ESG In Procurement: 6 Trends Shaping the Future

Key Takeaways:

Even with global trade being reshaped in real time, ESG expectations from regulators, investors, and consumers continue to rise.

As a result, supply chains are under more scrutiny than ever.

Procurement teams must now balance ESG requirements with cost, risk, and operational efficiency.

Over the years, this growing pressure has driven key ESG trends in procurement, reshaping how companies approach sustainability and supplier management.

In this article, we’ll explore six ESG trends shaping procurement’s future and how businesses leverage them to stay ahead in this evolving landscape.

Initially, supply chain transparency was driven by companies seeking better operational efficiency and cost reductions.

However, rising demands from consumers, investors, and regulators have introduced new priorities, particularly around environmental, social, and governance (ESG) factors.

Procurement teams now face increasing pressure to track, assess, and report ESG performance across all supplier tiers, especially high-risk ones.

A key driver of this shift is the surge in ESG regulations at global, regional, and national levels.

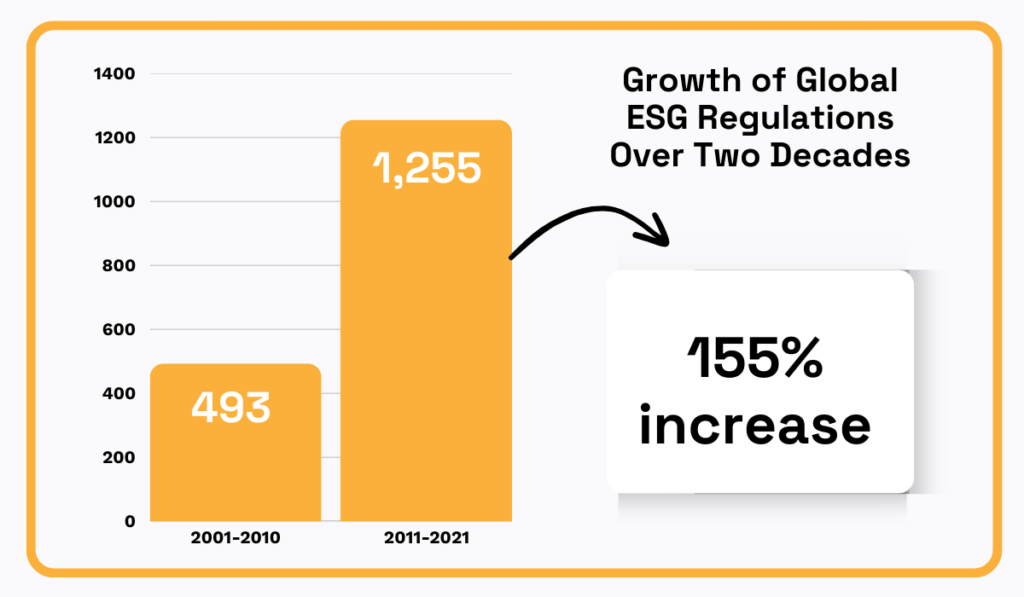

ESG Book’s research shows that ESG regulations have grown by 155% worldwide in the past decade.

Illustration: Veridion / Data: Edie

Although ESG regulations vary in purpose and scope, they collectively require companies to ensure end-to-end transparency across their supply chains.

This often means managing multiple suppliers at various levels, many of whom operate in regions or industries with high ESG risks.

By doing so, companies mitigate risks ranging from regulatory non-compliance and fines to significant reputational damage and revenue loss.

As a result, procurement teams face the challenge of collecting, verifying, and reporting ESG data across complex supply chains.

