Four Sources of Procurement Market Intelligence

Gathering market intelligence is crucial for making informed procurement decisions, developing strategies, identifying cost-saving opportunities, as well as sourcing suppliers that are the right fit for your organization.

But with a vast amount of intelligence and a variety of sources for collecting data at your disposal, how do you decide what approach you should take?

In this article, we are going to present four important sources of procurement market intelligence you should consider and, hopefully, help you find the answer to this question.

So let’s dive right in!

One of the simplest and quickest ways to gather procurement market intelligence is through desk research.

Desk research, also known as secondary research, is a method of collecting data from various existing, publicly available sources across the Internet to get insights into market trends, supplier capabilities, and customer preferences.

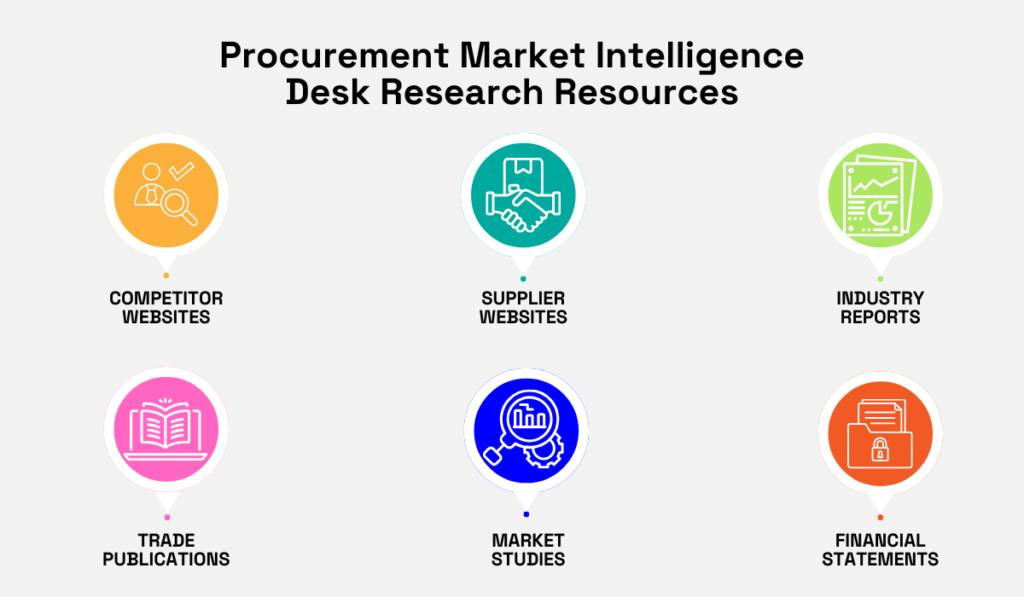

Below, you can see some of the resources commonly used in desk research.

Source: Veridion

This source of procurement market intelligence is a popular choice because of its convenience.

Firstly, desk research is both cost- and time-efficient.

For example, if you know who your competitors are, visiting their websites and downloading research studies or whitepapers takes seconds and generally doesn’t cost any money.

On top of that, this approach allows you to quickly collect a significant amount of data from various sources, giving you a more comprehensive picture of the market landscape.

All of this makes desk research a good starting point, as it is bound to provide you with some basic information that will steer your more granular research in the right direction.

With that being said, desk research is not without its disadvantages.

