The Full Guide to Supplier Segmentation

Key Takeaways:

How well do you know your suppliers?

With most organizations working with a variety of suppliers—whether for long-term partnerships or one-time projects—it’s essential to understand which relationships truly impact your bottom line.

That’s where supplier segmentation becomes a game-changer.

So if you’re looking to minimize risks, maximize value, and strengthen supplier interactions, this ultimate guide is for you.

Supplier segmentation is a strategic process that helps you categorize suppliers based on specific criteria and their importance to your core operations.

By evaluating suppliers you can determine the right amount of effort for each supplier relationship, and then group them accordingly.

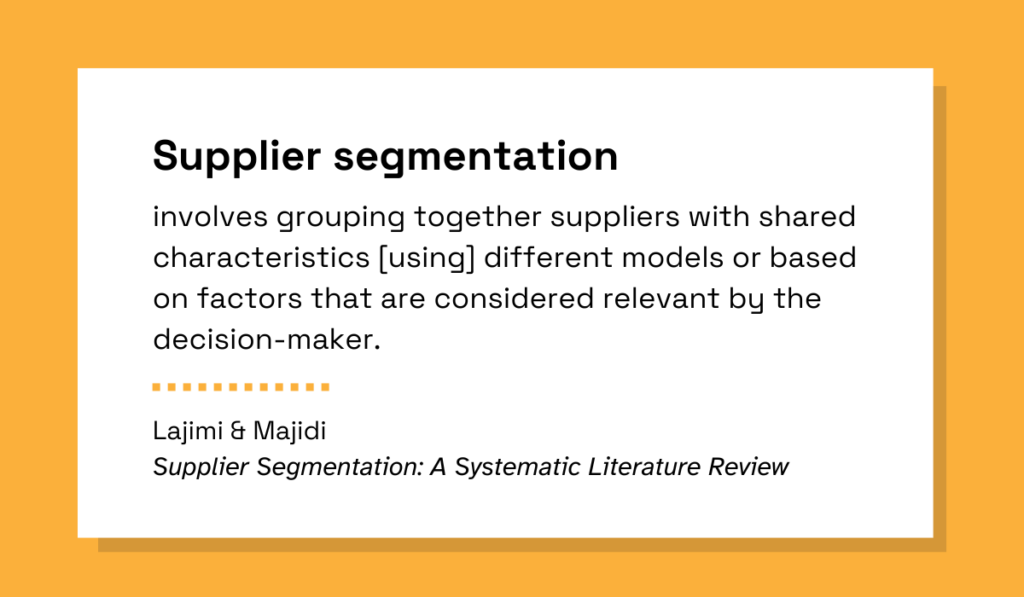

This definition sums it up nicely.

Illustration: Veridion / Definition: ResearchGate

As you can see, it’s up to each organization to identify key factors and pick the best segmentation model.

However, it all boils down to being able to answer these questions:

Once you understand all this, you can tailor your interactions more effectively.

In general, deducing the overall impact of your suppliers begins with this basic division.

| Tier 1 suppliers | Directly contribute to the organization’s final product or services by providing key components or systems. |

| Tier 2 suppliers | Supply intermediate components or specialized materials necessary for Tier 1 production processes. |

| Tier 3 suppliers | Provide Tier 2 suppliers with raw materials, basic inputs, or services that ensure operational efficiency. |

Tier 1 suppliers are closest to your operations, which is why they typically have to meet stricter quality and compliance standards.

These critical suppliers also receive extra attention in the sense of different capability-building programs.

Among Intel’s over 9,000 tier 1 suppliers, we identify approximately 400 “critical” suppliers that we directly engage through our capability-building programs.

The report goes on to elaborate that these 400 critical suppliers represent more than 78% of Intel’s spending, which helps cement their priority status.

However, supplier segmentation is rarely so straightforward.

Although the focus remains on key suppliers who drive the most value, companies may categorize suppliers differently based on factors like:

One thing’s certain: segmentation is a vital part of successful supplier relationship management (SRM) and it delivers several benefits.

Let’s zoom in on some of them.

Supplier segmentation enables you to build a strong and reliable supply chain.

What makes this possible are three concrete benefits that we’ll present in more detail.

