5 Trends Shaping the Future of Market Intelligence

Key Takeaways:

Market intelligence is changing. Not just in speed, but in structure, relevance, and reach.

What used to be static reports and siloed data is now evolving into real-time, predictive, and cross-functional insight.

AI, data integration, and rising expectations from leadership are reshaping how teams gather, share, and act on intelligence.

To stay ahead, organizations must adapt.

These five trends reveal where market intelligence is headed, and what it will take to lead the way.

AI is now standard in market intelligence.

It automates research, summarizes vast information, and accelerates workflows.

But speed alone isn’t the future.

Market intelligence depends on understanding data in context, and that context varies dramatically across sectors.

General-purpose AI lacks the depth needed for high-stakes, domain-specific analysis.

Internal performance metrics, industry-specific publications, regulatory filings, academic papers, and proprietary research all carry subtle nuances that generic models often miss.

They may misinterpret technical terms, hallucinate sources, or offer surface-level insights where depth is required.

We’ve already seen the fallout.

In early 2025, a federal judge in Wyoming threatened sanctions against two lawyers for submitting court filings with fictitious case citations hallucinated by an AI tool.

Source: Reuters

The lawyers admitted relying on a general-purpose chatbot that couldn’t distinguish fact from fiction.

Naturally, the skepticism is growing.

According to a recent AMPLYFI report, while most leaders agree that better information leads to better decisions, 78% believe tools like ChatGPT erode trust in AI.

Illustration: Veridion / Data: AMPLYFI

But this isn’t a rejection of AI.

It’s a call for the right kind.

Market intelligence teams are now turning to domain-specific AI platforms built for their industries, trained on relevant data, and designed to understand the context behind the numbers.

In pharma, this means parsing clinical trial data and regulatory notices. In defense, it’s intelligence from government filings and defense journals.

In the supply chain?

That’s where platforms like Veridion come in.

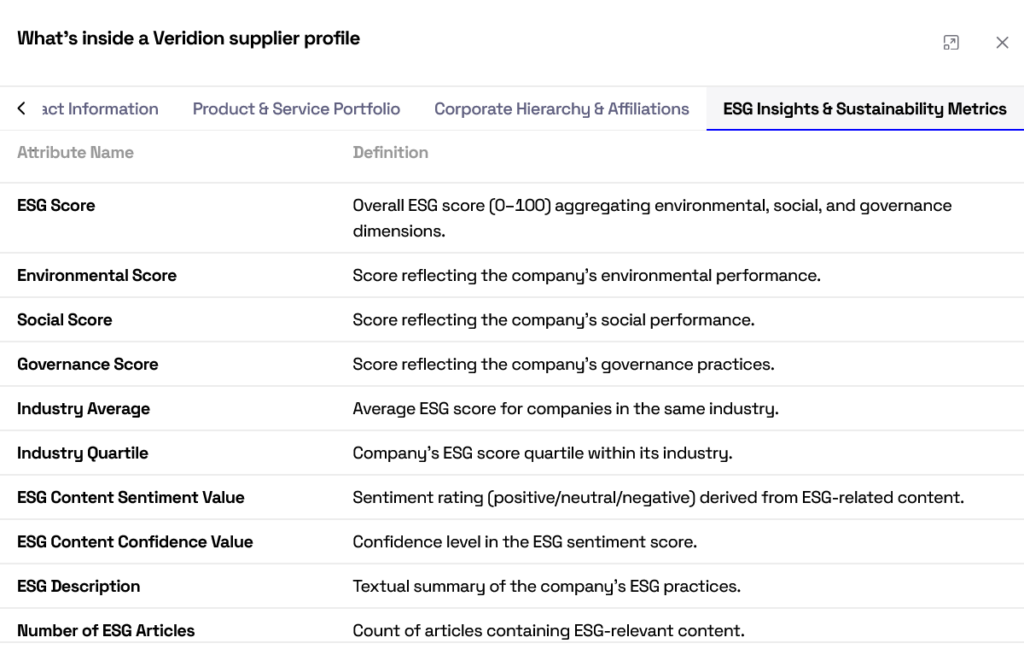

Veridion blends large-scale company data with AI to deliver near real-time insights across more than 130 million businesses, with 220+ structured attributes per company, including:

Below is just a small part of a company’s profile:

Source: Veridion

And because Veridion is rooted in structured, geo-tagged intelligence, it can do more than describe companies.

It can map markets, highlight supply risk, and surface strategic exposure.

Take its recent analysis of the UK supply chain.

By overlaying storm hazard data with more than 67,000 company locations, Veridion identified over 3,200 critical infrastructure sites in high-risk zones, including 2,561 factories, 604 logistics hubs, and 47 data centers.

