Key Components of Procurement Market Intelligence

Consider procurement market intelligence as a well-organized toolbox, with each compartment housing a tool designed for a specific purpose.

Supplier intelligence is your reliable map, leading you through the twists and turns of the suppliers you’ll collaborate with.

Product intelligence is a magnifying glass, zooming in on the finer details of your and competitors’ products.

And pricing intelligence? That’s your trusty calculator, diligently crunching numbers to keep you updated on market prices.

Today, we will explore all the critical components of this toolkit, explaining how each tool—or intelligence component—impacts your procurement process.

Our first stop? Supplier intelligence.

As its name suggests, this procurement intelligence focuses on suppliers—their capabilities, reliability, and financial stability.

Essentially, it means collecting and analyzing information about your potential suppliers in order to get a full grasp of their business activities.

As such, this intelligence helps procurement professionals decide which suppliers are reliable to work with and which ones come with the fewest risks.

On top of that, supplier intelligence is a great help in supplier negotiations and maintaining relationships with suppliers.

How do you go about collecting such intelligence?

The first step is to decide what exact data you will collect.

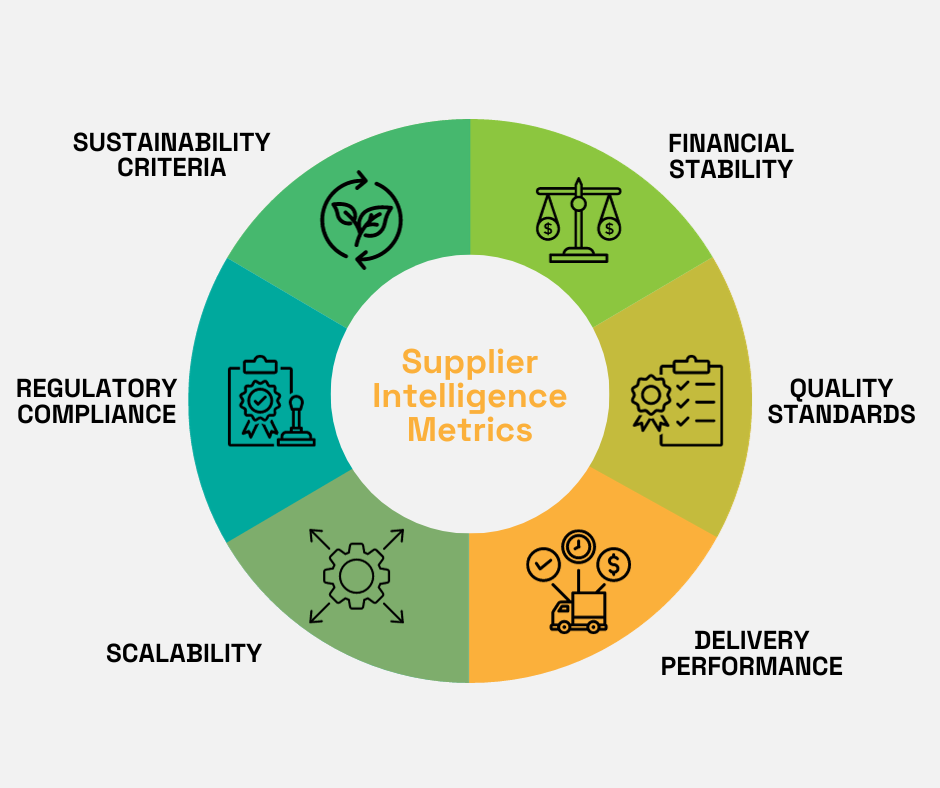

This includes defining criteria and key metrics like suppliers’ delivery times, quality standards, financial stability, pricing, and data on regulatory compliance and sustainability.

Source: Veridion

When you define the criteria that will guide your data collection, it’s time to see where you can get this information.

Now, supplier intelligence can be gathered through multiple sources—from direct communication with suppliers, through clients who worked with them, through onsite audits, or by leveraging third-party databases.

What’s most important here is that the sources you use to gather information on suppliers are reliable and accurate.

