Multi-Tier Supplier Collaboration: Benefits and Challenges

Key Takeaways:

As supply chains grow more complex and global, a company’s real exposure to disruption, risk, or inefficiency often lies deeper in Tier 2, Tier 3, and beyond.

These sub-tiers supply the materials and services that Tier 1 suppliers rely on—so when they falter, the entire upstream chain is at risk.

That’s why multi-tier collaboration is becoming essential for modern supply chains.

It offers significant benefits but also presents complex challenges.

Read on as we explore both—along with practical ways to enhance collaboration across supplier tiers.

The benefits of multi-tier supplier collaboration are becoming too large to ignore.

They directly affect a company’s ability to adapt to disruption, reduce waste, meet ESG goals, and bring innovative products to market faster.

Let’s begin with one of the most urgent priorities for procurement and supply chain leaders today: resilience.

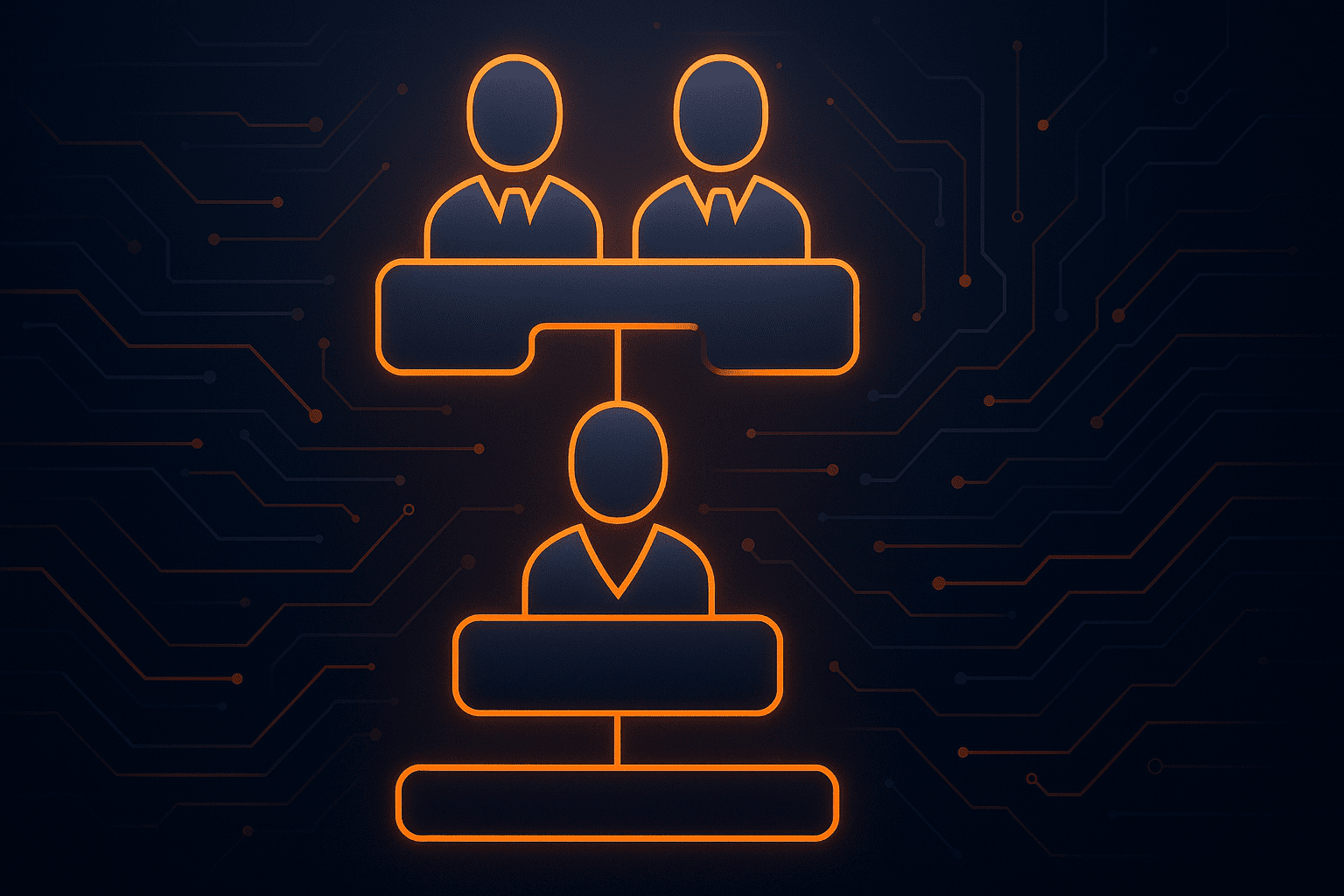

According to Proxima’s 2024 Supply Chain Barometer, 86% of CEOs are concerned about resilience in their supply chains.

