What Are the Benefits of Market Intelligence Tools?

Key Takeaways:

Market intelligence has long been at the core of how companies improve their products, services, and processes to stay ahead.

But traditional data collection and analysis often leave decision-makers one step behind, forced to react instead of lead.

Market intelligence tools change that.

They deliver faster, sharper, and more accessible insights, and create distinct advantages for businesses across industries.

In this article, we’ll explore the key benefits, why they matter, and how companies put them into practice.

One of the critical benefits of modern market intelligence tools is the freshness of collected market data and the speed at which it’s gathered.

Traditional methods often fall short here, leaving companies to base important decisions on information that may already be outdated or incomplete.

This can create a dangerous gap between perception and reality.

As Nisha Deore, research analyst at Decipher Market, points out in her article on the risks of outdated market data:

Illustration: Veridion / Quote: Cognitive Market Research

She illustrates this risk with an example:

A company that, relying on outdated research, failed to anticipate the shift from physical to digital media—a mistake that famously contributed to Blockbuster’s decline.

Retailers face similar pitfalls when they overstock items based on stale sales reports, while manufacturers relying on old supplier risk assessments can be hit by sudden disruptions.

Market intelligence tools help avoid these scenarios by continuously refreshing datasets. In doing so, the frequency of updates and the ability to verify data are critical.

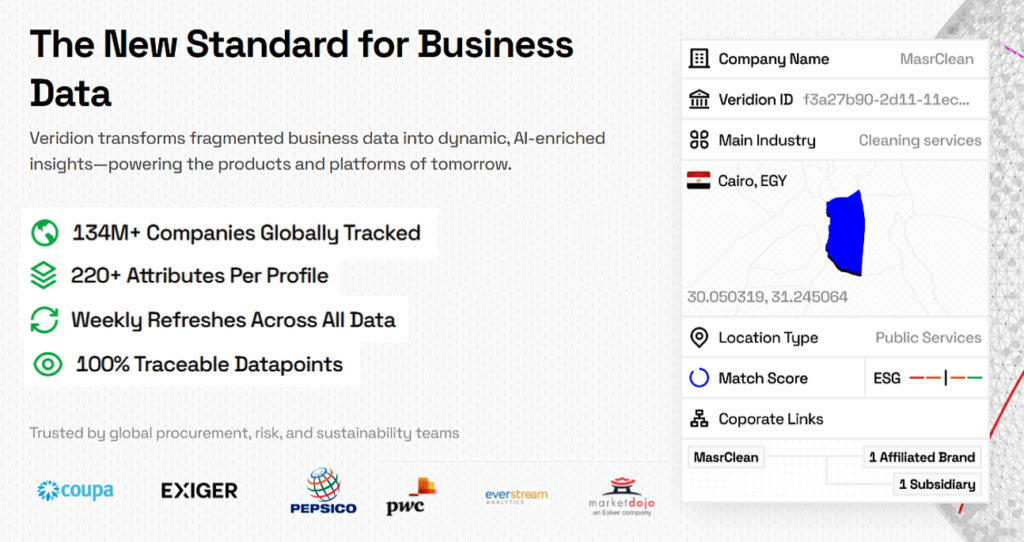

That’s why our AI-powered platform, Veridion, updates a global database of more than 130 million companies on a weekly basis, with every datapoint 100% traceable.

Companies and B2B service providers rely on Veridion’s near real-time data as a dependable foundation for market analytics, risk monitoring, sustainability assessments, and procurement solutions.

While Veridion’s intelligence offers the backbone for understanding markets, suppliers, and competitors, other valuable streams of near-real-time insight also play a role.

Pricing intelligence tools, for instance, enable retailers to adjust strategies instantly based on competitor moves, while social listening platforms capture live customer sentiment across channels.

This capability is illustrated by the example below.

