Procurement Market Intelligence: All You Need to Know

Some might say there’s no single secret ingredient for achieving success in the realm of procurement.

Well, they might be wrong.

Procurement market intelligence is increasingly being recognized as a vital strategic tool for procurement teams to enhance their risk mitigation, supplier selection, and cost minimization in today’s volatile markets.

But what exactly is it, and how does it work?

In this article, we provide the answers to those questions and more, so keep on reading to learn all the ins and outs of procurement market intelligence and explore the ways it can benefit your procurement too.

Market intelligence, at its core, involves gathering and studying market, industry, and competitor data.

The role of this data is pretty important.

It aids procurement professionals in identifying risks, discovering suppliers, staying informed about trends, and making accurate forecasts—undoubtedly crucial in today’s dynamic markets.

For example, commodity forecasting minimizes risk exposure and gives hedging recommendations. When CPOs have a good overview of the market, they can anticipate shifts and avoid costs.

Put simply, this information forms the foundation for procurement decisions, benefiting not only the procurement department but the entire business.

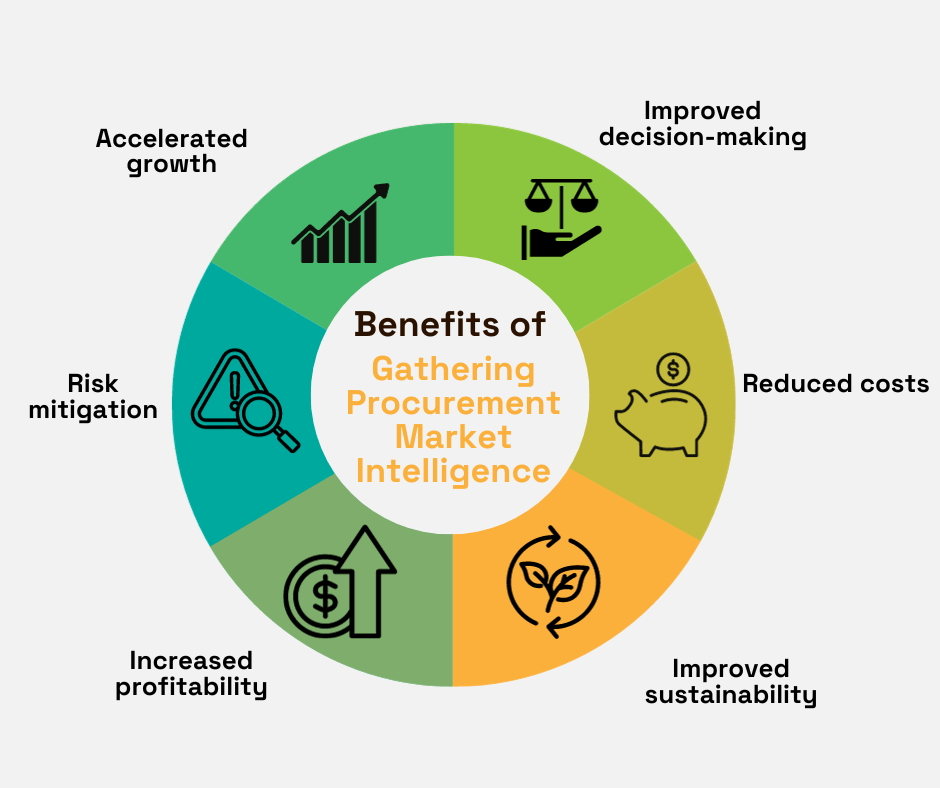

Now, let’s briefly examine some of the advantages of using market intelligence:

Source: Veridion

In essence, procurement market intelligence contributes to data-driven procurement processes, which often directly translates to reduced costs, improved profitability, sustainability, and accelerated growth.

Moreover, it serves as a valuable tool in addressing the myriad of challenges faced by procurement teams—be they from suppliers, markets, or internal operations, (such as transparency issues).

Nicolas Walden, a seasoned procurement advisor at the Hackett Group, concurs, emphasizing that data-driven risk management in procurement enables the anticipation of problems and better preparation to address them:

“Modern supply chains are complex beasts with many moving parts. Plus, the list of supply risks is ever-growing; it is in the procurement team’s best interest to understand how risks may be developing, ranging from the classic financial or inventory risks, all the way through to geographical and geopolitical risk.”

