Top 8 Procurement Fraud Statistics You Need to Know

Procurement is the backbone of many organizations, as it funnels financial resources into acquiring essential goods and services so that the rest of the company’s operations can work undisruptedly.

However, it’s no secret that this crucial function is vulnerable to exploitation, often becoming a breeding ground for fraudulent activities.

As a procurement professional, you understand just how critical it is to safeguard your organization against such risks.

That’s why grasping the landscape of procurement fraud is so important.

And what better way to understand the extent of this threat than with numbers and statistics?

So, let us present you with 8 statistics you must know to understand and better grapple with procurement fraud.

This statistic is derived from a survey conducted by SAS, a global leader in AI and analytics software.

It involved over 2,000 professionals from procurement, finance, internal audit, compliance, and ethics departments from 38 countries.

The survey reveals that 33% of businesses lack awareness of their losses due to procurement fraud.

Those who are aware report annual losses ranging from $10,000 to $150,000.

Unfortunately, this statistic points to a prevalent culture of negligence or ignorance within organizations, and the lack of ownership and poor procurement monitoring further aggravate the issue.

Source: Veridion

Many businesses lack clear responsibility for fraud prevention, leading to finger-pointing and weak defenses.

Responsibility is often diffused, with the finance function (33%) and procurement heads (23%) being the most common owners.

However, 19% of organizations have no clear personnel assigned to fraud prevention.

Additionally, over a quarter don’t audit for procurement fraud, while those who do rely heavily on manual processes (50%) or rule-based detection software (38%), neither of which offers consistent protection.

Illustration: Veridion / Data: SAS

If anything, these numbers underscore the urgent need for businesses to assess their fraud losses, decide who should take charge, and implement robust monitoring systems to combat fraud more effectively.

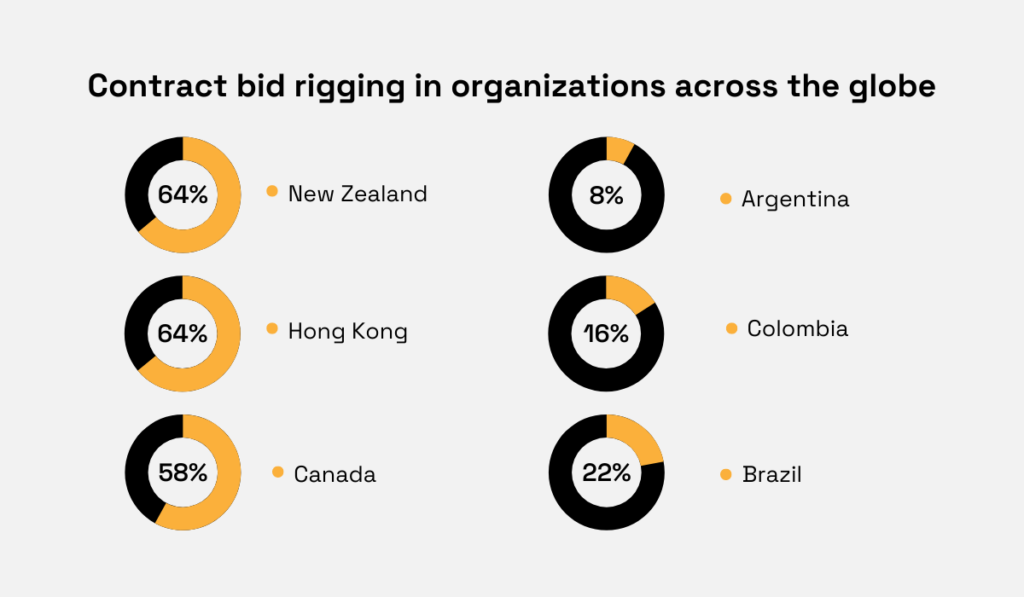

The same study from SAS also highlights the prevalence of contract bid rigging in global procurement, with over a third of organizations reporting having experienced it.

Bid rigging involves collusion among bidders to unfairly manipulate the bidding process.

Typically, conspiring bidders agree beforehand on who will win the contract and submit inflated bids to create an illusion of competition.

