5 Key Steps of the Strategic Procurement Process

Ready to step up your procurement game?

If so, you’ve come to the right place.

In this article, we dive deep into the five core phases of the strategic procurement process.

We’ll break down each step, highlight their benefits, and share actionable tips to help you ace every procurement stage like a pro.

So, keep reading and get ready to become a better procurement strategist.

At this stage, you’ll be focusing on thoroughly understanding your company’s needs, both current and future, regarding the products or services you intend to procure.

This involves identifying:

Getting this step right is a must. It aligns your procurement activities with the company’s goals, ensuring you hit your targets and achieve the most cost-effective outcomes.

To underscore the significance of accurate needs assessment, let’s consider the retail industry as an illustrative example. The same principles apply across various sectors.

Michael Tomching, founder and CEO of the apparel brand Cycology, explains how a misstep in needs assessment in retail can be quite costly, and even turn out to be a business killer:

“If you’ve got a heap of small-sized products but you’re out of stock of large, which is the one everyone goes for, you’ll lose out on sales and have capital tied up in inventory that’s not moving. It’s of absolutely no value to have heaps of the wrong sizes and it’s a massive risk to cash. The harsh reality is that if you don’t take care of inventory your business will be dead.”

Procuring too much of a product that doesn’t sell is like throwing away money, he elaborates, as you’re not just paying for the products themselves but also for their storage, transportation, and handling.

It’s a surefire way to sink your profitability.

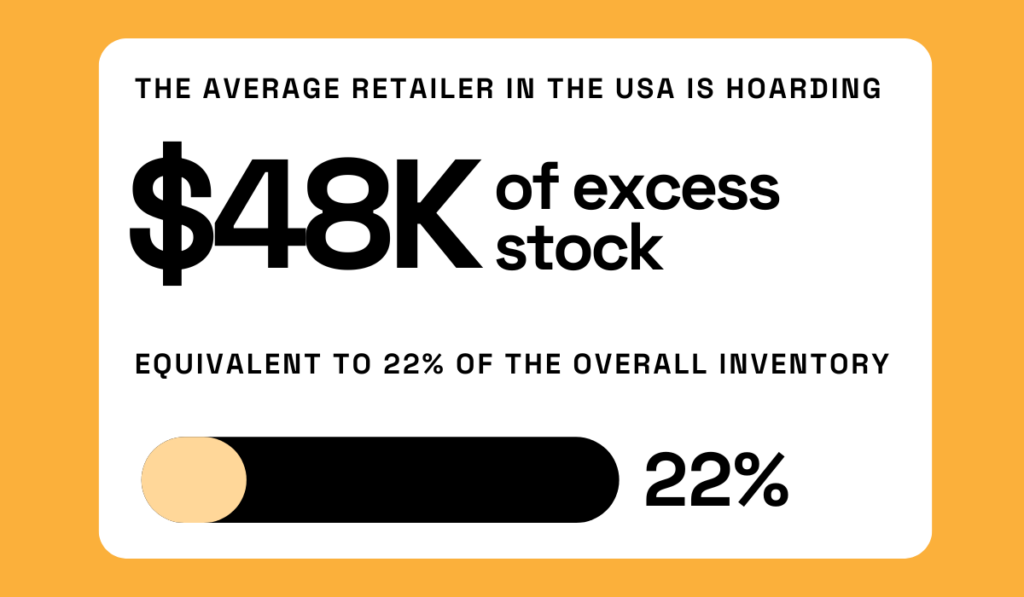

A survey from Inventory Planner has the numbers to back this up. It reveals that 42% of U.S. retailers struggle with overstocking, hoarding an average of $48,000 in excess stock, which is equivalent to 22% of their overall inventory.

Illustration: Veridion / Data: Inventory Planner

However, overstocking isn’t the only issue here.

Understocking can be just as harmful, leading to lost sales opportunities, operational disruptions, and strained supplier relationships due to emergency orders and frequent adjustments.

In both cases, the business loses.

