Procurement Cost Savings vs Cost Avoidance: What’s the Difference?

Understanding procurement cost savings and cost avoidance is crucial for organizations striving to enhance their bottom line and financial performance.

While these terms are sometimes used interchangeably, they represent two distinct concepts.

You can imagine procurement cost savings as trimming excess weight off your budget, while cost avoidance is like building strong walls to prevent new expenses from knocking on your door.

As you can see from this simple analogy, the difference between the two is more than obvious.

And understanding this and other differences is essential to know how to best approach costs in your procurement.

That’s why, today, we will define both procurement cost savings and cost avoidance, highlight all their differences, and discuss how you can maximize the benefits of both approaches.

All this will give you the knowledge to decide what approach is best for your procurement.

Let’s begin.

In procurement, cost savings relate to purposeful actions to trim existing expenses.

This includes negotiating better terms with suppliers, like securing discounts for ordering materials in bulk, optimizing procurement processes, and implementing technologies that enhance efficiency and reduce costs.

All these actions lead to immediate, quantifiable, and provable savings, which are evident in your financial statements. That’s why these kinds of savings are also called hard savings.

For example, let’s say your initial procurement costs for raw materials were $60,000, but through effective negotiations and deciding to order in larger quantities, you managed to reduce them to $45,000.

Your hard cost savings would amount to $15,000.

As you can see, calculating cost savings is straightforward—it’s the difference between the original costs and the reduced costs:

Source: Veridion

To express this as a percentage, divide the result by the original cost and multiply by 100.

Cost savings are essential for enhancing your organization’s bottom line and overall financial performance.

These hard savings improve profit margins, allowing more cash to stay in the company.

This gives you better budget flexibility for strategic investments and better financial agility in times of changes or disruptions.

However, it’s vital to balance cost reduction with preserving the value of goods and services.

The goal is not just to pay less but to ensure that cost-cutting measures don’t compromise quality or functionality.

Cost avoidance, on the other hand, involves proactive measures to prevent potential future costs. Often, it means spending more now to reduce or avoid future expenses.

A simple but effective comparison comes from your own home—it’s like buying a new energy-efficient washing machine.

Despite the initial higher cost, this machine’s reduced energy consumption will lead to lower utility bills over time, resulting in long-term savings.

Moreover, the new machine comes with a warranty. If it breaks down or requires repairs, you won’t incur additional costs, which means you will avoid more costs over time.

The same principle applies to procurement. For example, if you purchase some parts and initially pay a bit more for a prolonged warranty (or negotiate it as a value-added service), you ensure cost avoidance in the future.

Moreover, in procurement, cost avoidance is usually done to prevent costs such as legal disputes, late fees, and potential disruptions in the supply chain.

You can do that by carefully vetting suppliers, negotiating favorable terms, and assessing potential risks.

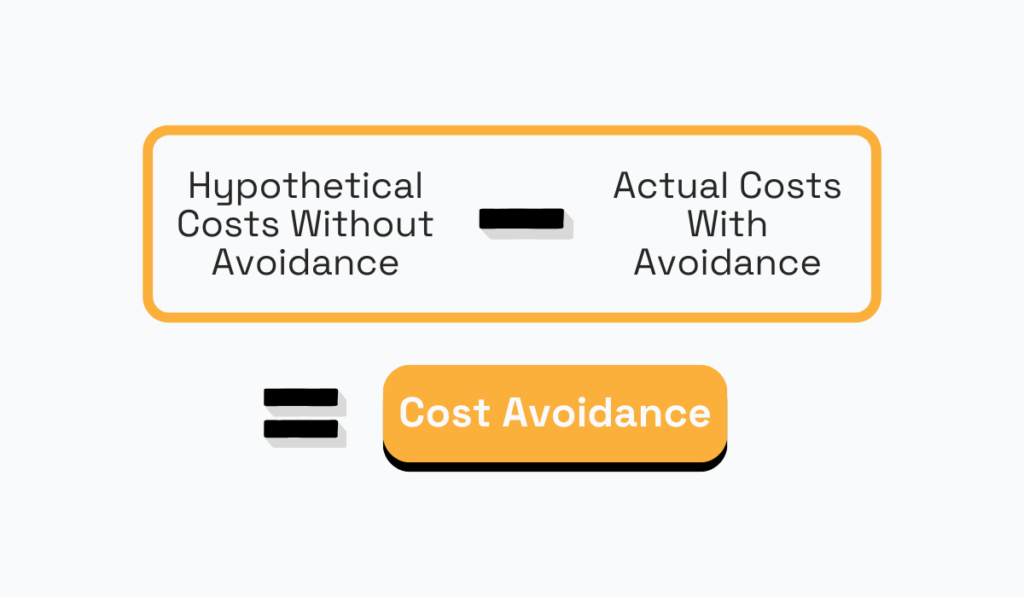

The calculation of cost avoidance is more complex, as it requires estimating the hypothetical costs that were prevented. The formula goes as follows:

Source: Veridion

However, since these costs are theoretical and intangible, the resulting savings are termed soft savings and are not apparent in financial statements and reports.

