Supplier Optimization: What You Need to Know

Key Takeaways:

Did you know that over a third of companies abandon their ESG goals because they can’t find qualified suppliers?

Investing in supplier optimization can help your organization address this gap by creating a supplier base that actively supports long-term growth and resilience.

Join us in unpacking why supplier optimization matters and the practical ways to get started.

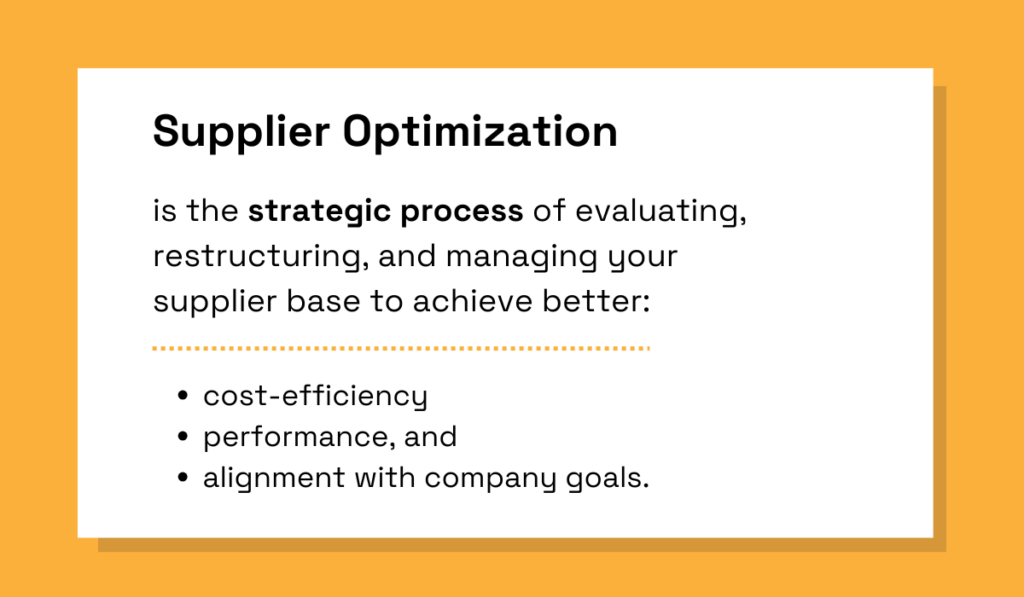

Supplier optimization is a strategic, data-driven process that evaluates the structure and performance of your supplier base to better align with long-term business goals.

Source: Veridion

Optimization is less about day-to-day relationship handling and more about looking at the bigger picture.

The key is to assess which suppliers deliver the most value in terms of pricing, quality, reliability, and innovation, and restructure the supply base accordingly.

This could mean consolidating to high-performing suppliers, introducing alternative sources to reduce risk, or adjusting the supplier mix to support ESG or regional sourcing goals.

This shift often results in fewer, but more strategic and long-term partnerships.

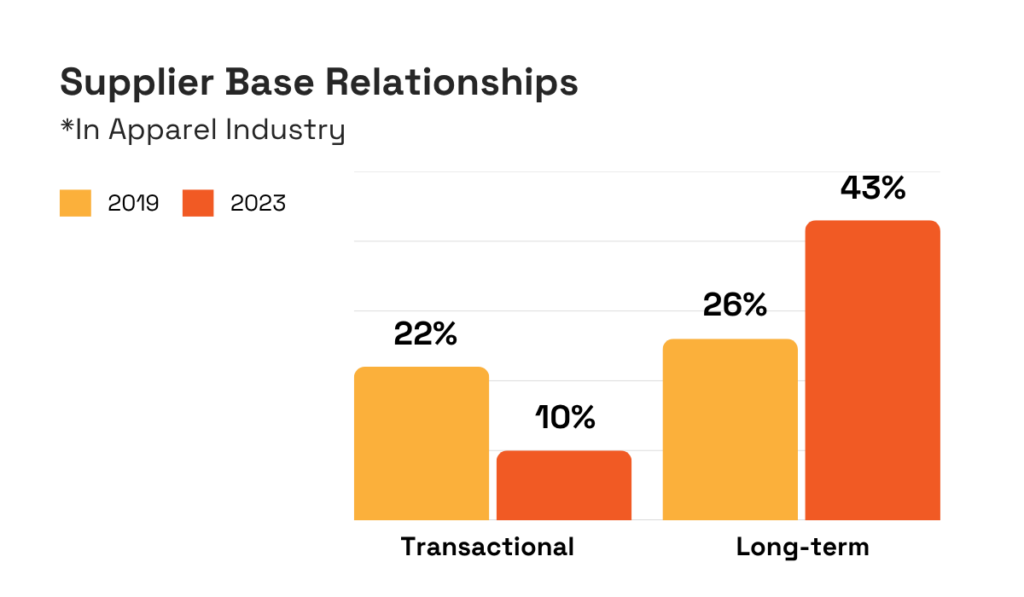

And the latter is a growing trend.