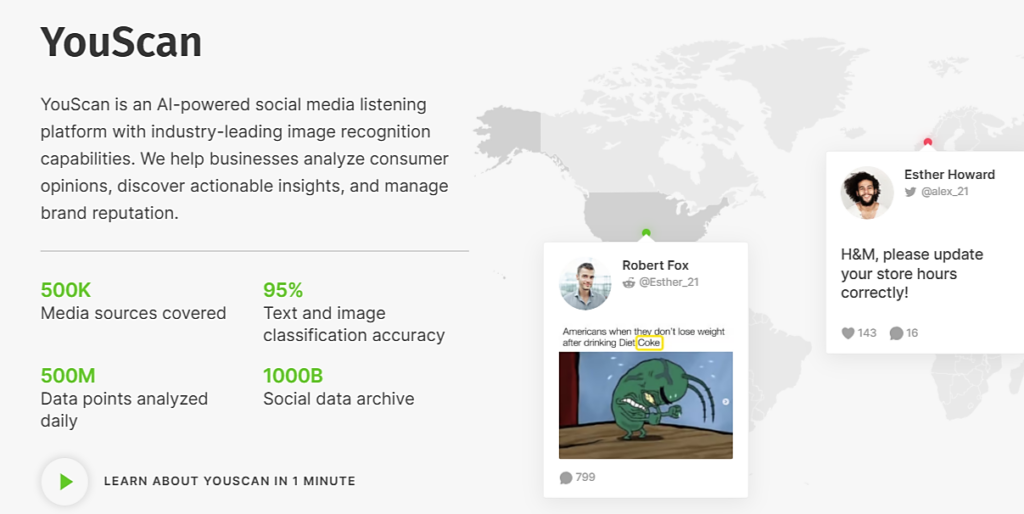

Source: YouScan

This market intelligence tool helps companies track brand reputation, online visibility, and customer sentiment in real-time.

By doing so, it enables faster crisis management and sharper competitor benchmarking.

To recap, near real-time access to these varied market intelligence streams gives decision-makers the ability to act in step with the market, rather than lag behind it.

Instead of relying on static data snapshots, companies can monitor dynamic shifts as they unfold and respond with agility.

But responsiveness also depends on how effectively this constant flow of data is transformed into insights, which is where the next benefit of market intelligence tools comes in.

Collecting data is only the first step—the real challenge lies in making sense of it.

Raw market information, even if it’s timely, can overwhelm decision-makers when it’s fragmented across multiple sources and locked inside static reports.

So, the problem isn’t data scarcity, but rather its volume and readiness for analysis.

Although he was referring to internal company data, Sateesh Seetharamiah, CEO of Edge Platforms, captures the issue perfectly.

His words resonate just as much when dealing with unstructured and unintegrated external data sources:

Illustration: Veridion / Quote: Supply Chain Digital

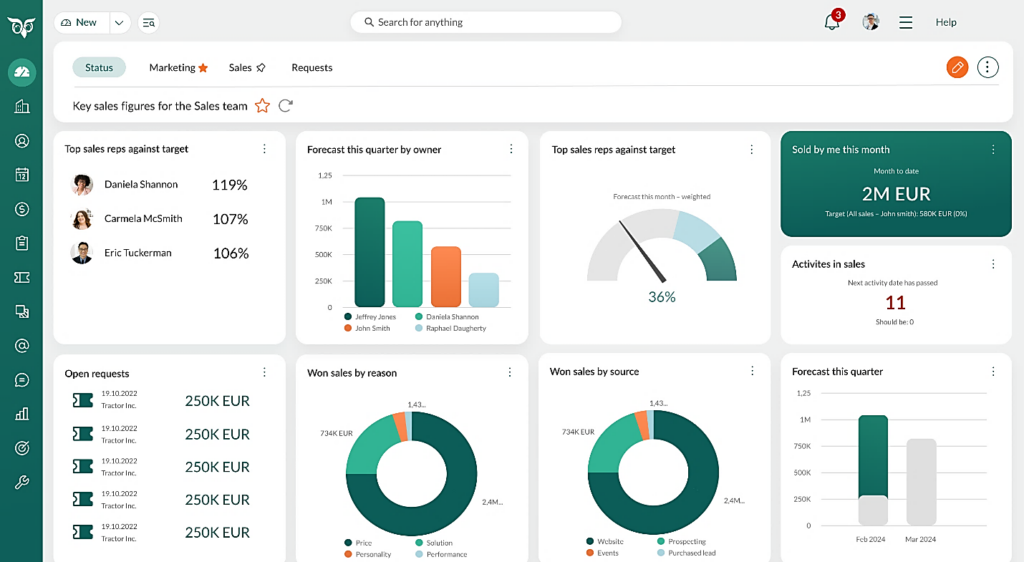

This is why advanced analytics and visualization tools—whether built into market intelligence platforms or used as standalone solutions—are so critical.

