The Cost of ESG In Procurement and How to Control It

Key Takeaways:

How much does being ESG compliant really cost?

For Ford, for example, the answer is more than $50 billion between 2022 and 2026—an enormous investment to accelerate its shift toward carbon neutrality.

Most procurement teams won’t face a figure like that, but the pressure to meet ESG goals is real and rising fast.

And it doesn’t come cheap.

This article explores what ESG really costs in procurement and how to reduce those costs without sacrificing your sustainability commitments.

Despite growing ESG momentum, many businesses are still struggling to align their sustainability goals with their budgets.

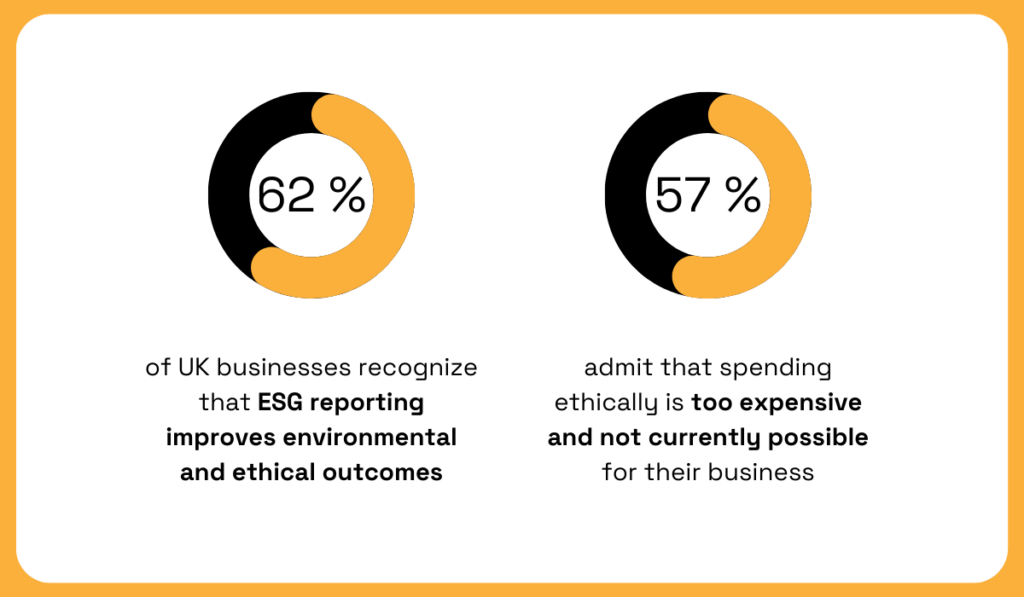

A recent report from Pleo found that, while 62% of UK companies believe ESG reporting improves environmental and ethical outcomes, 57% admit that spending ethically is simply too expensive for them right now.

Illustration: Veridion / Data: Pleo

That struggle—between the desire to do better and the reality of limited resources—is being felt most acutely in procurement.

Procurement leaders are being asked to deliver on ambitious ESG targets while controlling costs and maintaining operational efficiency.

It’s a difficult balance, and part of the challenge is understanding where the costs actually come from.

So, let’s start with the obvious ones.

Implementing ESG in procurement often begins with more expensive inputs.

For instance, sustainable materials usually come at a premium.

Certified organic cotton, for example, costs 20–30% more than regular cotton.

Illustration: Veridion / Data: Sockrates

And yet, it uses 91% less water and supports more ethical farming practices.

Recycled plastics, especially those that are traceable and certified, can also be significantly pricier than their virgin counterparts.

But ESG costs aren’t just about what you buy.

They’re also about how you buy it.

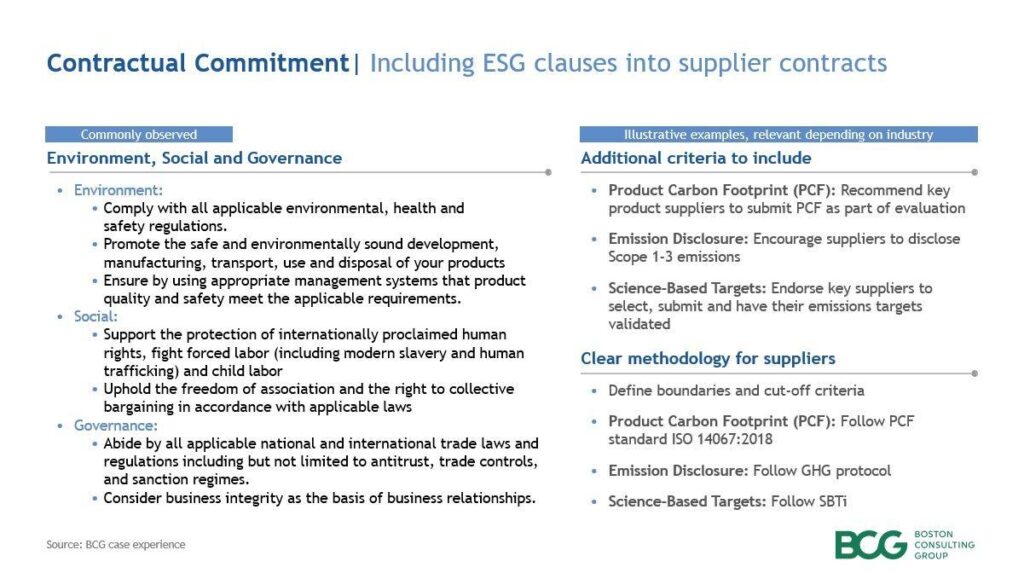

Working with ESG-compliant suppliers typically means longer onboarding processes, more detailed vetting, and stricter contract terms.

