Supplier Intelligence: The Ultimate Guide

Key Takeaways:

Have you ever wondered how industry giants like Toyota, Unilever, and Siemens make the right procurement decisions and manage risk across tens of thousands of suppliers?

How do they develop effective negotiation strategies? And how do they anticipate potential disruptions?

The short answer: supplier intelligence.

In this article, we’ll explore everything you need to know about it—from key use cases to the best methods for gathering supplier insights.

Get ready to boost transparency in your own supply chain and manage suppliers as effectively as the best in the industry.

Supplier intelligence encompasses all the critical insights into suppliers’ capabilities and potential risks that procurement professionals need to make informed, data-driven decisions.

It’s more than just a vendor’s pricing or product specifications. Supplier intelligence covers a wide range of factors, from ESG performance to financial health and beyond.

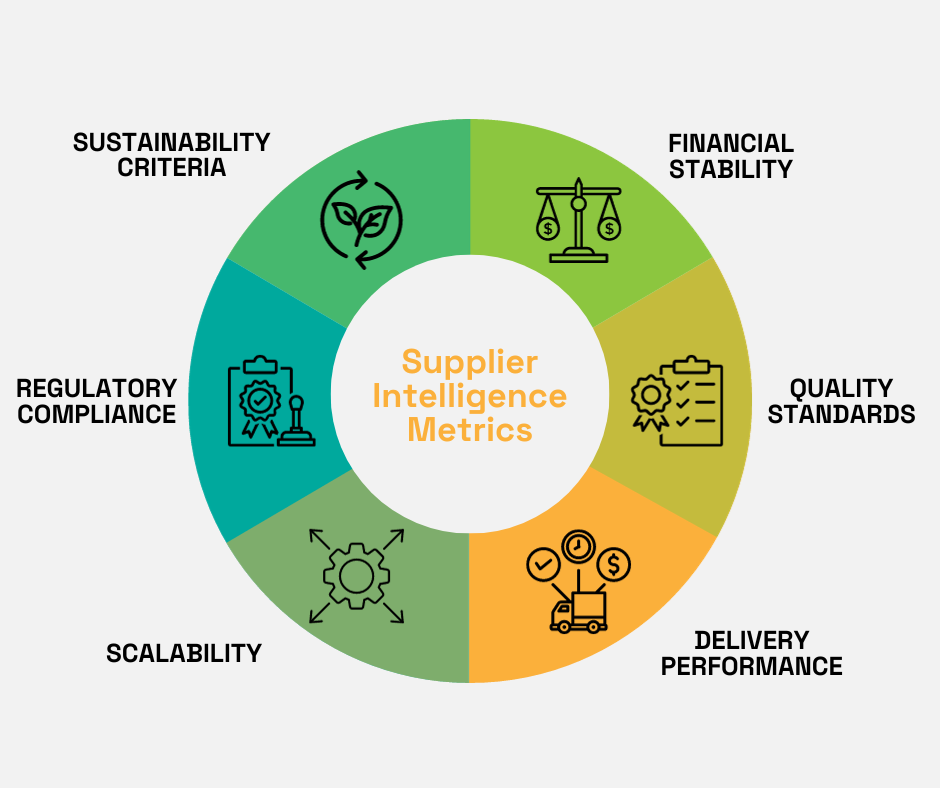

Below, you’ll find an overview of all these key elements.

Source: Veridion

But why is this information so important anyway?

Simple: without it, sourcing, evaluating, and monitoring suppliers becomes incredibly difficult, if not impossible.

It becomes a guessing game.

And when you’re in the dark, you risk partnering with unreliable suppliers, exposing your business to major disruptions.

Ingmar Mester, Director of Supplier Management and Sustainability at Hapag-Lloyd AG, a global shipping and container transportation company, agrees.

He maintains that you need absolute transparency in order to find trustworthy partners.

“It’s no longer enough just to know the financial rating of the supplier. You need to know a lot more about their operational capabilities, their plans, and you have to engage with them differently.”

And he’s absolutely right.

Only with a 360-degree view of a supplier can you truly assess their long-term potential as a partner.

And that’s precisely what supplier intelligence provides.

Now that we’ve covered what supplier intelligence is, let’s explore the specific processes where you can apply it for better outcomes.