Meaning that the data you collect has to be updated, timely, and relevant.

That’s why big data platforms have established themselves as the most reliable source of supplier intelligence.

Take, for example, our supplier sourcing enabler, Veridion. Through this tool, procurement teams get intelligence on millions of suppliers across the globe in mere minutes.

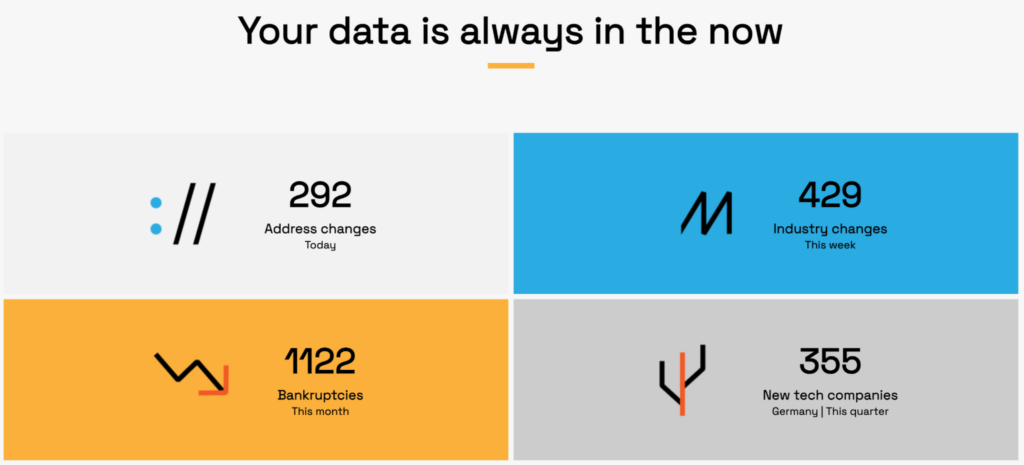

The best part is that the data in question is always fresh, updated, and in near-real-time.

Source: Veridion

How does Veridion work?

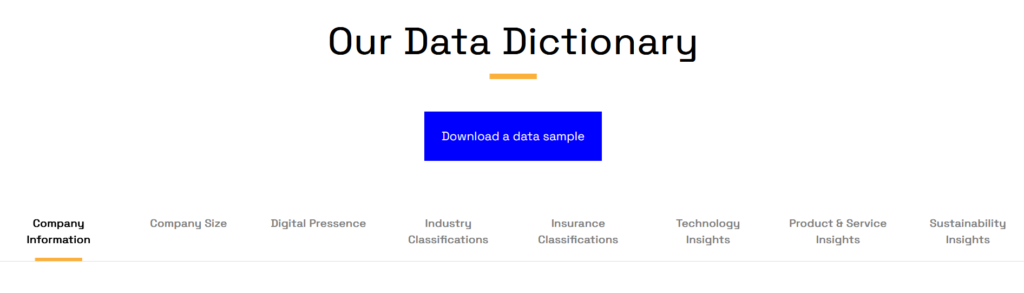

It’s simple—you integrate Veridion complex search API into your existing systems, and you get supplier data ranging from firmographic information like the location and size of the company to product specifications, certifications, insurance, ESG criteria, and even regulatory compliance.

Source: Veridion

In other words, you get a full grasp of supplier intelligence that helps you make data-driven decisions on potential suppliers.

As Matt Palackdharry, vice president of sales and commercial strategy of TealBook, points out,

Trusted supplier information is the most critical asset a procurement organization can possess.

Therefore, it’s crucial to gather and analyze only trusted supplier intelligence. The insights gained will help you source the most suitable suppliers and improve your overall supplier management.

Market intelligence involves a comprehensive assessment of overall market dynamics, including factors such as size, growth rate, and market trends.

In addition to these fundamental aspects, market intelligence also dives into pricing fluctuations and competitor information.

This type of intelligence is crucial for making informed decisions in response to market changes.

There are compelling reasons why market intelligence should be an integral part of your procurement toolkit:

Sources of market intelligence are diverse, ranging from industry publications and economic databases to comprehensive market research reports.