Procurement teams are expected to go beyond cost and delivery to evaluate suppliers on:

That takes time, effort, and often external support.

This is where ESG data providers and screening tools come in.

As expectations around transparency and traceability grow, procurement teams increasingly rely on platforms and services that offer supplier risk assessments, ESG ratings, and compliance monitoring.

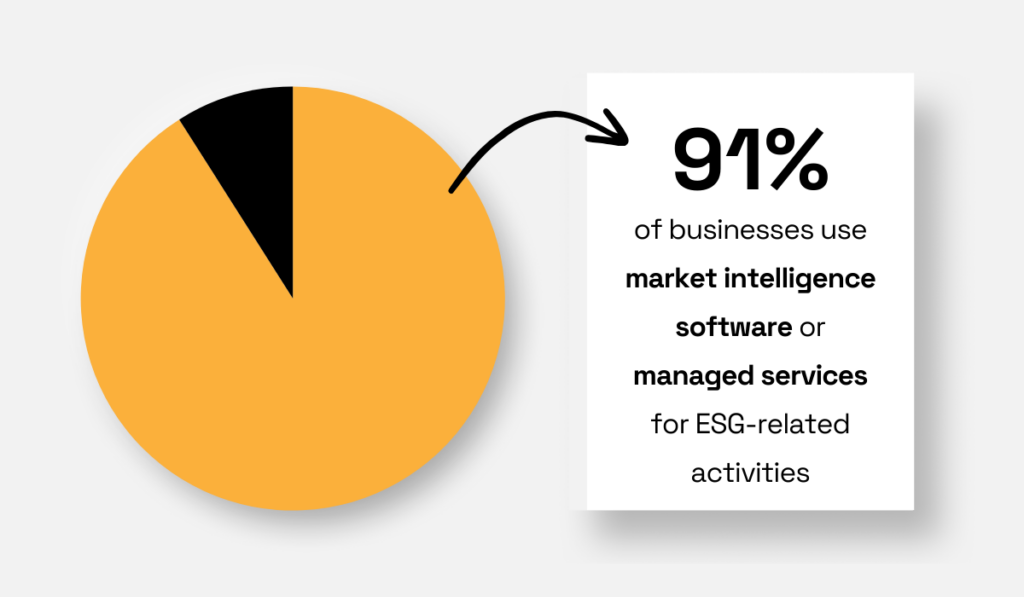

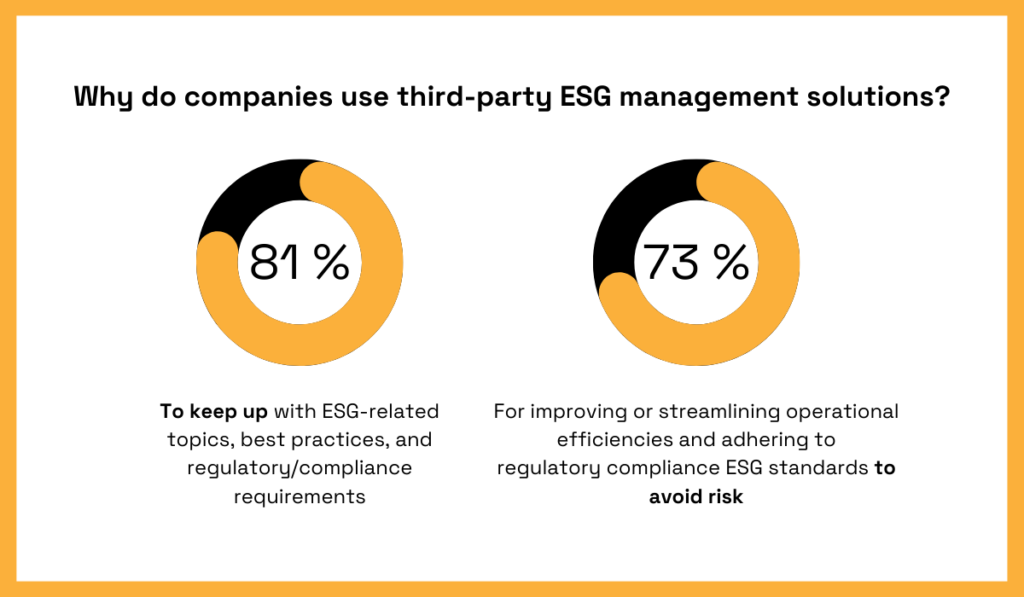

According to a Thomson Reuters report, 91% of businesses already use some form of ESG software or managed service.