Identifying key or strategic suppliers improves your ability to effectively allocate resources.

Resources are finite—no organization wants to squander its time and effort on less important processes and relationships.

Supplier segmentation helps you pinpoint which relationships deliver the highest value and should be prioritized.

Of course, this doesn’t mean ignoring everyone but the critical suppliers.

You’re simply optimizing resources by tailoring your management strategies. That can mean adjusting check-in intervals or required personnel.

| Category | Resource Allocation | Meeting Frequence | Account Manager |

|---|---|---|---|

| Strategic | High priority | Quarterly meetings or more | Yes |

| Operational | Moderate priority | Semi-annual or annual check-ins | As needed |

| Transactional | Low priority | As needed | No |

Think of it this way: supplier segmentation is a roadmap enabling you to focus your energy and resources in a way that guarantees the best outcomes.

Supplier segmentation also paves the way for stronger supplier relationships.

When strategic suppliers get additional attention and opportunities for long-term collaboration, it improves overall trust and performance.

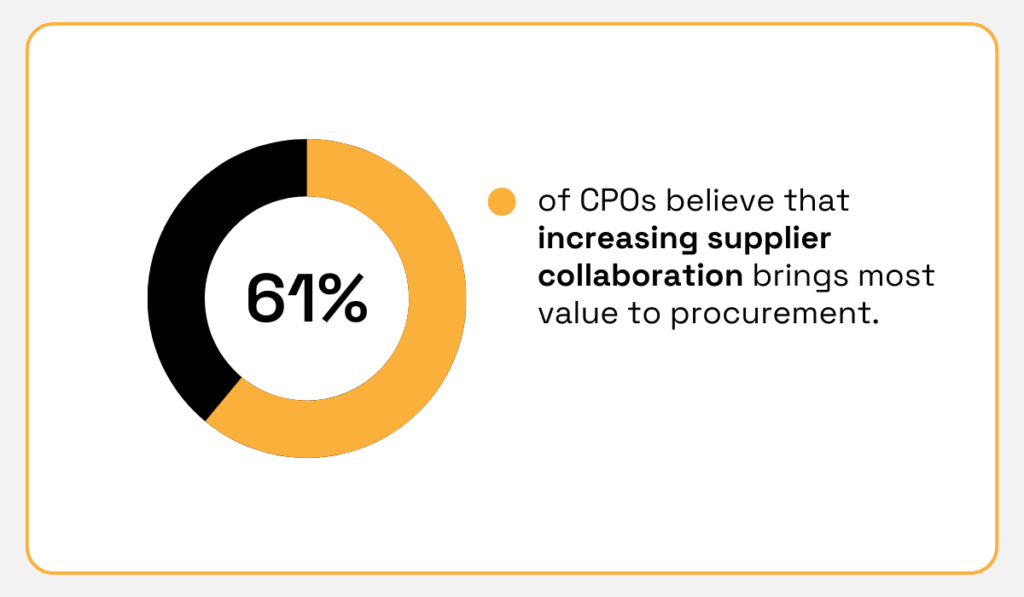

That’s one reason why Deloitte’s 2023 survey of 350 senior procurement leaders positioned supplier collaboration as a top procurement strategy.

Illustration: Veridion / Data: Deloitte

Other studies back this up with concrete numbers.

McKinsey’s 2020 survey showed that organizations that focused on building long-term partnerships yielded 2x the growth of their industry peers.

Plus, they lowered their operating costs.

It’s not difficult to see how supplier segmentation fits into all this.

Tailored engagement and collaboration with key suppliers depend on accurate categorization of suppliers.

After all, why make the extra effort if the supplier doesn’t demonstrate these four key qualities?

