How to Perform a Supplier Risk Assessment

In today’s globalized economy, companies often rely on a vast network of suppliers to ensure smooth and uninterrupted operations.

But each supplier brings a unique set of risks—some unavoidable but manageable with the right strategy.

That’s where supplier risk assessment comes in: a proactive approach to identifying potential pitfalls before they impact your business.

When done right, this process can make your supply chain more resilient, enhance compliance and sustainability, and even offer a competitive edge.

In this article, we’ll guide you through a step-by-step process for performing a thorough supplier risk assessment and realizing these benefits.

Start by listing all of your organization’s current suppliers. Next, categorize them according to key factors such as spending volume, importance to daily operations, and geographic location.

This should allow you to identify which suppliers are most crucial to your organization and should be prioritized in your risk assessment.

That’s because not all suppliers pose the same level of risk or are equally critical to your business, so a structured approach helps focus resources where they’re most needed.

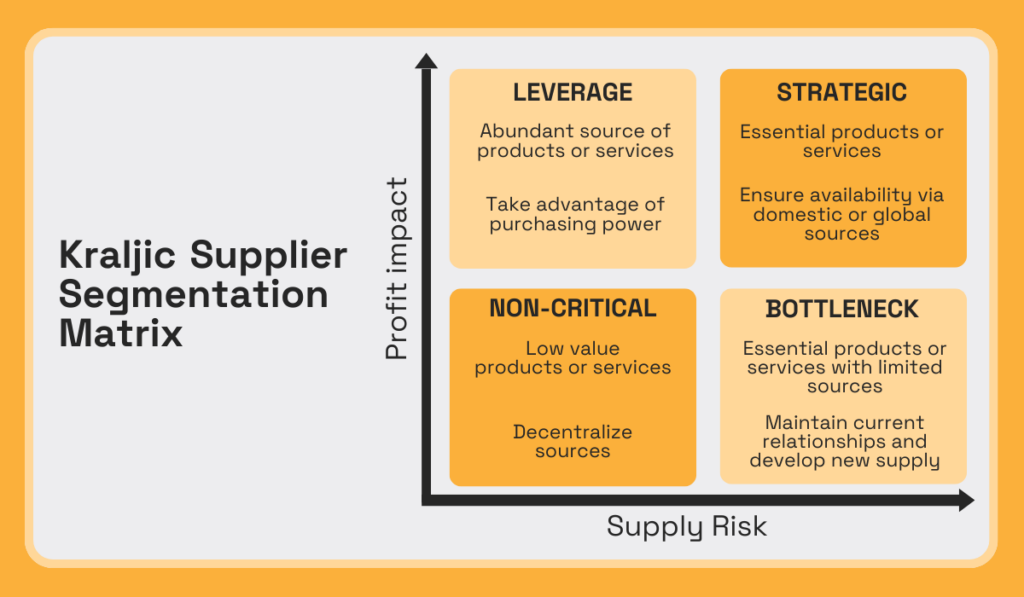

One of the most used tools for identifying critical suppliers is the Kraljic Matrix.

It allows you to categorize suppliers into four quadrants based on two key dimensions: profit impact and supply risk.

Illustration: Veridion / Data: Smartsheet

Suppliers in the Leverage, Strategic, and Bottleneck quadrants can be considered critical.

Among these, bottleneck suppliers are the most critical, as they provide essential products or services that are difficult to replace.

It’s best to maintain close relationships with them and try to mitigate risks by identifying or developing alternative sources.

Strategic suppliers follow next and require careful monitoring and the development of strong, long-term partnerships.

While still critical, leverage suppliers present lower risks as their products or services are more widely available and easily replaced.

With these suppliers, the focus is often on optimizing costs and improving contract terms while also managing potential risks.

The last group, non-critical suppliers, can be managed with a more hands-off approach.

Segmenting suppliers in this way helps your team identify which ones are most critical to the success of your business and, therefore, requires deeper risk assessments.

This segmentation also sets the stage for the next step in the risk assessment process: defining the risk criteria.

After categorizing suppliers by their importance, the next step is to define the risk criteria for assessing both current and potential suppliers.

Establishing specific risk factors is crucial for accurately measuring and comparing the potential risks each supplier may pose.

Without these criteria, assessments could become inconsistent or incomplete, potentially overlooking key risk areas.

