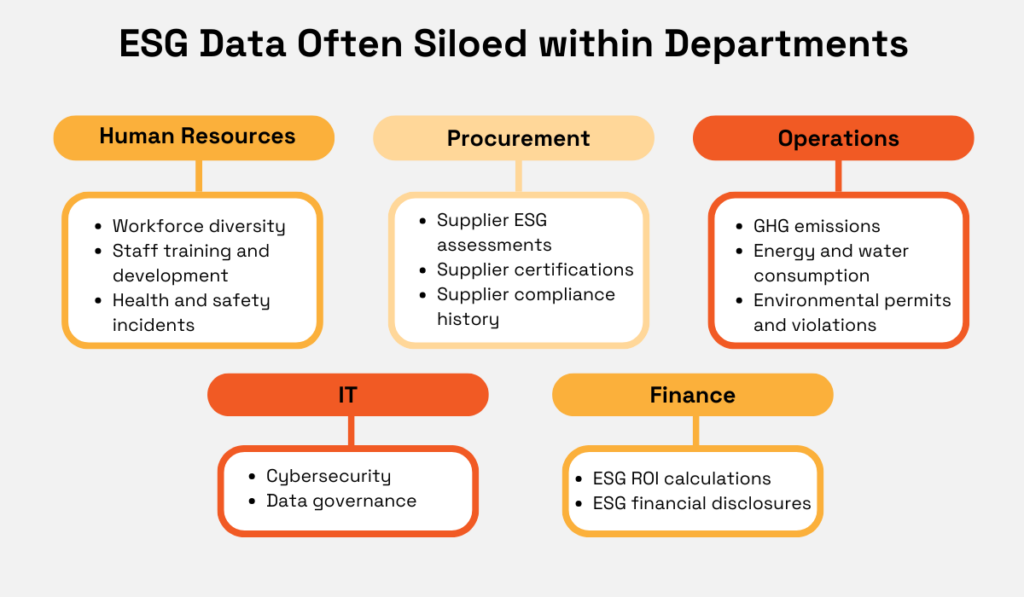

Often, the first and biggest issue in ESG benchmarking comes from inside your own company.

After all, ESG is incredibly broad, covering hundreds of potential metrics.

Think about it: your HR department tracks diversity data, your operations team monitors energy use, and your supply chain team looks at supplier ethics.

What often happens is that each department stores its information in separate systems, like spreadsheets, different software, or databases.

This quickly results in data silos.

Source: Veridion

And when data is siloed, there is no smooth, integrated flow of information between departments.

This means you can’t see the complete picture of your company’s ESG performance, and different teams might even report conflicting numbers for the same metric.

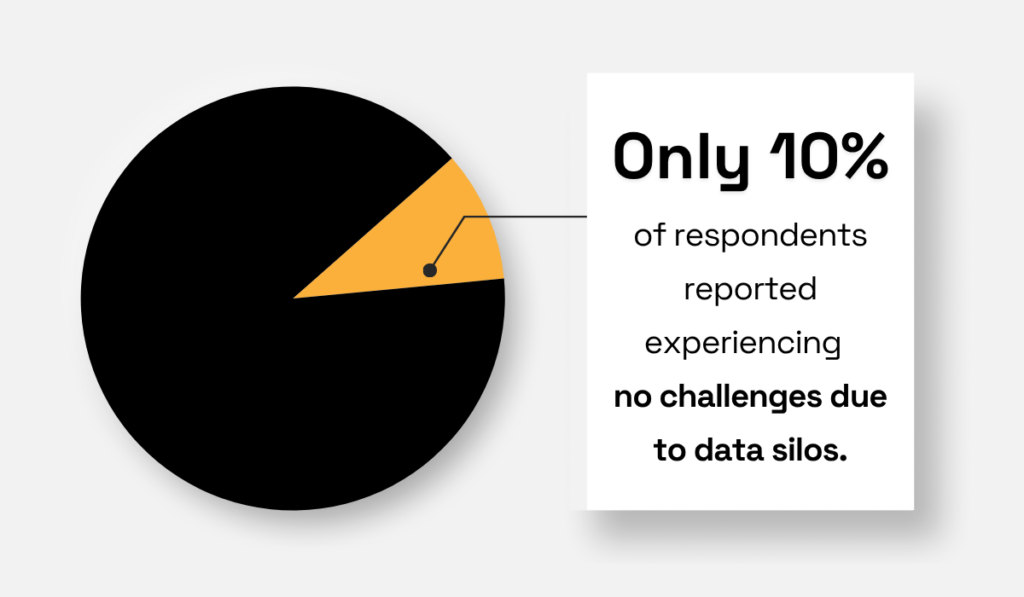

And this is by no means an unusual challenge.

