4 Procurement Risk Management Methods to Consider

There’s certainly no shortage of procurement risks, especially in today’s day and age fraught with global supply chain disruptions, geopolitical tensions, natural or manmade disasters, and rapidly evolving market dynamics.

To prevent these challenges from adversely affecting their bottom line and reputation, companies typically engage in comprehensive risk assessments.

This enables them to identify potential vulnerabilities and decide which of the four essential risk management methods best suit their procurement objectives and risk appetite.

In this article, we’ll cover what these methods entail and provide actionable tips on when to implement them to protect your procurement processes against potential pitfalls.

Before we delve into when you should consider risk avoidance as a prudent procurement risk management strategy, let’s quickly cover the basics.

The primary goal of procurement risk management is to identify, assess, and mitigate potential threats that could disrupt your company’s operations or compromise its business objectives and reputation.

Therefore, as one of the risk management methods in your arsenal, risk avoidance in procurement inherently begins (but does not end) with supplier selection.

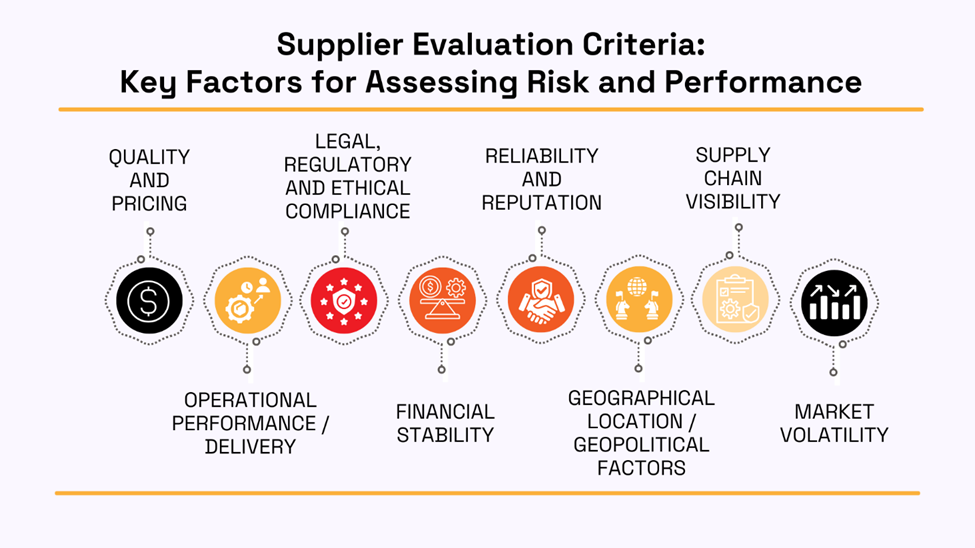

More specifically, the supplier sourcing process usually starts by identifying and evaluating potential suppliers against a set of predefined criteria, such as the ones illustrated below:

Source: Veridion

These criteria help your team determine what a potential supplier offers in terms of price, quality, and agile delivery, and what risks it potentially brings as your supply chain partner.

This should ensure that the finally selected supplier aligns with your company’s strategic goals, operational requirements, and quality standards.

In other words, those potential suppliers that do not meet your criteria and risk tolerance parameters are candidates for applying the risk avoidance method.

For instance, a supplier with a history of financial instability or non-compliance with regulatory requirements may pose significant risks to your supply chain.

In such cases, opting not to select that supplier is the essential form of risk avoidance.

However, making such risk avoidance decisions relies heavily on conducting proper supplier due diligence and thorough risk assessments.

To enable your team to do this efficiently, they need access to the latest supplier information and real-time market intelligence, which is best provided by online supplier-sourcing tools like our Veridion.

Source: Veridion

Using Veridion’s AI-powered global database of suppliers and advanced search functions, your team can quickly establish a shortlist of potential suppliers that meet your specific procurement criteria.

Likewise, these suppliers can be evaluated against a range of risk factors to determine whether the risks associated with each supplier require avoidance (i.e., not selecting the supplier) or other risk mitigation measures may be appropriate.

However, while selecting reliable suppliers is indeed a critical aspect of risk avoidance, it’s essential to recognize that the procurement process is dynamic and ongoing.

In other words, new risks emerge over time, which necessitates continuous monitoring of supplier- and market-related risks.

Source: Veridion

Given all the above, it’s clear that the risk avoidance method can, depending on the circumstances, be applied throughout the procurement lifecycle to address emerging risks identified through continuous risk monitoring.

For instance, let’s say there is a serious political or health crisis in your supplier’s home country or region that prevents or delays deliveries.

Terminating the contract with that supplier can sometimes be the only viable option to avoid the risk of further disruptions.

