Sustainable Procurement: A Practical Guide

Key Takeaways:

With 49% of investors prepared to divest from companies over weak ESG performance, delivering on sustainability commitments is a clear business priority.

Luckily, sustainable procurement offers one of the most effective and scalable ways of doing just that.

This guide breaks down the core principles, key obstacles, and proven tactics companies use to build responsible, resilient procurement strategies.

Looking to turn ESG goals into business value?

Start here.

Companies adopt sustainable procurement to protect their reputation, enhance competitiveness, and drive profitability.

In other words, it’s no longer a question of whether sustainability will reshape procurement, but when, and how quickly.

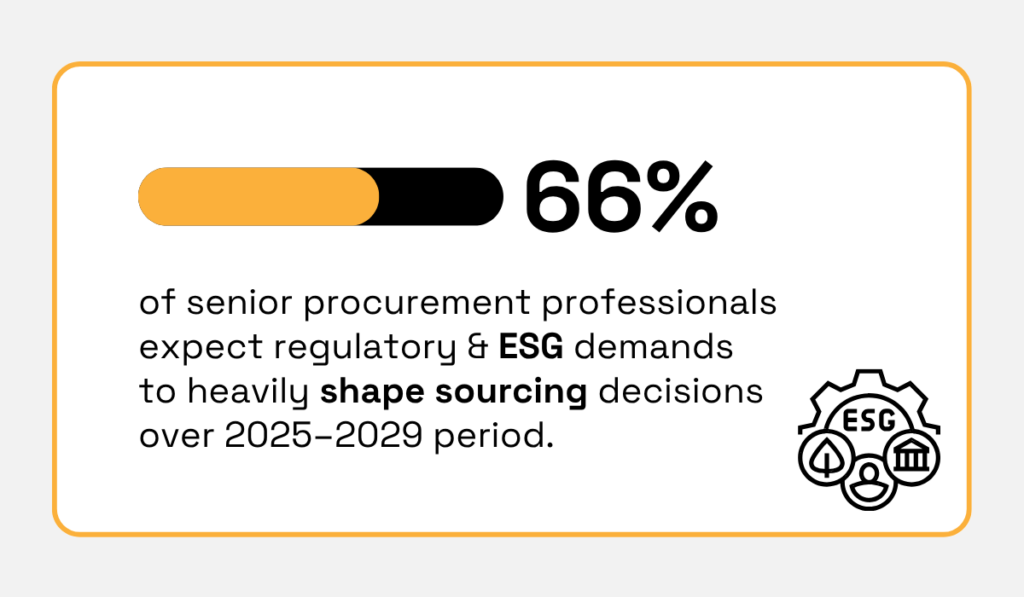

According to KPMG’s 2024 report, 66% of senior procurement leaders believe that regulatory and ESG demands will heavily influence sourcing decisions in the upcoming years.

Illustration: Veridion / Data: KPMG

As governments tighten reporting requirements and investors increasingly scrutinize supply chain practices, procurement teams are becoming the operational frontline of corporate sustainability efforts.

And for good reason.

Procurement decisions have far-reaching consequences beyond immediate price and delivery.

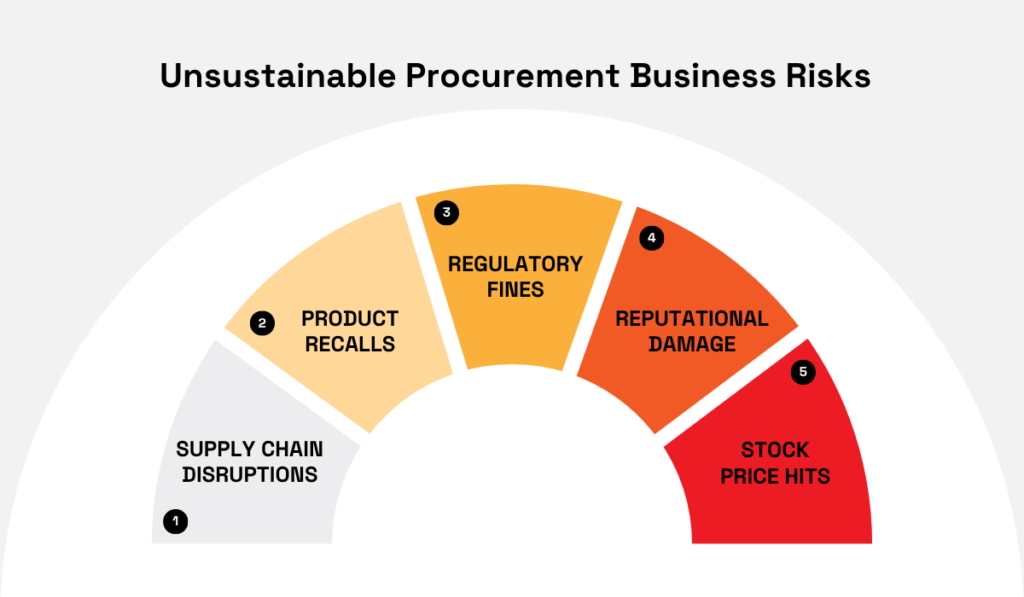

Just consider the cascading business risks tied to unsustainable procurement practices, from potential supply chain disruptions and fines to boycotts and stock price hits.