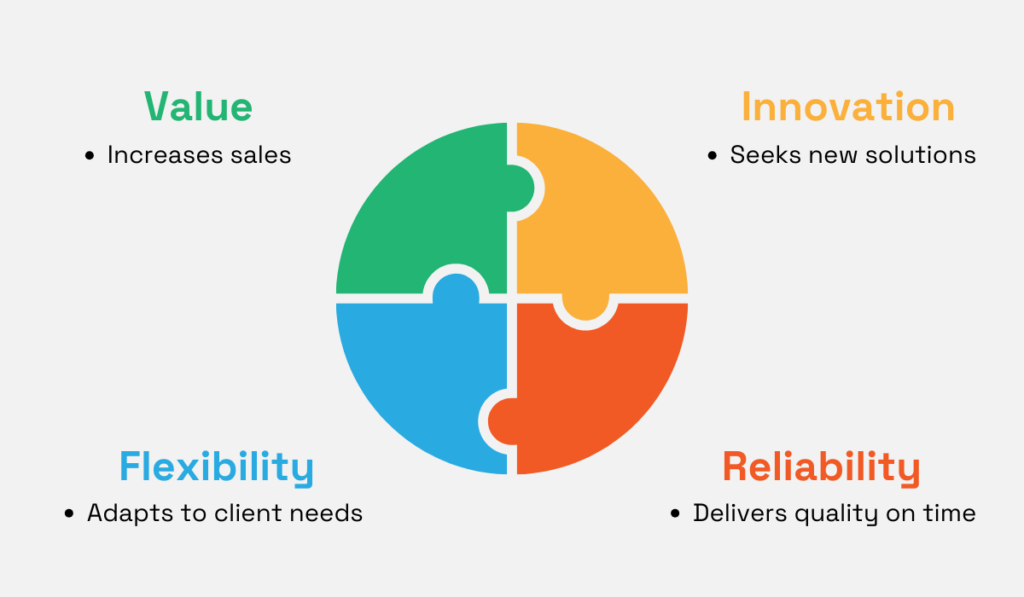

Source: Veridion

Value, innovation, flexibility, reliability—all these characteristics serve as guideposts for pursuing more active and fruitful collaboration.

Madison Goodwin, currently a VP of Business Operations at Hewlett Packard Enterprise, explains how, during her time at HP, being their top-tier supplier always came with expectations.

Illustration: Veridion / Quote: LinkedIn

That’s why innovation is one of the qualities to look for when segmenting your suppliers.

A thorough evaluation will also help you (re)assess which supplier relationships have limited potential for mutual growth.

In such cases, even if you’ve already invested in building a relationship, you will know to discontinue doing so in the future.

Ultimately, stronger supplier relationships are sure to create value on all levels, and it all starts with segmenting your suppliers.

Supplier segmentation is a critical component of effective risk management.

By segmenting suppliers, organizations can identify a wide range of potential risks, from financial instability to geopolitical exposure.

This process allows you to proactively map these risks and prepare for potential disruptions.

Failing to implement segmentation and proper planning can leave your business vulnerable, as was the case with Badger Sportswear.

In 2018, allegations of forced labor within their supply chain led to significant financial and reputational damage, with many colleges choosing to discontinue sales of the brand’s apparel.

Source: Guardian

The case highlights the need for robust supplier management practices, such as segmentation.

But don’t forget that vendor risks are not static.

This is why Conrad Smith, Founder & CEO of supplier management platform Graphite Connect, urges constant vigilance and reassessment of key supplier relationships.

He says that the risks evolve as relationships evolve.

Illustration: Veridion / Quote: Graphite Connect

At this point, you’re probably wondering exactly how to do all of this.

Vendor risks can be quite difficult to catch without the proper tools or methods.

That’s why we’ll dive into the practical tips next.

Effective segmentation requires you to collect and analyze data, but you first need to decide on a set of criteria for categorizing your suppliers.

Here’s a short overview of different segmentation models you can use.