This, naturally, undermines the principles of fair competition, resulting in inflated prices and reduced quality of goods or services procured.

It also violates antitrust laws and can lead to severe legal repercussions.

That’s why it comes as a surprise that countries like New Zealand, Hong Kong, and Canada exhibit high occurrences (64%, 64%, and 58%, respectively).

However, this is possibly due to more effective fraud detection methods.

On the other hand, South American nations like Argentina, Colombia, and Brazil report lower incidences.

Illustration: Veridion / Data: SAS

This may indicate underreporting in countries where fraud prevalence could actually be much higher.

All in all, this statistic warns that contact bid rigging is happening around the globe.

Also, it underscores the need for robust fraud detection mechanisms to curb bid rigging and ensure fair competition in procurement processes, ultimately safeguarding against inflated costs and compromised quality.

There is a notable trend of companies recognizing the need for more effective fraud detection methods.

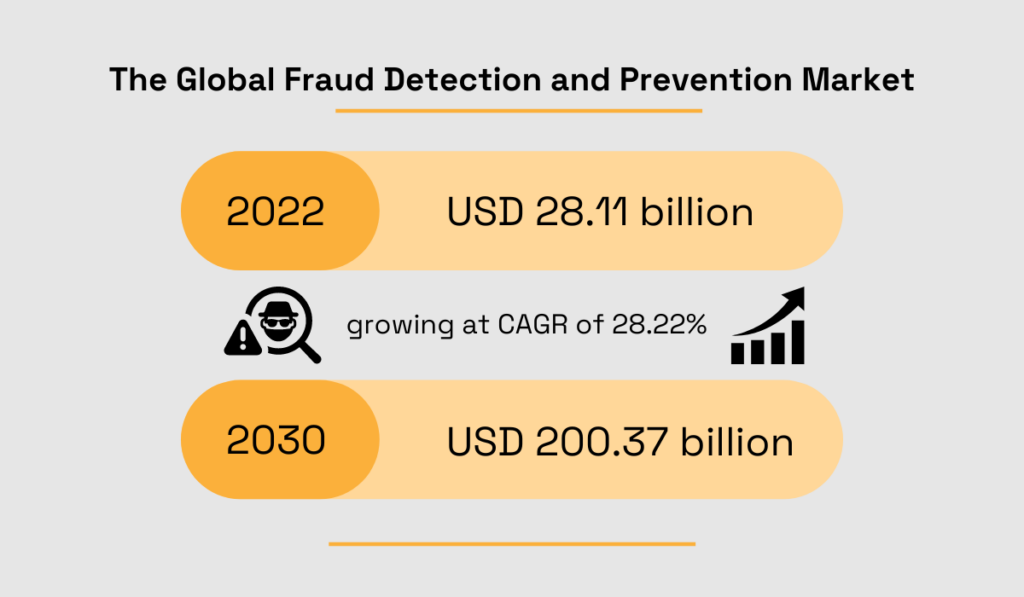

This growing recognition is driving the global fraud detection and prevention market towards substantial growth.

As businesses rely more on digital technologies, they face heightened vulnerability to fraudulent activities, necessitating stronger fraud detection measures.

Extrapolate’s projection of this market expansion from USD 28.11 billion in 2022 to approximately USD 200.37 billion in 2030 underscores the significance of this trend.

Illustration: Veridion / Data: Extrapolate

Furthermore, deploying advanced technologies such as artificial intelligence (AI) and data analytics is pivotal in this trajectory.

These technologies empower organizations to quickly analyze large volumes of data and enhance their ability to identify fraudulent patterns and behaviors.

Key market players such as IBM Corporation, SAS Institute Inc., and FICO lead the charge by developing cloud-based fraud detection and prevention software.

These solutions offer enhanced security features and real-time insights, making them essential tools for businesses seeking to mitigate fraud risks.

As the global market expands rapidly, it’s only natural that procurement processes embrace these advancements to safeguard against financial losses and ensure transparency and integrity in business transactions.

In 2023, 82% of senior leaders made fraud prevention their top priority, recognizing the grave consequences it poses—financial losses, reputational damage, and regulatory issues, to name a few.

And with over half of organizations falling victim to fraud annually, this shift in focus is both timely and crucial.