Source: Veridion

In Manchester, £1.6 billion in annual production sits in a known storm corridor. In Cardiff, 10% of consumer goods storage is exposed. In Glasgow, clustered data centers face growing weather threats.

This is what domain-specific AI enables:

Real visibility, grounded in context, backed by verifiable data.

What makes this different from general-purpose tools?

The future of market intelligence isn’t built on speed alone, but on depth, context, and AI that speaks the language of your industry.

For years, market intelligence has largely been retrospective and focused on analyzing what has already happened.

Reports would summarize last quarter’s performance, last year’s market shifts, or past customer behavior.

But in volatile markets, lagging indicators are no longer enough.

With billions of new data points generated every day, from regulatory updates and academic papers to social chatter and deep web sources, the challenge is no longer access to information.

It’s identifying what matters, fast.

So, the competitive edge now lies in seeing what’s coming, explains Paul Teather, CEO of AMPLYFI:

“Modern platforms need to spot emerging signals in real time and predict their impact. With billions of new data points emerging every second, they need to turn today’s weak signals into tomorrow’s strategic advantage.”

That’s why leading market intelligence platforms are now engineered around:

Such tools enable faster, more informed decisions, whether that’s a product team detecting shifting consumer demand, or a supply chain leader spotting early signs of disruption.

Some companies are already leveraging them.

Wendel, one of Europe’s leading investment firms, uses AlphaSense to monitor industry trends, scan broker research, and evaluate market dynamics in real time.

What once took hours of manual effort is now condensed into a few clicks, with custom dashboards surfacing timely intelligence across multiple sectors, explains Olivier Allot, Head of Investor Relations and Data Intelligence:

Illustration: Veridion / Quote: AlphaSense on YouTube

But others are going a step further.

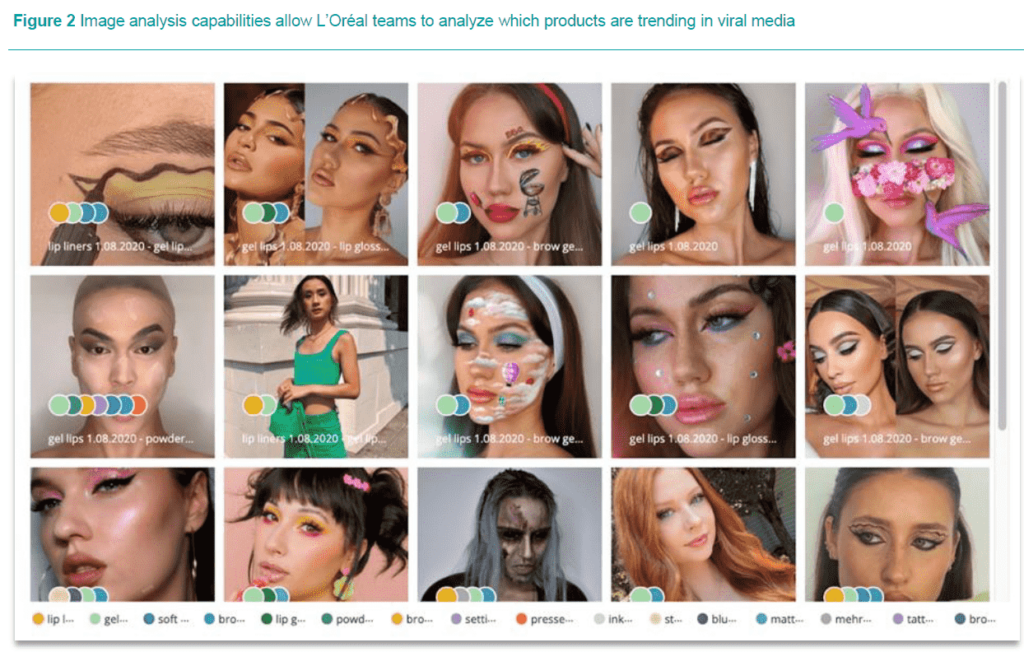

L’Oréal, the world’s largest cosmetics company, built an AI-powered intelligence engine called TrendSpotter to track emerging trends before they become obvious.

It analyzes over 25 million data points annually across 3,500 sources, from influencers and expert blogs to scientific publications.

Source: Ipsos

These early signals guide product innovation, marketing, and even acquisitions.

For example, TrendSpotter helped L’Oréal anticipate rising interest in virtual try-on technology, leading to its 2018 acquisition of Modiface, well before demand surged on TikTok and Instagram during the pandemic.

This is predictive intelligence in action:

Predictive intelligence is becoming a baseline capability. And increasingly, that foresight is what sets leaders apart.

But for predictive intelligence to reach its full potential, it can’t live in a vacuum.

In many large organizations, market intelligence is still treated as a standalone function, separate from sales, product, procurement, or risk.