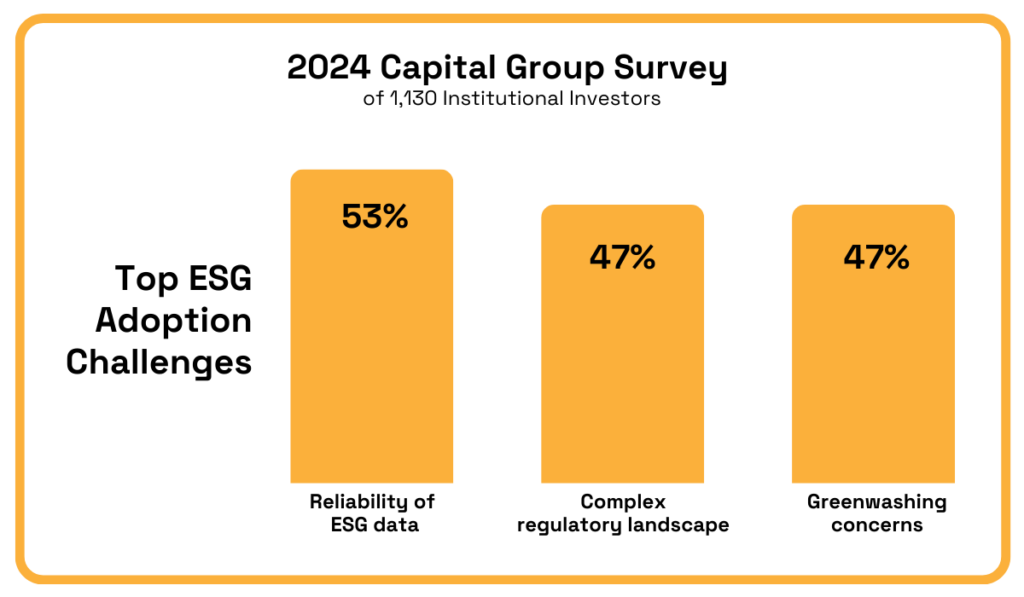

Not surprisingly, similar challenges are emphasized by another key group driving transparency on ESG issues and beyond—investors.

Illustration: Veridion / Data: Capital Group

So, given these ESG challenges for both procurement teams and investors, what actions do companies take to enhance supply chain transparency?

Best practices include:

Additionally, businesses are increasingly adopting blockchain for traceability, ESG data platforms for supplier assessments, and automated reporting tools for real-time visibility.

All these transparency efforts—especially at scale—increasingly rely on technology, which is transforming how procurement teams manage ESG compliance and risk.

The scope and complexity of ESG data have given rise to a range of digital platforms that support better decision-making.

These tools have been significantly enhanced by machine learning (ML) and, more recently, artificial intelligence (AI), which enable faster, smarter insights at scale.

In short, AI tools help teams:

Since building these capabilities in-house is costly and time-consuming, many companies use third-party platforms instead.