They transform vast, scattered datasets into interactive dashboards and intuitive visuals that reveal patterns, trends, and risks at a glance.

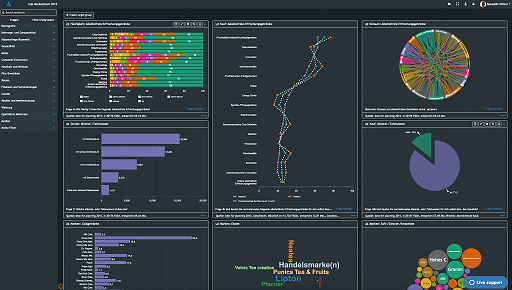

One example is DataLion, a data visualization tool for market research.

It allows teams to import external intelligence feeds, build custom monitoring dashboards, and automatically refresh reports as new data flows in.

This ensures insights stay continuously updated and consumption-ready.

Source: DataLion

In short, advanced analytics and visualization tools transform market data into clarity.

They make it possible for:

Ultimately, by centralizing diverse data streams into clear dashboards, visuals, and customizable reports, these tools ensure that insights are easier to interpret and share.

When paired with near real-time data, they also streamline overall intelligence workflows.

Nothing beats the operational efficiencies brought by market intelligence tools.

These platforms don’t replace analysts, but they save them significant time and effort that would otherwise be spent on manual research, collecting and cleaning information, and interpreting fragmented datasets.

Chin Tee Teo, former Global Supply Chain Director at Philips, describes how this looked in the past in a procurement context:

Illustration: Veridion / Quote: LinkedIn

In contrast, advanced tools like Veridion allow procurement teams to search the global supplier landscape and identify suitable suppliers in minutes rather than days or weeks.

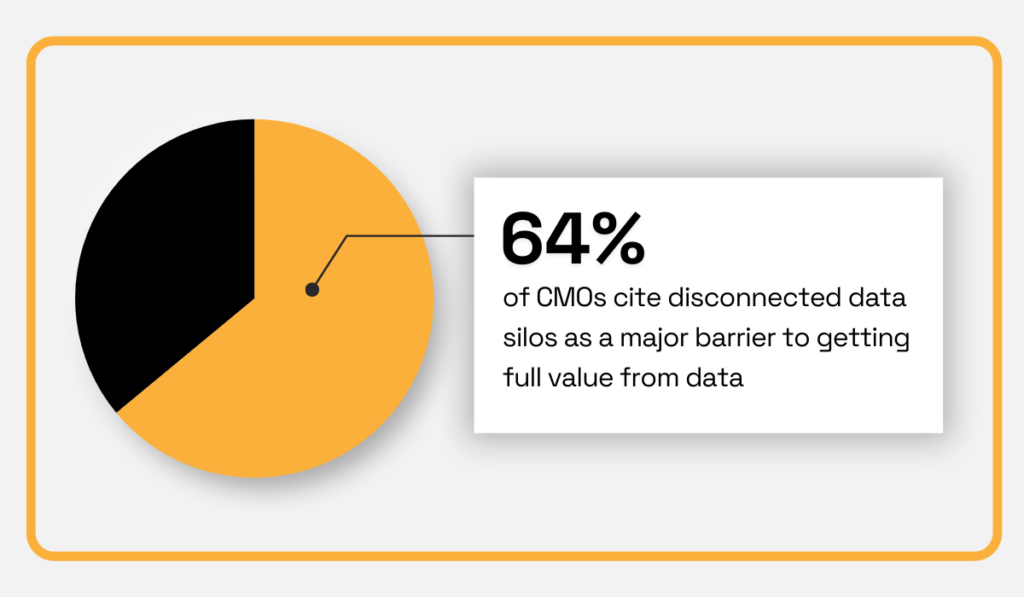

Another major obstacle to workflow efficiency is operational silos, which prevent insights from being shared across departments.

Integrating market intelligence sources into a centralized platform and making them accessible to all relevant stakeholders addresses this challenge directly.