Illustration: Veridion / Data: Thomson Reuters

These tools help companies stay ahead of fast-changing regulations, reduce the risk of non-compliance, and avoid reputational damage.

In fact, 73% of companies use them to streamline operational efficiency and ensure ESG alignment across their sourcing strategies.

Illustration: Veridion / Data: Thomson Reuters

If you’re interested in how these tools work in practice, check our detailed articles on top ESG data providers and screening tools that break it down further.

But even the best tools require skilled people to interpret and act on the insights they provide.

That’s another cost many companies overlook.

To truly embed ESG in procurement, you often need to bring in new expertise—whether that’s hiring sustainability officers, ESG analysts, or compliance professionals.

As of April 2025, the average annual salary for a Top Sustainability Officer in the U.S. is over $213,000.

Illustration: Veridion / Data: salary.com

Add that to your team, and the cost of “going green” starts to look more like a major strategic investment than a marginal expense.

And that’s just the beginning.

Beyond the visible investments in materials, technology, services, and people, ESG adoption brings a range of hidden costs that quietly build up behind the scenes.

One of the biggest is time.

ESG-focused supplier evaluations take longer.

Contracts are more complex, with new ESG clauses around emissions, labor standards, and environmental impact.

Source: World Economic Forum

On top of that, procurement teams must not only learn how to interpret ESG data but also how to apply it in sourcing decisions, manage digital compliance tools, and navigate unfamiliar regulatory landscapes.

Training and upskilling are essential, but they also take time and resources.

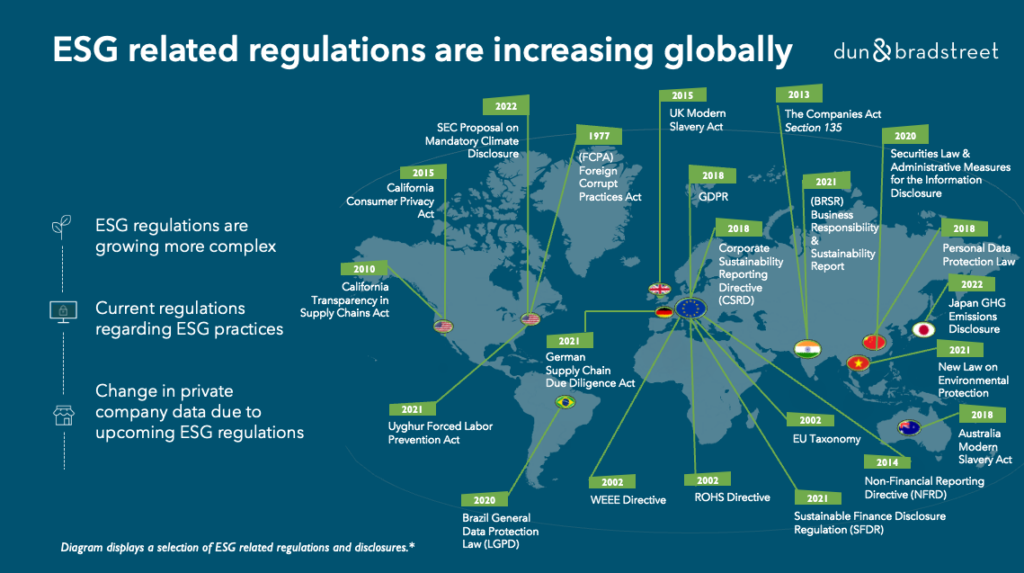

Keeping up with regulations is another ongoing challenge.

Over the past decade, the number of ESG regulations globally has grown by 155%.

Illustration: Veridion / Data: PR Newswire

In the EU alone, the Corporate Sustainability Reporting Directive (CSRD), the EU Deforestation Regulation, and the Corporate Sustainability Due Diligence Directive (CSDDD) are dramatically expanding reporting requirements.

The Carbon Border Adjustment Mechanism (CBAM) now requires importers to track the carbon emissions of their overseas suppliers.

Meanwhile, China is growing its Emissions Trading Scheme, and the U.S. SEC is introducing new climate disclosure requirements.

Source: Dun&Bradstreet

For procurement teams, this means a constant stream of updates, documentation, and reporting.

And all of this demands accuracy, consistency, and coordination across internal departments and external partners.

The administrative burden is real.

Without clean, centralized data and ESG-literate teams, companies face compliance gaps, missed deadlines, and costly corrective measures.

Poor-quality information or fragmented systems can further derail even the best-intentioned ESG efforts and lead to last-minute scrambles that stretch already thin budgets.

And then there’s one more hidden cost: supplier development.

Instead of just expecting suppliers to meet ESG standards, leading companies help them get there.

Take IKEA, for example.