A McKinsey survey of CPOs in the apparel industry, for instance, found that the share of deeper, strategic supplier relationships rose from 26% in 2019 to 43% in 2023.

Illustration: Veridion / Data: McKinsey & Company

In contrast, purely transactional relationships declined from 22% to just 10% over the same period.

These shifts reflect what supplier optimization looks like in practice—a move from transactional variety to a more structured, strategic supplier base.

Achieving supplier optimization typically combines:

But wait, how does this differ from Supplier Relationship Management (SRM)?

In short, while SRM is about managing ongoing supplier interactions, supplier optimization is geared toward strategically restructuring the supplier base to meet long-term objectives.

Here are the differences in the focus, objective, and scope:

| Supplier Relationship Management | Supplier Optimization | |

|---|---|---|

| Focus | Managing ongoing supplier relationships and interactions | Restructuring the supplier base in line with strategic goals |

| Objective | Foster collaboration and innovation, and address day-to-day issues | Reduce cost, eliminate redundancies, and improve performance |

| Scope | Ongoing, operational, and relationship-driven | Strategic, analytical, typically involves consolidation or segmentation |

Supplier optimization has become a priority in modern procurement for several reasons, and that’s what we’ll unpack next.

Supplier optimization delivers tangible, measurable value across several key areas of procurement.

It goes beyond simply trimming the supplier list, enabling organizations to improve operational resilience, enhance supplier performance, and more.

Let’s explore the core benefits of supplier optimization.

The effects of optimizing your supplier base immediately impact cost reductions.

While cost savings are a long-standing priority in procurement, ongoing cost pressures have made them more urgent than ever.

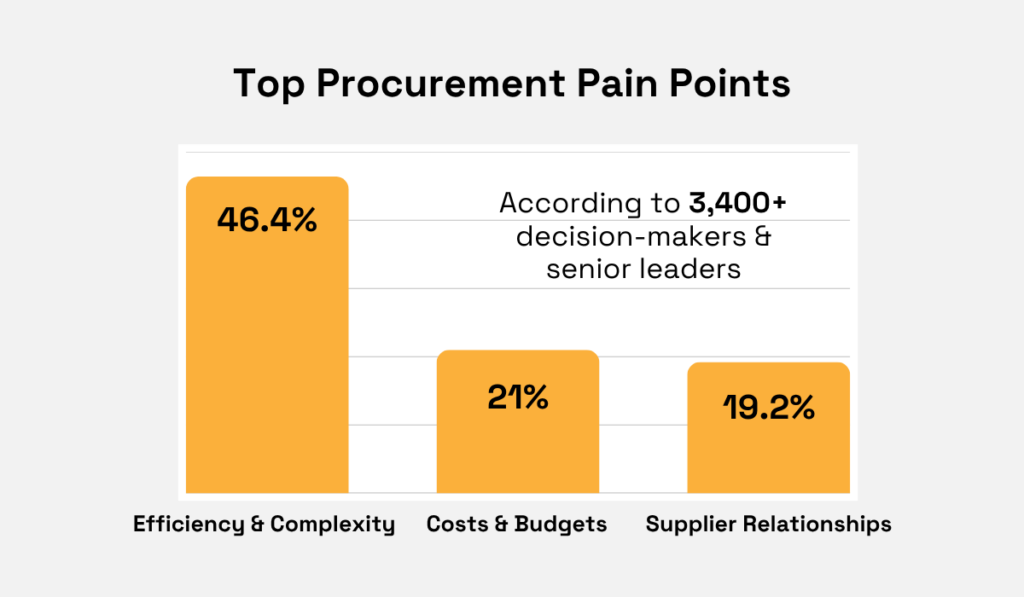

According to the 2025 Amazon Business Report, 21% of procurement leaders identified costs and budgets as their second most pressing pain point in 2024.

Illustration: Veridion / Data: Amazon Business

And that’s based on a survey of over 3,400 procurement decision-makers and leaders.

Supplier optimization directly addresses this pain point by consolidating purchases with a smaller number of trusted, high-performing suppliers.

This creates opportunities for volume-based discounts, negotiated pricing, and reduced contract management overhead.

But the benefits go deeper than immediate price cuts. Optimizing your supplier base also helps uncover and reduce hidden costs.

