8 Procurement Software Statistics Every Business Should Know

The procurement landscape is undergoing a rapid digital transformation.

In recent years, we’ve seen a surge in innovative software solutions promising to streamline many procurement processes.

As a procurement professional, keeping pace with these changes is essential for staying competitive and driving value for your organization.

But with so many evolving trends, it can be overwhelming to know where to focus your attention.

That’s why we’ve compiled eight key procurement software statistics that every business should know.

These insights will give you a clearer picture of the current landscape, help you identify potential areas for improvement, and ultimately allow you to make more informed decisions about technology investments.

So, buckle up and get ready to dive into the numbers.

Let’s take a look at the big picture: the state of the procurement software market.

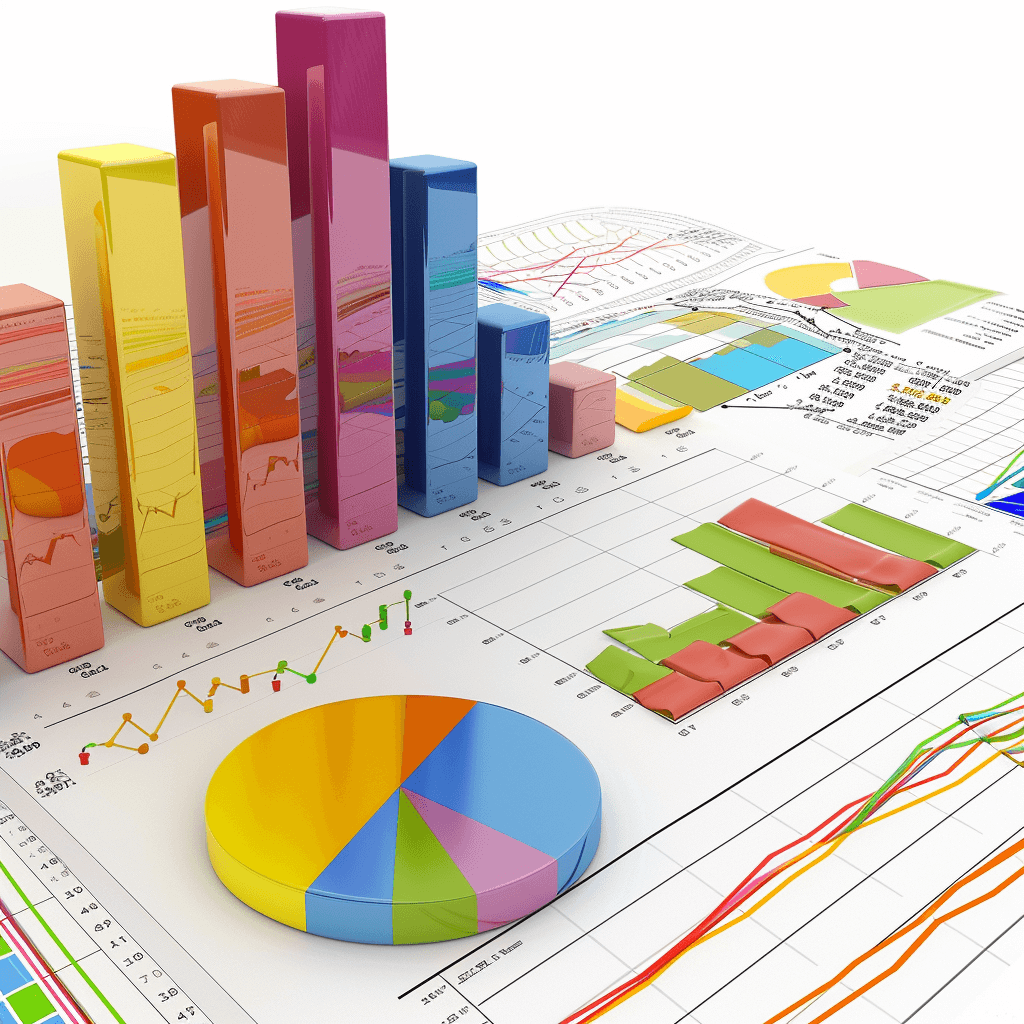

Data from Future Market Insights paints an impressive scene: by 2034, this market is projected to reach a whopping $19.50 billion, a significant leap from the $8.51 billion estimated for 2024.