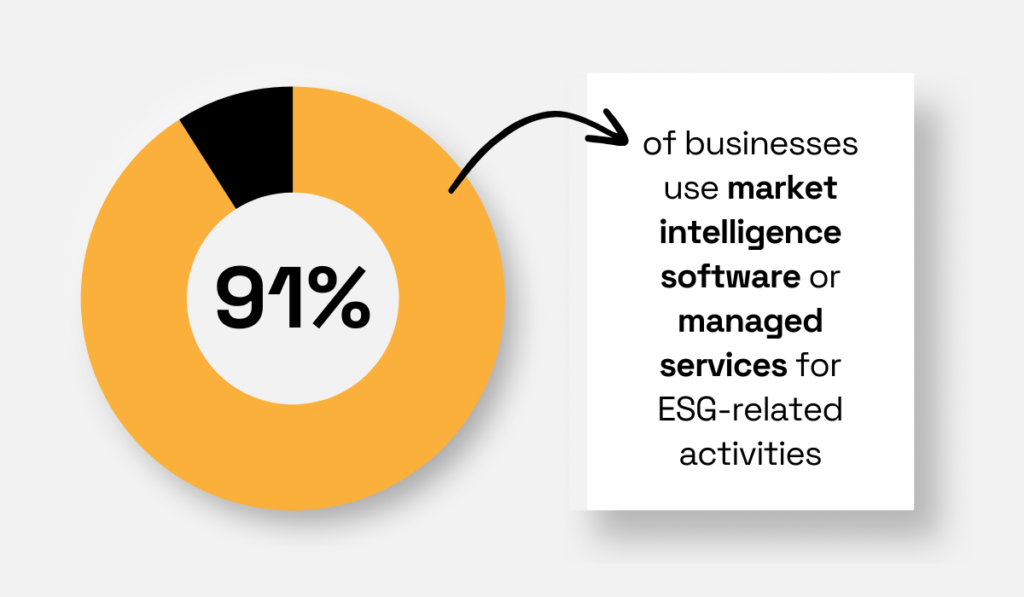

A 2023 Thomson Reuters report confirms this trend.

Illustration: Veridion / Data: Thomson Reuters

So, how does AI-driven technology support ESG decision-making?

Primarily, by helping companies efficiently collect, structure, and analyze ESG data from various internal and external sources.

This enables teams to align procurement strategies with corporate ESG goals and define clear criteria for evaluating suppliers.

Once those criteria are set, procurement professionals can leverage AI-powered market intelligence platforms to quickly identify and assess suppliers based on ESG standards.

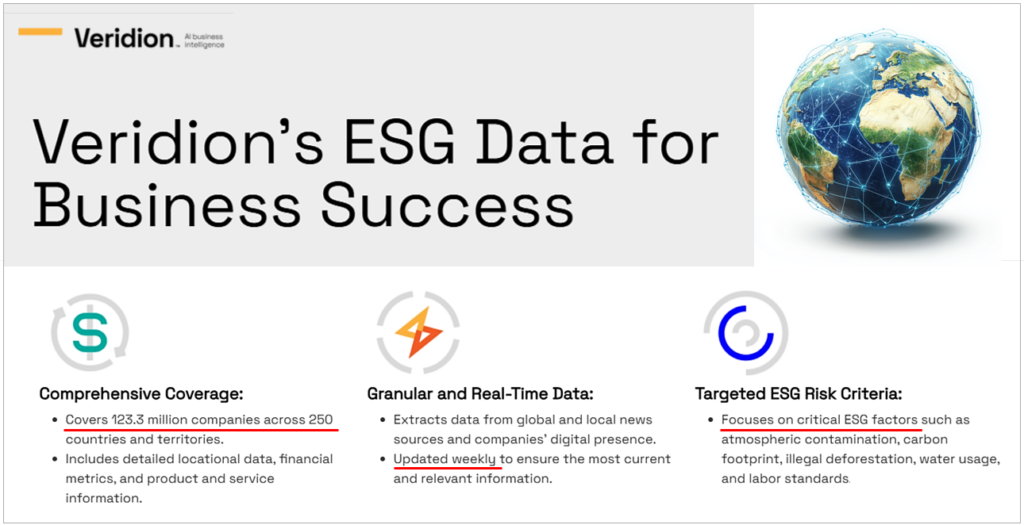

One such platform with unparalleled global coverage and an extensive ESG data validation process is our Veridion.

Source: Veridion

Veridion tracks all companies with an active online presence, building a global database of over 123 million businesses across 250 regions.

The data is updated weekly, with a focus on key ESG factors that matter most to procurement, like emissions, water use, deforestation, and labor standards.

What does this mean for your team in practice?

Veridion enables procurement teams to:

Since Veridion’s data can be integrated with other AI-driven solutions, businesses gain the flexibility to build an ESG technology ecosystem that fits their specific needs.

For example, integrating ESG data into well-designed software dashboards offers a user-friendly way to evaluate and continuously monitor supplier ESG performance.

Source: Achilles

ESG-related solutions with such dashboards streamline decision-making by enabling teams to compare supplier performance and identify risks.