In FY24, the company carried out over 1,240 supplier support activities, including training on internal audits, health and safety, and responsible recruitment.

Illustration: Veridion / Data: IKEA

This kind of capacity-building strengthens the supply chain over time, but it also requires sustained investment in training, communication, and follow-up.

It’s good practice, but it’s not free.

Yes, ESG comes with costs.

But the cost of not investing in ESG can be far greater—financially, operationally, and strategically.

Procurement teams that delay action are putting their organizations at risk, just as the stakes are getting higher.

With regulations tightening and stakeholders demanding more transparency, ESG inaction can leave companies exposed on multiple fronts.

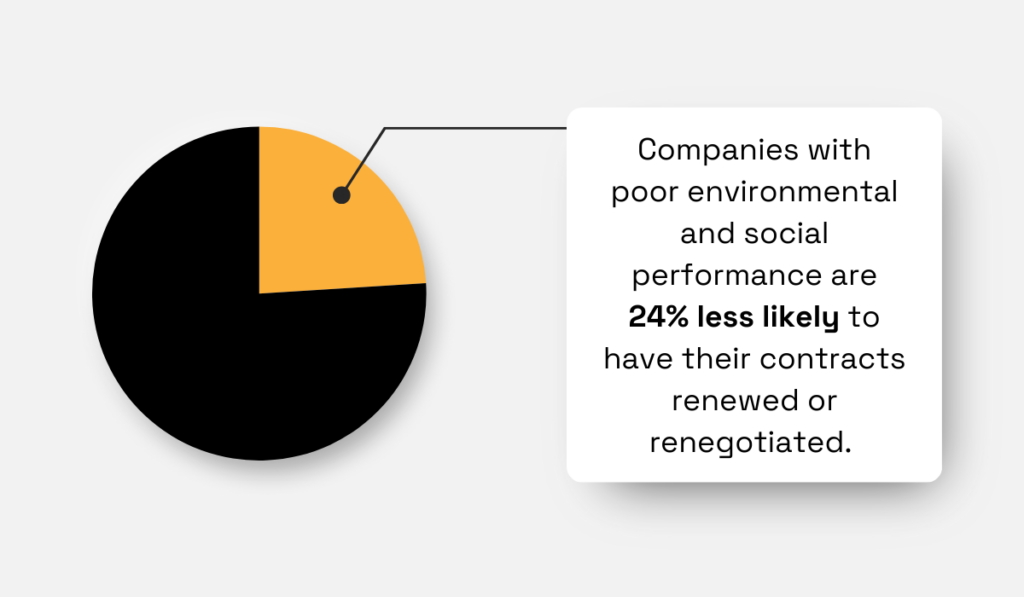

One of the most immediate risks is lost business.

According to recent research, companies with poor environmental and social performance are 24% less likely to have their contracts renewed or renegotiated.

Illustration: Veridion / Data: SSRN

That directly impacts revenue.

Buyers are increasingly embedding ESG criteria into RFPs and supplier scorecards, and suppliers that fall short are being left out of sourcing decisions.

For procurement teams, this means reduced supplier pools, last-minute replacements, and potential disruptions to supply continuity and quality.

Not to mention, if your company is the one falling short, it could mean being excluded from your customers’ supply chains entirely.

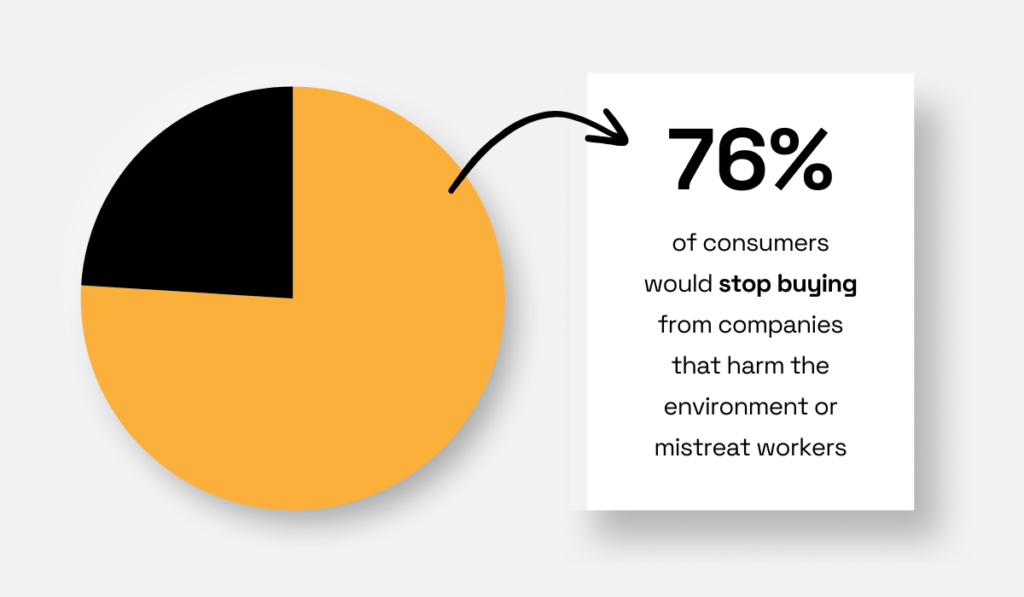

Meanwhile, consumers are watching too.