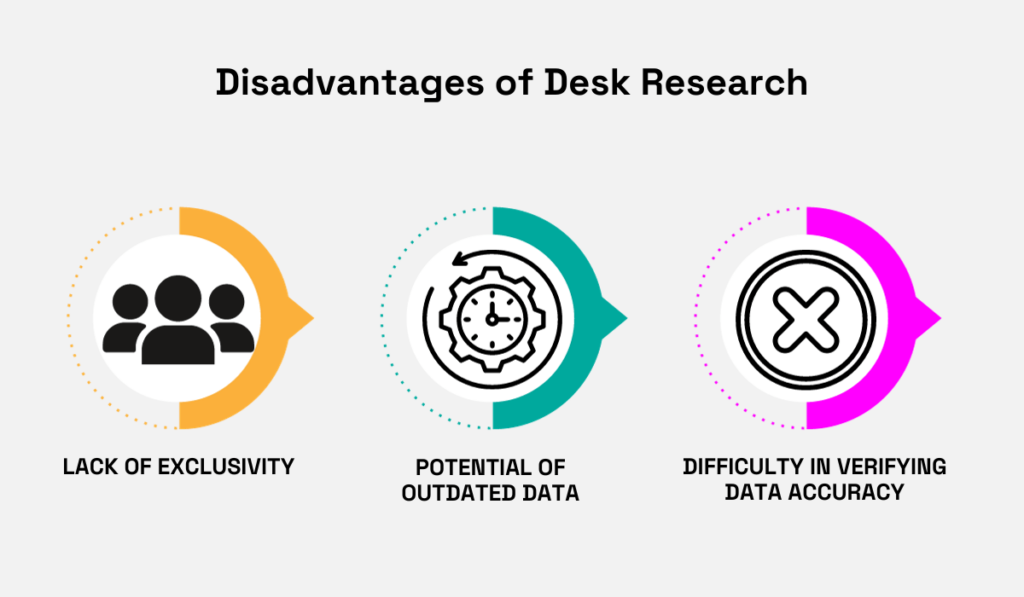

Source: Veridion

Namely, precisely because the resources used in desk research are widely available, there is a lack of exclusivity.

In other words, no matter how relevant the data may be to your organization, chances are that your competitors have found the exact same data, thereby taking away any potential for competitive advantage.

Aside from that, there is the issue of data freshness and accuracy.

If your industry is a fast-moving one, data becomes obsolete quickly. And relying on it—even as just a starting point—can cause you to come to incorrect conclusions.

Plus, every source you gather market intelligence from does research in its own way, which is bound to result in oscillations in quality and even conflicting information.

So, does all of this mean you should completely ditch desk research?

We don’t believe so.

When done right, desk research can be extremely useful in procurement. One example is quoted below.

Illustration: Veridion / Quote: Procurious

So, to make the most of desk research, focus on finding high-quality source material.

Before you get started, define exactly what kind of information you’re looking for.

This will help prevent you from getting sidetracked by data that seems almost right but is actually not relevant to your organization.

Combine this with the use of advanced search operators—such as Boolean operators and date filters—to enhance your search precision.

For example:

(“procurement trends" OR "market analysis" OR "industry report") AND ("supply chain" OR "vendor assessment" OR "cost analysis") NOT ("case study" OR "company-specific" OR "product review")

That way, you’ll filter out all of the resources that are outdated or inaccurate.

All in all, when utilized correctly, desk research can be a strong method of gathering procurement market intelligence, so don’t fully dismiss it.

If you feel like you’ve completely exhausted desk research resources, or you simply cannot find data that is fully relevant to your organization, it is time to consider a more personalized approach to gathering procurement market intelligence.

Ingmar Mester, Director of Supplier Management and Sustainability at the container shipping company Hapag-Lloyd, explains that having access to good intelligence is key for successful procurement operations.

Illustration: Veridion / Quote: Craft

Therefore, you should consider sourcing market intelligence from your suppliers.

After all, they are in the midst of all the hustle and bustle in your niche, and therefore have access to information that could help you make better strategic decisions.

Let’s say that your organization sources some of the goods from a supplier situated in an area prone to hurricanes.

Now, suppose you’ve made an effort to build a strong professional relationship with this supplier.

If that is the case, they’ll be more inclined to warn you about delivery disruptions that are likely to happen due to the upcoming hurricane season.

Having access to this information early on will help you and your team plan better and adapt to the situation by identifying an alternative sourcing option or changing schedules in order to accommodate for the delivery delay.