Source: Veridion

A single supplier misstep can trigger operational chaos and public backlash.

One PwC study reveals that 76% of consumers claim they would stop purchasing from companies that disregard the environment or treat their employees and community poorly.

And it’s not just consumers watching.

Investors are actively pulling capital from businesses that fail to address ESG risks.

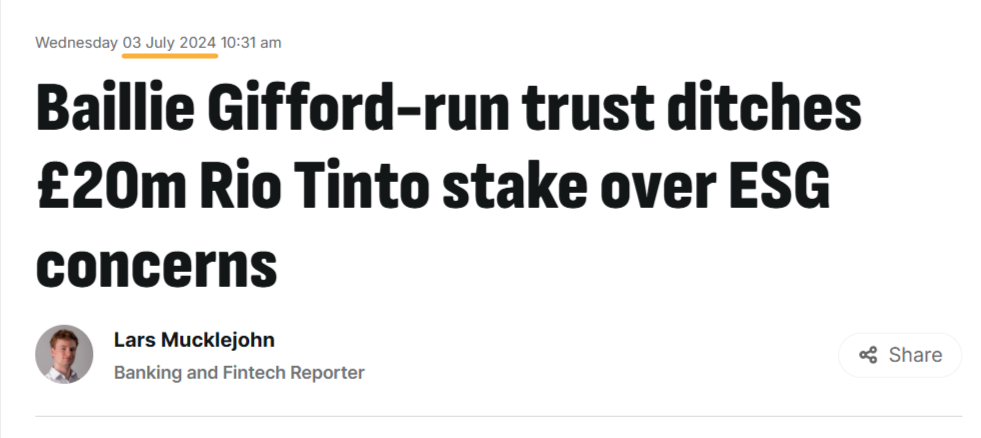

In last year’s high-profile example, Monks Investment Trust divested its £20 million stake in mining giant Rio Tinto.

Source: City AM

The justification?

Ongoing concerns over Rio Tinto’s approach to environmental governance and social impact.

And it’s hardly an isolated case.

PwC’s Global Investor Survey found that almost half of institutional investors are willing to divest from companies that don’t take ESG seriously enough.

Illustration: Veridion / Data: PwC

On the other hand, sustainable procurement delivers tangible business value, supporting ESG reporting, improving stakeholder confidence, and protecting against a variety of risks.

It’s also tied to financial performance.

For instance, a Kroll study revealed that ESG leaders outperform laggards in both annual returns and long-term valuation growth.

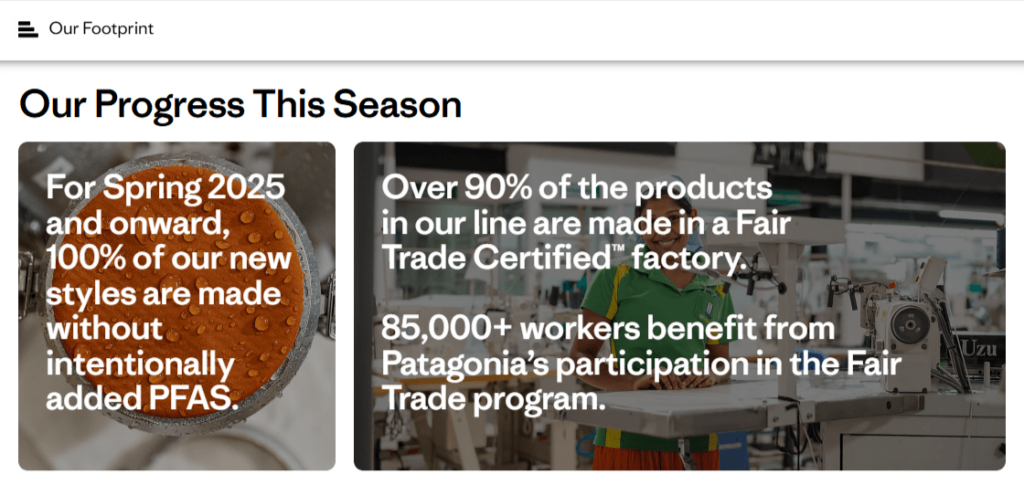

One of the clearest examples of this is outdoor apparel leader Patagonia.

Renowned for its transparent sustainability reporting and values-driven supply chain partnerships, Patagonia has embedded sustainable procurement into its business model for decades.

You can easily find all their ESG commitments and programs on the brand’s web page, along with the recent milestones.

Source: Patagonia

The secret to their ongoing success?