On the other hand, clear and well-defined risk criteria ensure that all suppliers are evaluated consistently and comprehensively.

As a reminder, common supplier risk criteria include:

Source: Veridion

Each criterion offers a specific lens through which to evaluate your suppliers.

For example, the pricing aspect assesses the risk of overpaying for goods or services,

examining how much a supplier charges for their products or services compared to other suppliers.

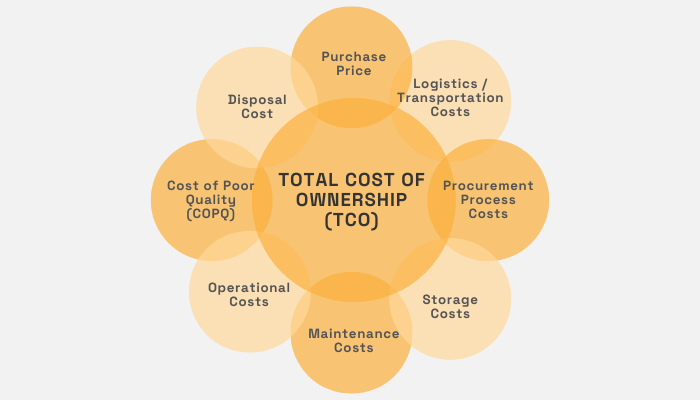

Additionally, the cost aspect goes beyond the purchase price and benchmarks the total cost of ownership (TCO) associated with a supplier.

Source: Veridion

As illustrated, this encompasses a range of expenses, including storage, maintenance, and costs tied to potential quality issues.

Comparing these TCOs with the actual or estimated TCOs of similar suppliers can help reveal inefficiencies and hidden risks that might affect your supply chain’s long-term profitability.

Another example is verifying a supplier’s compliance with legal and industry regulations, which determines whether your organization is exposed to risks from supplier non-compliance.

This is especially relevant given that, according to Gartner research, 83% of compliance and legal leaders reported identifying risks only after due diligence was completed.

But here’s a key tip: defining risk criteria is a team effort.

This is where collaboration with key stakeholders across departments proves invaluable.

For example:

So take the time to establish precise and relevant risk criteria and involve key stakeholders.

This will empower you to identify high-risk areas effectively.

Once defined, these criteria serve as benchmarks for evaluating suppliers, paving the way for a comprehensive risk assessment.

However, before any assessment can begin, you first need to collect supplier data.

Now, it’s time for your team to collect essential supplier data.

This is going to include two categories of data: internal and external.

Internal data includes everything your company has on your suppliers, such as:

This information is typically extracted from various procurement, supplier relationship management (SRM), and contract management software your company uses.

External sources of supplier data are equally essential for two key reasons:

Without external data, a risk assessment would be incomplete, as it limits insights into broader market standards and potential risks outside your or suppliers’ direct control.

To successfully gather the freshest, most accurate data on all suppliers, you can use a data provider like our Veridion.

Source: Veridion

With access to Veridion’s AI-powered, weekly updated, global database of suppliers, you can ensure your supplier profiles are enriched with reliable, up-to-date information.

This is essential for risk assessment, as studies show that up to 30% of supplier data changes annually.

Source: Veridion

Veridion’s data service helps you keep pace with these changes, ensuring you always have the most current insights to support effective risk management.

Overall, gathering supplier data from both internal and external sources is a crucial step in the risk assessment process.

Why? Because having comprehensive data provides a factual basis for assessing each supplier’s risk profile.

It also enables your team to identify potential risks that suppliers may not report in their assessment questionnaires.

With the risk criteria defined and initial supplier data collected, you now have a clear sense of what to focus on.

This information allows you to develop standardized questions to address any remaining gaps, ensuring a thorough assessment.

Having tailored questions will help gather the specific information required to evaluate the risk factors established in the second step.

An effective supplier questionnaire typically addresses the following core areas:

| Core Area | Purpose |

|---|---|

| Financial stability | Assess the supplier’s financial health to ensure they can meet contractual obligations. |

| Operational capacity | Evaluate the supplier’s manufacturing processes, reliability, and quality control systems. |

| Compliance | Verify the supplier’s compliance with legal requirements, industry regulations, standards, and relevant certifications. |

| Sustainability and ethics | Review the supplier’s environmental impact, social responsibility, and ethical practices. |

| Cybersecurity | Assess the supplier’s vulnerability to cyber threats and their data protection measures. |

Of course, this is just a generalized breakdown, meaning that questionnaires can cover other areas, depending on your needs.