Illustration: Veridion / Data: Future Market Insights

This translates to a compound annual growth rate (CAGR) of 8.6%, meaning we can expect steady, substantial growth year over year.

This projection underscores the rapid expansion we’re witnessing in the industry, especially when compared to its $7.5 billion valuation in 2023.

It’s clear that procurement software is becoming an increasingly vital tool for businesses worldwide.

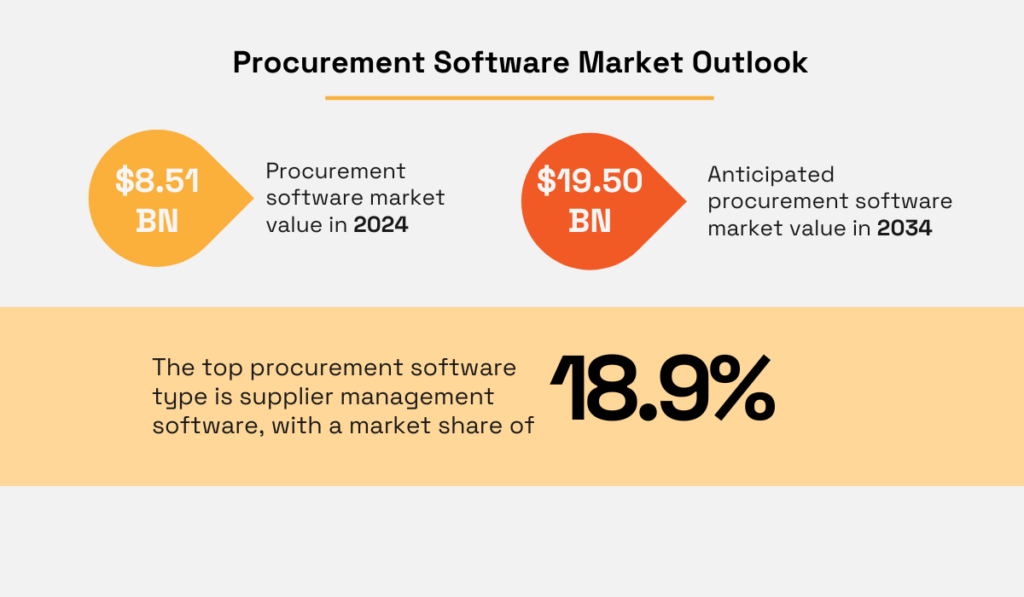

Delving deeper, the report highlights that supplier management software claims the largest slice of the procurement software pie, with an 18.9% market share.

This isn’t surprising, as the ability to foster better supplier collaboration and mitigate supplier risks is a major driving force behind the growing adoption of these tools.

Source: Veridion

Factor in the increasing complexity of procurement processes, coupled with the constant pressure to reduce costs, improve efficiency, and embrace digitalization, and it’s easy to see why this upward trajectory is likely to continue.

Procurement software isn’t just a nice-to-have anymore; it’s becoming a must-have for businesses that want to stay ahead of the curve.

The rise of procurement software isn’t just an isolated trend, as it’s a major player in the booming Software-as-a-Service (SaaS) market.

The global SaaS market is experiencing explosive growth, with GVR projecting a CAGR of 13.7% from 2023 to 2030.

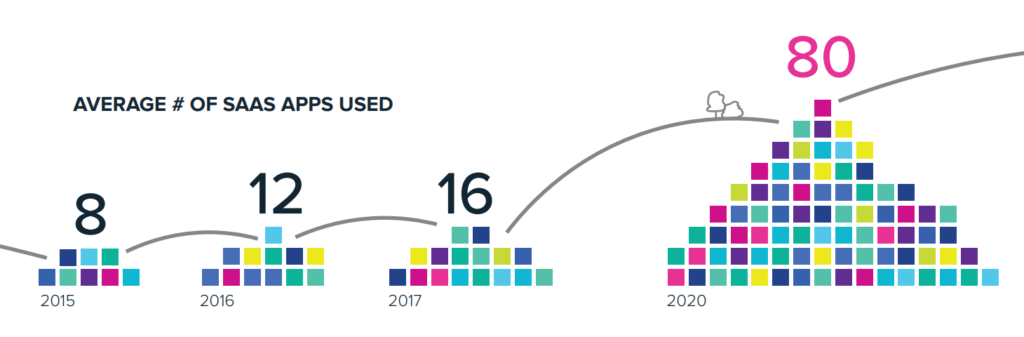

This is no surprise, as the average number of SaaS apps used by businesses has skyrocketed from a mere 8 in 2015 to 80 in 2020, and Productiv reports this number climbed even higher to 87 in 2023.