This revelation stems from a survey conducted on 75 US respondents by Trustpair, GIACT, and Treasury & Risk.

Ramesh Menon, Group Director of Product Management for Digital Identity & Fraud Solutions at GIACT, emphasizes that fraud prevention is an ongoing journey.

Illustration: Veridion / Quote: Trustpair

He also points out that the challenge of fraud demands a holistic approach across teams.

But it all starts from the top—with senior leadership.

As the statistic shows, senior leaders did recognize this.

They have also implemented various policies, such as changing payment processes, requiring multifactor authentication, and conducting more frequent account verifications to fortify defenses against fraud.

But why should this matter for procurement?

Simply put, fraud prevention is a collective effort that goes beyond safeguarding finances.

It’s about preserving integrity and trust throughout the entire supply chain.

By prioritizing fraud prevention, senior leaders set the tone for procurement departments, ensuring transparency, reliability, and ethical practices in supplier relationships.

This, ultimately, upholds the highest standards of accountability and integrity across all levels of the organization.

Amidst the efforts to bolster fraud detection and prevention, many companies still rely on manual workflows, leaving them vulnerable to fraudulent activities.

According to the same report by Trustpair, 70% of companies resort to phone calls to verify changes in supplier credentials.

This is particularly concerning, given that 55% of successful fraud attempts stem from unauthorized changes in legitimate payment credentials.

Equally concerning is the timing of credential checks.

While 74% of companies conduct account validation checks during supplier onboarding, the number drops drastically during other stages of the supplier relationship.

Checks before order placement, payment campaigns, or periodic reviews are often overlooked.

Source: Trustpair

It’s evident that ensuring the integrity of supplier credentials should be a continuous priority throughout the supplier relationship, and relying solely on phone calls for verification is insufficient.

Fortunately, there are more effective alternatives available.

Leveraging supplier databases, such as our Veridion, might be the optimal solution.

Veridion provides access to a constantly updated repository of global supplier information, ranging from firmographics to ESG criteria, compliance data, certifications, and more.

Source: Veridion

By utilizing Veridion, you can stay informed about suppliers’ credentials and even receive real-time alerts for any certificate losses or concerning behaviors.

This way, you can confidently mitigate risks, safeguard yourself against fraud, and ensure the integrity and reliability of your supplier relationships.

Fraud doesn’t just cost companies money—it wreaks havoc on their relationships with external collaborators, like suppliers, too.

According to Trustpair, GIACT, and Treasury & Risk, 39% of companies faced issues with suppliers as a result of fraud.

This isn’t surprising, considering the far-reaching impact of fraud beyond mere financial losses.

Source: Veridion

Firstly, fraud undermines trust between companies and their suppliers, leading to strained relationships and communication breakdowns.

Suppliers may hesitate to engage openly, fearing compromised interests or sensitive information leaks.

Late payments or non-payment due to undetected fraud can further strain these relationships, causing financial instability and disrupting cash flow for suppliers.

Additionally, fraud can expose suppliers to legal and financial risks, including unpaid invoices and contractual breaches, thereby tarnishing their reputation within the industry.

In essence, combating fraud isn’t just about protecting company assets—it’s about preserving trust, fostering transparent communication, and maintaining mutually beneficial relationships with suppliers.

Trustpair’s 2024 Fraud in the Cyber Era report reveals a concerning trend.

In 2023, a staggering 96% of US companies encountered at least one fraud attempt, a significant increase from 56% in 2022.

Source: Trustpair

Fraudsters are not only targeting more companies but are also highly successful at it, with 90% of targeted companies experiencing at least one successful attack, often resulting in substantial financial losses.

To make matters worse, in 78% of companies, fraud was successful multiple times.

This surge in fraud attempts is largely driven by cybercriminals exploiting vulnerabilities in digital channels.

In fact, cyber fraud accounted for 83% of these attempts.

Moreover, commonly used channels for fraud attempts include text messages, fake websites, and phone calls, with scammers leveraging generative AI tools to create convincing scams.

As industries embrace digitalization, the risk of fraud continues to grow.

