8 Types of Spend Analysis You Need to Know About

What are you buying? Who are you buying it from? Who is buying it, and how often? Are you getting what was promised at the agreed price?

These are just a few key questions that spend analysis can answer about your procurement.

But here’s the catch—it’s not enough to simply look at your overall procurement spend and compare it to your company’s budget.

To truly understand and optimize your spending, you need to dig deeper and analyze spend from different angles.

That’s why today, we’ll explore eight different types of spend analysis that can reveal opportunities for cost savings and improve your procurement spend management.

Let’s get started.

Direct spend analysis focuses on the costs related to the materials or services that are essential to creating your final product.

Think of it like this:

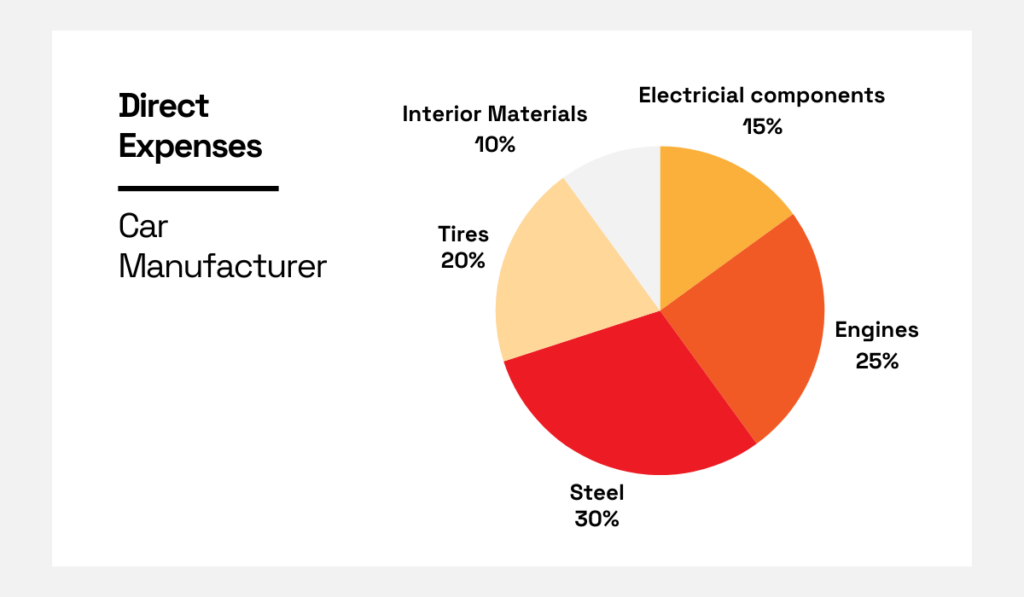

If you’re a car manufacturer, direct spend analysis examines how much you’re spending on steel, tires, engines, and any other components crucial to building a car.

This is what a breakdown like that could look like:

Source: Veridion

Analyzing these expenses is key because it helps you see exactly where your money is going and how you can optimize these critical costs.

For starters, with direct spend analysis, you get a clearer picture of which materials and services are essential to your business.

With this data, you can make more strategic sourcing decisions, such as diversifying suppliers to reduce risk or investing in long-term partnerships for critical supplies.

And because now you know which suppliers are the most crucial to your production, you can focus on building stronger relationships with them, ensuring more reliable supply chains and potentially better pricing or service agreements.

But how can you conduct this type of spend analysis?

Start by gathering data from your accounts payable systems, purchase orders, invoices, and contracts related to your direct materials.

Once you have that information, break down your spending by supplier, type of material, and frequency of purchases.

Look for patterns—are costs rising?

Are you relying too heavily on one supplier?

