How Successful Companies Use Market Intelligence for Business Growth

Key Takeaways:

Successful companies don’t wait for change. They anticipate it.

Market intelligence, whether it’s cultural insight, consumer behavior analysis, or trend forecasting, gives businesses the edge to innovate, localize, and expand with confidence.

To see how this plays out in the real world, let’s look at five companies that have used market intelligence as a strategic driver of growth.

We’ll start in Japan, with a beverage giant that saw a cultural shift decades before most Western brands even noticed it.

Japan generates over $12 billion in revenue annually from ready-to-drink (RTD) coffee.

More than any other country in the world.

But Coca-Cola didn’t need the latest Statista report to tell them that.

They understood the opportunity back in 1975.

At the time, Coca-Cola had already learned something many global brands still struggle with: Japan doesn’t just consume differently, it tastes differently.

Their insight, driven by cultural observation and early market signals, came through close attention to consumer behavior.

Japanese consumers were showing a clear preference for beverages that were less sweet and more balanced.

So, instead of pushing the standard Coca-Cola formula, the company developed a canned coffee brand tailored specifically to Japanese tastes.

Source: Fandom

They called it Georgia Coffee, a nod to the company’s U.S. home state, but the product was entirely Japanese in conception.

It quickly became a national favorite.

How did the story unfold?

Well, with the help of market intelligence.

Coca-Cola watched the market.

Japan had been warming up to canned coffee since 1969, when Ueshima Coffee Company first introduced the format.

Coca-Cola saw the trend building, studied the taste preferences, and then launched Georgia with variants that suited the local palate.

Over the years, Georgia evolved to reflect changing consumer behavior.

According to Taeko Ohuchi, Coca-Cola Japan’s Public Affairs & Communications Brand PR Manager, Japanese consumers now fall into four major flavor segments when it comes to RTD coffee:

It’s that last one that has become a standout, explains Ohuchi for FoodNavigator-Asia:

Illustration: Veridion / Quote: FoodNavigator-Asia

The first version, Georgia Grand Bito, sold more than 200 million units in its first year on shelves.

Today, there are around 30 Georgia variants sold in Japan, and two-thirds are blends of coffee and milk, with many leaning toward the lower-sugar side.

Source: Coca-Cola

What Coca-Cola did was simple, but powerful: they paid attention.

Their use of market intelligence wasn’t limited to consumption data.

They combined cultural insight, direct market feedback, and a deep understanding of local preferences.

Just as importantly, they recognized the growing success of Ueshima’s canned coffee and understood the momentum behind it.

By studying both consumers and competitors, Coca-Cola moved early with a product that felt truly native to Japan.

The result?

A product line that not only resonated with Japanese consumers but also helped Coca-Cola carve out a leading position in a highly competitive category.

And the appeal hasn’t gone unnoticed outside Japan.

Source: Reddit

That’s the kind of brand loyalty and product demand that happens when market intelligence drives product innovation.

At first glance, it’s easy to assume that a global confectionery giant like Mars would focus most of its energy on established markets.

After all, that’s where the per capita consumption of chocolate is highest.

Places like Europe, where a single country might consume ten times as much chocolate as India or Mexico.

But that’s exactly where Mars saw the opportunity, explains Mars Snacking’s Head of Global Emerging Markets, Blas Maquivar:

Illustration: Veridion / Quote: Financial Times

In 2019, the company launched Global Emerging Markets (GEM), a division focused on more than 130 countries spanning Asia, the Middle East, Africa, Brazil, Mexico, and beyond.

Together, these regions represent 65% of the world’s population, and a massive share of future snacking potential.

But what made Mars Snacking’s approach different was how they looked at these emerging markets.

They didn’t rely on global averages or simply bring in products from other markets unchanged.

Instead, they dove deep into local consumption patterns, flavor preferences, retail habits, and cultural context.

In other words, getting there meant more than shipping Snickers across borders.

The company started with on-the-ground research:

They adapted their product strategy accordingly.