But market intelligence provided by suppliers doesn’t only come in handy in troublesome times.

Namely, because they likely have an extensive network of peers and relationships with other industry professionals, your suppliers should also have an exclusive insight into new technologies and market trends.

With such information on hand, you can stay ahead of the curve.

So, how can you go about gathering market intelligence from your suppliers?

Here are some popular ways:

Illustration: Veridion / Data: Atamis

While periodically scheduling interviews with your key suppliers is a great way to both extract useful information and maintain a relationship with them, this is not always possible.

Stay prepared for such instances by creating RFPs that will help you gather market data without needing to get in touch with suppliers.

Apart from using RFPs to collect information about the supplier company, their pricing, and supply chain practices, include questions that will prompt the supplier to provide you with details about the competitive landscape and emerging market trends.

That way, you can get helpful information straight from the source.

So, if you’re on the hunt for market information tailored to your organization’s needs, don’t hesitate to reach out to your key suppliers.

If you’d prefer to rely on market intelligence gathered by employees within your organization, building an internal intelligence team might be the way to go.

Let’s start by exploring the roles you should consider bringing onto your internal intelligence team.

Source: Veridion

As you can see, an internal intelligence team can get pretty extensive, with a lot of different roles bringing their knowledge and expertise to the table.

For instance, your intelligence analysts will be in charge of researching market trends and supplier qualifications, and then summarizing those findings in a meaningful way.

Your data analysts will, on the other hand, be responsible for interpreting the collected data, and your cost analysts will analyze costs associated with procurement activities and identify cost-saving opportunities.

Your risk management specialists will ensure that risks associated with suppliers (and other external factors) are mitigated, and your strategic planners will develop long-term strategies to reach the organization’s objectives.

All in all, an internal intelligence team is going to consist of a lot of moving parts.

When put together, they can provide completely customized insights that are fully in alignment with the organization’s specific needs and goals.

And while building an internal intelligence team offers numerous benefits, it also includes some challenges.

For starters, this undertaking is both time- and resource-intensive.

It requires first finding skilled individuals who can take on their respective roles, and then providing them with proper training, as well as ensuring that they all collaborate effectively.

All of this also makes building such a team quite costly, which might be a deterrent for many.

So, if creating an internal intelligence team isn’t a realistic option for your organization, you can always turn to external intelligence providers, which we will discuss next.

External intelligence providers are entities whose role is to provide you with specialized data and help you improve your procurement processes and strategies.

Both syndicated and custom intelligence providers fall into this category.

Which option you decide to go for is going to depend on whether you need more general, standardized data, or data and research tailored to your organization’s specific needs.

In the following sections, we are going to discuss what you can expect from two kinds of external intelligence providers: market research firms and big data providers.

Market research firms are companies that “gather and analyze data about customers, competitors, distributors, and other actors and forces in the marketplace.”

Should you choose to use the services of such a company, they are going to provide you with various types of invaluable data that will help you make strategic procurement decisions.