Since supplier intelligence provides a complete view of suppliers’ financial health, compliance, and capacity, it enables you to identify those with a strong track record and stability.

This, in turn, helps you find the best fit for your company—one that drives success rather than hinders it.

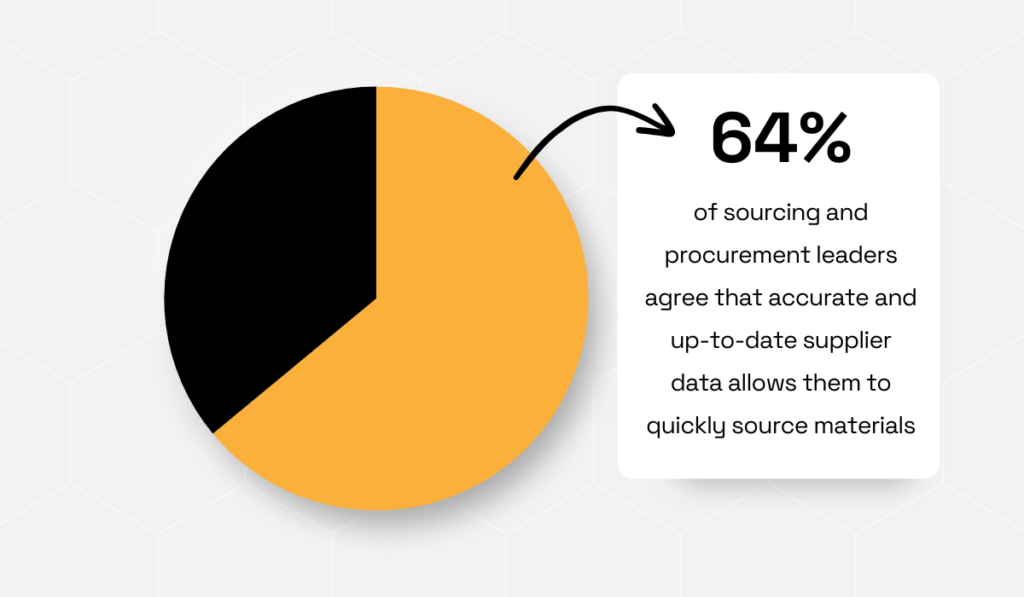

According to the 2022 TealBook survey, procurement professionals agree that supplier intelligence significantly boosts sourcing efficiency.

Nearly two-thirds (64%) of them state that accurate, up-to-date vendor data allows them to quickly source materials.

Illustration: Veridion / Data: TealBook

Why?

Because having the right information makes it infinitely easier to find the right suppliers.

This is especially true if you’re not focused only on finding the most cost-effective vendors, but looking for a long-term, strategic partner that aligns with your broader goals.

Take Northvolt, for example.

This Swedish battery manufacturer, specializing in lithium-ion technology for electric vehicles, prioritizes sustainability when sourcing cathode battery materials.

That’s why they dedicate so much effort to gathering the right data to ensure their suppliers meet strict ESG criteria.

Here’s how the company describes the process on its website:

Illustration: Veridion / Quote: Northvolt

This entails evaluating how suppliers control risks, track materials in production, and verify disclosed supply chain maps against purchasing records.

Northvolt leaves nothing to chance when selecting suppliers—and if you want long-term resilience and agility, neither should you.

This is where supplier intelligence comes in, showing you everything you need to know about suppliers so that you can partner with ones that perfectly align with your unique objectives.

If you want the upper hand when negotiating with suppliers, you absolutely need supplier intelligence.

By providing rich performance data, it highlights areas where suppliers may need improvement, such as delivery times or product quality, as well as potential hidden costs.

This gives you leverage in negotiations, helping optimize contracts and secure more favorable terms around quality and service levels.

Marc Kloepfel, CEO of procurement consultancy Kloepfel Group, puts it best:

Illustration: Veridion / Quote: LinkedIn

That’s right: supplier intelligence offers a detailed profile of each vendor, outlining their strengths, weaknesses, and threats.

Armed with those insights, you can more easily tailor your negotiation strategy.

Take Toyota, for example. The company takes a highly data-driven approach to negotiations.

According to Toyota Times, the company regularly revises supplier pricing while considering their capabilities as well:

Illustration: Veridion / Quote: Toyota Times

However, Toyota doesn’t use supplier data just to negotiate lower prices.