Illustration: Veridion / Data: Proxima

But where exactly do resilience issues come from, and how can collaboration with deeper-tier suppliers help?

One of the main causes is limited visibility and communication beyond Tier 1.

While most organizations have well-established relationships with their direct suppliers, sub-tier suppliers often remain invisible, even though this is where many disruptions originate.

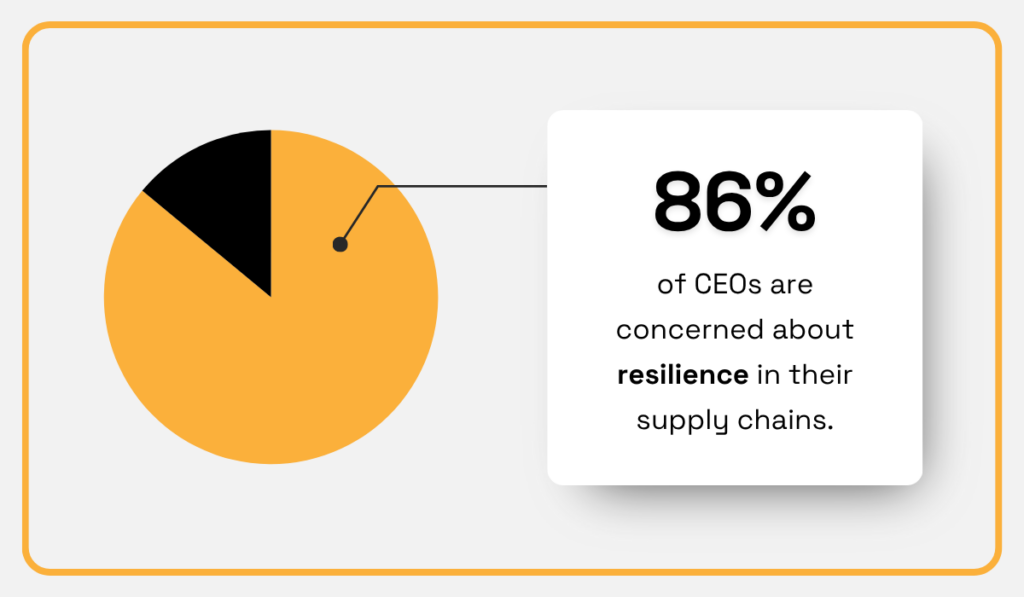

A study by Sphera confirms this, revealing that 85% of supply chain disruptions begin at Tier 2 or below.

Illustration: Veridion / Data: Sphera

Without direct collaboration, such as sharing forecasts, aligning production schedules, or proactively flagging risks, companies are left exposed to the unknown.

They are often caught off guard, only learning about an issue once a Tier 1 supplier fails to deliver.

Unfortunately, these events are common.

Data from the Business Continuity Institute shows that nearly 80% of organizations experienced at least one supply chain disruption in 2023, with most facing between one and ten.

Illustration: Veridion / Data: BCI

Collaborating across supplier tiers helps address these risks early.

For example, if a Tier 3 supplier is facing a material shortage or shipment delay, that information can be shared upstream, prompting preventive action from the OEM or Tier 1 supplier.

This kind of upstream-downstream coordination is what transforms visibility into resilience.

This approach was tested by a Fortune 100 automotive manufacturer working with TADA, a supply chain visibility platform.

The OEM mapped its multi-tier supply network and began sharing demand forecasts directly with Tier 2 and Tier 3 suppliers, bypassing traditional bottlenecks at the Tier 1 level.

Source: Tada Now

This resulted in faster adjustments to demand shifts, improved supplier coordination, and better planning across all tiers.

So, it wasn’t just the OEM that benefited.

