Common Supplier Segments Used in Procurement and SCM

Treating all suppliers the same isn’t practical—or effective.

Some suppliers are critical to your success, while others have smaller, more tactical roles.

Understanding these differences is the key to managing them more effectively.

It starts with segmenting suppliers into groups based on their importance and role in your operations.

You’ve probably heard of the Kraljic matrix, which classifies suppliers into four categories: strategic, leverage, bottleneck, and non-critical.

But today’s supply chains are more complex, requiring a deeper dive into supplier segmentation.

That’s exactly what we’ll do here. We’ll explore eight supplier segments, giving you a clearer picture of how to manage each.

Let’s start with the most impactful group: strategic suppliers.

Strategic suppliers are the ones you can’t afford to lose.

They provide critical components, services, or materials that directly affect the quality or functionality of your products.

At the same time, these suppliers support your company’s long-term goals, whether it’s achieving competitive advantage, driving growth, or meeting broader objectives like sustainability.

As procurement consultant Hewy Rappé puts it:

Illustration: Veridion / Quote: Linkedin

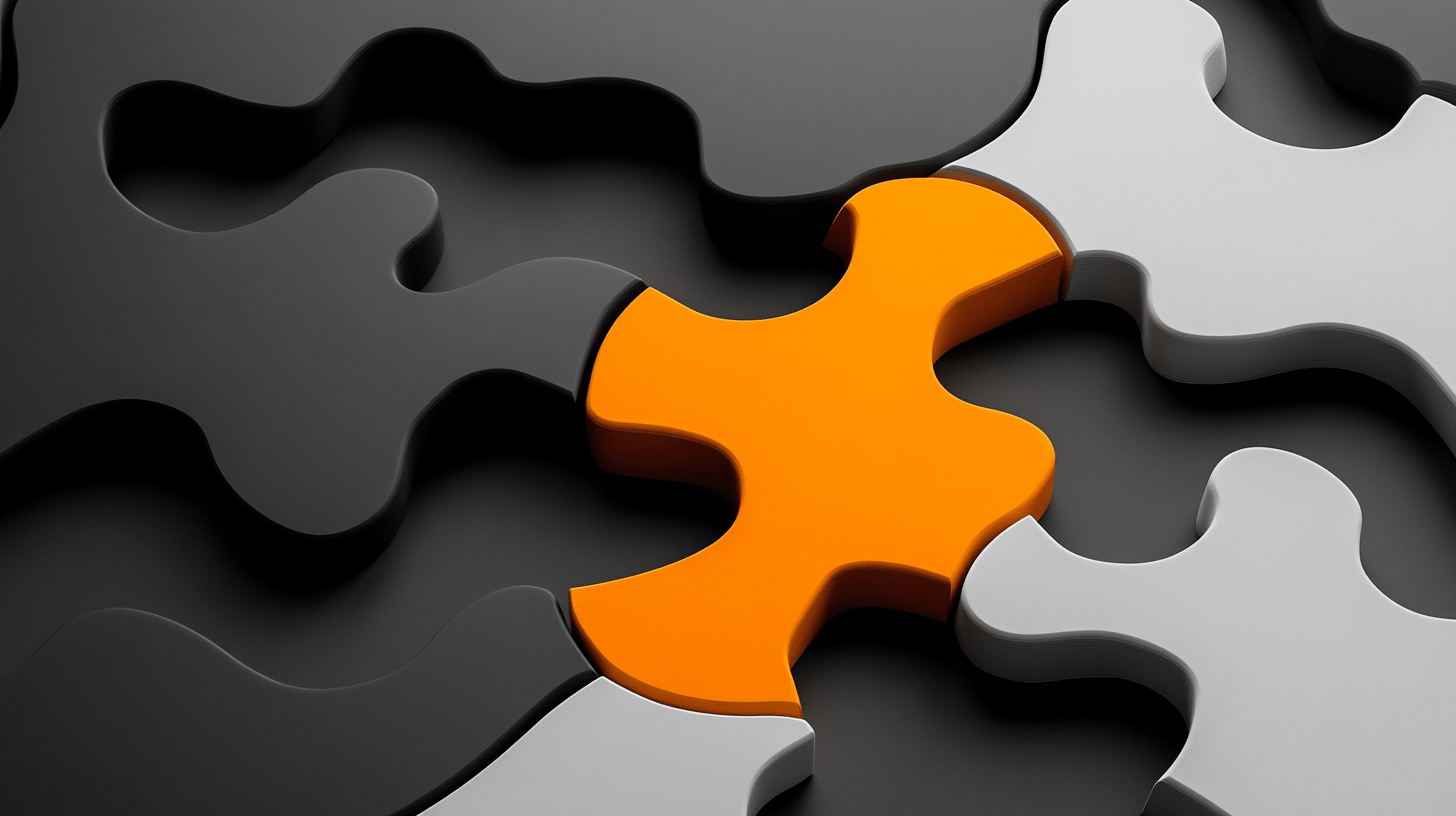

Take Gilead Sciences, a pharmaceutical company, for example.

For Gilead, strategic suppliers are critical not just to operations but also to achieving long-term goals like reducing greenhouse gas emissions.

Gilead segments its strategic suppliers by:

Gilead further segments these suppliers based on their Scope 3 maturity to focus efforts on those that can help achieve sustainability targets.

Source: Procurement Leaders

So, what should you focus on in managing strategic suppliers?

Above all, you should build partnerships that are collaborative, transparent, and aligned with your goals.

