Best Practices for Leveraging Market Intelligence

Key Takeaways:

Now more than ever, market intelligence (MI) is everywhere.

Data is easier to access than ever before, but collecting it is only half the battle.

The real advantage comes from knowing how to turn that information into meaningful action.

In this article, we’ll explore six best practices to help you get the most value from your market intelligence and turn insights into impact.

Market intelligence works best when you know exactly why you’re collecting it.

Broad strategic goals set the overall direction of what a company is trying to achieve, such as strengthening competitive positioning or reducing supply chain risk.

One level below, tactical goals pinpoint the precise information needed to achieve them.

For example, a strategic goal of risk management might translate into, among others, a tactical goal of tracking supplier facility health and safety incidents.

To illustrate how these two levels work together in determining what intelligence is gathered, here’s a quick reference table with common examples.

| Type of Market Intelligence | Strategic Goal | Tactical Goal |

|---|---|---|

| Competitive intelligence | Strengthen market positioning | Monitor competitor product launches and pricing changes |

| Customer intelligence | Improve customer satisfaction | Analyze social media sentiment after new product releases |

| Regulatory intelligence | Ensure compliance | Track upcoming regulatory changes in target markets |

| Supplier intelligence | Resilient supply chain | Monitor supplier operational and financial health |

| Market trends intelligence | Identify emerging opportunities | Monitor industry-specific keyword searches and trade publication mentions |

Both strategic and tactical goals inform your team about what specific data needs to be collected.

For more clarity, consider developing Key Intelligence Questions (KIQs).

These targeted questions guide what specific insights market intelligence should deliver, ensuring the collected data is relevant.

KIQs help align intelligence efforts with the real needs of decision-makers and stakeholders across departments, making insights more actionable.

As John McDonald-Dick, Head of Commercial Competitive Intelligence at UCB, a global biopharmaceutical leader, explains:

Illustration: Veridion / Quote: Octopus Intelligence

He adds that this approach makes intelligence gathering more focused and reduces wasted effort and resources.

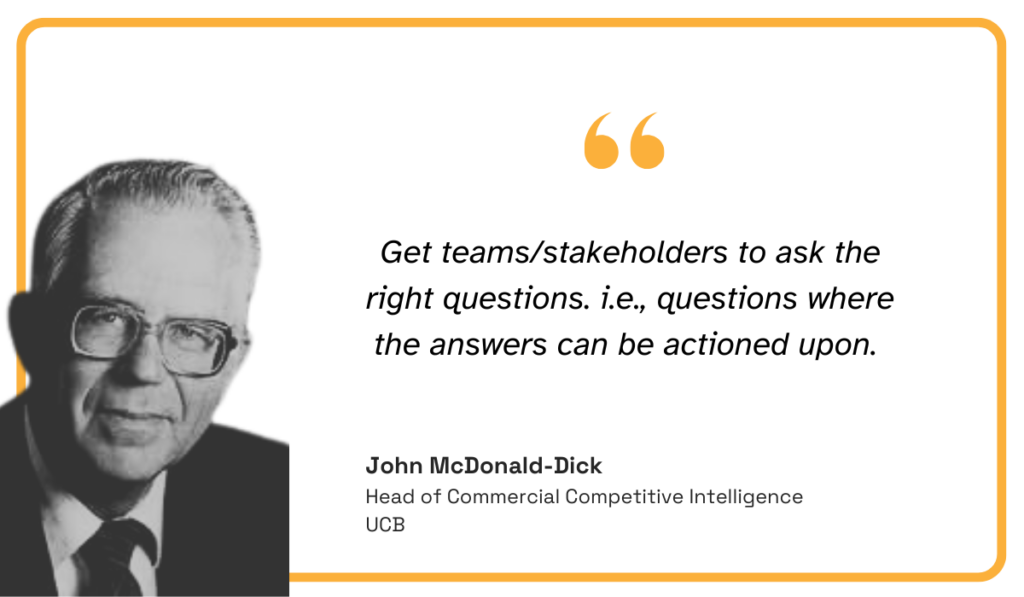

Beyond asking the right questions, you should set the right Key Performance Indicators (KPIs).

Here, it’s important to distinguish between two key types:

Below are examples of KPIs in both categories:

Source: Veridion

Essentially, tracking market and competitive KPIs is part of any market intelligence program, making it a much broader category.