Of course, there are other ESG decision-making tools—whether AI-powered or not—such as ESG scorecards, risk matrices, and heat maps.

These help procurement professionals prioritize supplier risks and align purchasing decisions with corporate ESG goals.

Beyond those, predictive analytics tools can forecast potential ESG-related disruptions, such as regulatory shifts or environmental incidents, allowing teams to take preventive action.

Overall, as ESG requirements grow in both complexity and volume, AI-driven technology will become indispensable for effective decision-making.

While environmental impact and carbon emissions remain important concerns, procurement is increasingly focusing on the social (S) aspect of ESG.

Among many social factors, this includes ensuring that suppliers uphold fair labor practices, protect workers’ rights, and maintain strong health and safety standards.

Companies are expected not only to evaluate their own practices but to extend this scrutiny across their entire supply chain.

While these expectations are formulated by regulators and investors, they’re primarily driven by consumers, whose awareness of social issues is reshaping their purchasing decisions.

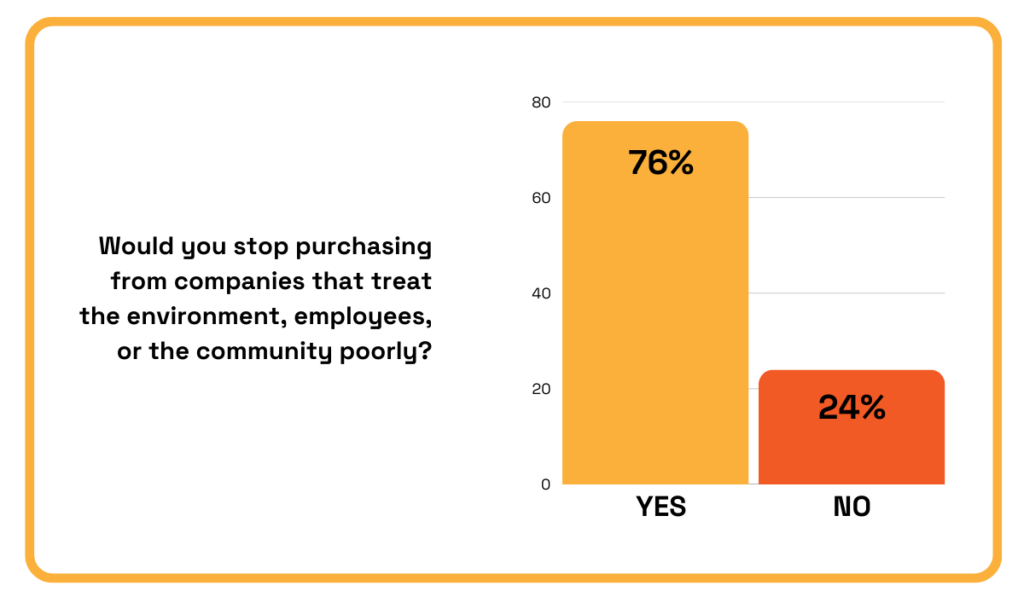

A 2021 PwC survey backs this up.

Three out of four consumers say they would stop purchasing from companies that mistreat workers, communities, or the environment.

Illustration: Veridion / Data: PwC

Naturally, this scrutiny extends to all suppliers a company engages with, prompting businesses to take proactive steps to prevent social inequalities within their supply chains.

Gemma Thompson, Senior Consultant for Strategy and Growth at Proxima, adds another perspective by emphasizing the urgency of such actions:

“There is also a feeling of urgency to get ahead of ethical sourcing before a non-compliance or issue arises in your supply chain, causing reputational and financial damage.”

In response, many companies have established stringent supplier codes of conduct that address labor standards, workplace safety, diversity, and community impact.

For example, Unilever has a binding policy for its suppliers, where 11 out of 17 principles focus directly on the fair treatment of workers and local communities.

Source: Unilever

Of course, codes of conduct and contractual embedding of social responsibility wouldn’t be effective without robust supplier tracking, monitoring, and reporting mechanisms.

