10 Spend Management Statistics You Need to Know About

Spend management.

It’s a challenging endeavor for many companies.

How to control it? What blocks it? Why are some companies successful at it and others aren’t?

We bring answers to all the questions and more.

So if you’re looking to stay on top of spend management best practices, you’ve come to the right place.

We’re going to explore some recent statistics about spend management that might change your perspective on managing corporate expenses.

Let’s start exploring the numbers.

First off, let’s explore the tangible impact of effective spend management: the potential cost savings.

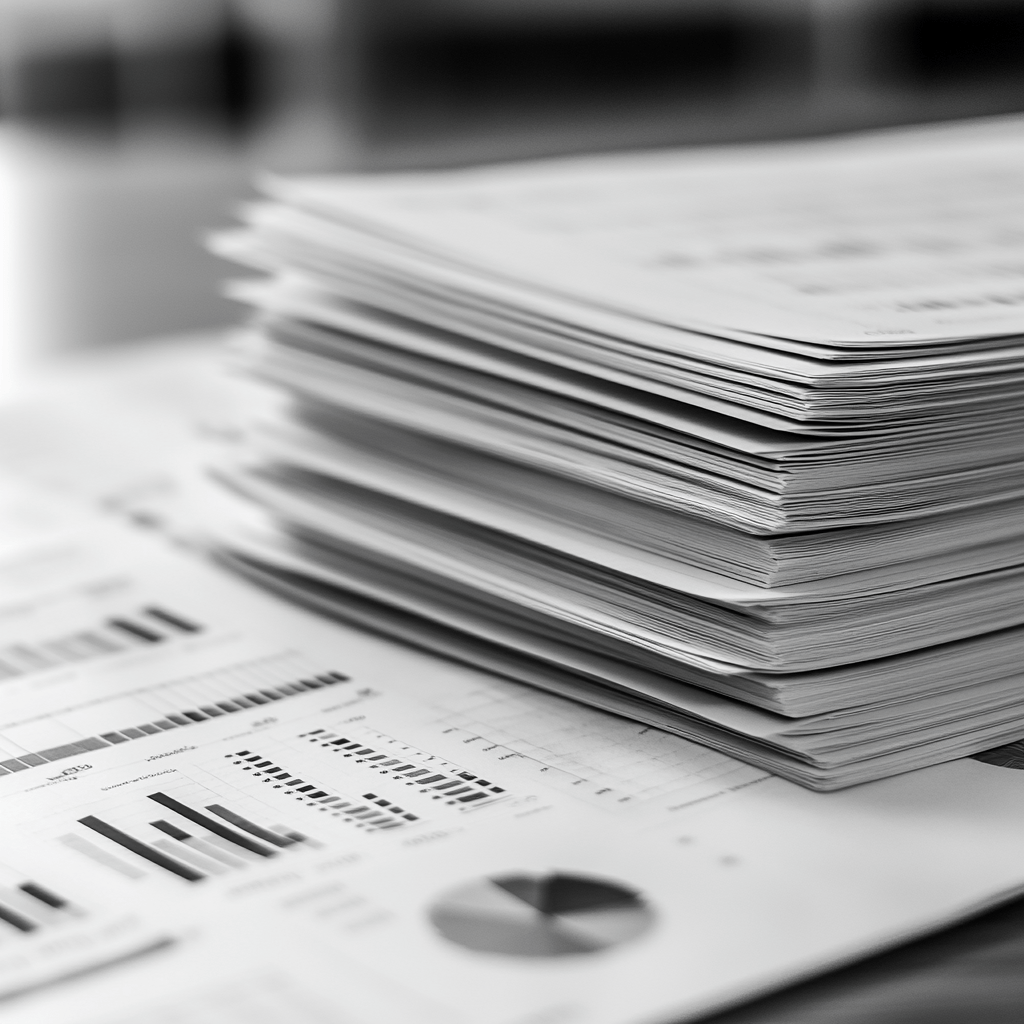

We’ll look at the data from Coupa’s Total Spend Management Benchmark Report from 2024.

This annual report gives financial leaders insights into how the best-performing companies manage their spending. And, the top organizations in 2024 achieved an impressive 5.8% reduction in their total spend.

While this is slightly lower than what we have seen in 2023 (6.6% savings), it’s still significantly higher than the average company’s savings of 2-3%.

Illustration: Veridion / Data: Coupa 2023 & 2024 reports

This highlights a clear correlation between effective spend management practices and increased savings.

It’s worth noting that Coupa also attributes these savings to a greater focus on the effective use of Business Spend Management (BSM) platforms.

BSM technology helps by:

The takeaway? Technology like BSM platforms can be the key to unlocking substantial savings and gaining a competitive advantage.

And implementing such systems can help organizations move closer to the benchmarks we’ve just explored.