And a survey of Chief Marketing Officers (CMOs) highlights the magnitude of the issue:

Illustration: Veridion / Data: Nielsen IQ

Centralized intelligence platforms empower teams across departments to work more efficiently and collaboratively.

Product development teams, for example, can monitor market feedback and emerging opportunities without manually compiling fragmented reports.

Marketing teams maintain their own dashboards to consolidate campaign data, customer insights, and competitor intelligence, allowing them to quickly spot trends and optimize strategies.

Sales teams access their dashboards and can also tap into shared insights, integrating prospect data directly into CRMs and tailoring outreach more effectively.

Source: SuperOffice

Ultimately, centralized market intelligence platforms streamline workflows by reducing manual research, consolidating fragmented data, and enabling intelligence sharing across teams.

While department-specific dashboards and reports remain tailored to each function, it’s important that authorized staff across the organization can access them.

This breaks down silos, fosters collaboration, and ensures executives and teams have a complete view of relevant information.

With analysts freed to focus on high-value work and teams leveraging shared intelligence, companies are better positioned to identify and manage risks.

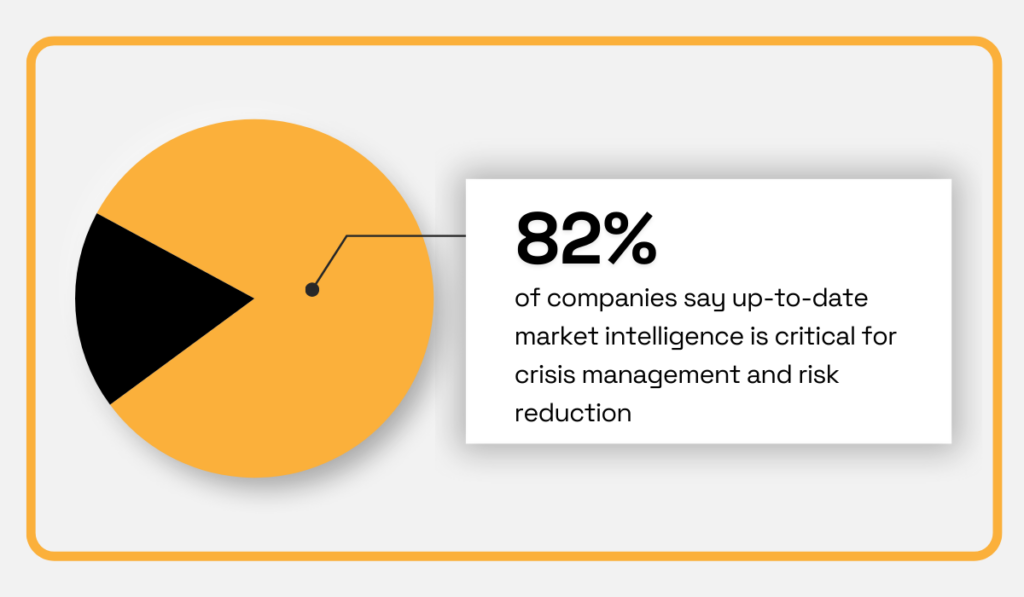

With or without market intelligence tools, one thing doesn’t change: risks.

From supply chain disruptions and regulatory changes to competitive shocks and reputational threats, companies face constant challenges.

Early detection and proactive management of these risks are essential to protect revenue, maintain compliance, and strengthen strategic resilience.

With near real-time feeds, AI-driven risk identification, and custom alerts, market intelligence platforms provide continuous monitoring of risk factors.

Ultimately, this helps organizations identify emerging threats before they escalate.

Research from Dun & Bradstreet shows that companies are well aware of how critical up-to-date data is for effective crisis and risk management.

Illustration: Veridion / Data: DNB

Risks can emerge from many directions: a supplier facing financial distress, a sudden regulatory change in a target market, or public scrutiny over environmental and social practices.

What makes them especially difficult to manage is that they rarely exist in isolation.

Operational, financial, and reputational risks often overlap and amplify one another.

To handle this complexity, companies need more than headlines or static reports.

They need structured intelligence that connects thousands of data points into a coherent picture.