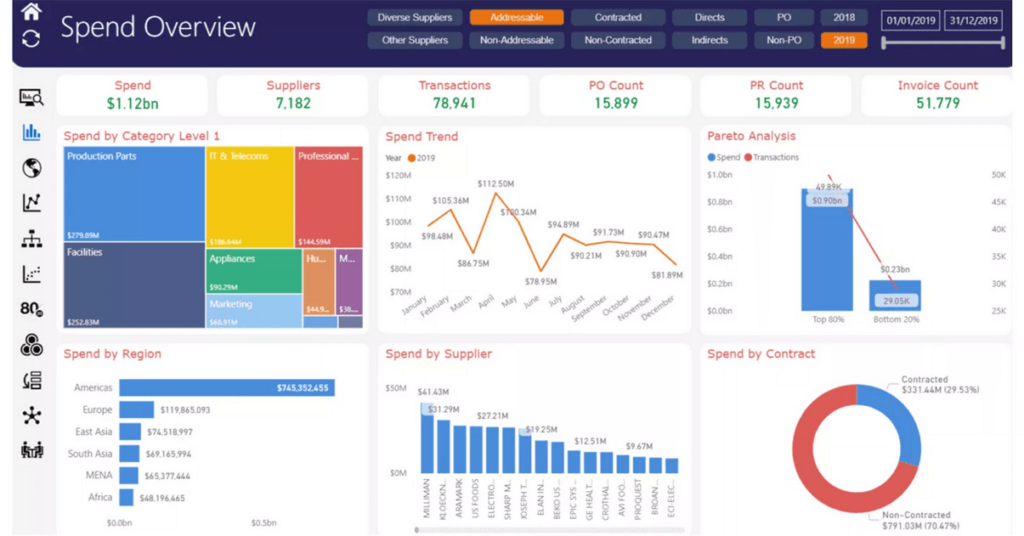

You might also use specialized spend analysis software for deeper insights.

Source: Simfoni

These tools can help you spot trends, compare prices across suppliers, and find opportunities to cut costs.

With this information, you can make smarter decisions about where to save money, which suppliers to negotiate with, or how to diversify your purchases.

Indirect spend analysis looks at the money your company spends on goods and services that don’t directly contribute to creating your final product.

This includes costs for:

While these expenses may seem less critical, there are two facts you need to be aware of:

Still, understanding where indirect spend goes can help you find opportunities for cost savings and improve operational efficiency in non-core areas.

However, the challenge with managing indirect spend is that it often gets scattered across different departments and is handled by various stakeholders.

On the other hand, direct spend is typically managed by a centralized procurement team.

This lack of centralized oversight over indirect spend makes it harder to track and control it.

