How Supplier Segmentation Helps Reduce Supply Chain Risks

Key Takeaways:

Supply chain risks have grown significantly in recent years.

Geopolitical instability, natural disasters, economic uncertainty, and global pandemics have all pushed supply chains to their limits.

For businesses, this means delays, higher costs, and in some cases, complete operational halts.

What often compounds these challenges is that many organizations treat all suppliers equally.

They lack the tools and processes to differentiate between suppliers that are critical to their operations, those that aren’t, or those with significant risk exposure.

As a result, vulnerabilities go unnoticed, and responses to risks come too late.

Supplier segmentation changes this dynamic.

How exactly? Read on to find out.

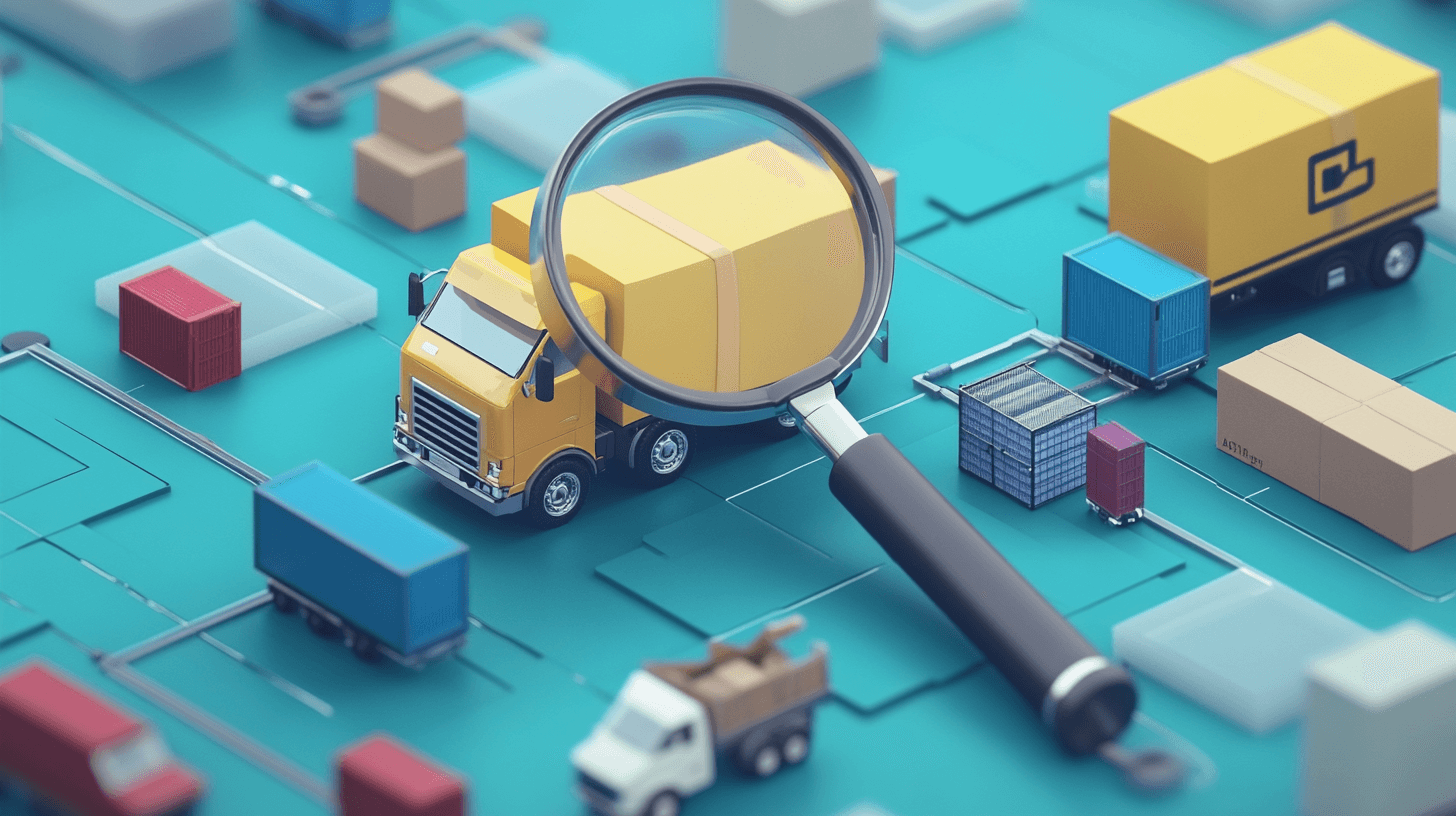

Supply chain visibility ranked as a top priority for over half of medium-sized and large companies in 2023.

Illustration: Veridion / Data: Fictiv

This makes sense—visibility is key to anticipating disruptions, improving decision-making, and reducing costs.

However, achieving it requires more than tracking shipments or monitoring supplier performance KPIs.

It starts with understanding your suppliers and their roles within your supply chain, which is where supplier segmentation becomes indispensable.

When you categorize suppliers based on their value, risks, or role, you gain clarity into who your most critical partners are and where potential vulnerabilities lie.

One concrete method is the Kraljic Matrix, a widely adopted tool that classifies suppliers into four categories based on risk and value, which you can see below:

Source: Veridion

However, supplier segmentation doesn’t have to follow a single framework like the Kraljic Matrix (though it’s a helpful tool).

Instead, you can tailor your segmentation to what matters most to your business.

For example, you can group suppliers based on:

| Performance | Suppliers with inconsistent delivery times, quality issues, or cost fluctuations. |

| Dependency | Suppliers heavily reliant on you as their primary customer or on another key buyer in the market. |

| Location or risk profile | Suppliers based on geographic risks like political instability, natural disasters, or trade regulations. |

Segmenting suppliers in these ways allows you to see the supply chain from every angle.

For instance, you can quickly uncover:

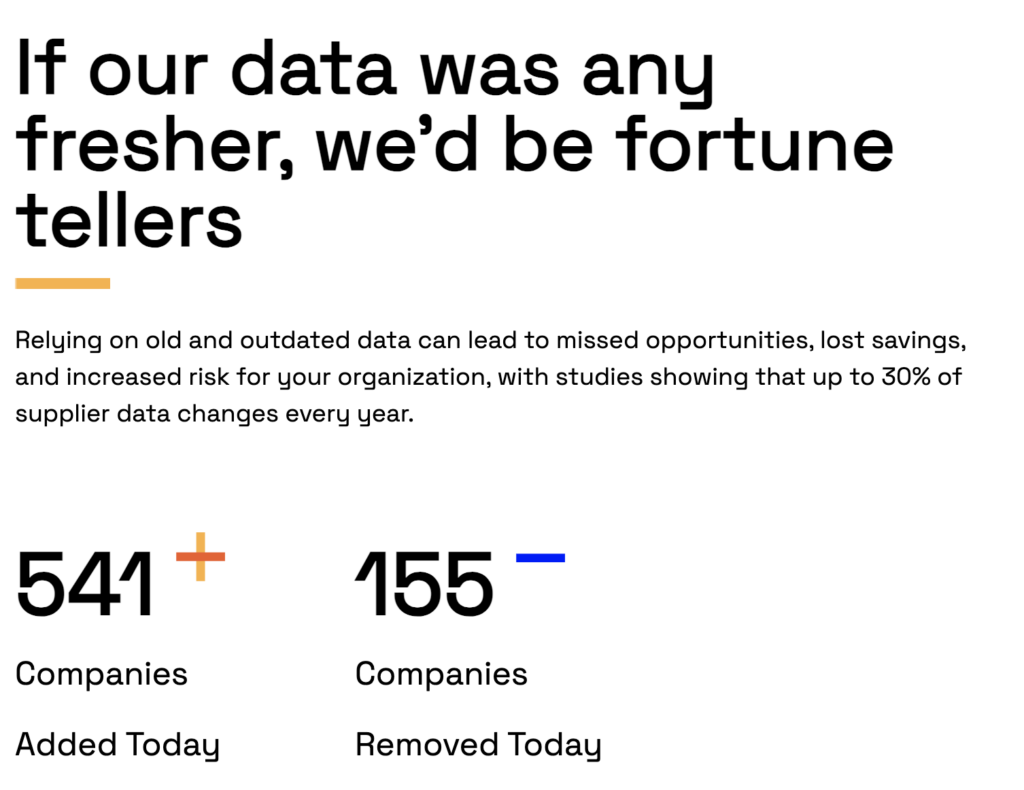

However, achieving this level of visibility requires detailed external data, such as geopolitical risk, trade regulations, and supplier-specific information on factors like bankruptcy warnings.

This data is difficult to obtain and track manually.

Advanced data platforms like Veridion solve this problem by processing massive datasets from diverse sources and creating comprehensive supplier profiles.

Source: Veridion

These profiles include the following data:

Since this data is refreshed weekly, Veridion can flag any changes in supplier profiles.

Source: Veridion

For example, it could notify you that a critical supplier is facing bankruptcy risks or has recently lost an important certification.

Ultimately, by segmenting your suppliers and making it a highly data-driven process, you can get more visibility into your supply chain and your relations with suppliers.

And you know what that means—better decision-making and fewer chances of supply chain disruptions.

One of the greatest risks in supply chain management is becoming overly dependent on a single supplier for critical materials or components.

And that’s not good for many reasons.

Jeff Long, business advisor, lists some of them for the Guardian:

Illustration: Veridion / Quote: Guardian

What’s more, while the product or service they provide may be essential to your business, it might be marginal for the supplier.

This creates a real risk of your vital product or service being discontinued if the supplier shifts priorities.

Natural disasters or political disruptions in a supplier’s region add another layer of vulnerability, potentially stopping their—and your—production.

Source: npr

So, how do you reduce this risk?

When you segment suppliers by factors like their role, geographic location, or the volume of business they handle for you, dependency patterns become clear.

And once you see the problem, you can act.

For instance, you can diversify your supplier base by sourcing materials from multiple vendors or regions.

Tesla, for example, follows this strategy to secure essential materials like lithium and nickel, both critical for manufacturing batteries used in electric vehicles.

Here’s a brief overview of Tesla’s suppliers for these materials:

| Supplier | Material | Country |

|---|---|---|

| Albemarle | Lithium | Australia (mine); China (refinery) |

| Livent | Lithium | Argentina (mine); China, USA (refinery) |

| Ganfeng | Lithium | China |

| Vale | Nickel | Canada |

| Prony Resources | Nickel | New Caledonia |

| BHP Nickel West | Nickel | Australia |

Data: electrek

Why is this a smart approach?

If Tesla relied on a single supplier or region, a geopolitical issue or natural disaster could disrupt its entire production line, jeopardizing its ability to meet demand.

By diversifying suppliers, Tesla ensures stability and maintains flexibility in case of unexpected challenges.

But there’s another advantage to supplier diversification beyond reducing risks: controlling costs.

Titus Sharpe, co-founder of MVF, a digital marketing and customer acquisition specialist, explains that if suppliers know they are your only supplier, they will try to push prices up.

But if they know they have competition, you can leverage it to your advantage.

Illustration: Veridion / Quote: Guardian

By reducing reliance on single suppliers, segmentation gives you leverage in negotiations and keeps costs in check.