These metrics can span everything from shifts in customer behavior to signs of competitive innovation.

Internal impact KPIs, on the other hand, are more focused but can be harder to quantify.

In both cases, securing senior leadership buy-in is essential for market intelligence to succeed.

Ultimately, leadership shapes the organization’s goals, decides how insights will be used, and allocates the resources for market intelligence.

This best practice is an obvious one, but still warrants further explanation.

For starters, there is no single software or platform that can collect and analyze all types of market intelligence.

That’s not surprising since market intelligence spans very different categories of data about your market environment, competitors, and customers.

Take the marketing department, for example.

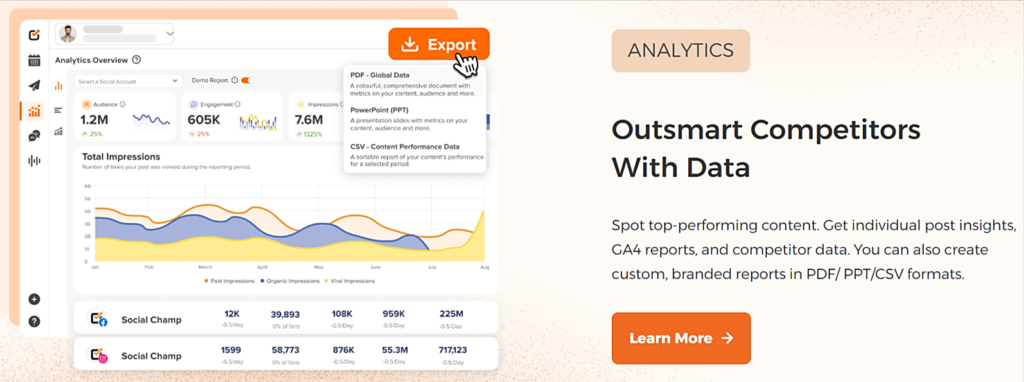

If their goal is to monitor what competitors are posting on social platforms and how audiences are responding, they could turn to a social media listening tool such as Brandwatch, Talkwalker, or Social Champ.

Source: Social Champ

These tools track conversations, sentiment, and trends across social channels, delivering real-time insights into public perceptions and competitor activity.

When the goal shifts to gathering direct customer feedback, teams might turn to tools like Google Forms or SurveyMonkey to collect structured input on customer preferences.

For broader market intelligence needs like identifying B2B opportunities, targeting mid-sized businesses (MSBs), or mapping competitive landscapes at regional and global levels, organizations often rely on specialized data discovery platforms.

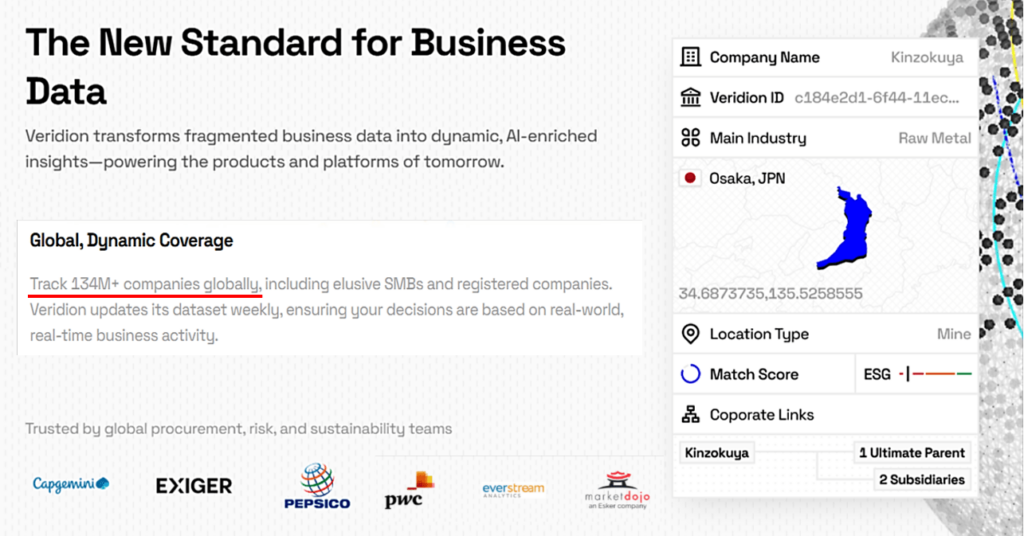

One example is Veridion, whose AI-powered bots continuously gather business data from vast online sources, feeding it directly into analytics platforms and decision-making tools.