The brand’s founder, Yvon Chouinard, built the company on a principle of longevity, prioritizing responsible growth over short-term gains.

Chouinard explains that much of this approach boils down to carefully choosing who to do business with:

Illustration: Veridion / Quote: McKinsey

Patagonia’s ongoing market success proves that investing in sustainable procurement doesn’t have to be a compromise, but a competitive advantage.

In short, if sustainability is the goal, this approach to procurement is how you deliver it at scale.

Sustainable procurement creates long-term value by rethinking how products are sourced, used, and reintroduced into the economy, all while managing ESG risks across the supply chain.

Simply put, it’s much more than buying greener products.

Sustainable procurement trends continue to evolve, but there are several core principles through which businesses drive responsible procurement strategies.

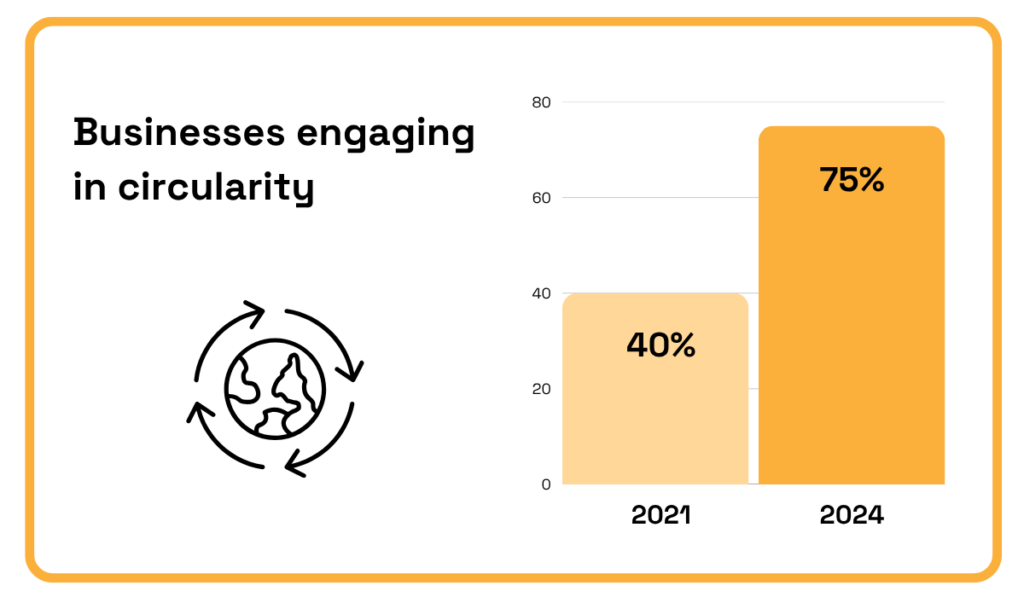

One of the most important is circularity, which focuses on reducing waste, promoting reuse and recycling, and minimizing resource consumption.

The World Economic Forum data shows a substantial jump in the number of companies actively engaging in circular initiatives, with the figure surging to around 75% in just three years.

Illustration: Veridion / Data: World Economic Forum

What’s more, in the next three years, the number of businesses is expected to reach around 95%.

But circularity isn’t possible without strong supplier partnerships.

To succeed, procurement teams need suppliers that share this long-term commitment, moving beyond price-driven, transactional deals toward partnerships built on shared values and continuous improvement.

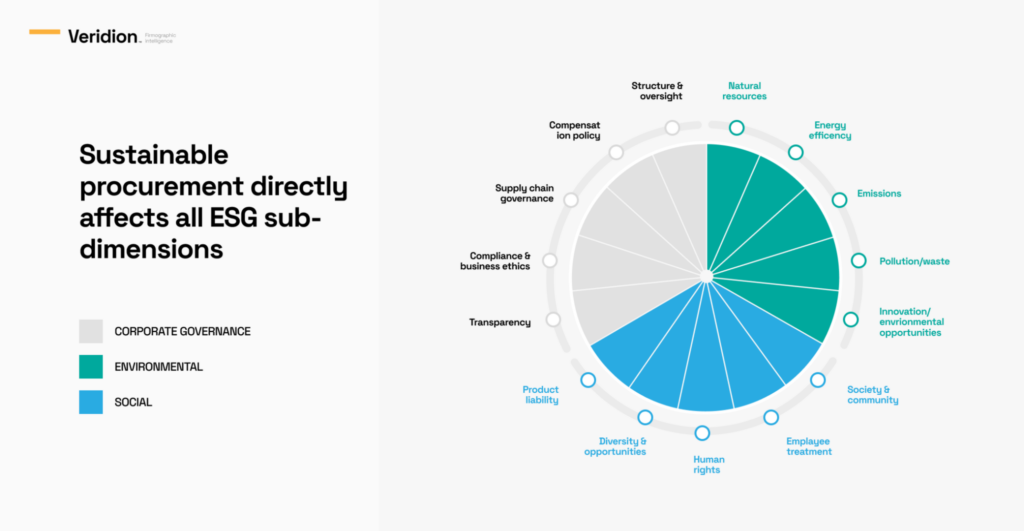

In doing so, procurement directly contributes to multiple ESG subdimensions, from emissions reduction and labor rights to regulatory compliance and ethical business conduct.