However, for the data to be truly actionable, Walden highlights the need to employ the right tools, like machine learning and AI, for compiling and analyzing it.

We’ll delve deeper into this later in the text.

Overall, the significance of procurement market intelligence in today’s ever-changing markets cannot be overstated.

To unlock all the benefits cited above, a comprehensive approach to market intelligence is necessary. This means gathering and analyzing information on the following four fronts.

It encompasses discovering, compiling, storing, and analyzing data related to various market drivers and constraints, such as:

Having access to this valuable information empowers you to gain a deeper understanding of the market itself, thereby enhancing your ability to navigate the often complex realm of procurement with more ease and efficiency.

Neeraj Khandelwal, the Global Category Manager of Software Procurement at Nokia, shares this perspective, too.

Illustration: Veridion / Data: LinkedIn

Armed with reliable data about the current market conditions, you can, for example, more effectively negotiate contracts, identify potential risks as well as anticipate, and then proactively respond to changes in demand.

Market analysis, in a way, acts as your window into the present and the future of the state of the market.

And as such, it enables you to strengthen negotiations, unlock competitive prices, and successfully align your procurement strategy with the markets’ dynamic conditions.

This component of procurement market intelligence involves understanding the competitive landscape of the industry you are in.

This entails gathering information about various elements that affect your competition as well as suppliers and leveraging those insights to optimize your own procurement process.

Some of the elements of competitive insights to watch out for are:

Vigilantly monitoring these can yield valuable information.

In terms of competitive dynamics, for instance, observing the behavior of competitors, understanding their strengths and weaknesses, and assessing their market positioning can guide your sourcing decisions.

Imagine you notice a competitor embracing new technology to elevate their product offerings. This isn’t just a tech upgrade; it signals a potential shift in consumer demand.

By monitoring these dynamics, you can:

Similarly, recognizing potential disruptors helps you anticipate market changes, associated risks, and develop strategies to mitigate their effect.

One notable example of a disruptor within the automotive industry is electric vehicles, which increased the demand for lithium-ion batteries and rare earth metals, and “led to changes in sourcing strategies and supplier relationships within the supply chain”, as highlighted in the article from Oboloo.

Staying informed about such changes and proactively addressing them minimizes the impact on businesses when they do occur.

Ultimately, no business operates in isolation. Each is affected by the actions of competitors, technological advancements, and other external factors.

Therefore, competitive insights should be, if they aren’t already, a vital part of your procurement decisions.

To ensure sourcing effectiveness, your market intelligence must also encompass various vendor performance data.

This is called supplier intelligence, and it centers around outlining a pool of qualified suppliers that meet predetermined screening criteria.

As emphasized by Ingmar Mester, Director of Supplier Management and Sustainability at Hapag-Lloyd AG, finding ideal vendors today requires a more comprehensive approach than merely examining their financial ratings:

“In order to find the right partners, you need to have transparency. It’s no longer enough just to know the financial rating of the supplier. You need to know a lot more about their operational capabilities, about their plans, and you have to deal with them very differently.”

It’s about going deeper to establish a dependable supply chain and ensure the success of future procurement endeavors.

So, what key performance indicators (KPIs) should you include in your supplier intelligence reports?

Here are some of the most important ones:

Monitoring and analyzing these KPIs enable a more thorough comparison of potential suppliers’ efficiency, moving beyond a sole focus on their prices.

This, in turn, helps with the selection of the most suitable business partners, nurturing and maintaining supplier relationships, and the development of effective negotiation strategies, all of which contribute to more lucrative procurement processes within the company.

Cost analysis or spend intelligence involves the examination of various procurement-related costs, encompassing both the base prices of procured items and indirect expenses, such as those associated with running a procurement department, for example.

Cost analysis entails more than just determining the “how much” and provides a comprehensive perspective on how funds are allocated within the procurement process.

Let’s delve into it below.

Source: Veridion

As you can see, spend analysis also reveals the “what,” “who,” “how”, and more, providing a unified overview of the company’s spending.

So, what does this mean for procurement?

Well, a thorough investigation of your expenses delivers numerous benefits that go beyond just achieving complete visibility into the business’s financial outflows.