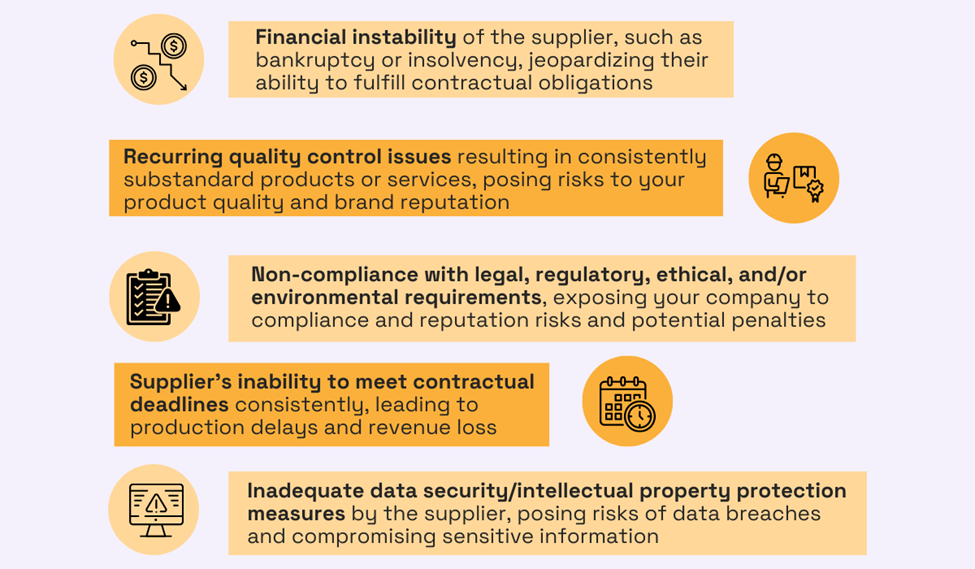

Other examples where risk avoidance might be warranted include:

Source: Veridion

Each of these examples highlights a specific risk associated with selected suppliers that could have significant consequences for the company, making risk avoidance a prudent strategy in certain circumstances.

In closing, we should note that risk avoidance, unlike other risk management methods covered here, aims to eliminate or sidestep the risks associated with specific suppliers altogether, which is easiest to do during supplier sourcing.

For existing supplier relationships, ongoing evaluation of procurement performance and continuous supplier risk monitoring ensures a proactive approach to identifying and addressing emerging risks throughout the procurement lifecycle.

Ultimately, this helps your procurement team determine when to apply risk avoidance and when other risk management methods are more appropriate to maintain supply chain resilience and operational continuity.

While risk avoidance seeks to eliminate risks in procurement, risk reduction acknowledges that some level of risk is inevitable.

For instance, you can’t stop an earthquake, fire, or flood from shutting down your supplier’s operations, resulting in supply chain disruptions.

That’s why the goal of risk reduction is to implement measures that minimize the likelihood of potential risks occurring and/or their impact if they do materialize.

So, let’s look at some effective risk reduction strategies, starting with supplier diversification.

As you know, relying on a single supplier for critical components or services increases the vulnerability of your supply chain to disruptions.

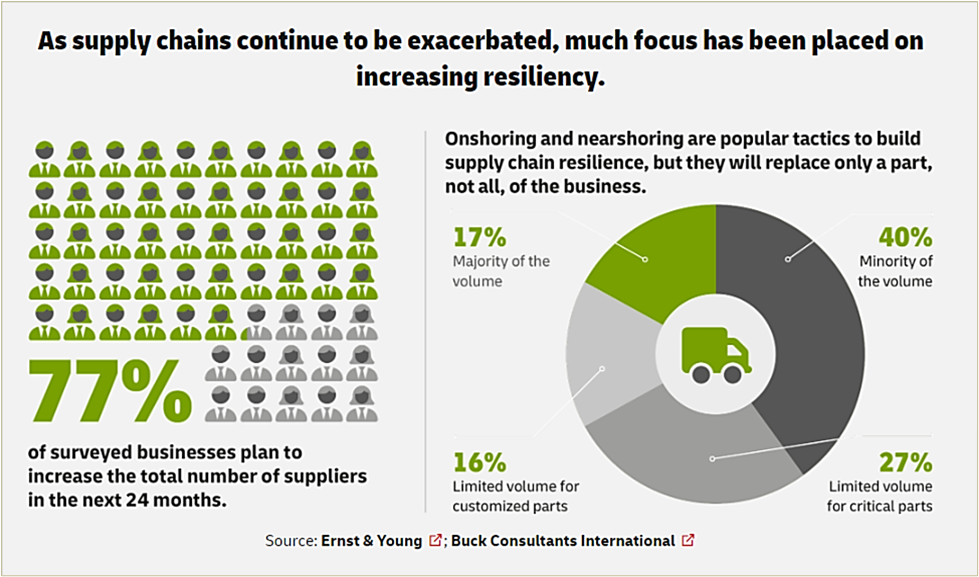

Consequently, a large majority (77%) of businesses, surveyed by DHL in 2022, stated their intent to increase the number of their suppliers in the next two years as a way to build supply chain resilience.