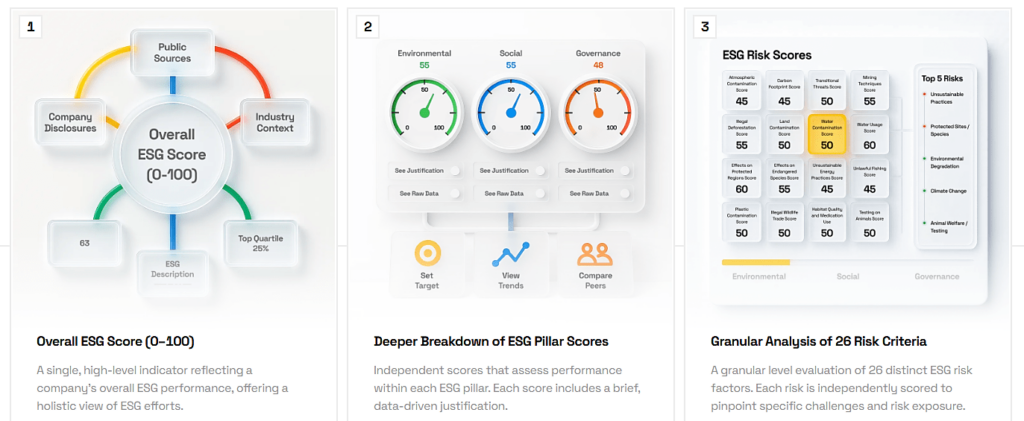

Take ESG-related risks, for example.

These range from carbon emissions and labor standards to governance practices and supply chain transparency.

Source: Veridion

In such cases, collecting and analyzing diverse datasets is the foundation for reliable scoring and effective risk monitoring.

In practice, this means transforming raw ESG datapoints into structured risk assessments that decision-makers can easily interpret.

To assist them, some intelligence tools provide a scoring framework that helps simplify complexity by combining an overall performance indicator with deeper pillar-level evaluations and highly granular risk criteria.

Source: Veridion

This approach enables companies to spot high-level exposure at a glance, drill into specific ESG risks, and take informed action based on clear evidence.

The same principle applies beyond ESG:

Whether it’s monitoring geopolitical events, supplier viability, or regulatory shifts, risk management is most effective when data is continuous, structured, and shareable across teams.

Altogether, the capabilities of market intelligence tools covered so far pave the way for the real outcomes: actionable insights, smarter decisions, and a sustained competitive edge.

At the end of the day, data only creates value if it leads to smarter decisions.

Raw figures, however comprehensive, don’t automatically reveal the right course of action.

That’s where market intelligence tools step in.

By converting complex datasets into clear, contextualized insights, they enable executives, managers, and frontline teams to allocate resources effectively and act with confidence.

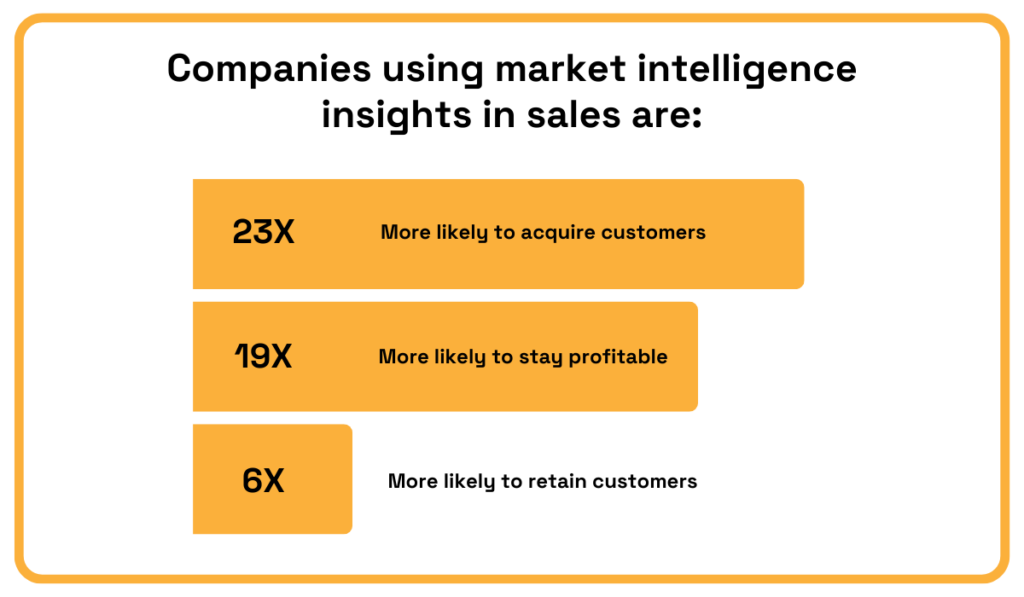

The business impact is clear.