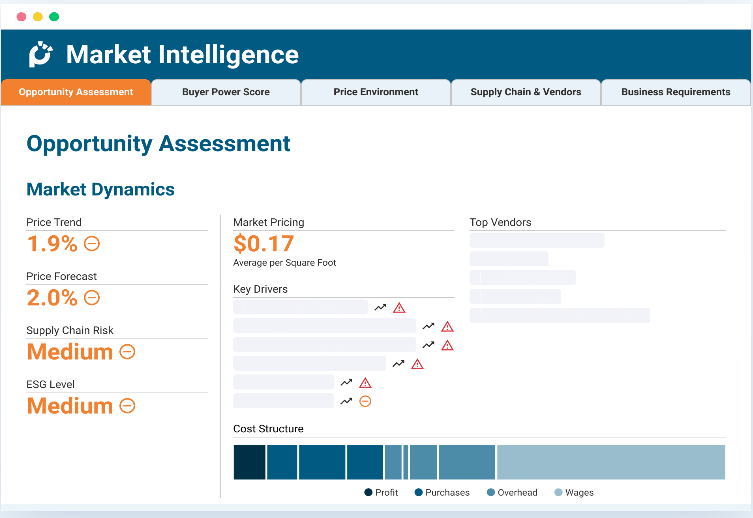

One notable example is ProcurementIQ’s market intelligence reports.

Source: ProcurementIQ

These reports provide detailed insights into various industries (more than 1000), covering critical aspects such as market size, key trends, competitive landscapes, and risk factors.

For instance, if you take a look at their market intelligence report on industrial PVC pipes, you will get data on:

By leveraging such detailed reports, you gain a thorough understanding of market conditions.

These insights can then guide you in adjusting your procurement strategy to the market demands.

In a nutshell, market intelligence enables adaptability and innovation, positions your organization to quickly respond to market changes, seize growth opportunities, and maintain a competitive edge.

In contrast to broader market intelligence, competitive intelligence focuses specifically on gathering and analyzing information about your competitors to gain a competitive advantage within your industry or sector.

It entails collecting data on competitors’ strengths, weaknesses, and market positioning.

Moreover, it involves analyzing their sourcing and other business strategies, their relationships with their vendors, scrutinizing their company culture, and adherence to government and industry regulations.

In essence, competitive intelligence involves collecting and analyzing any available data on your competitors that will help you make better decisions for your own procurement.

Here are a few examples of how you can use competitive intelligence:

| Strategic Positioning | Use insights about your competitors’ strengths and weaknesses to position your products or services in the market. Highlight your strengths in areas where your competitors have weaknesses. |

| Product Differentiation | Analyze your competitors’ products to identify gaps or areas where you can introduce distinctive features that set your products apart. |

| Pricing Optimization | Understand how your competitors price their products or services. This will allow you to optimize your pricing strategy, ensuring competitiveness while maintaining profitability. |

| Negotiation Advantage | Knowledge of your competitors’ supplier relationships and sourcing strategies can improve your negotiating with shared suppliers. This may lead to more favorable terms, pricing, or exclusivity arrangements. |

Now, what are the sources for this competitive intelligence?

Source: Veridion

For starters, if they are publicly available, you should review your competitors’ procurement policies and practices to understand how they approach procurement.

Moreover, their website and blog posts are also valuable sources for competitive intelligence.

For example, they may share case studies showcasing success stories that will emphasize their strengths and capabilities.

They may also share annual reports, which will give insights into financial performance, key objectives, and market positioning.

Attending industry-specific conferences is another wise strategy to gather intelligence on your competitors’ product launches, partnerships, and overall market positioning.

Plus, this is a good opportunity to network and gain insights from industry insiders.

Of course, market share reports and industry reports will also bring competitive intelligence.

All in all, competitive intelligence helps you understand what your competitors are proficient or deficient at.

This can empower you to improve your strategic decision-making and stay ahead of your competitors.