Source: Veridion

Traceability is another essential principle.

It ensures companies know exactly where their products and materials come from, how they’re produced, and under what conditions.

Reliable traceability reduces risk, helps companies meet circularity goals, and safeguards against reputational damage.

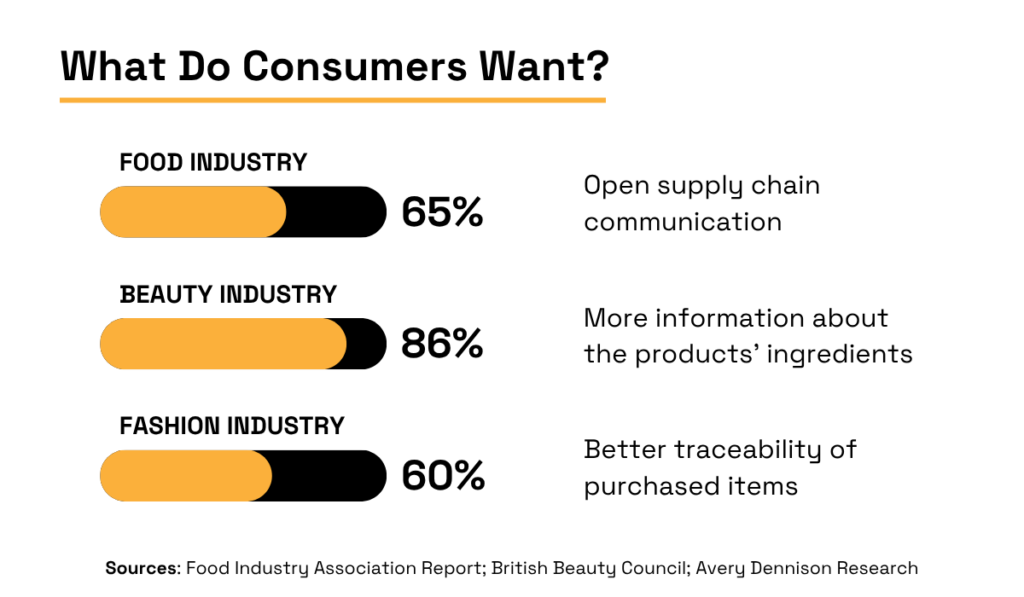

After all, consumers across industries are demanding greater transparency, and a growing majority now expect companies to provide full supply chain visibility.

Here are some interesting figures compiled by Oracle:

Illustration: Veridion / Data: Oracle

Balancing these and other ESG expectations with key business objectives remains one of the most persistent challenges in procurement.

But luckily, companies no longer have to treat it as a trade-off.

Gemma Thompson, senior consultant at Proxima, notes that decision-makers often felt forced to choose between ethical responsibility and financial performance.

Today, however, aligning the two is becoming both possible and necessary.

Illustration: Veridion / Quote: Procurement Magazine

This shift is driving interest in strategies that deliver measurable sustainability benefits without compromising business goals.

Local sourcing is one such example, helping companies cut transport-related emissions, reduce lead times, and support regional economies, all while improving supply chain resilience.

Organizations are also adopting tactics like supplier development programs and total cost of ownership (TCO) models to account for long-term environmental and social costs.

These principles and practices help businesses ensure operational efficiency and uncover hidden risks, positioning sustainable procurement as a smarter way to manage supply chains.

Even with clear principles and growing corporate commitments, putting sustainable procurement into practice brings real operational challenges.

Here are the key issues you need to overcome to make meaningful progress.

One of the most persistent obstacles in sustainable procurement is the lack of fresh, trustworthy data on suppliers’ sustainability practices.

Without accurate information, companies struggle to properly assess ESG risks across their supply chains.