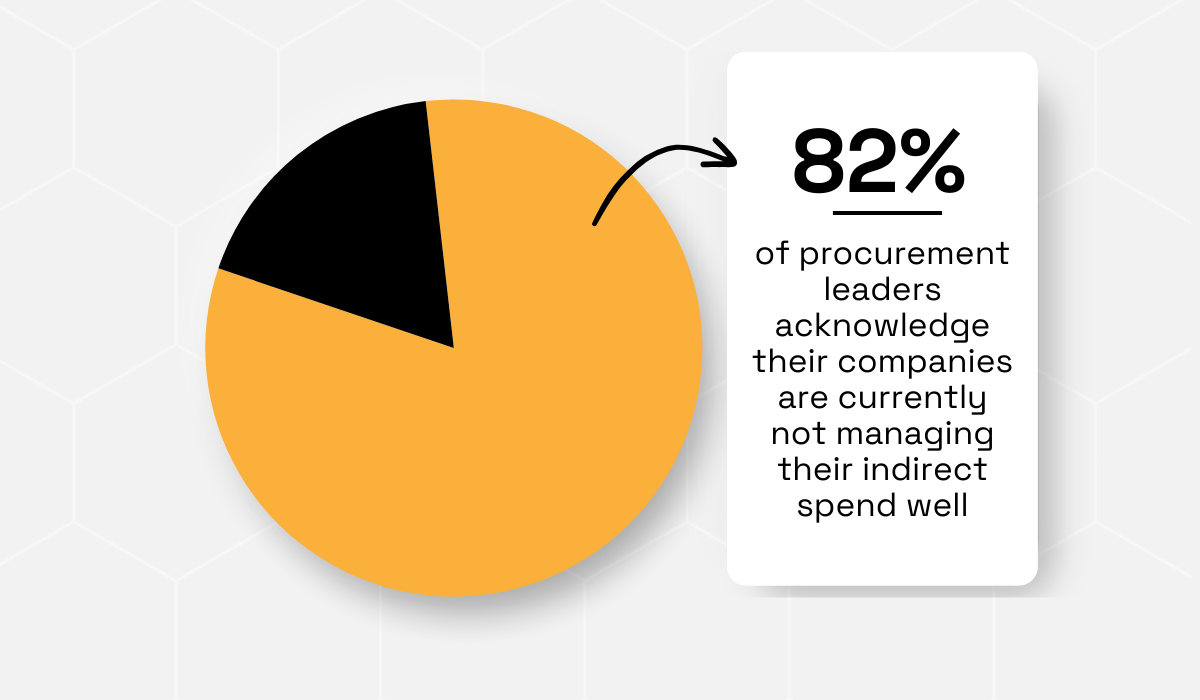

In fact, a 2023 survey by Globality reveals that more than 80% of procurement leaders believe their indirect spend isn’t properly managed because of data silos and a lack of collaboration.

Illustration: Veridion / Data: Globality

This high number highlights a common problem many organizations face—just how difficult it can be to gain control over indirect spend.

To tackle this, it’s smart to automate and digitize specific procurement processes.

By doing so, you gain better visibility and control over all spending, including indirect expenses.

A good example of this is Dräxlmaier Group, an international automotive supplier.

They recently adopted Ivalua’s spend management platform to handle both direct and indirect spend more effectively.

Robert Suvak, their Head of Global Procurement, explains:

Illustration: Veridion / Quote: PR Newswire

Such automation and centralization of indirect spend management can reveal hidden costs, as well as give you the chance to negotiate better deals, and ultimately drive greater savings and efficiency in your procurement.

Supplier spend analysis focuses on understanding how much you spend with each of your suppliers, which is crucial for managing costs and reducing risks in your supply chain.

This way, you can do three things:

To start, gather all your purchase orders, invoices, and contracts to create a comprehensive profile for each supplier.

It should include details like how much you spend with them, how frequently you place orders, and what specific products or services they provide.

By analyzing this data, you can see if you are overly reliant on a single supplier, which could be risky if that supplier encounters issues or raises prices.

It also helps you spot opportunities to consolidate suppliers, which can lead to better pricing and terms.

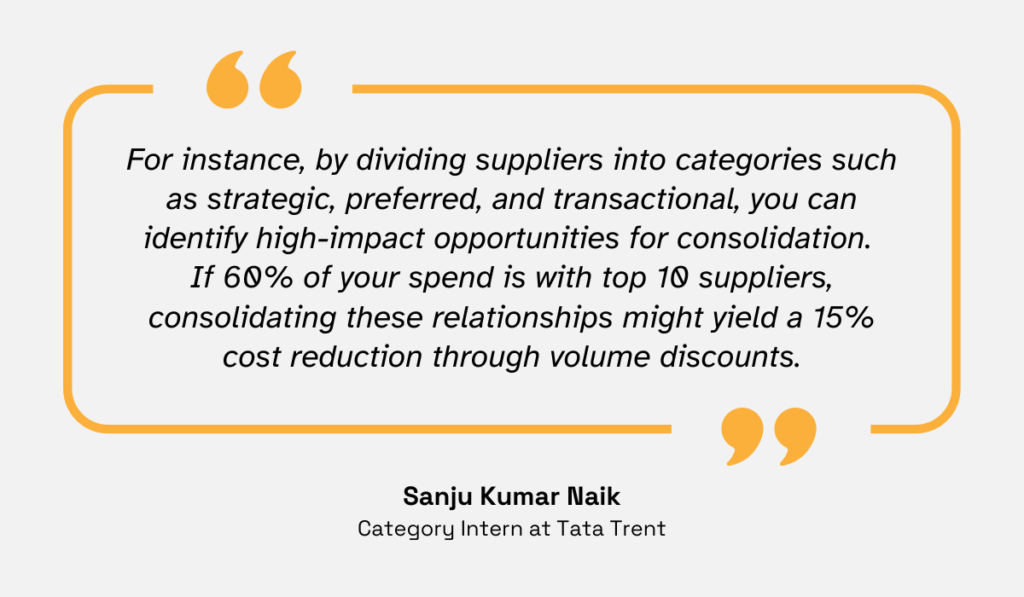

A crucial part of supplier spend analysis is categorizing your suppliers into groups such as strategic, preferred, and transactional.