Price intelligence is a crucial element of procurement market intelligence, ensuring you make optimal financial decisions and effectively manage vendors.

It involves monitoring and analyzing pricing strategies in the market to give you a competitive edge.

Price intelligence also sheds light on which factors influence price changes and fluctuations, such as:

When you understand these factors, you can also identify potential risks for your procurement and prepare strategies to mitigate them.

Where can you gather price intelligence?

Through comprehensive market analysis, which involves regularly collecting, analyzing, and comparing market data to monitor the prices in the industry.

Source: Veridion

As we saw above, market intelligence reports will dedicate significant parts to costs and prices.

Other industry reports, publications, price tracking tools, and price intelligence software will all be useful in collecting industry pricing data.

What’s also essential here, and arguably the best way to use price intelligence to make better business decisions, is to compare your prices to industry benchmarks.

For example, benchmarking against industry standards will prevent you from overpaying vendors, directly contributing to your cost-saving initiatives.

In summary, price intelligence is essential for your strategic procurement.

When you know market prices in real-time, you can adjust your pricing strategies, maintain cost-effective vendor relationships and make data-driven decisions that will lead to your overall procurement cost savings.

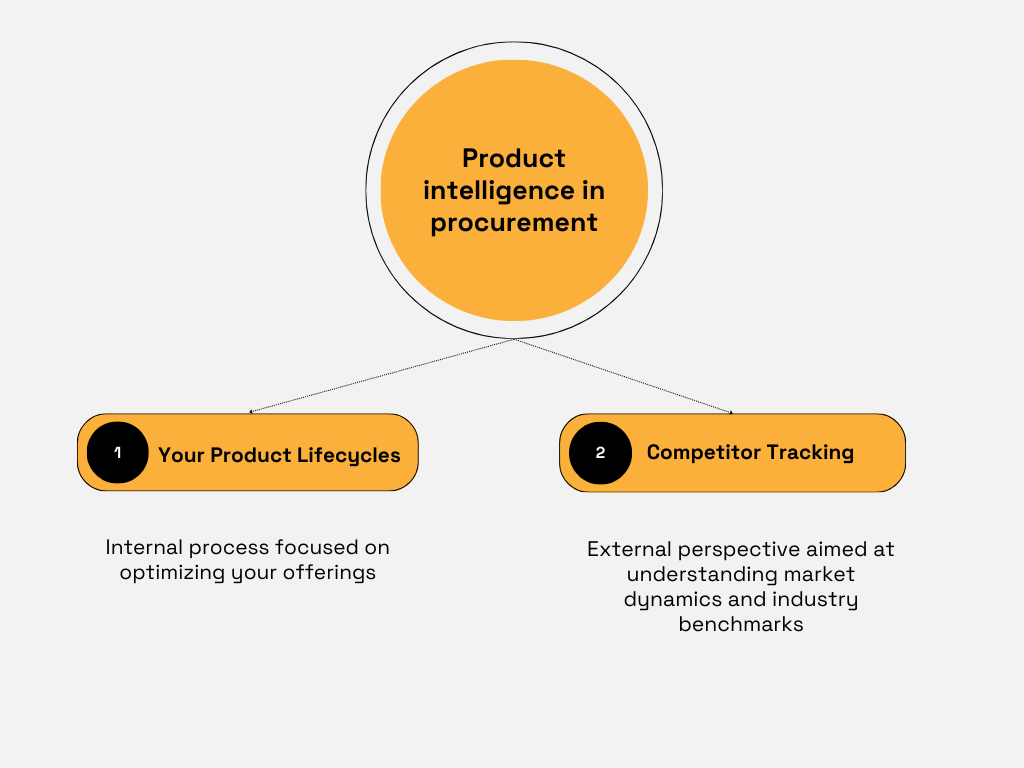

Product intelligence in procurement is a vital tool for navigating the market successfully by tracking the lifecycles of your and your competitor’s products.

This involves closely monitoring product development, pricing strategies, and performance metrics, providing essential insights for informed decision-making in procurement.

To gather this intelligence, you need to focus on two key areas.

