Best Practices for Efficient Spend Management

Managing company spending might sound straightforward, but anyone in procurement knows the reality is much more complex.

You’re expected to control costs, ensure compliance, and maintain good supplier relationships, all while handling countless invoices and purchase orders.

But if there’s no clear strategy in place, you could lose money due to inefficiencies, unexpected fees, or even strained relationships with suppliers.

Fortunately, these problems don’t have to be permanent.

There are proven best practices that can streamline your spend management, help you get more from every dollar, and ultimately strengthen your entire procurement process.

Here are six of them.

The foundation of effective spend management lies in understanding where and how your money is spent.

It might sound basic, but this insight is what helps you spot inefficiencies, reduce waste, and identify cost-saving opportunities.

If you don’t have spend visibility, it’s like trying to drive in the dark—you’re bound to crash.

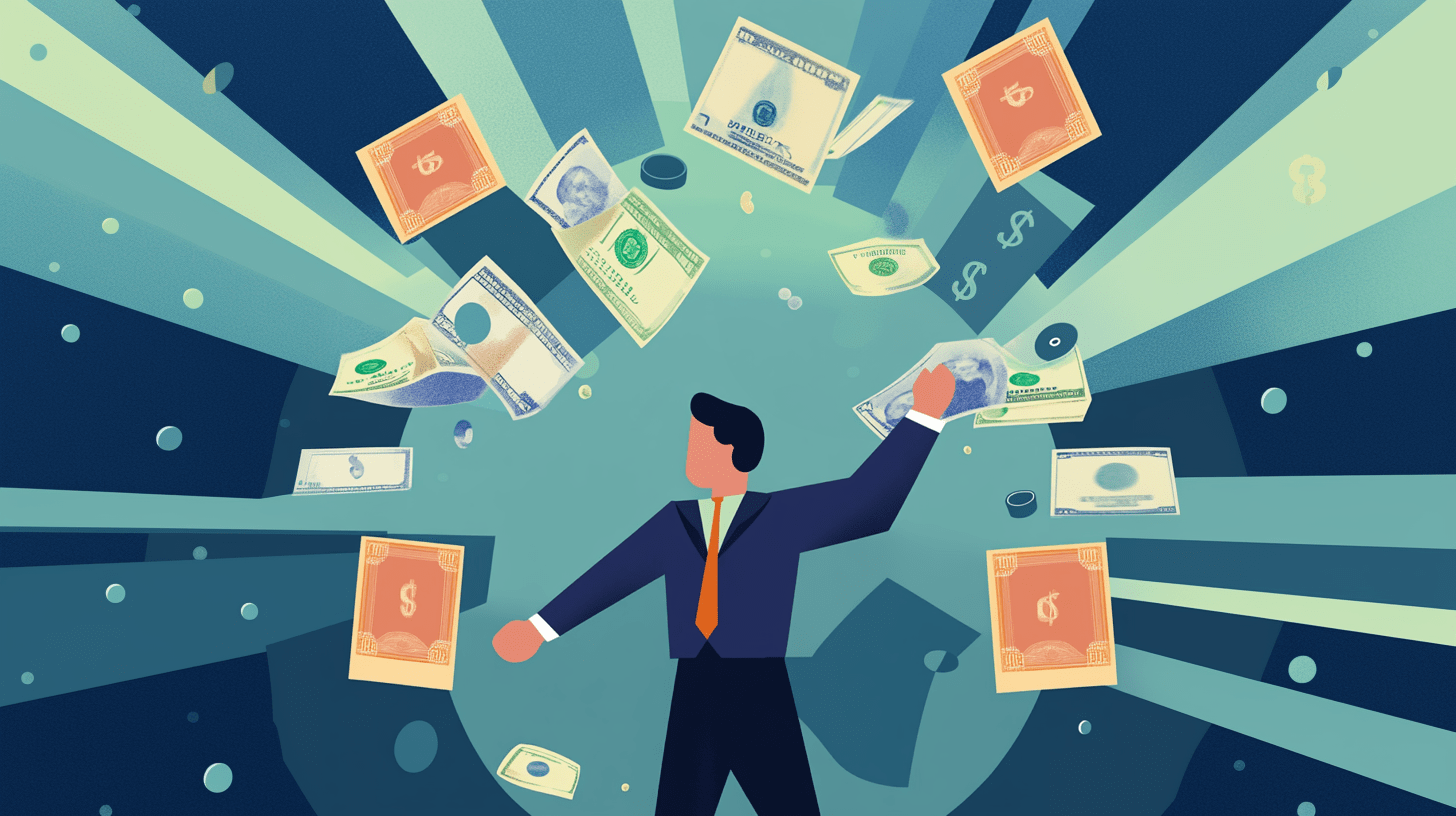

Research from APQC from a few years ago showed just how critical this is.

They found that companies actively analyzing their spend data saw significantly lower procurement costs.

For example, a business with a $5 billion revenue that embraced spend analysis spent around $8.5 million on procurement.

Meanwhile, a similar company without this practice was spending $19.5 million.

That’s an extra $11 million thrown out the window!

Illustration: Veridion / Data: APQC

So, what does effective spend analysis look like?

It breaks down your expenses in detail, across all departments, categories, and suppliers.

You analyze direct and indirect spend, check spending by supplier, look into maverick spend, and even dig into tail spend.

Each of these spend analysis types can reveal different insights, but there’s a catch—detailed analysis needs reliable, well-organized data.

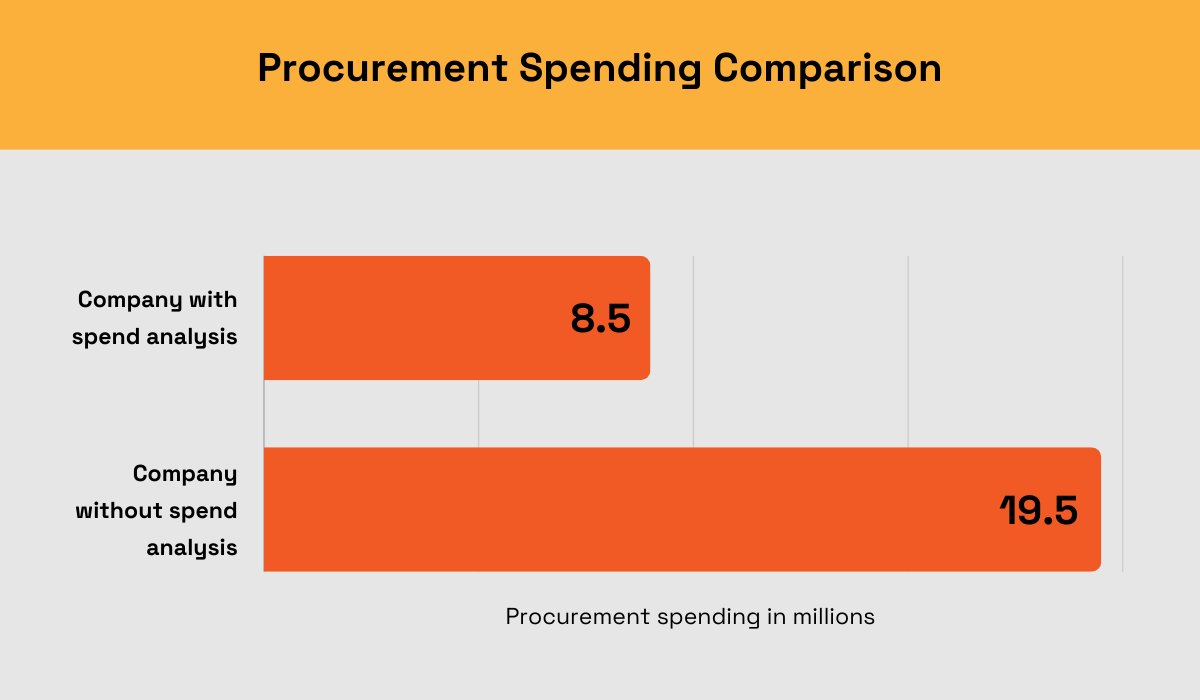

Consider an example from a fintech company struggling with a lack of visibility across its indirect spend categories.