In a PwC survey from 2021, as many as 76% of them said they would stop buying from companies that mistreat workers, communities, or the environment.

Illustration: Veridion / Data: PwC

These reputational risks may start with upstream suppliers, but the damage doesn’t stop there.

If a labor rights scandal or environmental violation surfaces in your supply chain, procurement can’t PR its way out of it—and by then, the backlash may already be hitting your bottom line.

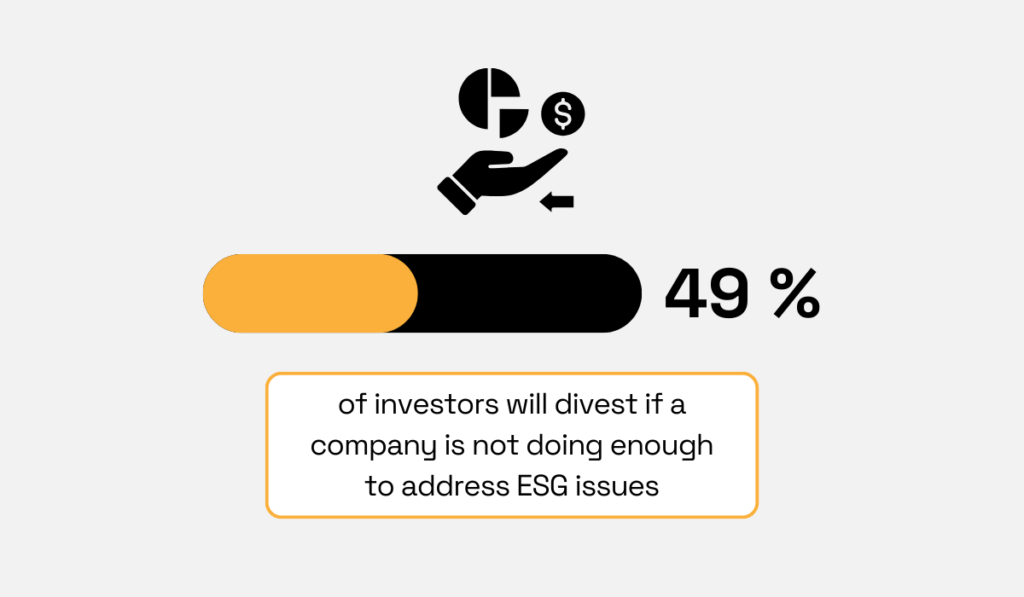

The impact on access to capital is also growing.

Investor expectations around ESG have shifted dramatically.

In fact, 49% of investors say they’re willing to divest from companies that fail to act on ESG.

Illustration: Veridion / Data: PwC

Credit rating agencies are factoring it in, too.

A Moody’s analysis of 12,000 companies found that 17% saw a negative impact on their credit ratings due to ESG issues, and 3% were significantly downgraded.

This isn’t just hypothetical.

In sectors like automotive, power, and heavy manufacturing, where ESG exposure is high, these financial penalties are already material and growing.

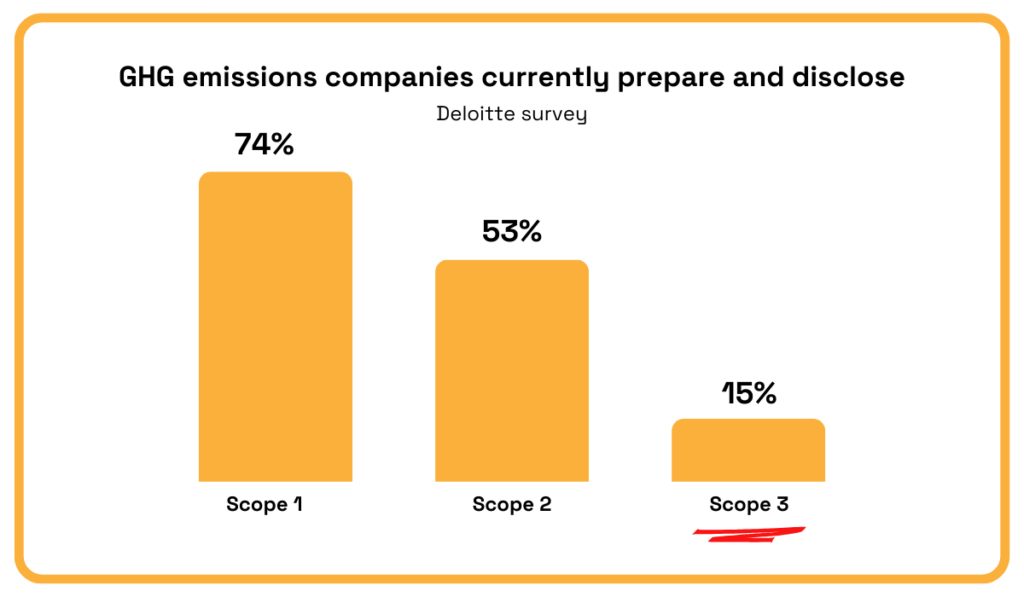

And then there’s the challenge of emissions—particularly Scope 3 emissions—which are largely driven by procurement through purchased goods and services.