Tier 2 suppliers also saw meaningful improvements, as one of them noted:

Illustration: Veridion / Quote: Tada Now

This is a clear example of multi-tier collaboration in action.

Instead of acting in silos, suppliers and buyers at all levels work from shared data and aligned priorities.

Tier 2 and Tier 3 suppliers benefit from real-time information, while the OEM gains early warning signals and better supply continuity.

Ultimately, resilience improves not because visibility exists, but because organizations use it to collaborate directly across tiers.

That collaboration—structured, timely, and mutual—is what enables supply chains to adapt instead of react.

Cost savings are often one of the most compelling—and measurable—benefits of multi-tier supplier collaboration.

This should matter now more than ever, as nearly every CEO ranks cost reduction as a top supply chain priority.

Illustration: Veridion / Data: Proxima

Yet, many companies still chase savings through siloed initiatives, negotiating harder with Tier 1 suppliers, cutting SKUs, or tweaking warehouse operations.

While these tactics can deliver short-term wins, the biggest opportunities lie elsewhere.

To unlock meaningful, system-wide savings, companies must connect the dots across all tiers of their supply network.

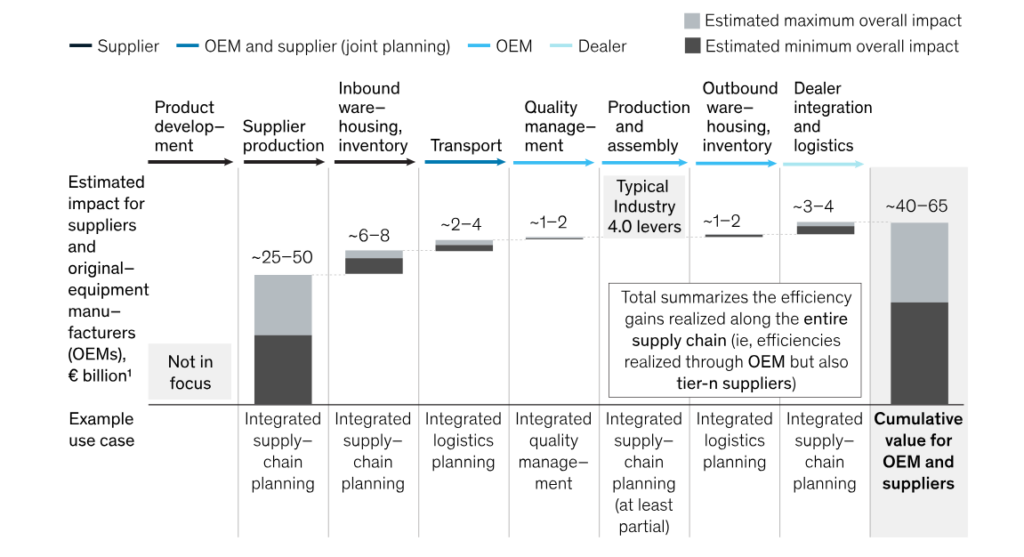

McKinsey’s research in the automotive sector found that deeper integration across supply chain tiers could generate €40 to €65 billion in annual savings for OEMs and suppliers.

A significant portion—around €25 to €50 billion—comes from improved production efficiency.

Source: McKinsey

These gains happen when OEMs, Tier 1s, and sub-tier suppliers collaborate on aligned production schedules, share real-time demand signals, and plan capacity jointly.

With better information and coordination, lower-tier suppliers can avoid last-minute changeovers, costly overtime, or idle time caused by component shortages.

Another major source of savings is inventory.

Poor visibility and fragmented communication often lead to excess stock, especially at lower tiers, where suppliers hedge against uncertainty by overproducing or overordering.

According to the same McKinsey analysis, integrated planning and better forecasting across tiers can reduce inventory buffers, leading to €6 to €8 billion in savings.

Illustration: Veridion / Data: McKinsey

But this level of optimization only works when all partners, from OEMs to raw material providers, share relevant data on inventory levels, lead times, and capacity constraints.

Even transportation becomes more efficient through multi-tier collaboration.

Emergency shipments, air freight, and last-minute routing changes are often symptoms of poor coordination across tiers.