Their financial data was fragmented, inconsistent, and unmanageable because they used multiple systems.

By consolidating all that data into a single platform, they managed to clean, standardize, and auto-categorize their spend information.

This gave them 100% visibility across their supplier landscape, reduced supplier count from 3,227 to 2,133, and revealed areas where they had been overspending.

By understanding their spend, they were able to rationalize their supplier base, control costs, and optimize purchasing decisions.

Here are the benefits summarized:

Source: Spendkey

In short?

Without detailed spend analysis, you’re leaving money on the table.

But when you take the time to understand your spending patterns, you can achieve significant cost savings, improve supplier negotiations, and drive better decision-making.

Another best practice you simply can’t go without is establishing a clear, comprehensive spending policy.

Without an official policy, everything is chaotic—people spend as they see fit, leading to uncontrolled spending.

But if you have a spending policy, you can control costs, ensure compliance, and maintain consistency across the organization.

That’s why a well-written spending policy should include the following elements:

| Defined acceptable expenses | What can and can’t be purchased using company funds |

| Approval processes | Clear steps that need to be followed to get a purchase approved |

| Spending limits | Budget limits for various teams and departments |

| Compliance requirements | Legal and company guidelines that must be respected |

| Expense reporting | How expenses should be documented and tracked |

Of course, it’s not enough to just have this policy written down. It will only be effective if employees understand and follow it.

A clear policy helps control costs, but if employees aren’t informed or fail to see its value, maverick spending will follow.

And this is where many companies stumble.

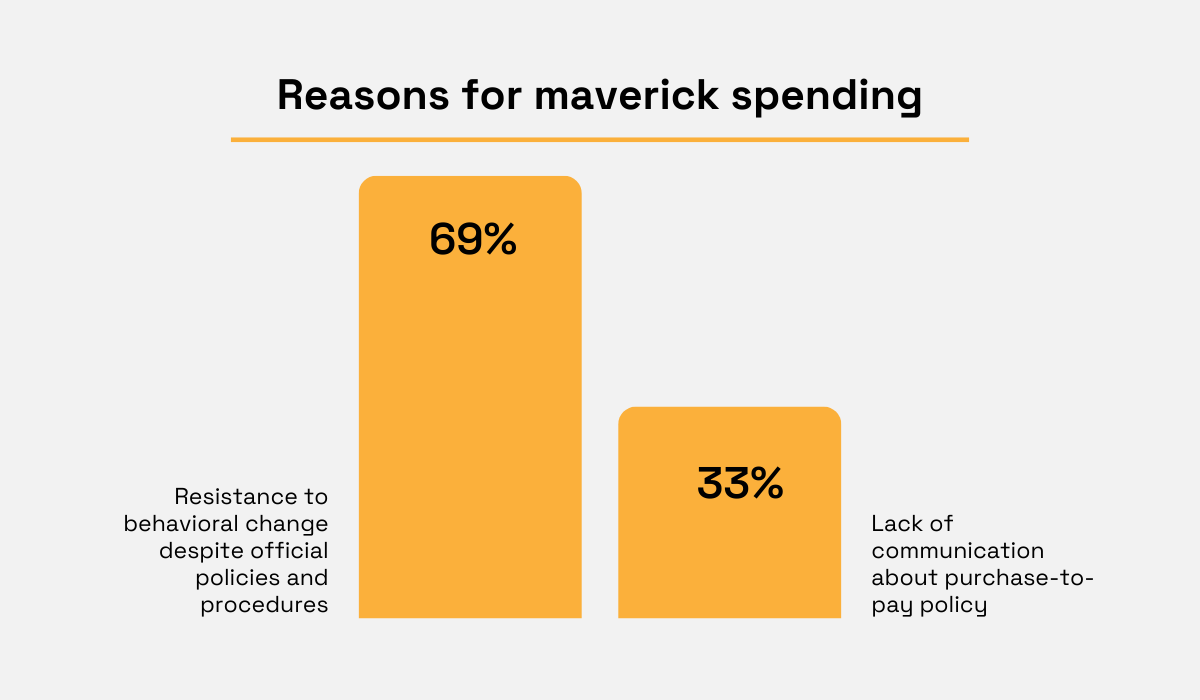

In fact, 69% of companies cite resistance to change, despite official policies, as a key reason for maverick spending.