These indirect emissions typically make up 80–90% of a company’s total carbon footprint, yet only 15% of companies currently report them.

Illustration: Veridion / Data: Deloitte

That leaves a massive blind spot in sustainability reporting, making it harder to meet emissions targets, comply with regulations, or respond credibly to investor questions.

The bottom line?

Failing to invest in ESG isn’t just about falling behind your peers.

It’s about exposing your organization to real and rising risks—from lost contracts and investor withdrawal to credit downgrades, reputational fallout, and a lack of visibility into your own emissions.

And while the cost of ESG implementation may be measurable, the cost of ESG inaction is often far less predictable—and far more damaging in the long run.

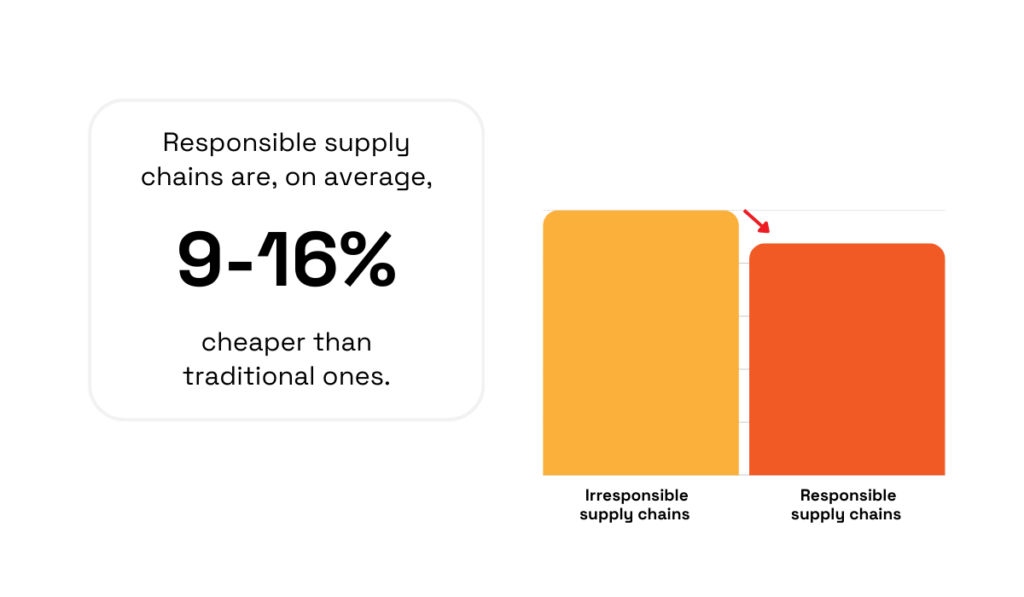

While ESG implementation introduces new complexities and expenses, it also opens the door to cost-saving opportunities.

When approached strategically, sustainable procurement can drive long-term efficiency, reduce risk, and improve operational resilience.

After all, according to the World Economic Forum, responsible supply chains are 9% to 16% cheaper than their less sustainable counterparts.

Illustration: Veridion / Data: World Economic Forum

So, how can procurement teams turn ESG from a cost center into a cost advantage?

Here are five proven strategies that help you save money while still meeting your environmental, social, and governance goals.

One of the biggest cost drains in ESG implementation is retrofitting existing suppliers to meet new standards.

That often means repeating audits, rewriting contracts, or paying consultants to clean up compliance gaps.

But by prioritizing ESG compliance from the beginning, during the supplier discovery phase, you skip all that complexity and cost.

Choosing ESG-aligned suppliers early simplifies onboarding, shortens evaluation cycles, and improves overall compliance rates.

These suppliers are also more likely to collaborate on innovation, from lower-emission packaging to ethical sourcing practices.

A great example of this comes from Allbirds, the footwear company known for sustainability.

When developing its sugarcane-based SweetFoam® soles, Allbirds collaborated with suppliers in Brazil that already had carbon-neutral operations and access to renewable energy.

Source: Fashionista

This resulted in a product that aligned with their ESG goals from the start, without needing expensive workarounds later on.

This kind of alignment reduces risk and lays the groundwork for cost-effective, scalable relationships.

But how do you identify those suppliers up front?

With the right tools.

Many procurement teams already use digital platforms for supplier discovery or eSourcing, but not all of these tools include verified ESG insights.

That’s a missed opportunity.