According to McKinsey, companies that apply market intelligence in sales are magnitudes more likely to acquire customers, remain profitable, and retain customers.

Illustration: Veridion / Data: McKinsey

Examples of companies using intelligence insights for smarter decisions are plentiful.

Retailers use real-time customer trend data to adjust product assortments, manufacturers monitor competitor moves to refine pricing strategies, and global brands leverage ESG information to guide investment decisions.

In each case, the common thread is the ability to move quickly from raw data to a clear decision point.

One notable example is P&G, the maker of numerous brands, including Gillette razors.

Following stainless steel tariffs in the first Trump administration and anticipating their return in the second term, Gillette translated market intelligence into a decisive sourcing shift.

Specifically, the company reduced sourcing from Japanese and Swedish steel producers while increasing procurement from India.

Source: Reuters

P&G’s example illustrates how market intelligence transforms complex data into actionable insights and timely decisions that protect margins and mitigate risk.

Across industries, the ability to act quickly and confidently on insights supported by market intelligence tools lays the foundation for the ultimate benefit:

Gaining a measurable competitive advantage.

Staying ahead of competitors isn’t just about reacting faster but also anticipating what’s coming next.

Market intelligence tools enable companies to do exactly that:

Detect early trends, monitor competitor moves, and integrate internal and external data to make proactive decisions.

By turning insights into action, these platforms help firms differentiate, innovate, and strengthen their long-term market position.

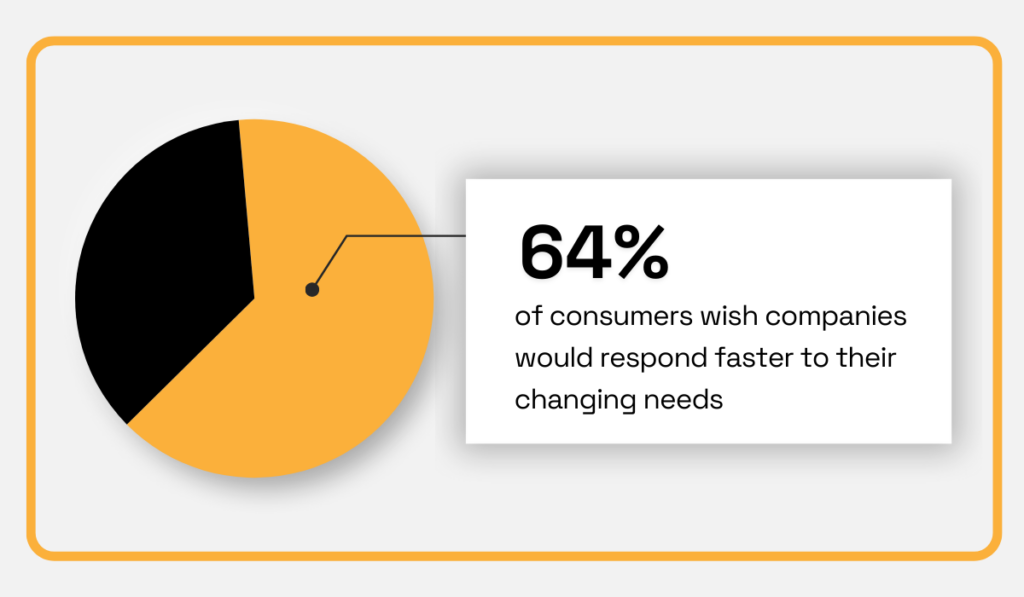

One key way this plays out is by responding quickly to changing customer needs.

A 2022 Accenture survey found that over 60% of consumers wish companies would react faster to shifts in customer behavior.