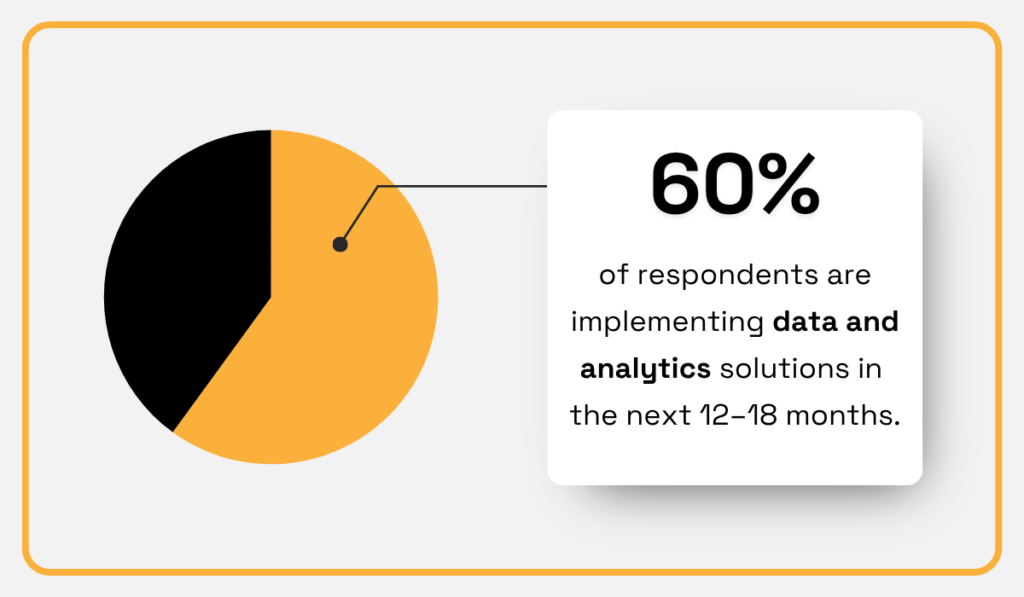

According to KPMG, 60% of procurement leaders plan to implement technology or data analytics solutions by the end of 2025 to improve visibility and address these gaps.

Illustration: Veridion / Data: KPMG

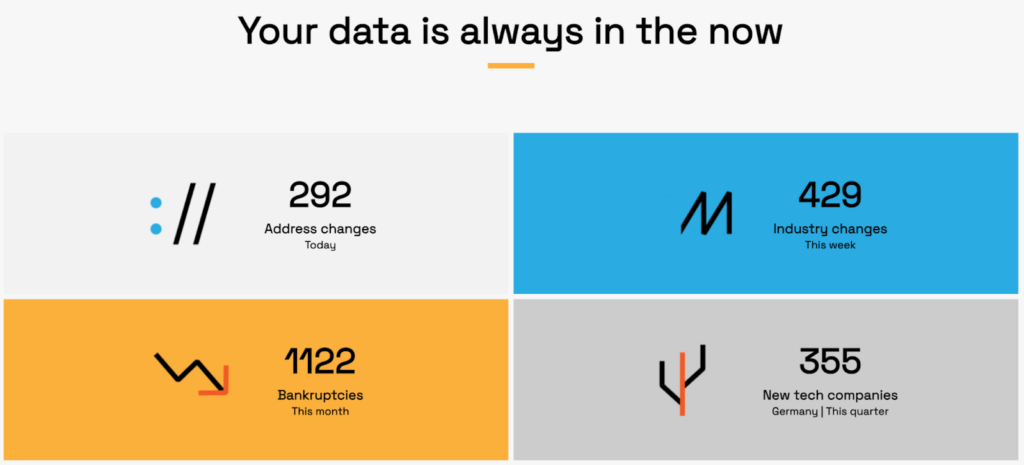

While automation helps procurement teams keep pace with today’s supply chain unpredictability, it’s ultimately about having the right data at the right time.

This is where AI-powered data providers such as Veridion prove invaluable.

With our platform, you can gain access to verified, near-real-time supplier data, enabling you to close critical information gaps early in the procurement process.

Source: Veridion

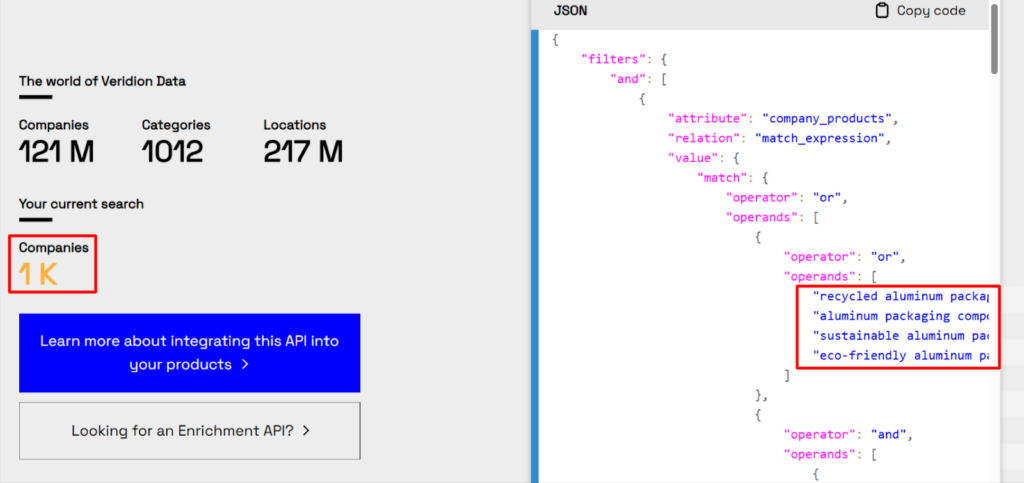

For example, a procurement manager using Veridion Scout for supplier discovery can quickly pinpoint manufacturers of recycled aluminum packaging in Europe with verified environmental certifications, low ESG risk scores, and traceable raw material sources.