Again, this is where various procurement technologies come into play, enabling real-time monitoring and data collection to ensure compliance.

Additionally, on-site visits and regular audits remain crucial to verifying that suppliers are meeting social standards.

Together, these efforts help companies maintain responsible supply chains, uphold their social commitments, and comply with ESG reporting requirements.

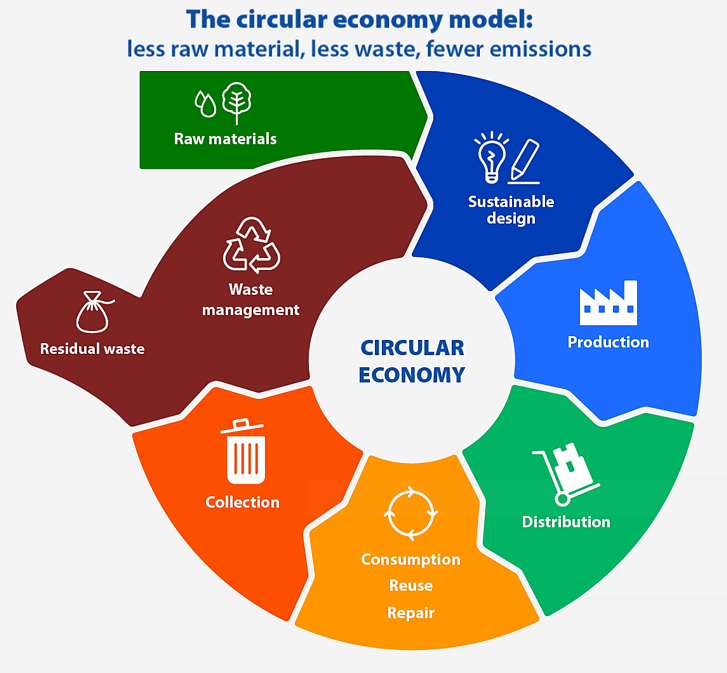

More businesses are moving away from the traditional linear supply chain toward a circular economy, focusing on waste reduction, resource efficiency, and extending product lifecycles.

Procurement plays a key role in this shift by sourcing recyclable materials, collaborating with suppliers on reuse initiatives, and embedding sustainability into product design.

When the circular economy model (shown below) is applied, it leads to lower raw material use, reduced waste, and fewer emissions.

Source: European Parliament

By integrating circular economy principles into sourcing strategies, procurement helps drive a meaningful reduction in the organization’s environmental footprint.

Beyond that, applying these principles can unlock cost-saving opportunities, spark innovation, and strengthen brand reputation.

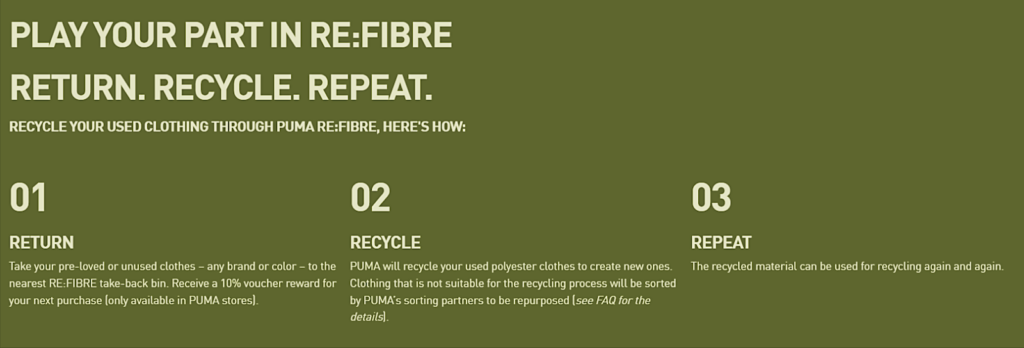

To illustrate, let’s look at Puma’s RE:FIBRE project.

