Supplier Segmentation Models: Different Ways to Segment Suppliers

Supplier segmentation is the process of categorizing suppliers based on specific criteria.

As such, it’s the very first step toward smarter resource allocation and strategic supplier management, leading to cost savings, better supply chain resilience, and many other perks.

But did you know there’s more than one way to segment your suppliers?

In this article, we’ll explore six different segmentation models, discussing what each one offers, and how they can help you maximize the value of your supplier relationships.

Ready to take your supplier management to the next level?

Let’s get started.

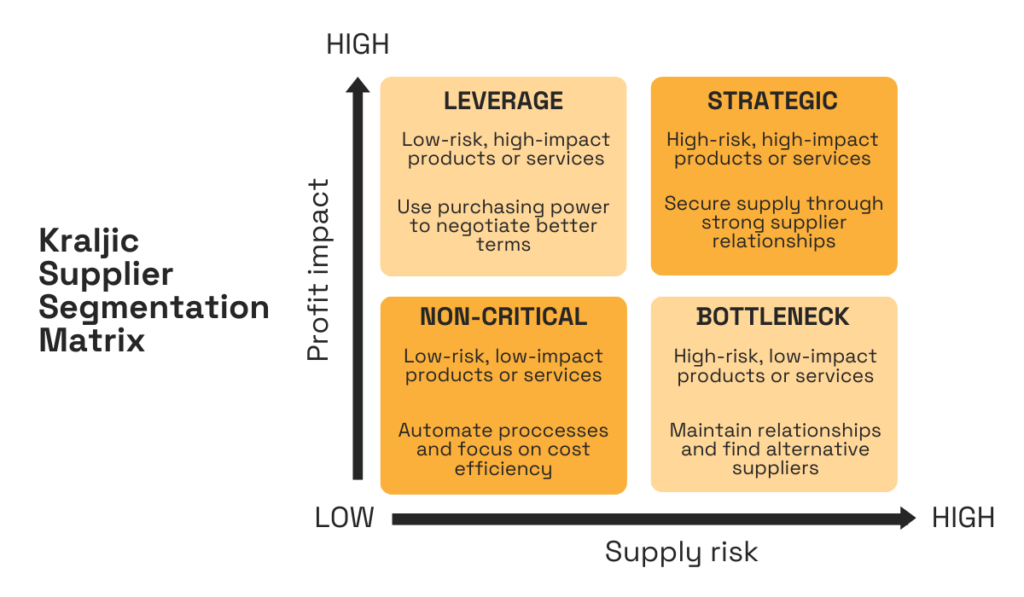

The Kraljic Matrix is one of the most widely used supplier segmentation tools.

It offers a structured approach to categorizing your supplier base and developing smarter purchasing strategies based on two key dimensions:

| Profit Impact | The supplier’s influence on the company’s financial performance, measured by factors such as cost, volume, or the criticality of the product or service to operations. |

| Supply Risk | The challenges of securing the product or service, influenced by factors like availability, logistics complexity, market competition, and technological volatility. |

Through these two dimensions, the Kraljic Matrix categorizes suppliers into four quadrants: Non-Critical, Leverage, Bottleneck, and Strategic.

You can see the breakdown of these categories in the image below:

Source: Veridion

Segmentation using this model allows companies to allocate their resources effectively and balance between risk and reward in their strategic sourcing efforts.

Sjoerd Goedhart, Owner of Goedhart Interim Management & Consultancy, captures the essence of the Kraljic Matrix perfectly:

Illustration: Veridion / Quote: Procurement Tactics

In short, the Kraljic Matrix is a vital first step in understanding your supplier base and its impact on your operations and profitability.

As such, it’s the foundation for informed decision-making.

So, if you’d like to learn more about this model, check out our detailed guide to the Procurement Strategy Matrix, where we discuss its applications, benefits, challenges, and more.