Source: BetterCloud

Notably, procurement software held the fifth-largest share of the global SaaS market in 2019 according to Tradogram.

This signifies the critical importance of procurement solutions, alongside systems like

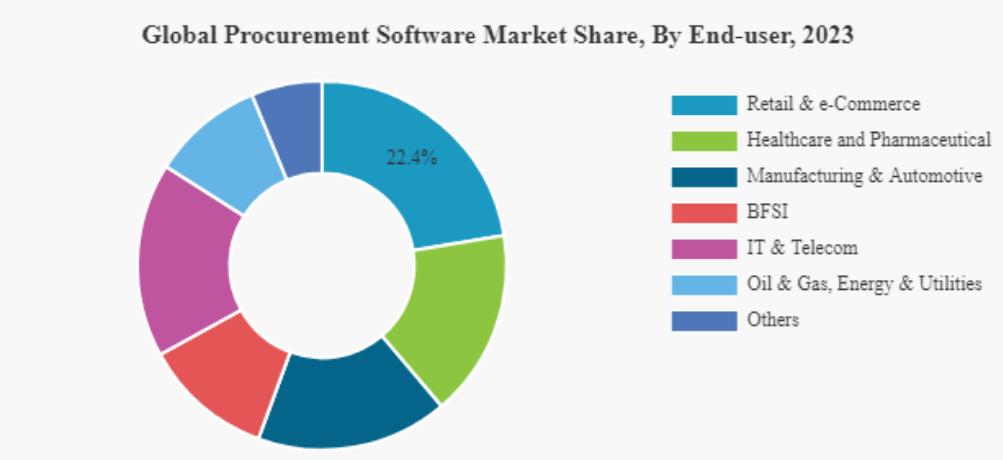

Interestingly, the retail and e-commerce, healthcare and pharmaceutical, and manufacturing and automotive industries are leading the charge in adopting procurement software which includes SaaS solutions.

Source: Fortune Business Insights

Furthermore, Fortune Business Insights reveals that these sectors account for the largest share of end-users, likely due to their complex supply chains and high volume of transactions.

So, if you’re in one of these industries or aim to be competitive overall, staying ahead of the curve is crucial.

Keep a close eye on emerging procurement SaaS trends and aim for more tech adoption to get a strategic advantage.

It’s a fascinating paradox—despite the undeniable rise of SaaS solutions, on-premises procurement software is holding its ground.