And 33% point to a lack of communication about purchase-to-pay policies.

Illustration: Veridion / Data: The Hackett Group

See the connection?

Employees need to understand a spending policy and, more importantly, grasp why it matters.

That’s why it’s essential to communicate your policy company-wide and make sure everyone is on the same page.

Don’t just send out an email and call it a day—educate your teams on the new guidelines.

Offer training sessions, create FAQ documents, and encourage managers to discuss the policy in their team meetings.

When everyone knows the rules and understands why they exist, you’ll see less overspending, fewer unapproved purchases, and smoother and standardized spend management.

Think about all the manual tasks involved in spend management—handling invoices, reconciling payments, tracking expenses, and approving purchases.

Not to mention searching for suppliers and managing them all together.

When done manually, these processes are repetitive, time-consuming, and prone to human error.

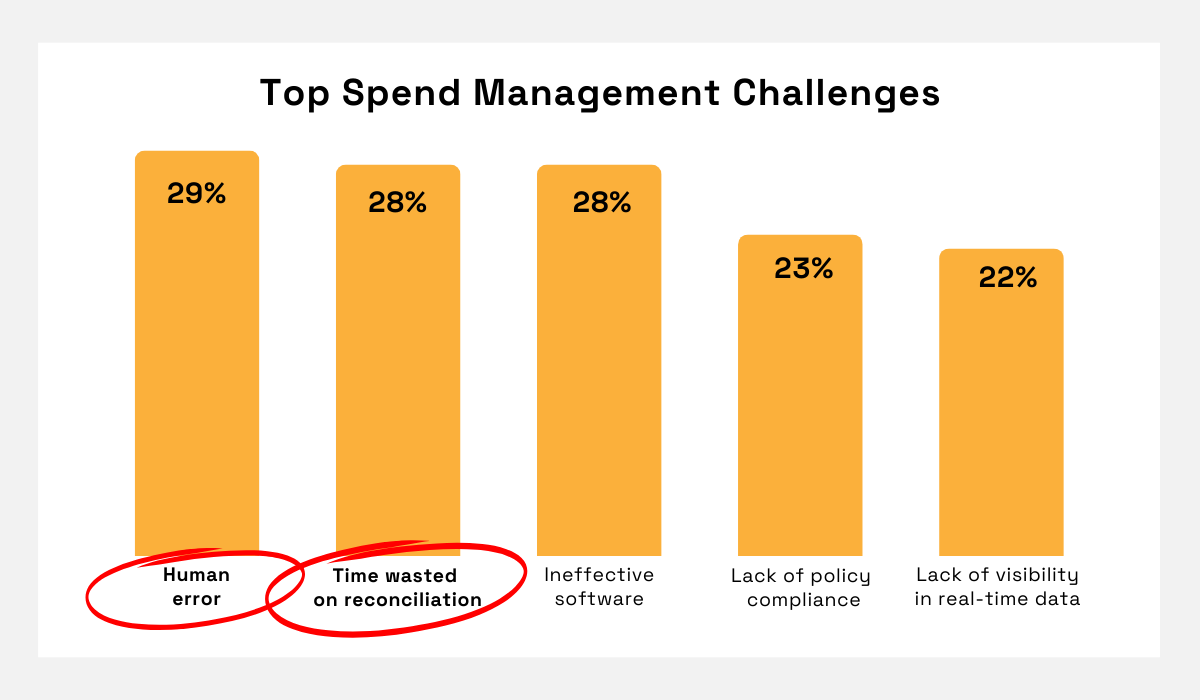

Statistics back this up.