They also use it to determine when not to push for cost reductions.

For instance, recently, recognizing the financial strain on many suppliers due to rising costs, Toyota chose to hold off on price negotiations.

Kazunari Kumakura, Toyota’s Purchasing Group Chief Officer, explained:

Illustration: Veridion / Quote: Reuters

That’s because negotiations aren’t just about cutting costs—they’re about building long-term value.

Sometimes, you have to push hard. Other times, stepping back is the smarter move.

The key to making the right call every time?

Insight into suppliers’ capabilities and risks—in other words, supplier intelligence.

The terms may have been negotiated and contracts signed, but you still need supplier intelligence to monitor supplier performance.

That way, you can spot issues early and take corrective action to minimize risk and disruptions.

Too often procurement assumes that once good suppliers are selected, regular (re)evaluations aren’t necessary.

Roman Belotserkovskiy, partner at McKinsey & Company, warns this is a big mistake, especially in today’s volatile times:

“Some worked with a single, reliable supplier [of key inputs] for 20 or so years but were suddenly presented with steep price increases or delivery cutbacks due to the supplier’s capacity constraints. Businesses have been disrupted as a result.”

Continuous supplier monitoring is the solution to such problems.

By gathering data on various aspects of suppliers’ business activity, you become much better equipped to proactively address problems in the making.

Unilever, for instance, diligently monitors palm oil suppliers’ ESG performance to safeguard its deforestation-free supply chain target.

Martin Huxtable, Unilever’s Global Procurement Director Sustainability & Surfactants, explains what kind of data they use:

Illustration: Veridion / Quote: Dialogue Earth

This entails certifications like the RSPOs, Global Forest Watch Pro, World Resources Institute (WRI) data, as well as data from Earthqualiser, Google Earth Engine, and more.

This data is further enriched by supplier-declared data, audits, and industry frameworks like the No Deforestation, No Expansion on Peat, and No Exploitation Implementation Reporting Framework.

Essentially, at Unilever, nothing flies under the radar.

It’s very clear they understand that you can’t fix what you don’t track.

But guess what?

You also can’t effectively track if you don’t have reliable data sources and gathering methods.

Supplier intelligence can be gathered in many different ways. Let’s review some of the most common ones.

Desk research involves manually gathering and analyzing supplier intelligence from publicly available sources, such as company websites, social media, and customer reviews.

Below are some common sources used in this type of research.

Source: Veridion

This is the most straightforward and budget-friendly method, which is why so many businesses rely on it.

But here’s the catch: it can get incredibly time-consuming and often delivers outdated or incomplete information, putting you at risk.

How bad can it get?

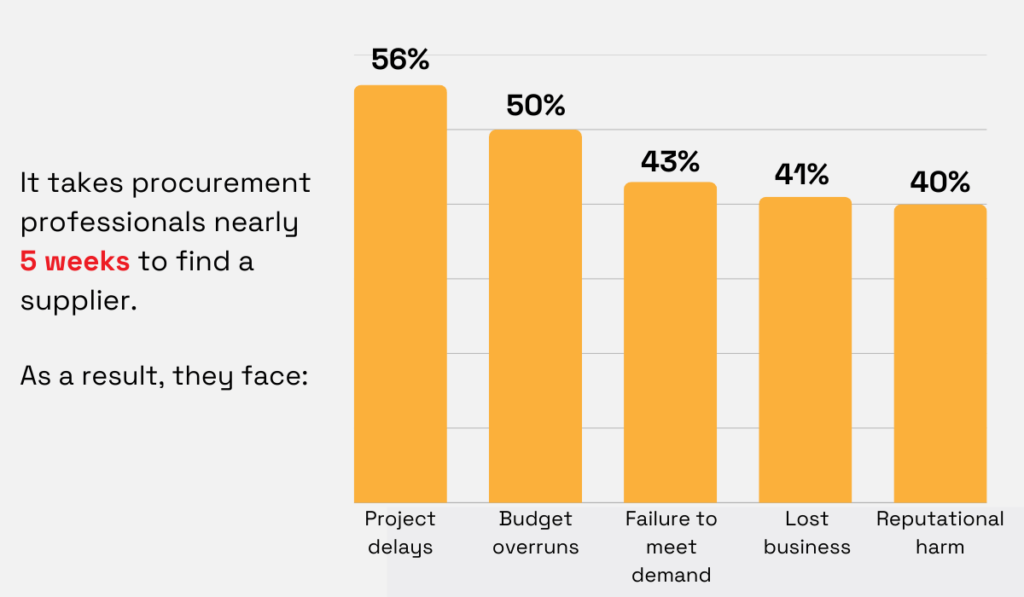

According to the TealBook survey we mentioned earlier, sourcing and procurement executives spend nearly five weeks searching for a supplier.