In fact, data silos are incredibly common.

A 2025 MuleSoft survey, which looked at various business sectors, found that the overwhelming majority of organizations struggle with them.

Illustration: Veridion / Data: MuleSoft

The same study also revealed another key issue:

Nearly one-third of the IT leaders surveyed said they have trouble moving data from all these different systems into a central place, like a data warehouse, to actually analyze it and find useful insights.

This hurts your ESG benchmarking efforts right from the start for two main reasons.

First, you can’t compare your performance against others if your own data is incomplete.

And second, if the data you manage to gather is inconsistent or inaccurate, any benchmark comparison you make will be unreliable.

The solution, therefore, is better data integration.

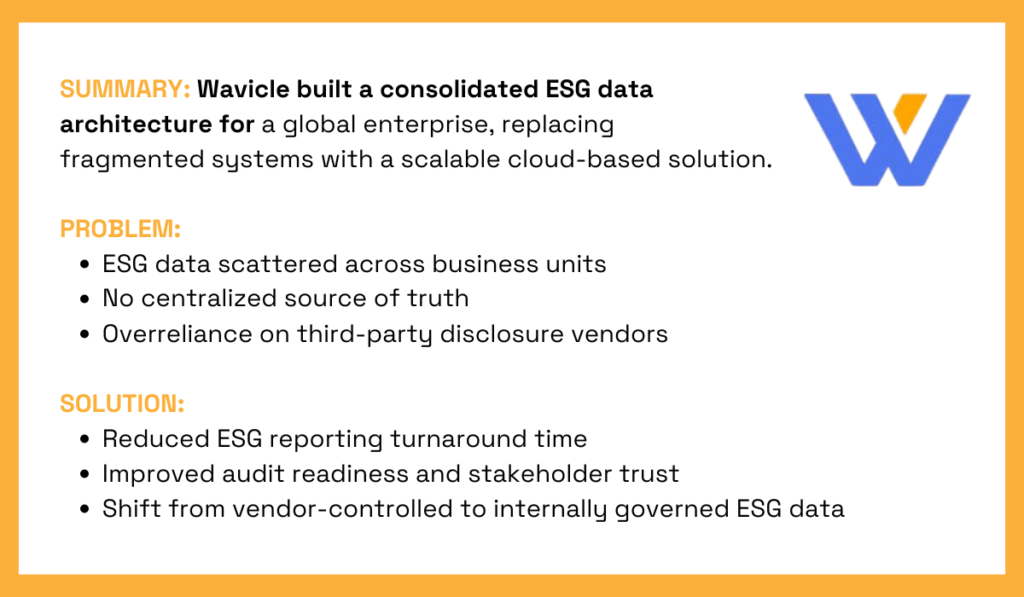

Let’s look at a real-life example to make this clearer.

Wavicle, a data and analytics consulting firm, worked with a large company that was facing this exact problem of fragmented ESG data.

Illustration: Veridion / Data: Wavicle

By building an integrated data architecture, Wavicle helped the company bring all its scattered ESG information into one place.

This created a centralized “source of truth”—a single, reliable source for all ESG data.

Only with similar systems and better data integration can ESG performance be confidently and accurately compared against industry benchmarks.

So, before you can look outside to compare your performance, you must first look inside, as breaking down internal data silos is the foundational step.

Naturally, once you have organized your internal information, the next challenge relates to external data.

More specifically, companies often struggle to benchmark themselves against their peers because of the limited availability of comparable and detailed ESG data.

According to an issue of Finance Monthly, many companies do not disclose ESG data yet, or the information they do share is practically unusable for direct comparison.

Illustration: Veridion / Quote: Finance Monthly

But even when public companies do disclose information, it can be inconsistent.

This is because one company might use a different reporting framework than another, or they might only choose to share information on the metrics where they perform well.

To make matters worse, a large number of private companies do not disclose any ESG data to the public at all.

This problem becomes very clear if we look at a large company database with ESG metrics, like the one from the London Stock Exchange Group (LSEG).

Illustration: Veridion / Data: LSEG

While the LSEG database contains ESG metrics and scores for about 14,500 public companies, it only has this data for around 1,300 private ones.

This massive gap means that if your key competitors are private, you will likely find very little information to benchmark your performance against them.

To overcome this, you need to use as much fresh and comprehensive data as possible, and this is where powerful data engines like Veridion can help.