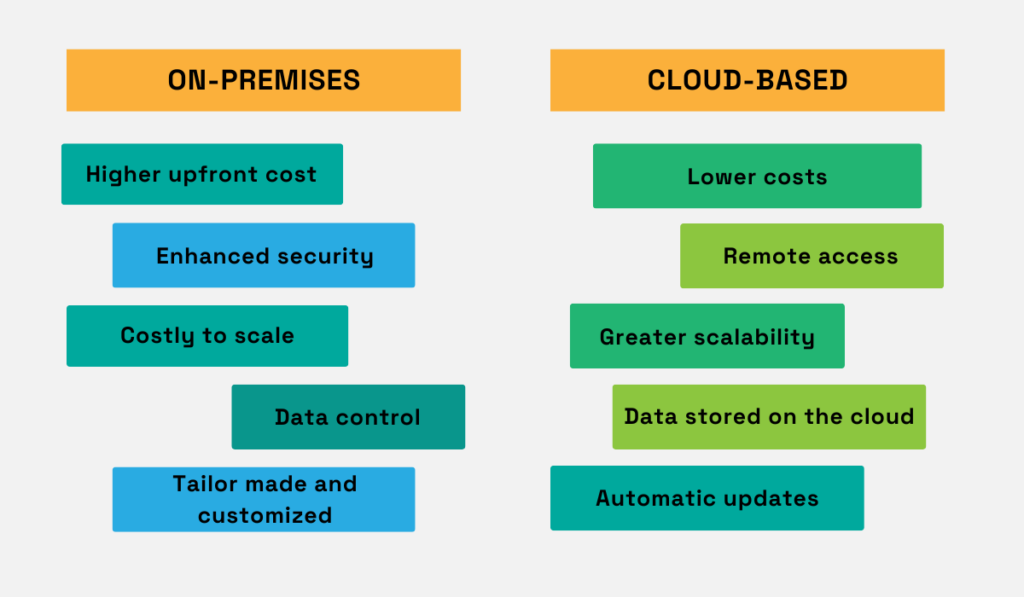

The procurement software market is bifurcated into two distinct categories:

On-premises, where the software is installed and run on a company’s own servers, and cloud-based (most commonly SaaS), where it’s hosted on the provider’s servers and accessed via the Internet.

The image below breaks down the key differences between these two categories.

Source: Veridion

According to Future Market Insights, on-premise procurement software currently dominates the market, claiming a 60.40% share in 2024.

This suggests that, even as businesses embrace SaaS for many functions, certain types of tools often see continued preference for on-premises solutions due to their unique nature.

This trend can be attributed to the perception that on-premises software offers a more secure and controlled environment for sensitive procurement data, such as:

As noted on Partner Portal, the absolute control of the systems is a key factor driving this trend.

Illustration: Veridion / Quote: Partner Portal

Companies prioritize the ability to customize security measures, access protocols, and data storage locations to meet their specific compliance and security needs.

Moreover, companies with existing on-premise infrastructure and legacy systems often find it easier to integrate on-premise procurement software.

So, despite the rise of cloud-based solutions, on-premises procurement software remains a significant force.

Now, let’s turn our attention to the key players in this global procurement software expansion.

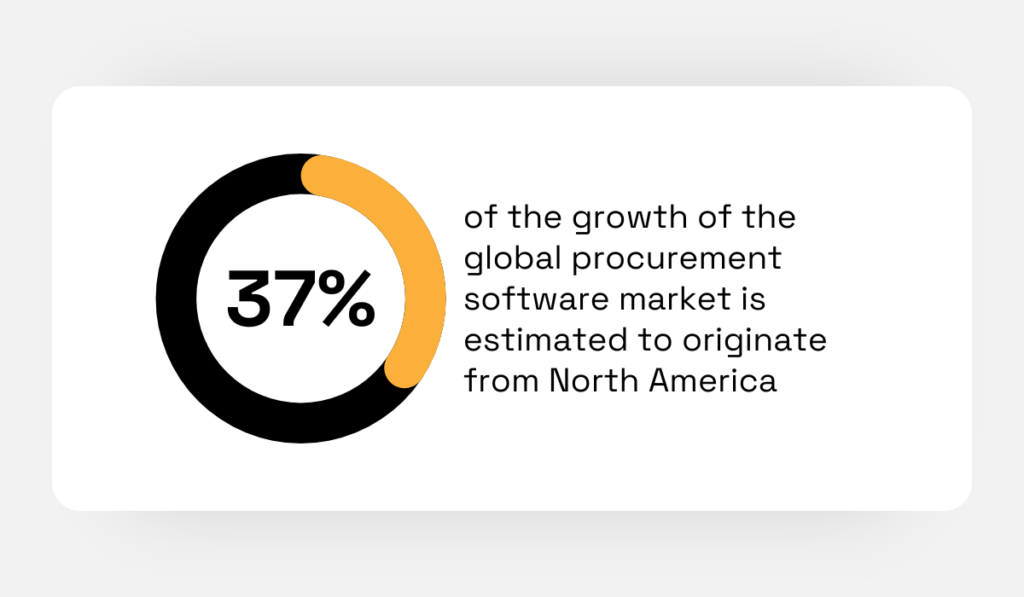

Technavio’s market research report shines a spotlight on North America, revealing that it contributes a substantial 37% share to the growth of the procurement software market.

Illustration: Veridion / Data: Technavio

This means that the region is not only adopting these solutions at a rapid pace but is also driving innovation and shaping the overall direction of the industry.

North America’s robust economy, coupled with its early adoption of digital technologies, has created a fertile ground for procurement software to flourish.