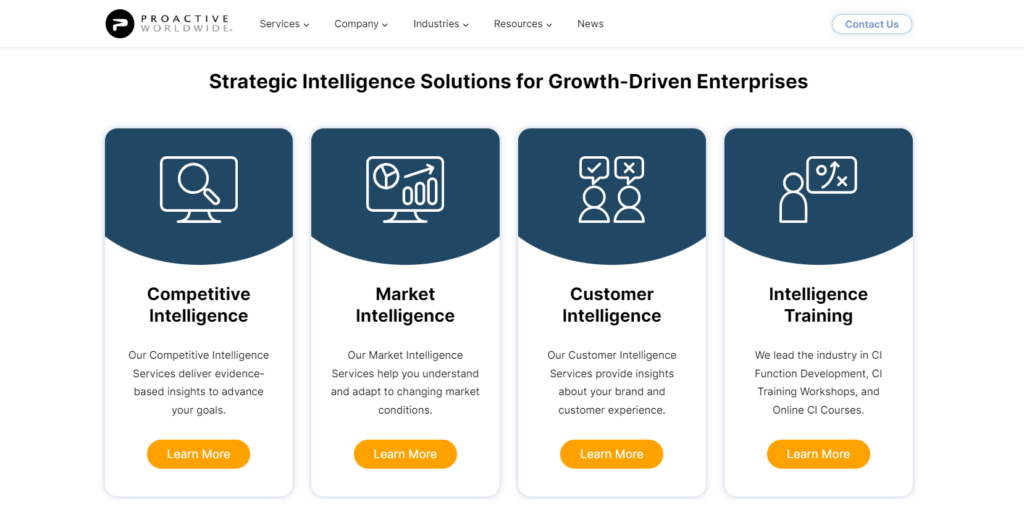

For example, one of the top market intelligence companies, Proactive Worldwide, prides itself on providing its clients with various types of data that will drive their growth.

Source: Proactive Worldwide

And if you’re wondering why not simply do all of this using the previously mentioned desk research approach, the answer is simple:

Market research companies specialize in collecting and analyzing market intelligence, and they often have access to a broader range of exclusive sources that allow them to create customized reports and studies for you.

Let’s say you decide to engage a market research company to create a custom, in-depth study for your organization.

To get the job done, they are probably going to need access to proprietary databases, and then have their analysts—who specialize in your industry—analyze the findings and create a comprehensive report.

This can get pretty costly, so make sure to conduct an ROI assessment before you make a commitment.

Source: The Farnsworth Group

Will the intelligence a market research firm can provide you with benefit your organization enough for it to be worth the investment?

If yes, this is an option worth considering.

But even the best market research agencies need to get their data from somewhere.

So, if you’d prefer to skip the middleman and gather large volumes of accurate and up-to-date data yourself, consider doing so with the help of big data providers.

Big data providers are companies that specialize in collecting big data and “have the infrastructure and technology in place to collect, process, and analyze large amounts of data in real time.”

As a procurement professional, you want to turn to such providers to gather information about demand patterns, price fluctuations, and supplier performance in your industry.

The latter—identifying and selecting the right suppliers—is one of the keys to successful procurement.

Yet, according to research conducted by McKinsey, most organizations search for suppliers manually, which makes this integral task both time-consuming and daunting.

Illustration: Veridion / Data: McKinsey

To overcome this hurdle and make big data collection and analysis more efficient, consider looking into AI-powered big data tools, such as Veridion, our own solution.

Veridion’s Search API allows you to tap into a global supplier database with over 60 data points for over 80 million companies, all within mere seconds.

Our data is updated on a weekly basis, meaning that any data we provide you with is always fresh and, therefore, reliable enough to help you make big decisions.

This is what our search API looks like:

Source: Veridion

Not only does our solution serve as a one-stop shop, eliminating the need for you to spend money with multiple data vendors—it also allows you to search various aspects of a business, like in the example above.

Simply put, if you’re looking for a supplier whose product has very specific traits, or one in a specific location and with no ESG controversies, Veridion has got you covered.

In summary, turning to big data providers for procurement market intelligence will allow you and your procurement team to quickly and autonomously sift through large volumes of fresh and relevant data, and find exactly what you need to optimize your procurement operations.

When it comes to procurement, market intelligence is invaluable.

It allows you to stay informed about current and upcoming market trends, plan for disruptions, mitigate risks, and identify the right suppliers and cost-saving opportunities.

However, the source(s) that you use to gather this information will depend entirely on your needs.

If you require a time- and cost-efficient method and don’t mind getting more generalized data, desk research may be a good starting point.

However, if you’re past the point of initial research, consider reaching out to your suppliers or external intelligence providers for a more personalized approach.

And if your company has the means to, building an internal intelligence team is a great way to collect and analyze data in-house.

Whatever source—or sources—of procurement market intelligence you end up opting for, we hope that this article helped you make the right decision.