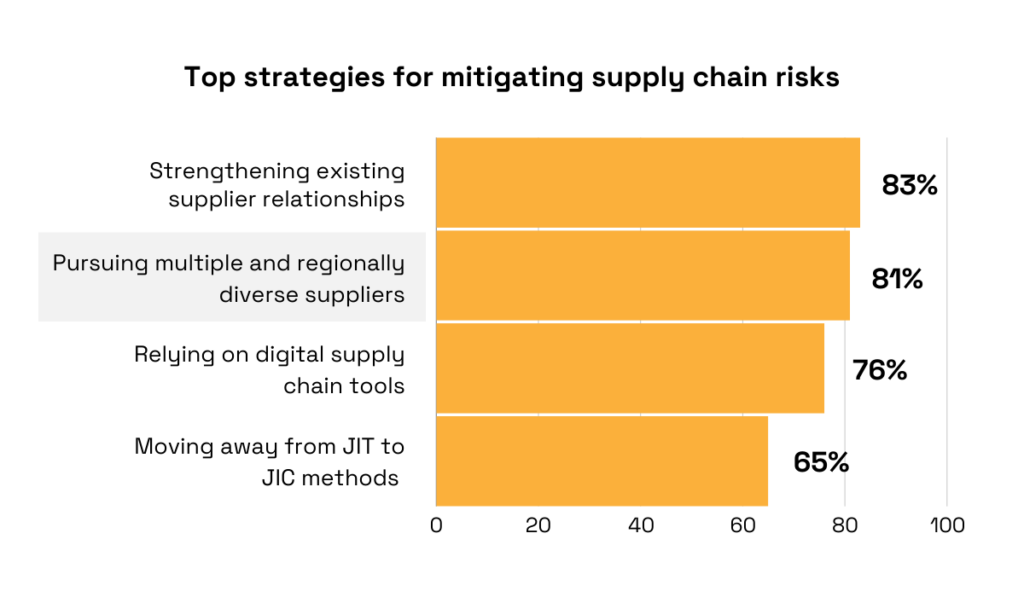

Statistics from Deloitte show that organizations have recognized the importance of diversifying suppliers for supply chain risk mitigation.

When the study was conducted in 2022, 81% of manufacturers planned to pursue multiple, geographically diverse suppliers.

Illustration: Veridion / Data: Deloitte

On top of that, the study revealed that businesses that already adopted regional diversification were less affected by supply chain disruptions than those concentrated in one region.

All in all, supplier segmentation helps you pinpoint over-reliance on single suppliers.

Without it, you might not even realize your vulnerabilities until a disruption happens.

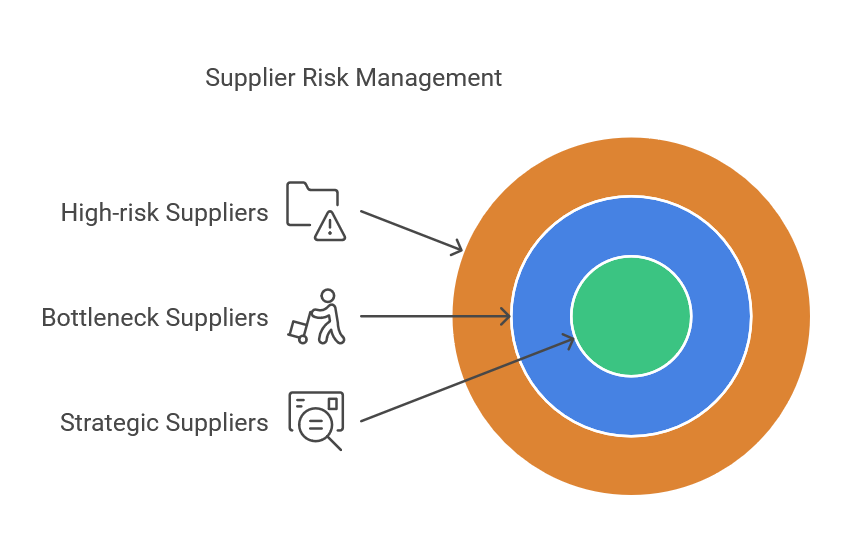

Supplier segmentation is an essential tool for building effective contingency plans because it enables you to categorize suppliers into three key groups:

Any disruption to these suppliers could ripple through your supply chain and harm your business in more ways than one.

Source: Veridion

Here, supplier segmentation proves its value once again.

By identifying which suppliers fall into these categories, you gain the clarity to create tailored contingency plans.