In hot climates with informal kiosks, they launched heat-resistant chocolate and smaller pack sizes for affordability.

For regions craving bold flavors, they introduced localized variants: passion-fruit Snickers in Brazil, saffron-pistachio blends in India, and chili-based treats in Mexico.

Source: Reddit

And, as Kavita Jain, VP of supply chain for the GEM division, points out, in the Middle East, where dates are a cultural staple, Mars developed Galaxy Dates packs:

Illustration: Veridion / Quote: Snack & Bakery

In more health-conscious pockets of these markets, Mars brought in sugar-free gum and Kind nut bars, aligning with rising interest in better-for-you snacking.

Fadi Abi-Nader, VP of One Demand, Global Emerging Markets at Mars, summarized their strategy:

Illustration: Veridion / Quote: Confectionery News

The recognition that cultural nuance and market insight go hand in hand has allowed Mars to treat emerging markets as engines of growth.

The company estimates that over 75% of future snacking growth will come from these regions, driven by urbanization, growing affluence, and the aspiration for global brands with local resonance.

The key takeaway?

Mars listened, localized, and acted with intention.

And in doing so, they turned market intelligence into market share.

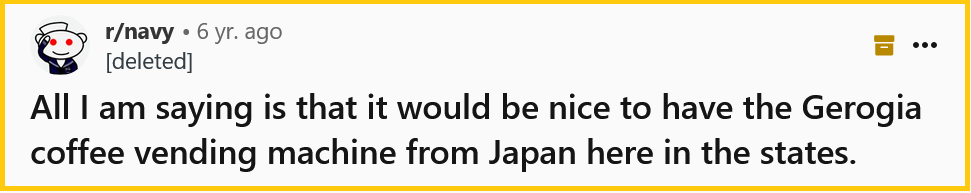

In beauty, being on-trend is everything.

But the real advantage comes from seeing those trends before they become obvious.

L’Oréal, the world’s largest cosmetics company, understands that following consumer trends is often too slow to win.

To maintain leadership across 150+ markets and dozens of brands, L’Oréal can’t just react to what people want today.

It has to predict what they’ll want next, explains Charles Besson, L’Oréal’s Global Social Insights & AI Director:

Illustration: Veridion / Quote: Ipsos

That philosophy led to the launch of TrendSpotter, an AI-powered intelligence engine.

TrendSpotter monitors over 3,500 online sources, from social media to expert blogs, to uncover what beauty trendsetters, influencers, professionals, and scientists are saying.

Its machine learning algorithms process more than 25 million data points annually, identifying early signals in everything from ingredients and textures to packaging and lifestyle preferences.

Source: Ipsos

Most importantly, TrendSpotter spots these shifts six to eighteen months before they hit the mainstream.

The insights flow directly into L’Oréal’s Prospective and Consumer Intelligence team, which uses them to guide R&D, marketing, and brand strategy.