Source: DHL

By diversifying the supplier base and establishing relationships with multiple suppliers, companies can spread disruption risks across different sources, thereby reducing dependence on any single supplier.

That way, if one of your suppliers defaults on their deliveries for any reason, your team can quickly pivot.

More precisely, they can increase orders from another supplier already familiar with your company’s specifications and requirements.

This risk reduction approach not only enhances supply chain flexibility and resilience but can also foster competition among suppliers, driving improved performance and building your negotiation leverage.

Another efficient risk reduction strategy involves contracts.

By carefully drafting supplier contracts and including specific clauses related to risk management, companies can mitigate potential risks.

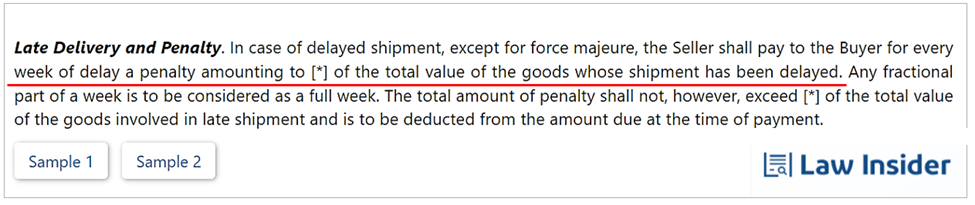

For example, contracts can include late delivery clauses to reduce the risk of delayed deliveries by clearly outlining the penalties involved.

You can see an example of such clause in the image below.

Source: Law Insider

As illustrated, this contract provision does not refer to late deliveries caused by force majeure events.

This keeps things fair and practical while motivating suppliers to remove any internal inefficiencies that could result in late delivery, thus reducing the risk of disruptions.

Similarly, contracts can stipulate performance metrics and quality standards, ensuring that suppliers adhere to agreed-upon specifications and minimizing the risk of substandard products or services.

Renegotiating existing contracts can also be a prudent strategy for risk reduction.

When new risks emerge or circumstances change, companies can proactively engage with suppliers to modify contract terms to better align with evolving business needs and mitigate potential risks.

For instance, if geopolitical tensions escalate in your supplier’s region, renegotiating the contract to diversify sourcing locations or establish alternative supply routes can reduce the risk of supply chain disruptions.

Renegotiation can also be a good strategy when prices of raw materials go down.

This allows companies to generate cost savings and minimize financial risks associated with procurement operations.

Source: Building

Lastly, your company can reduce its own risks by encouraging suppliers to implement their risk management measures.

More precisely, promoting a culture of risk awareness and fostering proactive risk management among suppliers strengthens the resilience of their supply chains and, in turn, reduces the likelihood of disruptions affecting your company.

The described risk reduction techniques provide a glimpse into the broader array of strategies available for minimizing the impact of potential risks on your supply chain operations.

In summary, risk reduction stands as the most commonly employed risk management approach, offering many possible variations tailored to specific procurement contexts.

Compared to risk avoidance and reduction methods, risk transfer involves shifting the financial burden or responsibility of managing certain risks from one party (your company) to another (your supplier or third parties).

While risk transfer doesn’t eliminate the risk itself, it reallocates it to another entity that may be better equipped to manage it.

For example, if your supplier’s responsibilities are limited to providing goods at their premises or another location (Ex Works, EXW), and they don’t handle transportation or logistics, you might opt to outsource logistics operations to a third-party logistics provider (3PL).

By doing so, the risks associated with transportation and warehousing are effectively transferred to the 3PL, which specializes in managing such risks.

In addition to risk transfer, this arrangement can provide other benefits for your company, which are illustrated below.

Source: Veridion

Therefore, partnering with a reliable logistics provider allows your company to transfer certain risks associated with transportation, inventory management, and supply chain disruptions to the service provider.

In general, companies can subcontract or outsource other aspects of their procurement operations, such as IT functions or data security, to transfer risks associated with those activities (infrastructure failure, cyberattacks) to third-party vendors.