This approach, as noted by Sanju Kumar Naik, a Category Intern at Tata Trent, allows companies to find high-impact opportunities for consolidation:

Illustration: Veridion / Quote: LinkedIn

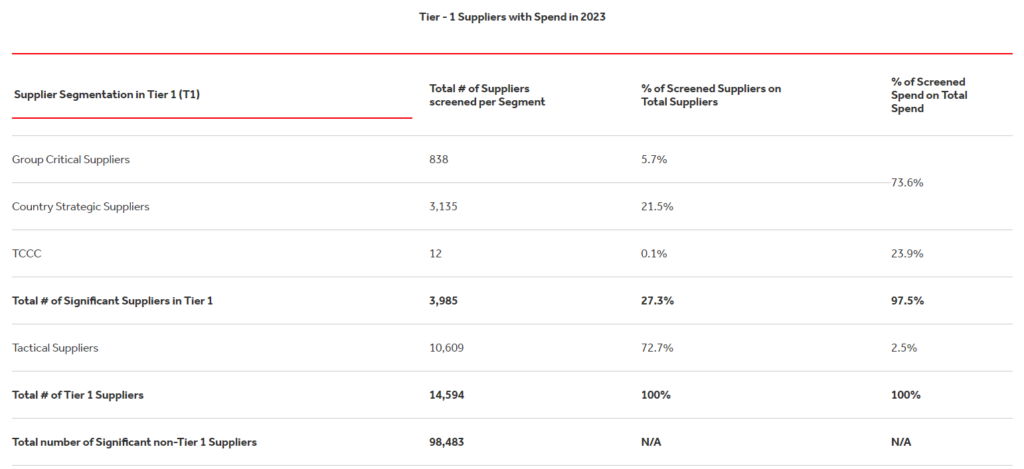

A practical example of this approach is how Coca-Cola HBC manages its suppliers.

They segment their suppliers into direct and indirect categories, and then further classify them based on their criticality and strategic importance.

Group critical suppliers handle essential items like sweeteners and packaging materials, which are vital for production, and Coca-Cola HBC spends a significant percentage of its budget on them.

Country strategic suppliers have a significant impact at a local level, while tactical suppliers represent low-volume and/or low-spend suppliers, providing goods or services where many alternative sources are available.

Below is a recap of Coca-Cola HBC’s spend visibility with suppliers in 2023.

Source: Coca-Cola HBC

This segmentation allows Coca-Cola HBC to prioritize relationships with key suppliers and negotiate more effectively, thus ensuring a stable and cost-effective supply chain.

Coca-Cola implements this strategy across all its partner companies, making its strategic procurement one of the best in the industry.

At the end of the day, it all boils down to this:

Supplier spend analysis isn’t just about tracking supplier-related expenses.

Instead, it’s a strategic way to make smarter decisions about who you do business with and how.

Category spend analysis groups your expenses into specific categories, such as IT, marketing, or manufacturing.

This helps you see which categories are consuming the most of your budget and where there might be opportunities to save money.