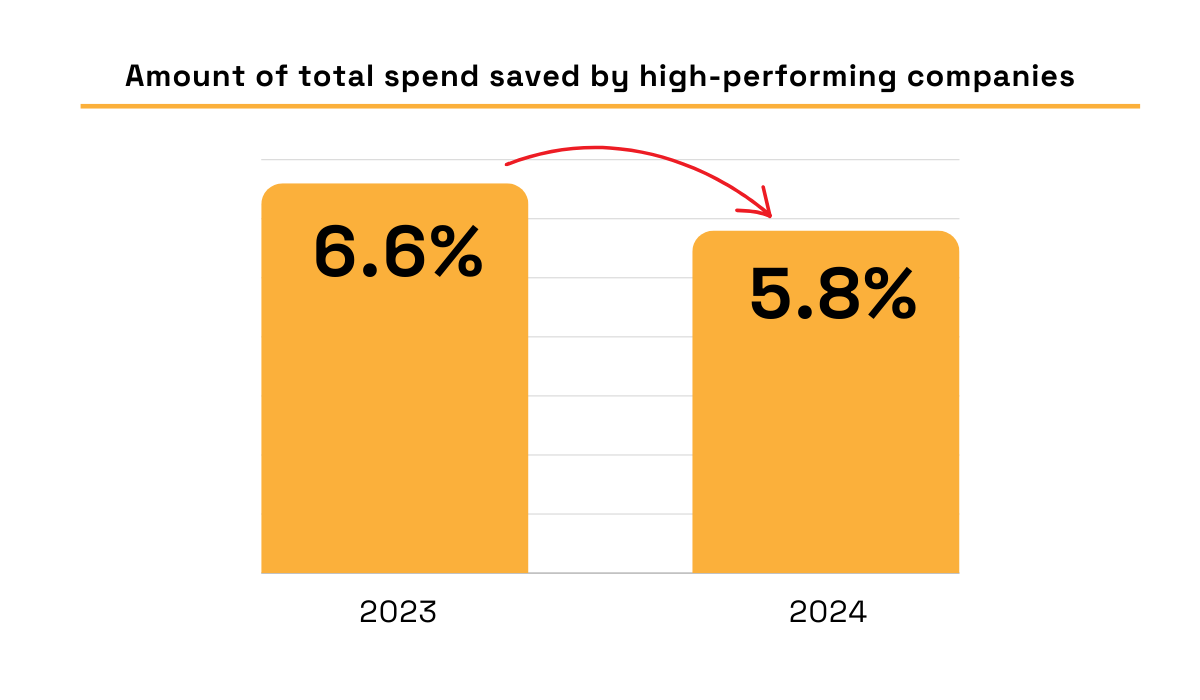

On the topic of technology, we can take a look at market size projections for BSM software.

Given BSM software’s ability to optimize company spending and drive savings, it’s not surprising that we’re seeing rapid growth in this market.

In fact, according to projections by Fortune Business Insights, we can expect dramatic growth in the BSM software market, reaching $57.22 billion by 2032.

Illustration: Veridion / Data: Fortune Business Insights

This growth represents a Compound Annual Growth Rate (CAGR) of 11.8%.

And, while North America is expected to hold the highest market share, the Asia-Pacific region is projected to exhibit the highest growth rate.

The types of solutions expected to see significant growth include:

This surge in growth is driven by the adoption and implementation of innovative AI and automation solutions by leading systems like Coupa, Proactis, GEP, SAP, Ivalua, and JAGGAER, among others.

Clearly, these projections only further demonstrate the value spend management systems bring to organizations.

So, finance and procurement teams should take note and take advantage of this cutting-edge technology to improve their operations.

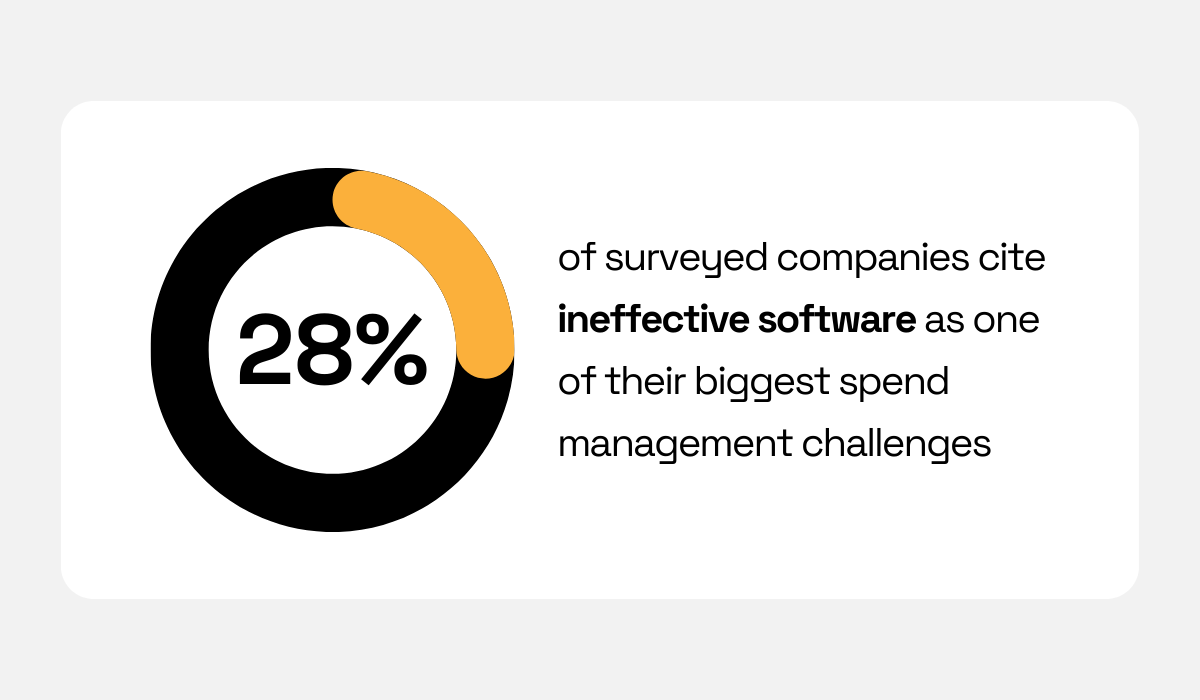

The rise of spend management software has, unfortunately, created some challenges of its own.