Source: Veridion

All they need to do is ask Scout in natural language to find suppliers matching their specific criteria.

By enriching searches with geographic filters, certification checks, and sustainability metrics, tools like this turn what used to be guesswork into a strategic, data-driven advantage.

Ultimately, reliable data is the foundation of smarter, more sustainable procurement decisions.

Sustainable alternatives often come with higher upfront costs.

This creates a natural tension between procurement’s traditional focus on immediate savings and the organization’s long-term sustainability goals.

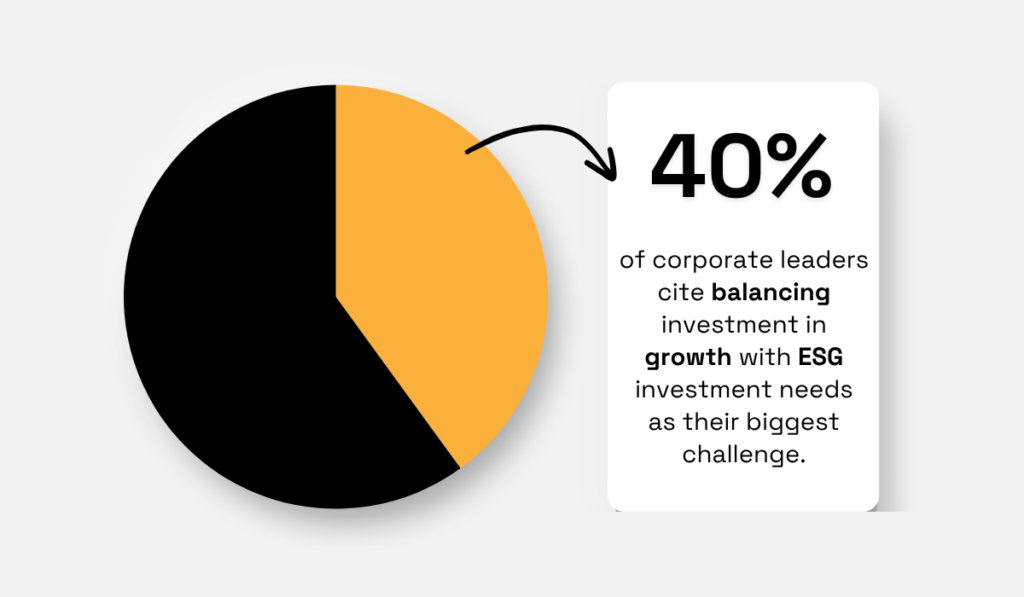

It’s a familiar dilemma for procurement leaders, with 40% of corporate executives reporting that balancing growth investments with ESG priorities is their biggest strategic challenge.

Illustration: Veridion / Data: PwC

And procurement is where these competing demands most often collide.

Yet, research shows sustainability can be financially sound.

McKinsey reports that companies with strong ESG performance reduce operating costs by 5–10% on average, largely through efficiency gains, reduced waste, and supply chain improvements.

One practical solution is adopting a Total Cost of Ownership (TCO) approach, which accounts not only for the purchase price but also long-term costs like environmental impact, operational risks, and reputational consequences.

Below are the main differences between traditional and TCO-based procurement:

| Traditional Procurement | TCO-Based Procurement |

|---|---|

| Focuses on the lowest upfront price | Considers full lifecycle costs |

| Prioritizes immediate cost savings | Balances cost with ESG and operational risks |

| Neglects end-of-life disposal or emissions | Includes environmental, social, and regulatory impacts |

| Transactional supplier relationships | Favors long-term, sustainable partnerships |

A simple mindset shift helps procurement teams reconcile sustainability and profitability, transforming ESG from a cost center into a competitive advantage.

Resistance to change is a common challenge in strategic procurement, and it’s even more pronounced when it comes to sustainable approaches.

Long-standing procurement teams can be hesitant to move away from established vendor relationships, pricing models, and familiar processes, especially when sustainability adds new complexities and perceived risks.

It’s not just about personal hesitation.