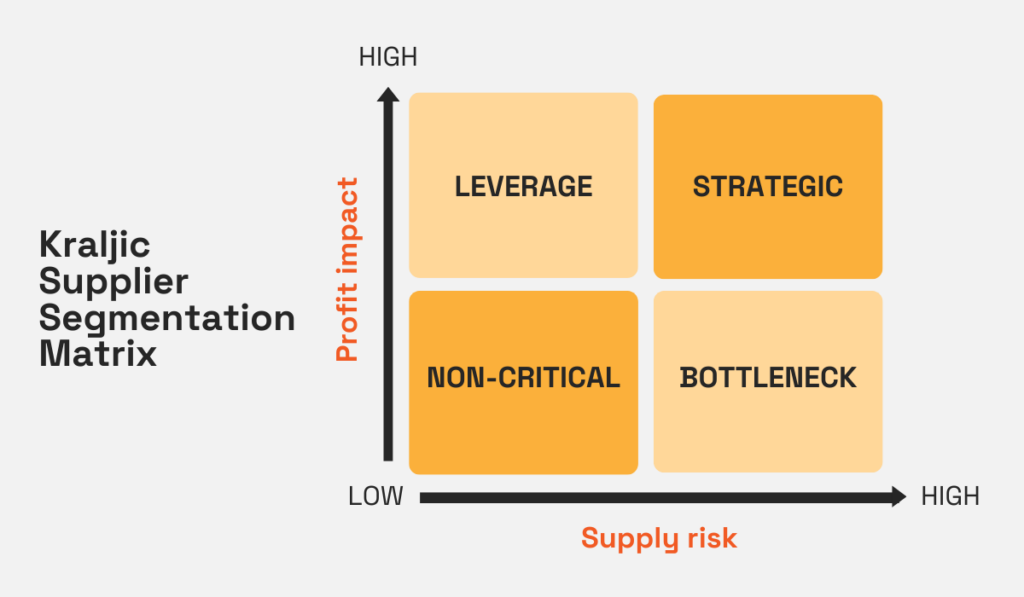

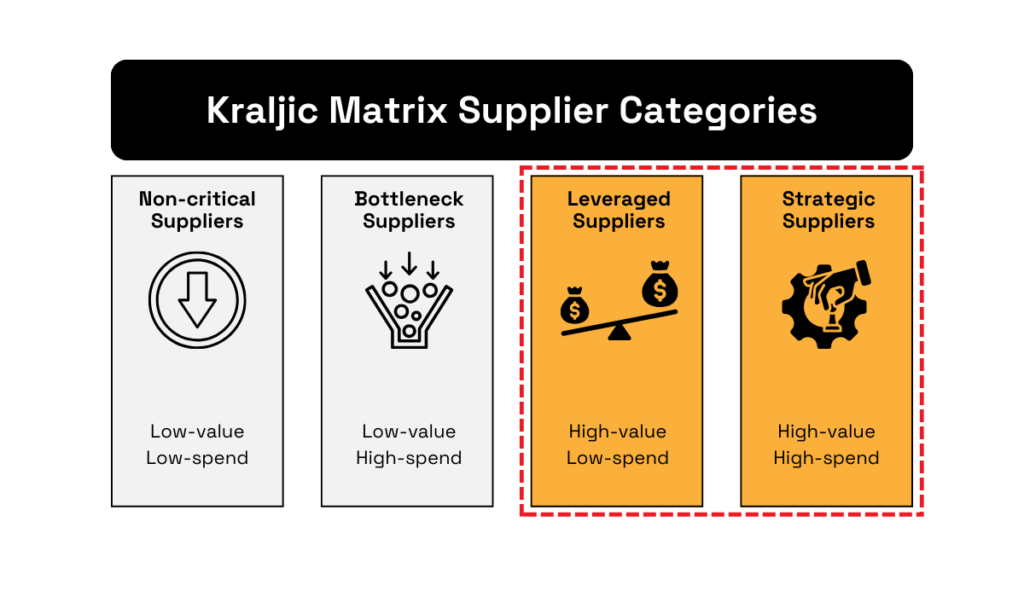

The Kraljic Matrix is one proven way of segmenting your suppliers by value and risk.

The two key factors for classification are profit impact and supply risk.

Source: Veridion

When you apply it, you get four segments of suppliers, knowing exactly which ones have the highest impact on your bottom line and which ones pose the highest risk to your supply chain.

The Kraljic Matrix also uncovers your most strategic suppliers, allowing you to direct sources where it matters most.

Source: Veridion

The Kraljic Matrix is easy to implement, and it promises to maximize your profits while reducing dependence on specific suppliers.

However, this simplicity is both an advantage and a downside.

This segmentation model doesn’t consider other important factors such as quality and delivery performance.

Moreover, it won’t reflect the dynamic shifts in the procurement landscape, says procurement leader Eman Abouzeid:

“[The Kraljic Matrix] does not consider changes in supplier relationships, market conditions, or strategic goals of the organization.“

Nevertheless, there’s a reason this model is so widely used, creating the foundation for a more complex segmentation in line with your unique circumstances.