That’s why procurement experts always take this initial phase seriously, no matter the industry they’re in.

They know business needs can change at any moment.

They know that fulfilling those needs is procurement’s main job.

And they know the most important thing about needs assessment—they can’t do it alone.

That’s right. You should always engage stakeholders from different departments within the company, such as sales, accounting, IT, and others when trying to identify internal requirements.

They can provide insights that you might miss on your own, as Marlene Paola Molina, Business Development Manager at Phoenix Calibration, explains:

“Integrating procurement with departments like sales/manufacturing/planning would allow us to plan purchases ahead of time or on time. One of the biggest issues procurement faces is working with too many urgent requirements, which leads to unplanned or over-budget orders […] Knowing about new product developments, or sales projections, season’s changes, could help a lot.“

Essentially, each department’s input should shape your procurement strategy, ensuring company needs are met and operations keep running smoothly.

So, regularly hold meetings with your colleagues, involve everyone, and think strategically about both the present and the future.

By doing so, you’ll surely nail this very first step of strategic procurement and help support overall business goals in the process.

Once you’ve got a clear idea of what you’re after, you’ll need to figure out who to get it from, and how to do so in the most cost-effective way.

This is where market research comes into play.

It involves gathering extensive data (also known as market intelligence) on market dynamics, potential suppliers, pricing trends, products, and other elements that could have an impact on your procurement process.

The goal?

To better understand the supply landscape, identify possible risks and opportunities, negotiate better contracts, and optimize your sourcing strategies.

Annie Pettit, an independent insights consultant, doesn’t mince words when it comes to the importance of market research.

Illustration: Veridion / Quote: Stravito

While she admits it won’t magically guarantee a 100% success rate, it’s your best shot at getting close.

Neglect it, on the other hand, and you’ll surely fail.

This is especially true today when markets are increasingly unpredictable, supply chains are getting more complex by the minute due to globalization, and disruptive technologies are reshaping industries almost beyond recognition.

Relying on instincts or assumptions simply doesn’t cut it anymore.

Ingmar Mester, director of supplier management and sustainability at Hapag-Lloyd, echoes this sentiment.

Illustration: Veridion / Quote: Craft

In procurement, being well-informed is everything, no doubt about that.

But now, you’re probably wondering: Where can I find this valuable market intelligence?

Don’t worry, we’ve got you covered.

Below, you’ll find a table detailing six components of market intelligence, along with their definitions and corresponding sources.

Let it serve as your roadmap during the market research phase.

| COMPONENT | DEFINITION | SOURCE |

|---|---|---|

| Supplier Intelligence | Suppliers’ capability, reliability, financial stability | Direct communication with suppliers, clients who worked with them, onsite audits, third-party databases |

| Market Intelligence | Market dynamics, size, growth rate, trends | Industry publications, economic databases, market research reports |

| Competitive Intelligence | Information about your competitors; their strengths and weaknesses, market positioning | Case studies, market share reports, industry reports, website or blog, social media |

| Price Intelligence | Price fluctuations, pricing strategies | Market analysis, market intelligence reports, price tracking tools, price intelligence software |

| Compliance Intelligence | Suppliers’ trade records, certifications, adherence to legal standards | Industry regulations, government databases, certifications |

| Product Intelligence | Product development, pricing strategy, performance metrics | Your product lifecycle, competitors’ products, their product development strategies, pricing approaches |

And once you’ve completed this step, you’ll emerge not just better-informed, but better equipped to conquer all the subsequent phases of the strategic procurement process.

Now is the time to delve deeper into your potential supplier’s data and thoroughly assess their pricing, quality, reliability, capacity, past performance, and adherence to ESG standards.

Taking the time to do this step right will help you discover truly dependable partners who will stand by you for the long haul, and minimize supplier risk down the line.

Think more consistent product or service quality, punctual deliveries, competitive pricing, and resilience during disruptions.