Veridion offers AI-curated, automated data gathering, with a global database of over 120 million companies across more than 200 locations.

Source: Veridion

Our extensive ESG offering allows you to access data that goes beyond what companies disclose themselves.

But how does this work?

Our proprietary algorithms use reliable sources ranging from the news to company websites, constantly scraping the web and updating company profiles with fresh ESG data.

The ESG aspects covered are illustrated below.

Source: Veridion

Of course, our database includes both private entities and lesser-known suppliers on top of public companies.

On top of that, the ESG analytics options available on Veridion’s data discovery platform include:

Using platforms with ESG data features like Veridion ultimately ensures your benchmarking is based on a much wider and more current set of information than public disclosures alone can offer.

When analyzing complex ESG data, many companies turn to scoring systems.

These scores help make sense of all the information and provide a straightforward way to benchmark performance.

However, a big issue can arise here: ESG ratings and scores can vary widely between different providers, often making them impossible to compare directly.

Hazel Ilango, a Principal Researcher at the Energy Shift Institute, comments on this very issue.

Illustration: Veridion / Quote: IEEFA

This happens because some ESG scoring providers use vastly different methodologies, weightings, and even definitions for the same metrics.

A lack of rating standardization can easily confuse stakeholders and undermine the credibility of your benchmarking efforts, as you’re not comparing things on a level playing field.

One way to address this is to look for established ESG rating providers that promise more objective and transparent scoring.

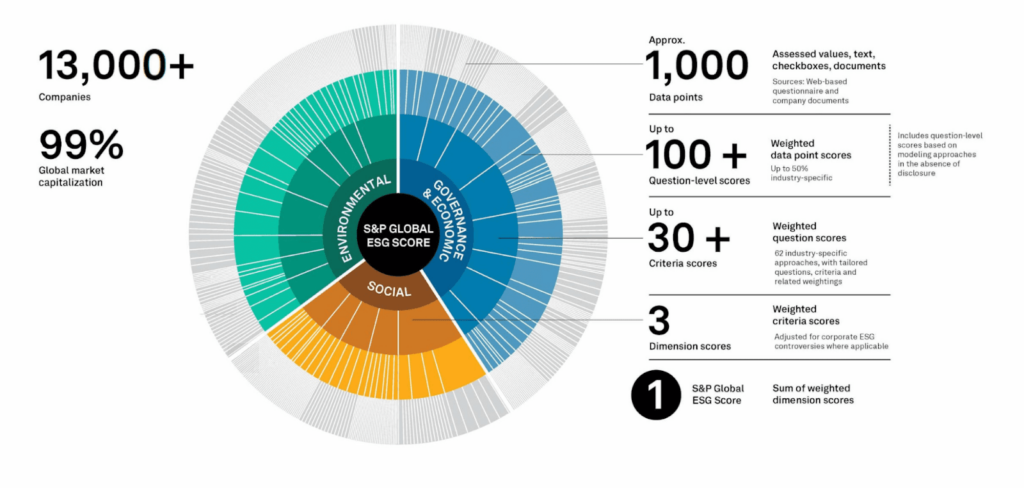

For example, S&P Global’s Sustainable1 is their central source for sustainability intelligence.

They offer ESG scores that are based on information from company disclosures, a detailed corporate sustainability assessment questionnaire, and their own modeling.

Source: S&P Global

Of course, it is also a great practice to simply look beyond the headline ESG scores and analyze the underlying metrics that contribute to them.

Comprehensive platforms like Veridion and even Sustainable1 offer this kind of granular data.

This allows you to see the specific data points that make up the overall score, giving you a much clearer context.