By asking the right questions and maintaining open communication, you can ensure that strategic suppliers help you achieve success while minimizing risks to your operations.

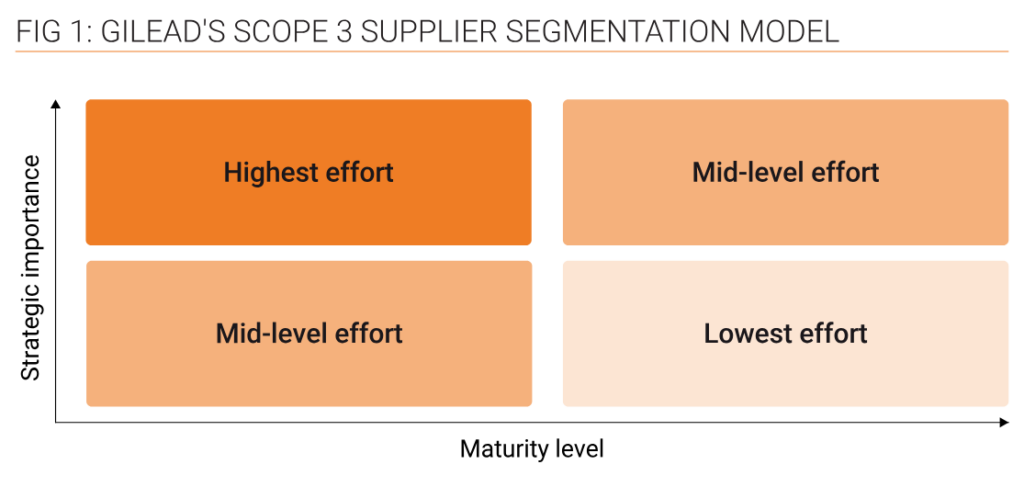

Tactical suppliers have an important role in keeping your daily operations running.

These are the suppliers you rely on for essential but non-strategic goods and services like:

Here, the focus shifts from deep collaboration to ensuring reliability and cost-efficiency.

That’s why managing tactical suppliers often comes down to minimizing administrative overhead and automating some parts of procurement.

For instance, using e-auctions, pre-negotiated contracts, or online catalogs can help you streamline tactical procurement and cut costs.

Source: Veridion

This also reduces constant back-and-forth with suppliers while empowering internal teams to order what they need within set guidelines.

However, this doesn’t mean you should overlook tactical suppliers’ performance altogether.

It’s still important to monitor if they deliver on time and meet quality expectations.

By assessing these basics, you can ensure tactical suppliers remain reliable while requiring minimal effort to manage.

The goal is simple: maximize efficiency while keeping these relationships low-maintenance.

Leverage suppliers offer commodities or services that are widely available from multiple sources.

These suppliers, such as providers of steel, paper, or fuel, know that they face stiff competition, which gives you, as a buyer, a strong negotiating position.

In other words, you have more leverage, as Shadi Bjerami, procurement and supply chain consultant, points out:

Illustration: Veridion / Quote: Linkedin

Their replaceability allows you to focus on driving down costs through tactics like competitive bidding or bulk purchasing agreements.