Source: Veridion

By tracking over 134 million companies worldwide, including hard-to-find SMBs, Veridion gives market intelligence teams timely, accurate, and verified business data.

Its unmatched global coverage and precision make it a dependable foundation for a wide range of market intelligence use cases.

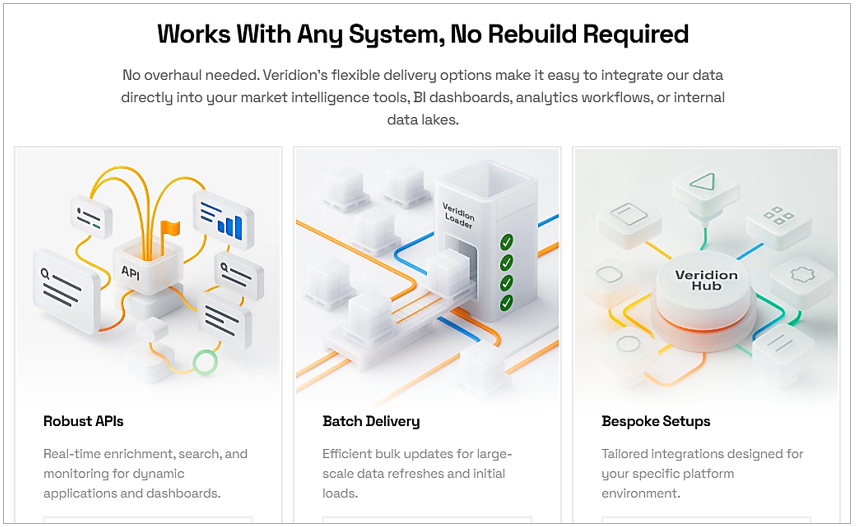

Access to Veridion’s dataset is possible through real-time APIs, large-scale batch exports, or customized workflows, making it easy to feed the data into your existing systems.

Source: Veridion

These integration options highlight a key principle when adopting market intelligence tools:

Select systems that integrate seamlessly and unify diverse data sources.

Scalability, ease of use, and data accuracy are equally important considerations.

The bottom line?

Whatever tools you choose, make sure they’re fed with fresh, relevant information.

Market intelligence loses its value quickly if the underlying data becomes outdated, making regular updates essential.

Without timely and accurate information, even the most advanced tools can mislead decision-makers, resulting in missed opportunities or poorly timed actions.

Whether it’s managing risk, tracking market trends and competitor moves, or driving customer-focused innovation, continuous monitoring forms the backbone of effective market intelligence.