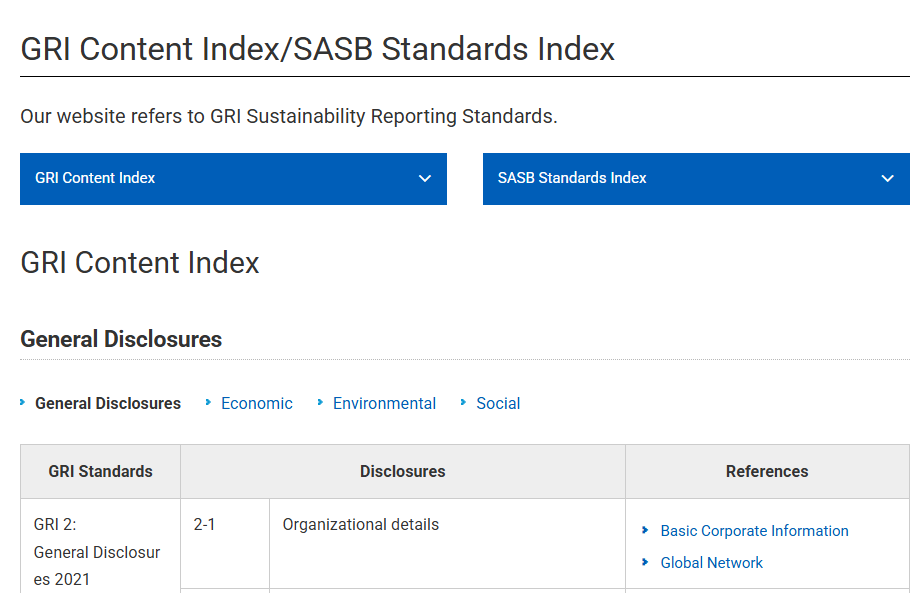

To help you focus on what truly matters for your business, you can also explore what ESG metrics to monitor by using the topic lists from organizations like the Sustainability Accounting Standards Board (SASB) or the Global Reporting Initiative (GRI).

Source: Omron

These lists identify the most financially relevant ESG topics for different industries, based on extensive research.

Using them can help you concentrate your benchmarking efforts on the issues that have the biggest impact on your sector, making your comparisons far more meaningful.

In essence, by combining transparent scoring providers with a deep dive into the specific metrics that are most material to your industry, you can cut through the noise of subjective ratings.

With hundreds of potential ESG metrics available, it is easy to become overwhelmed and try to measure everything at once.

As Stephanie Mooij, Head of Responsible Investment at Glide Healthcare, comments in one of her studies, companies can lose focus and start to see ESG metrics only as competitive benchmarks, rather than tools for improvement.

Illustration: Veridion / Quote: SSRN

While investigating over 218 ESG initiatives back in 2017, Mooij found that staff often complained that they could be making actual progress on their ESG journey.

Instead, they felt that tracking an excessive number of metrics had become a distraction that cost a lot of time.

This “reporting fatigue” at a company level is a substantial cost that is often overlooked, with time and work hours wasted on focusing on too many metrics.

With the increased focus on ESG and sustainability initiatives in recent years, the problem of metrics overload can become even worse.

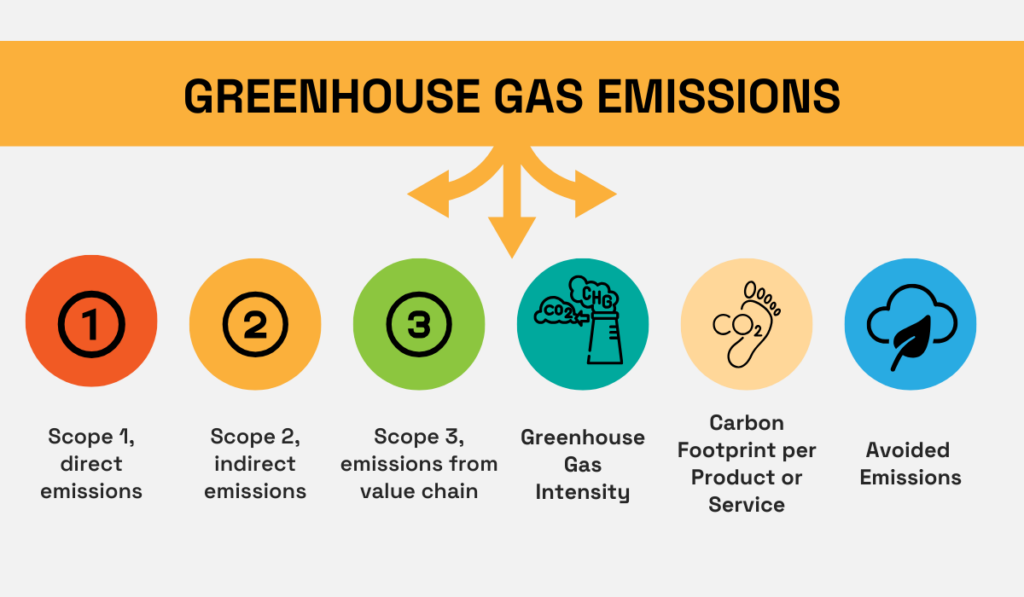

Many ESG metrics are also highly detailed.

For example, an environmental metric like greenhouse gas emissions is actually composed of many different aspects, as shown below.

Source: Veridion

If you aim to benchmark against every competitor on every single metric and all its components, you will be focusing on measurement instead of improvement.

A better approach?