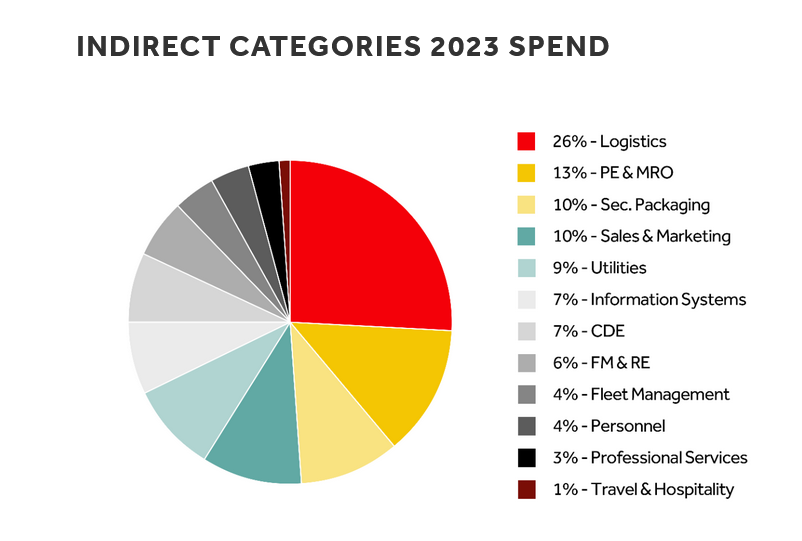

Sticking with the Coca-Cola HBC example, they track their indirect spending in categories like IT, production equipment, and maintenance services.

Below is an overview of spend per Coca-Cola HBC’s indirect categories for 2023:

Source: Coca-Cola HBC

By breaking down these expenses into categories, they can spot where they might be overspending and find ways to cut costs.

However, to perform effective category spend analysis, you need accurate and up-to-date data for each category.

This can be challenging if your data is scattered or outdated.

Luckily, that’s where advanced spend analysis tools come in handy.

For instance, a leading global commercial vehicle manufacturer based in Sweden used one such tool to tackle their spend management challenges.

The company, which has a turnover of around £11 billion and over 10,000 employees, was struggling with data accuracy and consolidation for their IT spend.

Despite significant internal efforts, progress was slow and resource-intensive.

However, with the help of a spend analysis tool, they were able to extract and consolidate spend data from their ERP systems quickly.

They could also examine IT spend within a specific operational country, focusing on various elements of third-party costs.

Spendkey’s solution provided real-time visibility into their spending and helped them identify £427,000 in IT vendor cost savings in less than 30 days.

The tool also revealed shadow spend and improved supplier landscape visibility, ultimately driving substantial cost savings and optimizing their procurement processes.

Below are the results:

Source: Spendkey

In summary, category spend analysis helps you manage and optimize spending by providing insights into how your budget is allocated across different categories.

Item spend analysis is all about figuring out how much your organization spends on individual items or products.

It helps you spot expensive items, find opportunities to buy in bulk, and improve how you manage inventory.

On top of that, by looking closely at spending for each item, you can see if you’re buying the same product from different suppliers at different prices.

Source: Veridion

To start with item spend analysis, match each item to its supplier and the department that ordered it.

This helps you understand not just the total cost for each item, but also who’s buying it and where.

For example, let’s say your company buys laptops for its employees.

You might find that the IT department is buying laptops from a supplier at $1,000 each, while the marketing department is getting the same laptops from another supplier at $1,200 each.

If you notice this, consolidating all laptop purchases with the first supplier could save you a good sum of money.

Why?

Because, by ordering in bulk from one supplier, you can negotiate a better price and streamline how you manage these purchases.

And, if by any chance, the first supplier is on your approved supplier list, it means the marketing department isn’t following the agreed-upon procurement policies.

This, on the other hand, doesn’t only increase your costs but also disrupts relationships with approved suppliers.

In short, item spend analysis gives you a clear picture of how you’re spending on individual products, so you can make smarter decisions and cut costs where possible.

Payment term spend analysis looks at the payment terms you’ve agreed on with your suppliers and how these terms impact your cash flow and potential cost savings.

Essentially, through this analysis, you can see if there’s room to negotiate better terms.

Think early payment discounts or extended payment periods to improve your financial health.

To get started, review your current supplier contracts to understand the payment terms you’re working with.

Are you paying most of your invoices within 30 days, or do some suppliers allow 60 or even 90 days?

You might find that some suppliers offer discounts if you pay early, while others might charge late fees if payments are delayed.

By understanding these terms, you can prioritize payments to take advantage of discounts and avoid extra costs.