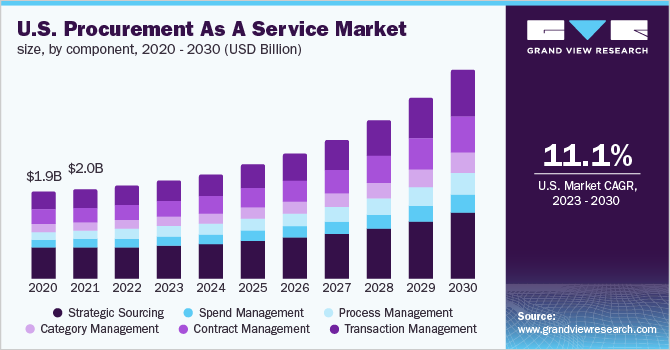

Interestingly, North America’s procurement growth isn’t confined to software alone.

GVR reports that the entire procurement as a service market is experiencing significant expansion in the region.

Source: GVR

This growth encompasses various aspects of procurement, with transaction management, contract management, and category management being the primary drivers.

But it’s not just North America that’s experiencing this growth.

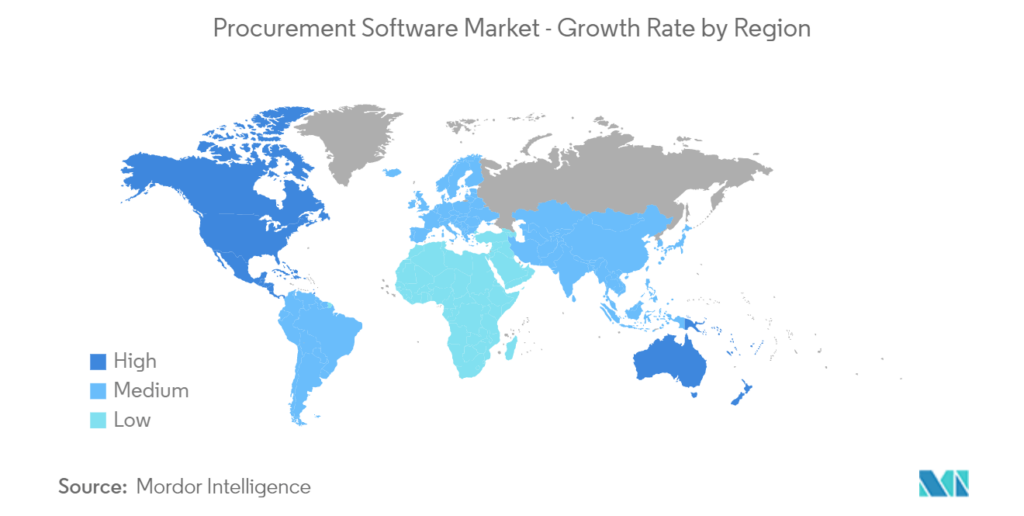

Mordor Intelligence’s data on regional market growth reveals a global trend.

Source: Mordor Intelligence

While North America and Australia are leading the pack, regions like South America, Europe, and the Asia Pacific are also witnessing a steady increase in procurement software adoption.

This is a testament to the fact that, regardless of location or industry, organizations are recognizing the value of digital tools in streamlining procurement processes, reducing costs, and improving overall efficiency.

As this trend continues, we can expect to see even greater innovation and competition in the procurement software market, ultimately benefiting businesses worldwide.

Interestingly, this impressive growth in procurement software adoption contrasts with a recent dip in technology funding across the board.

Deloitte’s 2023 Global Chief Procurement Officer Survey reveals a concerning trend: funding for procurement technology has dropped from 13.2% in 2021 to 10.9% in 2023.

This decline could potentially hinder the innovation and progress that the industry is experiencing.