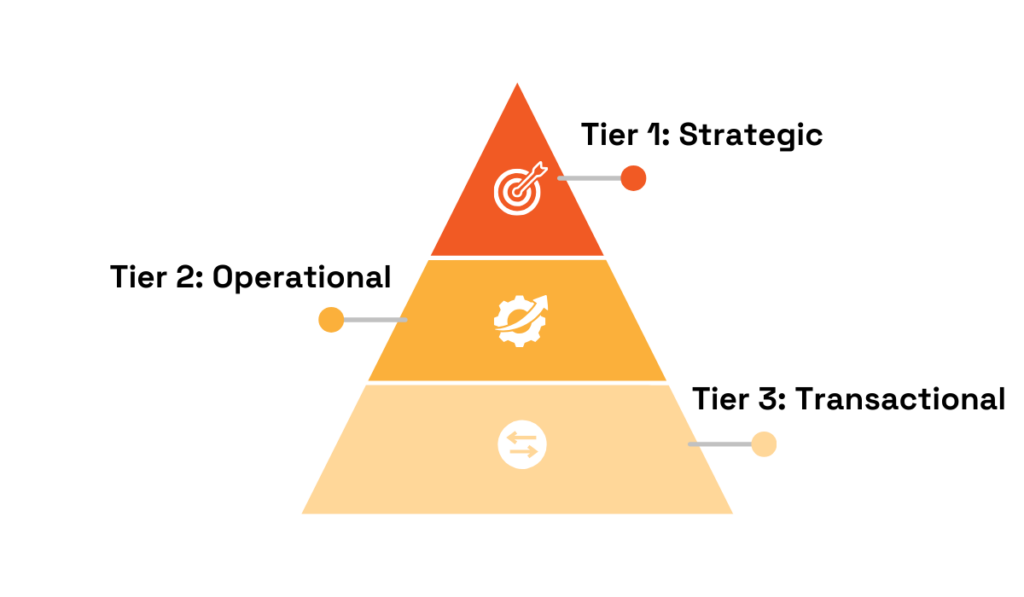

Another tried and true method is the pyramid approach, which classifies suppliers into three levels based on how their performance impacts the business.

A supplier pyramid typically has 3 tiers—strategic, operational, and transactional—although some organizations may prefer to put core partners into a separate, fourth category.

Source: Veridion

This provides a very clear, visual hierarchy, with the value of suppliers increasing the closer you are to the top.

In this segmentation framework, the focus is on operational excellence, so it’s a must on all three levels, but only top-tiered suppliers need to align with long-term strategy and promise future success.

The pyramid approach doesn’t provide a detailed segmentation, but it’s perfect for businesses looking to optimize their resources without needing to manage large supplier bases.

Nevertheless, there are challenges.