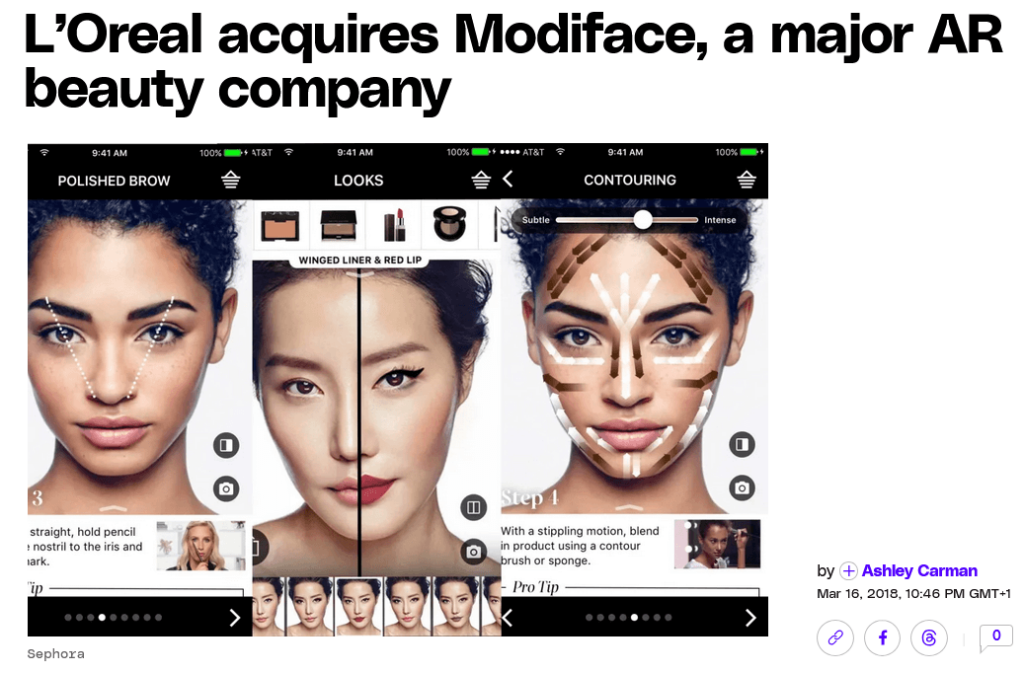

One example is the company’s early investment in augmented reality technology.

In 2018, L’Oréal acquired Modiface, a move driven by growing demand for virtual try-ons.

TrendSpotter surfaced this trend well ahead of its explosion on platforms like Instagram and TikTok during the pandemic.

Source: The Verge

Today, that tech powers digital experiences across more than 40 L’Oréal brands.

And the intelligence doesn’t stop at product development.

By analyzing how consumers talk about beauty online, what they ask, admire, or question, L’Oréal’s marketing teams can craft content and campaigns that mirror real consumer language and sentiment, in real time.

Trend prediction and precision might seem like opposites, but L’Oréal shows they don’t have to be.

With AI-powered systems, a trained eye for trendsetters, and a culture of innovation, the company has turned market intelligence into a core creative engine.

One that doesn’t just keep up with the beauty world, but shapes it.

When a company like Unilever spans hundreds of brands and operates in over 190 countries, making decisions without deep market intelligence is not an option.

But what sets Unilever apart isn’t just how much market intelligence it gathers.

It’s how effectively the company transforms cultural signals, social listening, and emerging consumer values into business strategy.

In the early 2010s, Unilever’s researchers began noticing that consumers, especially younger ones, were increasingly aligning their purchasing decisions with their values.

Environmental responsibility, ethical sourcing, and social impact were moving from niche concerns to mainstream expectations.

Paul Polman, Unilever’s CEO at the time, said:

“In a volatile world of growing social inequality, rising population, development challenges, and climate change, the need for businesses to adapt is clear, as are the benefits and opportunities. (…) Consumers are recognizing this too, increasingly demanding responsible business and responsible brands.”

Investors and regulators were also beginning to apply pressure, prioritizing ESG performance and transparency.

Of course, all this was backed by clear market data, consumer trend reports, and digital listening.

As a response, Unilever created its Sustainable Living Brands, a portfolio of products built around purpose and responsibility.

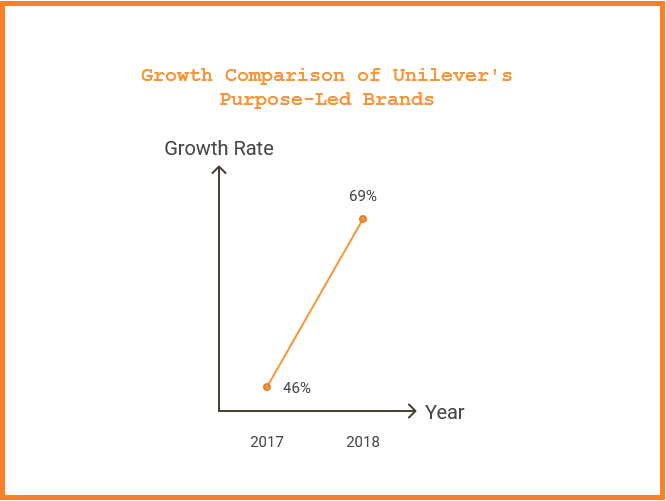

The impact was measurable.