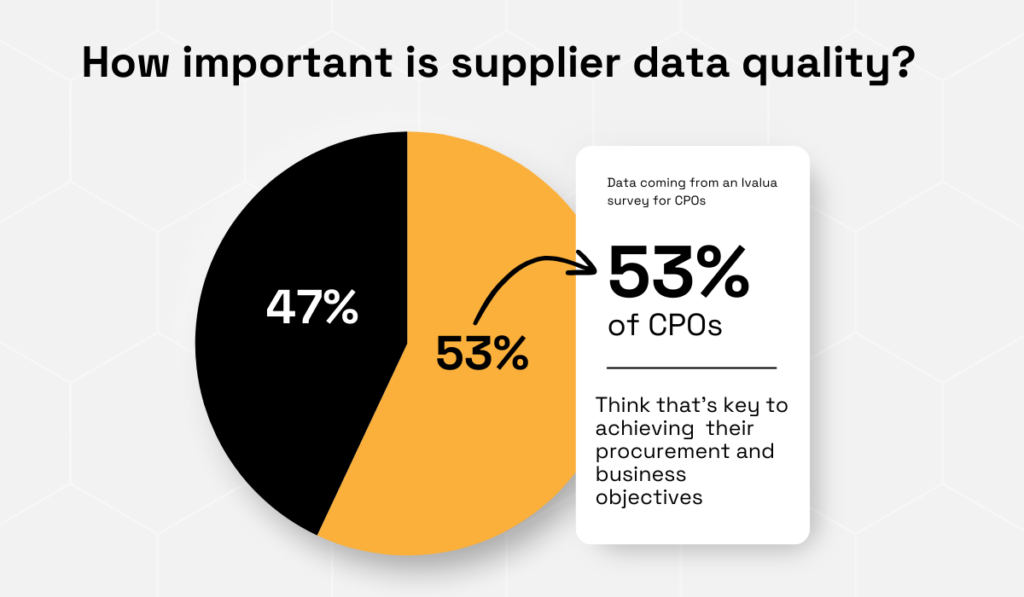

An Ivalua survey suggests that more and more procurement professionals are becoming aware of these perks.

As it turns out, 53% of them agree that improving the quality of their supplier data is pivotal for attaining their business and procurement goals.

Illustration: Veridion / Data: Ivalua

They seem to understand the very simple, yet key formula of procurement: better suppliers equal better procurement outcomes.

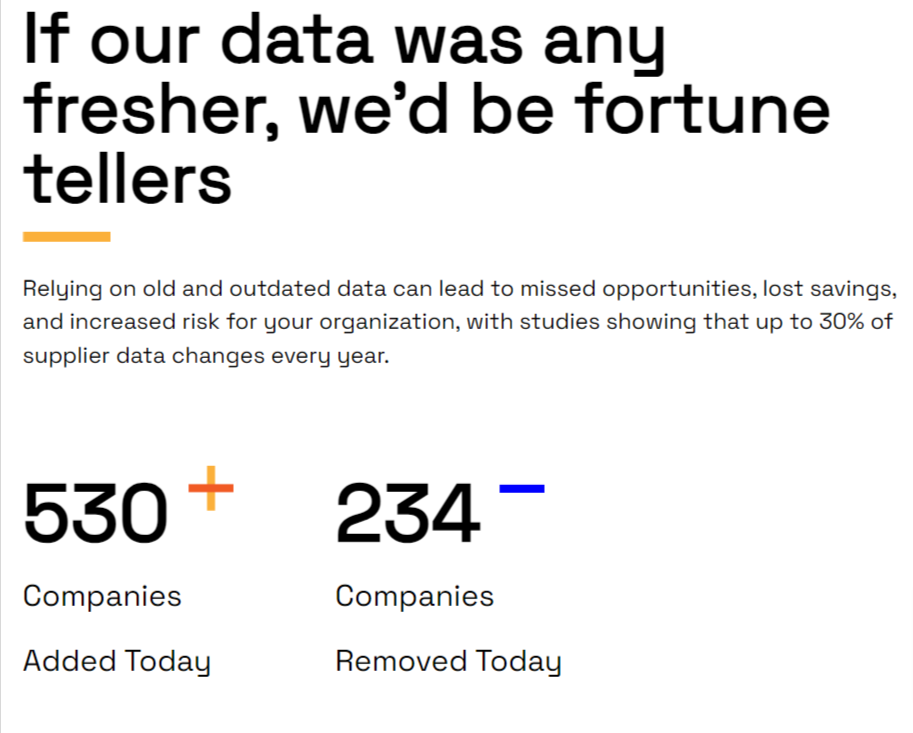

However, to nail this phase, you’re going to need only the most up-to-date, accurate, and detailed insights.