These statistics show that now, more than ever, companies must focus on robust cybersecurity measures and employee awareness training.

Finally, organizations will have to invest in advanced fraud detection technologies to thwart increasingly sophisticated cyber threats.

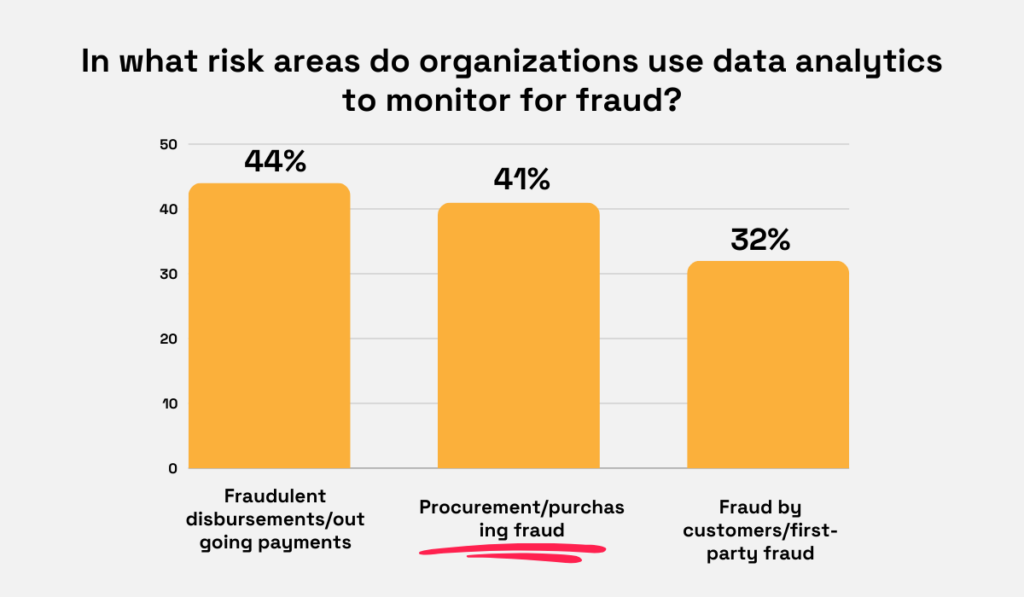

Let’s wrap up on a brighter note: 41% of organizations are now leveraging data analytics to closely monitor procurement for any signs of fraudulent activity.

This positive shift, highlighted in a report by The Association of Certified Fraud Examiners (ACE) and SAS, shows that companies are taking proactive steps to safeguard their procurement processes.

Illustration: Veridion / Data: ACFE

What’s even more promising is the growing interest in cutting-edge technologies like AI and machine learning for fraud detection.

By 2026, nearly a third of organizations plan to incorporate AI and machine learning into their anti-fraud strategies, indicating a strong momentum toward using advanced tools to enhance fraud prevention in procurement.

Moreover, the use of predictive analytics and modeling is expected to rise notably, with 22% of organizations planning to adopt this technology over the next two years.

The report also reveals the diverse array of data sources being tapped into for anti-fraud analytics, from internal structured data to public records and government watch lists.

Techniques like exception reporting, anomaly detection, and predictive analytics are becoming standard practice, with many companies focusing on identifying irregularities and red flags automatically.

This shift toward advanced technologies signals a proactive approach to combatting fraud, offering increased integrity and resilience in procurement practices.

It’s a promising step forward for ensuring transparency and trustworthiness in business transactions.

While some of the statistics we’ve explored today may not paint the most optimistic picture, they provide valuable insights into the current landscape of procurement fraud.

Yes, it’s concerning to know that a significant percentage of companies are unaware of their losses due to fraud, lack proper fraud monitoring mechanisms, or do not monitor for procurement fraud at all.

However, there’s a glimmer of hope in the shifting mindset, with senior leaders increasingly prioritizing fraud detection and prevention.

Additionally, the growing number of companies planning to implement new tools signifies a proactive approach to combatting fraud.

So, as you reflect on these numbers, remember: it’s up to you to stay vigilant and proactive in protecting your procurement and your organization.

Leverage these insights to strengthen your practices and stay on top of procurement fraud.