Take Walmart as an example.

The retail giant leverages its massive buying power to secure favorable terms from suppliers of generic goods, ensuring it stays competitive in the market.

By pitting multiple suppliers against each other, Walmart can negotiate lower prices without sacrificing quality.

When managing leverage suppliers, procurement teams should do two things:

However, despite the focus on price, it’s worth keeping an eye on suppliers’ service levels and reliability.

After all, even a leverage supplier can negatively impact your operations if they fail to meet expectations.

Bottleneck suppliers provide products or services that are difficult to replace but have low strategic importance for your overall business goals.

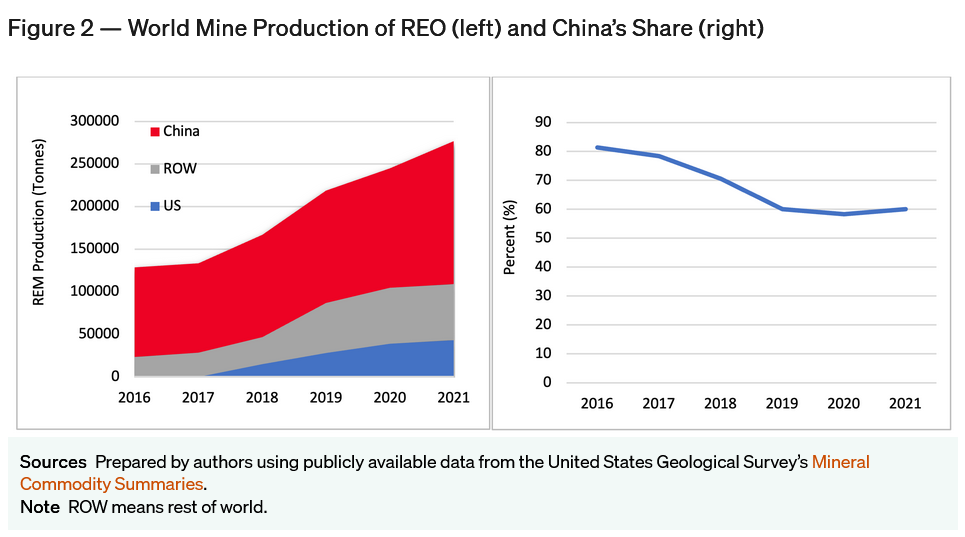

A perfect example is suppliers of rare earth elements (REEs) like neodymium, used in permanent magnets for wind turbines, electric vehicles (EVs), and advanced electronics.

Despite their critical role, the REE supply chain is highly concentrated, with China controlling over 60% of global production and an even larger share of processing.

Source: Baker Institute

This dominance leaves industries vulnerable to disruptions.

For instance, in 2023, China imposed export restrictions on gallium, graphite, and germanium, forcing countries to scramble for alternatives.

Most recently, China paused the export of REE-related mining and recycling technologies, further tightening global supply.

Source: Reuters

To manage bottleneck suppliers effectively, focus on risk mitigation.

Can you find alternative materials or redesign the product to use a more commonly available component?

For example, companies started exploring substitutes for rare earths and investing in recycling initiatives to reclaim materials from old electronics.

Another option is to develop a long-term partnership with your bottleneck supplier to secure consistent supply.

These approaches to bottleneck supplier management can shift the balance of power and reduce dependency.

Innovative suppliers drive growth by contributing to the development of new products, technologies, or processes that differentiate your company in the market.

Examples include technology providers or research collaborators who push the boundaries of what’s possible.