These indirect expenses typically stem from delivery delays, product defects, and excessive administrative tasks.

Source: Veridion

For example, poorly performing suppliers might regularly miss deadlines, causing production stoppages or other delays.

These disruptions carry financial consequences that often go unnoticed until they pile up.

Meanwhile, a narrower, carefully segmented supplier base allows procurement teams to focus on partners who consistently meet delivery schedules and quality expectations.

Keep in mind that consolidation doesn’t mean over-reliance on a handful of suppliers.

A well-optimized supplier base balances consolidation for cost efficiency with diversification to avoid dependency risks.

Strategic business adviser Jeff Long notes that suppliers with little to no competition are often tempted to raise prices or extend lead times with little warning or justification.

Illustration: Veridion / Quote: Guardian

That’s why supplier optimization is about striking the right balance—one that minimizes silent drains on the budget while opening new opportunities.

The bottom line is that reducing redundancies and inefficiencies within your supplier base will enable you to stay agile and keep costs in check.

One of the most immediate advantages of supplier optimization is enhanced supplier performance.

When a company consolidates its supplier base to focus on fewer key partners, it becomes much easier to set clear expectations, track outcomes, or address subpar performance.

Yet, surprisingly, many organizations still lack the visibility to do this effectively.

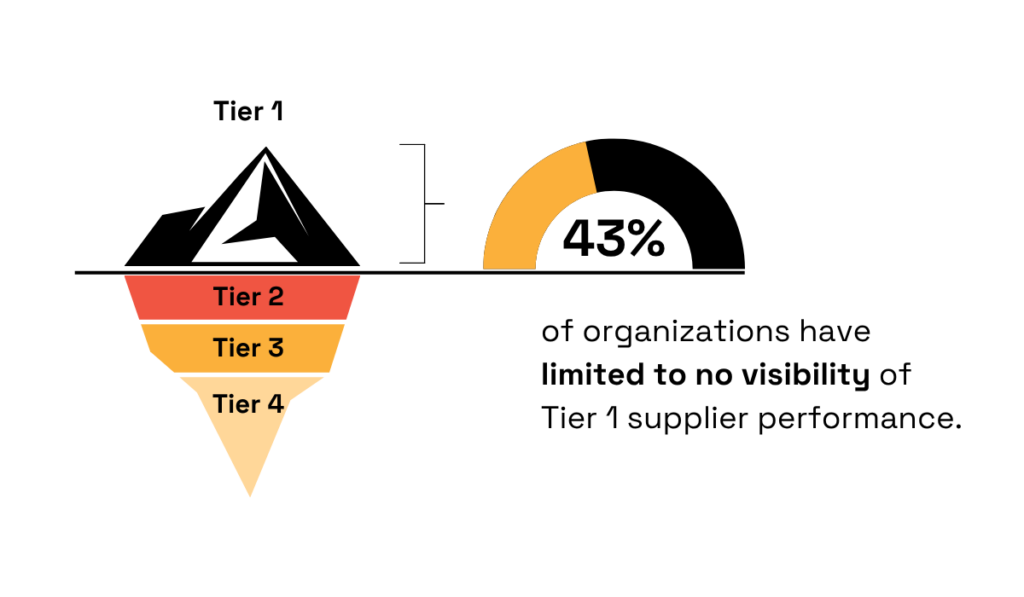

According to KPMG research, 43% of procurement leaders admit to having limited insight into the performance of their Tier 1 suppliers.

Illustration: Veridion / Data: KPMG

And that’s just the surface of the supply chain.

Much of this stems from the absence of supplier segmentation and strategic priorization.

Without a structured supplier optimization process, businesses often work with too many transactional suppliers.

That makes it difficult to track KPIs, enforce SLAs, and drive continuous improvement.

But when companies do optimize, the impact is tangible.

Focusing on a carefully selected group of suppliers enables better operational support, improved delivery coordination, and even joint innovation initiatives.

For example, a food manufacturing company reducing its supplier base from 60 to 25 core partners can better align those suppliers with shared KPIs for delivery, quality, and compliance.

This clarity creates a stronger foundation for long-term improvement, and often leads to investments in supplier development.

A good example is Stagecoach, the UK bus operator, which recently offered free sustainability training to 300 of its suppliers.

Source: Sustainable Times

As Greg Ritt, Group Head of Sustainability at Stagecoach, explains, their goal is to equip selected suppliers with the tools and support needed to actively contribute to the company’s net-zero goals.

Illustration: Veridion / Quote: Sustainable Times

This not only elevates supplier performance but also strengthens Stagecoach’s broader sustainability transition.

It’s a perfect example of how supplier optimization enhances performance across operational, financial, and environmental dimensions, setting the stage for bigger strategic wins.