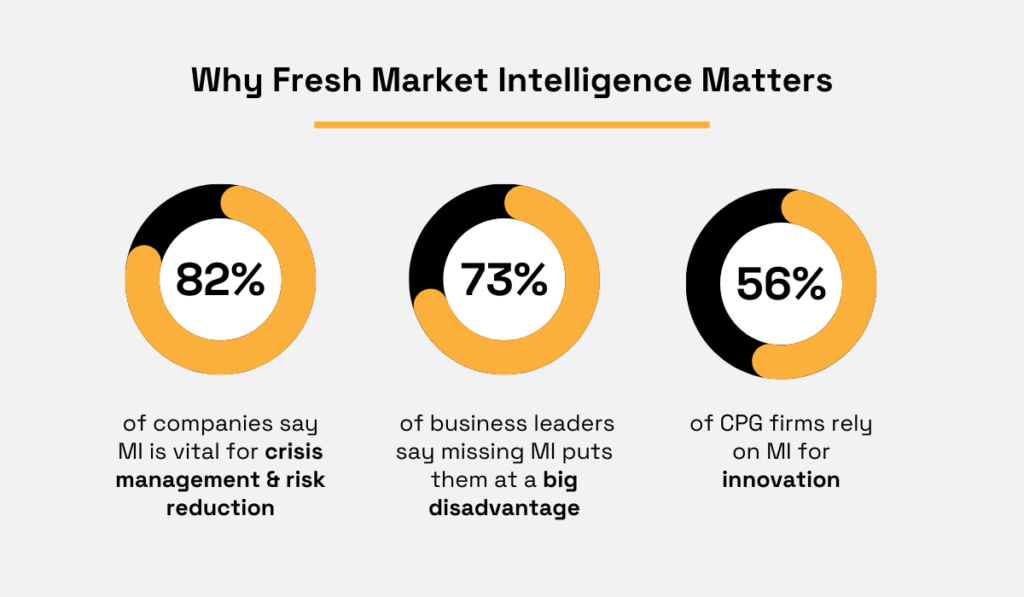

Research from Dun & Bradstreet shows just how critical fresh, relevant insights are—both for shaping long-term strategies and guiding day-to-day decisions.

Illustration: Veridion / Data: D&B

In some cases, market intelligence data points must be updated in real-time to enable swift, informed decisions.

A prime example of this is Amazon’s dynamic pricing tool, which tracks competitor prices, customer behavior, product demand, and stock levels to optimize pricing.

Amazon’s Automate Pricing function lets sellers define pricing rules, after which algorithms automatically adjust product prices based on these multiple data points.

As Ken Zhou, COO at My Amazon Guy, a full-service Amazon agency, explains:

Illustration: Veridion / Quote: My Amazon Guy

This automated process involves continuously tracking multiple market intelligence data points, with insights directly influencing pricing decisions in real time.

Another critical use case for near-real-time market intelligence—with a slightly longer update horizon—is risk management.

Companies need timely alerts on supplier changes, financial health, or operational disruptions to proactively mitigate risks before they impact business.

Some data platforms offer customizable risk factors, confidence scoring, and real-time alerts, enabling organizations to monitor suppliers closely and respond quickly to emerging threats.

Source: Veridion

Of course, there is market intelligence with longer-term horizons, such as quarterly and annual corporate and industry reports and strategic analyses.

Overall, the principle of data freshness applies across all departments, from procurement to product development, marketing, and the C-suite.

In short, keeping market intelligence fresh requires:

Now, let’s see how all this market intelligence should be shared to maximize its value and impact.

With market intelligence covering a wide range of data, sharing it meaningfully across teams is a complex challenge that demands robust solutions.

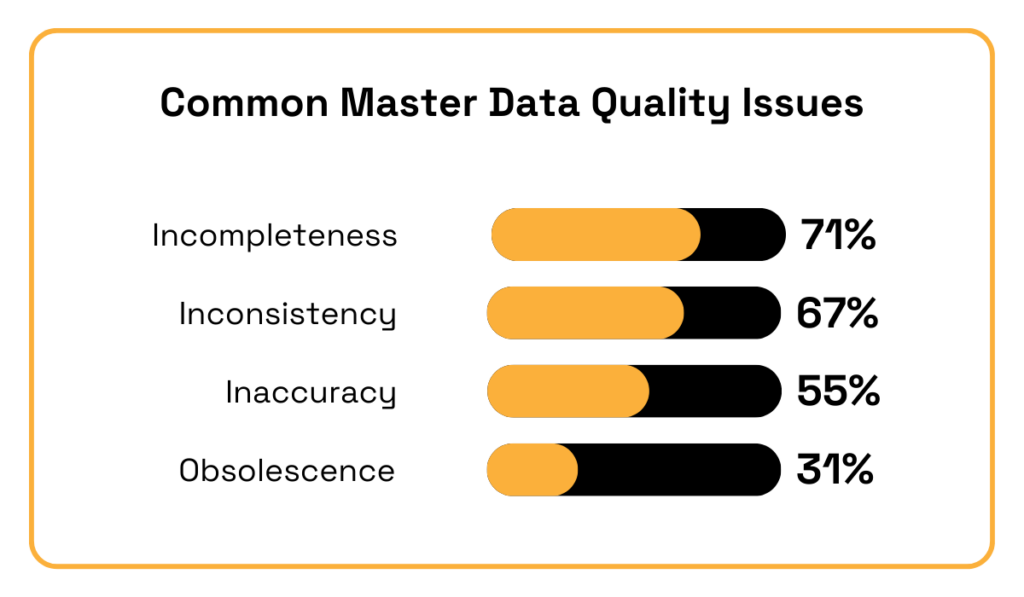

Many companies still struggle with the quality of data entering their systems or lingering from legacy sources.