When demand and supply are better aligned throughout the chain, companies can plan logistics more effectively, reduce reliance on costly expedited transport, and cut related emissions.

All this generates an additional €2 to €4 billion in annual savings, McKinsey estimates.

All in all, sustainable cost savings don’t have to come from driving prices down.

They can come from designing a more intelligent, better-connected supply network that avoids waste, reduces rework, and responds with agility.

But that’s only possible when visibility, trust, and collaboration extend beyond Tier 1.

Improving ESG performance is another powerful reason to build stronger ties across supply tiers.

As regulatory pressure increases and stakeholder expectations rise, companies are being held accountable not just for their own operations, but for the behavior and practices of every supplier involved in delivering their products.

Source: SDC

The problem is, most ESG risks are buried deeper in the supply chain.

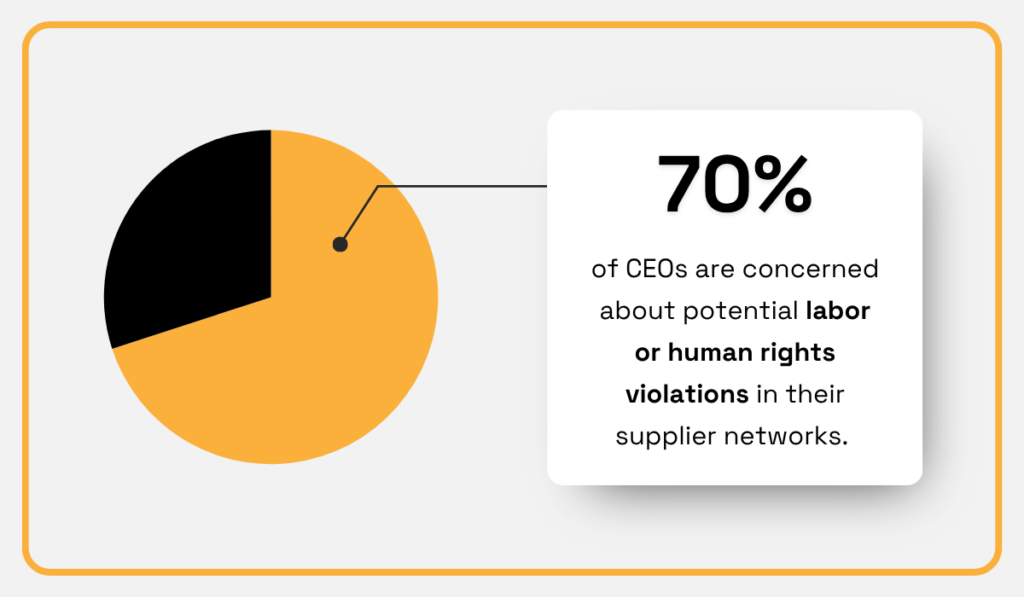

Proxima’s 2024 Supply Chain Barometer shows that 70% of CEOs are concerned about potential labor or human rights violations in their supplier networks.

Illustration: Veridion / Data: Proxima

And that concern is well-founded.

Violations like forced labor, unsafe working conditions, and high-emission manufacturing are most likely to occur at Tier 2, Tier 3, or beyond, where oversight is weakest and reporting systems are often unreliable.

It’s not limited to one industry either.

For example, a recent investigation linked jasmine farms, Tier 3 suppliers for Estée Lauder and L’Oréal, to instances of child labor.

Source: Google

This case is another stark reminder that ESG risks don’t stop at Tier 1—and neither should supplier management.

To address these risks, companies need two things: visibility and collaboration.

Visibility allows them to uncover where the risks are.

But without collaboration, they won’t have the relationships or influence to drive improvement.

That’s why multi-tier supplier collaboration is so important.

By working directly with sub-tier suppliers, companies can:

This approach pays off.

According to Sphera, 8 out of 10 organizations say that gaining visibility into deeper tiers strengthens supplier engagement on sustainability.

Illustration: Veridion / Data: Sphera

And leading companies are already putting this into practice.

Land O’Lakes, one of the largest food and agriculture cooperatives in the U.S., emphasizes working with its entire ecosystem, including 3PLs, retailers, and indirect suppliers, to achieve its ESG goals.

Dustin Braun, the company’s Vice President of Manufacturing, explains:

“We have to enable all these environmental and social targets that we have all signed up for, and work as an ecosystem to do that.”