Supplier optimization enables companies to narrow their supplier base and prioritize partners who meet ethical, environmental, and regulatory standards.

This approach helps minimize legal and reputational risks while advancing corporate social responsibility goals, making it a powerful tool for driving sustainability.

Yet, finding suppliers that meet these standards isn’t always easy.

According to the previously cited Amazon Business research, 38% of organizations struggle to adopt ESG mandates because it’s hard to identify qualified, sustainable suppliers.

Illustration: Veridion / Data: Amazon Business

Given this, it’s essential to clearly define what qualifies a supplier as sustainable.

As Mukesh Negi, Category Sourcing Expert at Verizon, points out, the starting point is ensuring suppliers meet all relevant legal and regulatory requirements.

Illustration: Veridion / Quote: LinkedIn

From there, organizations can identify suppliers that go beyond basic compliance and actively invest in sustainability programs that positively impact the entire value chain.

However, many organizations aren’t yet taking a proactive role in this area.

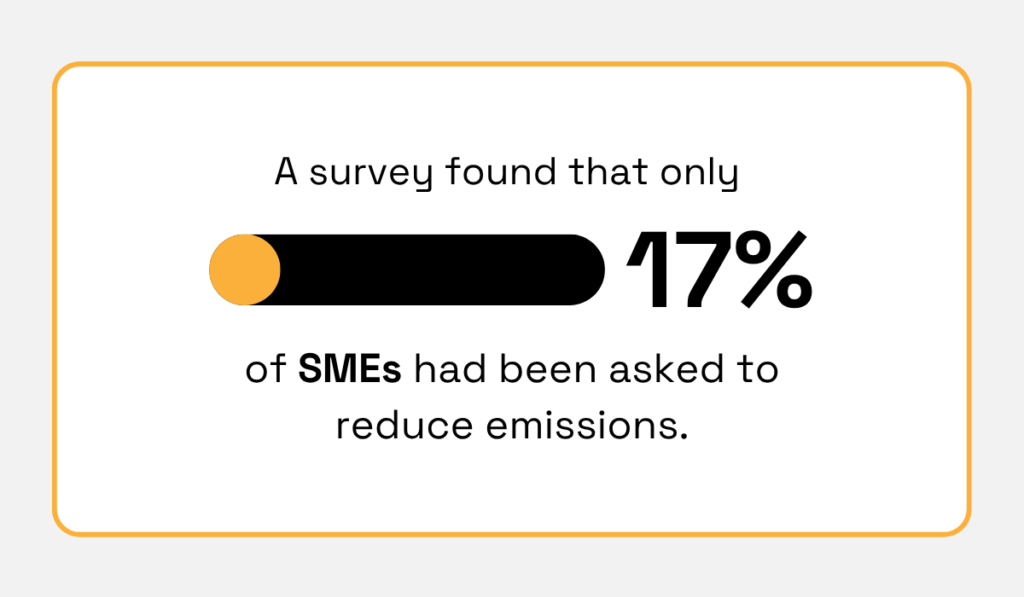

Research by the SME Climate Hub found that only 17% of small and medium-sized enterprises had been asked by corporate clients to lower their emissions.

Illustration: Veridion / Data: SME Climate Hub

This is notable because SMEs contribute around 40% of total business sector emissions in Europe.

This is where supplier optimization makes a difference.

By consolidating suppliers and focusing on high-performing, sustainability-driven partners, businesses can more effectively monitor ESG performance.

As supply chain expert Ulf Venne points out in Supply Chain Brain, market leaders must push sustainability standards throughout their supplier networks.

Illustration: Veridion / Quote: Supply Chain Brain

With a leaner, strategically selected supplier base, proactive supplier monitoring becomes much more manageable.

Supplier optimization is not a one-time project.

Rather, it’s an ongoing process with several key building blocks.

It typically starts with establishing clear governance, performance criteria, and onboarding protocols, then continues through segmentation, evaluation, and continuous improvement.

For Adam Hubbard, Senior Supply Chain Manager at EDF, it all begins with onboarding.

He explains that a structured onboarding process eliminates duplication, ensures clean data, and sets clear expectations from the outset.

Illustration: Veridion / Quote: HICX

A core part of this is the supplier code of conduct—a document that outlines the minimum standards suppliers must meet in areas such as labor rights, environmental responsibility, and product quality.