In fact, choosing the right software solution can make or break spend management, and a significant portion of organizations still struggle with ineffective systems.

In fact, for nearly one-third of companies, this is one of their biggest issues.

Illustration: Veridion / Data: Payhawk

These insights come from Payhawk’s 2024 Spend Management Pulse Report.

Payhawk surveyed over 100 senior professionals in the US (75%) and the UK (25%) across more than 11 industries with finance (41%), health (8%), education (6%), manufacturing (6%), and services (6%) among the most represented sectors.

Unfortunately, the other top challenges cited in the survey—human error and time wasted on reconciliation—are also closely related to ineffective spend management systems.

But, the silver lining is that choosing trustworthy, reliable spend management systems with the right features can essentially remove three of the biggest challenges faced in spend management.

Let’s continue with another key statistic from Payhawk’s Spend Management Pulse Report.

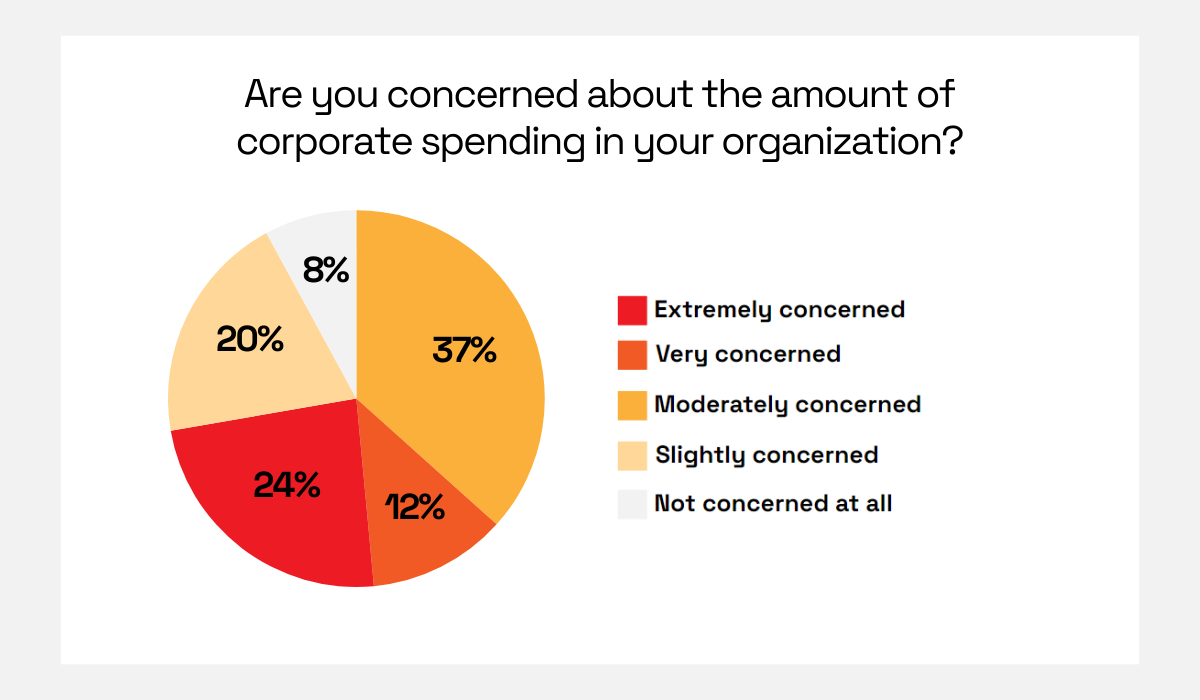

The survey reveals that 36% of respondents are extremely or very concerned about corporate spending in their organization.

Illustration: Veridion / Data: Payhawk

When we combine these 36% with the 37% who are moderately concerned, we see that the vast majority of senior executives are worried about this issue.

It’s important to note that Payhawk surveyed an equal ratio of small, medium-sized, and large companies.

This suggests that corporate spending concerns are widespread, regardless of company size.