When you treat ESG due diligence as a separate process, you duplicate effort, juggle more systems, and rack up more costs.

That’s why platforms like Veridion can be a game-changer.

Veridion uses advanced AI to analyze petabytes of data each week, tracking over 120 million companies across more than 240 countries and regions.

For each company, it builds a detailed profile with 60+ data points—including firmographics, compliance records, and a deep ESG taxonomy.

Source: Veridion

This means you can search for ESG-compliant suppliers before you even send an RFP.

All you have to do is ask our Scout what you need from suppliers, like below:

Source: Veridion

Later on, you can continue to monitor those suppliers for certifications, controversies, or ESG score changes—all from the same platform.

Weekly data updates and customizable alerts keep you in the loop automatically.

With a solution like Veridion, you don’t need separate tools for supplier discovery, ESG screening, and monitoring.

It’s one system that does it all—saving you time, reducing tech stack costs, and giving you confidence that you’re sourcing sustainably from the very first step.

When you integrate tools like this with sourcing platforms such as Market Dojo, you also streamline everything from negotiation to compliance.

That’s both convenient and a smart cost-control strategy.

One of the most effective ways to cut ESG-related costs is to rethink how resources flow through your supply chain.

Circular economy strategies—like incorporating recycled materials or finding new uses for production waste—not only reduce environmental impact, but can also lower procurement and waste management costs at the same time.

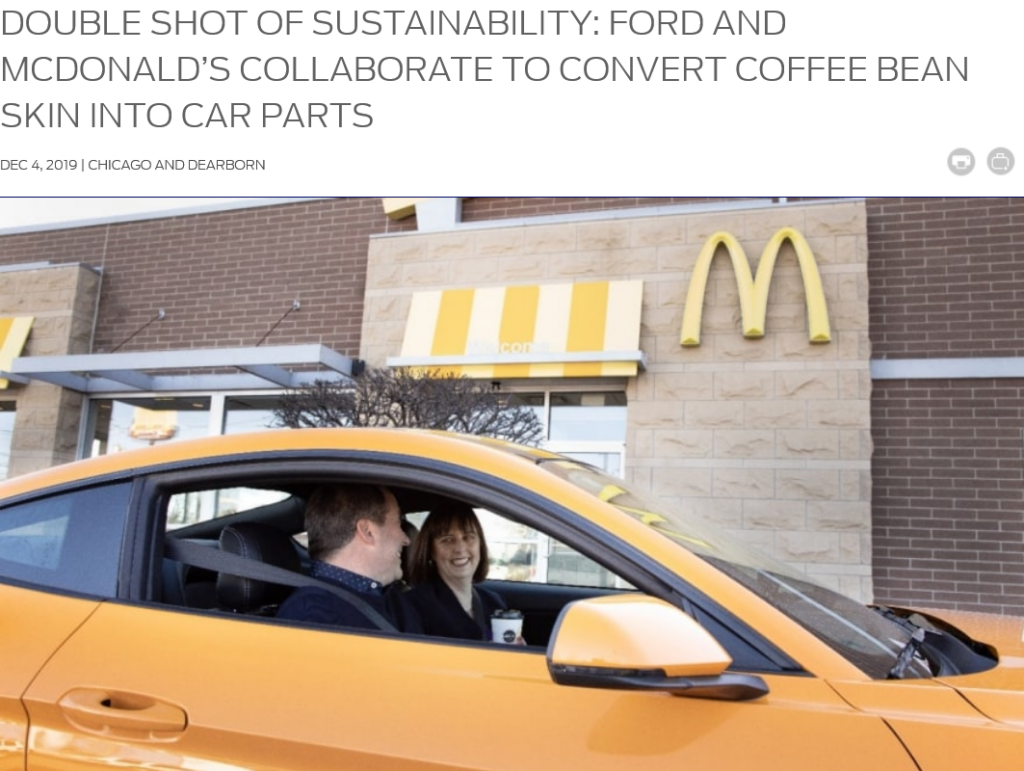

Ford is a great example.

As part of its multi-year, $50 billion investment in sustainability, the company is actively embedding circular practices into its global supply chain.

Source: Sustainability Magazine

In partnership with its suppliers, Ford is finding innovative ways to turn what used to be waste into valuable inputs.

For instance, the company now uses coffee bean husks from McDonald’s supply chain to create durable headlamp housings, which are lighter and require less energy to manufacture.

Source: Ford

They’re also transforming olive tree waste into interior car parts and working with suppliers to give discarded blue jeans a second life as insulation for trucks.

More than being just environmental feel-good stories, these examples demonstrate how circular thinking can reduce raw material dependence, stabilize input costs, and build more resilient supplier relationships.

And importantly, Ford is not doing this alone.

By working directly with suppliers to co-develop these materials, they’re proving that circularity isn’t just scalable but collaborative.

For procurement teams, this is a cue to explore suppliers that are innovating in similar ways.

Whether it’s by sourcing recycled materials or prioritizing partners that design with reuse in mind, circular economy models shift sustainability from a cost to a cost-saving strategy.