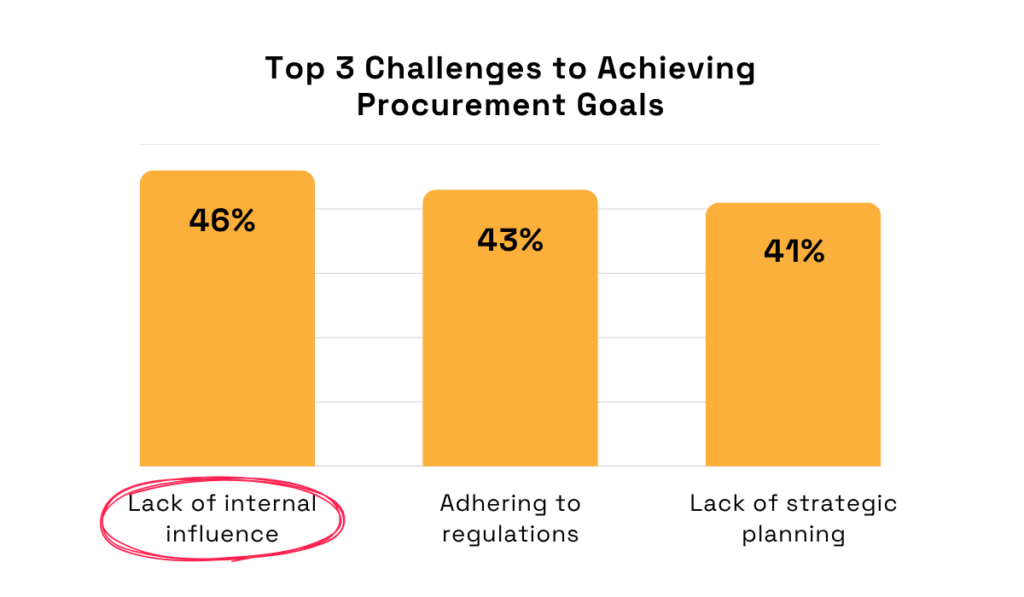

Procureability’s research identifies procurement’s lack of internal influence as the foremost challenge to achieving procurement goals.

Illustration: Veridion / Data: Procureability

This lack of influence often stems from internal misalignment and unclear cross-departmental priorities.

When procurement isn’t fully integrated into broader ESG strategies, it struggles to drive change or secure executive buy-in, making team-level resistance even harder to overcome.

When you also take into account common barriers like job security concerns, doubts about new practices, and a natural preference for the familiar, it’s clear why sustainable procurement transformations face inertia.

So, what can you do?

To move forward, companies need well-planned change management initiatives.

In practice, this means combining executive leadership support, internal incentives, and targeted training programs.

Source: Veridion

The common objective is to demonstrate how sustainable procurement aligns with both company values and operational priorities.

Open communication and early involvement in goal-setting can also improve buy-in and ease the transition toward sustainable practices.

Suppliers play a crucial role in helping companies meet ESG goals, but meaningful engagement doesn’t happen by accident.

It requires clear communication, realistic expectations, and ongoing collaboration.

Let’s see what you can do to engage suppliers.

Suppliers can’t meet goals they don’t fully understand.

So, one of the most effective ways to encourage engagement is by setting clear, realistic, and tailored sustainability expectations.

This isn’t about applying a one-size-fits-all model but recognizing the unique capabilities, limitations, and priorities of each supplier.

To make this work, companies should integrate sustainability criteria into supplier onboarding and contract processes and communicate performance expectations early on.

Typical expectations might include:

Two-way communication is essential in all this.

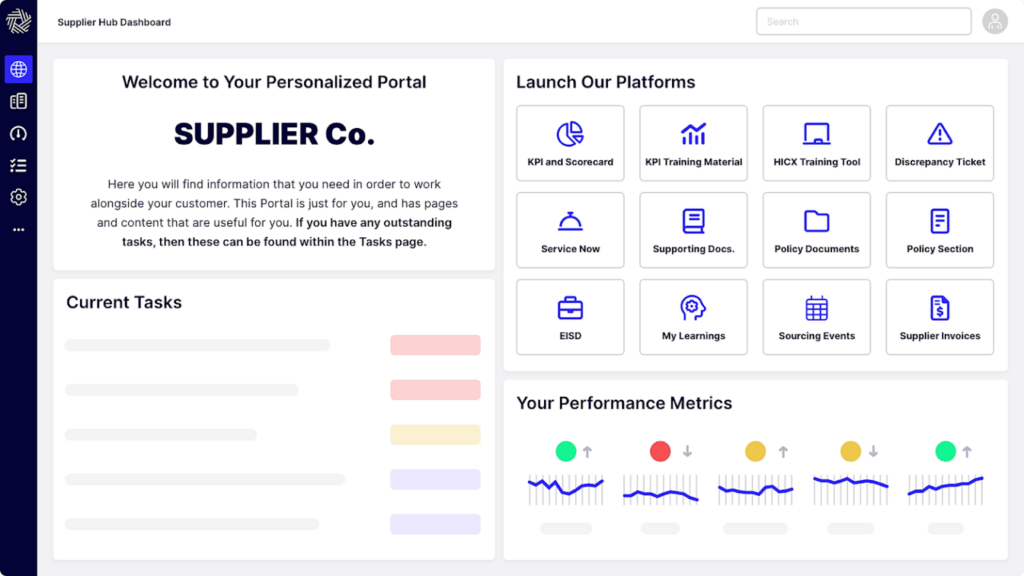

Supplier portals and digital collaboration platforms can help maintain open dialogue, keep key metrics and shared goals in sight, and encourage suppliers to flag challenges or propose solutions.