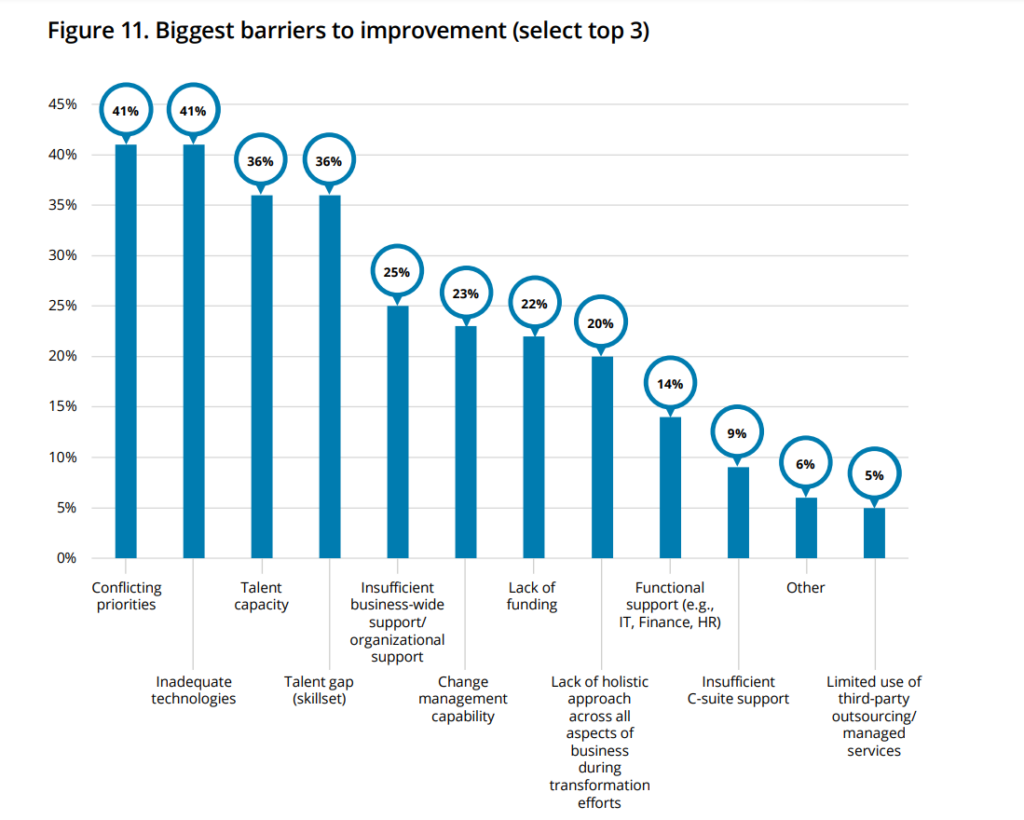

This statistic is particularly worrisome considering that the same Deloitte report identified inadequate technologies as the second most significant barrier to procurement improvement, as reported by CPOs.

Source: Deloitte

And this becomes even more problematic when you consider that lack of funding or budget has risen to second place as a barrier to successful digitalization, surpassing poor integration.

This suggests that some organizations are failing to recognize the full value of procurement software, leading them to cut funding in favor of other priorities.

To combat this trend, procurement professionals need to become advocates for technology within their organizations.

This involves a combination of highlighting successful case studies, quantifying potential ROI, and clearly articulating how modern tools can address pain points and improve overall performance.

The key is to make a compelling case for investment, demonstrating how procurement technology is not just a cost center, but a strategic asset that can transform the way businesses operate.

The decline in procurement technology funding might also stem from a lack of consensus within organizations regarding the specific goals and requirements for implementing procurement software.

A clear definition of needs is crucial for successful deployment.

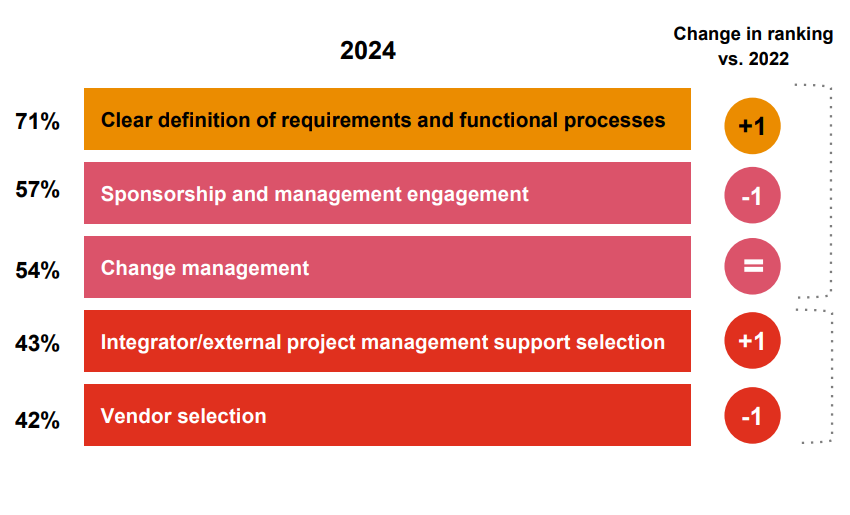

In fact, a staggering 71% of companies consider a clear definition of requirements to be the key success factor for implementing procurement software.