For example, a mid-sized manufacturing company might notice that they’re frequently paying late fees to a key supplier.

By negotiating a longer payment period or setting up early payments for a discount, they could save thousands of dollars annually.

To be able to do that, you should analyze your historical spend data.

Sudhan Chaudhari, Operations & Strategy Manager at Bowling Planet Consulting & Services, advises:

Illustration: Veridion / Quote: LinkedIn

By examining past payment behaviors, you can better negotiate terms that align with your cash flow needs, which ultimately leads to improved financial stability and cost savings.

In a nutshell, payment term spend analysis gives you a clearer picture of how to manage your cash flow more effectively and negotiate terms that benefit your bottom line.

Maverick spend analysis is all about catching and controlling spending that happens outside of your company’s official procurement rules.

It happens when departments make purchases without following the set guidelines or using approved vendors.

In some cases, maverick spending may also involve fraudulent activities.

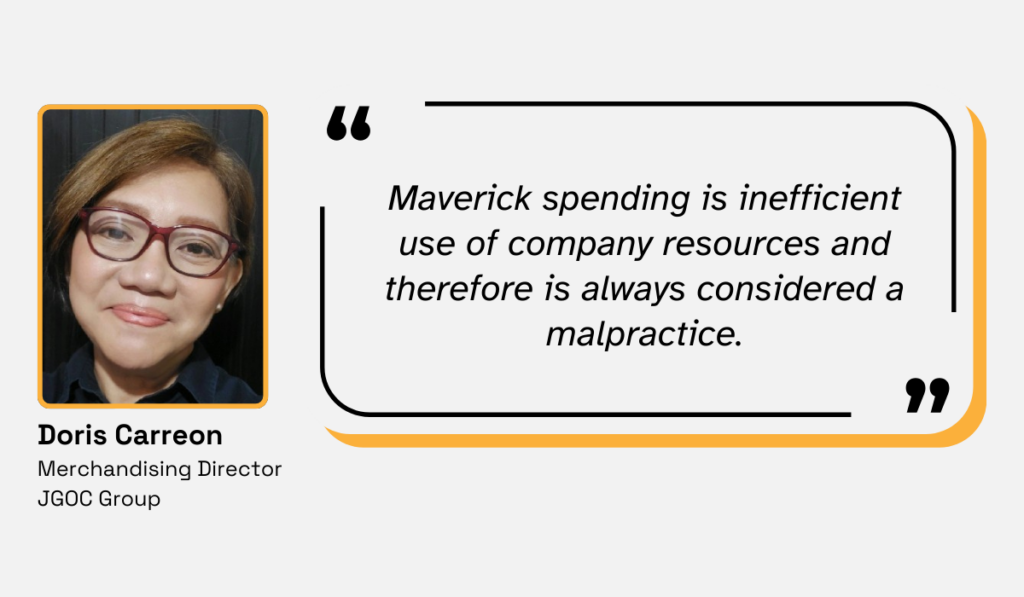

No matter what the reason for it, Doris Carreon, Merchandising Director for JGOC Group, points out that maverick spending wastes resources and should be avoided at all costs.

Illustration: Veridion / Quote: LinkedIn

She further suggests regularly checking spending against your budget to ensure everything aligns with the approved guidelines.

Another good way to control maverick spend is by making sure everyone uses a list of pre-approved suppliers.