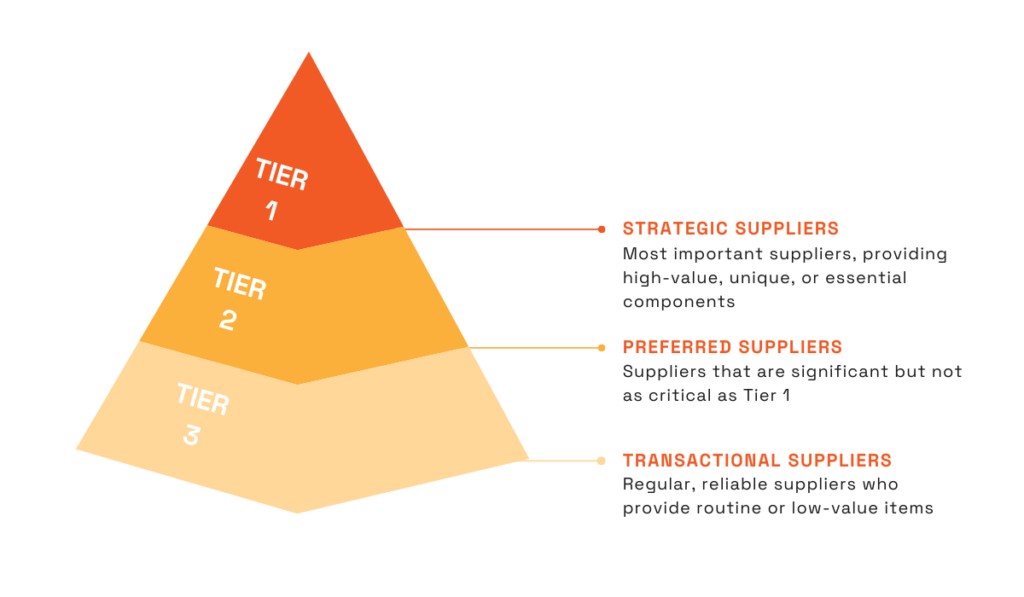

The pyramid approach is another tried-and-true segmentation model, categorizing suppliers based on their strategic importance to your business.

This method organizes suppliers into tiers, with each tier representing a different level of importance:

Source: Veridion

This hierarchy helps businesses focus their time, money, and attention on suppliers that matter most to their operations.

Meanwhile, streamlining transactions with lower-impact vendors helps control costs and save time.

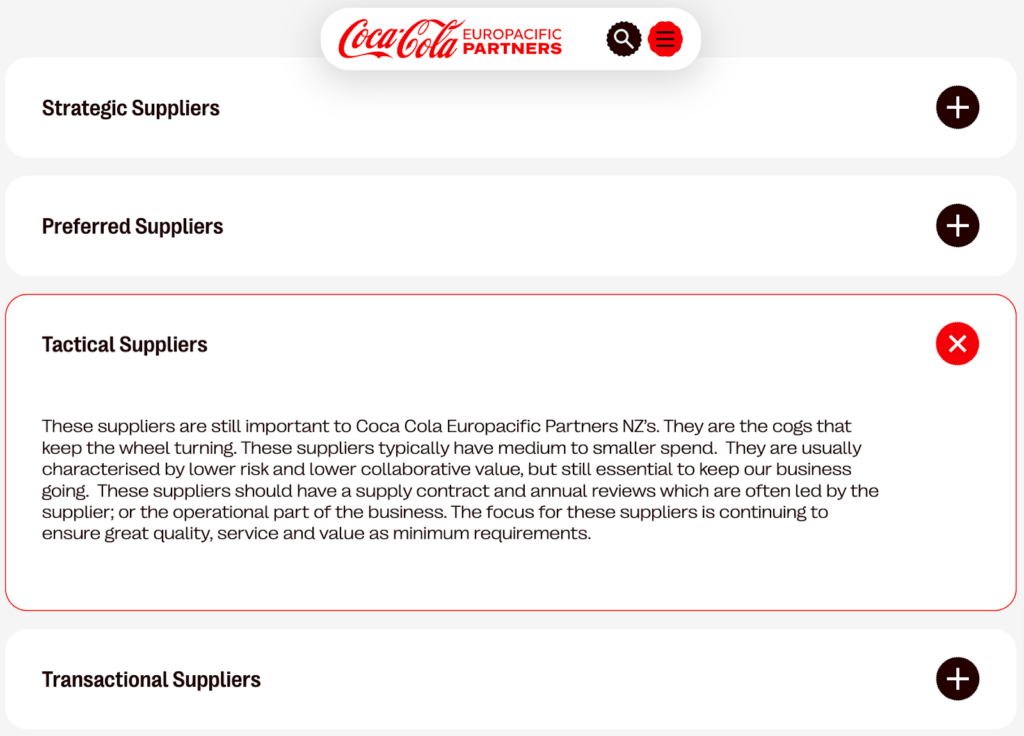

Overall, the model’s simplicity and efficiency make it a popular choice for companies across various industries, including global corporations like Coca-Cola Europacific.