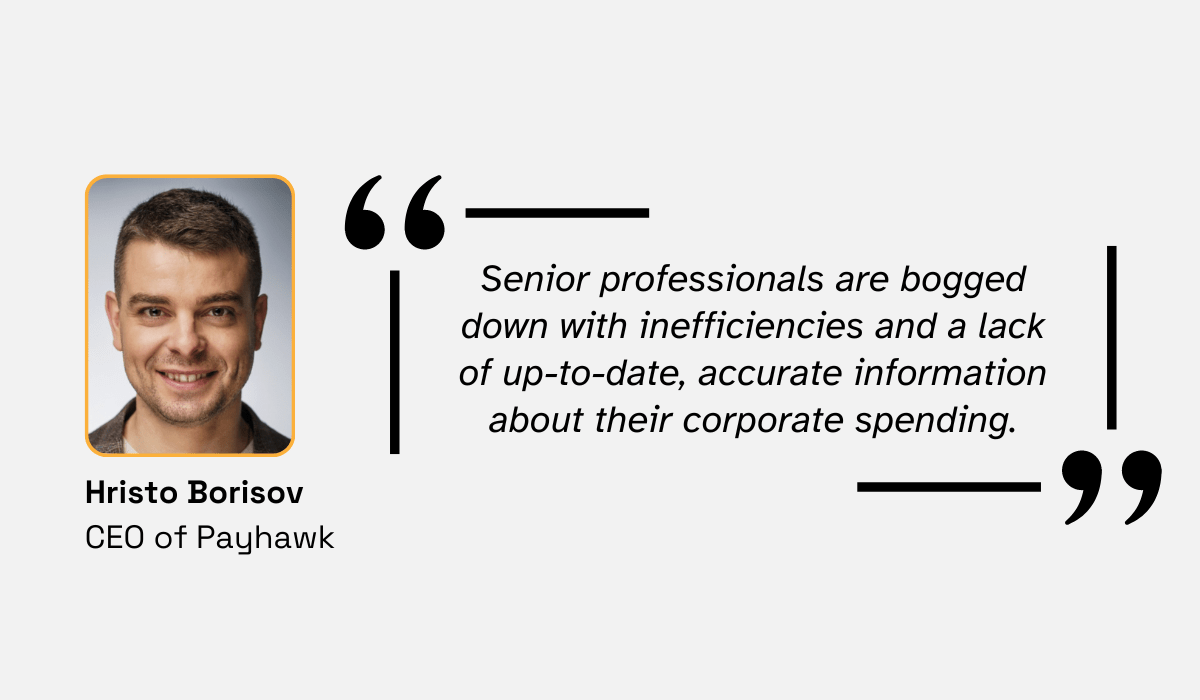

Commenting on the survey results, Hristo Borisov, CEO of Payhawk, states:

Illustration: Veridion / Quote: Payhawk

Borisov’s statement highlights a common pain point: the difficulty of obtaining real-time, reliable data on company spending.

Many organizations still rely on manual processes and outdated systems, making it challenging to track expenses and make informed and accurate spending decisions.

Overall, this statistic clearly stresses the need for more efficient and accurate spend management and spend control practices within organizations to combat this issue.

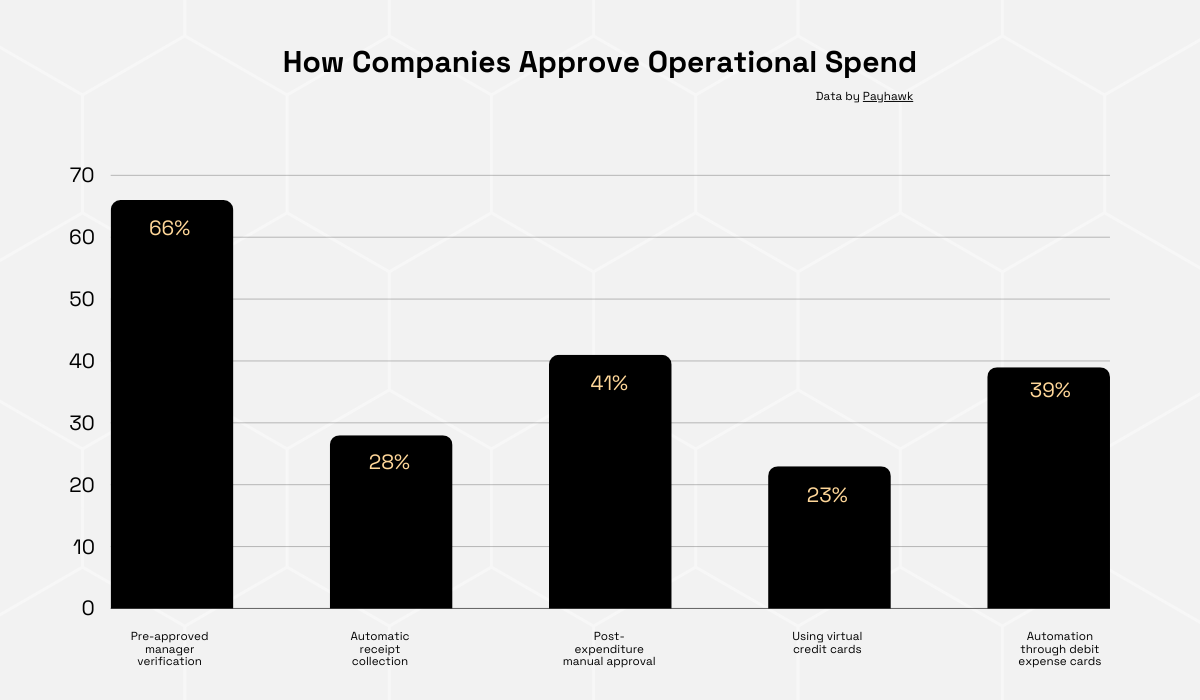

An important part of spend management is the approval process.

To understand potential inefficiencies and shed light on why senior executives worry about corporate spending amounts, Payhawk examined operational spend approval methods, with the top 5 methods shown below.

Illustration: Veridion / Source: Payhawk

As you can see, the top method used by 66% of companies is pre-approved manager verification. This approach involves managers reviewing and approving expenses before they are incurred.

Here’s a brief look at the pros and cons of this method.

| Pros | Cons |

|---|---|

| Ensures strict oversight | Can be time-consuming |

| Prevents unauthorized spending | May cause delays in purchases |

| Allows for budget control | Relies heavily on manager availability |

| Provides clear accountability |

The data confirms that companies often use multiple methods in conjunction, such as post-expenditure manual approvals, where managers or finance teams review receipts after purchases are made.

However, we should really be on the lookout for automated approval systems, which according to Payhawk, are only used by 39% of companies so far.

This method can significantly speed up the approval process while still allowing for manual checks on larger or more critical purchases. Automated approvals also tend to be more accurate and give access to instant reports to help keep everything within budget.

So, while manager verification currently dominates spend approvals, as companies continue to seek more efficient workflows, we may see a shift towards more automation.