This is only the starting point; it paves the way for additional advantages such as:

In short, this facet of procurement market intelligence is of utmost importance, especially when the goal is cost saving. Consequently, it should constitute an integral part of the foundation for your decision-making.

Now, as we reflect on all the components of market intelligence, it becomes apparent that this field is quite complex, involving diverse data.

The question that arises now is: how do you effectively compile this vast amount of information?

There are several different ways to gather procurement market intelligence, each with its own set of pros and cons.

In this section, we’ll be covering three of them:

The first method, desktop research, is by far the most widespread.

It involves manually browsing supplier websites, annual reports, trade publications, and analyst reports to compile relevant data.

While the process is straightforward, it can also be time-consuming and labor-intensive.

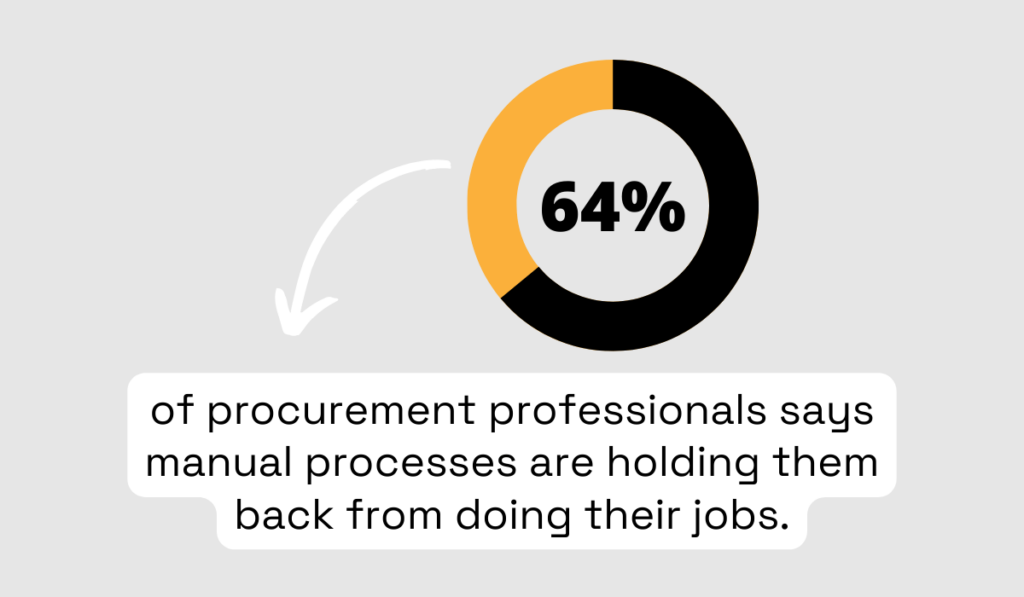

Research by Ivalua sheds light on why this could be a problem.

Illustration: Veridion / Data: Ivalua

As it turns out, almost two-thirds of procurement professionals agree that manual processes, including data collecting, hinder their efficiency and deter them from more useful work.

This is what happens with manual research. Instead of focusing on higher-value tasks, your team gets stuck browsing the internet looking for data.

To elaborate more on this, we’ve dedicated a whole article to the benefits of leaving manual processes behind and automating procurement.

Another valuable source of market intelligence is your suppliers.

Given their familiarity with the specific category space, suppliers can usually offer reliable information that your competitors might not have, giving you a competitive advantage.

However, it’s essential to be aware that suppliers may also be biased and exaggerate the demand for their products.

This brings us to the last intelligence resource in this section: AI.