Source: Veridion

First, you should regularly analyze your own product lifecycles, as this will enable you to optimize performance and adapt to changing market demands.

For example, let’s say you are a procurement manager for an automotive company.

For you, utilizing product intelligence would involve monitoring the lifecycles of specific car components.

For instance, analyzing the historical data reveals that a particular type of sensor used in vehicle models has a consistent demand during the first year of production but experiences a gradual decline afterward.

With this insight, you can adjust your procurement strategy accordingly:

Simultaneously, tracking competitors’ products is equally important.

Understanding their product development strategies, pricing approaches, and performance metrics will give you benchmarks and valuable insights.

This knowledge helps you identify market gaps and opportunities, shaping your own product strategies.

The result is the ability to create new, innovative offerings that directly address market needs and demands.

For example, one of your competitors introduces a new vehicle model equipped with advanced safety technology that receives positive reviews.

By closely tracking your competitor’s product development strategies and performance metrics, you recognize the increasing importance consumers place on improved safety features.

This prompts you to evaluate your own product offerings.

In response, you collaborate with suppliers to source state-of-the-art safety components and technology.

This process results in adjusting your pricing approach to remain competitive and introducing a revamped version of an existing model, emphasizing its advanced safety features.

As you can see from this (simplified) example, product intelligence directly influences your capacity to innovate and meet customer expectations and market demands.

So—to collect this intelligence effectively, analyze your product lifecycles and closely monitor competitors.

By doing so, you can make informed decisions that will ensure growth and competitiveness in the market.

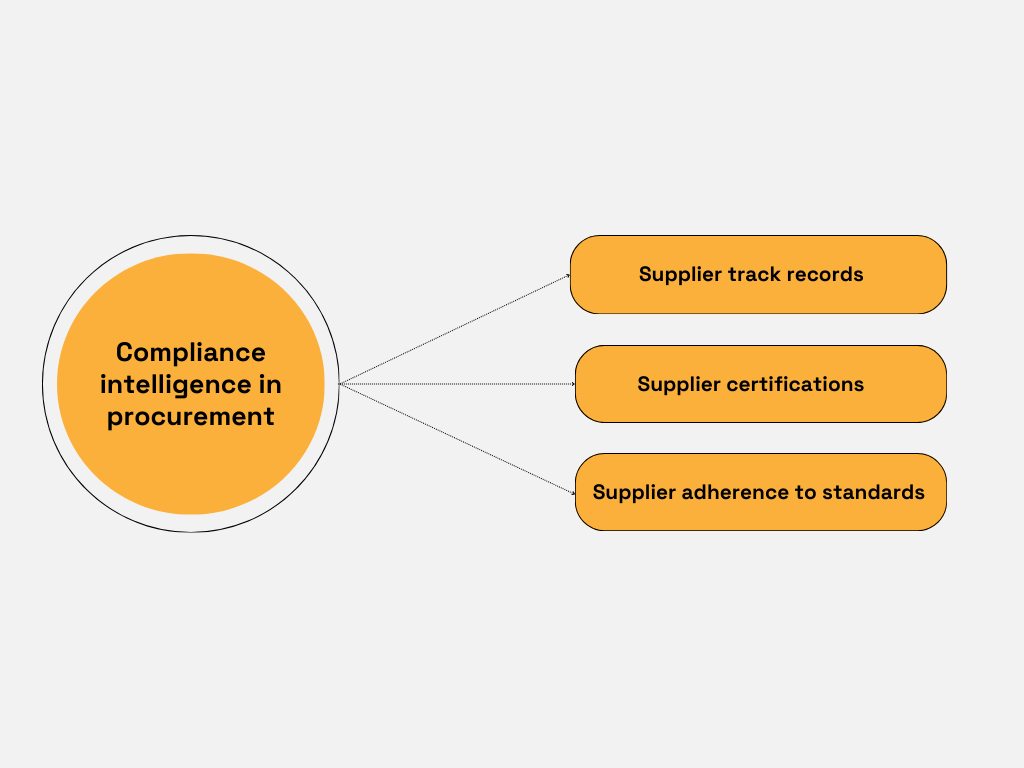

The last component of procurement market intelligence that we will mention today is compliance intelligence.