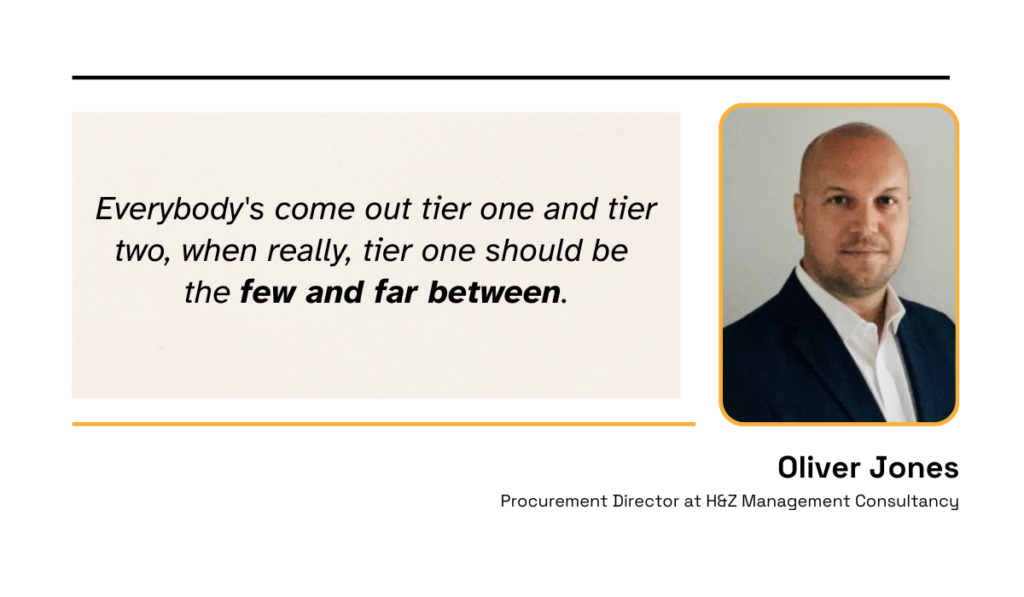

Procurement Director for H&Z Management Consultancy, Oliver Jones, explains that many organizations tend to overfill the first two tiers.

Illustration: Veridion / Quote: Art of Procurement

Using this segmentation the wrong way calls for additional work and reassessments.

While reassessments can be time-consuming, treating too many suppliers as critical instead of transactional can quickly lead to even more wasted resources.

The bottom line is that this approach can help you streamline your supplier management and resource allocation, as long as you avoid the common pitfalls.

Grouping suppliers by total spending enables you to identify where most of your procurement budgets go.

This, in turn, helps guide sourcing strategies.

In this context, the Pareto Principle or the 80/20 rule often applies.

It means that just 20% of your suppliers account for 80% of your procurement spend.

And when you put it like that, it’s much easier to find and concentrate your efforts on those high-value suppliers.

Now, how do you do that?

This segmentation model is pretty straightforward because it incorporates techniques like ABC spend analysis to assign the correct value to each supplier:

This can even be done in Excel, as explained in the video below.

Source: Accelerated Insight on Youtube

While it should be noted that this segmentation model doesn’t take into account any criteria beyond spend, you can make full use of spend management tools for in-depth insights.

Comprehensive procurement solutions like Ivalua have robust reporting capabilities, allowing you to easily identify your top-spend suppliers based on different categories.

Source: G2

Whether it’s monthly spending or by category, such analysis provides useful insights.

What’s more, modern spend management solutions often support predictive modeling, allowing you to factor in forecasted spend growth.

Even if a supplier doesn’t seem as important at the moment, these insights can help you plan and adjust your supplier management strategies on time.

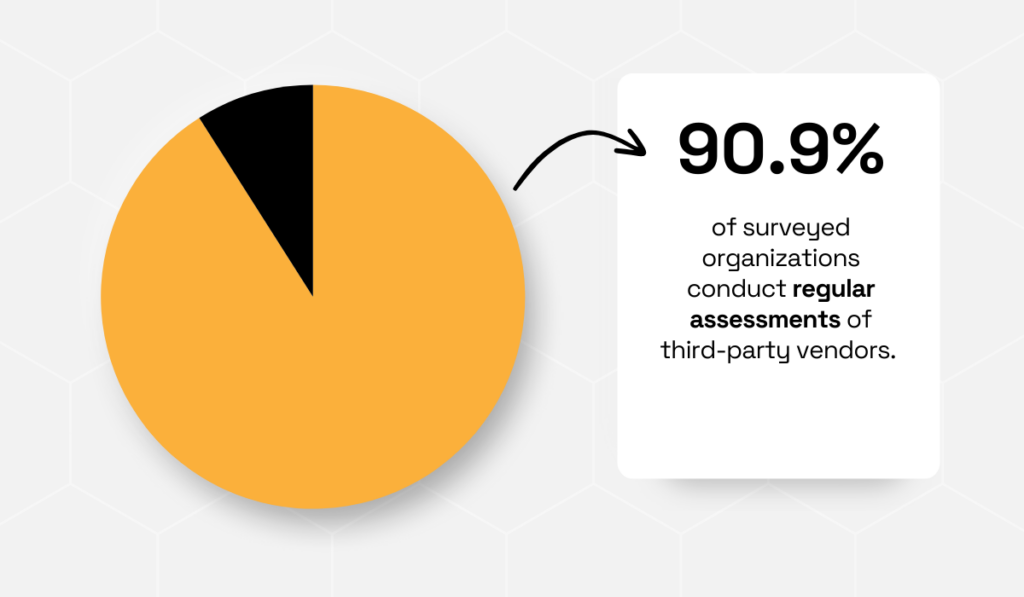

Finally, organizations can categorize suppliers solely based on their potential supply chain risk.