Source: Puma

This is a great example of a procurement-driven circular economy initiative that accomplishes multiple goals simultaneously.

By recycling polyester textile waste, Puma:

At the same time, they generate cost savings by collecting textile waste at their stores, turning it into free raw material while engaging customers with ESG messaging and loyalty rewards.

Source: Puma

Puma’s RE:FIBRE project shows how circular economy thinking can be embedded into sourcing practices in a way that benefits both business and the planet.

Of course, there are plenty of other ways to adopt circular economy principles in procurement.

For instance, companies can:

As circularity takes center stage in sustainability strategies, procurement will play an even bigger role in driving resource efficiency and product innovation.

This shift supports environmental goals and helps companies stay competitive in a market that increasingly values responsible production.

As ESG issues gain more attention from consumers, investors, regulators, and even employees, they have evolved from a checkbox compliance activity into a strategic value driver.

For procurement teams, this means moving beyond simply meeting regulatory requirements.

They’re now aligning ESG goals with broader business objectives like cost efficiency, innovation, and risk management.

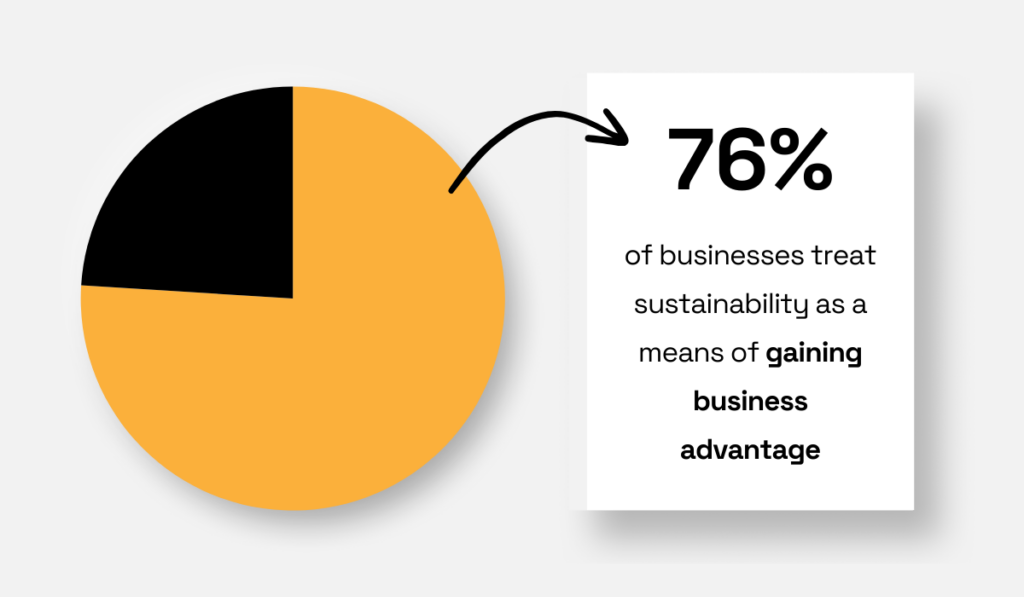

Many companies are already embracing this mindset.

A Sweep and Capgemini Invent survey found that 76% of businesses now view sustainability as a way to grow, attract customers, and improve efficiency.

Illustration: Veridion / Data: CDN

This growing emphasis on ESG also reflects a shift in how procurement is perceived within organizations.

Procurement teams today are expected to deliver far more than cost savings—they’re now seen as key contributors to strategic value creation.

As a result, company CPOs and their teams are gaining a stronger voice in high-level strategic decision-making.

However, this also comes with increased scrutiny from top leadership.

Another potential challenge is shifting the procurement function’s focus from short-term cost control to long-term value generation.

Still, the benefits of leveraging ESG as a strategic value driver are clear.