Joint initiatives like audits, assessments, and supplier development programs are becoming more common, with 67% of companies now using joint audits to increase transparency across their supplier networks.

These actions require deep-tier engagement, and without that collaboration, companies risk falling short of both compliance and credibility.

Innovation doesn’t always start with the brand.

In many industries, it begins far earlier: in raw materials, components, or even farming techniques developed by deep-tier suppliers.

Yet, too often, this innovation is overlooked because companies only engage with Tier 1 suppliers.

That leaves them blind to early-stage breakthroughs that could significantly enhance their products, shorten development cycles, or improve sustainability.

But the companies that recognize and tap into innovation at the sub-tier level gain a significant edge.

Take, for example, Gore-Tex®, a specialty materials company that operates as a Tier 2 supplier in the apparel industry.

Source: Gore-Tex

Its development of expanded polytetrafluoroethylene (ePTFE) transformed the performance wear category.

Brands like Nike, Patagonia, and The North Face didn’t invent the material.

But their willingness to collaborate with Gore-Tex allowed them to embed it in their products and set new standards for breathable, waterproof clothing.

Source: Google

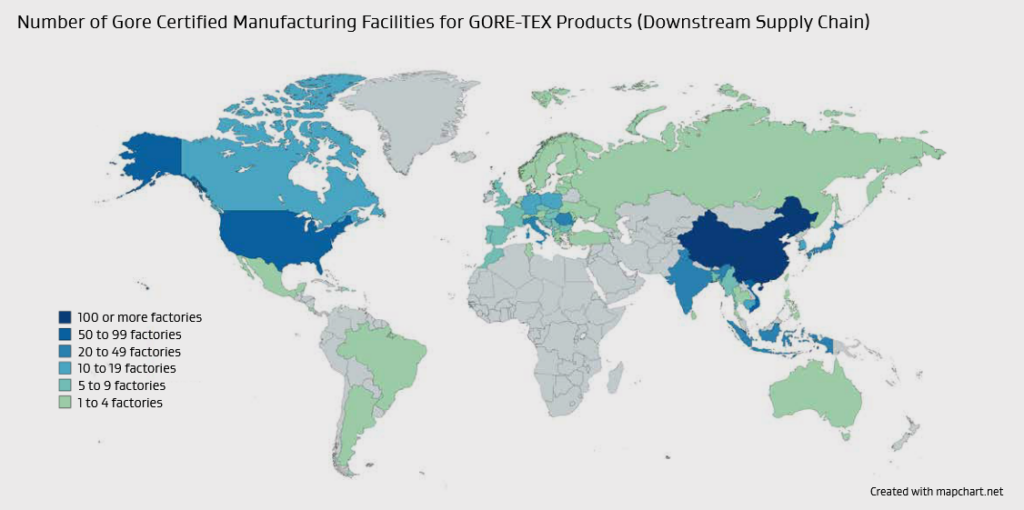

The map below shows just how far-reaching Gore-Tex’s downstream supply network is:

Source: Gore-Tex

This is the untapped potential of multi-tier collaboration.

By working directly with deep-tier suppliers on R&D initiatives, sharing market insights, or aligning on product roadmaps, companies can move faster, reduce time-to-market, and differentiate in crowded categories.

These relationships require trust, mutual benefit, and often co-investment.

But the payoff can be transformative.

So instead of viewing innovation as something that flows top-down, companies should begin asking:

Which of our sub-tier suppliers is already working on the next breakthrough, and how can we help bring it to market together?

The benefits of multi-tier supplier collaboration are compelling, but so are the challenges.

And it all starts with (in)visibility.

Most companies have a solid grasp of who their Tier 1 suppliers are. But visibility drops steeply beyond that point.