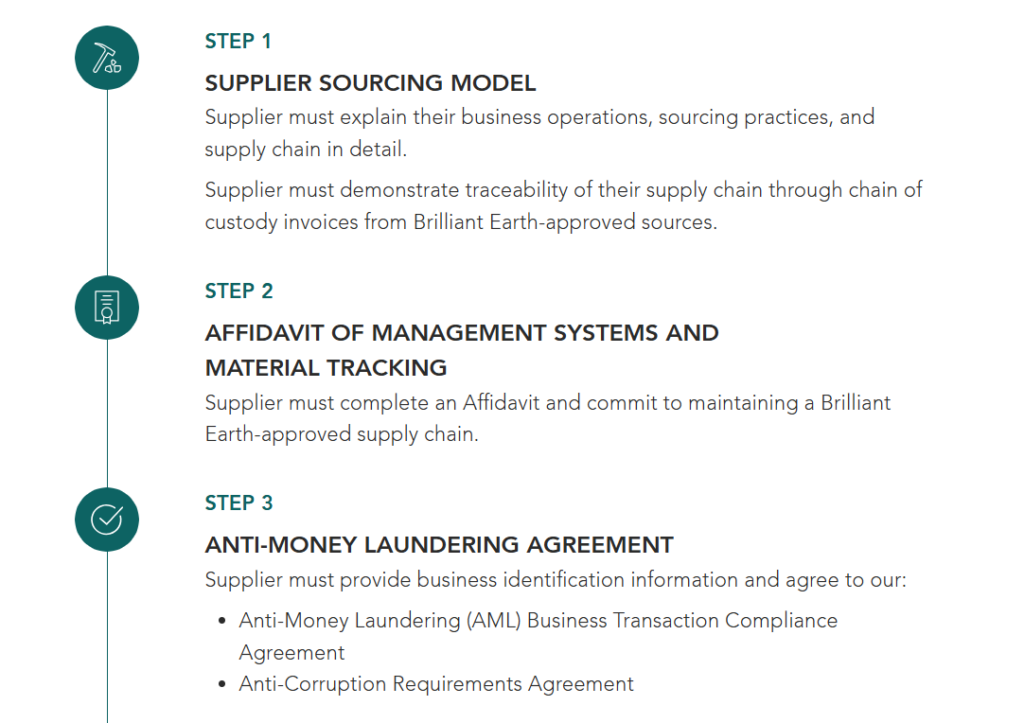

Take Brilliant Earth, a sustainable jewelry brand.

Their onboarding process is built around a clear supplier code, helping suppliers understand and meet expectations from the very beginning.

Source: Brilliant Earth

This kind of transparency not only reduces confusion but also lays the groundwork for future evaluations and performance management.

Supplier segmentation then builds on this solid foundation.

Not all suppliers have the same strategic importance, performance record, or risk profile, and treating them as a homogenous group leads to inefficiencies.

Segmentation involves grouping suppliers based on shared traits like:

Many organizations combine the traditional Kraljic matrix with advanced risk-based models to better identify which suppliers require strategic partnerships versus transactional oversight.

But supplier optimization doesn’t stop after onboarding or segmentation.

It’s sustained through regular audits and supplier evaluations.

Kristiina Tiilikainen from Lindström Group points out that audits also help companies refine their own internal processes, not just monitor supplier behavior.

Illustration: Veridion / Quote: Lindström Group

Audits track progress, flag new risks, and reinforce the standards set during onboarding.

And as organizations mature their optimization processes, many adopt technology to help manage and refine these activities, unlocking benefits in data visibility, performance tracking, and risk management.

To successfully optimize a supplier base, you need more than just policies and spreadsheets.

You need tools that provide reliable, timely, and actionable insights.