According to Payhawk’s 2024 Spend Management Pulse Report, 29% of companies cite human error as a top challenge of spend management, while 28% struggle with the time wasted on reconciliation.

Illustration: Veridion / Data: Payhawk

The solution for both?

By automating key processes like procurement, invoicing, and expense management, companies can significantly reduce manual effort and minimize errors.

For example, think about travel and expense (T&E) management.

Manually managing it can be a nightmare—tracking receipts, processing reimbursements, and matching every detail manually.

However, companies that automate this process see great benefits.

ExpenseAnywhere, a cloud-based T&E management tool, explains how one of their clients benefited from using their solution:

One of our customers, which had many field reps calling on retail stores, reduced its $4 million in annual mileage reimbursement costs by 20% after taking advantage of ExpenseAnywhere integration with MapQuest. A whopping savings of about $800,000 in the first year alone.

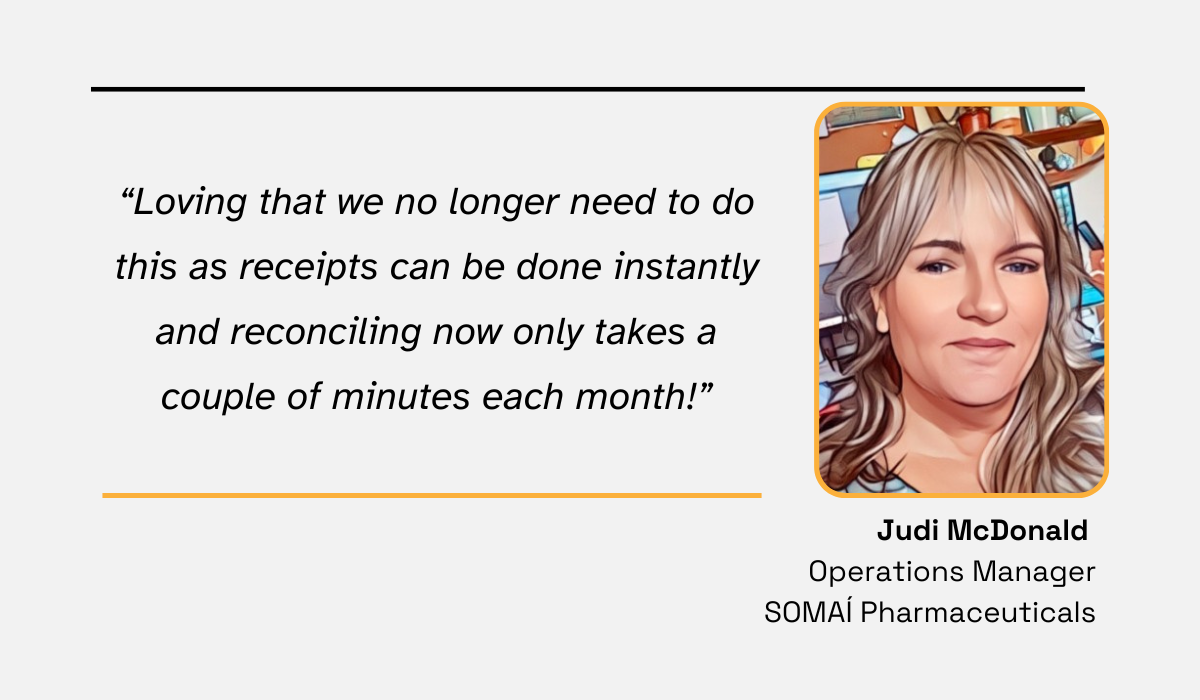

Another example is SOMAÍ Pharmaceuticals, an EU-GMP European pharmaceutical and biotech company.

Before automating spend management, their staff spent hours manually reconciling transactions, downloading reports, and chasing down missing receipts.

It was a slow, frustrating process.

However, after automating spend management, reconciliation now takes just a few minutes, as Judi McDonald, Operations Manager, shares:

Illustration: Veridion / Quote: Budgetly

But it’s not just about saving time.