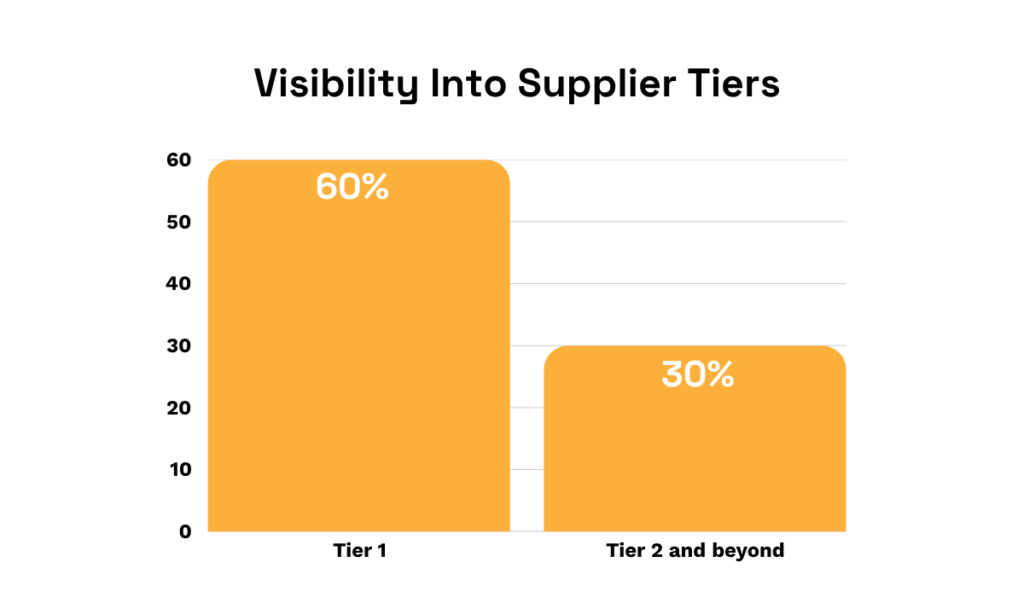

According to a 2024 McKinsey survey, 60% of companies report strong visibility into Tier 1, yet only 30% say the same for deeper-tier suppliers.

Illustration: Veridion / Data: McKinsey

Why?

Sub-tier suppliers often operate independently of direct contracts or formal oversight.

Their names might not even appear in the company’s systems.

In some cases, Tier 1 suppliers treat their own suppliers as proprietary information, reluctant to disclose details due to competitive or contractual concerns.

As a result, procurement and supply chain teams remain blind to critical suppliers of raw materials, components, or services—until something goes wrong.

This lack of transparency makes it impossible to proactively manage risk, ensure compliance, or collaborate on sustainability and innovation efforts.

But companies don’t have to stay in the dark.

Supplier mapping tools, risk platforms, and data services are making it faster and easier to uncover hidden layers of the supply chain.

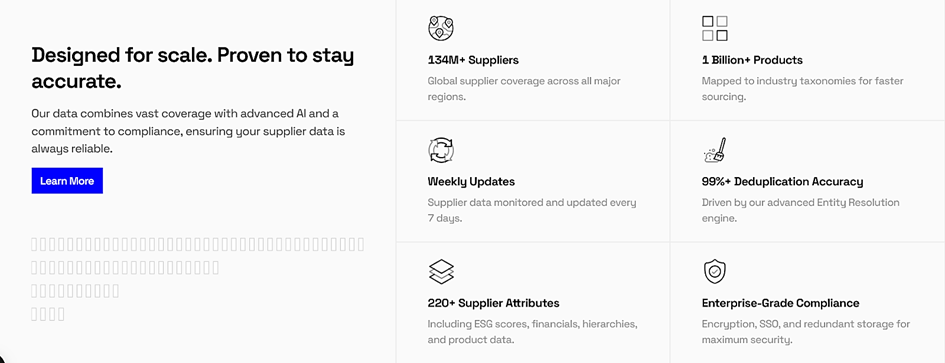

For example, Veridion’s AI-powered supplier intelligence platform scrapes petabytes of structured and unstructured data from across the web and turns it into rich, real-time supplier profiles.