For example, suppliers can also be asked about:

On that note, you should prioritize key risk areas where your team needs information to avoid overwhelming suppliers with questions.

So, after you prepare the questionnaire, ask suppliers to complete it.

Ensuring that the questions are clear and easy to answer is just as important as allowing suppliers enough time to provide thorough responses.

A well-prepared assessment questionnaire will provide you with specific, actionable insights to effectively evaluate supplier risk and make informed decisions.

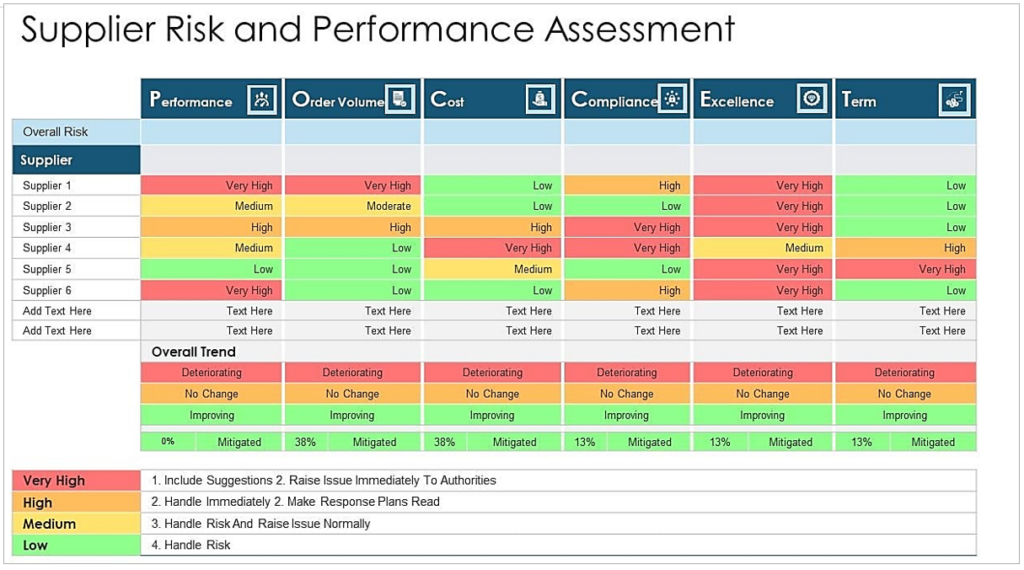

Now that you have all the necessary supplier data and market intelligence, you can calculate each supplier’s risk level.

This involves assigning scores to each supplier based on their performance across all identified risk criteria, ultimately generating an overall risk score.

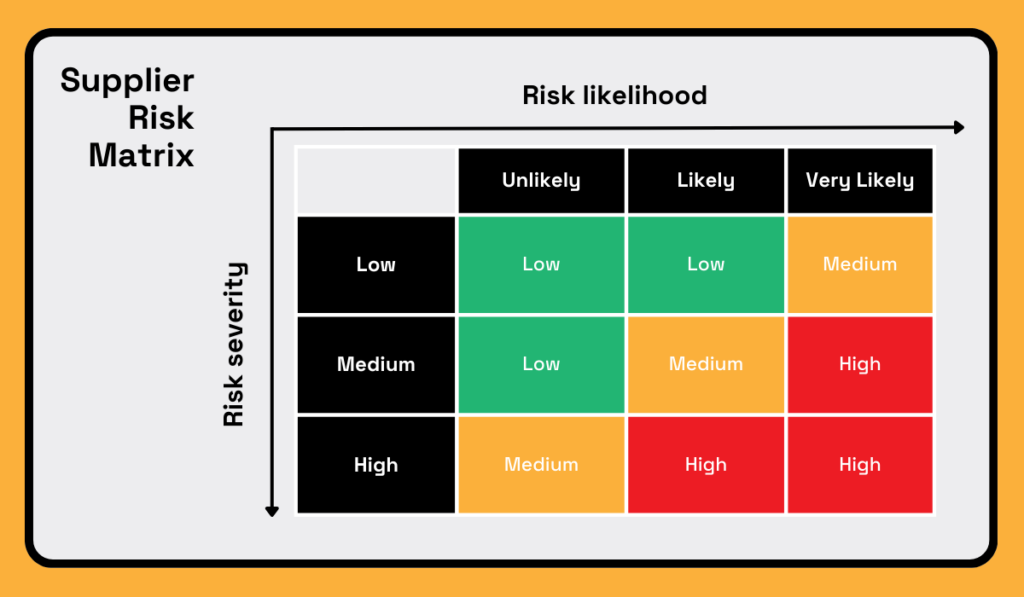

Risk scores can vary in detail but generally assess two main factors: the likelihood of a risk occurring and the severity of its potential impact.