Illustration: Veridion / Data: Accenture

This statistic underscores why companies must not only act on insights quickly but also anticipate trends before they fully emerge.

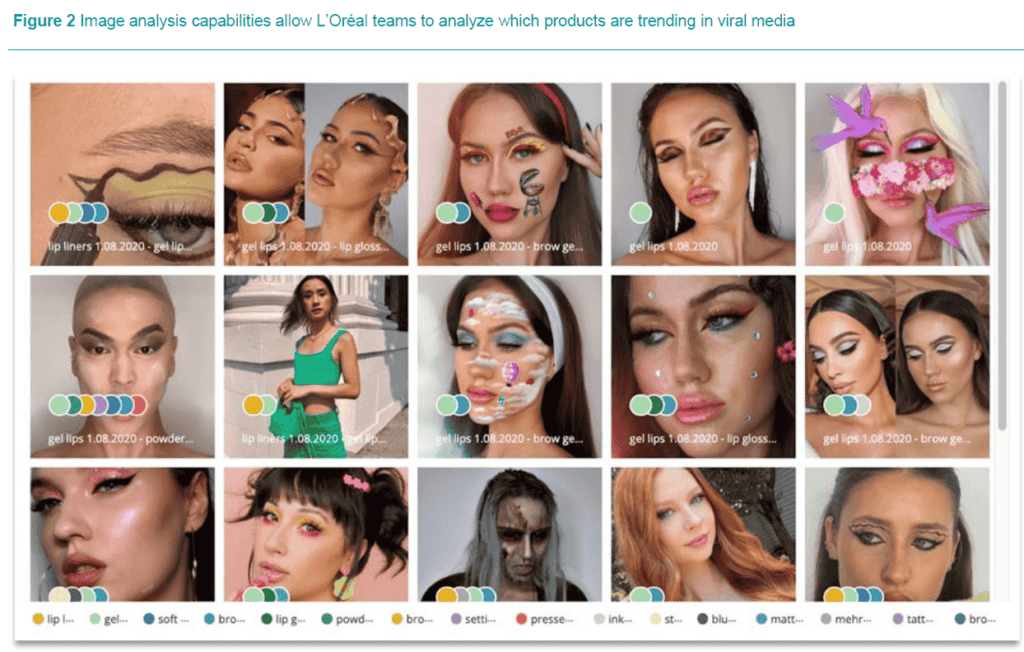

A good example comes from the beauty industry, where spotting trends first can make all the difference.

L’Oréal, the world’s biggest cosmetics company, has turned this principle into a competitive advantage with its AI-powered TrendSpotter engine.

Monitoring over 3,500 online sources—from social media to expert blogs—TrendSpotter analyzes more than 25 million data points annually to identify early signals in ingredients, textures, packaging, and lifestyle preferences.

Source: Ipsos

This enables L’Oréal to predict trends six to eighteen months in advance and use those insights to guide R&D, marketing, and brand strategies with precision.

Another example comes from Unilever’s brand Dove, where market intelligence drives agile product innovation.

When trendspotters detected a surge of buzz around Crumbl Cookies in the U.S., Dove acted quickly, partnering with the brand to release a cookie-scented body care collection.

By decoding social signals and early consumer conversations, the company was able to test and launch a product that became its top-performing new release of the year.

Source: Packaging Digest

This limited edition, Walmart-exclusive brand collaboration demonstrates how timely insights can translate directly into market success.

Of course, this agility is assisted by AI.

As Aaron Rajan, Global VP of Digital Technology at Unilever, explains:

“AI is helping us forecast demand more quickly by analyzing social signals and decoding conversations at scale in multiple languages.”

Together, these examples show how AI-driven market intelligence tools enable companies to stay ahead of competitors, act on opportunities first, and turn insights into tangible business results.

Whatever your industry or business niche, intelligence-driven insights foster agility and innovation—key differentiators for sustaining a competitive edge.

The volatility of today’s markets and the wide range of intelligence use cases make it clear that the role of market intelligence tools will only grow.

These platforms empower teams to turn raw, real-time data into actionable insights that drive smarter decisions, reduce risk, and unlock growth.

The takeaway is simple:

Define your intelligence needs, and then select and integrate the right tools into your market intelligence stack.