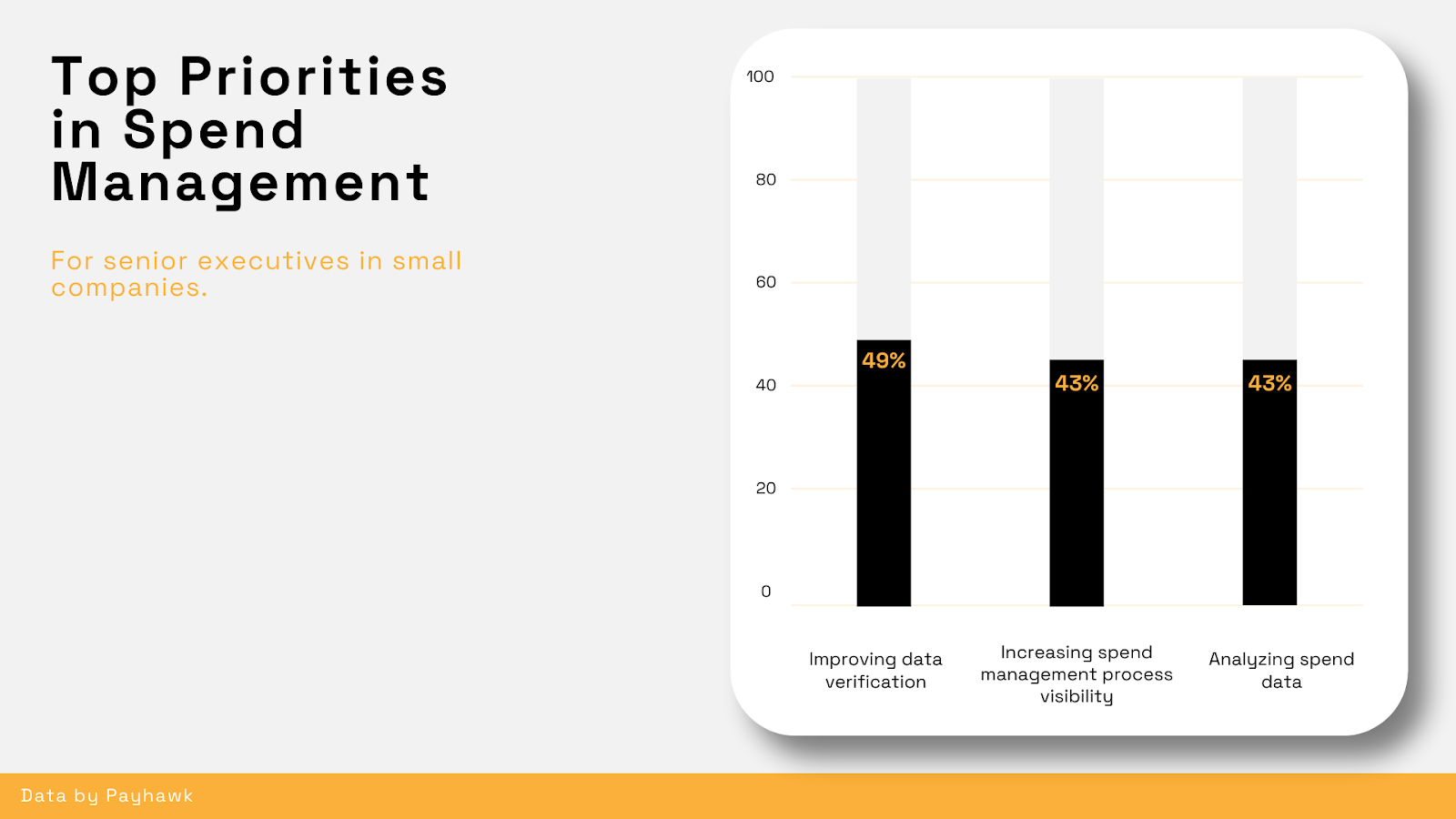

Next, let’s see what senior executives in small companies prioritize to improve spend management effectiveness.

The top three practices, according to Payhawk’s survey data, are illustrated below.

Illustration: Veridion / Data: Payhawk

As we can see, the top priority is improving data verification, with almost half of small organizations citing it as their main focus.

Small businesses might be particularly concerned about data verification due to limited resources and the potential impact of errors on their bottom line. After all, even a small discrepancy can have significant consequences for a company with tight profit margins.

But, even for larger companies, the benefits of prioritizing data verification are substantial and worth considering.

Source: Veridion

In short, verified, accurate data leads to fewer errors, preventing delays and enabling informed decisions about resource allocation, risk mitigation, and cost savings.

For businesses aiming for growth, this translates to a solid foundation for effective spend management and a competitive edge.