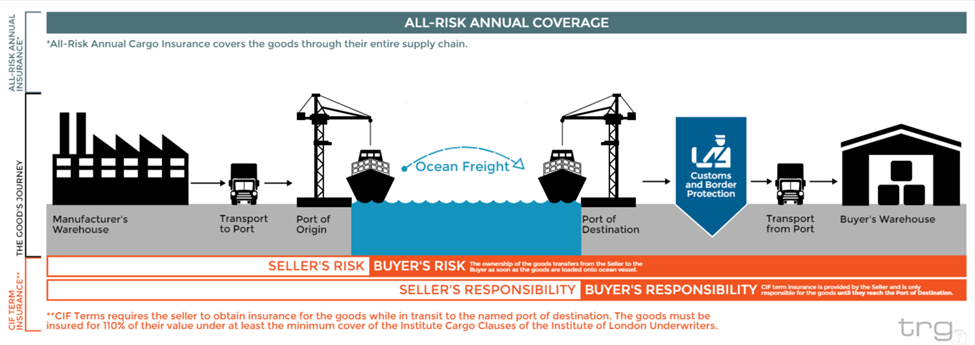

Another typical third party suitable for risk transfer is insurance companies.

More specifically, your company can decide to purchase insurance policies to transfer specific procurement risks to the insurance provider.

Illustration: Veridion / Data: Wall Street Mojo

Examples of insurable and transferrable procurement risks include:

For instance, marine cargo insurance can protect against losses during shipping.

But despite their risk transfer advantages, insurance policies can be costly and may not always provide coverage for the particular risks you aim to transfer.

Hence, it’s advisable to exercise caution and thoroughly review the policy terms and conditions.

Source: Trader Risk Guaranty

Another effective risk transfer strategy involves fixed-price contracts, which transfer the risk of price fluctuations from your company (i.e., the buyer) to suppliers.

In such contracts, the supplier agrees to provide goods or services at a predetermined price, shielding the buyer from cost increases.

Similarly, indemnity clauses in contracts can transfer specific risks to suppliers or other parties.

For example, a contract might stipulate that the supplier indemnifies the buyer against any legal claims arising from product defects.

Additionally, contract payments may be made contingent on specific supplier performance outcomes, such as timely delivery, quality standards met, or compliance with regulatory requirements.

That way, at least some of the risks associated with these performance factors are transferred from the buyer to the supplier.

In summary, the risk transfer method provides companies with valuable tools to mitigate the impact of various procurement risks by redistributing them to other parties better equipped to manage them.

Lastly, risk retention acknowledges that some procurement risks are either unavoidable or too costly to transfer or mitigate effectively.

Therefore, as a risk management method, risk retention involves accepting certain risks as they stand, rather than attempting to shift them to other parties or implementing measures to reduce their likelihood or impact.

For instance, companies operating in emerging markets with volatile political or economic conditions may face risks such as currency fluctuations, regulatory changes, or geopolitical instability.

Attempting to transfer these risks through insurance, contractual arrangements with suppliers, or other risk mitigation strategies may be complex or cost-prohibitive, leading companies to accept them as inherent to their operations.

A good example of forced risk retention due to currency fluctuations is Tramontina, a Brazilian cookware and home appliances company with 10,000 employees that exports its products to more than 120 countries.

Source: Tramontina

As Marcelo Borges, Tramontina’s US CEO says in a Financial Times article, currency fluctuations in regions like Latin America and Asia can be hard to predict.

When such fluctuations negatively affect the company’s bottom line, they often can’t pass the related costs onto customers because of the existing fixed-price contracts, forcing them to apply risk retention and bear the losses.

Illustration: Veridion / Data: Financial Times

The end of this quote highlights that, while risk retention may sometimes be unavoidable in the short term, it’s essential for the company to explore long-term solutions.

For instance, renegotiations upon contract renewal or hedging instruments, such as forward contracts or options, could help offset losses resulting from adverse currency movements.

Another example of calculated risk retention is when a company relies on a single supplier for a critical component.

For instance, semiconductors are critical components often sourced from just one supplier, as discussed in the article shown below.

Source: EY

Regardless of the component type, when it has unique specifications and requires a specific supplier’s expertise to manufacture it, finding alternative suppliers is generally challenging and would require substantial time and resources.

So, despite the risk of supply chain disruptions associated with this dependency, companies may choose to retain the risk due to the high costs involved in diversifying the supplier base.

Given all the above, a thorough assessment of each risk’s likelihood, potential operational impact, and associated costs is crucial for determining the appropriate risk management approach.

This enables procurement teams to discern between risks that can be effectively avoided, reduced, or transferred and those that are best retained, as they’re too complex, impractical, or prohibitively expensive to mitigate.

Ultimately, the risk retention method allows companies to make informed decisions about which risks they are willing to accept and manage internally.

In the end, let’s just highlight that effective procurement risk management involves strategic balancing of risk avoidance, reduction, transfer, and retention methods.

By understanding the nature of procurement risks and employing appropriate risk management methods, companies can safeguard their operations, protect their bottom line, and enhance their supply chain resilience.

Ultimately, proactive risk assessment, mitigation, and adaptation enable companies to navigate challenges, seize opportunities, and optimize their procurement processes to achieve long-term success and sustainable growth.