Complete automation of spend management processes captures accurate, real-time spend data, which means fewer opportunities for maverick spending or invoice fraud.

With comprehensive data, companies can also generate audit-friendly reports and gain insights that lead to better decision-making.

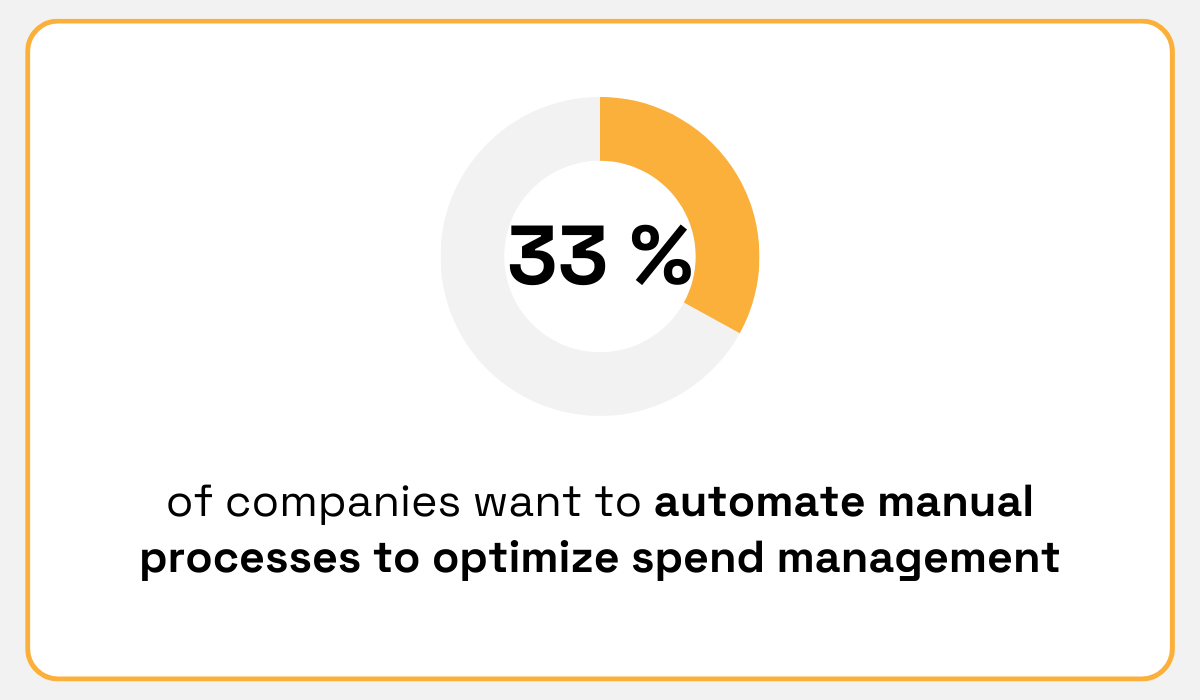

Given all this, it’s no surprise that 33% of companies are now looking in that direction to improve their spend management.

Illustration: Veridion / Data: Payhawk

As more businesses embrace this shift, the benefits are clear: streamlined processes, improved accuracy, and, ultimately, greater control over spending.

Regular procurement audits are crucial for effective spend management.

Even with a solid spending policy and automated systems, you can’t just have a “set it and forget it” mindset.

Periodically reviewing your organization’s spending practices and transactions ensures compliance and catches issues before they snowball.

Just think about maverick spend again.

It might not seem like a big deal at first—just a few off-the-books purchases here and there.

But it is a big deal.