By 2017, these brands were growing 46% faster than the rest of the portfolio. A year later, they were outpacing others by 69%, contributing up to 75% of Unilever’s total turnover growth.

Illustration: Veridion / Data: PETnology

But Unilever’s use of intelligence goes beyond long-term macro trends.

The company also listens closely to what’s happening right now, especially on social media.

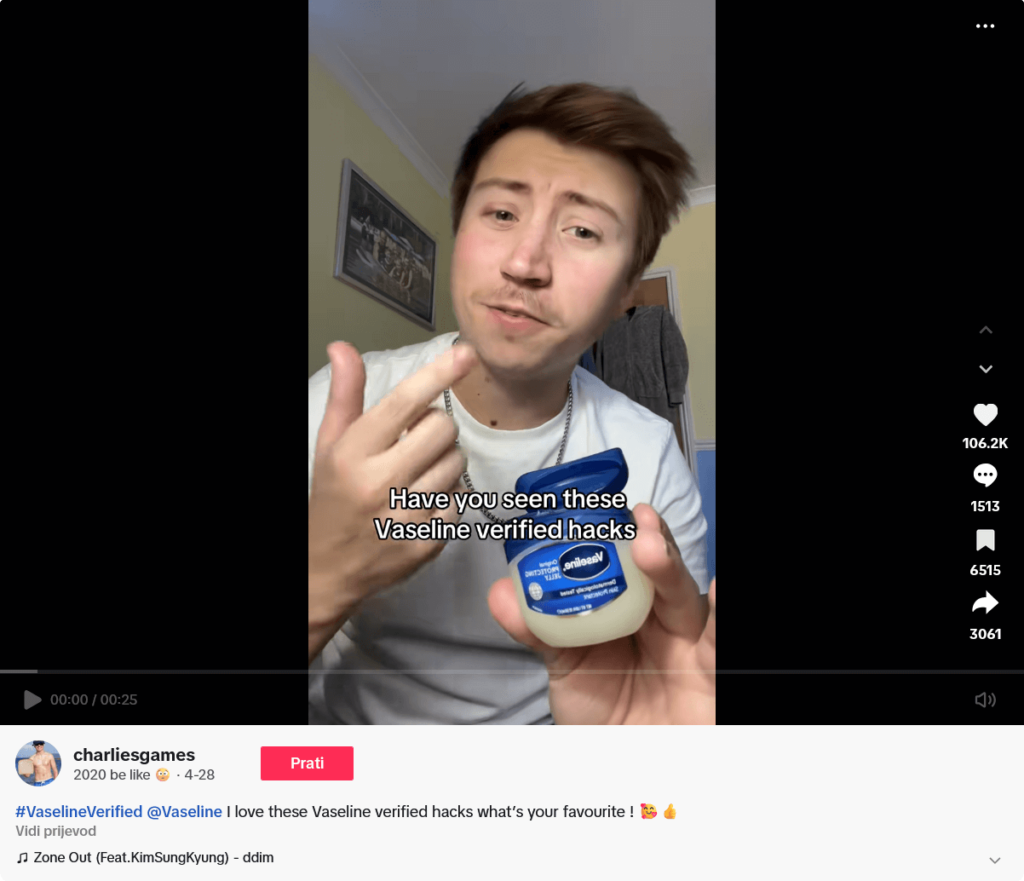

One recent example comes from Vaseline.

When Vaseline’s marketing team noticed millions of users on TikTok, Instagram, and YouTube sharing unconventional ways to use Vaseline, they passed those insights to Unilever’s R&D team.

Once the most popular “hacks” were validated, the brand launched a social-first campaign called #VaselineHacks, complete with a new #VaselineVerified label that turned user-generated content into an official endorsement.