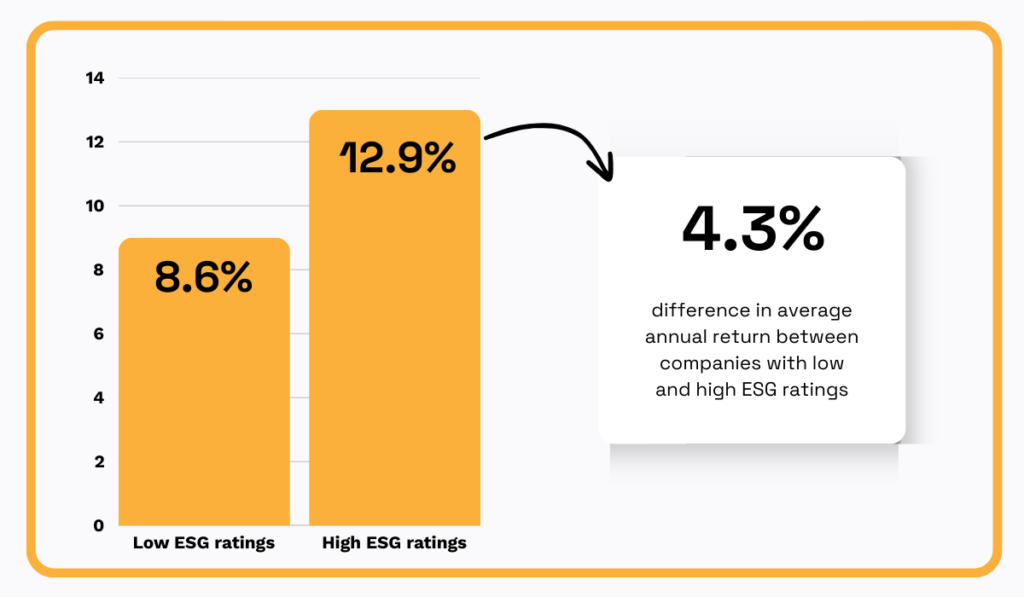

An analysis of over 13,000 companies reveals that businesses with high ESG ratings outperform their peers, delivering an average annual return that’s 4.3% higher.

Source: Kroll

As more companies embrace ESG as a core driver of long-term business value, procurement’s strategic role will only continue to grow.

However, to truly unlock this potential, companies must move beyond internal efforts and collaborate with suppliers to achieve shared ESG goals.

A large part of a company’s ESG commitments—and its ability to meet reporting requirements—depends on its suppliers.

This makes supplier collaboration on ESG goals a top priority for procurement teams.

As a result, procurement teams are shifting from audit-style ESG oversight toward more proactive supplier engagement and education.

Companies are co-developing ESG targets with vendors, launching joint initiatives, and building long-term partnerships to meet shared sustainability objectives.

Beyond ESG, strong supplier relationships also provide resilience during disruptions, whether caused by pandemics, regional conflicts, or shifts in global trade.