As a result, market intelligence gathered by one department often becomes siloed, overlooked, or lost, limiting its value for decision-making.

A McKinsey report highlights common data quality issues that hinder effective use of market intelligence across the organization.

Illustration: Veridion / Data: McKinsey

So, the first essential step is to clean, deduplicate, and standardize your master data records.

Equally important is to establish processes that keep those records regularly updated.

This creates a solid foundation for effective cross-departmental intelligence sharing.

But clean data alone isn’t enough.

Athanasia Kokkinogeni, former Senior Competitive Intelligence Analyst at Elekta, points out that how you communicate those insights is just as crucial:

Illustration: Veridion / Quote: Octopus Intelligence

Interdepartmental communication is best achieved through a mix of complementary channels and formats.

To make intelligence-sharing consistent across teams, organizations can:

Alongside these practices, fostering a data-driven culture that values openness and collaboration is essential for effective intelligence-sharing.

Finally, strong cross-functional collaboration is crucial for extracting insights and turning them into action.

With market intelligence spanning everything from consumer sentiment to supply chain shifts, extracting insights starts with setting clear goals and selecting the right analysis methods.

The choice of method depends on the type of raw market data available, the business questions asked, and the kind of insight needed.

For example, if the aim is to pinpoint which product features customers value most, conjoint or MaxDiff analysis can reveal priority attributes.

To segment customers for targeted marketing campaigns, cluster analysis is often the go-to approach.

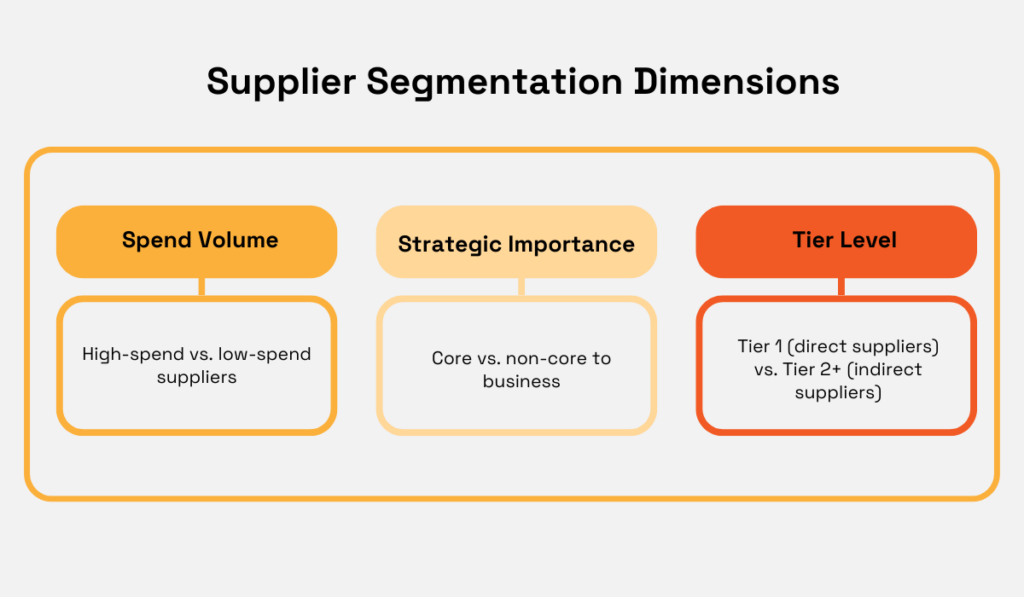

Likewise, companies apply segmentation techniques to their supplier base, grouping them by spend volume, strategic importance, and tier level.

Source: Veridion

This kind of segmentation helps companies prioritize supplier relationship management, negotiation strategies, and risk monitoring.

Another example is Gabor-Granger and regression analysis, commonly used to inform pricing strategies.

In practice, there are numerous established analysis techniques, each suited to extracting insights for different objectives.