Source: Veridion

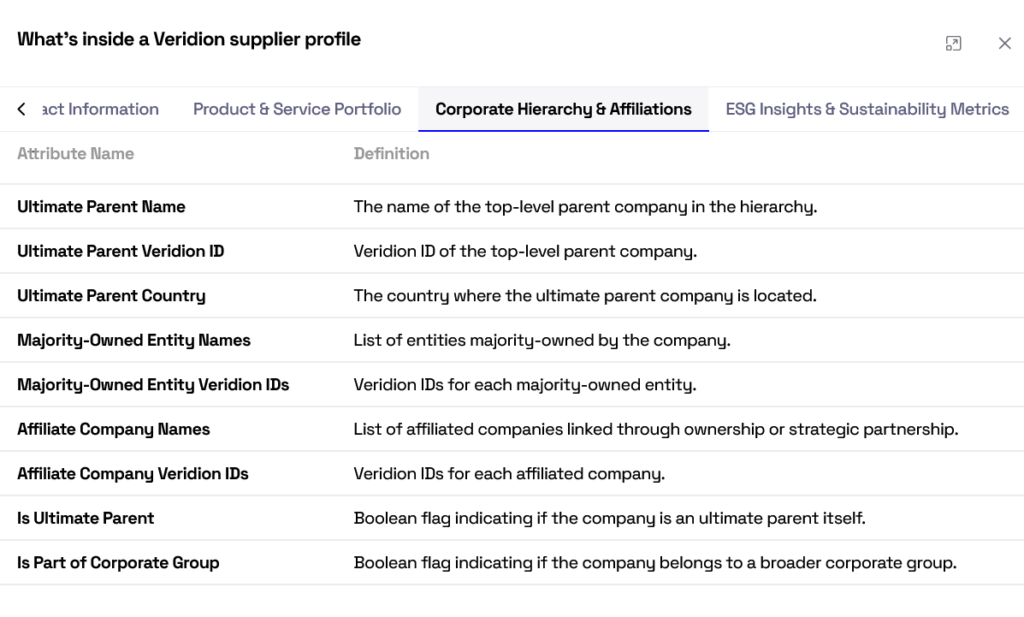

Profiles include more than 220 supplier attributes, ranging from firmographic and location information to emission estimates, compliance records, and ownership structure.

Source: Veridion

By using solutions like this, companies can rapidly map out who their sub-tier suppliers are, where they’re located, and what role they play.

This boosts transparency and lays the foundation for smarter decisions in sourcing, risk management, and ESG strategy.

Without this level of visibility, meaningful collaboration simply isn’t possible.

Even when companies know who their sub-tier suppliers are, another major challenge emerges: data gaps.

Multi-tier collaboration often breaks down because supplier data is incomplete, inaccurate, or wildly inconsistent.

In some supply chains, over 5,000 data fields are exchanged between partners—yet fewer than 100 are truly unique.

The rest is duplication, variation, or noise.

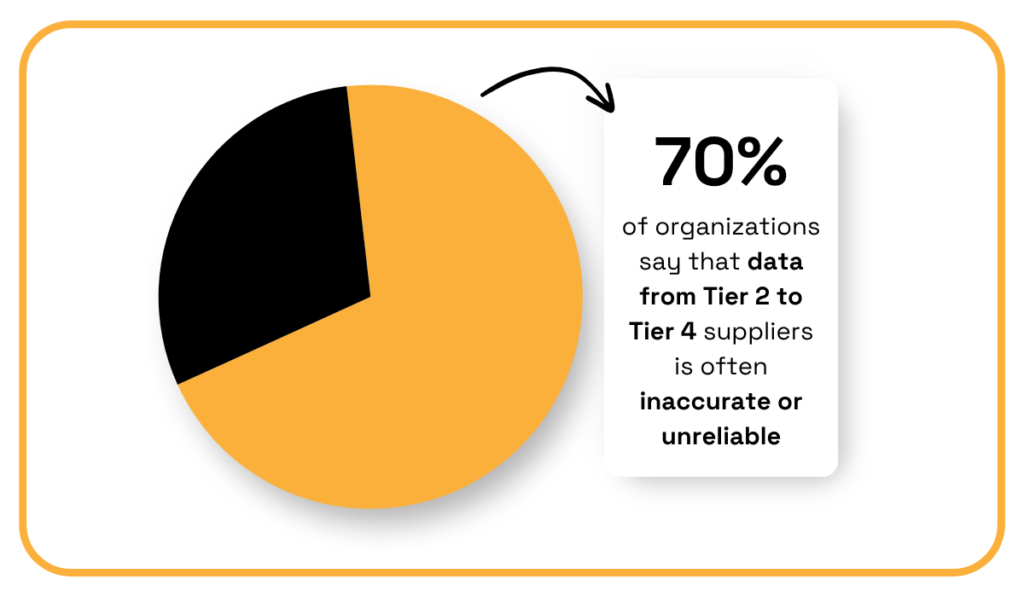

According to Sphera, as much as 70% of the data flowing in from Tier 2 to Tier 4 suppliers is unreliable or incorrect.