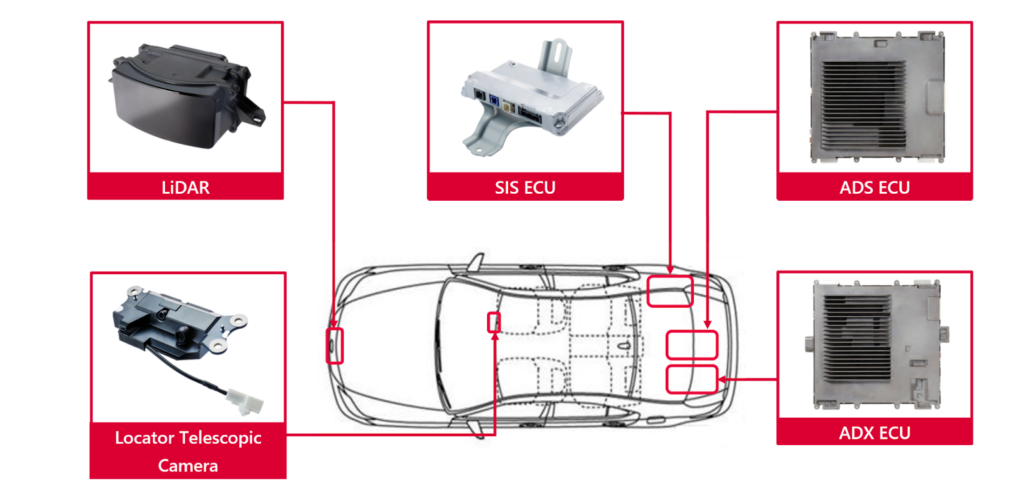

Take Toyota and DENSO, their key supplier and the world’s second-largest producer of automotive components, for example.

In 2019, these two companies partnered to establish a joint venture focused on next-generation in-vehicle semiconductors.

Source: Toyota

By combining DENSO’s semiconductor expertise with Toyota’s mobility knowledge, they develop cutting-edge technologies like sensors for automated vehicles and power modules for electric cars.

Source: DENSO

This partnership accelerated innovation and strengthened their competitive edge in the rapidly evolving automotive industry.

Managing innovative suppliers requires a strategic approach focused on collaboration and trust.

In fact, many times, your innovative suppliers will be your strategic suppliers and vice versa.

So, to maximize the value of these partnerships, prioritize early engagement in development projects and align on shared goals.

Regular communication, co-investment in R&D, and clearly defined objectives can transform your relationship with innovative suppliers into a source of long-term competitive advantage.

High-risk suppliers are those prone to disruptions due to factors like geopolitical instability, financial volatility, or operational vulnerabilities.

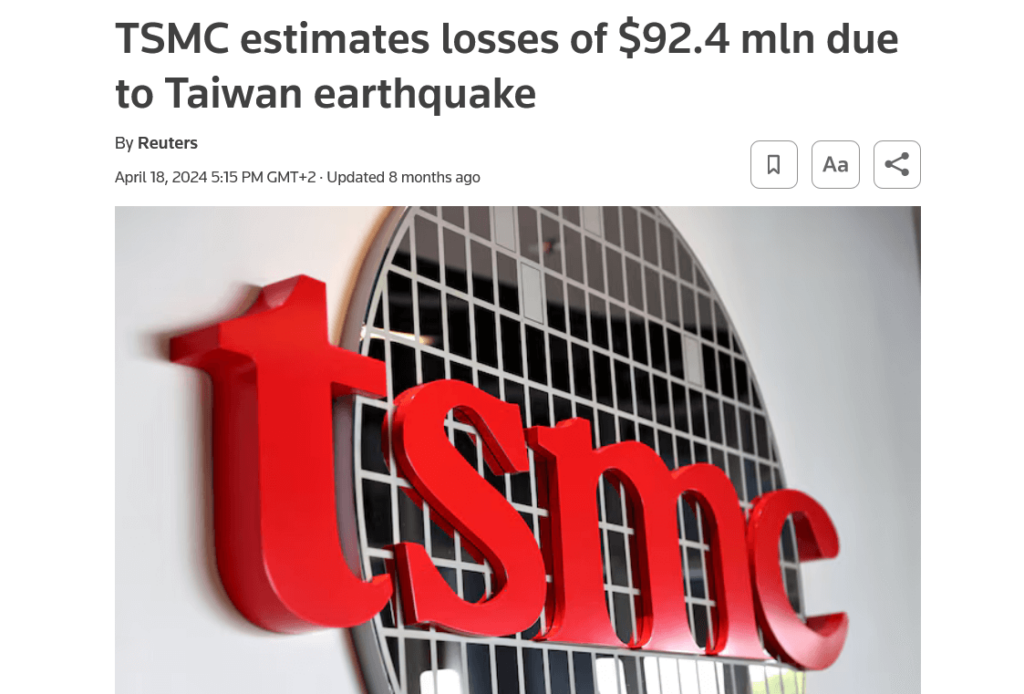

A notable example is Taiwan Semiconductor Manufacturing Company (TSMC), providing critical components for tech giants like Apple.