Still, tracking cost avoidance and implementing strategies for it remain valuable.

Because of its nature to assess risks, this proactive approach to cost management significantly benefits companies in the long run, shielding them from potential risks and contributing to financial stability.

While both cost savings and cost avoidance share the common goal of improving your financial health, they are different approaches to managing finances.

For better clarity, let’s recap their differences.

Source: Veridion

As you can see from the photo above, the primary distinction lies in the timing and nature of these financial strategies.

Cost savings involve quick and reactive actions that yield immediate and measurable reductions in current expenses.

In contrast, cost avoidance takes a more calculated and forward-thinking approach, focusing on preventing potential future costs.

Moreover, cost savings are tangible and impactful, directly reflected on financial statements. For instance, securing a discounted rate from a supplier immediately impacts the bottom line.

On the other hand, costs that are prevented or avoided can only be estimated hypothetically, and their value is not immediately apparent on financial statements.

Sometimes, the initial costs may be higher, but the real impact emerges in the long run. Still, tracking cost avoidance in procurement is necessary.

Cost avoidance supports sustainable financial practices rather than focusing solely on short-term gains. Therefore, it is crucial for a company’s long-term strategic planning.

To summarize, understanding these differences is essential if you want to optimize both reactive and proactive financial strategies within your procurement processes and have a well-rounded financial management approach.

Now that we understand cost savings, cost avoidance and their key differences, we will focus on ways to maximize both approaches.

We’re starting with cost savings.

You can realize cost savings in many ways, but getting the most out of it happens through the two practical ways we are about to explore—data analysis and supplier negotiation.

Let’s start with the former.

Analyzing your company’s spend data is a powerful tool for maximizing cost savings and enabling strategic financial decision-making.

This data analysis unveils insights that guide where you can reduce costs and save resources.

Suppose your data reveals that various departments consistently purchase the same office supplies but from different suppliers.

This poses challenges such as missing out on potential volume discounts and fragmented procurement volumes that reduce your collective bargaining power.

What’s more, this leads to increased administrative costs due to managing multiple suppliers and duplicated shipping expenses.

However, with the insight gained from data analysis, solutions become apparent.

For instance, consolidating your purchases with a single supplier offering lower costs and reliable delivery can lead to significant savings.

But your data analytics isn’t limited to internal spend analysis. It extends to gathering market intelligence.

Source: Veridion

Data analytics tools help you monitor market trends, track price fluctuations, and assess other factors influencing procurement costs.

This information can support your data-driven procurement decisions and uncover cost savings opportunities.

For example, analyzing market trends and historical data enables you to identify optimal times for making purchases, taking advantage of lower prices or favorable market conditions.

Additionally, monitoring trends helps you identify alternative products or materials that offer similar functionality at a lower cost, allowing for cost-effective substitutions without compromising quality.

In essence, analyzing your data provides numerous opportunities for cost savings.

Moreover, data analysis can be a solid foundation for negotiating better deals with suppliers, which is another way to maximize your cost savings.

As a procurement professional, your role extends beyond finding a supplier and crafting an initial contract agreement.

What’s even more critical is periodically reviewing supplier contracts and benchmarking prices and terms against industry standards.

Based on that information, you can negotiate better prices and more favorable payment terms, thereby saving costs.

Surprisingly, in their research, McKinsey revealed that eight out of every ten contracts didn’t have any form of a benchmarking clause.

Illustration: Veridion / Data: McKinsey

Contracts with this clause would allow for much stronger control, and pricing would have to be done in relation to market changes.

So, the first thing on the to-do list is rewriting your contracts to include a benchmarking clause and then regularly assessing benchmark prices and negotiating more favorable terms with your suppliers.

Say your company regularly sources software licenses from a trusted vendor.

Through a periodic review of the market, you notice changes in the software licensing landscape, with newer technologies and more optimal pricing models becoming available.

In response, you initiate negotiations with the existing supplier.

By leveraging your long-standing partnership and industry knowledge, you manage to secure a revised pricing structure that aligns with current market rates, reducing annual licensing fees from $20,000 to $15,000.

This shows how proactive negotiations with existing suppliers, based on market insights and benchmarking, can lead to significant cost savings.

But you shouldn’t focus only on negotiating better prices. You can achieve cost savings through favorable payment terms as well.

For instance, by negotiating extended payment timelines, your organization gains improved cash flow management, reducing immediate financial strain.

All in all, negotiating with your existing suppliers is another excellent strategy to maximize cost savings.

Now that we have shown you how to maximize your cost savings, we will do the same with cost avoidance. After all, only when you combine both approaches can you ensure you manage your costs most efficiently.

One excellent strategy to maximize cost avoidance is through risk management.

There are several types of procurement risks, from operational risks, risks in suppliers’ activities to risks in the supply chain due to economic changes, geopolitical events, natural disasters, and pandemics.

All these risks come with negative financial consequences.

And while some of these risks are simply not predictive (just remember COVID-19), for most of them, you can be prepared, at least up to some point.