Energy and emissions aren’t just environmental concerns—they’re direct cost drivers.

The more fuel you and your suppliers burn, the more you pay.

The more energy your logistics network consumes, the higher your operating expenses.

That’s why ESG strategies that prioritize carbon and energy efficiency often deliver some of the fastest returns.

Let’s take transportation as an example.

Simple adjustments like optimizing delivery routes, consolidating shipments, or working with local suppliers reduce emissions and shrink fuel bills.

These changes don’t require a complete supply chain overhaul, yet they have a measurable financial impact.

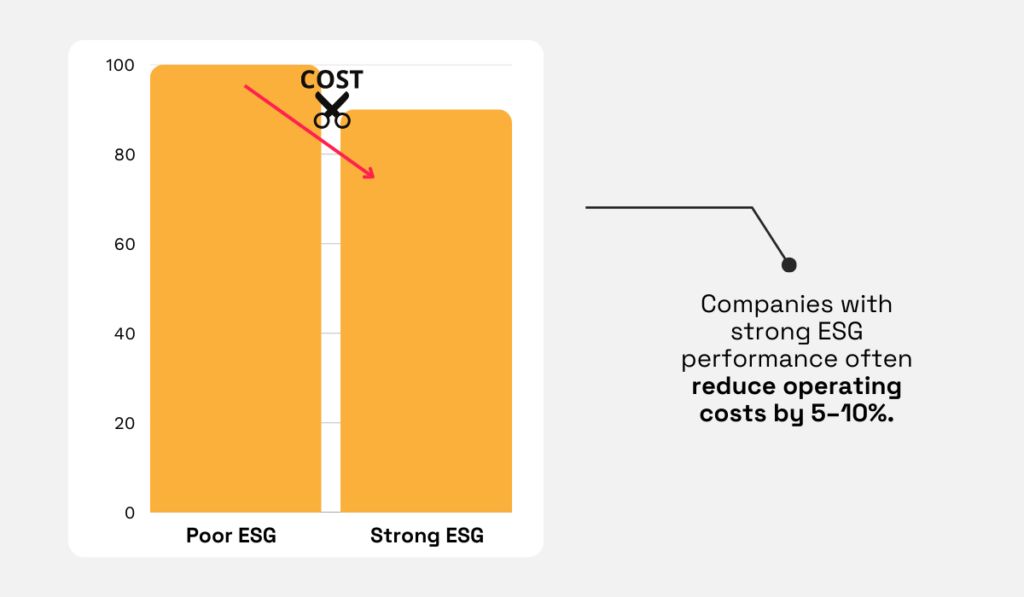

McKinsey research supports this:

Companies with strong ESG performance often reduce operating costs by 5 – 10%, largely due to gains in operational efficiency and waste reduction.

Illustration: Veridion / Data: McKinsey

It’s a straightforward equation—lower emissions often lead to lower costs.

And the benefits go even further.

Efficient logistics lead to faster delivery times, fewer damaged products, and a drop in returns.

Beyond being good for the environment, such operational improvements ripple across the procurement cycle.

By actively reducing your energy footprint, you both save money and tick off key ESG boxes like Scope 3 emissions and resource efficiency.

That’s how carbon and cost control go hand in hand.

The best tools and strategies won’t deliver results if your team doesn’t know how to use them, especially when it comes to ESG.

And in the fast-evolving world of ESG, general sourcing knowledge isn’t enough.

Procurement professionals need to understand emissions data, regulatory standards, and how to assess sustainability claims without falling for greenwashing.

That’s where ESG literacy comes in.

When your team knows how to read supplier disclosures, verify third-party certifications, and navigate compliance requirements, they make smarter decisions and avoid costly mistakes.

Fewer errors lead to fewer delays, fewer emergency workarounds, and fewer unplanned expenses that eat into margins.

And the benefit is long-term.

ESG-literate teams can:

Investing in upskilling today means your team is ready to navigate tomorrow’s regulations, without needing to outsource expertise or react under pressure.

In short, it’s one of the smartest, most cost-effective ESG investments you can make.

There’s no denying that ESG comes with real costs.

Between premium materials, compliance tools, regulatory pressure, and the time it takes to onboard and support the right suppliers, it’s easy to feel like sustainability is a financial burden.

But as we’ve seen, inaction might cost you even more.

From lost business and investor pullback to regulatory fines and damaged reputations, failing to meet ESG expectations can get expensive—fast.

And that risk only grows as regulations tighten and stakeholder scrutiny intensifies.

Fortunately, procurement doesn’t just carry the burden of ESG.

Rather, it holds the key to making it pay off.

By choosing ESG-aligned suppliers from the start, using smart tools that cut down on complexity, embracing circular models, improving efficiency, and upskilling your team, you can control ESG costs without compromising on your goals.

In fact, when done right, sustainable procurement isn’t a cost center at all.

It’s a driver of long-term savings, resilience, and competitive advantage.