This data comes from PwC’s comprehensive 2024 Digital Procurement Survey, which covers nearly 1,000 companies across almost 60 countries, providing a wide-ranging perspective on procurement trends and challenges.

Source: PwC

In the report, PwC emphasizes that, given the risky and turbulent times in procurement, digitalization—including the adoption of procurement software—can play a pivotal role in enhancing resilience, agility, and cost-effectiveness.

However, as the report highlights, agreement on both functional processes and requirements is essential for harmonizing and streamlining operating methods.

Source: Veridion

A clear definition of needs serves as a crucial input for ensuring that the chosen solution aligns with those needs, maximizing its effectiveness and delivering the desired outcomes.

This means that, before diving into software selection, organizations should invest time and effort in thoroughly defining their procurement processes, identifying pain points, and outlining the specific goals they hope to achieve with a new solution.

By doing so, they can avoid costly mistakes, ensure a smoother implementation process, and ultimately maximize the value derived from their procurement software investment.

When an organization invests in a procurement software solution, they want tangible results.

And one of the most sought-after outcomes is improved procurement efficiency.

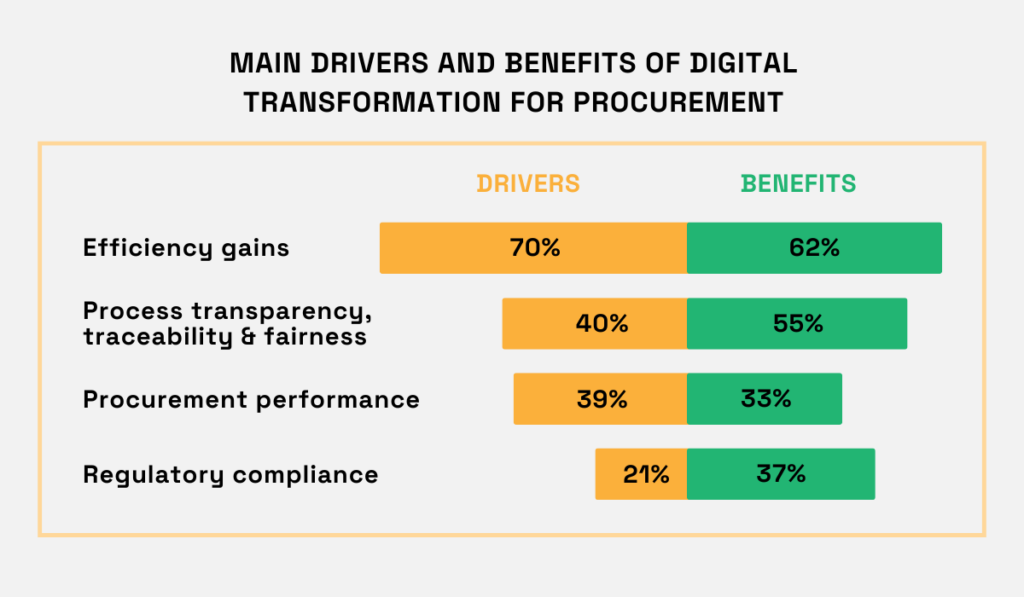

This desire for streamlined operations is reflected in PwC’s 2024 Digital Procurement Survey, which found that a significant 70% of respondents cited efficiency gains as the primary driver behind their digital procurement transformation efforts.

Illustration: Veridion / Data: PwC

While other drivers like process transparency, traceability, fairness (40%), procurement performance (39%), and regulatory compliance (21%) are certainly important, they pale in comparison to the overwhelming desire for efficiency.

Interestingly, the actual benefits reported by companies that have implemented procurement software closely mirror these drivers.

When asked about the observed benefits, 62% cited efficiency gains as the main outcome.