There are different types of procurement risks, from operational or compliance issues to wider geopolitical or geographical risks.

By identifying critical risks and carrying out risk assessments for each supplier, you can split suppliers into:

Luckily, research shows that the majority of organizations are well aware of the potential threats, and make regular risk assessments a priority.

Illustration: Veridion / Data: Cyber GRX

Let’s go back to Intel’s example for a moment.

The semiconductor and global tech giant has been consistently praised for its resilient supply chain.

They earned this reputation largely thanks to their risk-based approach.

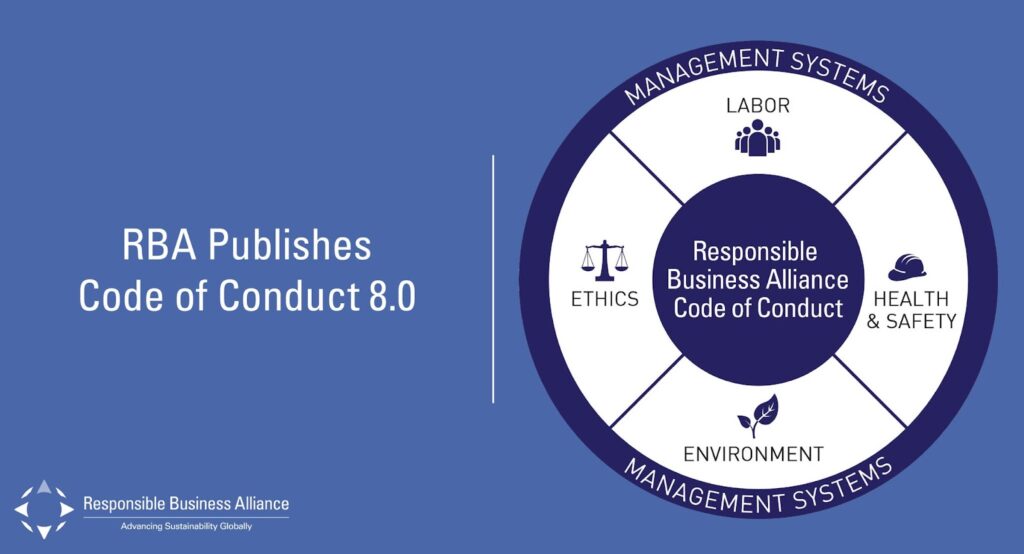

According to Intel’s Corporate Responsibility Report, we know they require all suppliers to comply with a set of standards outlined within the Responsible Business Alliance’s (RBA) Code of Conduct.

Source: RBA on LinkedIn

The RBA is widely recognized for its ethical and sustainable practices in the electronics industry.

As follows, Intel’s critical and high-risk suppliers have to complete an additional questionnaire to map any potential misalignments with the RBA Code and undergo an on-site audit.

Now, how does segmentation fit into all this?

For one, effectively deploying these measures and safety checks would be impossible without a thorough supplier segmentation.

You simply wouldn’t know who to prioritize.

Some common issues you’re likely to face when segmenting your suppliers are:

Now, resistance to change usually arises due to internal organizational factors, and navigating it requires clear communication and proactive change management.

But the other two obstacles have a more concrete solution: advanced technology.