Sure, you may try to obtain them through traditional methods such as manual desktop research or networking, but you’ll soon find out that the data they yield is neither the freshest nor most thorough.

Not to mention these methods are quite time-consuming and labor-intensive.

Fortunately, there are now far more efficient and reliable tools available.

Take our AI-powered supplier sourcing tool, Veridion, for instance.

It combs through a database of millions of suppliers via our real-time APIs until it identifies the right suppliers perfectly tailored to your needs.

This is what our Search API looks like, for example:

Source: Veridion

No matter the type of product or service you need, or how niche they may be, Veridion will deliver.

The best part?

We update our data weekly so that you can always stay well-informed about your suppliers and the products or services they provide.

Source: Veridion

Not to toot our own horn here, but manual sourcing methods simply pale in comparison.

At the end of the day, why would you want to enter into a business relationship with suppliers that don’t align with your needs, philosophy, or goals?

Such partnerships can only lead to inefficiency, disappointment, stress, and, ultimately, damage to the company.

That’s why this step is so important.

It helps ensure you find the most reliable suppliers who will eventually evolve into strategic allies, long before the ink touches the first contract.

Now that you’ve chosen your suppliers, it’s time to negotiate.

During this phase, you’ll define terms and conditions, including pricing, delivery schedules, payment terms, as well as quality standards, and then finalize contracts to formalize the agreement.

Nicolas Walden from The Hackett Group offers some valuable advice for future, strategic negotiators:

“Strategic negotiations allow both parties to win, and we do this through using facts to understand, then to shift each party’s interests, to a joint position where each party receives a benefit or gain. This strategic, interest-based approach is preferred over more traditional position-based approaches where one party to the negotiation wins and the other loses as we attempt to shift people to our preferred position.”

He mainly advocates for the win-win approach where both the supplier and buyer benefit from the agreement, which establishes the groundwork for a productive, long-term partnership.

Sure, focusing only on your own interests might yield some short-term advantages, but real procurement experts know that satisfying both parties’ needs can lead to more sustainable partnerships, improved supplier relations, and even better terms and conditions in the future.

Now, some inexperienced procurement professionals will incorrectly assume that this stage requires the least amount of research and work.

However, as Mark Raffan, negotiation trainer and CEO of Negotiation Ninja, will tell you, that’s certainly not the case.

Illustration: Veridion / Quote: Art of Procurement

Without proper preparation, you risk weakening your negotiation position, making it challenging to secure favorable terms or identify opportunities for cost savings.

Plus, it’s not a good look, either. A lack of preparation can considerably undermine your credibility and that of your team, potentially affecting your future collaborations.

The good news is that, if you completed previous steps diligently, you’ll already be well-prepared for this process.

Just remember to try to build rapport during the negotiation, be flexible while staying firm on the non-negotiables, and leverage your strengths, whether it’s your volume of business, market position, or alternative suppliers.

As Chester L. Karras, a renowned negotiation expert and founder of Karrass, a company specializing in negotiation training programs, once famously put it:

“In business, as in life, you do not get what you deserve, you get what you negotiate.”

So make sure you negotiate the best possible prices, the most favorable delivery terms, and the highest quality standards, all while laying the foundation for fruitful relationships with your suppliers.

You’ve completed all your market research, negotiated optimal terms with your suppliers, and finalized all necessary paperwork.

This must mean your work is finally finished, right?

Not quite.