These gains can manifest in various ways, from cost reductions and streamlined processes to faster, data-driven decision-making.

Source: Veridion

This alignment between drivers and outcomes is a powerful indicator that procurement software is delivering on its promise.

For procurement professionals, this statistic is a valuable piece of ammunition when advocating for technology investments.

It demonstrates that the primary goal of implementing procurement software—to improve efficiency—is not only achievable but also a common reality for those who have adopted these solutions.

So, by highlighting this data, procurement teams can build a stronger case for funding and resources, ultimately driving greater value for their organizations.

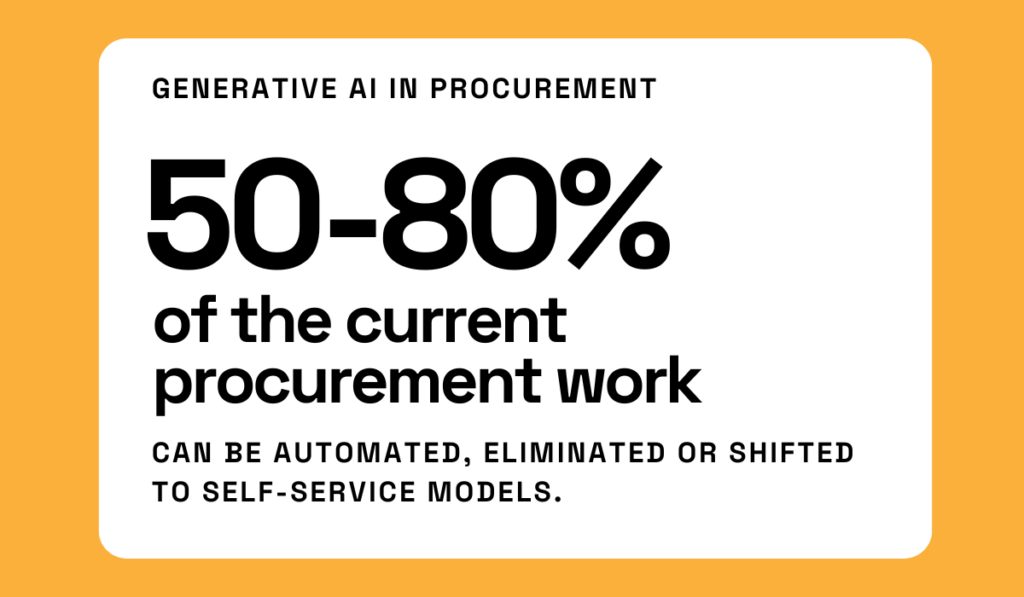

Finally, let’s wrap up with a look at the automation potential of procurement software, a factor that is revolutionizing the way procurement professionals work.

A staggering 50-80% of current procurement work can be either automated, eliminated, or shifted to self-service models by harnessing the power of procurement software and generative AI technology.

Illustration: Veridion / Data: KPMG

This eye-opening figure is derived from KPMG’s 2023 paper, “Unleashing the power of generative AI in procurement.”

The figure is based on extensive research, including work with clients and a study of 400 procurement leaders, as well as internal simulations and analysis, providing a robust estimate of automation’s potential impact.

KPMG predicts that generative AI will permeate the entire procurement lifecycle, from category management and sourcing to contract management and invoice-to-pay.

Source: Veridion

While the report goes into the specifics of how each stage will be enhanced by generative AI, the overarching theme is clear: automation will play a pivotal role.

AI-powered tools will take over data-intensive tasks, identify insights, and uncover opportunities, freeing up procurement professionals to focus on strategic decision-making and value creation.

The takeaway is that the potential for automation in procurement is immense, promising a future where technology handles the heavy lifting, allowing professionals to focus on strategic initiatives and driving greater value for their organizations.

There you have it—eight eye-opening procurement software statistics that shed light on the state of the industry and the potential impact of digital solutions.

These numbers reveal a landscape ripe with opportunities for businesses willing to embrace technology and adapt to changing trends.

Now it’s time to take action.

Use these statistics as a springboard to explore the vast array of procurement software options and their potential impact on your business, and see what will best help you achieve your procurement goals.

Stay ahead of the curve by integrating these insights and watch your business thrive.