You can see their supplier tiers below:

Source: Coca-Cola AEP

You’ll notice there’s an additional, “tactical” tier included to address suppliers that fall between “preferred” and “transactional.”

That’s the beauty of the pyramid approach (as well as many other models): it can be customized to fit your needs perfectly.

Compared to the Kraljic Matrix, this model is a bit simpler, focusing on only one dimension: strategic importance.

The Kraljic matrix, on the other hand, offers a more detailed analysis by balancing risk with financial impact, making it better suited for businesses managing a complex supplier base.

That said, many organizations actually use a hybrid approach that combines both models.

For instance, they might:

This layered analysis ensures you get the best of both worlds, even further boosting your decision-making and overall supplier management efforts.

This model segments suppliers based on the severity of their risk profiles.

It starts with conducting thorough risk assessments for each supplier, and then categorizing them into:

Risk-based segmentation is a crucial component of efficient risk mitigation.

It provides a clear understanding of how seriously a supplier could jeopardize your company’s operations, which helps identify and mitigate issues proactively.

That way, you strengthen your ability to manage disruptions and prevent catastrophic supply chain failures.

Considering that currently, 40% of procurement professionals cite risk management as their primary concern, the importance of this segmentation model is clear.

Illustration: Veridion / Data: Inspectorio

Unlike other models, this method specifically focuses on risk exposure, making it particularly effective for industries with dynamic or high-risk supply chains.

However, its data requirements are higher than traditional methods, as risk-based segmentation requires detailed insights into every aspect of supplier performance.

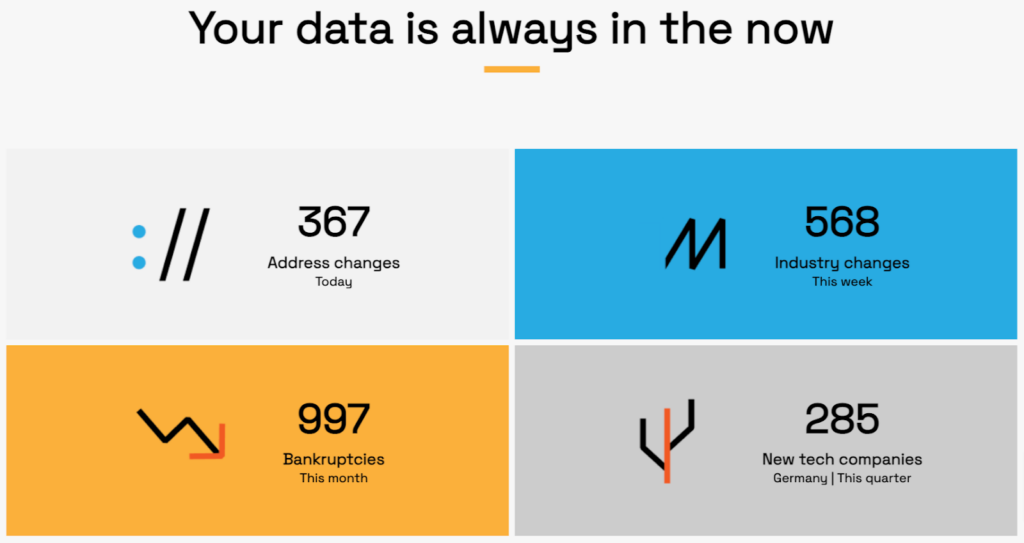

This is where AI-driven supplier data platforms like Veridion play a vital role.

Veridion continuously scans the internet to provide the most up-to-date supplier data, enabling you to quickly spot potential disruptions and changes in a supplier’s business activity.

Source: Veridion

For instance, you can:

Essentially, tools like Veridion make risk-based segmentation smarter and simpler.

They cut through the noise, giving you reliable, actionable insights to categorize suppliers based on what’s actually happening in their businesses—right now.