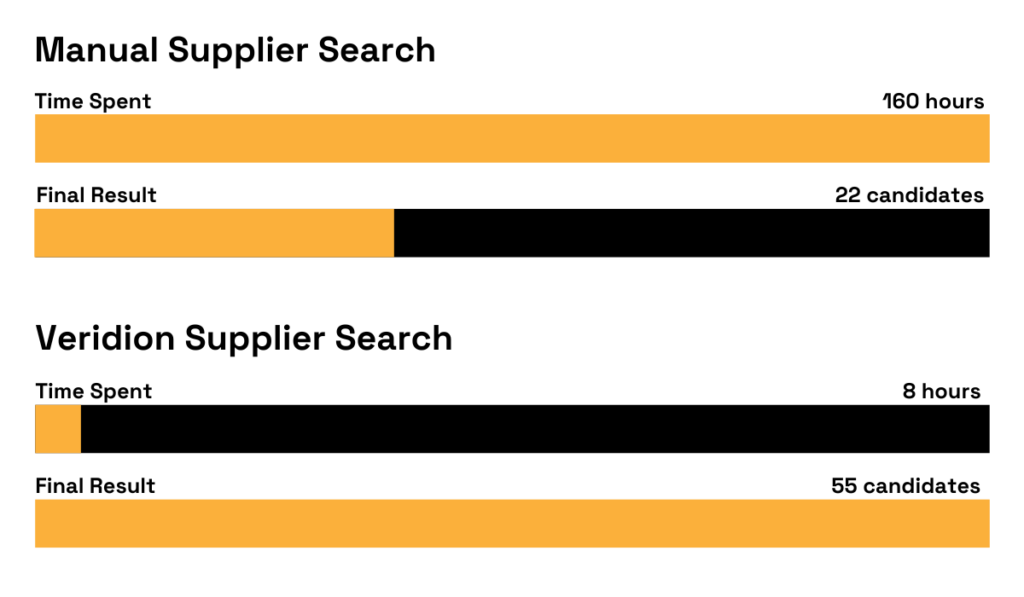

To make such a list, you can use our supplier sourcing service—Veridion.

It will help you find reliable suppliers that meet your requirements much more quickly and efficiently, as the image below shows:

Source: Veridion

Now, to conduct a maverick spend analysis, start by reviewing your purchase data.

Look for instances where spending doesn’t follow the approved contracts or where items are bought from suppliers who are not on the approved list.

For example, if a department purchases office supplies from an unapproved vendor at a higher price than negotiated with the approved suppliers, this constitutes maverick spending and should be addressed.

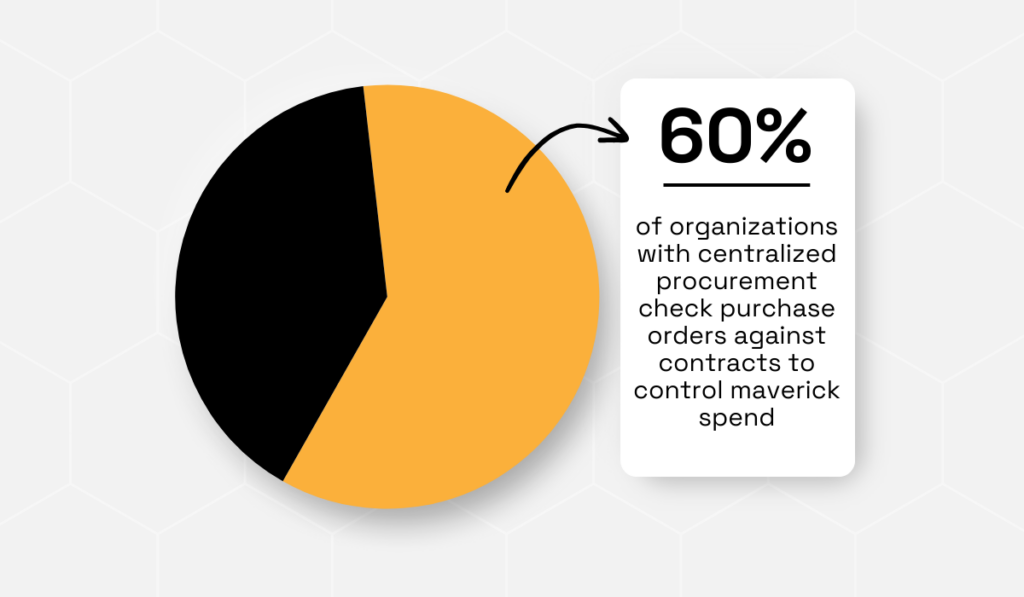

Luckily, 60% of organizations with centralized procurement do check purchase orders against contracts to control maverick spend, and 56% provide access to a list of these approved suppliers.