For instance, if a bottleneck supplier is critical to your operations, you might establish dual-sourcing agreements to reduce reliance on a single vendor or stockpile key materials to prevent disruptions.

In fact, dual-sourcing is becoming a widely adopted contingency plan, with 73% of companies reporting progress on dual-sourcing strategies.

Illustration: Veridion / Data: McKinsey

But dual sourcing doesn’t always mean finding an entirely new supplier.

As John Dickson, former CPO at AstraZeneca, explained, they work with existing suppliers that have a network of regional operations:

Illustration: Veridion / Quote: Deloitte

By leveraging a supplier’s capacity to deliver across multiple locations, you can build resilience into your supply chain without the added complexity of onboarding multiple vendors.

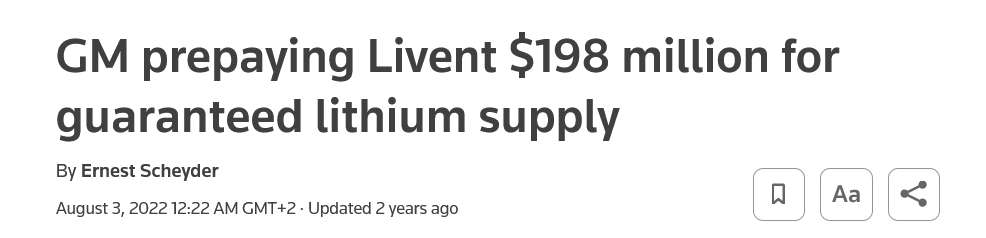

Then, with strategic suppliers, you might negotiate long-term contracts with guarantees for supply continuity.

One powerful example of this is General Motors’ decision in 2022 to secure a six-year supply of lithium, essential for electric vehicle batteries, from Livent Corp (Arcadium Lithium PLC).

Recognizing Livent as a critical supplier, GM prepaid $198 million to lock in their supply and safeguard production.

Source: Reuters

So, what’s the bottom line?

Supplier segmentation is the foundation that allows you to determine where contingency plans are most needed.

Without it, you simply wouldn’t know which suppliers to prioritize, and where to allocate your resources.

By categorizing suppliers—such as strategic, preferred, tactical, and transactional—you can clearly prioritize where to allocate your resources.

That includes time, personnel, and budget.

High-risk or high-value suppliers need more frequent risk assessments, regular audits, and deeper collaboration, for instance.

On the other hand, low-risk suppliers require minimal oversight, freeing up your resources to address the previous group.

Take Coca-Cola Europacific Partners New Zealand as an example.

They segment their suppliers into tiers based on strategic importance, risk, and collaboration potential.

For transactional suppliers with minimal impact, interactions are kept simple, and performance reviews are unnecessary.

Source: Coca-Cola EP

Meanwhile, tactical suppliers receive more attention, with yearly assessments and resource investment to ensure consistent supply and mitigate potential risks.

Source: Coca-Cola EP

Such a targeted approach to resource allocation and supplier risk management reduces waste and focuses efforts on potential risk points.

On top of that, it helps align stakeholders on the value of these actions.

As Oliver Jones, director of the procurement practice at H&Z Management Consultancy puts it:

“You have to explain to the business quite clearly, ‘this is why we spend more time with this supplier, and not this supplier.’ You have to make the things that don’t seem quantifiable, quantifiable, and make what is very subjective, objective.”

When you segment your suppliers, you can demonstrate the logic behind prioritizing resources, as well as reduce risks and maintain supply chain resilience.

Hopefully, we’ve made it clear that supplier segmentation is a crucial, if not the first, step to reducing supply chain risks.

By categorizing suppliers based on their importance and risk, you can direct your efforts where they matter most.

This approach helps you identify vulnerabilities, avoid over-reliance on single suppliers, and optimize resource allocation.

If you’re looking to reduce risks, increase resilience, and make more informed decisions about your supply chain, now’s the time to reassess your supplier segmentation process and take action.