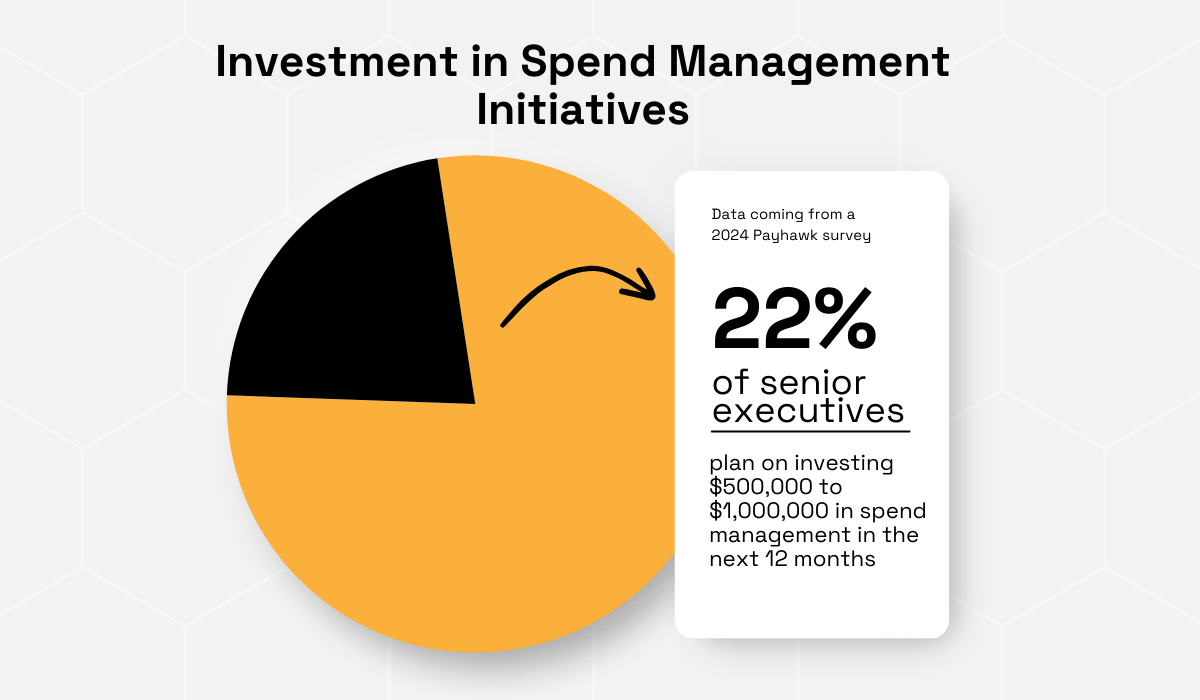

Moving beyond traditional, paper-based spend management requires commitment, both in terms of adopting new practices and financial investment.

That’s why not many companies do it.

In fact, Payhawk’s survey found that only 22% of organizations were planning to invest between half a million and a million dollars in spend management initiatives over the next year.

Illustration: Veridion / Data: Payhawk

Such serious investments can enable organizations to implement new technologies, automate processes, and gain better control over their spending.

But, while this 22% represents a considerable portion when looking at the complete picture, it’s clear that most companies aren’t planning such large investments.

In fact, 10% of surveyed companies said they planned to invest only up to $10,000, and the majority (62%) planned to invest less than $250,000.

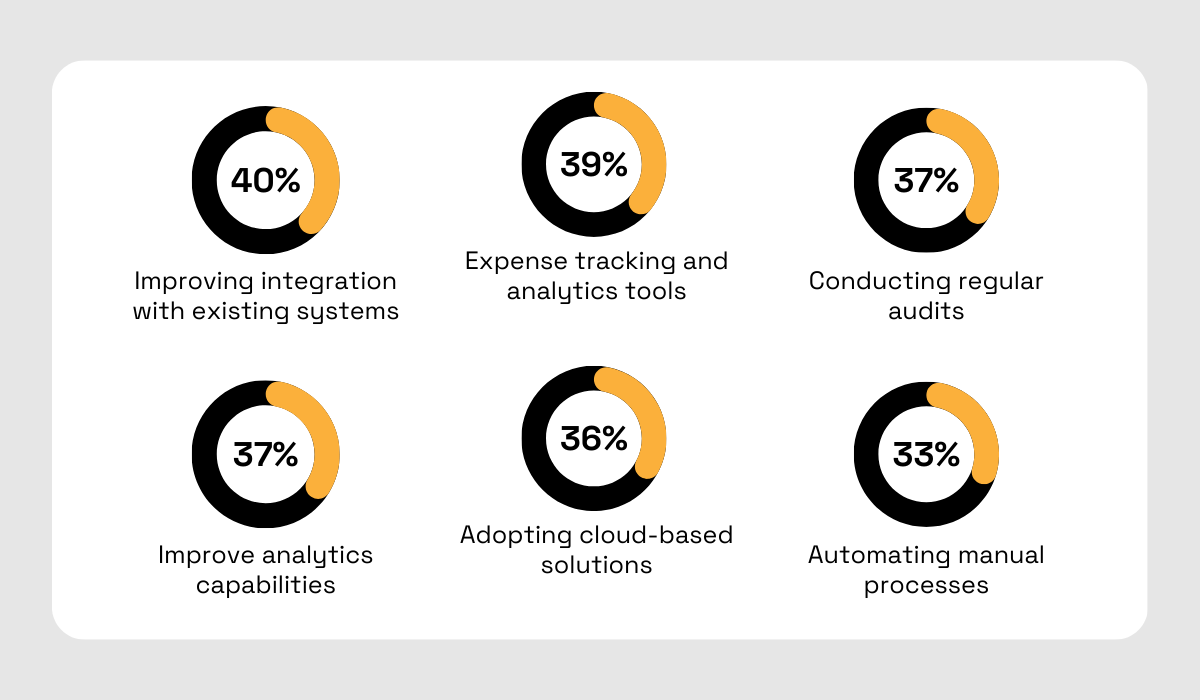

Those who are investing, said they are mostly focusing on these areas.

Illustration: Veridion / Data: Payhawk

As you can see, there’s a mix of technology investments, investments in practices like audits, and a focus on optimizing existing processes.

So, while investment levels vary based on company priorities and resources, the clear trend is that most companies will invest in some spend management initiatives.

Digging deeper into the list of spend management investment areas, we can see that automation is a priority for a third of organizations.

While it’s not the top priority, the benefits of automation, along with the rise of artificial intelligence and machine learning, are gradually making these technologies a significant trend in spend management.