This model segments suppliers based simply on the amount of money your organization spends with them.

It’s the most basic approach to supplier segmentation, providing a quick and easy way to determine where to focus your supplier management efforts.

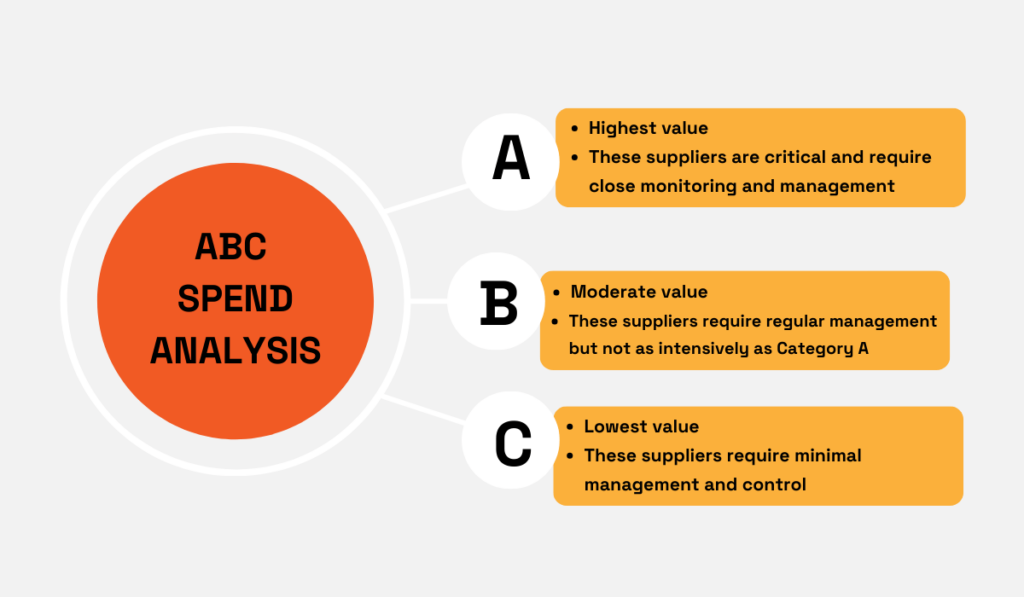

In this model, ABC spend analysis is most commonly used.

It organizes your suppliers according to their impact on your spending in order to assign them value:

Source: Veridion

This helps you identify where most of your spending occurs, enabling strategic resource allocation to minimize risks or reduce overreliance on specific suppliers.

While spend-based segmentation is very simple, it can still be pretty useful, particularly if your goal is identifying cost-saving opportunities and optimizing spend.

And, according to experts, this is very likely the case.

As Chris Sawchuk, Principal and Global Procurement Advisory Practice Leader at the consulting firm The Hackett Group, notes, cost-cutting is always procurement’s top priority.

Illustration: Veridion / Quote: Procurement Magazine

Spend-based segmentation absolutely supports this goal.

Sure, it’s less complex than other methods but it serves its purpose well.

And for more advanced segmentation, you can always combine it with other models to achieve a more nuanced understanding of your supplier landscape.

This model focuses on categorizing suppliers based on their environmental and social practices rather than traditional factors like cost, quality, and reliability.

It represents a newer approach to segmentation that has gained traction with the growing emphasis on sustainability.

The model evaluates suppliers across three dimensions:

Here you can tailor the categories to suit your specific needs and objectives.

For example, some possible categories might include:

| Leaders | Suppliers with excellent ESG performance |

| Improvers | Suppliers committed to improvement but needing support |

| Risks | Suppliers with poor ESG performance or a high risk of non-compliance |

| Low Impact | Suppliers with minimal environmental or social impact |

For some inspiration, consider Gilead Sciences, an American biopharmaceutical company.