The consequences?

Too many to count, from operational disruptions and budget overruns to reputational damage.

Illustration: Veridion / Data: TealBook

Yes, all of this—just because gathering data and selecting a supplier took too long.

That’s exactly what you risk with desk research.

That said, if you carefully vet your sources, and use the data you find wisely, it can still be a powerful and cost-effective approach, especially as a starting point in your research.

And you can always supplement it with additional methods to boost accuracy and depth if necessary.

Another option is to request data directly from suppliers through surveys, face-to-face interviews, RFx processes, and similar tools.

This approach allows you to collect more detailed and up-to-date information compared to desk research.

For example, Siemens follows this strategy when assessing supplier ESG performance.

The company partners with ctrl+s, which hosts the external carbon management platform supplier+s.

Siemens invites selected suppliers to complete the Carbon Web Assessment (CWA) on supplier+s, which helps them understand vendors’ carbon emissions and reduction efforts.

You can learn more about it in the video below:

Source: Siemens Knowledge Hub on YouTube

Gathering supplier intelligence directly from suppliers makes sense—they have the most relevant information, right?

Well, sometimes.

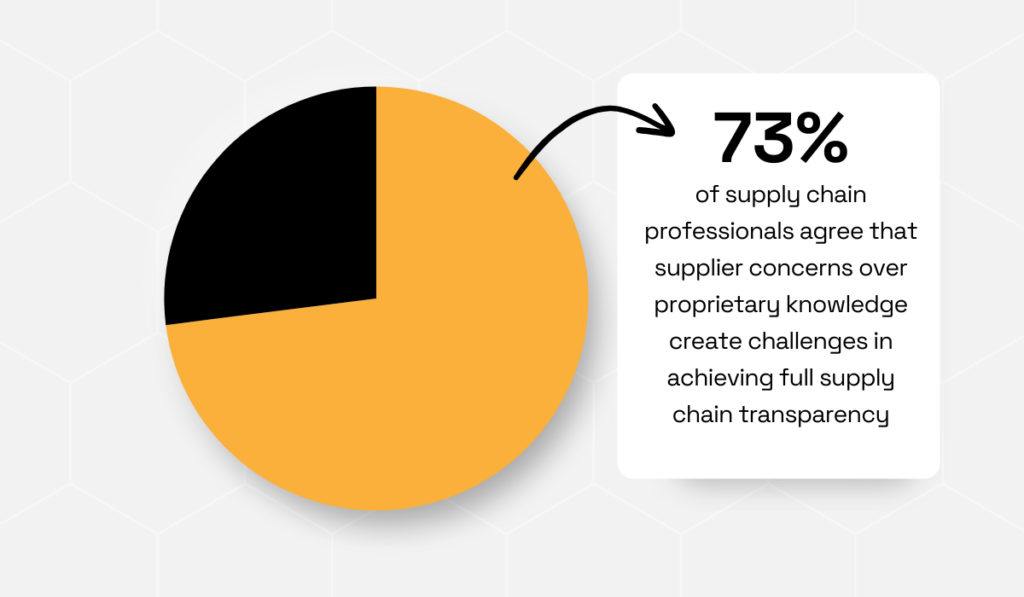

When sourcing data directly from suppliers, there’s always a risk of biased or incomplete data.

After all, not all suppliers will be willing to share sensitive business information.

In fact, a 2023 WTW survey found that 73% of supply chain professionals agree that supplier concerns over proprietary knowledge create challenges in achieving full supply chain transparency.

Illustration: Veridion / Data: WTW

So, while this method can be incredibly valuable, it only works if you have a strong, trust-based relationship with your suppliers.

If not, you might need to explore other ways to get the insights you need.