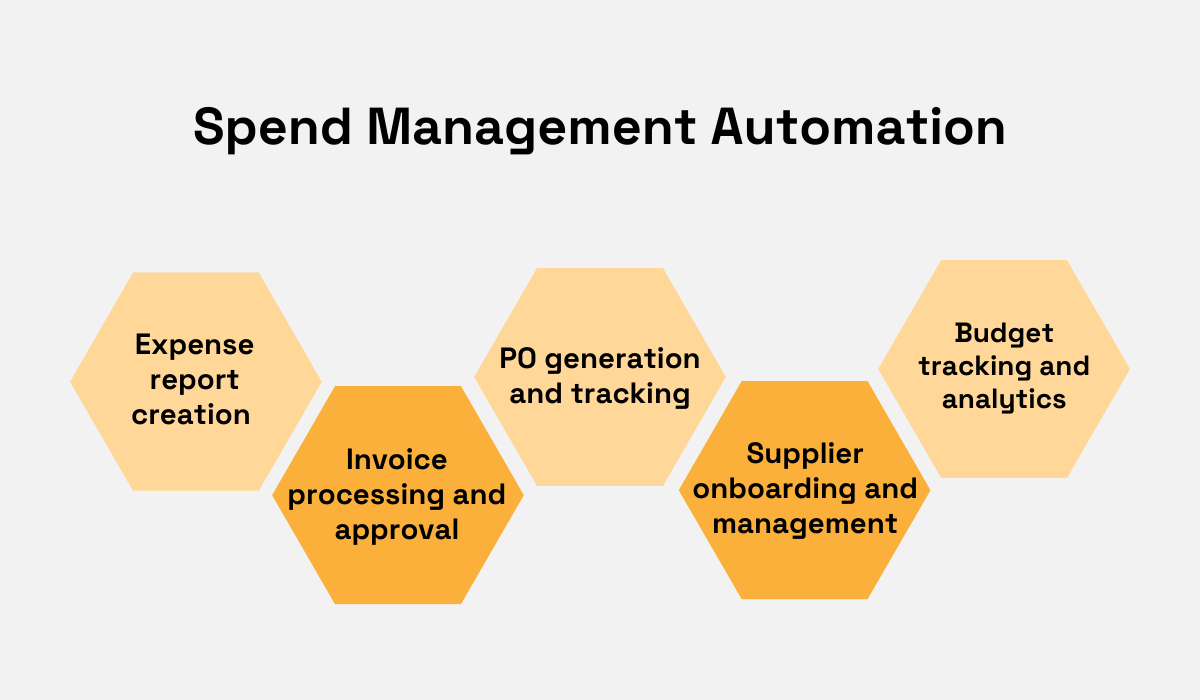

Let’s take a look at some tasks that can be automated.

Source: Veridion

Modern systems can replace manual reporting and purchase order creation, invoice management, and even automate supplier management through spend analysis and compliance tracking.

This replaces error-prone and time-consuming manual work with accurate, efficient automated processes.

There’s also potential for automating entire workflows. Christina Cooksey, head of creative production at Red Antler, a marketing agency in New York, provides an example:

Time savings don’t end with data collection and categorization. Spend management software also can sync with bookkeeping software like QuickBooks to automate a significant amount of accounting functions.

In summary, as automation technology continues to advance, we can expect to see more companies leveraging these tools to streamline their spend management processes.

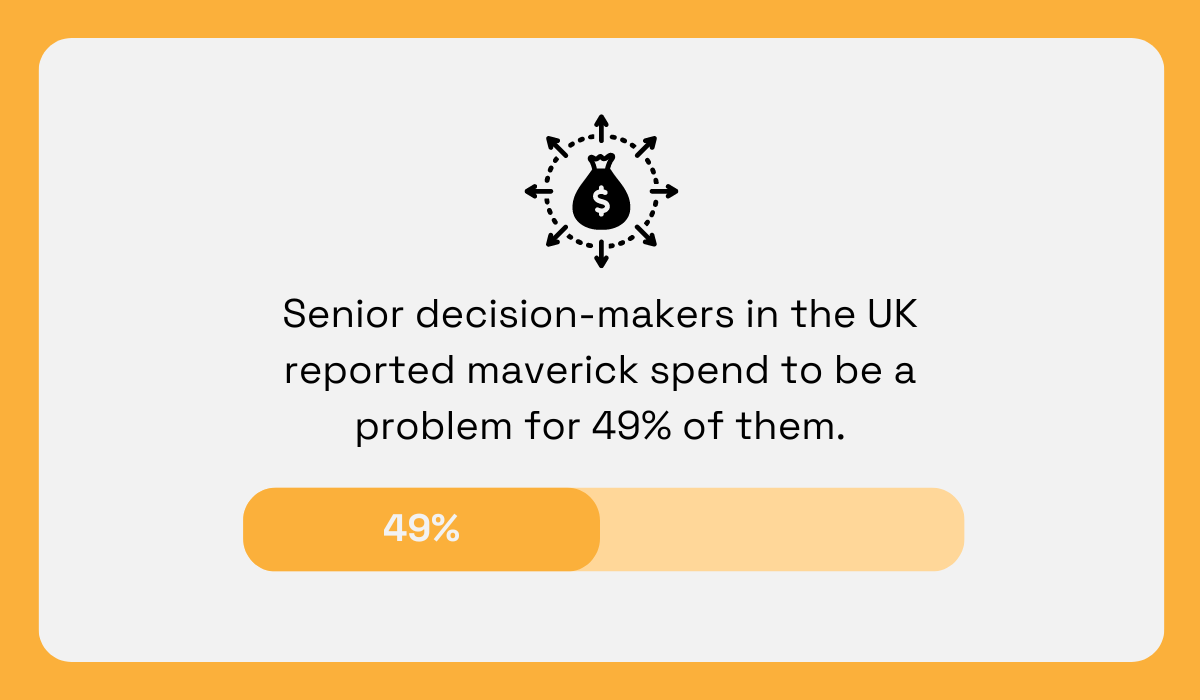

Now, let’s turn to a common issue that many organizations struggle with—maverick spending.