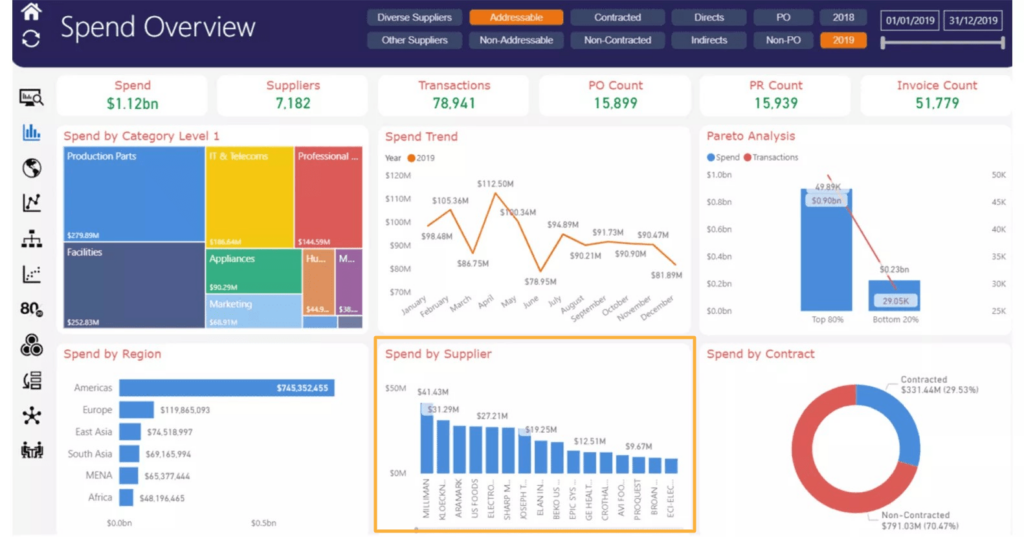

Several technology solutions play an essential role in this process, with spend management tools often being the first stop.

These platforms help procurement teams track where the money goes, identify category overspending, and consolidate purchases.

Solutions like Simfoni provide intuitive, comprehensive dashboards to help you visualize spending patterns by category, region, contract, or supplier.

Source: Simfoni

Increased visibility enables even the largest enterprises to pinpoint individual issues, renegotiate contracts, and rethink supplier groups.

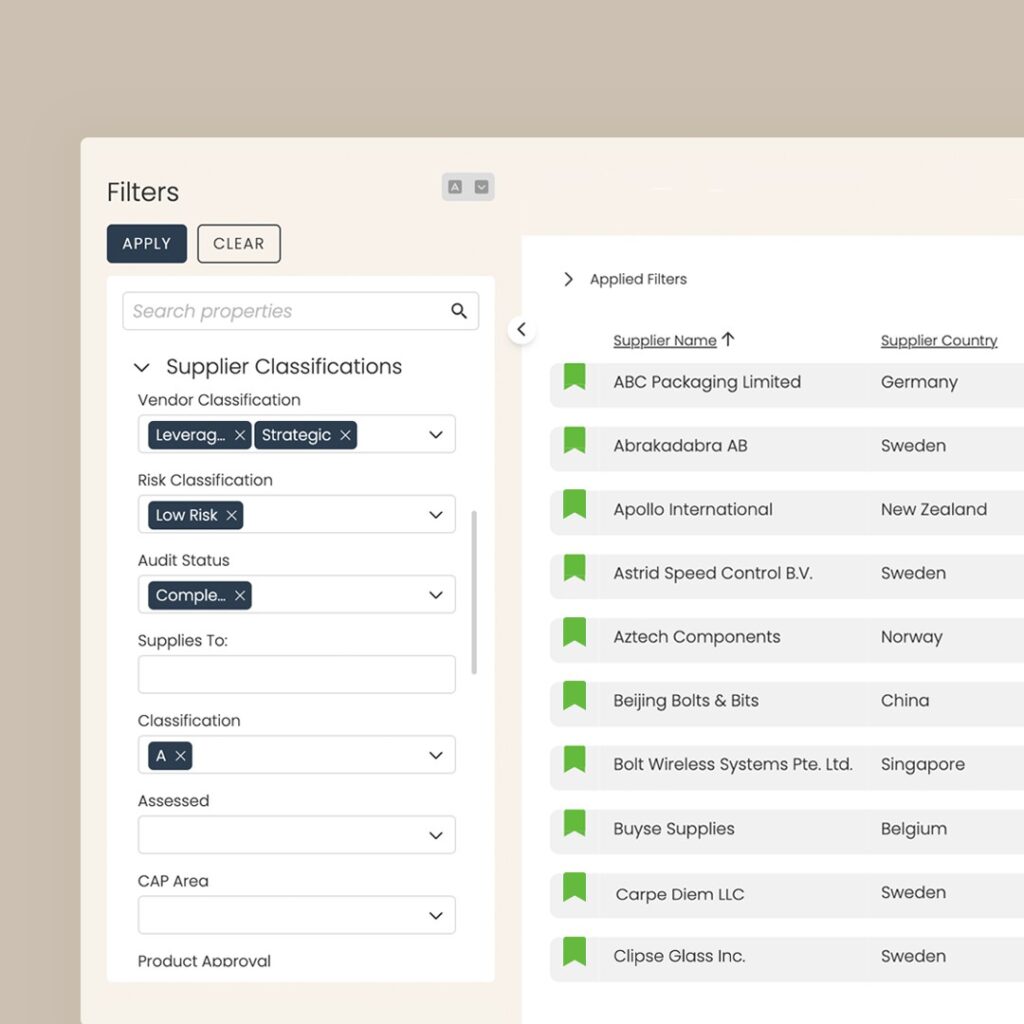

Next, Supplier Relationship Management (SRM) platforms streamline supplier data, performance metrics, and risk indicators into a single, accessible system.