Illustration: Veridion / Data: Coupa

By sticking to this list, you can make sure spending is within approved limits and possibly even negotiate better deals.

All in all, maverick spend analysis helps keep spending in check, ensures compliance with procurement policies, minimizes fraud, and helps you stay within budget.

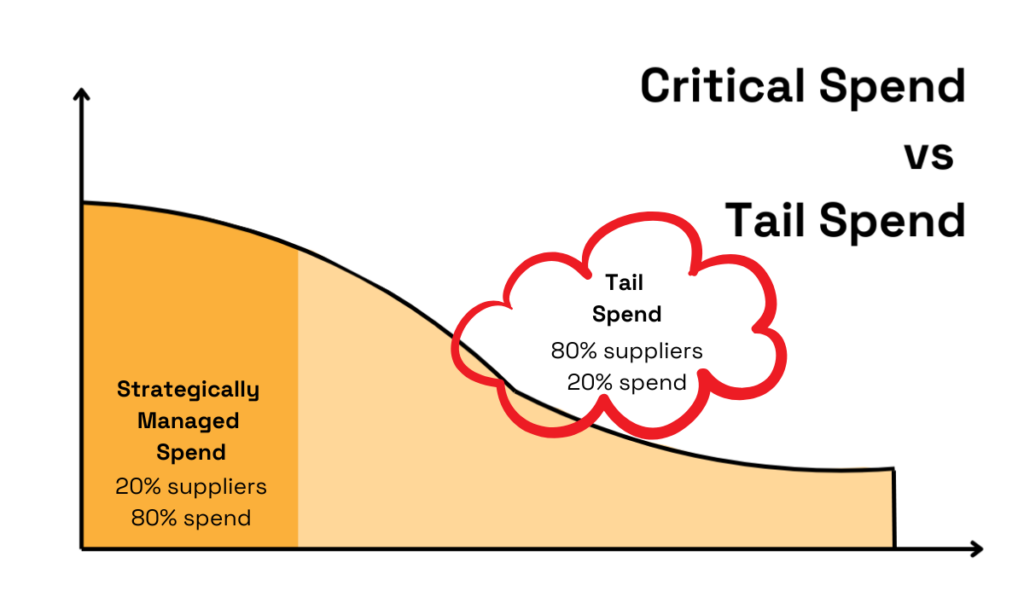

Tail spend analysis focuses on a small portion of your spending that involves a large number of low-value or infrequent purchases.

Although these transactions only make up about 20% of your total spend, they can account for around 80% of your purchase orders.

Source: Veridion

This analysis helps identify and manage these smaller, often overlooked expenses.

Tail spend includes things like office supplies, travel costs, or minor equipment purchases.

Yes, these items might seem insignificant individually, but together, they can lead to inefficiencies and unnecessary costs.

For example, if your company buys coffee for the office from various vendors, consolidating these purchases to one supplier can already reduce some costs.

Essentially, tail spend analysis reveals such opportunities by examining where these small expenses are going and finding ways to manage them more effectively.

Surely, tail spend isn’t just about small items like office coffee.

It can accumulate in various areas of your organization, such as maintenance, repair, and operations.

For example, if your company frequently buys minor tools or parts from different suppliers, these small expenses can add up and lead to inefficiencies.

Donnie Finkler, Global Commodity Manager at Dana Incorporated, has seen this first hand:

Illustration: Veridion / Quote: LinkedIn

However, he further notes that, by analyzing your tail spend, you can spot these small but numerous transactions and find ways to consolidate them with fewer, more strategic suppliers.

The key takeaway?

Do a tail spend analysis to control and optimize spending on low-value items and discover potential savings by focusing on the smaller, often ignored areas of your budget.

These eight types of spend analysis are like different lenses through which you can view your procurement spending.

By looking at your expenses from multiple angles, you can more easily discover hidden inefficiencies and, therefore, reduce costs and improve the overall health of your procurement process.

It all comes down to applying insights from these various spend analysis types to make smarter, more informed decisions that will ultimately lead to more cost-effective procurement and better financial outcomes for your organization.