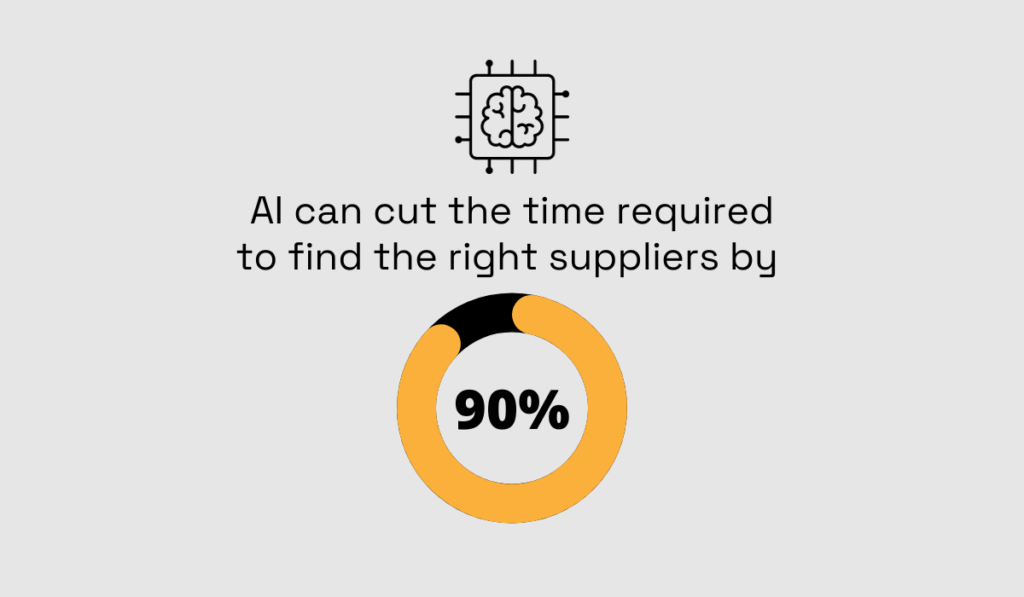

What other methods of data gathering may take weeks to accomplish, AI does in seconds.

For instance, when it comes to collecting supplier insights, AI swiftly scours the internet, extracts relevant information, analyzes it for you, and presents a pool of potential candidates within moments.

In fact, research has shown that AI reduces the time required for finding the right suppliers by 90%.

Illustration: Veridion / Data: McKinsey & Company

An excellent example of this is our AI-powered supplier enabler tool, Veridion, which provides users with a constantly updated global supplier database with over 60 data points for over 80M companies.

Using our Search API, you can specify necessary criteria and find suppliers that fit them.

For example:

Source: Veridion

With such rich market data, selecting suppliers has never been easier.

In summary, there are various methods and tools for procurement market intelligence gathering, but it’s crucial to weigh their advantages against the disadvantages to ensure the information you obtain is accurate, reliable, up-to-date, and actionable.

We believe AI has a tremendous advantage in this context. Many other professionals concur and advocate for leveraging modern technology and AI as the most effective approach in this regard.

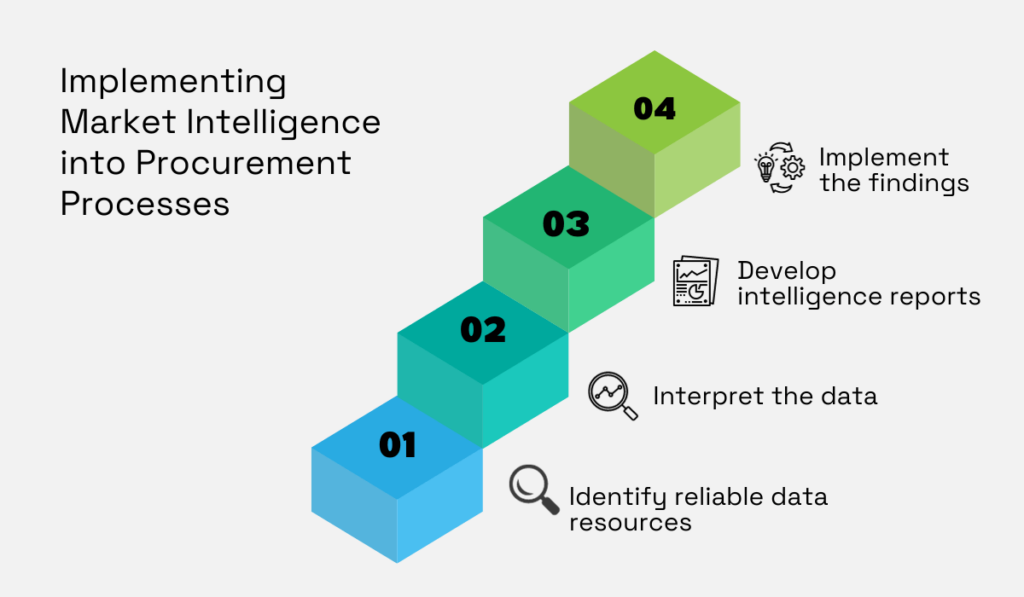

Now that you’re familiar with where and how to locate procurement market intelligence, it’s essential to integrate it into your processes effectively.