Essentially, it involves gathering and analyzing data on suppliers’ track records, certifications, and adherence to legal standards.

Compliance intelligence is crucial for staying well-informed about legal requirements and industry-specific standards.

Source: Veridion

This ensures that your procurement practices align with established regulations, mitigating the risk of legal complications and penalties.

When seeking compliance data on suppliers, a robust compliance intelligence strategy involves tapping into various sources.

These include industry regulations, government databases, and certifications, all of which are valuable resources.

Additionally, leveraging advanced tools and platforms like Veridion can provide fresh and comprehensive data on compliance.

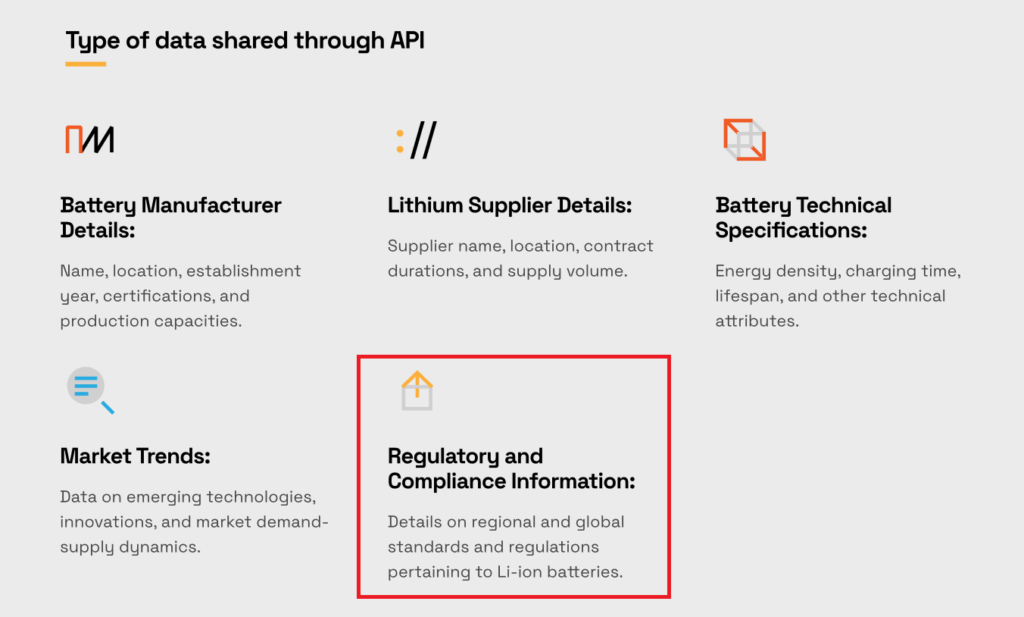

To fully understand the role of such data sources in maintaining organizational compliance with legal and regulatory requirements, take a look at this case study we did at Veridion.

In brief, we showed that, in addition to bringing comprehensive data on suppliers, our complex search API also shares information on regional and global standards and regulations (as well as market trends).

Source: Veridion

Different regions have distinct rules and regulations governing Li-ion battery manufacturing and disposal, so this information is crucial when selecting your suppliers.

In summary, compliance intelligence is a cornerstone in constructing a procurement strategy that prioritizes legal adherence and ethical sourcing, so collecting this information is essential for every procurement team.

Procurement market intelligence comprises various types and components, intricately interwoven to construct a comprehensive understanding of suppliers, competitors, pricing, and market dynamics.

While today we explored six key components of procurement market intelligence, there are even more dimensions, such as geopolitical intelligence, technology intelligence, and social media intelligence, that we didn’t mention.

In essence, any area within procurement that involves gathering and analyzing information becomes its own kind of procurement market intelligence.

And, as you may recall from the beginning, it is this multitude of intelligence types that form your toolkit.

The tools inside assist you, each in its own way, to make strategic decisions and successfully navigate your procurement.