TSMC is considered a high-risk supplier because of Taiwan’s exposure to natural disasters and ongoing geopolitical situation.

For instance, a 7.4 magnitude earthquake in April 2024 briefly halted TSMC’s production, resulting in a $92 million loss.

Source: Reuters

Additionally, Taiwan’s political situation, particularly its strained relationship with China, adds layers of uncertainty to its supply stability.

For companies like Apple, TSMC’s location and reliance on specific operational conditions present inherent risks.

To address these risks, Apple has been involved in the decision to build a new TSMC chip fabrication plant in Arizona, which will reduce reliance on a single geographic location.

Source: CNBC on YouTube

Nearshoring to the U.S. will also secure Apple a more stable supply of chips while maintaining a relationship with a high-risk supplier.

All in all, managing high-risk suppliers requires robust risk mitigation strategies, including:

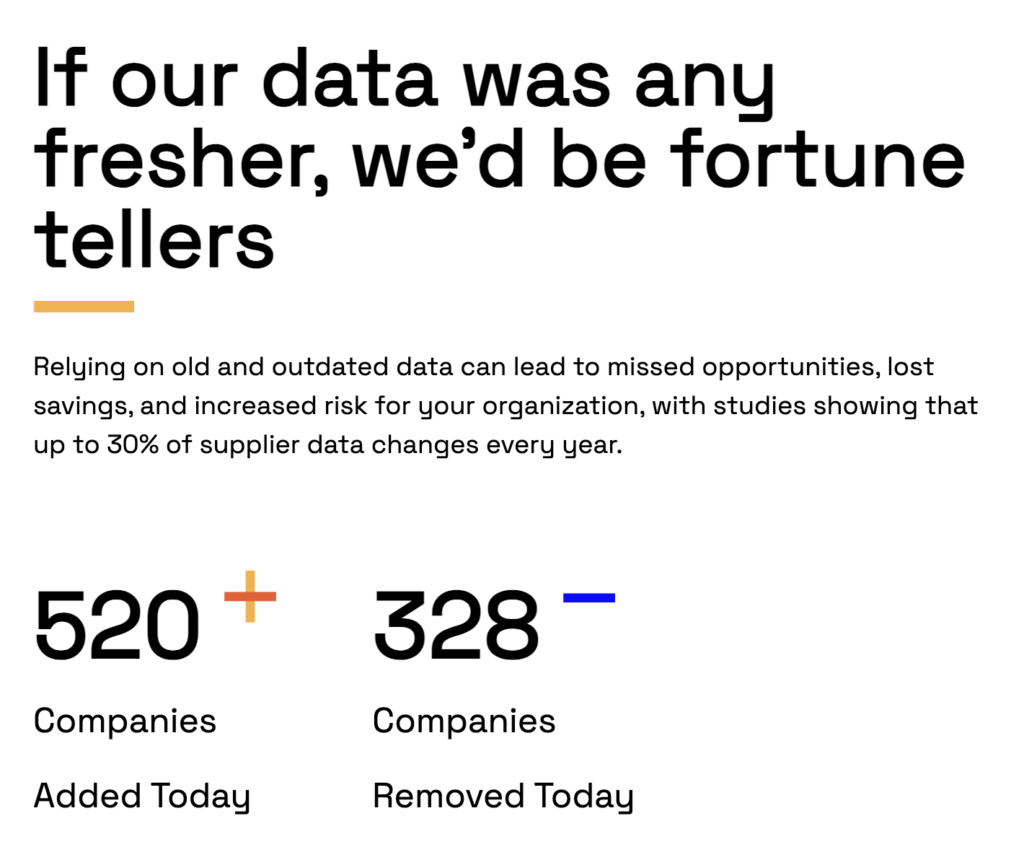

The latter can be easily done with services like Veridion.

Source: Veridion

Our data platform refreshes supplier data weekly, bringing accurate insights on supplier risk factors, from geopolitical changes and ESG risks to supplier financial health and changes in suppliers’ activities.

Preferred suppliers have a strong track record for reliability, quality, and compliance, often chosen for long-term partnerships.

These suppliers are not only consistent but also align with your company’s values and goals.

A prime example is TSMC, which, despite its high-risk profile, is also a preferred partner for Apple.

Apple has committed to being TSMC’s largest customer, significantly strengthening their long-term relationship.