Here’s a breakdown of the four crucial steps involved.

Source: Veridion

The initial phase focuses on identifying which processes, (e.g. negotiation or supplier evaluation), could benefit the most from this intelligence and choosing relevant sources for your data.

To achieve that, Gordon Withrow, Principal of Gordon Withrow and Company, LLC, emphasizes the importance of utilizing multiple sources and cross-comparing data to derive the most value from them.

Source: LinkedIn

He cautions against relying solely on a single source, emphasizing that doing so may lead to drawing subjective conclusions and result in inefficient decision-making.

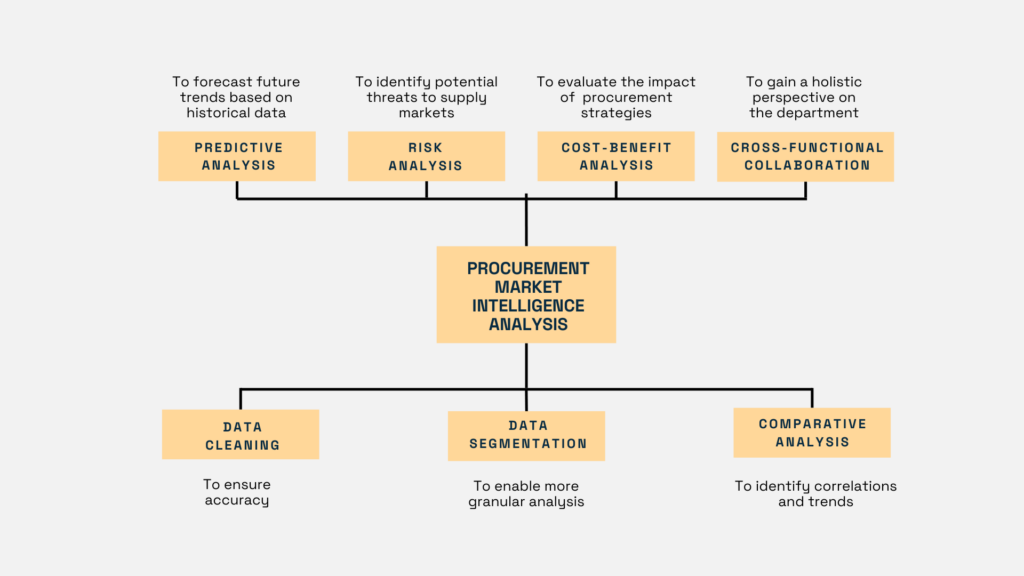

After selecting your sources, the next step involves interpreting the data—a nuanced process depicted in the image below.

Source: Veridion

Despite its complexity, this is non-negotiable if you aim to extract actionable insights from the information.

Having the team trained in data literacy is of importance here. After all, if the information cannot be easily accessed or comprehended, it won’t be of much use to you.

Moreover, to ensure everyone on the team comprehends the collected intelligence, it’s important to present it clearly.

That’s what the next phase—intelligence reports—is all about.

To nail your reports, present the findings in a structured way, incorporating an executive summary, methodology, and visual aids such as charts and graphs for enhanced data visualization.

Additionally, articulate actionable recommendations derived from intelligence. Clearly explain what this information can help you achieve.

The final step is to leverage the data to improve your workflows.

For successful implementation and the improvement of procurement processes, establishing clear communication channels between the decision-makers in procurement, supply chain, finance, and data analytics is imperative.

If you follow these steps, your procurement market intelligence will surely be translated into well-informed sourcing strategies, negotiations, and overall decision-making, ensuring a strategic and impactful use of available data.

If there’s one key takeaway we want you to leave this article with, it’s this: procurement market intelligence is a valuable investment of time and effort.

Why?

Because this data truly holds the potential to significantly enhance your procurement processes.

Remember, the market doesn’t wait for anyone. To stay ahead, you need to remain vigilant and keep your finger on its pulse at all times.

Market intelligence, especially when paired with cutting-edge technologies like AI, empowers you to make that happen.

It’s not just about keeping up; it’s about leading the way in procurement excellence.