Narrow down the focus by looking at what metrics truly matter for your organization, whether that is your stakeholders, your industry, or your long-term sustainability strategy.

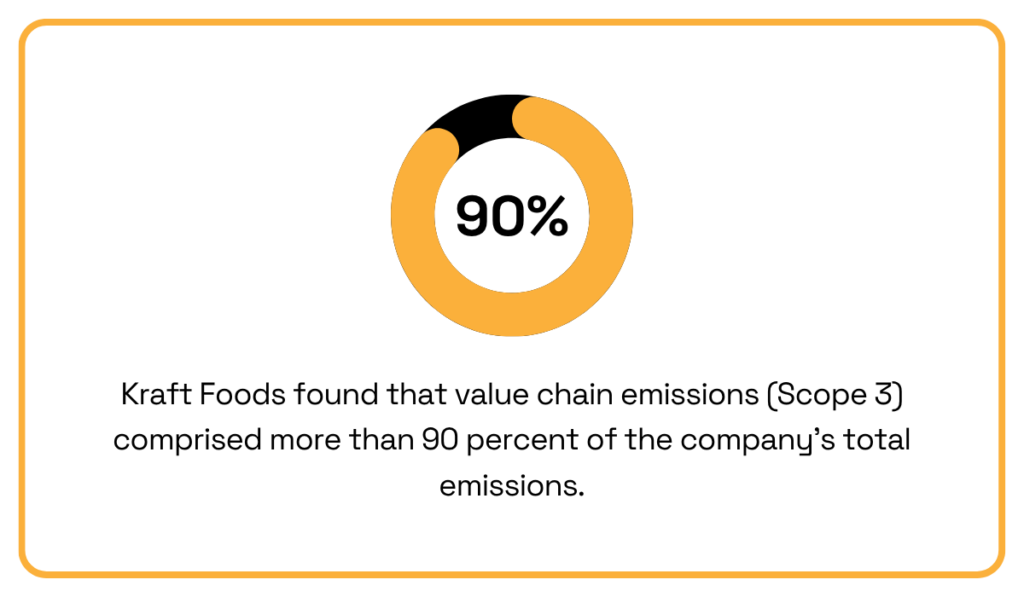

For example, Kraft Foods, the major food and beverage company, explored its own ESG data and found that its Scope 3 emissions—those from its supply chain and product use—accounted for the vast majority of its total emissions.

Illustration: Veridion / Data: GHGProtocol

In their case, focusing and benchmarking on this specific metric would be the most impactful strategy.

Since this area represented their biggest environmental footprint, any improvements here would be far more significant than small gains across dozens of less critical metrics.

And the same goes for your organization: the key should be to look at your individual situation and prioritize what you measure.

Finally, it’s important to be aware that the world of ESG is not static.

The standards and regulations that guide reporting are constantly shifting, and keeping track of these changes is a major challenge for ESG benchmarking.

This constant evolution makes it difficult to maintain consistent, year-over-year comparisons for your own company and against peers, as a benchmark from two years ago might not be relevant today.

As Mary Schapiro, Vice Chair of Global Public Policy at Bloomberg, explains, unified standards are essential for providing the comparable and reliable data that investors and other stakeholders need.

Illustration: Veridion / Source: Anthesis

Luckily, the aim in the modern landscape is moving toward creating common reporting standards.

It is important to pay attention to these developments, as they promise to make benchmarking much easier and more reliable by creating a common language for all companies.

For example, the ISSB Standards have started being followed by countries around the world.

Source: IFRS

Countries like Canada, China, the UK, Singapore, and Hong Kong are creating their own reporting standards that are aligned with this ISSB framework.

However, some regional variations will always exist, so it’s best for ESG teams to closely follow developments and for ESG benchmarking to be flexible.

This is best done by promoting continuous education in ESG and sustainability skills within companies.

For instance, take a look at the sustainable procurement training offered by CIPS.

Source: CIPS

Many professional courses like these exist to help teams stay current with the latest regulations.

These programs are highly beneficial for benchmarking because they ensure your team can correctly interpret and apply new standards, leading to more accurate comparisons.

Ultimately, only by staying informed and investing in your team’s knowledge can you navigate evolving standards and keep your benchmarking relevant.

You should now have a clearer picture of the ESG benchmarking landscape and the inherent challenges.

It’s true that data limitations, subjective scores, and ESG metrics overload can seem daunting, especially as sustainability standards evolve.

But we hope this guide has provided you with the practical solutions needed to navigate these issues confidently.

Hopefully, putting some of these strategies into practice will help you build a benchmarking process that truly drives progress for your organization.