Maverick spend refers to purchases made outside of established procurement processes and contracts. It often involves bypassing approved suppliers, exceeding authorized budgets, or failing to follow purchasing guidelines.

This type of “off-the-books” spending can be a significant problem. In fact, data from OneAdvanced reveals that maverick spend was a concern for 49% of senior decision-makers in the UK in 2022.

Illustration: Veridion / Data: OneAdvanced

Their annual business report presented survey findings from over 5,000 senior decision-makers in the United Kingdom.

Importantly, 46% of respondents were senior managers, 21% were company owners, CEOs, or managing directors, and 19% were directors.

This means the survey captured the perspectives of those directly responsible for managing and overseeing company finances.

The data suggests that organizations are recognizing the need to address maverick spending.

It also serves as a reminder for organizations to assess their own maverick spending practices and tackle this preventable problem.

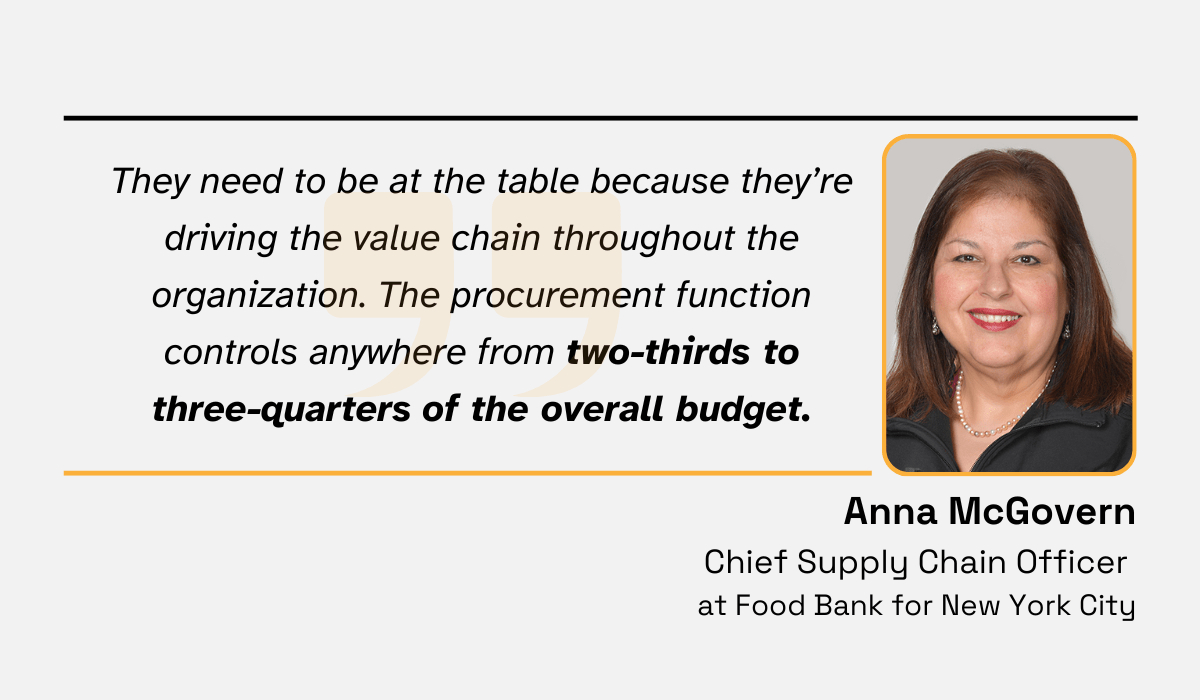

Finally, let’s examine spend management visibility, a crucial aspect that greatly contributes to issues like maverick spending.

We’ll show data from The Economist Intelligence Unit’s survey of 507 finance executives in the US, UK, France, and Germany. These individuals represented various industries, with 75% being CFOs and 25% being corporate finance professionals at or above the Vice President level.

The survey found that a striking 60% of respondents lacked complete visibility into their organizations’ transactions.

Illustration: Veridion / Data: The Economist

This lack of insight can negatively impact entire organizations, potentially leading to overspending, missed cost-saving opportunities, and increased financial risk.

This alarming statistic highlights the urgent need for greater transparency and the breakdown of silos within organizations.

As one Chief Supply Chain Officer, Anna McGovern, points out, one crucial step is connecting procurement and finance departments, and involving procurement professionals in financial discussions and decision-making.

Illustration: Veridion / Quote: Procurify

Ultimately, achieving greater spend visibility requires a cultural shift towards openness and collaboration, as well as investments in tools and technologies that can provide real-time insights into spending data.

By taking these steps, companies become empowered to proactively manage their finances and contribute to the long-term success of the organization.

Throughout this article, we’ve explored various data points and recent trends that paint a picture of how businesses are handling their expenses.

From the growing adoption of digital solutions to the persistent challenges of manual processes, data verification, and visibility issues, we’ve covered quite a bit of ground.

These insights can serve as valuable tools.

You might use them to benchmark your own practices, make a case for new tools or processes, or simply gain a better grasp of the spend management landscape.

Stay informed and proactive, and you’ll be equipped to turn your team into an asset for your company’s spend management efforts.