While the risk likelihood can include labels such as negligible, very high, or critical, a straightforward and commonly used approach is to rank risks as low, medium, or high.

To illustrate, here’s a simple supplier risk matrix.

Source: Veridion

Imagine a key supplier providing an essential component for production, with few alternative suppliers available.

The supplier’s financial performance has been declining in recent quarters, making the risk of financial instability “Likely.”

If the supplier were to experience financial trouble or become insolvent, it would cause significant disruptions in the supply chain, so the severity of this risk is considered “High.”

This combination of “Likely” risk and “High” impact results in an overall risk level of “High” for financial stability.

Repeat this process for each critical supplier identified in the first step and for each additional risk criterion identified in the second step.

By plotting each supplier’s risk likelihood and severity on the matrix, you can ultimately visualize and compare risk profiles in a clear and structured way.

Source: Slidegeeks

Finally, you can assign each supplier an overall risk score, typically based on the highest level of risk among the evaluated criteria.

Quantifying risk levels in this way helps prioritize suppliers and make informed decisions on appropriate risk mitigation strategies.

Although your risk assessment is completed, there’s more work to be done.

With the risks identified, you can now explore strategies to reduce or mitigate them.

Depending on the risk, this may involve diversifying suppliers, creating contingency plans, or requiring performance bonds to secure supplier commitments.

In rare cases where a high-risk situation can’t be effectively mitigated, you may decide to phase out the supplier and seek alternative partners.

The following table offers examples of potential supplier risks and corresponding mitigation strategies:

| Supplier Risk | Potential Mitigation Strategy |

|---|---|

| High financial instability | Develop alternative suppliers; secure a performance bond to cover losses in case of non-delivery. |

| Limited operational capacity | Partner with additional suppliers to ensure production backup; establish contingency inventory. |

| Regulatory compliance issues | Conduct regular audits; provide regulatory compliance training for suppliers. |

| Low cybersecurity readiness | Require enhanced data security measures; conduct cybersecurity assessments. |

| Inadequate sustainability practices | Set clear sustainability targets; monitor and reward compliance over time. |

When deciding on appropriate mitigation strategies, prioritize high-impact risks that—if they materialize— could have immediate effects on operations or compliance.

It’s also crucial to consider the feasibility, cost, time, and resources needed for each strategy.

Ultimately, well-designed risk mitigation strategies enable your team to proactively manage risks, reducing the likelihood of supply chain disruptions and financial losses.

Effective supplier risk management requires regular reviews and updates to the assessment process.

Market conditions, supplier performance, and regulatory environments are constantly changing, which means new risks can emerge at any time.

By closely monitoring these changes, you can identify potential risks early and adjust your mitigation strategies accordingly.

Leveraging tools that offer real-time supplier data, market intelligence, and automated alerts can be incredibly valuable for continuous risk monitoring.

That’s exactly what Veridion’s supplier risk monitoring feature provides.

Source: Veridion

You can set customized risk factors, such as a supplier’s financial difficulties, regulatory and ESG issues, or local/regional political and economic risks.

Then, if Veridion’s AI-powered bots pick up such information on the web, you’ll receive an alert along with data reliability/confidence scores.

Now your team is informed and can decide whether and what appropriate action should be taken to mitigate potential disruptions.

While tools like Veridion provide essential real-time data for third-party risk management (TPRM), this functionality automates only one aspect of proactive risk monitoring.

In other words, ongoing supplier performance assessments—through audits, feedback, and scorecards—remain essential for a well-rounded risk management approach.

We hope this overview of the steps involved in performing a supplier risk assessment has made the process clearer and more manageable.

Successful supplier risk management starts with a thorough initial assessment, followed by proactive mitigation and continuous monitoring.

By leveraging the right tools and methodologies, your procurement team can make informed decisions to minimize risks and protect your business from operational and financial disruptions.