This partnership benefits both companies.

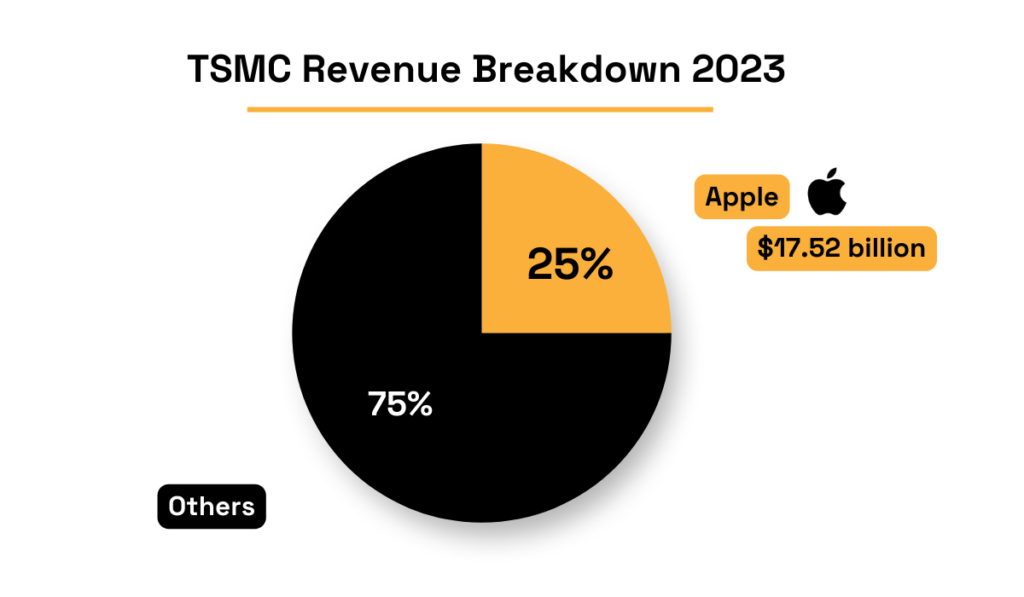

Apple holds a dominant position, with a 50% boost in TSMC’s orders and contributing $17.52 billion, or 25% of TSMC’s total revenue in 2023.

Illustration: Veridion / Data: FPT Semiconductor

In return, Apple receives preferential treatment, including dedicated engineers to assist with custom chip designs and influence over TSMC’s R&D priorities, such as improvements in power consumption.

By working closely together, they can optimize the chip manufacturing process to meet Apple’s specific needs, with issues prioritized during production.

For procurement teams, managing preferred suppliers means fostering deep, collaborative relationships that go beyond price negotiations.

It’s about optimizing performance, driving innovation, and resolving issues swiftly.

These suppliers are integral to your success, and as such, your focus should be on strengthening the partnership through continuous communication, aligning goals, and ensuring mutual growth and benefits.

Fringe suppliers provide low-value or non-critical products or services, often with minimal impact on your overall supply chain or business operations.

They are usually small businesses, niche providers, or offer low-volume components.

For example, a local company supplying promotional materials for a one-off event is a fringe supplier.

While their service fulfills a need, it doesn’t influence your strategic goals or require a long-term partnership.

Managing fringe suppliers typically involves streamlined procurement processes, minimal oversight, and cost-effective, transactional management.

Interestingly, fringe suppliers can sometimes disrupt markets by competing with larger players in specific niches.

For example, articles from Vanguard highlight how fringe companies in Nigeria’s dishwashing soap and bitters markets challenge established brands by introducing price competition or unique offerings.

Source: Vanguard

While this may not apply directly to your procurement process, it shows how fringe suppliers can gain influence if market conditions shift.

In short, fringe suppliers play a small but helpful role, meeting non-critical needs without requiring much effort to manage.

Supplier segmentation isn’t just a one-time exercise but an ongoing process that evolves with your business and market conditions.

A supplier might move from low-risk to high-risk or from non-critical to preferred, depending on changes in their role, capabilities, or the external environment.

However, by segmenting your suppliers, you gain clarity and control, so you can manage different suppliers more effectively.

Ultimately, supplier segmentation empowers you to reduce risks, strengthen relationships, and unlock value across your supply chain.

Learn more about supplier segmentation. Check out our ultimate guide on the topic.