The campaign didn’t just resonate—it scaled.

Source: TikTok

To deliver on that demand at speed, Unilever also invested in operations that could match its insight-driven marketing.

In China, the company’s Hefei factory is now equipped with end-to-end autonomous capabilities, allowing products to be shipped directly to consumers as quickly as trends go viral.

This social and cultural market intelligence is driving new product development, too.

For example, when Unilever’s trendspotters saw a surge in buzz around Crumbl Cookies in the U.S., Dove partnered with the brand to release a cookie-scented body care collection, which launched in Walmart stores.

Source: Packaging Digest

It became Dove’s top-performing new release of the year.

Behind this agility is a growing use of AI, explains Aaron Rajan, Global VP of Digital Technology:

Illustration: Veridion / Quote: Unilever

In short, Unilever doesn’t wait for market trends to become obvious.

It decodes them early, tests them quickly, and acts on them fast.

Whether it’s building purpose-led brands, launching culturally tuned campaigns, or scaling demand through smart factories, it’s all backed by market intelligence.

When geopolitical tides shift, even the most established companies need to move fast.

Procter & Gamble, one of the world’s largest consumer goods companies and the maker of Gillette razors (among other brands), knows this all too well.

One of its key raw materials—ultra-thin stainless steel used in Gillette blades—was hit with steep tariffs during the Trump administration.

During the first term, P&G faced $1.4 billion in external costs, including tariffs that cut into profits.

So when Trump returned to office in early 2025, the company didn’t wait to react.

According to U.S. import data reviewed by Reuters, P&G had already begun quietly shifting much of its sourcing to Jindal Stainless, an Indian manufacturer capable of producing high-grade razor steel at a significantly lower cost.

Source: Reuters

By 2025, the majority of its U.S. imports for Gillette were coming from India.

This wasn’t a simple cost-cutting move.

It was a strategic sourcing decision grounded in multiple layers of market intelligence:

It’s a textbook case of how market intelligence can turn potential disruption into a competitive advantage by enabling faster, smarter sourcing decisions.

And it’s exactly the kind of decision Veridion helps companies make.

Imagine facing similar pressure:

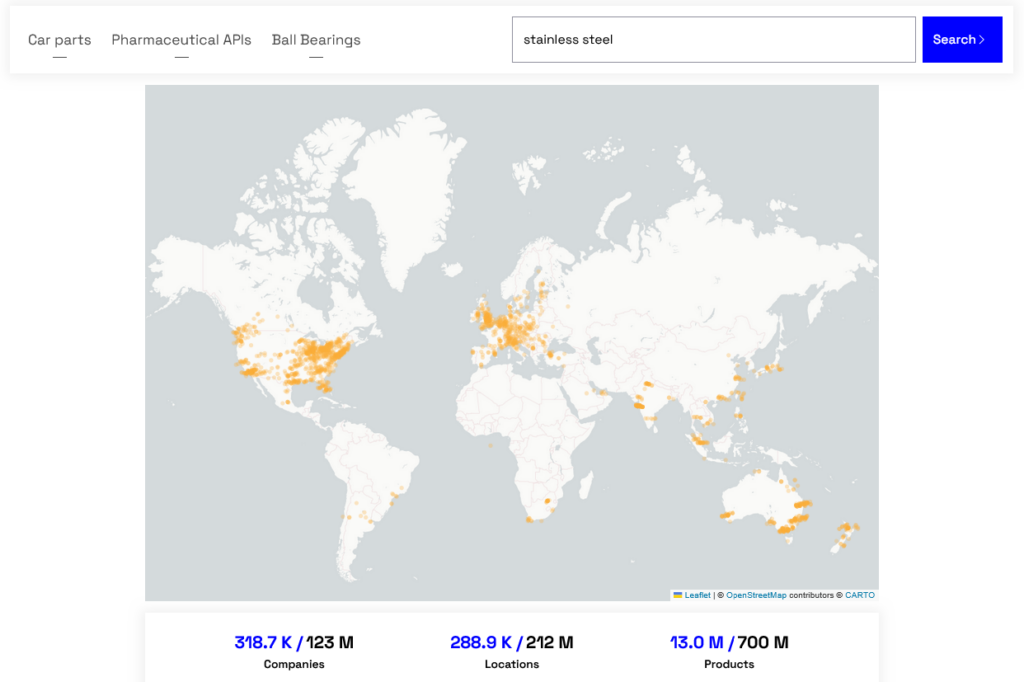

With Veridion’s AI-powered market intelligence platform, you can instantly map out qualified suppliers across the globe, filter them by operational footprint, compliance history, ESG policies, or production capabilities, and benchmark options before disruption hits.

Source: Veridion

Veridion tracks structured data on over 134 million companies worldwide, including many SMBs that traditional platforms often overlook.

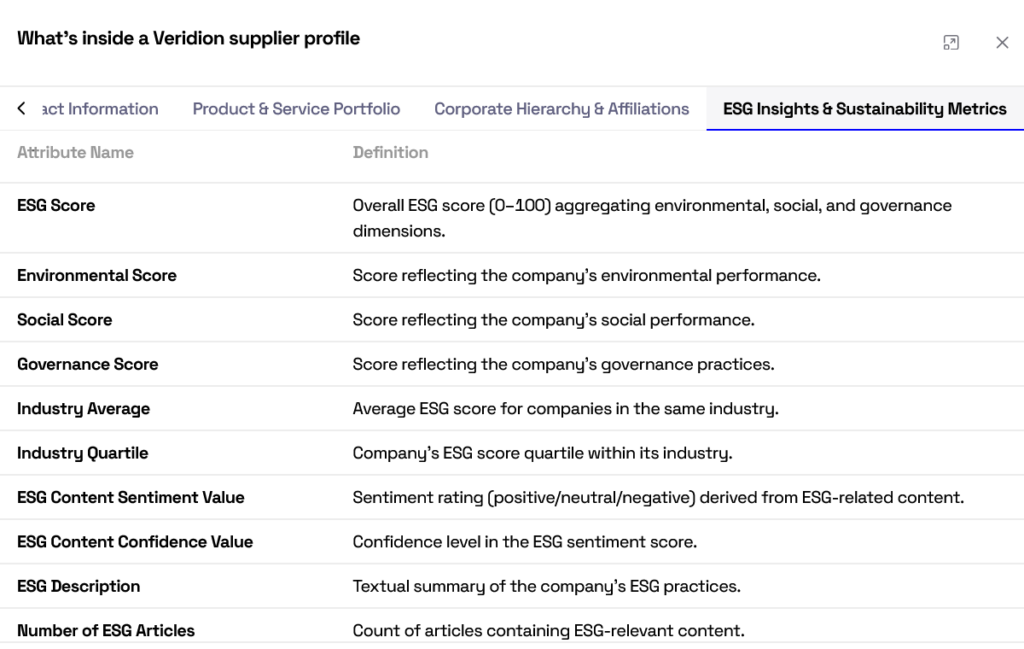

Each company profile includes more than 220 attributes, from firmographics to ESG indicators and technographic stacks.

Below is just a small part of a supplier profile:

Source: Veridion

This gives procurement, strategy, and sourcing teams a far more nuanced and actionable view of the global supplier landscape.

Beyond supplier discovery, Veridion enables custom market sizing and sector research.

Whether you’re evaluating new categories, locating hard-to-find suppliers, or building strategic partnerships, Veridion brings clarity to complex decisions.

In moments where agility matters, traditional supplier directories and manual research just won’t cut it.

What you need is real-time, high-resolution intelligence.

And Veridion delivers it.

From beverages to beauty, confectionery to consumer goods, these five companies show how market intelligence drives growth.

Whether it’s spotting emerging trends, adapting to cultural preferences, or responding to real-time feedback, the smartest brands stay curious, informed, and ready to act.

Across industries, the lesson is the same: listen closely, learn quickly, and let market intelligence guide your next move.