This makes it easier to maintain consistent records and identify trends over time.

Kodiak Hub, for example, centralizes supplier information and offers intuitive visualizations that highlight performance gaps, improvement opportunities, and supplier risk profiles at a glance.

Source: Kodiak Hub

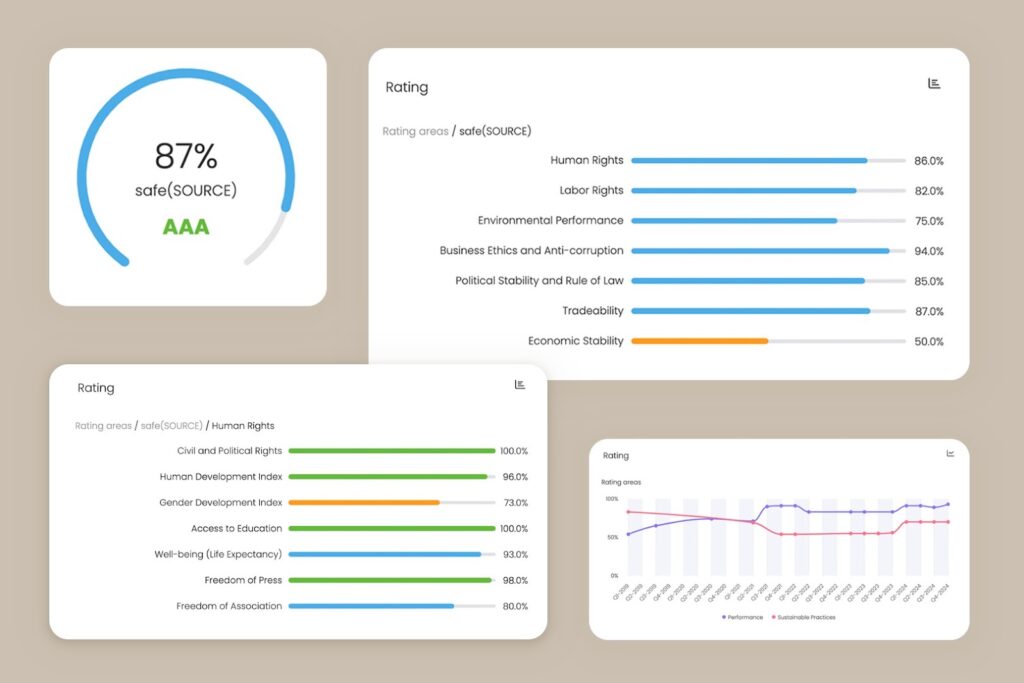

One standout feature is Kodiak Hub’s safe (SOURCE) module, which delivers contextual risk insights based on a supplier’s production location and business activities, as well as country-specific factors.

Source: Kodiak Hub

However, even the most advanced SRM systems require fresh, reliable data to function effectively.

As pointed out by our very own Chad Moore, Veridion’s Sales Director, understanding how to mitigate supplier risks depends on knowing basic business and location data.

Illustration: Veridion / Quote: Wonder Services on YouTube

Without this foundational data, but also the broader context surrounding their operations, risk scores and supplier profiles quickly become outdated and unreliable.

That’s where Veridion steps in.