But across these departments, teams are constantly generating or encountering valuable external market signals:

These insights often stay siloed, locked in different tools, dashboards, or formats, and never make it into the broader market intelligence workflow.

That fragmentation is costly.

According to GfK and the CMO Council, 64% of CMOs cite disconnected data as a major barrier to getting full value from intelligence.

Illustration: Veridion / Data: NIQ

And too many companies are dealing with this problem.

MuleSoft reports that 90% of organizations struggle with fragmented and isolated data environments.

Illustration: Veridion / Data: MuleSoft

This leads to operational inefficiency and missed opportunities.

When market signals aren’t shared across teams, decisions are slower, strategies are misaligned, and risks go unnoticed.

Modern organizations are breaking down these silos by connecting intelligence sources across functions, often through AI-powered platforms that unify, distribute, and contextualize data in real time.

Gonzalo Garcia Villanueva, former CMO at NielsenIQ, gives an example:

“For example, predictive analytics on consumer purchase behavior not only guides marketing; it also informs pricing, product, channel management, and supply chain management. And forecasts that were previously siloed within operational teams can be used by sales teams to tailor their approaches.”

So, when a platform detects a meaningful market signal, say, a geopolitical disruption or a shift in buyer behavior, it activates a cross-functional response:

Overall, companies are recognizing that intelligence is a shared foundation for decision-making across the enterprise, and no longer a department-specific asset.

And as integration improves, the value of intelligence multiplies.

If intelligence integration is about connecting data across teams, democratization is about putting that intelligence in everyone’s hands.

Before, market intelligence was the domain of specialized roles:

Analysts would gather data, interpret findings, and deliver insights through reports or presentations.

Access to tools and sources was limited. And anyone outside the intelligence function had to wait, often days or weeks, to get the answers they needed.

That model no longer works.

Today, business moves faster, decisions need to be made in hours, not weeks, and people across the organization need direct access to insights to act with confidence.

Democratization makes that possible, mostly thanks to advances in AI-powered platforms.

Modern intelligence platforms now offer:

This trend is already reshaping how companies work.

A 2025 Opendatasoft study found that 84% of business users feel significantly more efficient when they can access information directly, without relying on a technical intermediary.

Illustration: Veridion / Data: Opendatasoft

Democratization of market intelligence also changes the role of intelligence professionals.

Instead of serving as bottlenecks or report writers, they now become strategic enablers, validating sources, customizing access, training colleagues, and focusing on complex analysis.

Emma Russell, Head of Marketing at AMPLYFI, agrees:

Illustration: Veridion / Quote: AMPLYFI

In other words, democratization doesn’t dilute market intelligence.

It amplifies it.

When insights are widely accessible, teams can move faster, dive deeper, and make smarter, more aligned decisions.

The implications are far-reaching.

Organizations are tackling more complex challenges, exploring new markets, and developing richer expertise.

They’re spending more time understanding client needs and less time chasing down data.

And most importantly, they’re identifying opportunities that would have been missed in the old, centralized model.

Data sovereignty, once treated as a compliance checkbox, is now a core consideration in how companies choose and use market intelligence platforms.

As organizations become more data-driven, concerns about where data is stored, how it’s processed, and who can access it have moved from legal to strategic priorities.

For market intelligence teams handling sensitive insights, this matters more than ever.

Several forces are accelerating this shift:

In this context, trust in intelligence platforms depends not just on what they deliver, but how they operate.

This is particularly critical in sectors like finance, defense, healthcare, and advanced manufacturing, where data sovereignty isn’t just about avoiding fines, but about protecting intellectual property, competitive advantage, and national security.

One recent case highlights the broader stakes.

In 2025, TikTok was fined €530 million for failing to guarantee that EU user data sent to China wouldn’t be accessible to Chinese authorities.

Source: The Guardian

While not a market intelligence platform, the case underscores the risks of unclear data governance: regulatory action, reputational damage, and loss of user trust.

For market intelligence, the implications are clear:

At its core, this trend reflects a larger truth:

Data is not neutral.

Where it lives, how it moves, and who can see it all matter.

For intelligence to remain trusted and actionable, sovereignty must be designed in, not bolted on.

The five trends shaping the future of market intelligence all signal a clear shift:

Market intelligence is becoming more connected, more strategic, and more central to decision-making.

But with greater impact comes higher expectations.

Organizations that want to succeed have to rethink how intelligence is gathered, shared, and applied.

They will have to invest in platforms that match the complexity of their markets, empower teams to explore and act on insights directly, and ensure that intelligence flows not just faster, but smarter, aligned with strategic goals and built for impact.

The future of market intelligence lies not in gathering more data, but in building the systems, skills, and structures that turn data into real advantage.