Now it’s time to start monitoring your suppliers’ performance. This will ensure all contractual obligations are met, help you nip any potential risk or disputes in the bud, and keep operations running smoothly.

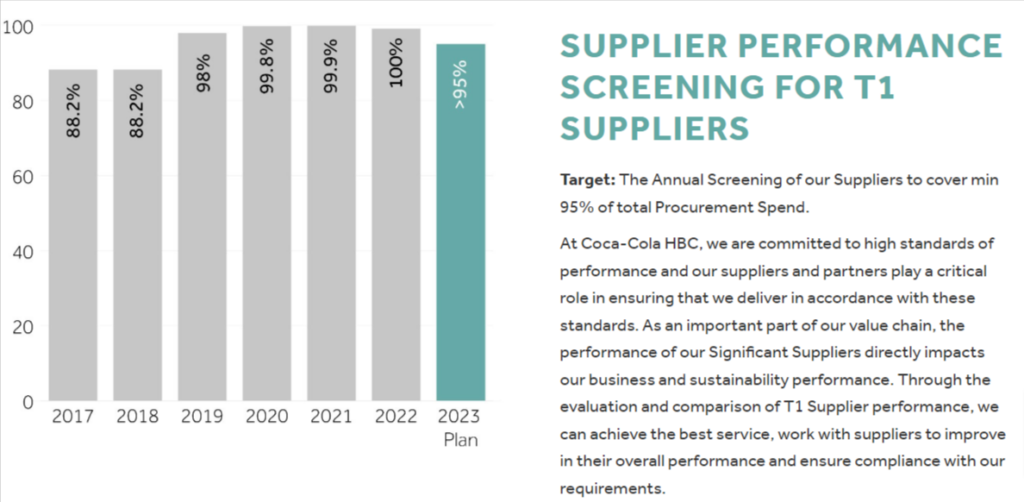

Take a cue from Coca-Cola, renowned for its diligent management of T1 suppliers.

With 95% of their total procurement spend allocated to annual supplier screenings, they maintain rigorous standards, ensuring full transparency, top-tier service, and quality assurance.

Source: Coca-Cola

That way, they protect their reputation, keep providing superior products to their customers, and maintain successful operations.

So, how exactly do you go about monitoring supplier performance? What KPI should you pay attention to?

Here are some of the most common ones:

These metrics provide a clear view of your suppliers, highlighting both their strengths and weaknesses.

Armed with this insight, you’ll always know when it’s time to take corrective action through communication, collaborative problem-solving, and Performance Improvement Plans (PIPs), to get your supplier relationships back on track.

However, let’s face it: monitoring these metrics manually, with tools like spreadsheets, can quickly become overwhelming and time-consuming.

Given your already busy schedule, finding time for this extra work might not seem worth the effort.

Fortunately, there’s a solution.

Systems like supplier relationship management (SRM) software, for example, compile all relevant supplier data automatically, making the process of performance tracking that much easier, faster, and more accurate.

Plus, these solutions can also analyze the data, providing you with clear, actionable insights through customized reports.

Some platforms even issue alerts if supplier efficiency drops below predefined levels, ensuring you’re informed about what’s going on with your partners in real time.

It’s no wonder, then, that 64% of CPOs now use technology for supplier performance management.

Illustration: Veridion / Data: The Hackett Group

It’s the most effective way to gain those valuable insights—insights that help ensure contracted suppliers meet quality, timeliness, and cost standards while mitigating risks and nurturing long-term partnerships.

Mastering strategic procurement isn’t a walk in the park, but it’s far from impossible.

With the right digital tools, in-depth market and supplier research, and strategic supplier negotiation, you can definitely unlock incredible benefits for the entire business.

In any case, it seems like procurement professionals today face a crucial choice.

They can either stick with short-term gains and cost-cutting, keeping the procurement function tactically limited, short-sighted, and reactive.

Or they can adopt a more strategic approach, following the necessary steps to improvement, and transform the function into a valuable business partner that delivers long-term value.

Which path will you choose?