Illustration: Veridion / Data: Sphera

These inconsistencies make collaboration difficult.

Without trustworthy data, companies struggle to share forecasts, align production timelines, or track ESG compliance across tiers.

Why does this happen?

Smaller suppliers often use outdated systems or spreadsheets.

Others may not prioritize data accuracy, especially if they aren’t incentivized to do so.

And when every supplier uses a different format, even basic details like product categories or lead times become difficult to align.

Fixing this requires smarter infrastructure.

Companies must standardize data formats, integrate centralized data platforms, and use AI tools to reconcile discrepancies, flag anomalies, and automate data validation.

Again, this is where supplier data enrichment tools come into play.

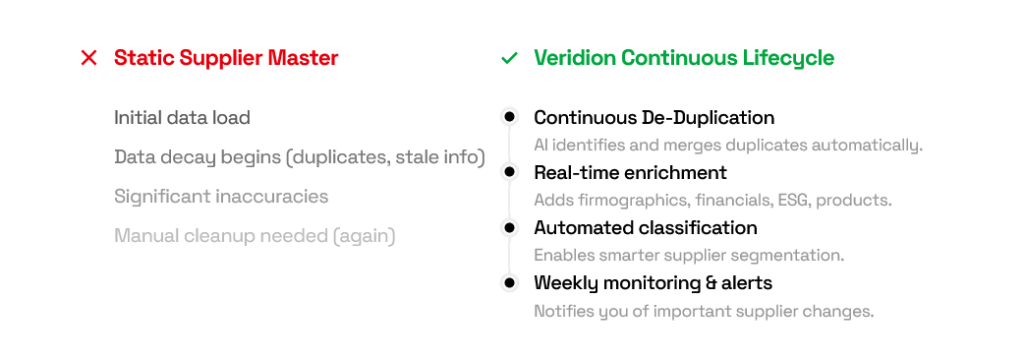

Veridion, for example, helps companies continuously update and verify supplier information, filling in gaps, correcting errors, and ensuring every tier speaks the same data language.

Source: Veridion

Watch the video below to see how data enrichment works in Veridion:

Source: Veridion

Instead of relying on manual, self-reported data from hundreds or thousands of sub-tier suppliers, companies can scale enrichment across the network and overcome supplier data gaps.

Multi-tier collaboration is, more than anything else, about people, mindsets, and incentives.

And this is where many efforts stall.

Collaboration requires a fundamental shift away from transactional, cost-focused supplier relationships toward longer-term, value-based partnerships.

As Bill Read, a former partner in Accenture’s supply chain practice, explains:

Illustration: Veridion / Quote: Supply Chain Brain

But most procurement and supply chain teams, and their suppliers, are not structured or incentivized to operate this way.

For example, internal KPIs often emphasize price reductions, not shared outcomes.

Processes are built for managing Tier 1 contracts, not facilitating transparency or coordination across multiple tiers.

And communication between tiers is usually indirect, filtered through layers of contracts and intermediaries.

Smaller suppliers, in particular, often face their own barriers.

From limited staff and outdated systems to a lack of capacity to participate in multi-tier initiatives like joint planning, compliance tracking, or digital onboarding.

These cultural and organizational gaps make deep-tier collaboration difficult to scale, even when the business case is strong.

Overcoming them requires deliberate effort:

Larger companies can lead this change by simplifying collaboration, building trust, and designing supplier programs that encourage participation from deeper tiers.

Because without alignment on goals, processes, and incentives, even the best data and tools can’t deliver real collaboration.

It’s becoming clear that true supply chain strength is forged in the deeper supplier tiers.

While Tier 2 and Tier 3 suppliers may still be out of sight for many companies, they’re central to resilience, cost efficiency, ESG performance, and innovation.

But collaboration at these levels doesn’t happen by accident.

It requires visibility, trust, and the right infrastructure.

Procurement leaders who prioritize multi-tier engagement and equip their teams with the tools and incentives to act will be the ones who build smarter, stronger, and more future-ready supply networks.