And if you are, you can avoid costs that result from such disruptions.

One strategy that makes you better prepared for procurement risks is supplier diversification.

Let’s see why.

If your organization heavily relies on a single supplier for a critical component and that supplier faces unexpected issues like bankruptcy or production halts, it could lead to severe disruptions in your production and increased costs.

Diversifying suppliers reduces dependency, ensuring alternative sources can fulfill your needs and avoiding potential costs associated with a supply chain disruption.

For example, sometimes you can supplement your offshore suppliers with nearshore alternatives.

However, managing risks across the entire supply chain can be challenging.

That’s why solutions exist that can assist procurement teams in risk assessment and mitigation.

Take our Veridion, for example.

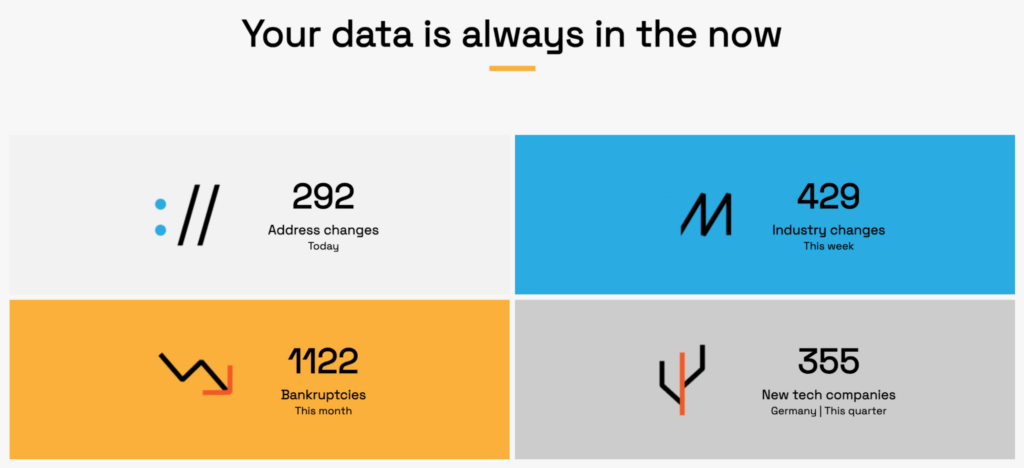

Veridion is a comprehensive supplier sourcing platform equipped with near-real-time data and analytics tools that can be instrumental in vetting each supplier.

Source: Veridion

This ensures that every supplier you consider working with aligns with your required risk and profile specifications.

Moreover, Veridion’s real-time data (which you can access through our search API integrated into your systems) and analytics tools enable you to continuously monitor market trends, price fluctuations, and supplier-related changes.

Most importantly, you can also receive timely supplier alerts, notifying you about crucial changes in supplier activities, such as a shift in location or the loss of a significant certificate.

Source: Veridion

This early warning system empowers you to make informed decisions and take preventive measures before risks escalate into costly issues. In other words, you can avoid costs.

In essence, procurement risks are costly. But with the right strategies and right tools in place, you can avoid both risks and the costs that would come with them.

Maximizing cost avoidance takes a savvy turn through negotiating value-added services (VAS).

This approach empowers companies to extract extra benefits from suppliers without incurring additional costs, effectively curbing potential future expenses.

Let’s jump straight into practical examples to illustrate this concept.

Remember our washing machine analogy from earlier and the warranty it came with?

Extended warranty is an example of a great value-added service.

When acquiring high-value equipment, negotiating for extended warranty service from the supplier at no extra cost ensures coverage for potential repairs or replacements over an extended period.

That means you will avoid future costs when it comes to breakage or repairs.

Now, let’s say your company is procuring machinery.

Collaborating with the supplier allows skillful negotiation for a VAS, such as complimentary oil changes for a specified period.

This strategic move ensures prolonged cost avoidance by addressing future maintenance expenses.

For complex machinery or software, it would also be prudent to negotiate for complimentary training sessions and ongoing support services.

The skill development allows for proper use and can prevent costly errors and downtime in the future, thereby enhancing operational efficiency.

Another highly beneficial VAS, particularly for procurement, would be working with suppliers that offer real-time tracking systems for shipments.

This would give you visibility into the entire supply chain and enable proactive decision-making in case of delays.

As evident, these value-added services, often incurring little to no cost, serve as excellent strategies to avoid future expenses.

So, when working with suppliers, prioritize those offering such services to maximize your cost avoidance!

And that concludes our guide for today. We began by explaining the concepts of cost savings and cost avoidance and highlighted their key differences.

We also delved into practical ways to maximize both cost savings and cost avoidance in your financial management.

While cost savings offer immediate and measurable benefits and bring higher profit margins, cost avoidance is equally important.

Despite its lack of immediate impact and measurement, cost avoidance is a strategic approach that prevents future costs that could disrupt your financial management and your company’s bottom line.

In essence, comprehending and utilizing procurement cost savings and cost avoidance in tandem is the optimal way to ensure the health of your company’s finances.