If you need deep, broad, fresh, and accurate supplier intelligence—and you need it fast—AI is the way to go.

Did you know McKinsey found that AI-powered tools cut the time to find new suppliers by more than 90%?

Illustration: Veridion / Data: McKinsey & Company

That’s because AI processes massive amounts of data at speeds no human could match, giving you instant access to insights you’d never find on your own—all with minimal effort on your end.

Take our AI-driven big data platform, Veridion, for example.

Using advanced machine learning models, Veridion scans billions of websites and processes petabytes of data every week.

The result?

A vast, continuously updated database of millions of suppliers and products worldwide.

Source: Veridion

But this isn’t just a list of company names and locations.

Veridion delivers rich, in-depth business profiles—from ESG performance to financial risks—giving you everything you need to make smarter decisions.

You just type in what you’re looking for using plain, natural language, and Veridion delivers.

Traditional desk research simply can’t compete with AI in speed, precision, depth, or breadth.

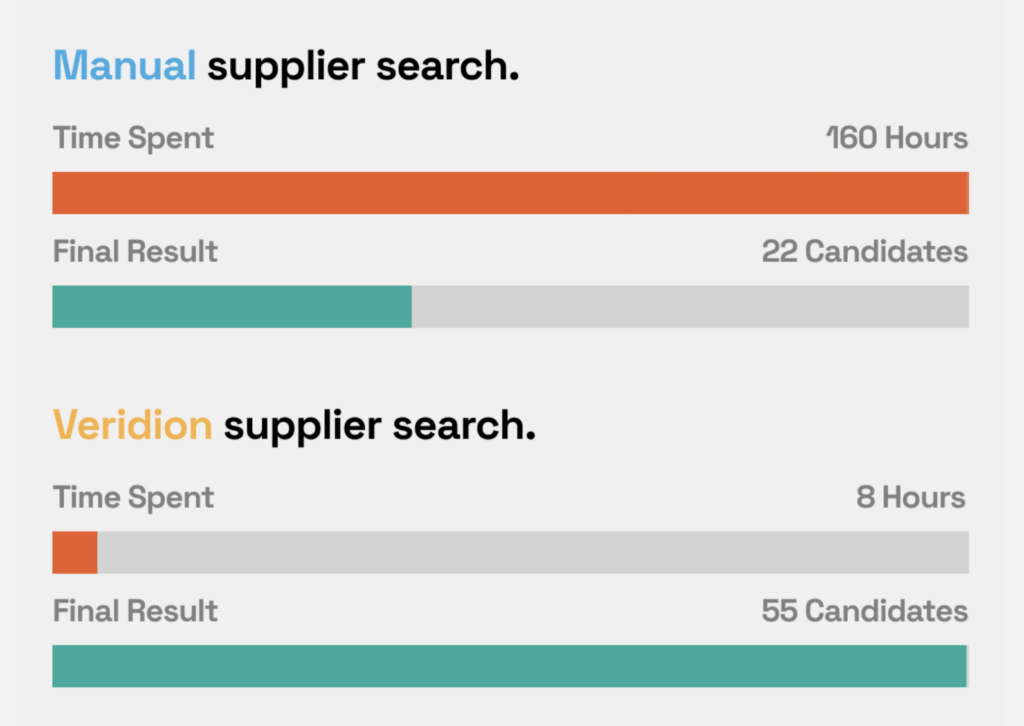

To illustrate, the graph below compares the time and results of a supplier discovery initiative conducted by two full-time employees versus a Veridion-powered search by a single data analyst.

Source: Veridion

As you can see, AI doesn’t just work faster—it delivers exponentially better results.

So, whether you’re looking for new suppliers or enriching your existing supplier records, it’s time to give AI a serious thought.

If you want the best possible data, it’s your safest bet.

In today’s fast-moving and increasingly complex supply chains, relying on outdated or incomplete supplier information is a risk you just can’t afford.

Whether you’re aiming for cost efficiency, sustainability, or strategic supplier relationships, fresh, precise supplier intelligence is at the center of it all.

It empowers you with the insights you need to source more strategically, negotiate effectively, and mitigate risks proactively.

Simply put, it’s that missing piece that can add significant value to your business.

So, do your research, analyze the data, and apply what you’ve learned.

You’ll be amazed at the benefits you’ll unlock.