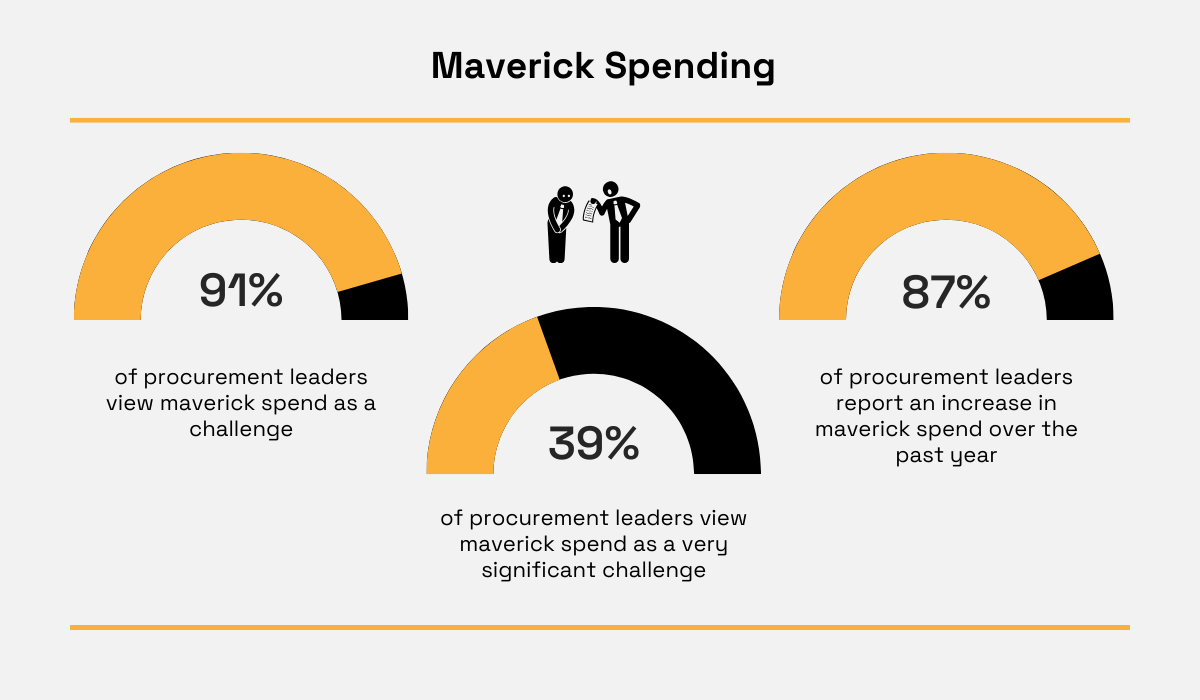

A recent study by WBR Insights, ProcureCon, and SDi highlighted the extent of this issue.

As you can see in the following image, 91% of procurement leaders view maverick spend as a challenge, with 39% considering it a very significant one.

Illustration: Veridion / Data: SDi

And it’s getting worse—87% reported an increase in maverick spending over the past year.

Maverick spend quickly adds up, leading to unplanned expenses, difficulty in tracking spend, and missed opportunities for negotiated savings.

Even worse, it opens the door to more serious problems, like procurement fraud.

Fortunately, regular audits help enforce adherence to spending policies, catch any deviations, and ensure your team is sticking to the rules.

However, a survey by SAS revealed that more than one-fourth (26%) of companies don’t audit for procurement fraud, which means many are missing opportunities to catch costly mistakes or deliberate deception.

Illustration: Veridion / Data: SAS

Make sure you are not one of them and audit your internal processes.

You might as well reveal cost-saving opportunities like Britain’s National Audit Office did.

They conducted an audit that revealed billions of pounds in potential savings through improved procurement practices.

Source: Financial Times

If anything, this shows how the versatility of audit benefits.

They aren’t just for enforcing rules but can also show you ways to save and make processes more efficient.

It would be a waste not conducting them regularly.

Strong supplier relationships are the backbone of effective procurement.

But here’s the catch—it’s not enough to just know who your suppliers are.

You need to evaluate how well they’re performing and if they’re truly delivering value for your business.

Understanding these dynamics is key to ensuring you’re getting high-quality products and services at competitive prices.

When analyzing supplier partnerships, several factors come into play.

By regularly assessing these elements, you not only optimize spending but also mitigate risks that could disrupt your supply chain.