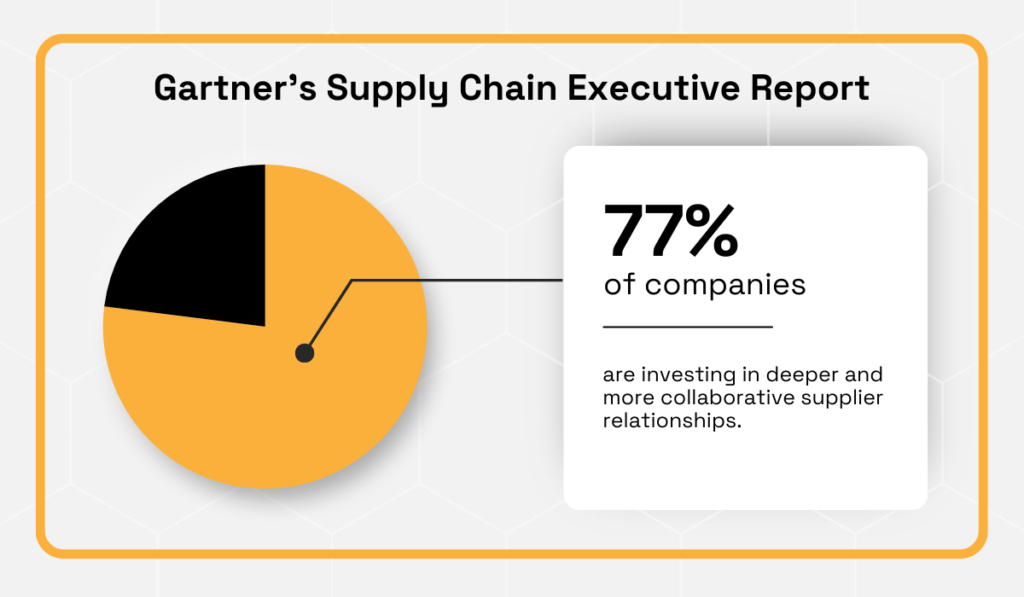

A 2021 Gartner report shows that most companies are already investing in this direction:

Illustration: Veridion / Data: Gartner

To achieve alignment with their ESG goals, companies are:

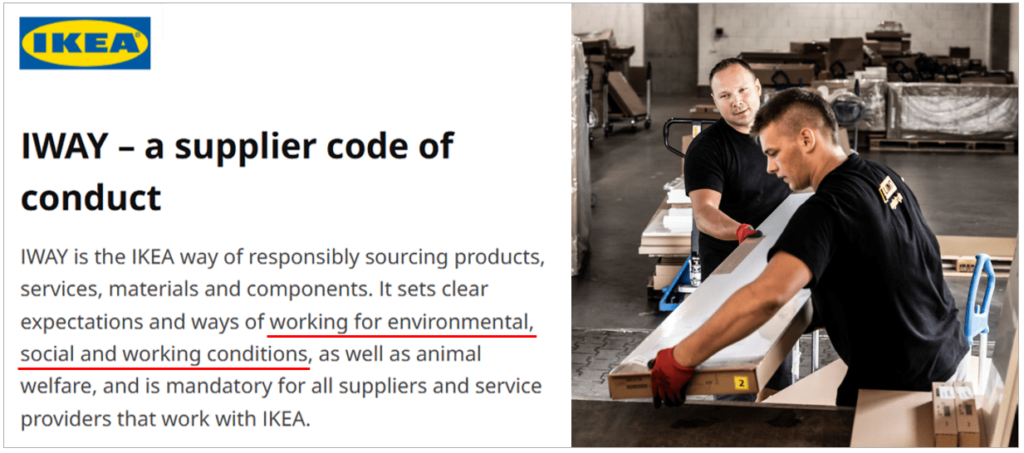

Of course, supplier alignment with corporate ESG goals begins by embedding ESG criteria into sourcing decisions and setting clear expectations through supplier codes of conduct.

One well-known example is IKEA’s IWAY Supplier Code of Conduct, which outlines specific environmental, social, and labor requirements for all suppliers and service providers.

Source: IKEA

Given the critical need for close collaboration, procurement’s role is evolving to drive ESG maturity across the supply base through proactive supplier management.

However, several barriers stand in the way:

As ESG continues to gain importance, overcoming these challenges will be essential for companies looking to strengthen supplier relationships and achieve mutual ESG progress.

From embedding ESG into sourcing decisions to driving innovation through supplier collaboration, procurement is now at the center of companies’ sustainability agendas.

The six trends we’ve discussed highlight how procurement is evolving from a back-office function to a strategic force that shapes long-term business resilience, compliance, and value creation.

As ESG expectations continue to rise, procurement teams that embrace this shift—and use the right tools—will be instrumental in helping their organizations build more sustainable and responsible global supply chains.