HICX’s solution is just one example of such a platform.

Source: HICX

Ultimately, it’s about fostering trust, transparency, and mutual accountability to ensure a smooth sustainability journey.

Not all suppliers have the resources, expertise, or infrastructure to meet increasingly complex sustainability requirements.

Without adequate support, companies risk leaving capable suppliers behind or undermining their own ESG ambitions.

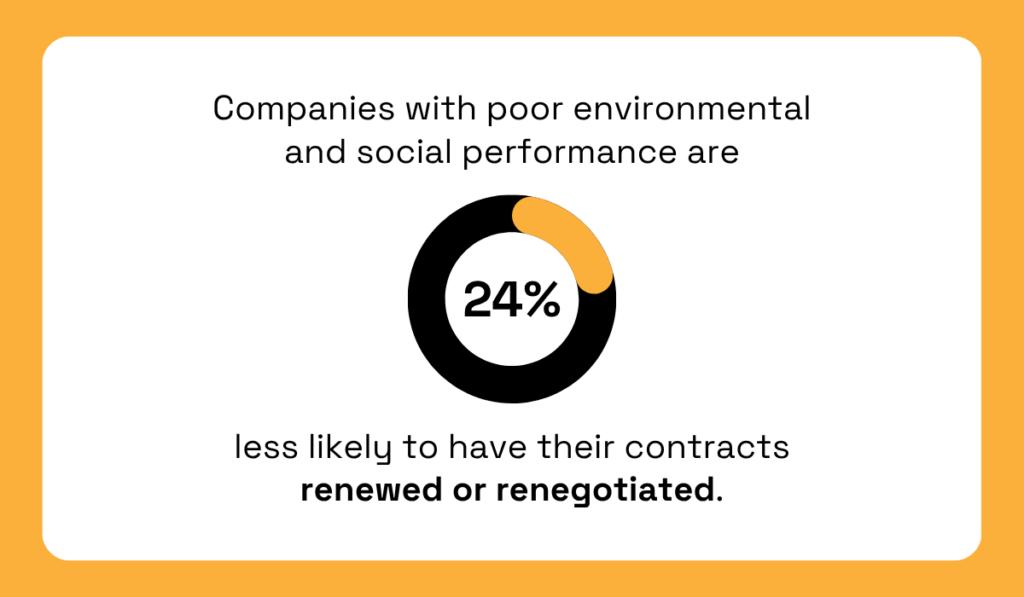

In fact, a recent study found that suppliers with weak ESG performance are significantly less likely to have their contracts renewed or renegotiated.

Illustration: Veridion / Data: SSRN

To avoid this disconnect and encourage good outcomes, organizations need to actively invest in supplier success.

This can take the form of training workshops, shared templates for reporting and improvement plans, or financial support for third-party audits and certifications.

Leading brands are already setting this standard.

Siemens, for example, offers suppliers access to a dedicated carbon management platform.

Source: Siemens

Suppliers using the platform can access emissions tracking tools, resources, and support services to help them align with the company’s climate goals.

Naturally, platforms themselves are just an extension of different targeted programs.

Consider Unilever’s supplier collaboration program.

This initiative has been one of the key drivers behind the company’s impressive 72% reduction in Scope 1 and 2 GHG emissions since 2015.

Source: Unilever

In short, providing resources while inviting supplier feedback helps lay the groundwork for sustainable procurement and strong partnerships that deliver lasting value on both sides.

Positive reinforcement plays a crucial role in driving supplier engagement and continuous improvement.

While clear expectations and support programs are essential, companies also need to actively recognize and reward suppliers that meet or exceed sustainability targets.

According to Gartner, 77% of companies now invest in deeper, more collaborative supplier relationships.

Illustration: Veridion / Data: Gartner

And one proven way to strengthen those ties is by offering meaningful incentives.

These rewards can take several forms:

Some companies even introduce performance-based bonuses or access to joint innovation programs for suppliers that demonstrate leadership in sustainability.

Still, finding the right balance between incentives and accountability is essential.

As Gary Gustafson, president of G-force Consulting, puts it:

Illustration: Veridion / Quote: Smartsheet

This principle applies far beyond ESG, but is especially relevant here because strong supplier performance means better risk mitigation and healthier, more resilient supply chains.

Adopting sustainable procurement practices doesn’t mean sacrificing profit for principles.

Instead, those principles and commitments help secure long-term operational, reputational, and financial resilience, becoming key drivers of overall business success.

There’s no single tactic or challenge to prioritize.

Balanced cost models, reliable supplier data, and positive supplier engagement must work together to drive impact.

Our advice?

The sooner you invest in sustainable processes and reliable data, the stronger your company’s position will be, even in a rapidly evolving market.