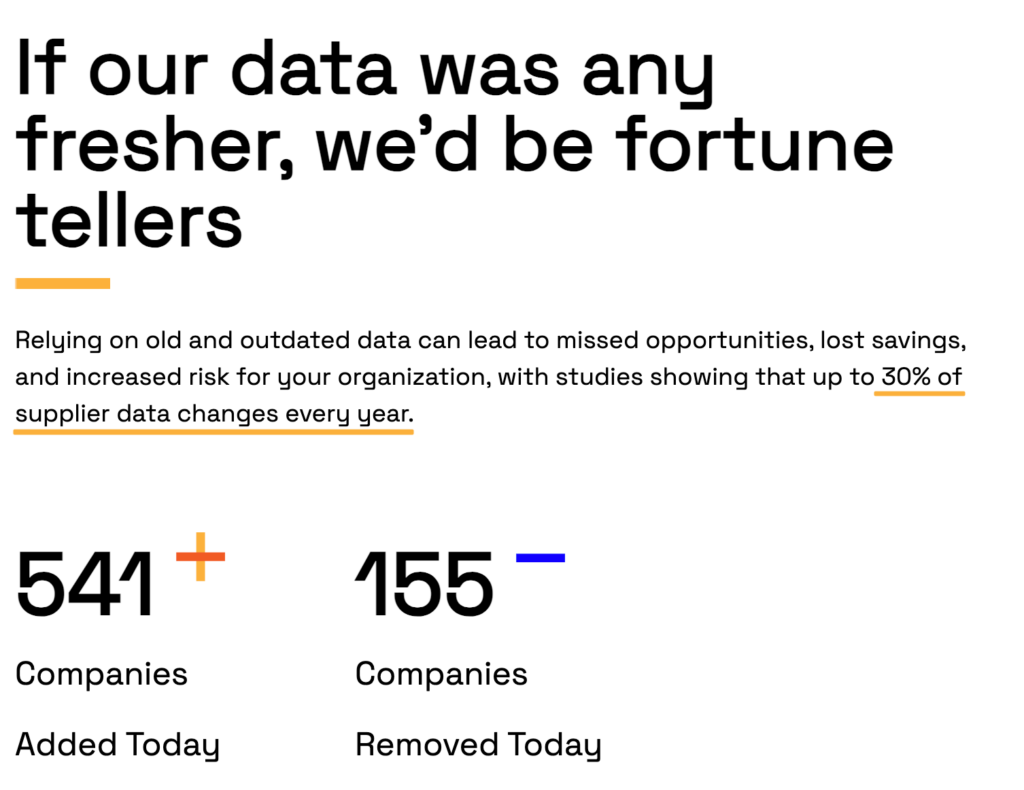

Our AI-powered global database delivers constantly updated information on 130+ million suppliers worldwide.

With details like firmographics, operational scope, ESG standards, and location-based risk factors refreshed weekly, Veridion ensures your supplier optimization strategy rests on current, high-quality data.

Source: Veridion

And this is no surface-level data.

Veridion’s AI bots scour and cross-check multiple sources for maximum accuracy and precision.

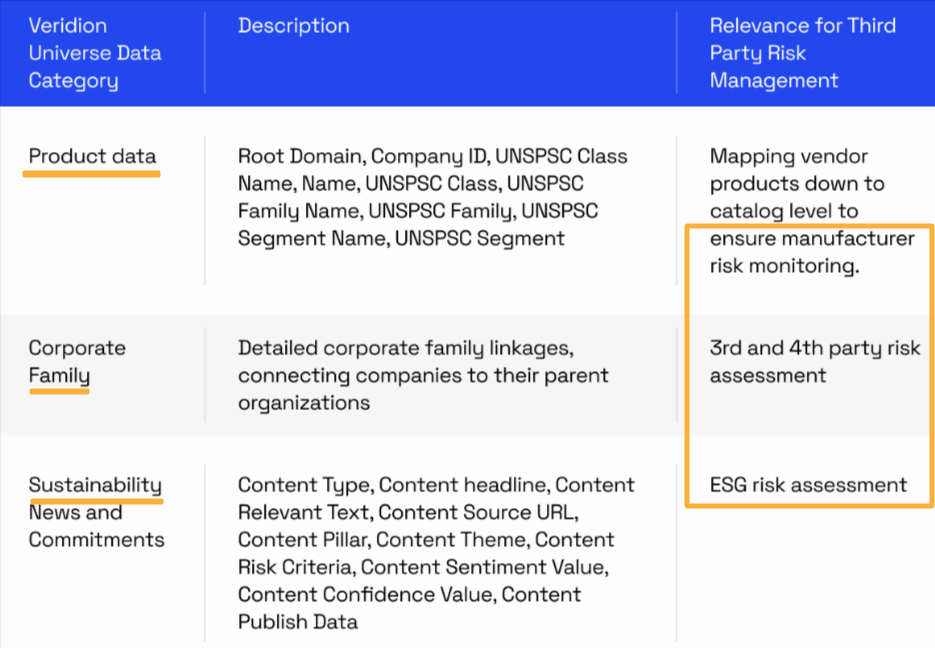

This ensures you can visualize your entire supply chain, down to the n-th category, and stay ahead of geopolitical, ESG, and other risks.

Source: Veridion

Anticipating emerging risks—whether related to ESG, compliance, or geopolitical shifts—helps guide ongoing supplier optimization efforts.

It enables organizations to focus development initiatives where they matter most and uncover new strategic opportunities.

But this only works if the underlying data is complete, current, and trustworthy.

Without it, even the most advanced tools or well-designed strategies fall short.

Reliable, up-to-date information is the foundation of any effective supplier optimization program.

Supplier optimization has evolved from a tactical option to a strategic necessity.

Reducing costs, managing risk, and reaching sustainability goals all depend on having the right suppliers in place and the right data at your fingertips.

With the right technologies in place, procurement teams can build smarter, leaner, and more resilient supply chains.

The key is a structured, data-driven approach where every supplier relationship is continuously assessed and improved.