Moreover, through regular supplier analysis, you can find ways to build lasting partnerships that add value in the long term.

Take, for example, how Heineken Ethiopia approaches its suppliers.

In one market, they only had access to one certified welding company.

Rather than settling for that, they collaborated with a certification agency to train and certify additional local suppliers.

Illustration: Veridion / Quote: Procure Scape

This not only improved safety standards but expanded their supplier pool, creating more choices and ensuring their supply chain was stronger and safer.

It’s a win-win for everyone involved.

But why does this matter?

You’re not just managing transactions—you’re building strategic relationships.

Philip King, former Cash Flow Expert at Tide, puts it well:

Illustration: Veridion / Quote: Tide

You can do that by offering fair pricing, timely payments, and treating suppliers as partners.

When you become their preferred client, they’ll go the extra mile for you—whether it’s offering the best teams or prioritizing your business during critical times.

To make supplier analysis even more efficient, you can use tools like Veridion’s supplier discovery platform.

With simple searches, you can find suppliers and evaluate them based on certifications, financial stability, compliance, and sustainability, among other factors.

And you can do it fast.

Instead of spending hours manually searching for the right suppliers, Veridion helps you find reliable partners that meet your specific criteria in seconds.

Source: Veridion on YouTube

All in all, by continually assessing and refining your supplier relationships, you make smarter procurement decisions, secure better deals, and strengthen your supply chain.

When you manage supplier partnerships thoughtfully, you can manage your spending smarter, too.

Implementing best practices for efficient spend management is one thing, but ensuring they’re delivering results is another.

To gauge your success and continually refine your approach, you need to track key performance indicators (KPIs).

They give you real-time insights into how well you’re controlling costs, optimizing supplier relationships, and improving procurement processes.

But the question is—which KPIs should you track?

Well, the ones that are directly related to how you spend.

Below is a brief overview of the KPIs that fall into this category and why each is essential.

| KPI | What it measures | Benchmark | Why you should track it |

| Spend Under Management | Percentage of total spending that procurement oversees | Up to 80% (Sievo) | More control over spend, better deals, standardized processes, and cost optimization |

| Structured Spend | Percentage of purchases made through approved platforms | 70.4% (Coupa Report) | Ensures consistency and efficiency by channeling purchases through approved sources |

| On-Contract Spend | Percentage of spend via pre-negotiated contracts | 83.7% (Coupa Report) | Locks in better terms, helps avoid unexpected costs, and maximizes contract benefits |

| Spend with Primary Suppliers | Percentage of total suppliers with whom a company spends 80% of its total spend | 17.4% (Coupa Report) | High concentration with key suppliers leads to stronger relationships and better pricing |

| Pre-Approved Spend | Percentage of spend linked to approved purchase orders | 96.1% (Coupa Report) | Ensures spending is authorized and aligned with internal policies |

| Maverick Spend | Unauthorized purchases made outside approved processes | N/A | Helps maintain procurement discipline, prevents budget leaks and fraud |

| Year-over-Year Savings | Progress in cost reduction over time | High-performing companies save 5.8% of their overall spend (Coupa) | Monitors success in cutting costs and improving efficiency year after year |

| Cost Avoidance | Ability to prevent unnecessary spending | N/A | Tracks how well your team avoids costs that could have been incurred without careful management |

In addition to these financial KPIs, it’s also important to track supplier management KPIs.

Some of them are:

Tracking these metrics can improve spend management efficiency by ensuring you’re working with dependable suppliers who consistently meet quality, time, and performance expectations.

By doing so, you can mitigate risks, prevent costly delays, and maintain smooth, efficient operations.

So, remember to keep a close eye on all these essential KPIs if you want to further enhance spend management.

It’s more than clear that effective spend management isn’t just about cutting costs.

Rather, it’s about understanding how your company spends, setting clear policies, and using technology to streamline processes.

Combine these practices with strong supplier relationships and KPI tracking, and you’ll have the means to make smarter, faster decisions.

Saved money will inevitably emerge as a result of those efforts.