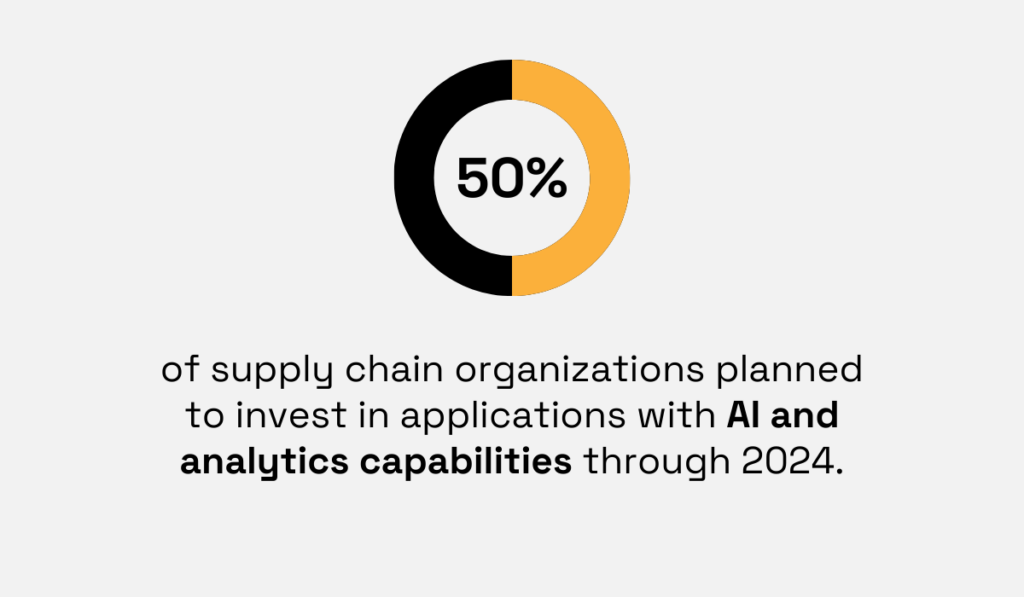

KPMG’s 2024 study on supply chain trends reveals that half of responding organizations are on track to investing in AI and boosting their analytics capabilities.

Illustration: Veridion / Data: KPMG

If you’re wondering what these tools bring to the table, the answer is speed, accuracy, and reliable data.

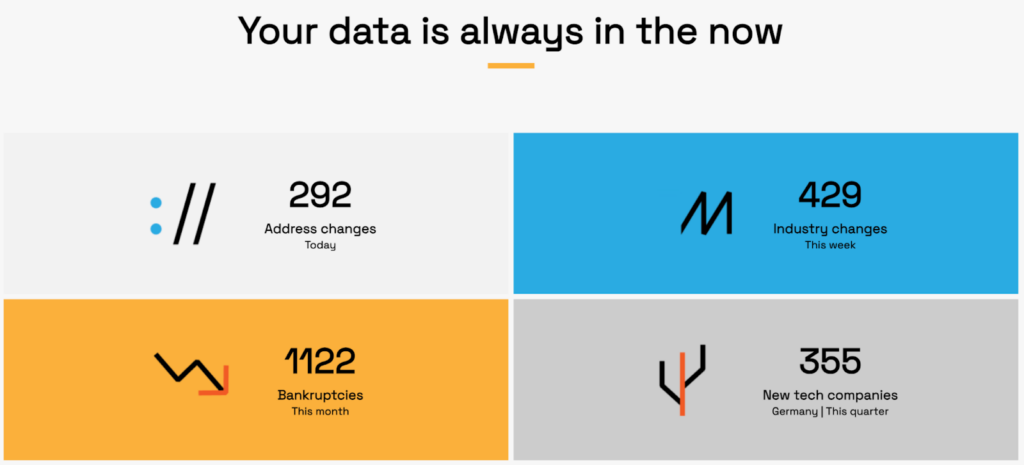

Our AI-powered data service excels in all three areas.

Veridion provides the most accurate, up-to-date global supplier data, enabling you to comb through all organizations with an active digital presence.

This data can enhance all your procurement operations, accelerating supplier sourcing, evaluation, and segmentation efforts.

Thanks to weekly updates, you’ll be able to map and prepare for any market changes.

Source: Veridion

Finally, you can also use our data for third-party risk management.

Thanks to fresh and reliable data, you’ll be able to uncover any vendor risks and changes in their business activities for the duration of your interaction or partnership, enabling you to (re)group them accordingly.

Ultimately, every organization is bound to experience some supplier segmentation challenges, but you can equip yourself with the tools that will help you overcome them.

Effective supplier segmentation helps you unlock your full supply chain potential.

Today, categorizing suppliers requires the use of different segmentation models and an excellent understanding of dynamic criteria.

With thoughtful planning and the right technology, you can stay agile and streamline operations while enhancing decision-making.

Embrace segmentation, and you’ll not only overcome challenges but be in a better position to seize new opportunities!