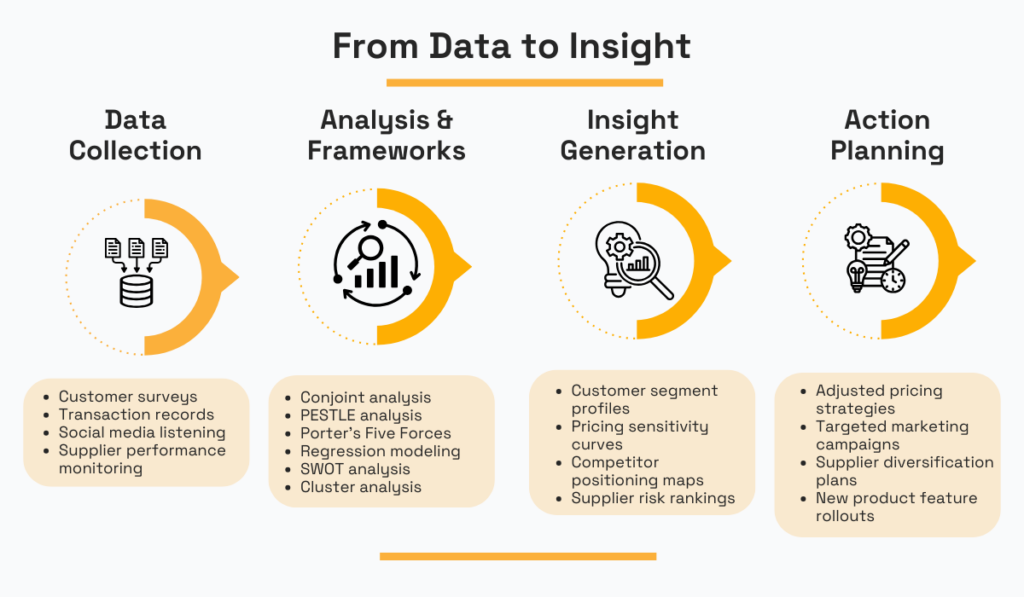

The broader process typically follows a structured path:

The following visual outlines this process with concrete examples for each stage.

Source: Veridion

Given the above, it’s clear that moving from data to insight-driven action can take many forms, making this process part art and part science.

The key lies in selecting the right methods that align with your specific goals and available data—whether strategic frameworks or statistical models.

This is where the earlier best practices we covered—clear goals, MI tools, regular updates, and cross-team collaboration—come together.

Combined, they ensure that insights are not only discovered but also successfully translated into meaningful action.

Turning market intelligence into concrete business actions is the key driver of growth and competitive advantage.

There are many examples of leading companies across industries demonstrating how data-driven insights shape their strategies and decision-making effectively.

For instance, Mars Wrigley’s expansion into emerging markets such as Mexico, India, Vietnam, and Nigeria relies heavily on deep localization.

This means tailoring products and services to evolving local trends and consumer preferences, which requires extensive, localized market intelligence.

As Fadi Abi-Nader, VP of One Demand, Global Emerging Markets (GEM) at Mars Wrigley, notes:

Illustration: Veridion / Quote: Confectionery News

He adds that entering these markets with a one-size-fits-all approach would simply fail.

With Mars estimating that 75% of future snack category growth will come from these emerging markets, the company relies on detailed market intelligence and a structured, step-by-step approach to guide its expansion.

Similarly, Zara has transformed the fashion industry by embedding data-driven insights deeply into its operations.

The retailer continuously collects sales data, customer preferences, and social media signals to predict trends and respond rapidly to shifting demands.

Source: Medium

Zara’s intelligence-driven approach enables the brand to rapidly design and deliver fashion collections that meet evolving customer demand while minimizing overstock and waste.

With many market intelligence use cases still uncovered, let’s highlight some general best practices that can help companies turn insights into impactful action.

These include:

Together with the MI impact KPIs mentioned earlier, these practices help consistently translate market intelligence efforts into meaningful and measurable business results.

Essentially, all best practices for leveraging market intelligence share the same objective:

Establishing a robust pipeline where fresh data is verified, transformed into actionable insights, and shared effectively across teams.

This, in turn, enables your company to make faster, more informed decisions, seize opportunities ahead of competitors, and minimize risks through proactive, evidence-based strategies.

So, with clear goals and the right tools, you can make data truly work for you.