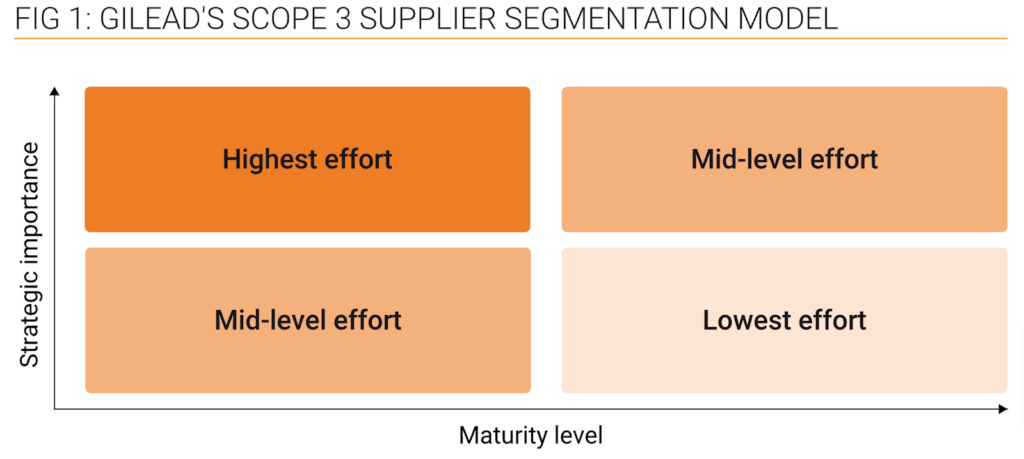

They segment their critical suppliers based on the maturity of their Scope 3 greenhouse gas emissions reduction programs.

Here’s how it works:

First, Gilead segments its suppliers by criticality and the relative power dynamic in the relationship.

Then, they overlay these results with a separate ranking assessing each supplier’s Scope 3 maturity—a spectrum ranging from no program at all to those with active decarbonization plans.

Ultimately, they end up with a matrix like this:

Source: Procurement Leaders

Depending on their maturity level, suppliers are then offered support to improve their programs and develop their capabilities.

However, Dru Krupinsky, Senior Procurement Manager at Gilead who leads this program, explains they don’t focus on all suppliers:

Illustration: Veridion / Quote: Procurement Leaders

Unlike other previously mentioned methods that may only touch on sustainability, this model is built entirely around it.

This makes it invaluable for identifying suppliers aligned with your ESG goals and prioritizing those who contribute to your long-term sustainability strategy.

As such, it’s ideal for organizations in industries where sustainability is one of the key business drivers, like consumer goods, automotive, energy, or retail.

The criticality-based supplier segmentation model categorizes suppliers based on the importance of the goods or services they provide to an organization’s operations.

It evaluates two key factors:

Based on those factors, suppliers are then classified as Critical or Non-Critical groups.

Segmenting suppliers in this way helps you better understand how essential a certain vendor’s output is to your business continuity, performance, and value creation.

This model is particularly useful for managing long-term, high-stakes relationships with suppliers that provide critical inputs, such as raw materials or high-tech components.

According to Venminder, a third-party risk management solutions provider, one simple way to establish a supplier’s criticality is by asking these three questions:

Now, looking at these questions, you might notice that this approach has quite a similar focus to risk-based segmentation.

However, there’s a clear distinction between a critical and high-risk supplier, warns Tom Rogers, Founder & CEO of Vendor Centric, a consultancy that helps clients with vendor lifecycle management:

Illustration: Veridion / Quote: LinkedIn

Critical suppliers are those whose goods or services are vital to your business’s operations and success, which means their disruption could halt your business activities.

On the other hand, high-risk suppliers may not be critical to your operations, but their instability, geographic location, or other risk factors still pose potential threats to the organization.

Compared to other segmentation models, the criticality-based model provides a bit wider picture as it integrates risk management with the strategic importance of suppliers.

Other models, like the Kraljic Matrix or spend-based categorization, are quite efficient too, but may not capture the depth of criticality like the criticality-based segmentation.

Ultimately, no matter which segmentation model you choose, two things are absolutely critical for success.

First, data is king.

Without accurate and detailed information, your segmentation efforts can fall apart, leading to errors, misclassifications, and poor purchasing decisions or strategies.

To prevent that, use the tools, like supplier data platforms, that provide reliable insights into all aspects of your suppliers’ performance.

Second, don’t treat segmentation as a one-time task.

Businesses evolve, and so do your suppliers.

So, regularly review their performance and recategorize them to reflect any changes in their operations.

By staying proactive, you’ll keep your segmentation relevant and your supply chain agile, ready to handle whatever comes next.

Good luck!